Key Insights

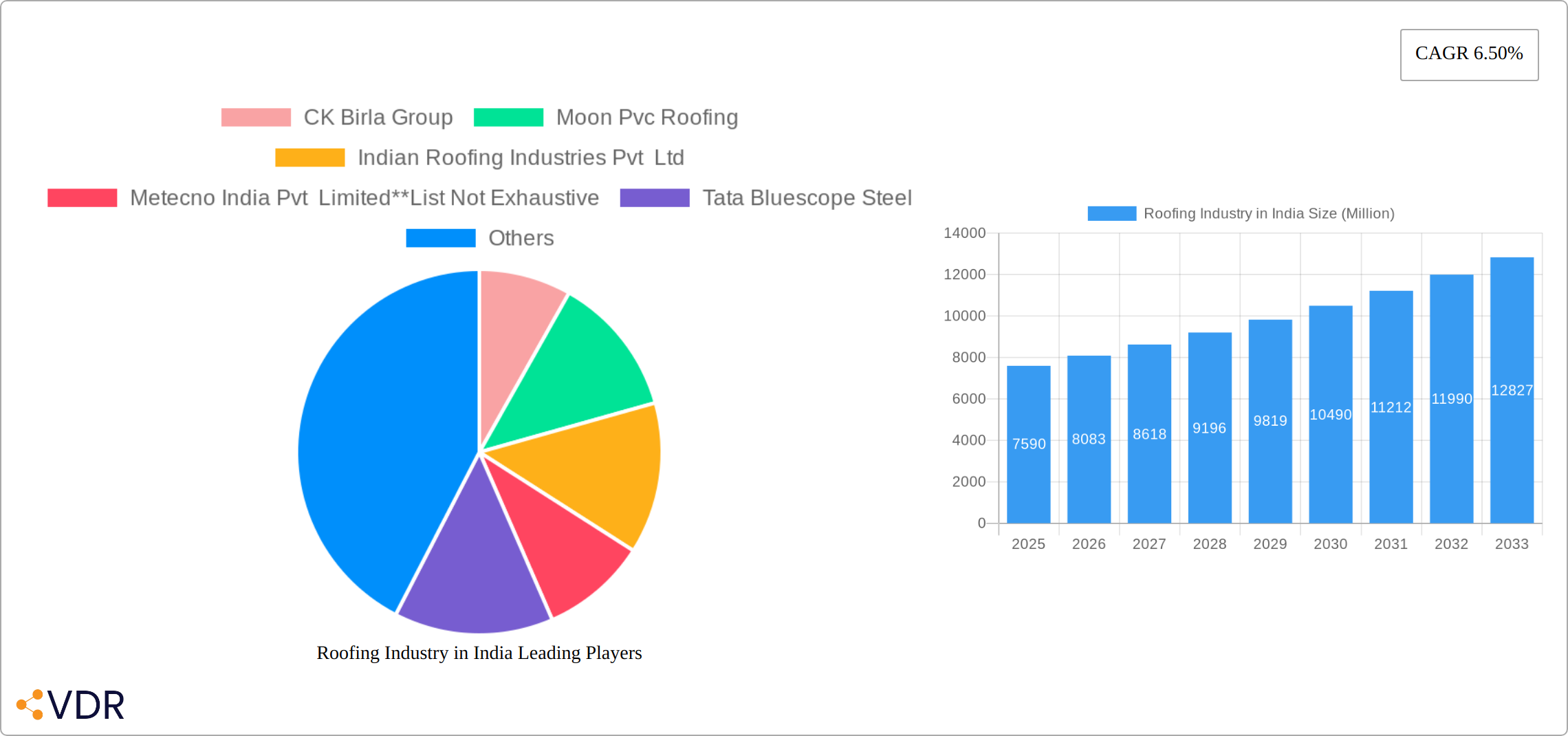

The Indian roofing industry, valued at ₹7.59 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033. This expansion is driven by several key factors. Firstly, India's burgeoning construction sector, fueled by rapid urbanization and infrastructure development initiatives like the Smart Cities Mission, is significantly increasing demand for roofing materials. Secondly, a shift towards improved building aesthetics and enhanced energy efficiency is boosting the adoption of premium roofing solutions, such as metal and tile roofs, over traditional bituminous options. Furthermore, government initiatives promoting sustainable building practices are indirectly driving demand for eco-friendly roofing materials. However, challenges remain. Fluctuations in raw material prices, particularly for metals and bitumen, pose a significant constraint. Additionally, the industry faces competition from cheaper, albeit less durable, alternatives, requiring manufacturers to innovate and offer value-added services. Segmentation analysis reveals that commercial construction currently dominates the market, followed by residential and industrial segments. Within materials, bituminous roofing remains prevalent, though metal and tile roofing segments are witnessing the fastest growth. Finally, the slope roof segment is larger than the flat roof segment, reflecting the architectural preferences in India's diverse regions. Regional variations exist, with Southern and Western India showing higher growth potential due to robust real estate activity.

The competitive landscape is dynamic, with established players like CK Birla Group, Tata Bluescope Steel, and Everest Industries Limited competing alongside emerging companies. The forecast period (2025-2033) promises continued growth, driven by sustained infrastructure investment, rising disposable incomes, and the increasing preference for durable and aesthetically appealing roofing solutions. Strategic partnerships, technological advancements in material science, and effective marketing strategies will be crucial for companies to capitalize on the growth opportunities within this expanding market. Companies focusing on sustainable, high-quality, and innovative roofing solutions are poised to gain a significant market advantage in the coming years. While data regarding the precise breakdown by region and material type is limited, analyzing regional economic activity and construction trends provides a reasonable basis for forecasting future market segmentation.

This comprehensive report provides an in-depth analysis of the Indian roofing industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report segments the market by sector (Commercial, Residential, Industrial), material (Bituminous, Tiles, Metal, Other), and roofing type (Flat, Slope), offering granular insights into a multi-billion-dollar market.

Roofing Industry in India Market Dynamics & Structure

The Indian roofing industry presents a moderately fragmented market structure, featuring several large national players alongside numerous smaller, regional operators. Market concentration remains relatively low, especially within the residential sector. This dynamic landscape is significantly shaped by the growing demand for energy-efficient and durable roofing solutions, driving innovation in materials and manufacturing processes. Stringent building codes and environmental regulations play a crucial role, influencing product selection and overall market practices. Competition from traditional and substitute materials like thatch and reinforced concrete persists, particularly in rural areas. The end-user base is diverse, encompassing individual homeowners, large-scale construction firms, and commercial and industrial developers. Mergers and acquisitions (M&A) activity has shown moderate growth in recent years, primarily driven by strategies focused on vertical integration and geographic expansion. The influence of government policies and initiatives on materials selection and market trends should also be noted.

- Market Concentration: Low to moderate, with a few dominant players holding approximately [Insert Percentage]% market share. [Add detail on market share distribution if available]

- Technological Innovation: Strong emphasis on energy efficiency (e.g., cool roofing technologies), lightweight materials reducing structural load, and enhanced durability for extended lifespan.

- Regulatory Framework: Building codes and environmental standards significantly influence material choices and necessitate compliance for market entry.

- Competitive Substitutes: Traditional materials like thatch and concrete, along with other cost-effective alternatives, pose competition, primarily in rural markets. [Add details on market share of substitute materials if available]

- End-User Demographics: A diverse range of end-users exists, including individual homeowners, commercial builders, industrial developers, and infrastructure projects.

- M&A Activity: Moderate activity ( [Insert Number] deals per year between 2019-2024) with strategies prioritizing expansion into new markets and vertical integration within the value chain. [Add details on types of M&A deals if available]

Roofing Industry in India Growth Trends & Insights

The Indian roofing market has exhibited consistent growth from 2019-2024, fueled by robust construction activity, rapid urbanization, and government initiatives promoting infrastructure development (e.g., Smart Cities Mission, Housing for All). The market size in 2024 is estimated at ₹ [Insert Amount] Million, demonstrating a CAGR of [Insert Percentage]% during this period. The adoption of advanced roofing materials is steadily increasing, particularly within the commercial and industrial segments. Technological advancements, introducing materials with superior performance, are reshaping the industry. Consumer preferences are shifting towards aesthetically pleasing, durable, and energy-efficient roofing solutions. The forecast period (2025-2033) projects sustained growth, with a projected market size of ₹ [Insert Amount] Million by 2033 and a CAGR of [Insert Percentage]%. Metal roofing is anticipated to gain significant market penetration due to its durability and cost-effectiveness. This future growth trajectory is underpinned by continued investment in infrastructure projects and the ongoing trend of rapid urbanization. [Consider adding information on specific growth areas within the roofing industry].

Dominant Regions, Countries, or Segments in Roofing Industry in India

The residential construction sector dominates the Indian roofing market, followed by the commercial and industrial sectors. Within materials, the bituminous segment currently holds the largest market share, while metal roofing is expected to witness significant growth in the forecast period. Urban areas, particularly in major metropolitan cities, exhibit higher demand due to high construction activity.

- By Sector: Residential construction dominates, driven by increasing housing demand and rising disposable incomes.

- By Material: Bituminous materials hold the largest market share currently, followed by tiles and metal roofing.

- By Roofing Type: Slope roofs are more prevalent than flat roofs.

- Key Drivers: Rapid urbanization, increasing infrastructure development, government housing schemes, and rising disposable incomes.

Roofing Industry in India Product Landscape

The Indian roofing product landscape is diverse, encompassing a wide range of materials, including bituminous roofing, clay and concrete tiles, metal sheets (galvanized iron, aluminum, and color-coated steel), and specialized products like PVC and fiberglass reinforced polymer roofing. Recent innovations prioritize energy efficiency (e.g., cool roofing that reflects solar radiation), enhanced durability for longer lifespans, and lightweight designs to minimize structural loads. These advancements improve product performance and aesthetic appeal, addressing environmental concerns and construction challenges across diverse climatic regions. Unique selling propositions frequently focus on thermal performance, superior water resistance, and aesthetically pleasing designs. Manufacturers are also investing in improved roofing installation techniques to achieve faster and more efficient construction processes. [Add details on specific product types and their market share if possible].

Key Drivers, Barriers & Challenges in Roofing Industry in India

Key Drivers: Rapid urbanization driving increased housing demand, rising disposable incomes leading to greater spending on home improvement, government infrastructure projects (e.g., Smart Cities Mission, affordable housing schemes), and a growing awareness of energy-efficient building solutions.

Key Challenges: Fluctuations in raw material prices (e.g., steel, bitumen), intense competition among numerous players, potential supply chain disruptions affecting availability and cost, stringent regulatory compliance requirements adding complexity, and a shortage of skilled labor impacting installation and maintenance capabilities. These challenges significantly impact production costs and profitability for businesses operating in this sector. [Add details on specific challenges and their impact on the market]

Emerging Opportunities in Roofing Industry in India

Emerging opportunities include growing demand for sustainable and eco-friendly roofing materials, rising adoption of metal and other advanced materials in the residential segment, increasing demand for specialized roofing solutions for industrial and commercial applications, and government policies promoting green buildings. Untapped rural markets also present a substantial opportunity for growth.

Growth Accelerators in the Roofing Industry in India Industry

Several factors have the potential to significantly accelerate growth within the Indian roofing industry. These include technological advancements in manufacturing and materials science leading to improved product quality and efficiency, strategic partnerships among roofing manufacturers, material suppliers, and construction companies enabling better coordination and distribution, and expansion into new geographical markets, especially penetrating under-served rural areas. Government incentives promoting sustainable building practices and the adoption of innovative roofing solutions for diverse applications can further stimulate faster market expansion. [Add further detail on specific growth accelerators].

Key Players Shaping the Roofing Industry in India Market

- CK Birla Group

- Moon Pvc Roofing

- Indian Roofing Industries Pvt Ltd

- Metecno India Pvt Limited

- Tata Bluescope Steel

- Bansal Roofing Products Limited

- Hindalco Ind Ltd

- Dion Incorporation

- Everest Industries Limited

- Aqua Star

Notable Milestones in Roofing Industry in India Sector

- 2020: Launch of a new energy-efficient roofing tile by Everest Industries.

- 2021: Acquisition of a regional roofing manufacturer by CK Birla Group.

- 2022: Introduction of a new metal roofing system with improved weather resistance.

- 2023: Government announcement of new building codes favoring sustainable roofing materials. (Further details required)

- 2024: Major expansion of manufacturing capacity by Tata Bluescope Steel.

In-Depth Roofing Industry in India Market Outlook

The Indian roofing industry is projected to experience robust growth over the forecast period (2025-2033), driven by sustained construction activity, increasing urbanization, and adoption of advanced materials. The market's future potential is significant, with numerous opportunities for innovation and market expansion. Strategic partnerships, technological breakthroughs, and government support will be crucial in shaping the industry's trajectory. Focus on sustainability, energy efficiency, and affordability will be critical for success in this dynamic market.

Roofing Industry in India Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

-

2. Material

- 2.1. Bituminous

- 2.2. Tiles

- 2.3. Metal

- 2.4. Other Materials

-

3. Roofing Type

- 3.1. Flat Roof

- 3.2. Slope Roof

Roofing Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Roofing Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions

- 3.3. Market Restrains

- 3.3.1. The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increasing Construction Activities to Bolster the Growth of the Roofing Industry in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Bituminous

- 5.2.2. Tiles

- 5.2.3. Metal

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Roofing Type

- 5.3.1. Flat Roof

- 5.3.2. Slope Roof

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Bituminous

- 6.2.2. Tiles

- 6.2.3. Metal

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Roofing Type

- 6.3.1. Flat Roof

- 6.3.2. Slope Roof

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Bituminous

- 7.2.2. Tiles

- 7.2.3. Metal

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Roofing Type

- 7.3.1. Flat Roof

- 7.3.2. Slope Roof

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Bituminous

- 8.2.2. Tiles

- 8.2.3. Metal

- 8.2.4. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Roofing Type

- 8.3.1. Flat Roof

- 8.3.2. Slope Roof

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Bituminous

- 9.2.2. Tiles

- 9.2.3. Metal

- 9.2.4. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Roofing Type

- 9.3.1. Flat Roof

- 9.3.2. Slope Roof

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Bituminous

- 10.2.2. Tiles

- 10.2.3. Metal

- 10.2.4. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Roofing Type

- 10.3.1. Flat Roof

- 10.3.2. Slope Roof

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. North India Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Roofing Industry in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 CK Birla Group

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Moon Pvc Roofing

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Indian Roofing Industries Pvt Ltd

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Metecno India Pvt Limited**List Not Exhaustive

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Tata Bluescope Steel

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Bansal Roofing Products Limited

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Hindalco Ind Ltd

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Dion Incorporation

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Everest Industries Limited

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Aqua Star

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.1 CK Birla Group

List of Figures

- Figure 1: Global Roofing Industry in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Roofing Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India Roofing Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Roofing Industry in India Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Roofing Industry in India Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Roofing Industry in India Revenue (Million), by Material 2024 & 2032

- Figure 7: North America Roofing Industry in India Revenue Share (%), by Material 2024 & 2032

- Figure 8: North America Roofing Industry in India Revenue (Million), by Roofing Type 2024 & 2032

- Figure 9: North America Roofing Industry in India Revenue Share (%), by Roofing Type 2024 & 2032

- Figure 10: North America Roofing Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Roofing Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Roofing Industry in India Revenue (Million), by Sector 2024 & 2032

- Figure 13: South America Roofing Industry in India Revenue Share (%), by Sector 2024 & 2032

- Figure 14: South America Roofing Industry in India Revenue (Million), by Material 2024 & 2032

- Figure 15: South America Roofing Industry in India Revenue Share (%), by Material 2024 & 2032

- Figure 16: South America Roofing Industry in India Revenue (Million), by Roofing Type 2024 & 2032

- Figure 17: South America Roofing Industry in India Revenue Share (%), by Roofing Type 2024 & 2032

- Figure 18: South America Roofing Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Roofing Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Roofing Industry in India Revenue (Million), by Sector 2024 & 2032

- Figure 21: Europe Roofing Industry in India Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Europe Roofing Industry in India Revenue (Million), by Material 2024 & 2032

- Figure 23: Europe Roofing Industry in India Revenue Share (%), by Material 2024 & 2032

- Figure 24: Europe Roofing Industry in India Revenue (Million), by Roofing Type 2024 & 2032

- Figure 25: Europe Roofing Industry in India Revenue Share (%), by Roofing Type 2024 & 2032

- Figure 26: Europe Roofing Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Roofing Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Roofing Industry in India Revenue (Million), by Sector 2024 & 2032

- Figure 29: Middle East & Africa Roofing Industry in India Revenue Share (%), by Sector 2024 & 2032

- Figure 30: Middle East & Africa Roofing Industry in India Revenue (Million), by Material 2024 & 2032

- Figure 31: Middle East & Africa Roofing Industry in India Revenue Share (%), by Material 2024 & 2032

- Figure 32: Middle East & Africa Roofing Industry in India Revenue (Million), by Roofing Type 2024 & 2032

- Figure 33: Middle East & Africa Roofing Industry in India Revenue Share (%), by Roofing Type 2024 & 2032

- Figure 34: Middle East & Africa Roofing Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Roofing Industry in India Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Roofing Industry in India Revenue (Million), by Sector 2024 & 2032

- Figure 37: Asia Pacific Roofing Industry in India Revenue Share (%), by Sector 2024 & 2032

- Figure 38: Asia Pacific Roofing Industry in India Revenue (Million), by Material 2024 & 2032

- Figure 39: Asia Pacific Roofing Industry in India Revenue Share (%), by Material 2024 & 2032

- Figure 40: Asia Pacific Roofing Industry in India Revenue (Million), by Roofing Type 2024 & 2032

- Figure 41: Asia Pacific Roofing Industry in India Revenue Share (%), by Roofing Type 2024 & 2032

- Figure 42: Asia Pacific Roofing Industry in India Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Roofing Industry in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Roofing Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Roofing Industry in India Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Roofing Industry in India Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Global Roofing Industry in India Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 5: Global Roofing Industry in India Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Roofing Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Roofing Industry in India Revenue Million Forecast, by Sector 2019 & 2032

- Table 12: Global Roofing Industry in India Revenue Million Forecast, by Material 2019 & 2032

- Table 13: Global Roofing Industry in India Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 14: Global Roofing Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Roofing Industry in India Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Global Roofing Industry in India Revenue Million Forecast, by Material 2019 & 2032

- Table 20: Global Roofing Industry in India Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 21: Global Roofing Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Roofing Industry in India Revenue Million Forecast, by Sector 2019 & 2032

- Table 26: Global Roofing Industry in India Revenue Million Forecast, by Material 2019 & 2032

- Table 27: Global Roofing Industry in India Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 28: Global Roofing Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Germany Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Italy Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Spain Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Russia Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Benelux Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Nordics Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Roofing Industry in India Revenue Million Forecast, by Sector 2019 & 2032

- Table 39: Global Roofing Industry in India Revenue Million Forecast, by Material 2019 & 2032

- Table 40: Global Roofing Industry in India Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 41: Global Roofing Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Turkey Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Israel Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: GCC Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: North Africa Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East & Africa Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Roofing Industry in India Revenue Million Forecast, by Sector 2019 & 2032

- Table 49: Global Roofing Industry in India Revenue Million Forecast, by Material 2019 & 2032

- Table 50: Global Roofing Industry in India Revenue Million Forecast, by Roofing Type 2019 & 2032

- Table 51: Global Roofing Industry in India Revenue Million Forecast, by Country 2019 & 2032

- Table 52: China Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: India Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: South Korea Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: ASEAN Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Oceania Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Roofing Industry in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Roofing Industry in India?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the Roofing Industry in India?

Key companies in the market include CK Birla Group, Moon Pvc Roofing, Indian Roofing Industries Pvt Ltd, Metecno India Pvt Limited**List Not Exhaustive, Tata Bluescope Steel, Bansal Roofing Products Limited, Hindalco Ind Ltd, Dion Incorporation, Everest Industries Limited, Aqua Star.

3. What are the main segments of the Roofing Industry in India?

The market segments include Sector, Material, Roofing Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Disposable Income and Middle-Class Expansion; Increased Awareness of Roofing Solutions.

6. What are the notable trends driving market growth?

Increasing Construction Activities to Bolster the Growth of the Roofing Industry in India.

7. Are there any restraints impacting market growth?

The presence of counterfeit or substandard roofing materials in the market poses a significant challenge; The roofing industry faces a shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Roofing Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Roofing Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Roofing Industry in India?

To stay informed about further developments, trends, and reports in the Roofing Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence