Key Insights

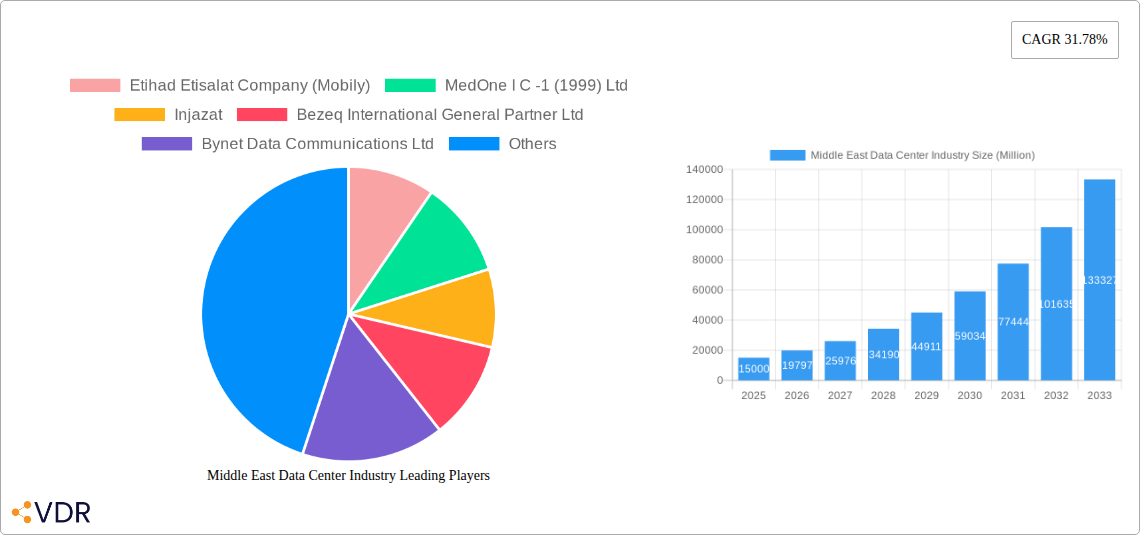

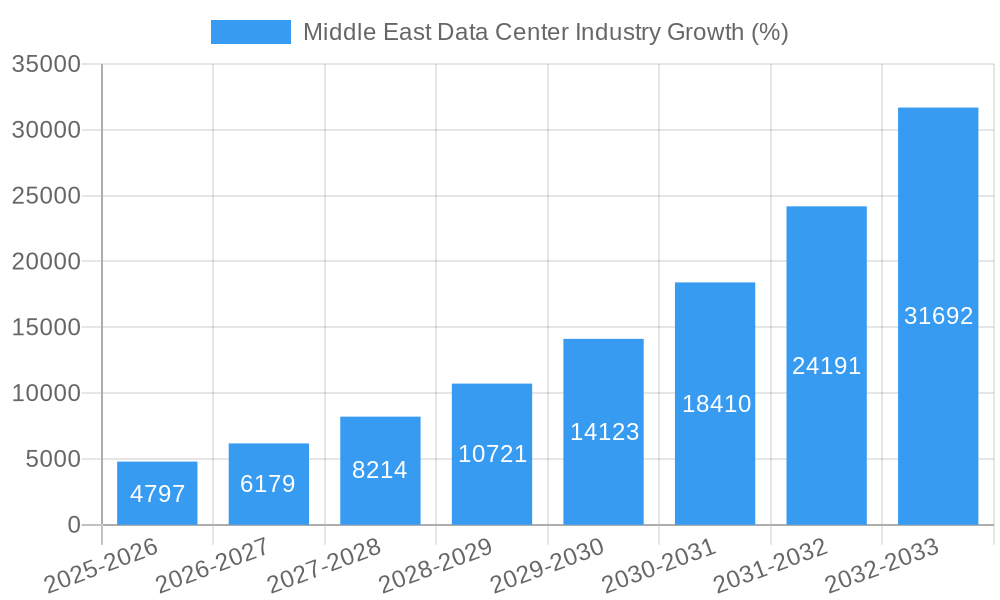

The Middle East data center market is experiencing robust growth, fueled by a surge in digital transformation initiatives across various sectors, including finance, government, and telecommunications. The region's burgeoning population, expanding internet penetration, and increasing adoption of cloud computing and big data analytics are key drivers. The market's Compound Annual Growth Rate (CAGR) of 31.78% from 2019 to 2024 indicates a significant upward trajectory. This growth is further propelled by investments in 5G infrastructure and the increasing demand for edge computing solutions to support low-latency applications. The market is segmented by data center size (large, massive, medium, mega, small), tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (utilized, non-utilized), end-user (other), and country (Israel, Saudi Arabia, UAE, and the Rest of the Middle East). Key players like Etihad Etisalat (Mobily), Injazat, Bezeq International, and others are actively contributing to this expansion. The increasing focus on data sovereignty and government regulations supporting digital infrastructure are expected to further boost the market's expansion in the coming years.

While significant growth is projected, challenges remain. The high initial investment costs associated with data center construction and maintenance, coupled with potential power shortages in some areas, act as restraints. However, proactive measures such as energy-efficient technologies and strategic partnerships between public and private sectors are mitigating these challenges. The ongoing expansion of hyperscale data centers, driven by global cloud providers, contributes significantly to overall market value, particularly in the UAE and Saudi Arabia, which are witnessing rapid growth in their digital economies. The increasing demand for colocation services and the rise of specialized data centers focused on specific sectors (e.g., finance, healthcare) are also shaping the market's landscape. The forecast period (2025-2033) is expected to witness even greater expansion, with the market continuing to benefit from the region's economic diversification strategies and technological advancements.

Middle East Data Center Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East data center industry, encompassing market dynamics, growth trends, dominant players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report analyzes various segments including data center size (large, massive, mega, medium, small), tier type (Tier 1, Tier 2, Tier 3), absorption (utilized, non-utilized), and end-user industries across key countries: Israel, Saudi Arabia, United Arab Emirates, and the Rest of the Middle East.

Middle East Data Center Industry Market Dynamics & Structure

The Middle East data center market is experiencing significant growth driven by factors such as increasing digitalization, government initiatives promoting digital transformation, and the rise of cloud computing. Market concentration is moderate, with several large players alongside numerous smaller providers. Technological innovation is a key driver, with advancements in areas like AI, IoT, and edge computing fueling demand for advanced data center infrastructure. Regulatory frameworks are evolving to support the industry's expansion, although varying regulations across countries present some challenges. Competitive substitutes, such as cloud services from global providers, exert pressure on the market. End-user demographics are shifting towards increased adoption across diverse sectors including finance, healthcare, and government. M&A activity is relatively high, with strategic partnerships and acquisitions contributing to market consolidation.

- Market Concentration: Moderate, with a few dominant players and several smaller ones. XX% market share held by top 5 players in 2024.

- Technological Innovation: High, driven by AI, IoT, and edge computing, leading to demand for higher capacity and more efficient data centers.

- Regulatory Framework: Evolving, with some variations across countries, creating both opportunities and challenges for expansion.

- Competitive Substitutes: Cloud services from global providers are a key competitive factor.

- M&A Activity: Significant, with numerous deals in recent years, XX M&A deals closed in 2024.

- Innovation Barriers: High initial investment costs, lack of skilled workforce in some regions.

Middle East Data Center Industry Growth Trends & Insights

The Middle East data center market is experiencing robust growth, driven by the region's rapid digital transformation and increasing demand for cloud services. The market size is projected to expand significantly in the forecast period (2025-2033). The Compound Annual Growth Rate (CAGR) is estimated to be XX% during this period. This growth is fueled by factors such as the rising adoption of cloud computing, increasing data consumption, and government initiatives to support digital infrastructure development. Technological disruptions, particularly the adoption of 5G and edge computing, are creating new opportunities and accelerating market growth. Consumer behavior is shifting towards increased reliance on digital services, further boosting demand for data center capacity. The market penetration rate for cloud services is increasing steadily and expected to reach xx% by 2033. Furthermore, the adoption of hyperscale data centers is gaining momentum, creating opportunities for large-scale infrastructure investments.

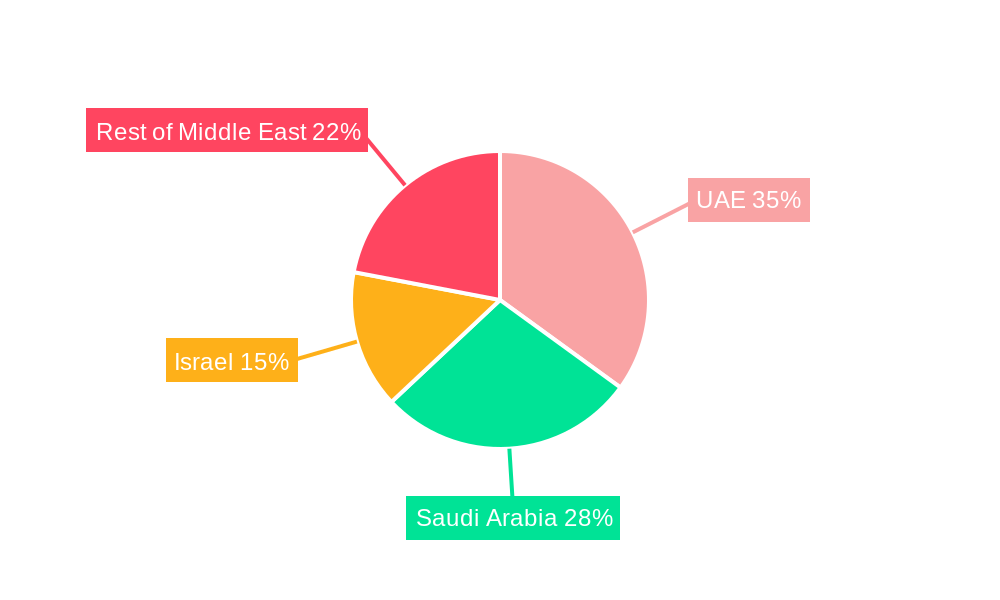

Dominant Regions, Countries, or Segments in Middle East Data Center Industry

The United Arab Emirates (UAE) currently holds the largest market share in the Middle East data center industry, followed by Saudi Arabia. This dominance is attributed to several factors, including strong government support for digital infrastructure development, a thriving business environment, and a large and growing population. Israel also plays a significant role, benefiting from its advanced technological capabilities and strategic location. Within the segmentation, the demand for large and mega data centers is experiencing the fastest growth due to the increasing requirements of cloud providers and large enterprises. The utilization rate of data center capacity is also rising, indicating strong demand.

- Key Drivers in the UAE: Government initiatives like the Dubai 2040 Urban Master Plan, substantial foreign investment in tech infrastructure, and a business-friendly regulatory environment.

- Key Drivers in Saudi Arabia: Vision 2030's emphasis on digital transformation, significant investments in national infrastructure, and a growing demand for cloud services.

- Key Drivers in Israel: A highly developed technology sector, a skilled workforce, and strong government support for the tech industry.

- Segment Dominance: Large and mega data centers are experiencing the fastest growth. Utilized absorption is increasing, indicative of high demand.

Middle East Data Center Industry Product Landscape

The Middle East data center market offers a diverse range of products and services, including colocation, managed services, cloud services, and hyperscale data centers. Product innovations focus on enhanced efficiency, scalability, and security. Advancements in areas like AI-powered management systems, improved cooling technologies, and increased automation are driving performance metrics. Unique selling propositions include strategic location, robust security features, and compliance with international standards. The market is seeing a shift toward more sustainable solutions, with an increased focus on energy-efficient data center designs and renewable energy sources.

Key Drivers, Barriers & Challenges in Middle East Data Center Industry

Key Drivers:

- Government Initiatives: Digital transformation strategies and investments in national infrastructure projects are driving market growth.

- Technological Advancements: The adoption of cloud computing, AI, IoT, and 5G are fueling demand for advanced data center solutions.

- Economic Growth: The expanding economies of the region are creating opportunities for data center investments.

Key Challenges:

- High Infrastructure Costs: Building and operating data centers requires significant capital investment.

- Energy Costs: High energy consumption represents a substantial operating expense.

- Regulatory Hurdles: Varying regulations across countries can create complexity for market entry and operation. The impact is estimated to reduce market growth by XX% annually.

Emerging Opportunities in Middle East Data Center Industry

- Edge Computing: The growth of IoT and 5G is creating significant opportunities for edge data centers.

- Hyperscale Data Centers: Large-scale investments in hyperscale infrastructure are attracting global cloud providers.

- Specialized Data Centers: Demand for specialized facilities to support specific industries (e.g., healthcare, finance) is growing.

Growth Accelerators in the Middle East Data Center Industry

Technological breakthroughs in areas such as AI-powered resource management and advanced cooling technologies are contributing to significant efficiency gains and cost reductions. Strategic partnerships between data center operators and cloud providers are driving expansion and market consolidation. Government initiatives promoting investment in digital infrastructure and attracting foreign investment are further accelerating market growth. The expansion into underserved regions and the focus on sustainable data center operations are creating significant long-term opportunities.

Key Players Shaping the Middle East Data Center Industry Market

- Etihad Etisalat Company (Mobily)

- MedOne I C -1 (1999) Ltd

- Injazat

- Bezeq International General Partner Ltd

- Bynet Data Communications Ltd

- EdgeConneX Inc

- Gulf Data Hub

- Khazna Data Center

- Electronia

- HostGee Cloud Hosting Inc

- MEEZA

- Etisalat

Notable Milestones in Middle East Data Center Industry Sector

- October 2023: Launch of M-VAULT 4's fourth data center building in Qatar, providing access to Microsoft Cloud services. This significantly enhances cloud infrastructure in the region.

- October 2022: Khazna Data Centers partnered with Masdar and EDF to build a solar PV plant, powering its new data center and promoting sustainability in the sector.

- October 2022: Khazna Data Centers announced the development of DXB2 and DXB3 data centers, adding 43 MW of IT load capacity. This expansion demonstrates significant investment and confidence in the market's growth.

In-Depth Middle East Data Center Industry Market Outlook

The Middle East data center market is poised for continued robust growth, driven by sustained investments in digital infrastructure, the expansion of cloud services, and the increasing adoption of advanced technologies. Strategic opportunities exist in the development of edge data centers, hyperscale facilities, and specialized data centers catering to specific industry needs. The focus on sustainability and energy efficiency will further shape the market landscape. The long-term outlook is highly positive, with significant potential for market expansion and the emergence of new players and innovative solutions.

Middle East Data Center Industry Segmentation

-

1. Data Center Size

- 1.1. Large

- 1.2. Massive

- 1.3. Medium

- 1.4. Mega

- 1.5. Small

-

2. Tier Type

- 2.1. Tier 1 and 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. End User

- 3.1. BFSI

- 3.2. Cloud

- 3.3. E-Commerce

- 3.4. Government

- 3.5. Manufacturing

- 3.6. Media & Entertainment

- 3.7. Telecom

- 3.8. Other End User

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

Middle East Data Center Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Data Center Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 31.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitization of the BFSI Industry; Cost-efficiency in Managing Personal Finance

- 3.3. Market Restrains

- 3.3.1. Lack of Human Expertise and Empathy; Nascency of the Technology

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 5.1.1. Large

- 5.1.2. Massive

- 5.1.3. Medium

- 5.1.4. Mega

- 5.1.5. Small

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 and 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Cloud

- 5.3.3. E-Commerce

- 5.3.4. Government

- 5.3.5. Manufacturing

- 5.3.6. Media & Entertainment

- 5.3.7. Telecom

- 5.3.8. Other End User

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 6. United Arab Emirates Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Data Center Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Etihad Etisalat Company (Mobily)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MedOne I C -1 (1999) Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Injazat

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bezeq International General Partner Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bynet Data Communications Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 EdgeConneX Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Gulf Data Hub

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Khazna Data Center

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Electronia

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 HostGee Cloud Hosting Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 MEEZA5

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Etisalat

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Etihad Etisalat Company (Mobily)

List of Figures

- Figure 1: Middle East Data Center Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Data Center Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 3: Middle East Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Middle East Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Middle East Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Middle East Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: Middle East Data Center Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Arab Emirates Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Qatar Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Israel Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Egypt Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Oman Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Middle East Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Middle East Data Center Industry Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 17: Middle East Data Center Industry Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 18: Middle East Data Center Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 19: Middle East Data Center Industry Revenue Million Forecast, by Absorption 2019 & 2032

- Table 20: Middle East Data Center Industry Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 21: Middle East Data Center Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Saudi Arabia Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United Arab Emirates Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Israel Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Qatar Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Kuwait Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Oman Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Bahrain Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Jordan Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Lebanon Middle East Data Center Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Data Center Industry?

The projected CAGR is approximately 31.78%.

2. Which companies are prominent players in the Middle East Data Center Industry?

Key companies in the market include Etihad Etisalat Company (Mobily), MedOne I C -1 (1999) Ltd, Injazat, Bezeq International General Partner Ltd, Bynet Data Communications Ltd, EdgeConneX Inc, Gulf Data Hub, Khazna Data Center, Electronia, HostGee Cloud Hosting Inc, MEEZA5, Etisalat.

3. What are the main segments of the Middle East Data Center Industry?

The market segments include Data Center Size, Tier Type, End User , Absorption , Colocation Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Digitization of the BFSI Industry; Cost-efficiency in Managing Personal Finance.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Lack of Human Expertise and Empathy; Nascency of the Technology.

8. Can you provide examples of recent developments in the market?

October 2023: Mohamed bin Ali bin Mohamed Al-Mannai, minister of communications and information technology, has launched the M-VAULT 4's fourth data center building. Customers in Qatar can access cloud services through the Microsoft Cloud data center region housed in the new data center facility.October 2022: The prominent network of hyperscale data centers in the Middle East and North Africa region, a joint venture between Khazna Data Centers, and Masdar and EDF have inked a deal to build a ground-mounted solar photovoltaic (PV) plant to power Khazna's new data center in Masdar City.October 2022: The company announced the development of DXB2 and DXB3 with a joint capacity of 43 MW of IT load. The DXB3 facility is an extension of an existing facility transferred to Khazna following the strategic partnership between G42 and e&.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Data Center Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Data Center Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Data Center Industry?

To stay informed about further developments, trends, and reports in the Middle East Data Center Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence