Key Insights

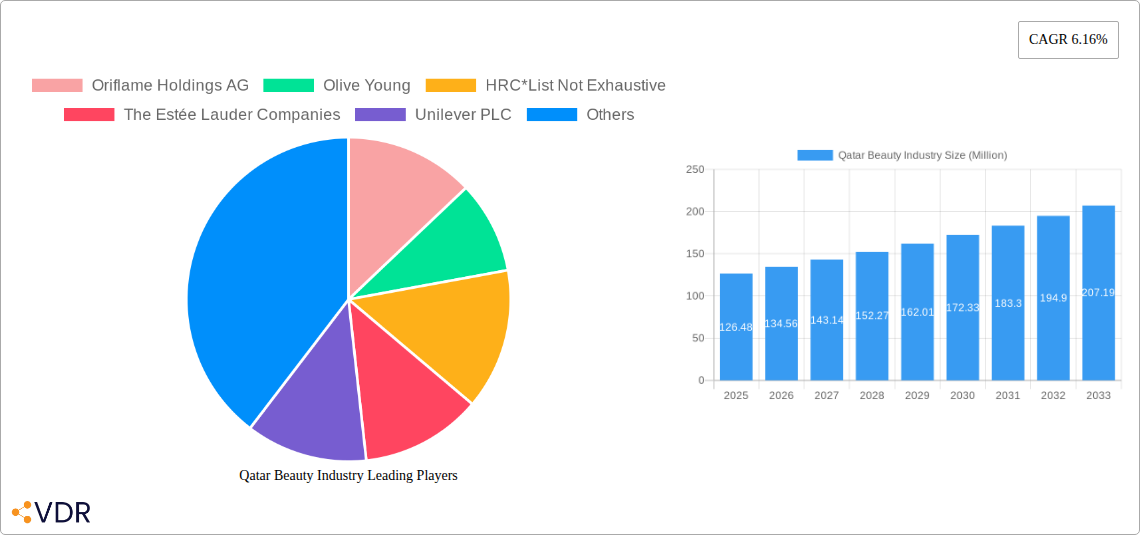

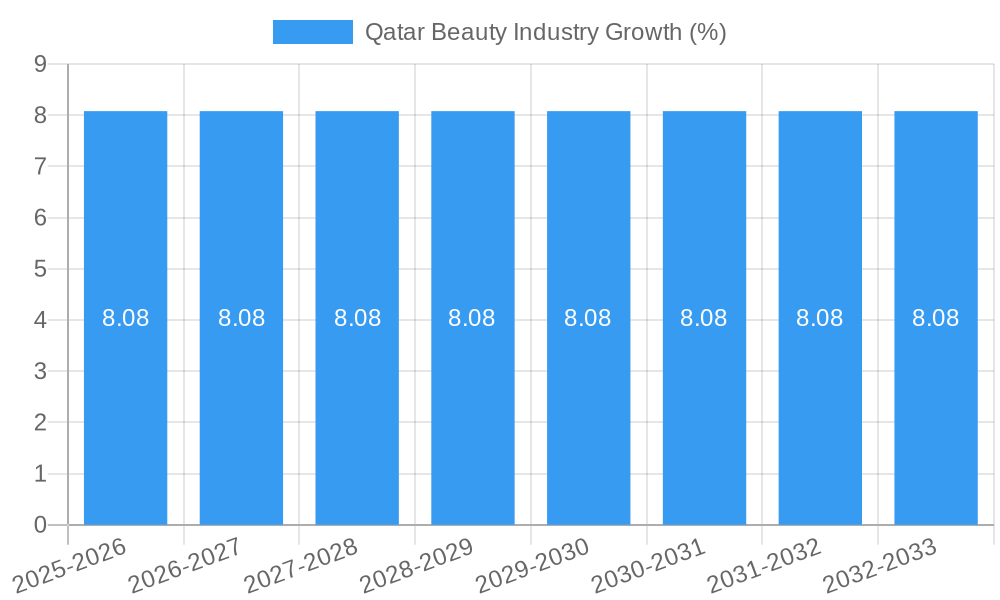

The Qatari beauty industry, valued at $126.48 million in 2025, is projected to experience robust growth, driven by a rising young population with increasing disposable incomes and a growing preference for premium and personalized beauty products. The market's Compound Annual Growth Rate (CAGR) of 6.16% from 2019 to 2024 suggests a continued upward trajectory, fueled by factors such as the expanding tourism sector and a heightened awareness of personal grooming and self-care amongst consumers. Key segments contributing to this growth include color cosmetics (especially lip and nail products), hair styling and coloring products, and online retail channels. The rise of e-commerce has significantly broadened market access, contributing to increased sales and convenience for consumers. Competition is intense, with both international giants like L'Oréal, Estée Lauder, and Unilever, and local players like Belo Essentials vying for market share. Potential restraints could include economic fluctuations affecting consumer spending and the increasing prevalence of counterfeit products within the retail landscape. However, the overall outlook remains optimistic, with continued expansion anticipated throughout the forecast period (2025-2033).

The strong performance of the color cosmetics and hair care segments reflects a growing trend towards self-expression and personal style amongst Qatari consumers. Hypermarkets and supermarkets continue to dominate distribution channels, but the rapid growth of online retail presents significant opportunities for brands to expand their reach and target specific demographics. Future growth will likely be influenced by factors such as the increasing popularity of natural and organic beauty products, the rising demand for personalized skincare solutions, and the evolving preferences of younger consumers who are more digitally savvy and receptive to influencer marketing. To thrive in this dynamic market, companies will need to adapt to evolving consumer demands, leverage innovative marketing strategies, and ensure a strong supply chain to meet growing demand. Furthermore, addressing concerns related to product authenticity will be crucial in maintaining consumer trust and fostering long-term market growth.

This comprehensive report provides an in-depth analysis of the dynamic Qatar beauty industry, encompassing market size, growth trends, key players, and future prospects. From color cosmetics to hair styling products, and across various distribution channels, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to navigate this thriving market. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024.

Qatar Beauty Industry Market Dynamics & Structure

The Qatar beauty market exhibits a moderately concentrated structure, with both international and regional players vying for market share. Technological innovation, driven by trends like personalized beauty and sustainable formulations, is a key driver. Stringent regulatory frameworks concerning product safety and labeling influence market dynamics. The market faces competition from substitute products like natural remedies and homemade beauty solutions. The end-user demographic is diverse, encompassing varying age groups, income levels, and cultural preferences. M&A activity in the region has been moderate, with several strategic acquisitions aimed at expanding market reach and product portfolios.

- Market Concentration: Moderately Concentrated (xx%)

- Innovation Drivers: Personalized beauty, sustainable ingredients, digital marketing.

- Regulatory Landscape: Stringent safety and labeling regulations.

- Substitute Products: Natural remedies, DIY beauty products.

- M&A Activity: Moderate, with xx deals recorded in the last 5 years. (estimated)

- End-User Demographics: Diverse, reflecting Qatar’s multicultural population.

Qatar Beauty Industry Growth Trends & Insights

The Qatar beauty market is experiencing robust growth, driven by rising disposable incomes, increasing awareness of beauty and personal care, and the growing popularity of online retail. The market size is projected to reach xx million by 2025 and continue to grow at a CAGR of xx% during the forecast period. The adoption rate of premium and specialized beauty products is increasing, reflecting a shift towards sophisticated consumer preferences. Technological disruptions, such as AI-powered personalized recommendations and AR/VR applications for virtual try-ons, are transforming the customer experience and driving market expansion. Consumer behavior is evolving towards a greater preference for ethically sourced, sustainable, and inclusive beauty products.

Dominant Regions, Countries, or Segments in Qatar Beauty Industry

The Doha metropolitan area currently dominates the Qatar beauty market, owing to higher purchasing power and concentration of retail outlets. Within product segments, color cosmetics, specifically lipsticks and eye makeup, holds a significant market share, followed by hair styling and coloring products. Online retail stores are experiencing rapid growth, driven by convenience and accessibility. Hypermarkets/supermarkets continue to be a major distribution channel, owing to their widespread presence and competitive pricing.

- Dominant Region: Doha metropolitan area.

- Leading Product Segments: Color Cosmetics (xx Million), Hair Styling and Coloring Products (xx Million).

- Fastest-Growing Distribution Channel: Online Retail Stores (xx% CAGR).

- Key Drivers: Rising disposable incomes, increasing awareness of beauty & personal care, convenience of online shopping.

Qatar Beauty Industry Product Landscape

The Qatar beauty market is characterized by a diverse product landscape encompassing innovative formulations, advanced technologies, and a wide range of product applications. Key trends include the rise of natural and organic ingredients, customized skincare solutions, and multifunctional beauty products. Brands are increasingly focusing on unique selling propositions such as exclusive formulations, advanced technologies, and sustainable packaging. Technological advancements in areas like ingredient delivery systems and packaging are enhancing product performance and user experience.

Key Drivers, Barriers & Challenges in Qatar Beauty Industry

Key Drivers: Rising disposable incomes, increasing brand awareness through social media marketing, growing preference for premium and specialized products, and the entry of international brands contribute significantly to market growth.

Challenges: Competition from regional and international brands, fluctuations in raw material prices, and stringent regulatory requirements present challenges for market players. Supply chain disruptions can also affect product availability and pricing. Furthermore, counterfeiting and the grey market present concerns for brand owners and consumers.

Emerging Opportunities in Qatar Beauty Industry

The growing demand for personalized beauty solutions presents a significant opportunity for brands offering customized products and services. The rise of e-commerce platforms and social media marketing creates new avenues for brand building and customer engagement. The increasing awareness of sustainability and ethical sourcing creates opportunities for brands focusing on environmentally friendly and socially responsible practices. Furthermore, untapped market segments such as men’s grooming and specialized beauty solutions for specific skin types and concerns present considerable potential.

Growth Accelerators in the Qatar Beauty Industry Industry

Strategic partnerships between international and local brands can foster market penetration and brand awareness. The adoption of advanced technologies in product development, marketing, and customer service enhances efficiency and improves the customer experience. Expanding distribution networks across various channels improves product accessibility and affordability. Moreover, government initiatives promoting the beauty sector can further stimulate growth.

Key Players Shaping the Qatar Beauty Industry Market

- Oriflame Holdings AG

- Olive Young

- HRC*List Not Exhaustive

- The Estée Lauder Companies

- Unilever PLC

- L'Oréal SA

- Johnson & Johnson

- Shiseido Co Ltd

- Procter & Gamble Company

- Beiersdorf AG

- Belo Essentials

- Laboratoires Pierre Fabre

Notable Milestones in Qatar Beauty Industry Sector

- May 2021: Carolina Herrera's ready-to-wear makeup line launched exclusively at Sephora stores and online in Qatar.

- March 2022: MAC launched MAC Stack mascara with a large-scale outdoor advertising campaign in the Middle East.

- March 2023: Olive Young, a K-beauty retailer, expanded into the Middle East with its own color cosmetics line, Wakemake.

In-Depth Qatar Beauty Industry Market Outlook

The Qatar beauty market presents significant growth opportunities in the coming years, driven by factors like rising disposable incomes, evolving consumer preferences, and technological advancements. Brands that adapt to the changing landscape by focusing on innovation, sustainability, and personalized experiences are poised to gain a competitive edge. Strategic investments in e-commerce and digital marketing are crucial for expanding market reach and enhancing customer engagement. The market's future potential is promising, with sustained growth projected throughout the forecast period.

Qatar Beauty Industry Segmentation

-

1. Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Makeup Products

- 1.1.2. Eye Makeup Products

- 1.1.3. Lip and Nail Makeup Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair Colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Specialty Stores

- 2.3. Pharmacy and Drug Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Qatar Beauty Industry Segmentation By Geography

- 1. Qatar

Qatar Beauty Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Workforce and Surge in Travel and Tourism; Strategic Innovations by Market Players

- 3.3. Market Restrains

- 3.3.1. High Dominance of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Natural/Organic Facial Makeup Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Beauty Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Makeup Products

- 5.1.1.2. Eye Makeup Products

- 5.1.1.3. Lip and Nail Makeup Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair Colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Pharmacy and Drug Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Oriflame Holdings AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Olive Young

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HRC*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Estée Lauder Companies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Unilever PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oréal SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Johnson & Johnson

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shiseido Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Procter & Gamble Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Beiersdorf AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Belo Essentials

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Laboratoires Pierre Fabre

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Oriflame Holdings AG

List of Figures

- Figure 1: Qatar Beauty Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Beauty Industry Share (%) by Company 2024

List of Tables

- Table 1: Qatar Beauty Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Beauty Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Qatar Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Qatar Beauty Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Qatar Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Qatar Beauty Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Qatar Beauty Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Qatar Beauty Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Beauty Industry?

The projected CAGR is approximately 6.16%.

2. Which companies are prominent players in the Qatar Beauty Industry?

Key companies in the market include Oriflame Holdings AG, Olive Young, HRC*List Not Exhaustive, The Estée Lauder Companies, Unilever PLC, L'Oréal SA, Johnson & Johnson, Shiseido Co Ltd, Procter & Gamble Company, Beiersdorf AG, Belo Essentials, Laboratoires Pierre Fabre.

3. What are the main segments of the Qatar Beauty Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Workforce and Surge in Travel and Tourism; Strategic Innovations by Market Players.

6. What are the notable trends driving market growth?

Growing Demand for Natural/Organic Facial Makeup Products.

7. Are there any restraints impacting market growth?

High Dominance of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In March 2023, with its own color cosmetics line, K-beauty retailer Olive Young is expanding into the Middle East. In 2023, it announced plans to introduce more of its brands. The retailer's regional headquarters would also be in the United Arab Emirates. It decided to enter the market with Wakemake, a makeup line that may be well-liked by domestic customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Beauty Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Beauty Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Beauty Industry?

To stay informed about further developments, trends, and reports in the Qatar Beauty Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence