Key Insights

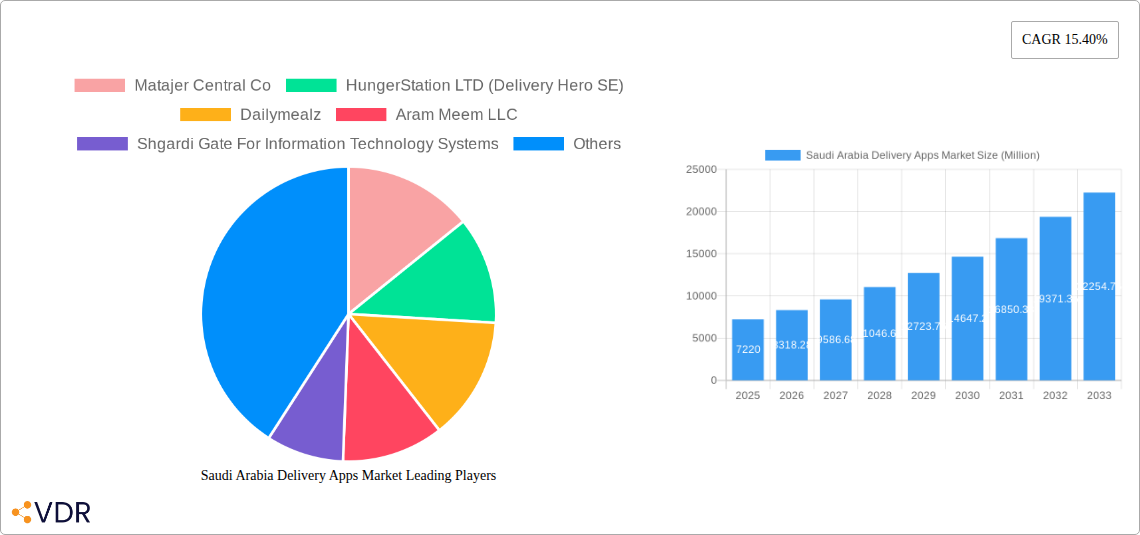

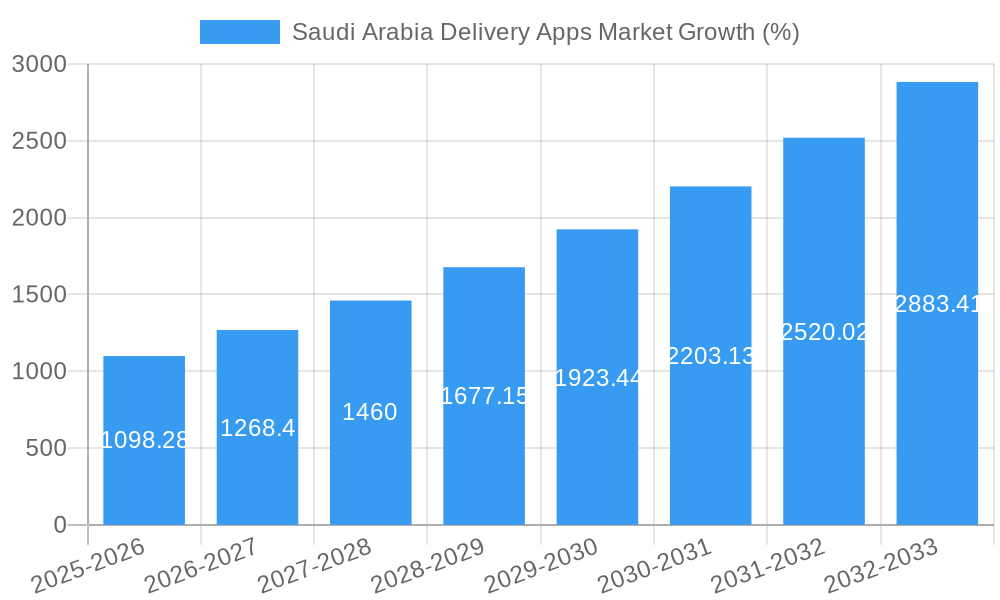

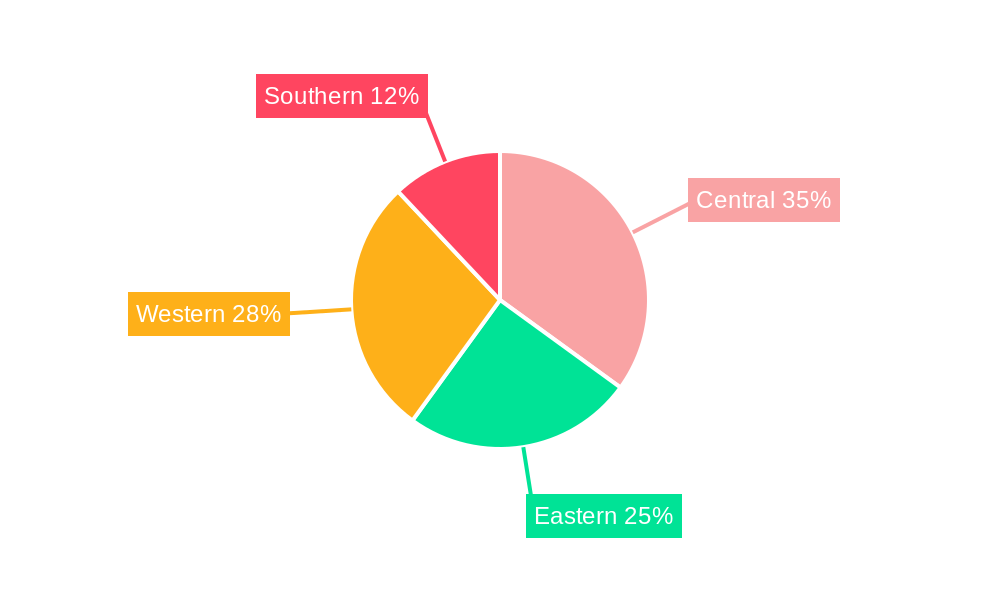

The Saudi Arabia delivery apps market, valued at $7.22 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.40% from 2025 to 2033. This surge is driven by several factors. The increasing smartphone penetration and internet access across the Kingdom are fueling the adoption of on-demand services. A rapidly expanding young and tech-savvy population readily embraces convenient online ordering and delivery options. Furthermore, the government's initiatives to foster digital transformation and e-commerce are creating a conducive environment for market expansion. The diverse range of services offered, encompassing food, groceries, pharmaceuticals, and other on-demand goods, contributes to market dynamism. Key players like Talabat, HungerStation, and Jahez are actively investing in technology and logistics to enhance service quality and expand their reach across different regions of Saudi Arabia (Central, Eastern, Western, and Southern). Competitive pricing strategies and promotional offers also play a crucial role in driving market growth. However, challenges remain, including ensuring reliable and timely delivery, managing operational costs effectively, and addressing potential regulatory hurdles related to food safety and data privacy.

The segmentation of the Saudi Arabian delivery apps market reveals significant growth potential across all service types. Food delivery apps currently hold the largest market share, driven by evolving food consumption habits and the preference for convenient dining options. Grocery delivery apps are also experiencing rapid expansion, fuelled by busy lifestyles and a growing preference for online grocery shopping. Pharmacy delivery apps are gaining traction, driven by the need for convenient access to medications, especially for elderly and chronically ill individuals. The "other on-demand delivery apps" segment, encompassing everything from courier services to specialized product delivery, demonstrates notable growth potential as consumer demand for diverse on-demand solutions continues to rise. This robust growth, however, faces potential challenges from increasing competition, potential economic fluctuations, and the need for constant innovation to meet evolving consumer expectations.

Saudi Arabia Delivery Apps Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the rapidly expanding Saudi Arabia delivery apps market, encompassing its market dynamics, growth trends, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategists. The report segments the market by service type: Food Delivery Apps, Grocery Delivery Apps, Pharmacy Delivery Apps, and Other On-demand Delivery Apps, providing granular analysis of each segment's performance and growth potential. The report values are presented in Million units.

Saudi Arabia Delivery Apps Market Market Dynamics & Structure

The Saudi Arabian delivery apps market is characterized by high growth potential, driven by increasing smartphone penetration, a young and digitally-savvy population, and government initiatives promoting e-commerce. The market is experiencing significant consolidation, with mergers and acquisitions playing a crucial role in shaping the competitive landscape. Market concentration is moderate, with a few dominant players and numerous smaller, niche players. Technological innovation, particularly in areas such as AI-powered delivery optimization and contactless delivery, is a key driver. However, regulatory frameworks and data privacy concerns present challenges. The market also faces competition from traditional delivery methods.

- Market Concentration: Moderate, with the top 5 players holding approximately xx% of market share in 2025.

- Technological Innovation: Focus on AI, automation, and enhanced user experience.

- Regulatory Framework: Evolving regulations on data privacy and food safety impacting market players.

- Competitive Substitutes: Traditional delivery services and in-store purchases remain strong competitors.

- End-User Demographics: Predominantly young, urban population with high smartphone penetration and online shopping affinity.

- M&A Trends: Significant M&A activity in recent years, indicating consolidation and market expansion strategies. An estimated xx M&A deals were closed between 2019 and 2024.

Saudi Arabia Delivery Apps Market Growth Trends & Insights

The Saudi Arabia delivery apps market witnessed robust growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing urbanization, and a shift towards convenient consumption patterns. The market size is estimated at xx million units in 2025, experiencing a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological disruptions, such as the introduction of drone delivery and the expansion of delivery networks into underserved areas. Consumer behavior is shifting toward greater reliance on on-demand services and preference for cashless payments. The adoption rate of delivery apps is projected to continue increasing, with significant penetration expected in both urban and semi-urban areas. Specific metrics like CAGR and market penetration will be analyzed in detail within the report, illustrating the market's dynamic evolution and growth trajectory.

Dominant Regions, Countries, or Segments in Saudi Arabia Delivery Apps Market

The Food Delivery Apps segment is currently the largest and fastest-growing segment within the Saudi Arabian delivery apps market. This dominance is largely driven by the high popularity of online food ordering and the convenience it offers. Major cities like Riyadh, Jeddah, and Dammam are leading the growth, fueled by higher internet penetration, a denser population, and robust infrastructure supporting delivery services.

- Key Drivers for Food Delivery Apps: High demand for convenience, diverse culinary options, and competitive pricing strategies among apps.

- Growth Potential: Untapped potential in smaller cities and towns and increasing demand for specialized cuisines and dietary options. The grocery delivery segment is also witnessing rapid growth, propelled by increasing preference for online grocery shopping, particularly among busy professionals and families. Pharmacy delivery apps show considerable potential, driven by the demand for healthcare convenience and accessibility.

Dominant Regions: Riyadh, Jeddah, and Dammam are driving the growth due to high population density, internet penetration, and developed logistics infrastructure.

Saudi Arabia Delivery Apps Market Product Landscape

The Saudi Arabian delivery apps market features a diverse range of products offering varying degrees of customization and functionality. Innovation is evident in the development of advanced features such as real-time tracking, multiple payment options, and personalized recommendations. Competitive differentiation is achieved through superior user interfaces, loyalty programs, and strategic partnerships with restaurants and retailers. Technological advancements such as AI-powered route optimization and chatbots are improving the efficiency and customer experience.

Key Drivers, Barriers & Challenges in Saudi Arabia Delivery Apps Market

Key Drivers:

- Increasing smartphone penetration and internet access.

- Growing preference for convenience and online services.

- Government initiatives supporting e-commerce and digital transformation.

- Rising disposable incomes and urbanization.

Key Challenges:

- Intense competition among numerous delivery apps.

- Dependence on reliable delivery infrastructure and logistics.

- Regulatory hurdles and data privacy concerns.

- Fluctuations in fuel prices impacting delivery costs. The challenges of maintaining consistent delivery times and managing rider availability can significantly impact customer satisfaction and brand reputation.

Emerging Opportunities in Saudi Arabia Delivery Apps Market

- Expansion into underserved regions: Reaching beyond major cities to tap into growing demand in smaller towns and rural areas.

- Hyperlocal delivery services: Focusing on niche markets and specialized products with quick turnaround times.

- Integration with other services: Partnering with businesses such as laundry services, dry cleaners, and flower shops to broaden offerings.

- Personalization and customization: Utilizing data analytics to offer tailored recommendations and improve customer experience.

Growth Accelerators in the Saudi Arabia Delivery Apps Market Industry

Long-term growth in the Saudi Arabia delivery apps market will be driven by strategic partnerships between delivery platforms and retailers, technological breakthroughs like drone delivery and autonomous vehicles, and market expansion into new service categories, such as same-day delivery of everyday essentials and specialized goods. The continued focus on user experience and technological advancements will be crucial in sustaining market momentum and attracting new users.

Key Players Shaping the Saudi Arabia Delivery Apps Market Market

- Matajer Central Co

- HungerStation LTD (Delivery Hero SE)

- Dailymealz

- Aram Meem LLC

- Shgardi Gate For Information Technology Systems

- The Chefz (Jahez International Company For Information Systems Technology)

- Jahez International Company For Information Systems Technology

- Shatirah House Restaurant Co

- MRSOOL Inc

- Carrefour Ksa (Majid Al Futtaim Retail)

- Lugmety

- Al Dawaa Medical Services Company

- Nahdi Medical Company

- Careem Networks FZ-LLC (Uber Technologies Inc)

- Bindawood Holding

- Talabat (Delivery Hero SE)

Notable Milestones in Saudi Arabia Delivery Apps Market Sector

- 2020: Launch of several new grocery delivery apps, increasing market competition.

- 2021: Significant investment in delivery infrastructure and technological upgrades by major players.

- 2022: Introduction of contactless delivery options due to the pandemic, becoming a standard feature.

- 2023: Several mergers and acquisitions among smaller players, leading to market consolidation.

- 2024: Increased adoption of AI-powered features such as optimized routing and real-time tracking.

In-Depth Saudi Arabia Delivery Apps Market Market Outlook

The future of the Saudi Arabia delivery apps market is extremely promising, with continued growth projected for the next decade. Technological innovation, strategic partnerships, and expansion into new segments will drive this growth. Opportunities exist for companies to leverage data analytics, personalize services, and focus on delivering a seamless customer experience. The market's success will hinge on adapting to evolving consumer preferences, navigating regulatory changes, and investing in reliable infrastructure.

Saudi Arabia Delivery Apps Market Segmentation

-

1. Service Type

- 1.1. Food Delivery Apps

- 1.2. Grocery Delivery Apps

- 1.3. Pharmacy Delivery Apps

- 1.4. Other On-demand Delivery Apps

Saudi Arabia Delivery Apps Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Delivery Apps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Smartphone Penetration Fueled the Growth of the Market; Convenient Payment Gateways Play a Pivotal Role in Augmenting the Growth of Delivery Apps in Saudi Arabia

- 3.3. Market Restrains

- 3.3.1. Consumers Desire for Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Rise in Smartphone Penetration to Fuel the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Food Delivery Apps

- 5.1.2. Grocery Delivery Apps

- 5.1.3. Pharmacy Delivery Apps

- 5.1.4. Other On-demand Delivery Apps

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Central Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Delivery Apps Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Matajer Central Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 HungerStation LTD (Delivery Hero SE)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dailymealz

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aram Meem LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Shgardi Gate For Information Technology Systems

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Chefz (Jahez International Company For Information Systems Technology)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Jahez International Company For Information Systems Technology

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Shatirah House Restaurant Co

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MRSOOL Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Carrefour Ksa (Majid Al Futtaim Retail)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Lugmety

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Al Dawaa Medical Services Company

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nahdi Medical Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Careem Networks FZ-LLC (Uber Technologies Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Bindawood Holding

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Talabat (Delivery Hero SE)

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Matajer Central Co

List of Figures

- Figure 1: Saudi Arabia Delivery Apps Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Delivery Apps Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Delivery Apps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 10: Saudi Arabia Delivery Apps Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Delivery Apps Market?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the Saudi Arabia Delivery Apps Market?

Key companies in the market include Matajer Central Co, HungerStation LTD (Delivery Hero SE), Dailymealz, Aram Meem LLC, Shgardi Gate For Information Technology Systems, The Chefz (Jahez International Company For Information Systems Technology), Jahez International Company For Information Systems Technology, Shatirah House Restaurant Co, MRSOOL Inc, Carrefour Ksa (Majid Al Futtaim Retail), Lugmety, Al Dawaa Medical Services Company, Nahdi Medical Company, Careem Networks FZ-LLC (Uber Technologies Inc, Bindawood Holding, Talabat (Delivery Hero SE).

3. What are the main segments of the Saudi Arabia Delivery Apps Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Smartphone Penetration Fueled the Growth of the Market; Convenient Payment Gateways Play a Pivotal Role in Augmenting the Growth of Delivery Apps in Saudi Arabia.

6. What are the notable trends driving market growth?

Rise in Smartphone Penetration to Fuel the Growth of the Market.

7. Are there any restraints impacting market growth?

Consumers Desire for Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Delivery Apps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Delivery Apps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Delivery Apps Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Delivery Apps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence