Key Insights

The North American clean energy market, currently valued at approximately $X million in 2025 (estimated based on the provided CAGR of >7.20% and unspecified market size XX), is poised for robust growth through 2033. Driven by increasing government incentives promoting renewable energy adoption, stringent environmental regulations aimed at reducing carbon emissions, and a growing corporate commitment to sustainability, this sector demonstrates significant potential. Key drivers include the decreasing cost of renewable energy technologies, particularly solar and wind power, making them increasingly competitive with fossil fuels. Furthermore, advancements in energy storage solutions address the intermittency challenges associated with solar and wind, furthering their market penetration. The market is segmented into hydro, solar, wind, bioenergy, and others, with solar and wind likely holding the largest market shares due to their scalability and technological advancements. While growth is projected to be strong, challenges remain, including grid infrastructure limitations, permitting complexities, and land-use conflicts.

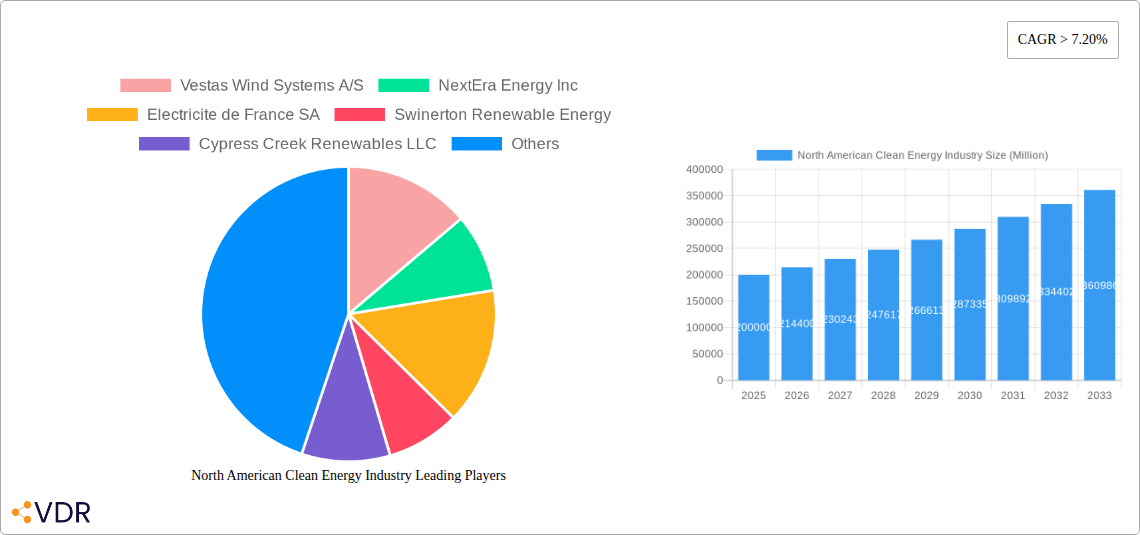

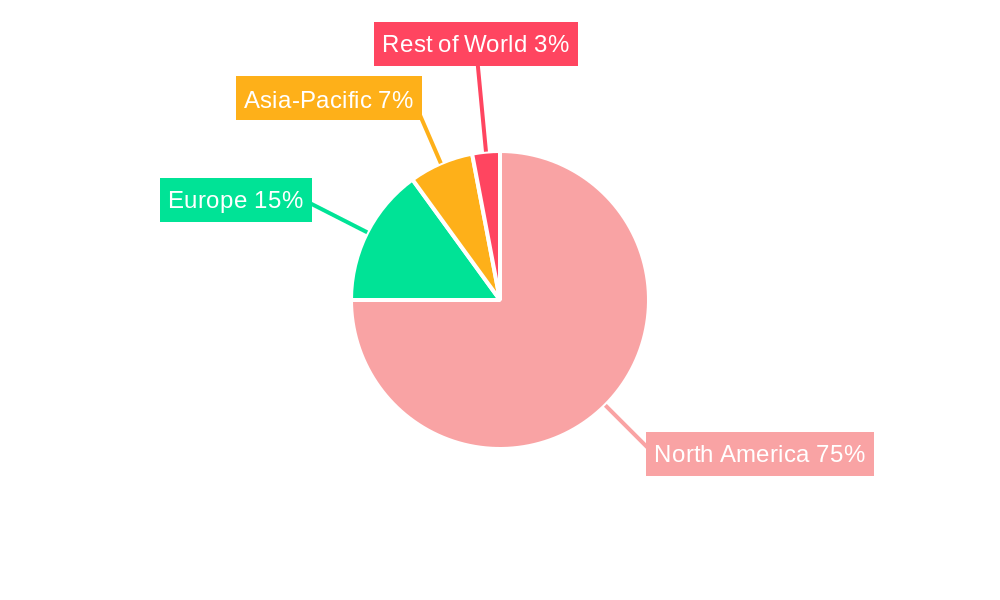

Despite these restraints, the projected CAGR of over 7.20% indicates a substantial market expansion over the forecast period (2025-2033). The United States, Canada, and Mexico represent the core of the North American market, each contributing unique dynamics. The US, with its diverse geography and substantial policy support, likely holds the largest share. Canada benefits from abundant hydropower resources, while Mexico's solar potential is considerable. Major players such as Vestas, NextEra Energy, EDF, and others are actively shaping the landscape through investments in renewable energy projects, technology innovation, and market consolidation. Continued growth will depend on effective policy frameworks, technological innovation, and sustained private sector investment in the clean energy infrastructure.

North American Clean Energy Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North American clean energy market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). We delve into market dynamics, growth trends, key players, and emerging opportunities across various segments, including hydro, solar, wind, bioenergy, and others. The report is crucial for investors, industry professionals, policymakers, and anyone seeking a deep understanding of this rapidly evolving sector. This market analysis covers the parent market of Renewable Energy and its child market, focusing specifically on North America.

Keywords: North American clean energy, renewable energy market, solar energy, wind energy, hydro energy, bioenergy, clean energy transition, cleantech, market analysis, market forecast, industry trends, renewable energy investment, IRA impact, North American energy, Vestas, NextEra Energy, EDF, GE, Canadian Solar.

North American Clean Energy Industry Market Dynamics & Structure

The North American clean energy market is characterized by increasing consolidation, driven by technological advancements and supportive government policies. Market concentration is moderate, with a few large players holding significant market share, but a considerable number of smaller companies also contributing significantly. The market size in 2025 is estimated at $xx Billion.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Continuous improvements in solar panel efficiency, wind turbine technology, and energy storage solutions are key drivers. Barriers include high initial investment costs and grid integration challenges.

- Regulatory Framework: Government incentives, such as tax credits and subsidies, significantly influence market growth. However, regulatory inconsistencies across different states and provinces create challenges.

- Competitive Substitutes: Fossil fuels remain a significant competitor, particularly in the short-term, but are gradually being replaced by cleaner alternatives due to environmental concerns and economic factors.

- End-User Demographics: Growth is fueled by a rising demand for sustainable energy from residential, commercial, and industrial sectors. Increasing awareness of climate change is significantly influencing consumer preferences.

- M&A Trends: The number of M&A deals in the sector has increased significantly in recent years, primarily driven by the need for expansion, technological integration, and accessing new markets. The total deal value in 2024 was approximately $xx Billion.

North American Clean Energy Industry Growth Trends & Insights

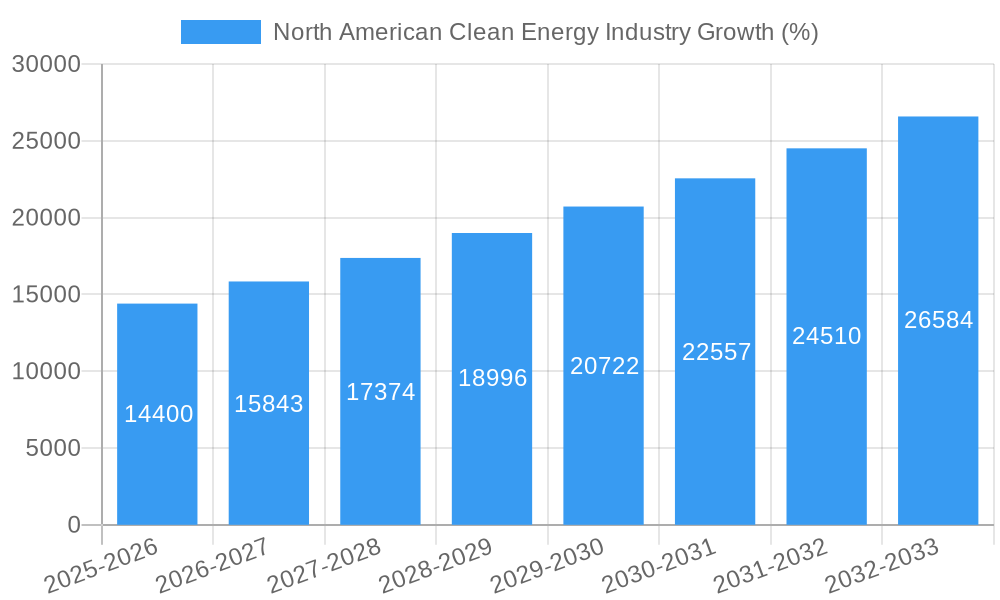

The North American clean energy market is experiencing robust growth, driven by several factors including supportive government policies, declining costs of renewable energy technologies, and increasing environmental awareness. The historical period (2019-2024) saw a Compound Annual Growth Rate (CAGR) of xx%, while the forecast period (2025-2033) is projected to show a CAGR of xx%. Market penetration of renewable energy sources in the total energy mix is steadily increasing, and is expected to reach xx% by 2033. Technological disruptions, such as advancements in energy storage and smart grid technologies, are further accelerating market growth. Shifts in consumer behavior, emphasizing sustainability and reducing carbon footprint, are also contributing to the market's expansion. The market size is expected to reach $xx Billion by 2033.

Dominant Regions, Countries, or Segments in North American Clean Energy Industry

The Western United States and Canada's provinces of Ontario and British Columbia are leading the market, benefiting from favorable regulatory environments, abundant renewable resources, and significant investments in clean energy infrastructure. The solar segment currently dominates, driven by decreasing costs and technological improvements. Wind energy also holds a substantial share, particularly in states with high wind speeds.

- Key Drivers:

- Favorable Government Policies: Tax incentives, renewable portfolio standards (RPS), and carbon pricing mechanisms stimulate growth.

- Abundant Resources: Access to ample solar irradiance, wind resources, and hydroelectric potential supports large-scale deployments.

- Infrastructure Development: Investments in transmission infrastructure and smart grid technologies are improving grid integration.

- Dominance Factors: The Western United States and certain Canadian provinces have established themselves as hubs for renewable energy development, attracting significant investments and fostering a robust ecosystem of businesses and expertise. The high growth potential of these regions is driven by supportive policies, plentiful resources, and a relatively developed grid infrastructure.

North American Clean Energy Industry Product Landscape

The North American clean energy market showcases a diverse range of products, including advanced solar panels with higher efficiency and improved durability, increasingly efficient and cost-effective wind turbines, smart grid solutions for efficient energy distribution, and advanced energy storage systems. These innovations boast enhanced performance metrics, improved grid integration capabilities, and reduced environmental impact, driving market expansion and enhancing competitiveness. Unique selling propositions include greater efficiency, reduced operational costs, and enhanced lifecycle sustainability.

Key Drivers, Barriers & Challenges in North American Clean Energy Industry

Key Drivers:

- Decreasing costs of renewable energy technologies.

- Government policies supporting renewable energy adoption.

- Growing awareness of climate change and sustainability.

Key Challenges:

- Intermittency of renewable energy sources (solar and wind).

- Grid integration challenges associated with managing the influx of renewable energy.

- Supply chain disruptions affecting the availability of critical raw materials. The impact of these disruptions on 2025 market growth is estimated to be xx%.

Emerging Opportunities in North American Clean Energy Industry

Emerging opportunities include the development of offshore wind energy, the integration of renewable energy into existing infrastructure, and the growth of green hydrogen production. The increasing demand for energy storage solutions and the expansion into emerging markets further present significant opportunities. Untapped markets include rural communities and underserved regions that can benefit from decentralized renewable energy systems.

Growth Accelerators in the North American Clean Energy Industry

Technological breakthroughs, especially in energy storage and efficiency enhancements, are crucial growth catalysts. Strategic partnerships between technology providers, utilities, and developers accelerate market adoption. Expansion into new markets, such as offshore wind and green hydrogen, unlocks further potential. The Inflation Reduction Act (IRA) in the US, significantly boosts investment and accelerates growth.

Key Players Shaping the North American Clean Energy Industry Market

- Vestas Wind Systems A/S

- NextEra Energy Inc

- Electricite de France SA

- Swinerton Renewable Energy

- Cypress Creek Renewables LLC

- General Electric Co

- Schneider Electric SE

- Signal Energy LLC

- Canadian Solar Inc

- Strata Solar LLC

- MA Mortenson Co

Notable Milestones in North American Clean Energy Industry Sector

- October 2022: The United States and India announced a new energy task force to promote renewable energy integration. This significantly boosted international cooperation in the clean energy sector.

- October 2022: Following the signing of the IRA, almost USD 28 billion in new manufacturing investments were announced, primarily in solar, battery, and electric vehicle production. This demonstrates the significant impact of policy support on investment and job creation.

In-Depth North American Clean Energy Industry Market Outlook

The North American clean energy market is poised for continued strong growth, driven by technological advancements, supportive government policies, and rising consumer demand for sustainable energy solutions. Strategic partnerships and investments in innovative technologies, such as advanced energy storage and smart grids, will further propel market expansion. The market presents significant opportunities for investors, businesses, and policymakers focused on achieving a sustainable energy future.

North American Clean Energy Industry Segmentation

-

1. Type

- 1.1. Hydro

- 1.2. Solar

- 1.3. Wind

- 1.4. Bioenergy

- 1.5. Others

-

2. Geography

- 2.1. Canada

- 2.2. United States

- 2.3. Rest of North America

North American Clean Energy Industry Segmentation By Geography

- 1. Canada

- 2. United States

- 3. Rest of North America

North American Clean Energy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth

- 3.4. Market Trends

- 3.4.1. Solar Energy is Expected to have Significant Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hydro

- 5.1.2. Solar

- 5.1.3. Wind

- 5.1.4. Bioenergy

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Canada

- 5.2.2. United States

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.3.2. United States

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Canada North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hydro

- 6.1.2. Solar

- 6.1.3. Wind

- 6.1.4. Bioenergy

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Canada

- 6.2.2. United States

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United States North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hydro

- 7.1.2. Solar

- 7.1.3. Wind

- 7.1.4. Bioenergy

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Canada

- 7.2.2. United States

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hydro

- 8.1.2. Solar

- 8.1.3. Wind

- 8.1.4. Bioenergy

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Canada

- 8.2.2. United States

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North American Clean Energy Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Vestas Wind Systems A/S

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 NextEra Energy Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Electricite de France SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Swinerton Renewable Energy

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cypress Creek Renewables LLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 General Electric Co

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Schneider Electric SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Signal Energy LLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Canadian Solar Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Strata Solar LLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 MA Mortenson Co

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Vestas Wind Systems A/S

List of Figures

- Figure 1: North American Clean Energy Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North American Clean Energy Industry Share (%) by Company 2024

List of Tables

- Table 1: North American Clean Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North American Clean Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: North American Clean Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 5: North American Clean Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 7: North American Clean Energy Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North American Clean Energy Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 9: North American Clean Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North American Clean Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 11: United States North American Clean Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North American Clean Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 13: Canada North American Clean Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North American Clean Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 15: Mexico North American Clean Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North American Clean Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North American Clean Energy Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North American Clean Energy Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: North American Clean Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 21: North American Clean Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 23: North American Clean Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North American Clean Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 25: North American Clean Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 27: North American Clean Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 29: North American Clean Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North American Clean Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 31: North American Clean Energy Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 32: North American Clean Energy Industry Volume Gigawatt Forecast, by Type 2019 & 2032

- Table 33: North American Clean Energy Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North American Clean Energy Industry Volume Gigawatt Forecast, by Geography 2019 & 2032

- Table 35: North American Clean Energy Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North American Clean Energy Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Clean Energy Industry?

The projected CAGR is approximately > 7.20%.

2. Which companies are prominent players in the North American Clean Energy Industry?

Key companies in the market include Vestas Wind Systems A/S, NextEra Energy Inc, Electricite de France SA, Swinerton Renewable Energy, Cypress Creek Renewables LLC, General Electric Co, Schneider Electric SE, Signal Energy LLC, Canadian Solar Inc, Strata Solar LLC, MA Mortenson Co.

3. What are the main segments of the North American Clean Energy Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Integration Of Renewable Energy Generation4.; Aging Power Grids And Investments In Transmission And Distribution Infrastructure.

6. What are the notable trends driving market growth?

Solar Energy is Expected to have Significant Growth in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Raw Material Prices And Investment In Distributed Renewable Energy Generation Affect The Growth.

8. Can you provide examples of recent developments in the market?

In October 2022, the United States and India announced that a new energy task force would be established to promote the extensive integration of renewable energy required to enable the clean energy transition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Clean Energy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Clean Energy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Clean Energy Industry?

To stay informed about further developments, trends, and reports in the North American Clean Energy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence