Key Insights

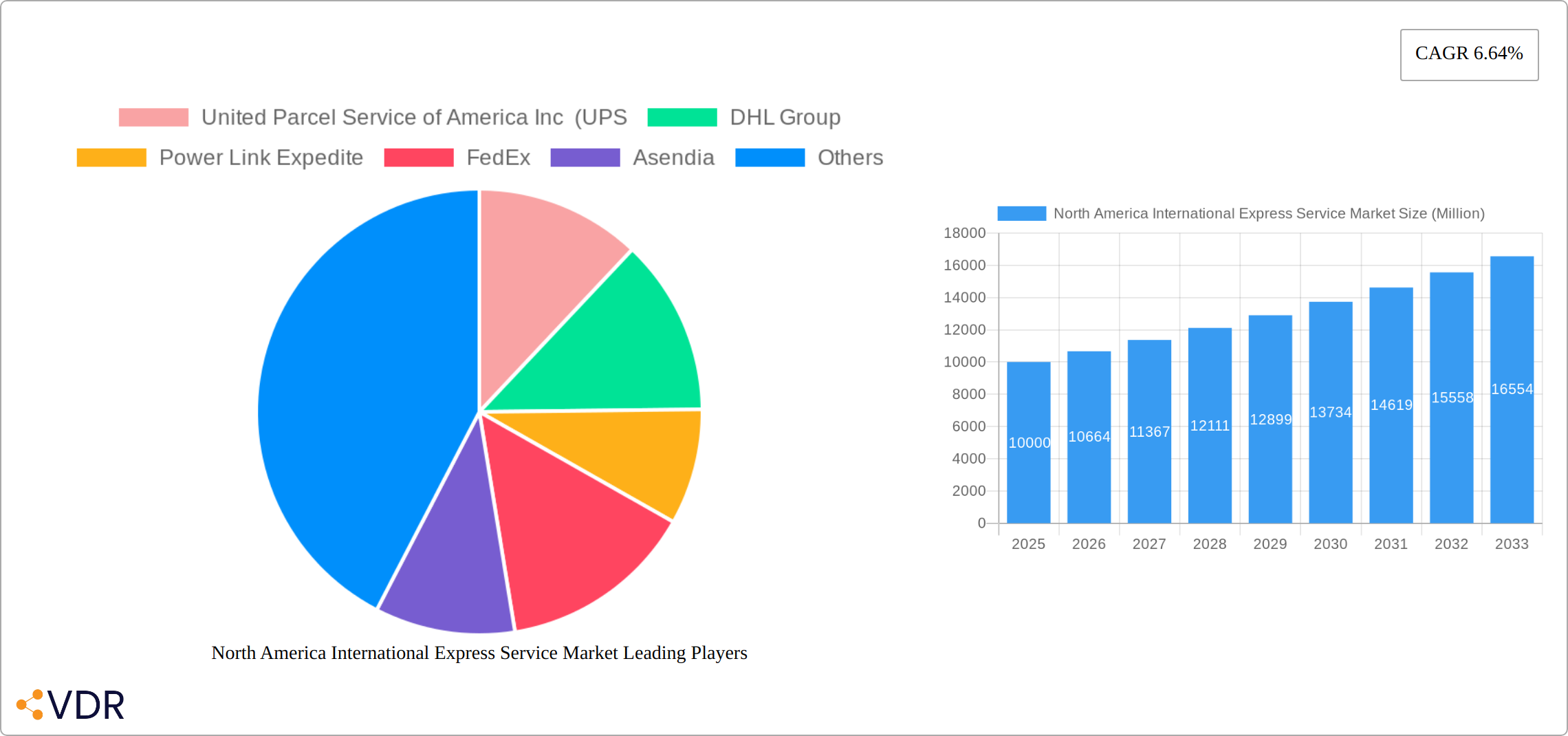

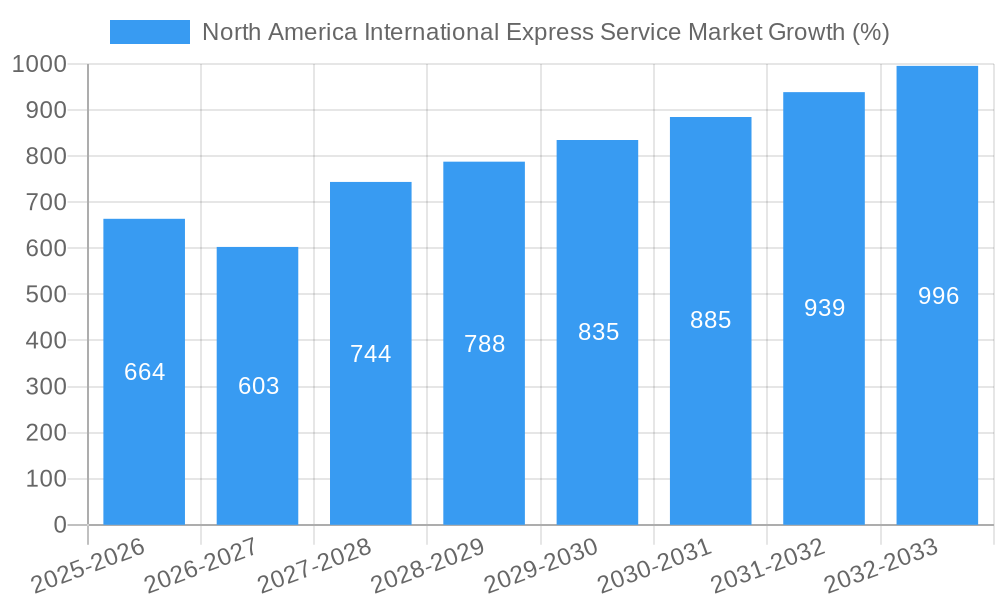

The North America international express service market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.64% from 2025 to 2033. This expansion is fueled by several key drivers. The surge in e-commerce, particularly cross-border transactions, significantly boosts demand for swift and reliable international shipping. Simultaneously, the increasing globalization of businesses necessitates efficient and expedited delivery solutions for both raw materials and finished goods, further propelling market growth. Technological advancements, such as improved tracking systems and automated sorting facilities, enhance operational efficiency and customer satisfaction, contributing to market expansion. However, factors such as fluctuating fuel prices and geopolitical instability pose challenges to consistent growth. Furthermore, the increasing complexities of international trade regulations and customs procedures can add operational hurdles.

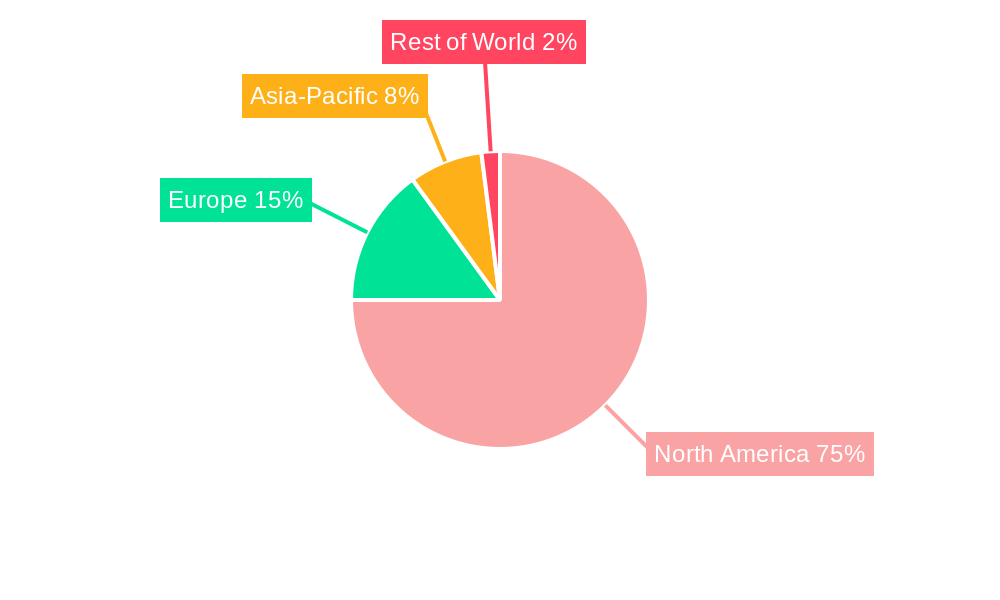

Segment-wise, the market is categorized into heavy, medium, and lightweight shipments. While precise segmental market share data is unavailable, it's reasonable to assume that the medium-weight shipment segment currently holds the largest share, driven by the prevalent nature of e-commerce packages. Heavyweight shipments are expected to grow steadily, driven by increasing industrial goods exports. The competitive landscape comprises major players like UPS, FedEx, DHL, and others, each vying for market dominance through strategic partnerships, technological innovation, and expanded service offerings. Within North America, the United States commands the largest share of the market due to its robust economy and high volume of international trade. Canada and Mexico also contribute significantly, albeit at a smaller scale, reflecting their respective levels of import and export activities. The forecast period suggests sustained growth, influenced by continued e-commerce expansion and ongoing globalization efforts. The market will likely see increased investment in technology and infrastructure to accommodate this rising demand.

North America International Express Service Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America international express service market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this rapidly evolving market. The market is segmented by shipment weight (heavy, light, medium) and encompasses both the parent market (international express services) and the child market (North American operations). The total market value is predicted to reach xx Million units by 2033.

North America International Express Service Market Dynamics & Structure

The North American international express service market is characterized by a high degree of concentration, with major players like UPS, FedEx, and DHL holding significant market share. Technological innovation, particularly in automation and tracking, is a key driver, while regulatory frameworks and cross-border trade policies significantly impact operations. Competitive pressures from alternative shipping methods and the rise of e-commerce influence market dynamics. The market's end-user demographic is broad, including businesses of all sizes and individual consumers. Mergers and acquisitions (M&A) activity is common, reflecting consolidation and expansion strategies.

- Market Concentration: The top 3 players hold approximately xx% of the market share (2025 estimate).

- Technological Innovation: Investment in AI-powered logistics, automated sorting systems, and real-time tracking are driving efficiency gains.

- Regulatory Landscape: Cross-border regulations, customs procedures, and security protocols influence operational costs and delivery times.

- Competitive Substitutes: Freight forwarding, postal services, and specialized courier services pose competitive threats.

- M&A Activity: The past five years have seen xx M&A deals, primarily focused on expanding geographic reach and enhancing service capabilities.

North America International Express Service Market Growth Trends & Insights

The North America international express service market exhibits a strong growth trajectory, driven by the continued expansion of e-commerce, globalization of supply chains, and increasing demand for faster and more reliable delivery options. The market's Compound Annual Growth Rate (CAGR) from 2019 to 2024 was xx%, and is projected to reach xx% from 2025 to 2033. Technological disruptions, such as the adoption of drone delivery and autonomous vehicles, are further accelerating market growth. Consumer behavior shifts towards same-day and next-day delivery are shaping market expectations. Market penetration in underserved regions presents significant opportunities for growth. The increased adoption of digital platforms and automated solutions has improved market efficiency.

Dominant Regions, Countries, or Segments in North America International Express Service Market

The dominant segment within the North America international express service market is medium-weight shipments, accounting for approximately xx% of the market share in 2025. This segment is driven by the widespread growth of e-commerce, which is characterized by significant volumes of medium-sized parcels. The leading region for market growth is the Northeast, benefiting from high population density and robust economic activity. Major cities like New York and Boston serve as hubs for international trade. Canada also shows robust growth, facilitated by increased cross-border trade with the US.

- Key Drivers for Medium-Weight Shipments: E-commerce growth, improved logistics infrastructure, and rising consumer demand for fast delivery.

- Northeast Region Dominance: High population density, established logistics networks, and a strong presence of major international players contribute to its leading position.

North America International Express Service Market Product Landscape

The North American international express service market is a dynamic landscape offering a diverse array of products and services designed to meet the evolving needs of businesses and individuals. This includes expedited delivery options for time-sensitive shipments, specialized handling for oversized or fragile goods, temperature-controlled transportation for pharmaceuticals and other sensitive materials, and high-value item delivery with enhanced security protocols. Recent innovations have significantly impacted the market, with advancements such as real-time tracking with GPS and predictive analytics, utilizing AI-powered route optimization, the implementation of sustainable packaging materials made from recycled and renewable resources, and improved security features including tamper-evident seals and advanced authentication technologies. Furthermore, the adoption of automated sorting systems, drone delivery for last-mile logistics in select areas, and the integration of blockchain technology for enhanced transparency and security have revolutionized efficiency and delivery times. Key differentiators within this competitive market often focus on speed, reliability, comprehensive tracking capabilities, and proactive customer service.

Key Drivers, Barriers & Challenges in North America International Express Service Market

Key Drivers: The rapid growth of e-commerce, globalization of supply chains, and increasing demand for faster delivery options are major drivers. Government initiatives aimed at improving infrastructure and facilitating cross-border trade further accelerate market growth. Technological advancements continue to improve operational efficiency and reduce costs.

Key Challenges: Supply chain disruptions, fluctuating fuel prices, and intense competition pose significant challenges. Stricter regulatory compliance and security requirements increase operational complexity and costs. The labor shortage within the industry impacts overall efficiency.

Emerging Opportunities in North America International Express Service Market

Significant growth opportunities exist for businesses operating within the North American international express service market. Expanding service networks into currently underserved rural areas presents a considerable opportunity to tap into new customer bases. The integration of blockchain technology offers increased transparency and security, building trust and mitigating risks associated with international shipments. The increasing demand for specialized services, particularly temperature-controlled shipping for pharmaceuticals and other temperature-sensitive goods, and secure handling of high-value items, fuels further growth. The market also witnesses a rising demand for sustainable shipping solutions, prompting innovation in eco-friendly packaging and transportation methods. Last-mile delivery optimization through innovative technologies, such as autonomous vehicles and optimized routing algorithms, presents considerable potential for cost reduction and efficiency gains, creating a competitive advantage for forward-thinking companies. Moreover, strategic partnerships and collaborations with complementary businesses can create synergistic benefits and expand market reach.

Growth Accelerators in the North America International Express Service Market Industry

Several key factors are driving substantial growth within the North American international express service market. Significant technological advancements, including the widespread adoption of automation in warehousing and sorting facilities, the implementation of AI-powered logistics platforms for route optimization and predictive analytics, and the exploration of drone delivery technology for enhanced efficiency, are key contributors. Strategic partnerships and mergers & acquisitions are strengthening market presence and expanding service capabilities across geographical regions. Government initiatives aimed at improving infrastructure, particularly transportation networks and customs processing, and investments in technological upgrades are creating a more supportive environment for market expansion. Increased cross-border e-commerce activity continues to fuel demand for efficient and reliable international shipping services. Finally, a growing focus on sustainability within the logistics sector is pushing innovation in eco-friendly transportation and packaging, creating both opportunities and competitive pressures.

Key Players Shaping the North America International Express Service Market Market

- United Parcel Service of America Inc (UPS)

- DHL Group

- Power Link Expedite

- FedEx

- Asendia

- International Distributions Services (including GLS)

- OnTrac

- Aramex

- DTDC Express Limited

Notable Milestones in North America International Express Service Market Sector

- July 2023: DHL Express invested USD 9.6 million in a new Denver service point, significantly expanding capacity and strengthening its network in a key North American transportation hub.

- March 2023: Aramex partnered with AD Ports Group to establish a new Non-Vessel Operating Common Carrier (NVOCC) enterprise, strategically expanding its global reach and enhancing its capabilities in international freight forwarding.

- February 2023: Aramex reported a 27% decrease in annual net profit to USD 45.02 million, primarily attributed to unfavorable currency exchange rate fluctuations. This highlights the impact of macroeconomic factors on the profitability of express delivery companies.

In-Depth North America International Express Service Market Market Outlook

The North America international express service market is poised for continued growth, driven by technological advancements, expanding e-commerce, and the increasing demand for reliable and efficient delivery solutions. Strategic partnerships, investments in infrastructure, and the adoption of sustainable practices will shape the future market landscape. The market presents significant opportunities for both established players and new entrants, particularly in niche segments and underserved regions.

North America International Express Service Market Segmentation

-

1. Shipment Weight

- 1.1. Heavy Weight Shipments

- 1.2. Light Weight Shipments

- 1.3. Medium Weight Shipments

-

2. End User Industry

- 2.1. E-Commerce

- 2.2. Financial Services (BFSI)

- 2.3. Healthcare

- 2.4. Manufacturing

- 2.5. Primary Industry

- 2.6. Wholesale and Retail Trade (Offline)

- 2.7. Others

North America International Express Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America International Express Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America International Express Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.1.1. Heavy Weight Shipments

- 5.1.2. Light Weight Shipments

- 5.1.3. Medium Weight Shipments

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. E-Commerce

- 5.2.2. Financial Services (BFSI)

- 5.2.3. Healthcare

- 5.2.4. Manufacturing

- 5.2.5. Primary Industry

- 5.2.6. Wholesale and Retail Trade (Offline)

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 6. United States North America International Express Service Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America International Express Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America International Express Service Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America International Express Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 United Parcel Service of America Inc (UPS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 DHL Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Power Link Expedite

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 FedEx

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Asendia

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 International Distributions Services (including GLS)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OnTrac

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Aramex

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 DTDC Express Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 United Parcel Service of America Inc (UPS

List of Figures

- Figure 1: North America International Express Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America International Express Service Market Share (%) by Company 2024

List of Tables

- Table 1: North America International Express Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America International Express Service Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 3: North America International Express Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 4: North America International Express Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America International Express Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America International Express Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America International Express Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America International Express Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America International Express Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America International Express Service Market Revenue Million Forecast, by Shipment Weight 2019 & 2032

- Table 11: North America International Express Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: North America International Express Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America International Express Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America International Express Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America International Express Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America International Express Service Market?

The projected CAGR is approximately 6.64%.

2. Which companies are prominent players in the North America International Express Service Market?

Key companies in the market include United Parcel Service of America Inc (UPS, DHL Group, Power Link Expedite, FedEx, Asendia, International Distributions Services (including GLS), OnTrac, Aramex, DTDC Express Limited.

3. What are the main segments of the North America International Express Service Market?

The market segments include Shipment Weight, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

July 2023: With the USD 9.6 million investment, DHL Express acquired a location closer to the commercial core in downtown Denver. The new DHL Service Point includes nearly 56,000 sq. ft of combined warehouse and office space, along with 60 positions for vehicles to load and unload shipments around its conveyable sorting system.March 2023: Aramex signed a joint venture with AD Ports Group, one of the leading global trade, logistics, and industry facilitators, to develop and operate a new Non-Vessel Operating Common Carrier (“NVOCC”) enterprise.February 2023: Aramex's annual net profit dropped by 27% to USD 45.02 million due to currency fluctuations in certain markets, primarily in Lebanon and Egypt. Its 2022 revenue was broadly in line with 2021, while Q4 2022 revenue decreased 5% to USD 0.416 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America International Express Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America International Express Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America International Express Service Market?

To stay informed about further developments, trends, and reports in the North America International Express Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence