Key Insights

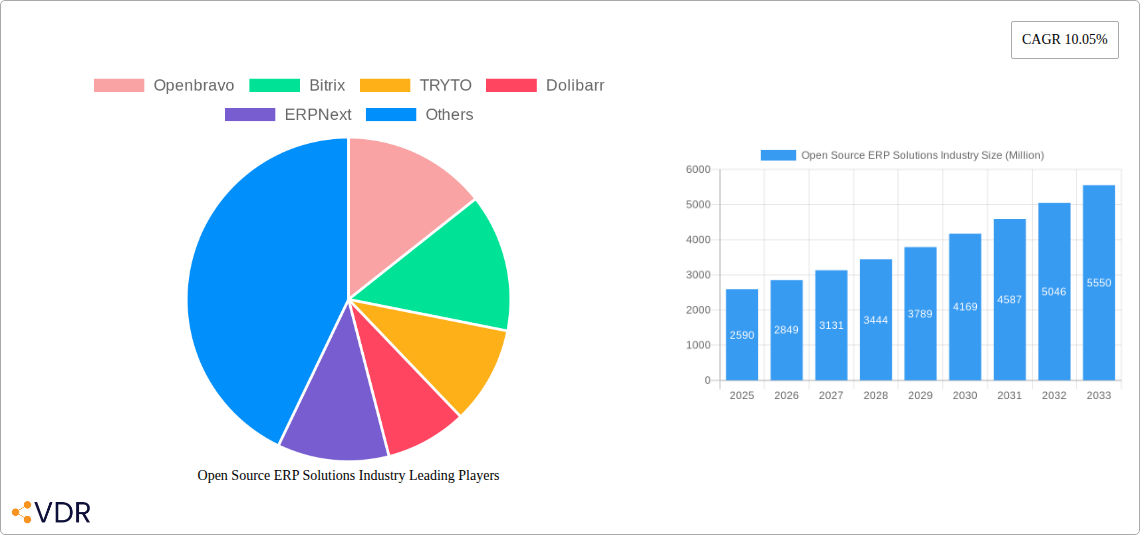

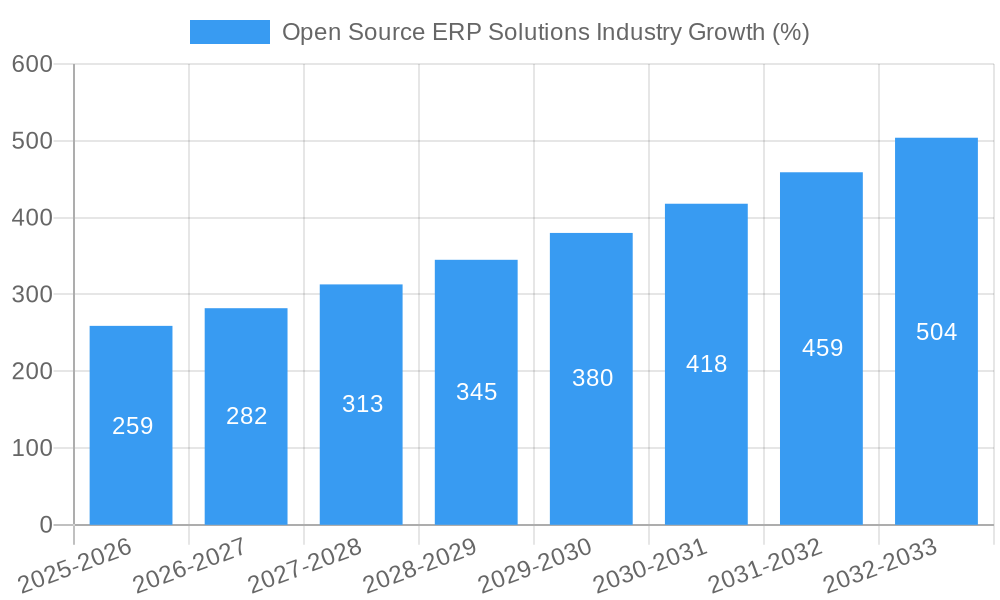

The open-source ERP (Enterprise Resource Planning) solutions market is experiencing robust growth, projected to reach $2.59 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.05% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the inherent cost-effectiveness of open-source solutions appeals to small and medium-sized companies (SMEs) seeking to optimize their IT budgets without compromising functionality. Secondly, the increasing demand for customization and flexibility drives adoption, as open-source ERP systems allow businesses to tailor solutions to their specific needs, unlike proprietary alternatives. The rise of cloud-based deployment further enhances accessibility and scalability, attracting larger enterprises seeking agile and cost-efficient solutions. Key industry verticals driving growth include Information Technology, BFSI (Banking, Financial Services, and Insurance), Telecommunications, and Healthcare, all of which benefit from the improved efficiency and data management capabilities of modern ERP systems.

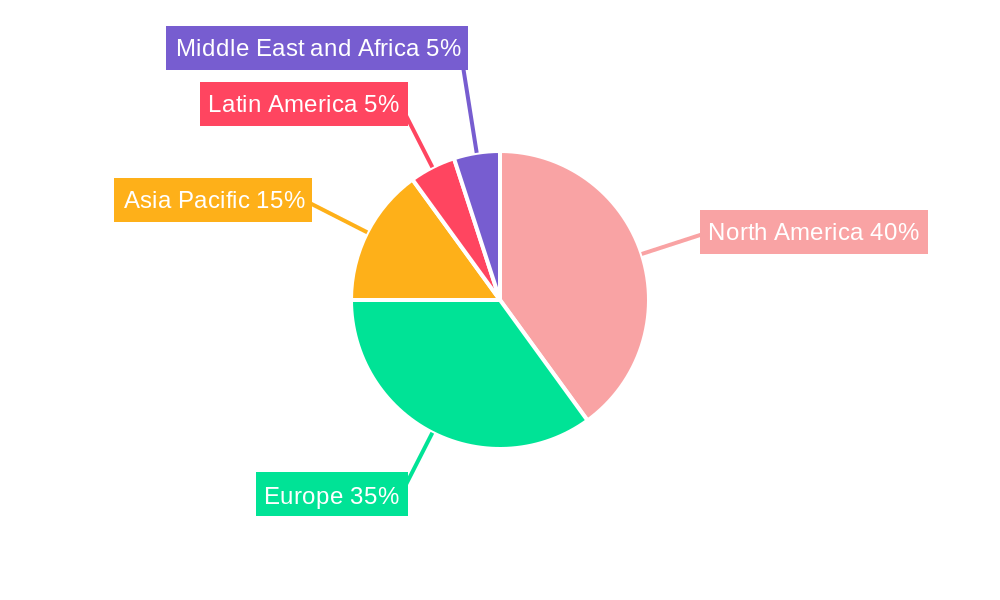

The market segmentation reveals a significant presence of both cloud and on-premises deployments, catering to diverse business needs and IT infrastructure capabilities. While large companies often opt for customized, on-premise solutions, SMEs are increasingly leveraging cloud-based open-source ERPs for their ease of implementation and reduced operational overhead. Geographical distribution indicates a strong presence across North America and Europe, with significant growth potential in the Asia-Pacific region fueled by increasing digitalization and technological advancements. However, challenges remain, including the need for robust technical support and integration complexities, which may slow down adoption in certain segments. The competitive landscape features a mix of established players like Openbravo and newer entrants, indicating continuous innovation and market evolution. The long-term forecast suggests that this market will continue its upward trajectory, driven by evolving business requirements and the enduring appeal of open-source flexibility and cost-effectiveness.

Open Source ERP Solutions Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Open Source ERP Solutions market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024. The report segments the market by deployment mode (cloud, on-premises), organization size (SMEs, large companies), and end-user verticals (Information Technology, BFSI, Telecommunication, Healthcare, Retail, Education, and Others). Key players like Openbravo, Bitrix, TRYTO, Dolibarr, ERPNext, Metasfresh, iDempiere, Compiere, xTuple, MixERP, OpenPro, and ERP are analyzed in detail. The total market size is projected at xx Million in 2025.

Open Source ERP Solutions Industry Market Dynamics & Structure

The Open Source ERP Solutions market exhibits a moderately fragmented structure, with several established players and emerging entrants vying for market share. Technological innovation, particularly in areas like AI and cloud computing, is a major driver of growth. Regulatory frameworks concerning data privacy and security significantly impact market dynamics. Cloud-based solutions are witnessing accelerated adoption, presenting a compelling alternative to traditional on-premises deployments. The market also sees increasing consolidation through mergers and acquisitions (M&A), as larger players seek to expand their capabilities and market reach. The number of M&A deals in the period 2019-2024 was xx.

- Market Concentration: Moderately fragmented, with xx% market share held by the top 5 players in 2025.

- Technological Innovation: Cloud computing, AI, and machine learning are driving innovation.

- Regulatory Landscape: Data privacy regulations (e.g., GDPR) influence vendor strategies.

- Competitive Substitutes: Proprietary ERP solutions and specialized SaaS applications pose competition.

- End-User Demographics: SMEs and large enterprises across various verticals are driving adoption.

- M&A Activity: A moderate level of consolidation is observed, with xx M&A deals recorded in the past five years.

Open Source ERP Solutions Industry Growth Trends & Insights

The Open Source ERP Solutions market is experiencing robust growth, driven by increasing adoption across diverse industries. The market witnessed a CAGR of xx% during 2019-2024 and is projected to maintain a CAGR of xx% from 2025 to 2033. Technological disruptions, such as the rise of cloud computing and the integration of AI, are significantly impacting market adoption rates. Businesses are shifting towards flexible and scalable solutions, leading to increased demand for open-source ERP systems.

The cloud deployment model is gaining significant traction, fueled by its cost-effectiveness and ease of access. Consumer behavior shifts towards digital transformation and automation are further contributing to the market's expansion. Market penetration is estimated at xx% in 2025, projected to reach xx% by 2033. The total market size is expected to reach xx Million by 2033.

Dominant Regions, Countries, or Segments in Open Source ERP Solutions Industry

The North American and European regions currently dominate the Open Source ERP Solutions market, driven by higher adoption rates among large enterprises and a robust technological infrastructure. However, significant growth potential exists in the Asia-Pacific region, particularly in developing economies experiencing rapid digital transformation.

- By Deployment Mode: The cloud segment is experiencing the highest growth, driven by scalability and cost-effectiveness.

- By Organization Size: SMEs constitute a larger portion of the market, owing to the cost-effectiveness and flexibility of open-source solutions.

- By End-user Verticals: The IT and BFSI sectors are key drivers, followed by the telecommunication and retail sectors. The Healthcare sector is also showing significant growth potential.

North America holds the largest market share in 2025, estimated at xx Million, due to high technological maturity and strong enterprise adoption. Europe and Asia-Pacific are expected to witness significant growth during the forecast period.

Open Source ERP Solutions Industry Product Landscape

Open source ERP solutions offer a wide array of features tailored to different business needs. Products integrate functionalities such as accounting, inventory management, customer relationship management (CRM), supply chain management (SCM), and human resource management (HRM). Key advancements include improved user interfaces, enhanced mobile accessibility, and robust integrations with other business applications. The unique selling proposition lies in flexibility, customization, cost-effectiveness, and community support. Technological advancements focus on AI-driven insights, improved data analytics, and enhanced security features.

Key Drivers, Barriers & Challenges in Open Source ERP Solutions Industry

Key Drivers:

- Cost-effectiveness: Open-source solutions eliminate licensing fees, resulting in significant cost savings.

- Flexibility and Customization: Open-source solutions can be adapted to specific business requirements.

- Community Support: Large and active communities provide extensive support and resources.

- Increased Security and Transparency: Open-source code allows for greater transparency and improved security audits.

Key Challenges:

- Implementation Complexity: Implementing complex ERP systems can be challenging and require specialized expertise. This leads to higher implementation costs and longer deployment times.

- Lack of Standardized Support: While community support is available, it may not always be sufficient, leading to potential downtime. This results in xx Million loss annually.

- Integration Difficulties: Integrating open-source ERP systems with legacy systems can pose challenges.

Emerging Opportunities in Open Source ERP Solutions Industry

The rising adoption of cloud-based solutions, the expansion into new verticals (e.g., manufacturing and agriculture), and the integration of emerging technologies like blockchain and IoT present significant opportunities. Untapped markets in developing countries offer substantial growth potential. The demand for specialized industry solutions tailored to specific business needs is driving innovation.

Growth Accelerators in the Open Source ERP Solutions Industry Industry

Technological advancements, strategic partnerships (e.g., between open-source vendors and cloud providers), and aggressive market expansion strategies are key growth catalysts. Investing in R&D and developing innovative solutions tailored to specific industry needs will further propel market expansion. Focus on improving user experience, streamlining implementation processes, and enhancing security features will attract a larger customer base.

Key Players Shaping the Open Source ERP Solutions Industry Market

Notable Milestones in Open Source ERP Solutions Industry Sector

- July 2021: Odoo receives USD 215 million in funding, achieving unicorn status.

- April 2021: Samsung Electronics launches its N-ERP system, leveraging open APIs.

In-Depth Open Source ERP Solutions Industry Market Outlook

The Open Source ERP Solutions market is poised for sustained growth, driven by technological advancements, increasing adoption across diverse industries, and the expansion into untapped markets. Strategic partnerships and investments in R&D will further accelerate market expansion. Focus on improving user experience and addressing implementation challenges will unlock significant growth potential. The market is projected to witness considerable expansion, with a strong focus on cloud-based solutions and vertical-specific applications.

Open Source ERP Solutions Industry Segmentation

-

1. Deployment Mode

- 1.1. Cloud

- 1.2. On-premises

-

2. Organization Size

- 2.1. Small and Medium Sized Companies

- 2.2. Large Companies

-

3. End-user Verticals

- 3.1. Information Technology

- 3.2. BFSI

- 3.3. Telecommunication

- 3.4. Healthcare

- 3.5. Retail

- 3.6. Education

- 3.7. Other End-user Verticals

Open Source ERP Solutions Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Open Source ERP Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Seamless Customer Experience; Integration of Advanced Technologies such as AI

- 3.2.2 IoT

- 3.2.3 and Analytics

- 3.3. Market Restrains

- 3.3.1. Rising Complexities to Implement Transition from Manual to Software Testing Process

- 3.4. Market Trends

- 3.4.1. Cloud Deployments to Witness Highest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.1.1. Cloud

- 5.1.2. On-premises

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Sized Companies

- 5.2.2. Large Companies

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Information Technology

- 5.3.2. BFSI

- 5.3.3. Telecommunication

- 5.3.4. Healthcare

- 5.3.5. Retail

- 5.3.6. Education

- 5.3.7. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6. North America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.1.1. Cloud

- 6.1.2. On-premises

- 6.2. Market Analysis, Insights and Forecast - by Organization Size

- 6.2.1. Small and Medium Sized Companies

- 6.2.2. Large Companies

- 6.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 6.3.1. Information Technology

- 6.3.2. BFSI

- 6.3.3. Telecommunication

- 6.3.4. Healthcare

- 6.3.5. Retail

- 6.3.6. Education

- 6.3.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7. Europe Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.1.1. Cloud

- 7.1.2. On-premises

- 7.2. Market Analysis, Insights and Forecast - by Organization Size

- 7.2.1. Small and Medium Sized Companies

- 7.2.2. Large Companies

- 7.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 7.3.1. Information Technology

- 7.3.2. BFSI

- 7.3.3. Telecommunication

- 7.3.4. Healthcare

- 7.3.5. Retail

- 7.3.6. Education

- 7.3.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8. Asia Pacific Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.1.1. Cloud

- 8.1.2. On-premises

- 8.2. Market Analysis, Insights and Forecast - by Organization Size

- 8.2.1. Small and Medium Sized Companies

- 8.2.2. Large Companies

- 8.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 8.3.1. Information Technology

- 8.3.2. BFSI

- 8.3.3. Telecommunication

- 8.3.4. Healthcare

- 8.3.5. Retail

- 8.3.6. Education

- 8.3.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9. Latin America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.1.1. Cloud

- 9.1.2. On-premises

- 9.2. Market Analysis, Insights and Forecast - by Organization Size

- 9.2.1. Small and Medium Sized Companies

- 9.2.2. Large Companies

- 9.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 9.3.1. Information Technology

- 9.3.2. BFSI

- 9.3.3. Telecommunication

- 9.3.4. Healthcare

- 9.3.5. Retail

- 9.3.6. Education

- 9.3.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10. Middle East and Africa Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.1.1. Cloud

- 10.1.2. On-premises

- 10.2. Market Analysis, Insights and Forecast - by Organization Size

- 10.2.1. Small and Medium Sized Companies

- 10.2.2. Large Companies

- 10.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 10.3.1. Information Technology

- 10.3.2. BFSI

- 10.3.3. Telecommunication

- 10.3.4. Healthcare

- 10.3.5. Retail

- 10.3.6. Education

- 10.3.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 11. North America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Open Source ERP Solutions Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Openbravo

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bitrix

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 TRYTO

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Dolibarr

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 ERPNext

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Metasfresh

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 iDempiere

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Compiere

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 xTuple

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 MixERP

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 OpenPro

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 ERP

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Openbravo

List of Figures

- Figure 1: Global Open Source ERP Solutions Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 13: North America Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 14: North America Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 15: North America Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 16: North America Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 17: North America Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 18: North America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 21: Europe Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 22: Europe Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 23: Europe Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 24: Europe Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 25: Europe Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 26: Europe Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 29: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 30: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 31: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 32: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 33: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 34: Asia Pacific Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 37: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 38: Latin America Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 39: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 40: Latin America Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 41: Latin America Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 42: Latin America Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Deployment Mode 2024 & 2032

- Figure 45: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Deployment Mode 2024 & 2032

- Figure 46: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 47: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 48: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by End-user Verticals 2024 & 2032

- Figure 49: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by End-user Verticals 2024 & 2032

- Figure 50: Middle East and Africa Open Source ERP Solutions Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Open Source ERP Solutions Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 3: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 5: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Open Source ERP Solutions Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 17: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 18: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 19: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 21: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 22: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 23: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 25: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 26: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 27: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 29: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 30: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 31: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 33: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 34: Global Open Source ERP Solutions Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 35: Global Open Source ERP Solutions Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Open Source ERP Solutions Industry?

The projected CAGR is approximately 10.05%.

2. Which companies are prominent players in the Open Source ERP Solutions Industry?

Key companies in the market include Openbravo, Bitrix, TRYTO, Dolibarr, ERPNext, Metasfresh, iDempiere, Compiere, xTuple, MixERP, OpenPro, ERP.

3. What are the main segments of the Open Source ERP Solutions Industry?

The market segments include Deployment Mode, Organization Size, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.59 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Seamless Customer Experience; Integration of Advanced Technologies such as AI. IoT. and Analytics.

6. What are the notable trends driving market growth?

Cloud Deployments to Witness Highest Market Growth.

7. Are there any restraints impacting market growth?

Rising Complexities to Implement Transition from Manual to Software Testing Process.

8. Can you provide examples of recent developments in the market?

July 2021 - Odoo, a Belgium-based provider of open-source ERP software, received USD 215 million from Summit Partners. This investment values the startup at over EUR 2 billion, making Odoo the first unicorn out of Wallonia, the region in Belgium where it is based.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Open Source ERP Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Open Source ERP Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Open Source ERP Solutions Industry?

To stay informed about further developments, trends, and reports in the Open Source ERP Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence