Key Insights

The Saudi Arabian beauty and personal care market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, driven by several key factors. Rising disposable incomes, a burgeoning young population increasingly influenced by social media beauty trends, and a growing awareness of personal grooming are fueling demand for a wider array of cosmetics and personal care products. The market's expansion is further supported by increased foreign investment in the sector and the development of sophisticated retail infrastructure, including the expansion of online retail channels. Key product segments exhibiting strong growth include color cosmetics (driven by high demand for trendy products), lip and nail make-up, and hair styling and coloring products. The preference for premium and international brands, coupled with the rise of e-commerce, presents opportunities for both established global players like L'Oréal, Estee Lauder, and Procter & Gamble, and local brands aiming to capture market share.

However, challenges remain. The market's growth, though substantial, might be tempered by fluctuating oil prices impacting consumer spending, and the potential for economic downturns. Furthermore, increasing competition from both international and domestic brands, coupled with stringent regulatory requirements surrounding product safety and labeling, necessitates careful market navigation for companies seeking to succeed in this dynamic landscape. The diversification of product offerings to meet evolving consumer preferences, investment in digital marketing strategies, and a strong focus on customer experience will be crucial for success. The strategic partnerships with local distributors and effective supply chain management will be critical to ensuring robust market penetration across the region.

Saudi Arabia Beauty and Personal Care Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the dynamic Saudi Arabia beauty and personal care market, encompassing market size, growth trends, key players, and future projections. The study period covers 2019-2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this thriving sector.

Saudi Arabia Beauty and Personal Care Market Dynamics & Structure

The Saudi Arabian beauty and personal care market exhibits a complex interplay of factors influencing its structure and growth. Market concentration is moderately high, with major multinational players like Unilever PLC, L'Oréal SA, and Procter & Gamble holding significant shares alongside established local companies such as The Saudi Factory for Perfumes and Cosmetics Ltd and Madi International. Technological innovation, particularly in areas like personalized skincare and digital beauty solutions, is a key driver. The regulatory framework, while evolving, plays a role in shaping product formulations and marketing practices. The market sees competition from substitute products, particularly in natural and organic segments, driving innovation and diversification. The young, affluent, and increasingly fashion-conscious demographic fuels demand, with significant spending power. M&A activity within the sector remains moderate but growing, with strategic acquisitions aimed at expanding market reach and product portfolios.

- Market Concentration: Moderately high, with leading multinational and local players dominating market share. Estimated xx% market share held by top 5 players in 2025.

- Technological Innovation: Strong driver, with focus on personalized beauty, digital tools, and sustainable ingredients.

- Regulatory Framework: Evolving, influencing product formulations and marketing claims.

- Competitive Substitutes: Growing presence of natural and organic products exerts competitive pressure.

- End-User Demographics: Young, affluent population with high spending on beauty and personal care.

- M&A Trends: Moderate but increasing activity focused on expanding market presence and product lines; estimated xx M&A deals in 2024.

Saudi Arabia Beauty and Personal Care Market Growth Trends & Insights

The Saudi Arabia beauty and personal care market has experienced robust growth in recent years, driven by factors such as rising disposable incomes, increasing urbanization, and a growing awareness of personal grooming. Market size reached an estimated value of XXX million units in 2025, reflecting a significant increase from the historical period (2019-2024). The adoption of new technologies, including e-commerce platforms and personalized beauty solutions, has further propelled market expansion. Consumer behavior is shifting towards premium and luxury products, as well as those with natural and organic ingredients. This trend is reflected in the rising popularity of international brands and the growing demand for specialized skincare and hair care solutions. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching a projected value of XXX million units by 2033. Market penetration, particularly in online retail, is expected to increase significantly in the coming years.

Dominant Regions, Countries, or Segments in Saudi Arabia Beauty and Personal Care Market

The Saudi Arabian beauty and personal care market showcases significant regional disparities in growth, with metropolitan areas like Riyadh and Jeddah leading in consumption. Online retail channels are experiencing remarkable expansion, fueled by rising internet penetration and the ease of accessing diverse product offerings. While specialty stores maintain a strong presence due to personalized service and brand immersion, hypermarkets and supermarkets retain substantial market share through their convenience and competitive pricing. Pharmacies and drugstores cater to a specific consumer segment seeking skincare with therapeutic benefits. The color cosmetics sector is a primary growth engine, reflecting a surge in interest in makeup and self-expression. Similarly, hair styling and coloring products are in high demand, driven by fashion trends and the desire for hair enhancements. This dynamic market is further segmented by product type (skincare, haircare, makeup, fragrance), price point (mass, premium, luxury), and distribution channels (online, offline).

- Leading Distribution Channel: Online Retailing, exhibiting the most significant growth potential.

- Leading Product Type: Color Cosmetics and Hair Styling/Coloring products demonstrate the highest consumer demand.

- Key Growth Drivers: Rising disposable incomes, increasing urbanization, evolving consumer preferences towards premium and specialized products, and the influence of social media and beauty influencers.

Saudi Arabia Beauty and Personal Care Market Product Landscape

The Saudi Arabian beauty and personal care market boasts a diverse product portfolio, encompassing a wide array of cosmetics, skincare, hair care, and fragrances. Innovation is a key feature, with the introduction of customized beauty solutions, natural and organic products, and technologically advanced formulations designed to address specific skin and hair concerns. Brands are increasingly emphasizing unique selling propositions built on ingredient efficacy, sustainable practices, and technological breakthroughs. The market has witnessed a notable influx of smart beauty devices, advanced formulations utilizing cutting-edge ingredients, and personalized skincare regimens tailored to diverse consumer needs. The growing awareness of natural and organic ingredients, as well as halal-certified products, is also shaping the market landscape.

Key Drivers, Barriers & Challenges in Saudi Arabia Beauty and Personal Care Market

Key Drivers: Rising disposable incomes, increasing urbanization, and the significant impact of social media in promoting beauty trends and influencing consumer choices. Government support for entrepreneurship and local businesses fosters market growth. The widespread adoption of e-commerce enhances accessibility and convenience for consumers. Furthermore, the growing interest in personalized beauty solutions and the increasing demand for high-quality, innovative products drive market expansion.

Key Challenges & Restraints: Supply chain disruptions remain a significant concern, impacting product availability and pricing. Strict regulatory requirements for product safety and labeling create obstacles for smaller companies. Intense competition from established multinational brands presents challenges for smaller local players. Fluctuations in oil prices can influence consumer spending patterns. Estimated impact of supply chain issues in 2024 is xx% decrease in product availability. Counterfeit products also pose a considerable challenge.

Emerging Opportunities in Saudi Arabia Beauty and Personal Care Market

Untapped opportunities exist in niche segments such as men's grooming, specialized skincare for specific skin conditions, and sustainable and ethically sourced products. Innovative beauty technology, personalized beauty regimens, and the integration of augmented reality (AR) and virtual reality (VR) in beauty experiences offer significant potential. Evolving consumer preferences towards natural and organic ingredients create opportunities for brands offering high-quality, sustainable products.

Growth Accelerators in the Saudi Arabia Beauty and Personal Care Market Industry

Sustained long-term growth is fueled by technological advancements in product formulation, packaging, and distribution. Strategic collaborations between international and local brands stimulate market expansion and product innovation. The continuous expansion of e-commerce infrastructure and improved logistics networks significantly enhance consumer accessibility and convenience. Government initiatives supporting entrepreneurship and fostering the growth of local businesses contribute significantly to the market's expansion. Furthermore, the increasing adoption of digital marketing strategies and influencer collaborations are key growth accelerators.

Key Players Shaping the Saudi Arabia Beauty and Personal Care Market Market

- The Estée Lauder Companies Inc.

- Procter & Gamble

- Unilever PLC

- L'Oréal SA

- The Saudi Factory for Perfumes and Cosmetics Ltd.

- Madi International

- Oriflame Cosmetics SA

- Shiseido Company Limited

- Beiersdorf AG

- Avon Cosmetics

Notable Milestones in Saudi Arabia Beauty and Personal Care Market Sector

- September 2023: Charlotte Tilbury opens two stores in Riyadh, expanding its presence in the Saudi market.

- August 2023: Launch of Zvezda Beauty, introducing new cosmetic and skincare products to the market.

- January 2023: Happier Skincare expands into the Middle East, including Saudi Arabia, through e-commerce.

In-Depth Saudi Arabia Beauty and Personal Care Market Market Outlook

The Saudi Arabia beauty and personal care market is poised for continued strong growth driven by robust economic performance, increasing consumer spending, and a burgeoning e-commerce sector. Strategic partnerships between international and local brands, coupled with technological innovation, promise to shape future market dynamics. The market's evolution is anticipated to be characterized by the increasing prominence of premium products, personalized beauty solutions, and a growing focus on natural and sustainable ingredients. Significant opportunities exist for companies that effectively adapt to evolving consumer preferences and leverage innovative approaches to distribution and marketing.

Saudi Arabia Beauty and Personal Care Market Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Make-Up Products

- 1.1.2. Eye Make-Up Products

- 1.1.3. Lip and Nail Make-up Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair Colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Hypermarkets/supermarkets

- 2.3. Pharmacy and Drug Stores

- 2.4. Online Retailing

- 2.5. Other Distribution Channels

Saudi Arabia Beauty and Personal Care Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Beauty and Personal Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Popularity of Natural Variants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Beauty and Personal Care Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Make-Up Products

- 5.1.1.2. Eye Make-Up Products

- 5.1.1.3. Lip and Nail Make-up Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair Colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Hypermarkets/supermarkets

- 5.2.3. Pharmacy and Drug Stores

- 5.2.4. Online Retailing

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

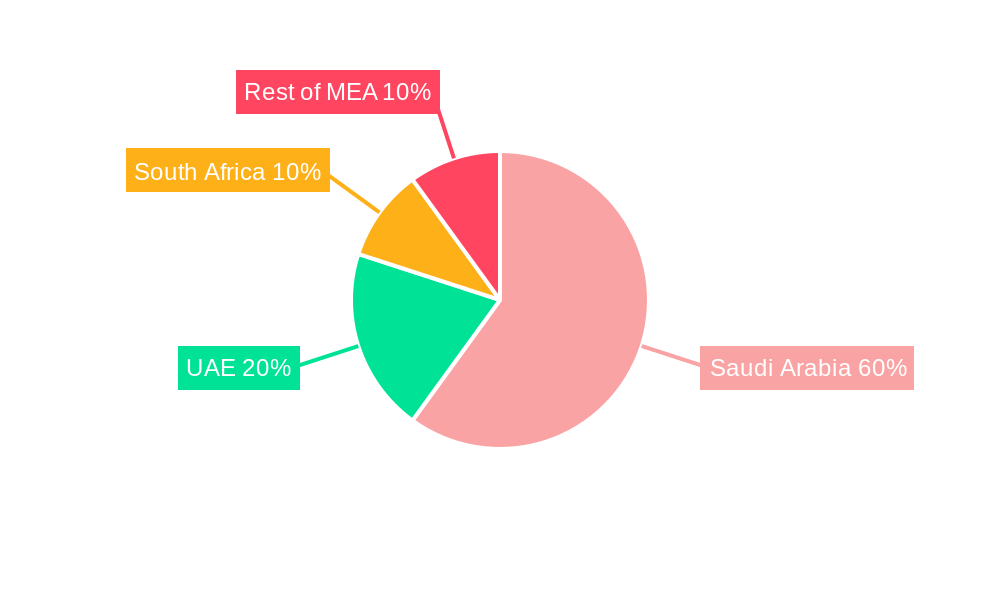

- 6. UAE Saudi Arabia Beauty and Personal Care Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Saudi Arabia Beauty and Personal Care Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Saudi Arabia Beauty and Personal Care Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Saudi Arabia Beauty and Personal Care Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The Estee Lauder Companies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Procter & Gamble

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Unilever PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 L'Oréal SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Saudi Factory for Perfumes and Cosmetics Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Madi International

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Oriflame Cosmetics SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Shiseido Company Limited*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Beiersdorf AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Avon Cosmetics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: Saudi Arabia Beauty and Personal Care Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Beauty and Personal Care Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Saudi Arabia Beauty and Personal Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Saudi Arabia Beauty and Personal Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Saudi Arabia Beauty and Personal Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Saudi Arabia Beauty and Personal Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Saudi Arabia Beauty and Personal Care Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Beauty and Personal Care Market?

The projected CAGR is approximately 1.60%.

2. Which companies are prominent players in the Saudi Arabia Beauty and Personal Care Market?

Key companies in the market include The Estee Lauder Companies Inc, Procter & Gamble, Unilever PLC, L'Oréal SA, The Saudi Factory for Perfumes and Cosmetics Ltd, Madi International, Oriflame Cosmetics SA, Shiseido Company Limited*List Not Exhaustive, Beiersdorf AG, Avon Cosmetics.

3. What are the main segments of the Saudi Arabia Beauty and Personal Care Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics.

6. What are the notable trends driving market growth?

Increasing Popularity of Natural Variants.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

September 2023: Charlotte Tilbury, the renowned British beauty brand, opened two new stores in Riyadh, Saudi Arabia. The store claims to include the brand's award-winning makeup and skin care products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Beauty and Personal Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Beauty and Personal Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Beauty and Personal Care Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Beauty and Personal Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence