Key Insights

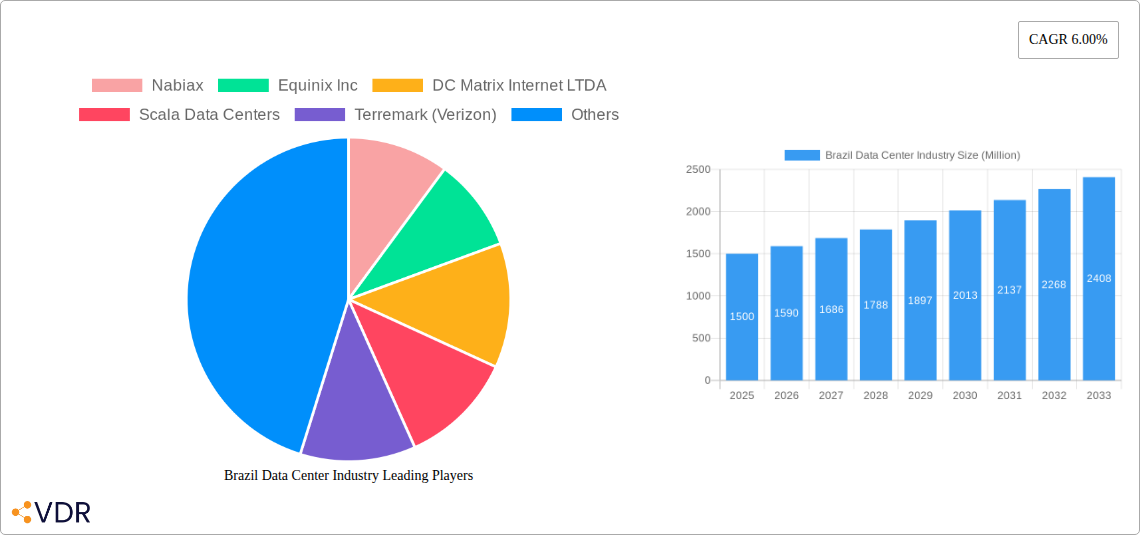

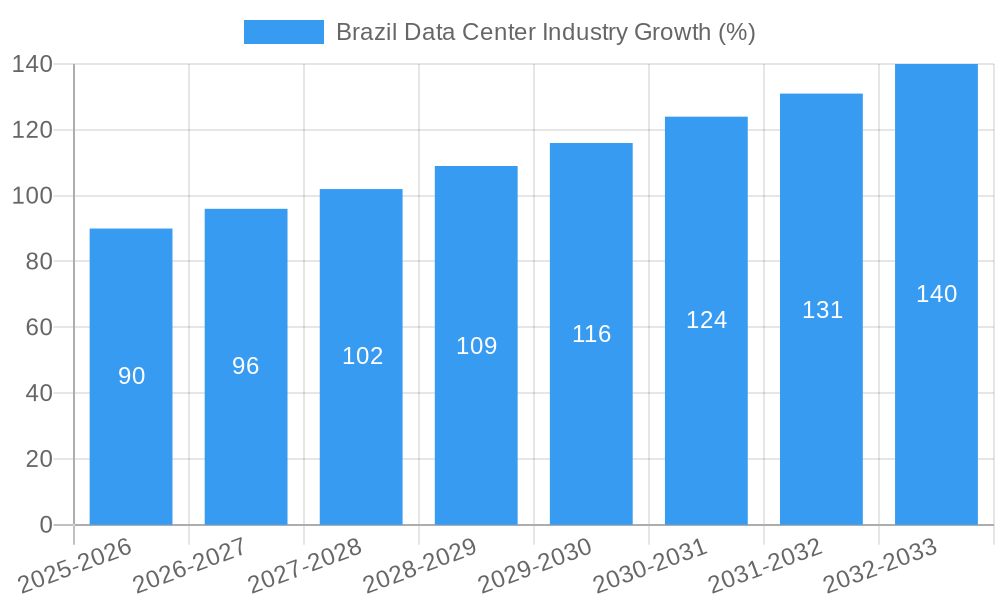

The Brazil data center market, valued at approximately $X million in 2025 (assuming a reasonable value based on global market trends and the provided CAGR), is projected to experience robust growth at a compound annual growth rate (CAGR) of 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and digital transformation initiatives across various sectors, including finance, telecommunications, and government, is significantly boosting demand for data center infrastructure. Furthermore, the growth of e-commerce and the expanding digital economy in Brazil are creating a need for reliable and scalable data center capacity, particularly in major metropolitan areas like Rio de Janeiro and São Paulo. The increasing focus on edge computing deployments, to reduce latency and improve application performance, also contributes to market growth. While challenges like potential regulatory hurdles and infrastructure limitations exist, the overall market outlook remains positive, driven by strong economic growth and digitalization trends within the country.

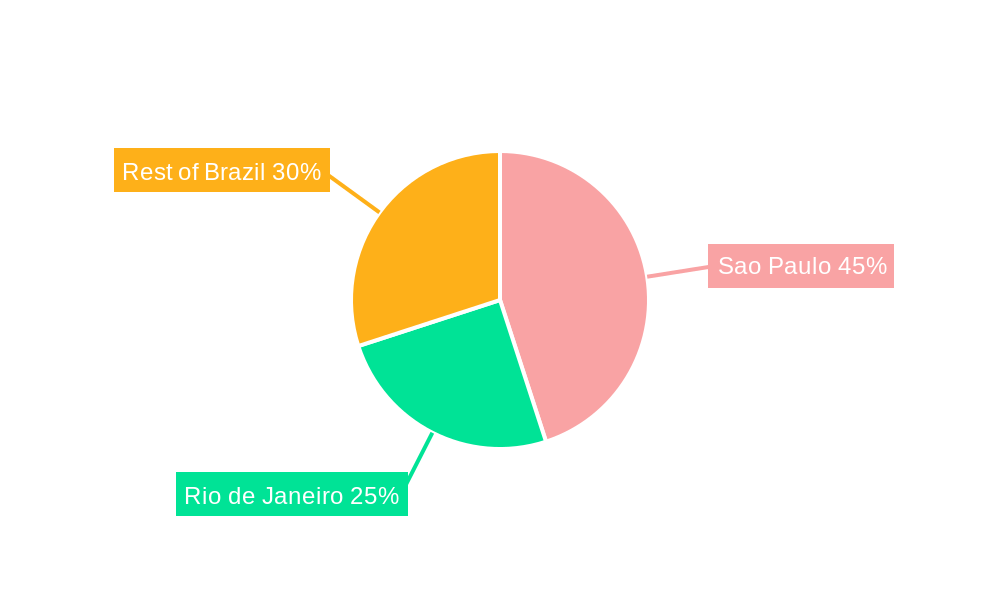

The market is segmented by hotspot location (Rio de Janeiro, São Paulo, Rest of Brazil), data center size (large, massive, medium, mega, small), tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (utilized, non-utilized), and other end-user segments. Key players like Equinix, Ascenty (Digital Realty Trust), and others are actively investing in expanding their data center footprints in Brazil to meet the rising demand. The increasing adoption of hyperscale data centers, particularly in São Paulo, represents a significant opportunity for growth. The competitive landscape is characterized by a mix of both global and local providers, resulting in a dynamic market with ongoing consolidation and expansion efforts. Continued investment in renewable energy sources and improved connectivity infrastructure will further accelerate growth in the coming years. The forecast period of 2025-2033 presents substantial opportunities for data center operators and related businesses within the Brazilian market.

Brazil Data Center Industry: Market Analysis & Forecast 2019-2033

This comprehensive report delivers an in-depth analysis of the burgeoning Brazil data center industry, providing crucial insights for investors, industry professionals, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report forecasts market growth, identifies key players, and analyzes market dynamics across various segments. The report utilizes data from reliable sources to offer quantitative and qualitative insights, facilitating informed decisions.

Brazil Data Center Industry Market Dynamics & Structure

The Brazilian data center market is experiencing rapid growth, driven by increasing digitalization, cloud adoption, and government initiatives. Market concentration is moderate, with a mix of global giants and local players. Technological innovation, particularly in areas like edge computing and hyperscale facilities, is a significant driver. The regulatory framework is evolving, focusing on data privacy and security. Competitive substitutes include colocation facilities and cloud services, but data center demand remains strong. End-user demographics are diverse, including financial institutions, telecommunication companies, and government agencies. M&A activity is increasing, reflecting consolidation trends within the sector.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Strong focus on edge computing, AI-optimized infrastructure, and sustainable data centers.

- Regulatory Framework: Emphasis on data sovereignty and cybersecurity regulations, impacting investment decisions.

- Competitive Substitutes: Cloud services and colocation facilities pose some competition.

- End-User Demographics: Diverse, including financial services, telecom, government, and large enterprises.

- M&A Trends: Increasing consolidation, with larger players acquiring smaller companies to expand their footprint. Estimated xx M&A deals in the past 5 years.

Brazil Data Center Industry Growth Trends & Insights

The Brazilian data center market exhibits robust growth, driven by factors such as rising internet penetration, the expansion of e-commerce, and increased adoption of cloud services. The market size has seen a significant increase from xx million in 2019 to xx million in 2024, registering a CAGR of xx% during the historical period. The forecast period (2025-2033) is projected to see continued expansion, reaching xx million by 2033, driven by significant investments in infrastructure and technological advancements. Adoption rates for cloud services and colocation are high, particularly amongst large enterprises. Technological disruptions, such as the rise of edge computing and the increasing importance of data security, are reshaping the industry landscape. Consumer behavior shifts toward digital services and remote work have further accelerated the demand for data center capacity.

Dominant Regions, Countries, or Segments in Brazil Data Center Industry

Sao Paulo and Rio de Janeiro dominate the Brazilian data center market, attracting significant investment due to their robust infrastructure, skilled workforce, and established business ecosystems. The "Rest of Brazil" segment shows growing potential as digital infrastructure expands beyond major cities. Large and Mega data centers are experiencing the fastest growth, driven by hyperscale cloud providers. Tier III and Tier IV facilities are preferred due to their higher levels of redundancy and reliability. Utilized absorption rates are high, reflecting strong market demand.

- Sao Paulo: Dominates due to established infrastructure, skilled workforce, and high concentration of businesses.

- Rio de Janeiro: Significant market share, driven by its status as a major financial and commercial hub.

- Data Center Size: Large and Mega data centers experiencing rapid growth, driven by hyperscale cloud providers.

- Tier Type: High demand for Tier III and Tier IV facilities for increased reliability and redundancy.

- Absorption: Utilized absorption rates are high, reflecting strong demand and limited available capacity.

Brazil Data Center Industry Product Landscape

The Brazilian data center industry offers a range of products and services, including colocation, managed services, cloud connectivity, and cybersecurity solutions. Product innovations focus on energy efficiency, modular designs, and enhanced security features. Data center providers are increasingly adopting sustainable practices, utilizing renewable energy sources to reduce their carbon footprint. Key performance indicators include uptime, power usage effectiveness (PUE), and mean time to repair (MTTR). Unique selling propositions include localized expertise, strong security measures and competitive pricing strategies.

Key Drivers, Barriers & Challenges in Brazil Data Center Industry

Key Drivers:

- Increasing cloud adoption and digital transformation initiatives within the Brazilian economy

- Government investments in digital infrastructure, and incentives for data center development

- Growing demand for data storage and processing across various sectors (finance, healthcare, government)

Key Barriers & Challenges:

- High initial investment costs for data center construction and deployment, particularly in areas with limited infrastructure.

- Power infrastructure limitations in some regions, leading to increased operational costs and potential disruptions.

- Skill gap in IT workforce, creating difficulty in finding qualified personnel to manage and maintain complex data center infrastructure.

Emerging Opportunities in Brazil Data Center Industry

Untapped market potential lies in smaller cities and regions of Brazil, requiring investment in infrastructure and skilled workforce development. Edge computing represents a significant opportunity, particularly in supporting applications with low latency requirements. The growing adoption of AI and machine learning creates opportunities for specialized data center services, optimized for high-performance computing.

Growth Accelerators in the Brazil Data Center Industry Industry

Technological breakthroughs in energy-efficient cooling systems, modular data center designs, and AI-powered management tools are accelerating growth. Strategic partnerships between data center operators, technology providers, and government agencies are facilitating infrastructure development. Expansion strategies involving new data center campuses in strategic locations across Brazil are supporting market expansion.

Key Players Shaping the Brazil Data Center Industry Market

- Nabiax

- Equinix Inc

- DC Matrix Internet LTDA

- Scala Data Centers

- Terremark (Verizon)

- Quantico Data Center

- Link Datacenter

- Lumen Technologies Inc

- HostDime Global Corp

- ODATA (Patria Investments Ltd)

- EdgeUno Inc

- Ascenty (Digital Realty Trust Inc)

Notable Milestones in Brazil Data Center Industry Sector

- November 2022: Ascenty announces a US$290 million investment in five new data centers across South America, including Brazil.

- October 2022: Equinix opens a new hyperscale data center in Sao Paulo, with a planned capacity of 14.4MW.

- August 2022: Scala Data Centers opens a new 6MW data center in Sao Paulo, with plans for expansion.

In-Depth Brazil Data Center Industry Market Outlook

The Brazilian data center market is poised for continued robust growth, driven by strong demand from both domestic and international players. Strategic investment in infrastructure, technological innovation, and expansion into untapped markets will be crucial factors in shaping future market dynamics. The focus on sustainability, energy efficiency, and enhanced security features will further enhance the industry's attractiveness to investors and end-users. This presents significant opportunities for data center operators, technology providers, and investors seeking high-growth potential in the region.

Brazil Data Center Industry Segmentation

-

1. Hotspot

- 1.1. Rio de Janeiro

- 1.2. Sao Paulo

- 1.3. Rest of Brazil

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Brazil Data Center Industry Segmentation By Geography

- 1. Brazil

Brazil Data Center Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Rio de Janeiro

- 5.1.2. Sao Paulo

- 5.1.3. Rest of Brazil

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nabiax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equinix Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DC Matrix Internet LTDA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Scala Data Centers

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Terremark (Verizon)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Quantico Data Center

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Link Datacenter

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lumen Technologies Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HostDime Global Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ODATA (Patria Investments Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 EdgeUno Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ascenty (Digital Realty Trust Inc )

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nabiax

List of Figures

- Figure 1: Brazil Data Center Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Data Center Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Data Center Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Brazil Data Center Industry Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Brazil Data Center Industry Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Brazil Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Brazil Data Center Industry Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Brazil Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Brazil Data Center Industry Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Brazil Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Brazil Data Center Industry Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Brazil Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Brazil Data Center Industry Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Brazil Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Brazil Data Center Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Brazil Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Brazil Data Center Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Brazil Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Data Center Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Brazil Data Center Industry Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Brazil Data Center Industry Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Brazil Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Brazil Data Center Industry Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Brazil Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Brazil Data Center Industry Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Brazil Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Brazil Data Center Industry Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Brazil Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Brazil Data Center Industry Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Brazil Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Brazil Data Center Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Brazil Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil Data Center Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Data Center Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Brazil Data Center Industry?

Key companies in the market include Nabiax, Equinix Inc, DC Matrix Internet LTDA, Scala Data Centers, Terremark (Verizon), Quantico Data Center, Link Datacenter, Lumen Technologies Inc, HostDime Global Corp, ODATA (Patria Investments Ltd), EdgeUno Inc, Ascenty (Digital Realty Trust Inc ).

3. What are the main segments of the Brazil Data Center Industry?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

November 2022: Ascenty will invest R$1.5 billion (US$290 million) in the construction of five new data centers in South America. The locations of the data centers will be Brazil, Chile, and Colombia.October 2022: In So Paulo, Brazil, Equinix opened a brand-new hyperscale data center. The new SP5x facility, which is situated in Santana de Parnaba close to the organization's SP3 IBX data center, has a capacity of roughly 5MW in its initial phase. After all, phases are finished, the data center should have a total capacity of 14.4MW. According to the business, it plans to spend a total of $116.4 million on the facility.August 2022: In Brazil's So Paulo, Scala Data Centers has opened a new data center. At the business' Tamboré campus in So Paulo's Barueri neighborhood, SP4 is now operational. With 6MW of IT power capacity in use, the site is operational in its initial stage. The second stage of SP4 is anticipated to begin operations in September, adding 6MW of IT capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Data Center Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Data Center Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Data Center Industry?

To stay informed about further developments, trends, and reports in the Brazil Data Center Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence