Key Insights

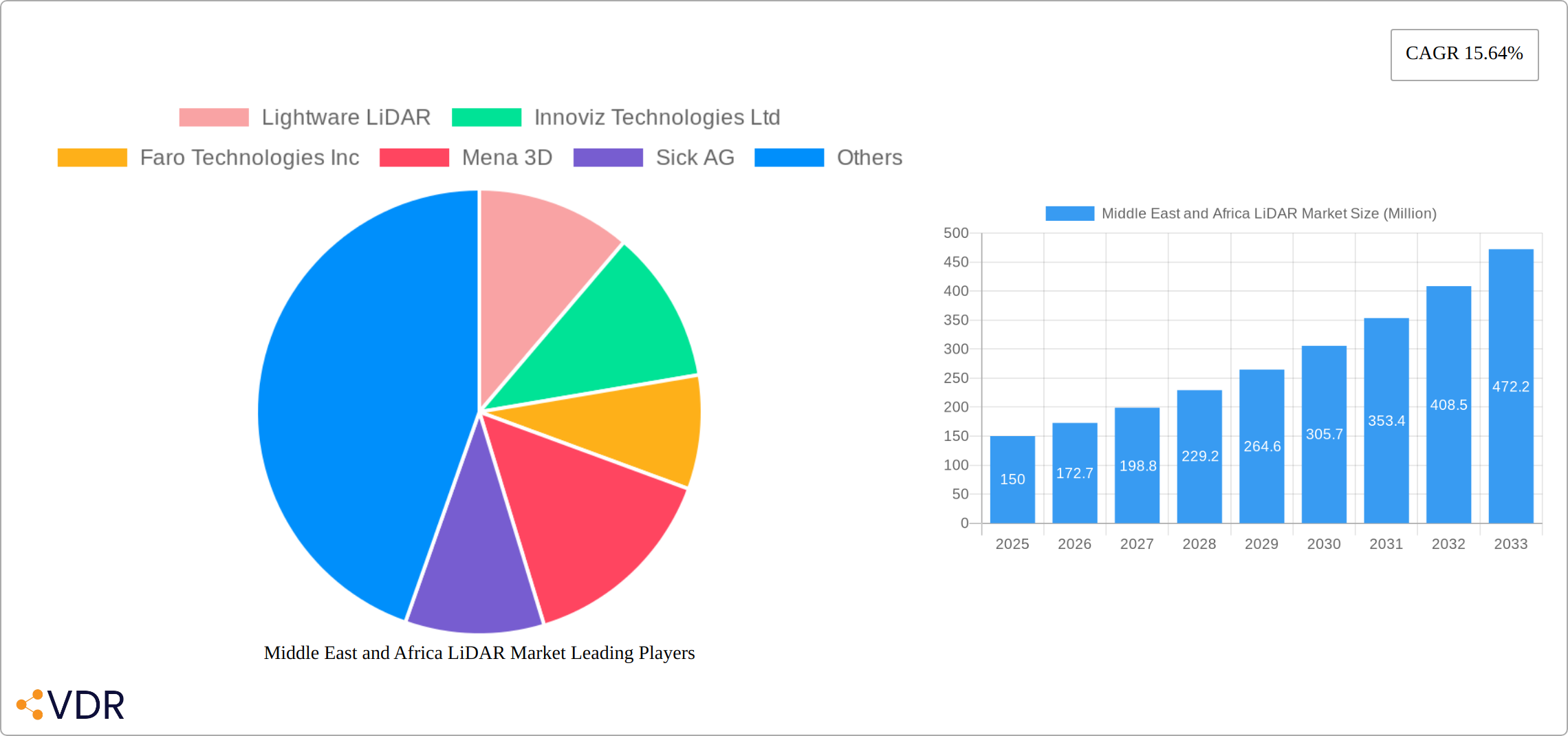

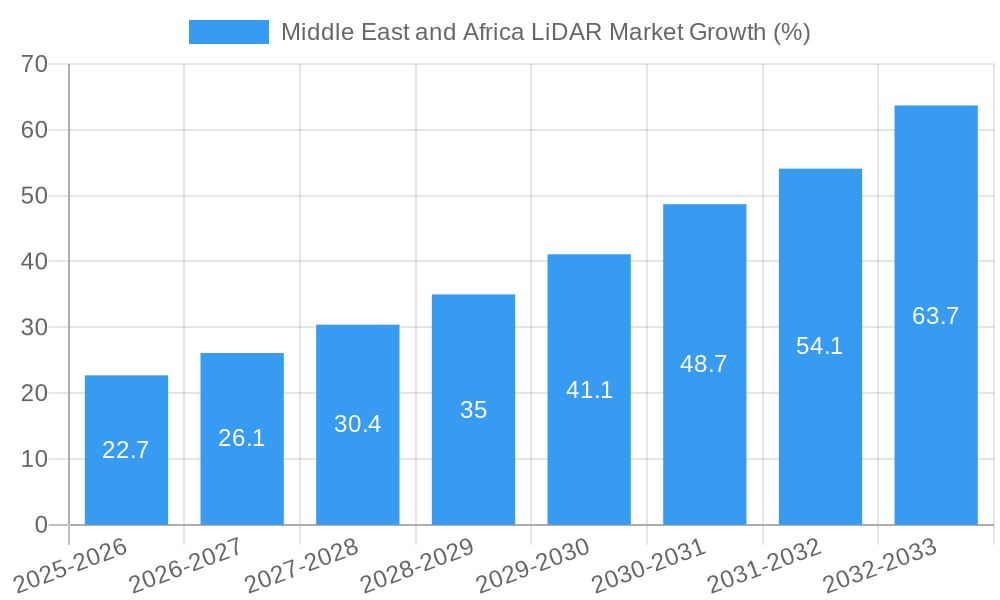

The Middle East and Africa (MEA) LiDAR market is experiencing robust growth, projected to expand significantly between 2025 and 2033, driven by a Compound Annual Growth Rate (CAGR) of 15.64%. This expansion is fueled by several key factors. Firstly, substantial investments in infrastructure development across the region are creating a high demand for precise surveying and mapping technologies, making LiDAR a crucial tool for various projects, including urban planning, construction, and resource management. Secondly, the burgeoning automotive industry, particularly the rise of autonomous vehicle development, is a major driver. LiDAR sensors are essential for the advanced driver-assistance systems (ADAS) and self-driving capabilities of these vehicles, fueling strong demand from automotive manufacturers and suppliers. Thirdly, the increasing adoption of LiDAR in precision agriculture for efficient land management and crop monitoring contributes to market growth. The MEA region's unique geographical features, including diverse terrains and challenging environments, further necessitate accurate mapping and surveying solutions offered by LiDAR technology. Finally, government initiatives focused on technological advancement and digital transformation in several MEA countries are bolstering the adoption of advanced technologies like LiDAR.

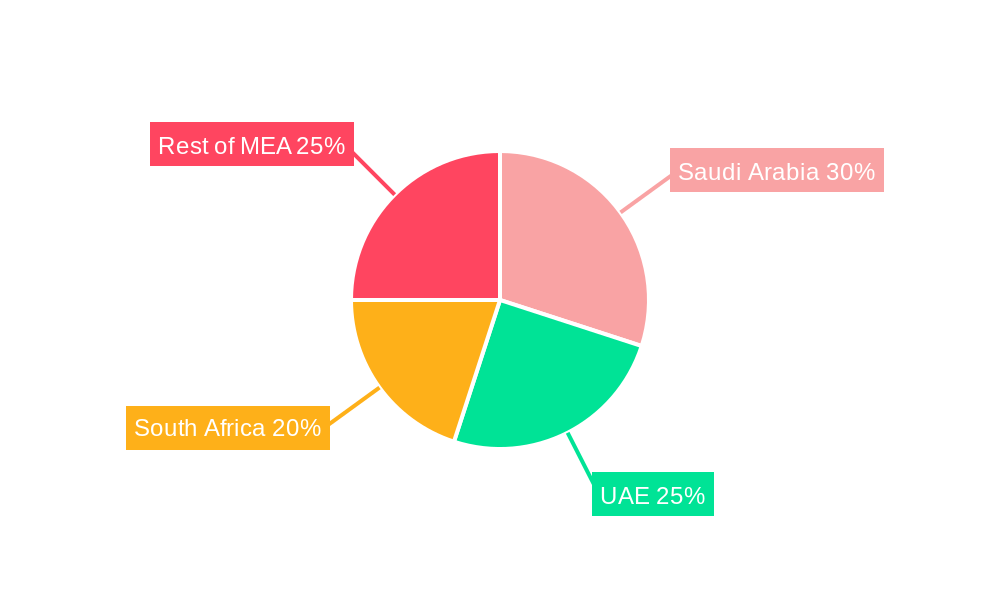

However, market growth is not without its challenges. High initial investment costs associated with LiDAR systems can hinder adoption, especially for smaller companies and organizations with limited budgets. Furthermore, the complex technical expertise required for data acquisition, processing, and analysis can present a barrier to entry for some users. Despite these limitations, the significant advantages of LiDAR in terms of accuracy, speed, and data richness are outweighing these challenges, leading to continued market expansion. The market segmentation reveals that aerial LiDAR currently holds the largest share, reflecting the considerable need for large-scale mapping projects, while the automotive and engineering sectors are prominent end-users. Countries like Saudi Arabia and the United Arab Emirates are leading the adoption, benefiting from substantial government investments and a well-established infrastructure. South Africa and other nations in the region are expected to witness significant growth in the coming years, as infrastructure development and technological adoption accelerate. The presence of both international players like Trimble and Leica Geosystems and regional companies like Mena 3D highlights the dynamic and competitive landscape of the MEA LiDAR market.

Middle East and Africa LiDAR Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa LiDAR market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market is segmented by product (Aerial LiDAR, Ground-based LiDAR), components (GPS, Laser Scanners, Inertial Measurement Unit, Other Components), end-user (Engineering, Automotive, Industrial, Aerospace & Defense), and country (Saudi Arabia, United Arab Emirates, South Africa, Rest of Middle East and Africa). Key players analyzed include Lightware LiDAR, Innoviz Technologies Ltd, Faro Technologies Inc, Mena 3D, Sick AG, Falcon-3D, Trimble Inc, Globalscan Technologies LLC, Neptec Technologies Corp, and Leica Geosystems Ag. The report projects a market value reaching xx Million by 2033.

Middle East and Africa LiDAR Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and industry trends. The market exhibits moderate concentration, with a few major players and numerous smaller niche companies. Technological innovation, particularly in sensor technology and data processing, is a key driver. Regulatory frameworks concerning data privacy and airspace usage influence market growth. The presence of alternative surveying technologies (e.g., photogrammetry) poses competitive pressure.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Significant advancements in sensor miniaturization, higher point density, and improved data processing capabilities are driving adoption.

- Regulatory Landscape: Varied across countries, with some regions exhibiting stricter regulations regarding data acquisition and usage.

- Competitive Substitutes: Photogrammetry and other surveying techniques compete with LiDAR, especially in certain applications.

- M&A Activity: A moderate level of M&A activity is observed, with xx deals recorded between 2019 and 2024, primarily focused on consolidating market share and acquiring technological capabilities.

- End-User Demographics: Engineering and infrastructure development are significant drivers, followed by increasing adoption in the automotive sector for autonomous vehicle development.

Middle East and Africa LiDAR Market Growth Trends & Insights

The Middle East and Africa LiDAR market is experiencing robust growth, driven by increasing infrastructure development, urbanization, and the expanding adoption of autonomous vehicles. The market size expanded from xx Million in 2019 to xx Million in 2024, exhibiting a CAGR of xx%. This trend is projected to continue, with the market expected to reach xx Million by 2033, representing a CAGR of xx% during the forecast period. Technological disruptions, such as the development of solid-state LiDAR, are further fueling market expansion. Consumer behavior shifts towards greater reliance on precise mapping and 3D modeling contribute to increased demand. Specific metrics highlighting market penetration in various segments, like the adoption of Aerial LiDAR in mapping large infrastructure projects or the utilization of Ground-based LiDAR in precision agriculture, further strengthen our insights.

Dominant Regions, Countries, or Segments in Middle East and Africa LiDAR Market

The Middle East and Africa LiDAR market is experiencing significant growth, driven by substantial investments in infrastructure development, urbanization, and technological advancements. Saudi Arabia and the United Arab Emirates (UAE) are leading the Middle Eastern market, fueled by mega-projects like Neom and Vision 2030, along with a strong push towards smart city initiatives. In Africa, South Africa holds the dominant position, primarily due to its robust mining sector, ongoing urbanization, and expanding infrastructure projects. Analyzing the product segment, Aerial LiDAR currently holds a larger market share, primarily utilized for large-scale mapping and surveying for infrastructure projects. However, Ground-based LiDAR is demonstrating rapid growth, finding significant applications in autonomous driving, precision agriculture, and detailed site surveys for construction. The Engineering and Automotive sectors represent the largest end-user segments, demanding high-accuracy 3D mapping and modeling capabilities.

- Key Growth Drivers:

- Massive Infrastructure Investments: Projects like Neom in Saudi Arabia and numerous smart city initiatives across the region are driving demand for precise surveying and mapping solutions.

- Mining Sector Expansion: South Africa's established mining industry continues to leverage LiDAR for efficient resource management and operational optimization.

- Urbanization and Development: Rapid urbanization across the Middle East and Africa necessitates advanced mapping and planning technologies, fueling LiDAR adoption.

- Technological Advancements: The emergence of more affordable and robust solid-state LiDAR systems is expanding the market's reach and applications.

- Autonomous Vehicle Development: The growing automotive sector's focus on autonomous vehicles is stimulating demand for high-precision LiDAR sensors for navigation and object detection.

- Precision Agriculture: Improved crop management and yield optimization are driving adoption in the agricultural sector.

Middle East and Africa LiDAR Market Product Landscape

The LiDAR market in the Middle East and Africa encompasses a diverse range of products, including aerial and terrestrial (ground-based) systems. Aerial LiDAR systems remain crucial for large-scale mapping and surveying, particularly in infrastructure development and environmental monitoring. Ground-based LiDAR systems offer high-precision measurements, finding applications in diverse sectors such as construction, mining, autonomous vehicle development, and precision agriculture. The market is witnessing significant advancements in LiDAR technology. Solid-state LiDAR, characterized by its enhanced durability, reduced weight, and improved reliability, is rapidly gaining traction, surpassing the limitations of traditional mechanical systems. Furthermore, ongoing innovations focus on increasing accuracy, resolution, and operational range while simultaneously reducing costs and system size, making LiDAR accessible to a broader range of applications.

Key Drivers, Barriers & Challenges in Middle East and Africa LiDAR Market

Key Drivers: Government investments in infrastructure development, increasing demand for precise mapping in various industries, and technological advancements leading to more efficient and cost-effective LiDAR solutions are driving market growth. Further, the growing adoption of autonomous vehicles is a significant driver, particularly in the automotive sector.

Key Barriers & Challenges: The high initial investment cost of LiDAR systems, the need for skilled personnel to operate and process data, and data privacy concerns act as significant market barriers. Supply chain disruptions, particularly concerning the availability of specialized components, and the complexity of regulatory frameworks across different countries also pose challenges. Estimated impact on market growth due to these challenges is approximately xx% reduction in CAGR by 2033.

Emerging Opportunities in Middle East and Africa LiDAR Market

Untapped markets in less-developed regions of Africa, coupled with the growing application of LiDAR in precision agriculture and environmental monitoring, present significant opportunities. The integration of LiDAR with other technologies, such as AI and machine learning, is opening new avenues for data analysis and application development. Increased demand for 3D city modeling for urban planning provides a lucrative growth avenue.

Growth Accelerators in the Middle East and Africa LiDAR Market Industry

Several factors are poised to propel the growth of the Middle East and Africa LiDAR market. The ongoing advancements in solid-state LiDAR technology are significantly reducing costs and improving performance, broadening market accessibility. Strategic collaborations between LiDAR manufacturers and key players in the automotive and infrastructure sectors are fostering innovation and market penetration. Supportive government initiatives promoting advanced technologies, along with investments in improving digital infrastructure, are creating a favorable environment for LiDAR adoption. Furthermore, increasing awareness of the benefits of LiDAR technology across various sectors, coupled with rising demand for precise spatial data, is contributing to the market's dynamic growth trajectory.

Key Players Shaping the Middle East and Africa LiDAR Market Market

- Lightware LiDAR

- Innoviz Technologies Ltd

- Faro Technologies Inc

- Mena 3D

- Sick AG

- Falcon-3D

- Trimble Inc

- Globalscan Technologies LLC

- Neptec Technologies Corp

- Leica Geosystems Ag

Notable Milestones in Middle East and Africa LiDAR Market Sector

- 2021: Launch of several new solid-state LiDAR sensors by major technology providers, marking a significant shift towards more affordable and efficient systems.

- 2022: Several government initiatives across the Middle East and Africa announced investments and policies promoting the adoption of LiDAR technology in infrastructure projects, particularly focusing on sustainable development and smart city implementations.

- 2023: Significant investments in joint ventures between LiDAR manufacturers and prominent automotive companies focused on developing advanced driver-assistance systems (ADAS) and autonomous driving capabilities, and partnerships between LiDAR companies and engineering firms for large scale infrastructure projects.

- Ongoing: Continued development and implementation of high-resolution mapping projects utilizing LiDAR across various sectors, including mining, environmental monitoring, and precision agriculture.

In-Depth Middle East and Africa LiDAR Market Market Outlook

The future of the Middle East and Africa LiDAR market is bright, driven by sustained investment in infrastructure, technological advancements, and the expanding adoption of LiDAR across diverse sectors. Strategic partnerships and government support will play a pivotal role in unlocking the market's full potential. The market is poised for continued strong growth, with significant opportunities for both established players and new entrants. The projected market value offers attractive investment prospects for companies seeking to capitalize on this dynamic and rapidly evolving market.

Middle East and Africa LiDAR Market Segmentation

-

1. Product

- 1.1. Aerial LiDAR

- 1.2. Ground-based LiDAR

-

2. Components

- 2.1. GPS

- 2.2. Laser Scanners

- 2.3. Inertial Measurement Unit

- 2.4. Other Components

-

3. End-User

- 3.1. Engineering

- 3.2. Automotive

- 3.3. Industrial

- 3.4. Aerospace & Defense

Middle East and Africa LiDAR Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa LiDAR Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Applications In Government Sector; Increasing Demand of LiDAR Sensors in Oil and Gas Industry

- 3.3. Market Restrains

- 3.3.1. ; High Cost of The LiDAR Systems

- 3.4. Market Trends

- 3.4.1. The Growing Usage of Drones will drive the Growth of this Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Aerial LiDAR

- 5.1.2. Ground-based LiDAR

- 5.2. Market Analysis, Insights and Forecast - by Components

- 5.2.1. GPS

- 5.2.2. Laser Scanners

- 5.2.3. Inertial Measurement Unit

- 5.2.4. Other Components

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Engineering

- 5.3.2. Automotive

- 5.3.3. Industrial

- 5.3.4. Aerospace & Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. South Africa Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa LiDAR Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Lightware LiDAR

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Innoviz Technologies Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Faro Technologies Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Mena 3D

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sick AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Falcon-3D

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Trimble Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Globalscan Technologies LLC*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Neptec Technologies Corp

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Leica Geosystems Ag

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Lightware LiDAR

List of Figures

- Figure 1: Middle East and Africa LiDAR Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa LiDAR Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa LiDAR Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa LiDAR Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Middle East and Africa LiDAR Market Revenue Million Forecast, by Components 2019 & 2032

- Table 4: Middle East and Africa LiDAR Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Middle East and Africa LiDAR Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa LiDAR Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa LiDAR Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Middle East and Africa LiDAR Market Revenue Million Forecast, by Components 2019 & 2032

- Table 15: Middle East and Africa LiDAR Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Middle East and Africa LiDAR Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bahrain Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Jordan Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Lebanon Middle East and Africa LiDAR Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa LiDAR Market?

The projected CAGR is approximately 15.64%.

2. Which companies are prominent players in the Middle East and Africa LiDAR Market?

Key companies in the market include Lightware LiDAR, Innoviz Technologies Ltd, Faro Technologies Inc, Mena 3D, Sick AG, Falcon-3D, Trimble Inc, Globalscan Technologies LLC*List Not Exhaustive, Neptec Technologies Corp, Leica Geosystems Ag.

3. What are the main segments of the Middle East and Africa LiDAR Market?

The market segments include Product, Components, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Applications In Government Sector; Increasing Demand of LiDAR Sensors in Oil and Gas Industry.

6. What are the notable trends driving market growth?

The Growing Usage of Drones will drive the Growth of this Market.

7. Are there any restraints impacting market growth?

; High Cost of The LiDAR Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa LiDAR Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa LiDAR Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa LiDAR Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa LiDAR Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence