Key Insights

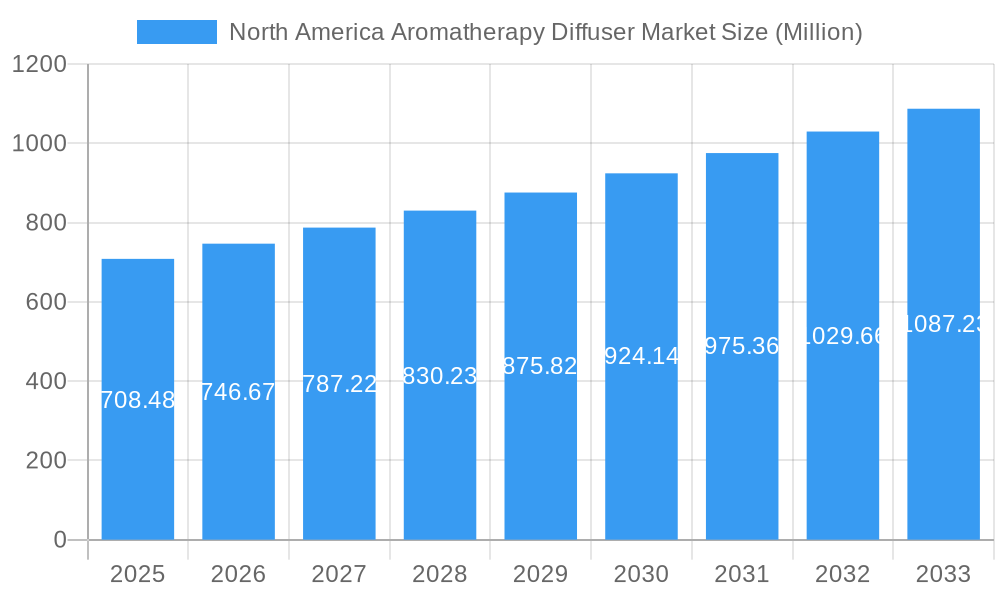

The North America aromatherapy diffuser market, valued at $708.48 million in 2025, is projected to experience robust growth, driven by increasing consumer awareness of aromatherapy's health benefits and the rising popularity of holistic wellness practices. The market's Compound Annual Growth Rate (CAGR) of 5.28% from 2025 to 2033 indicates a steady expansion, with significant potential for further growth. Key drivers include the rising prevalence of stress and anxiety, leading to increased demand for relaxation techniques. The shift towards natural and organic products further fuels market expansion, as consumers prioritize healthier alternatives for home fragrance and stress management. The market is segmented by product type (ultrasonic, nebulizer, others) and distribution channel (supermarket/hypermarket, convenience stores, specialist stores, online retailers, others). Ultrasonic diffusers are currently the dominant segment due to their affordability and ease of use, but nebulizers are gaining traction due to their ability to disperse essential oils more effectively. Online retailers are experiencing rapid growth as a distribution channel, driven by the convenience and accessibility of e-commerce. Major players like NOW Health Group Inc, Young Living Essential Oils LC, and DoTERRA are leveraging brand recognition and product innovation to maintain their market share. The competitive landscape is characterized by both established brands and emerging players, leading to increased product diversity and innovation.

North America Aromatherapy Diffuser Market Market Size (In Million)

Growth within the North American aromatherapy diffuser market is also influenced by evolving consumer preferences. The demand for aesthetically pleasing and technologically advanced diffusers is increasing, leading to product innovation in design and functionality. Smart diffusers integrating with smart home technology are gaining popularity. However, factors like the relatively high price of some premium diffusers and potential safety concerns related to the use of essential oils may restrain market growth to some extent. Nevertheless, the continued emphasis on wellness and self-care, coupled with increasing disposable incomes in North America, points towards sustained growth for the aromatherapy diffuser market throughout the forecast period. The market is likely to see further segmentation based on specific aromatherapy benefits, such as sleep improvement or mood enhancement, creating opportunities for niche players.

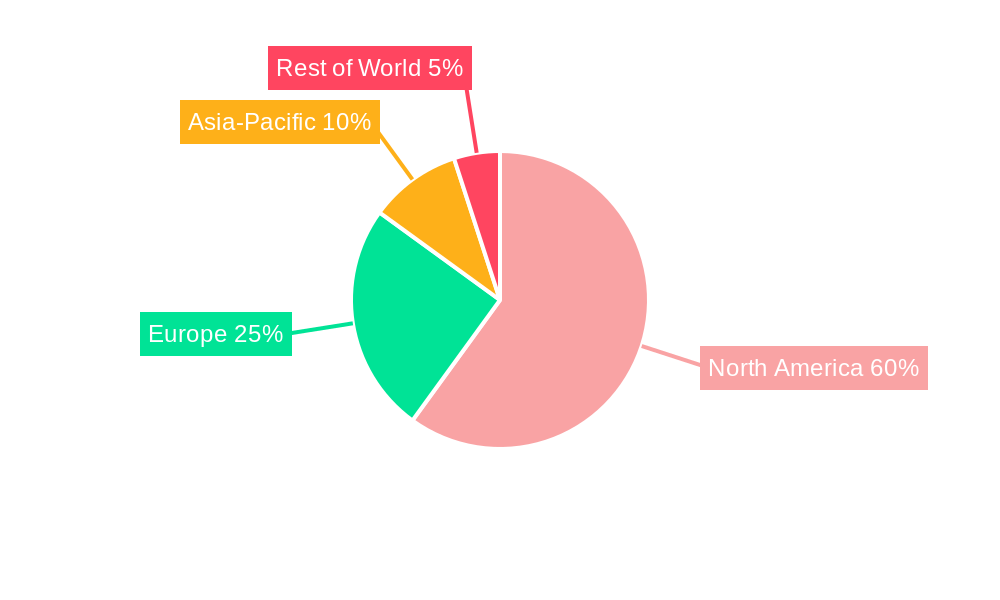

North America Aromatherapy Diffuser Market Company Market Share

North America Aromatherapy Diffuser Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America aromatherapy diffuser market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is invaluable for industry professionals, investors, and anyone seeking to understand this rapidly evolving market. The market is segmented by product type (Ultrasonic, Nebulizer, Others) and distribution channel (Supermarket/Hypermarket, Convenience Stores, Specialist Stores, Online Retailers, Others). The total market size is projected to reach xx Million units by 2033.

North America Aromatherapy Diffuser Market Dynamics & Structure

The North America aromatherapy diffuser market is characterized by moderate concentration, with key players like NOW Health Group Inc, Edens Garden, Young Living Essential Oils LC, Vitruvi US Corp, and DoTERRA holding significant market share. Technological innovation, particularly in areas like smart diffusers and personalized scent experiences, is a key growth driver. Regulatory frameworks related to essential oil safety and product labeling influence market dynamics. Competitive substitutes include candles, reed diffusers, and other air fresheners. The end-user demographic is broad, encompassing individuals seeking stress relief, improved sleep quality, and enhanced home ambiance. M&A activity has been relatively modest in recent years, with xx deals recorded between 2019 and 2024, suggesting a focus on organic growth strategies.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on smart features, app integration, and personalized scent profiles.

- Regulatory Framework: Compliance with safety and labeling regulations for essential oils is crucial.

- Competitive Substitutes: Candles, reed diffusers, and other air freshening products pose competition.

- End-User Demographics: Broad appeal across age groups and demographics, driven by wellness trends.

- M&A Activity: Relatively low, with xx M&A deals recorded between 2019 and 2024.

North America Aromatherapy Diffuser Market Growth Trends & Insights

The North America aromatherapy diffuser market experienced a CAGR of xx% during the historical period (2019-2024), driven by increasing consumer awareness of aromatherapy benefits, rising disposable incomes, and the growing popularity of wellness products. Market penetration is currently estimated at xx%, with significant potential for future growth. Technological disruptions, such as the introduction of smart diffusers and innovative scent delivery systems, are accelerating market expansion. Consumer behavior shifts towards personalized wellness solutions and eco-friendly products further fuel market growth. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033.

Dominant Regions, Countries, or Segments in North America Aromatherapy Diffuser Market

The United States dominates the North America aromatherapy diffuser market, accounting for approximately xx% of total market value in 2024. Strong consumer demand for wellness products and a well-established retail infrastructure contribute to this dominance. Canada also holds a significant market share, driven by a similar trend towards wellness and self-care. Within product types, ultrasonic diffusers command the largest market share (xx%), followed by nebulizer diffusers (xx%) and others (xx%). Online retailers are the fastest-growing distribution channel, driven by consumer preference for convenience and online shopping.

- Dominant Region: United States, owing to strong consumer demand and well-established retail infrastructure.

- Key Drivers (US): High disposable incomes, strong wellness trends, and extensive retail networks.

- Key Drivers (Canada): Growing focus on wellness, increasing adoption of aromatherapy, and similar retail landscape.

- Dominant Product Type: Ultrasonic diffusers due to their affordability, ease of use, and wide availability.

- Fastest Growing Channel: Online retailers, driven by convenience and expanding e-commerce sector.

North America Aromatherapy Diffuser Market Product Landscape

The North America aromatherapy diffuser market features a diverse range of products, from basic ultrasonic diffusers to sophisticated smart diffusers with app connectivity and personalized settings. Innovations include improved scent delivery systems, quieter operation, and aesthetically pleasing designs. Performance metrics focus on diffusion efficiency, coverage area, noise levels, and ease of use. Many diffusers emphasize unique selling propositions such as long-lasting battery life, automated shut-off features, and essential oil compatibility.

Key Drivers, Barriers & Challenges in North America Aromatherapy Diffuser Market

Key Drivers: Growing consumer awareness of aromatherapy benefits, rising disposable incomes, increasing demand for wellness products, and technological advancements in diffuser technology.

Challenges & Restraints: Intense competition among numerous brands, potential for product safety concerns with essential oils, and supply chain disruptions affecting availability and pricing. The regulatory landscape, including essential oil safety standards, could also pose significant challenges. These factors could impact the market by xx% by 2030.

Emerging Opportunities in North America Aromatherapy Diffuser Market

Emerging opportunities lie in expanding into untapped markets such as smaller towns and rural areas, developing innovative applications for diffusers in commercial settings (e.g., spas, hotels), and catering to niche consumer preferences with tailored scent blends and diffuser designs. The market for smart, connected diffusers is also expected to experience substantial growth.

Growth Accelerators in the North America Aromatherapy Diffuser Market Industry

Technological advancements in diffuser technology, strategic partnerships between diffuser manufacturers and essential oil brands, and expansion into new geographical markets and distribution channels will be key growth catalysts. The development of personalized scent profiles and AI-driven scent recommendations represents a particularly significant opportunity.

Key Players Shaping the North America Aromatherapy Diffuser Market Market

- NOW Health Group Inc

- Edens Garden

- Young Living Essential Oils LC

- Vitruvi US Corp

- ZAQ

- Newell Brands Inc

- Aromis Ltd

- Organic Aromas

- Escents Aromatherapy

- Scentsy Inc

- DoTERRA

- Aromatech Inc

- Saje Natural Wellness

Notable Milestones in North America Aromatherapy Diffuser Market Sector

- June 2021: Saje Natural Wellness collaborated with The Little Market, launching a limited-edition Aroma Mosaic diffuser.

- March 2022: The Gift of Scent introduced a line of USB aromatherapy diffusers in the US.

- April 2022: Newell Brands Inc. launched the WoodWick Radiance diffuser.

In-Depth North America Aromatherapy Diffuser Market Outlook

The North America aromatherapy diffuser market is poised for continued growth, driven by ongoing technological innovation, expanding consumer awareness, and the increasing adoption of aromatherapy practices. Strategic partnerships, market diversification, and the development of sophisticated, user-friendly products will be crucial for capturing market share and realizing the full potential of this dynamic market. The market's future success hinges on addressing challenges related to regulatory compliance and maintaining sustainable supply chains.

North America Aromatherapy Diffuser Market Segmentation

-

1. Product Type

- 1.1. Ultrasonic

- 1.2. Nebulizer

- 1.3. Others

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retailers

- 2.5. Others

North America Aromatherapy Diffuser Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Aromatherapy Diffuser Market Regional Market Share

Geographic Coverage of North America Aromatherapy Diffuser Market

North America Aromatherapy Diffuser Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness

- 3.3. Market Restrains

- 3.3.1. High Risk and Safety Concerns; Fluctuating Weather Patterns

- 3.4. Market Trends

- 3.4.1. Increasing Demand From Spas and Wellness Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Aromatherapy Diffuser Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ultrasonic

- 5.1.2. Nebulizer

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retailers

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NOW Health Group Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Edens Garden

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Young Living Essential Oils Lc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vitruvi US Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ZAQ

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Newell Brands Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aromis Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Organic Aromas

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Escents Aromatherapy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Scentsy Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DoTERRA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Aromatech Inc *List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saje Natural Wellness

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 NOW Health Group Inc

List of Figures

- Figure 1: North America Aromatherapy Diffuser Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Aromatherapy Diffuser Market Share (%) by Company 2025

List of Tables

- Table 1: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America Aromatherapy Diffuser Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Aromatherapy Diffuser Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States North America Aromatherapy Diffuser Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Aromatherapy Diffuser Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Aromatherapy Diffuser Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Aromatherapy Diffuser Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Aromatherapy Diffuser Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Aromatherapy Diffuser Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Aromatherapy Diffuser Market?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the North America Aromatherapy Diffuser Market?

Key companies in the market include NOW Health Group Inc, Edens Garden, Young Living Essential Oils Lc, Vitruvi US Corp, ZAQ, Newell Brands Inc, Aromis Ltd, Organic Aromas, Escents Aromatherapy, Scentsy Inc, DoTERRA, Aromatech Inc *List Not Exhaustive, Saje Natural Wellness.

3. What are the main segments of the North America Aromatherapy Diffuser Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 708.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Interest in Adventure Tourism; Growing Focus on Health and Wellness.

6. What are the notable trends driving market growth?

Increasing Demand From Spas and Wellness Centers.

7. Are there any restraints impacting market growth?

High Risk and Safety Concerns; Fluctuating Weather Patterns.

8. Can you provide examples of recent developments in the market?

April 2022: Nowell Brands Inc. launched the WoodWick Radiance diffuser - a battery-operated diffuser designed to reflect the brand's iconic hourglass silhouette and provide consumers with an easy-to-change refill process that doesn't require water.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Aromatherapy Diffuser Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Aromatherapy Diffuser Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Aromatherapy Diffuser Market?

To stay informed about further developments, trends, and reports in the North America Aromatherapy Diffuser Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence