Key Insights

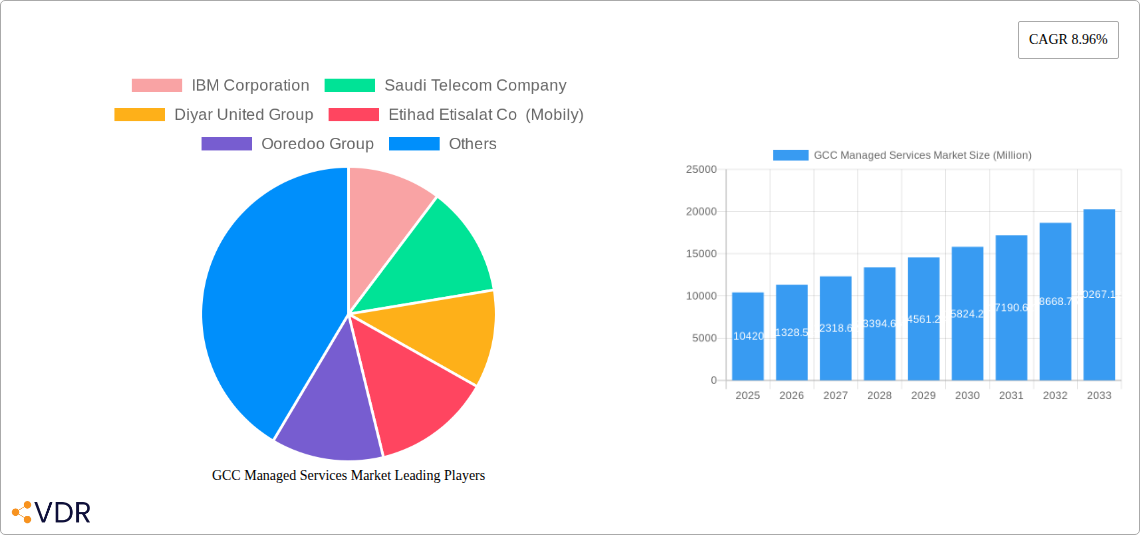

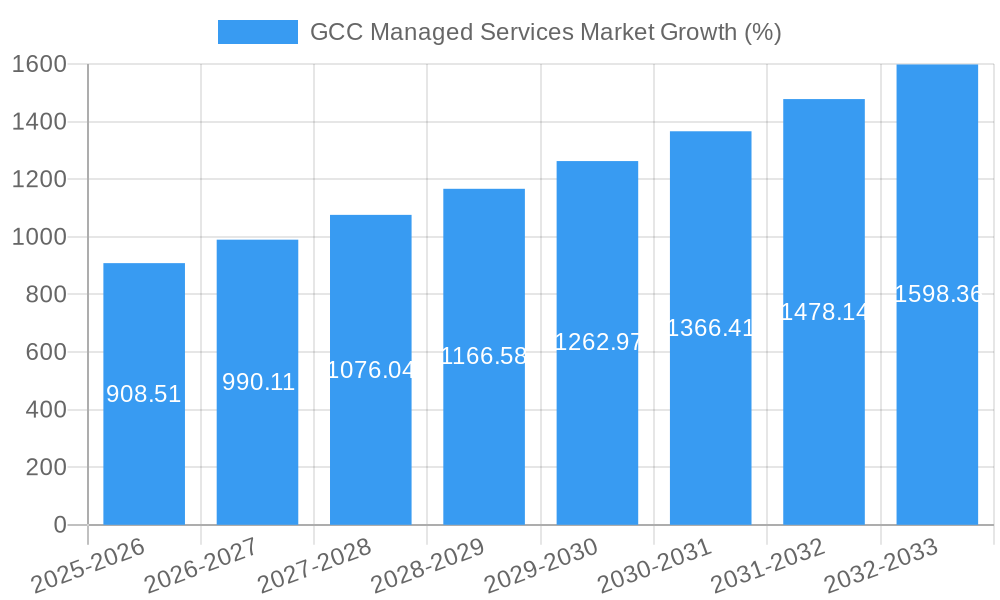

The GCC Managed Services Market is experiencing robust growth, projected to reach $10.42 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.96% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cloud technologies across various sectors, including IT & Telecom, BFSI (Banking, Financial Services, and Insurance), and Oil & Gas, fuels the demand for managed services that ensure seamless operations and enhanced security. Furthermore, the region's governments are actively investing in digital transformation initiatives, creating a favorable environment for managed service providers. The rising complexity of IT infrastructure and the need for cost optimization are also contributing to the market's growth. Key players like IBM, Saudi Telecom Company, and others are capitalizing on this opportunity, offering a wide range of services, including managed infrastructure, hosting, security, cloud, and disaster recovery solutions. The diverse service portfolio caters to specific industry needs, fostering market segmentation and specialized service offerings. Competitive pricing strategies and strategic partnerships also contribute significantly to market expansion.

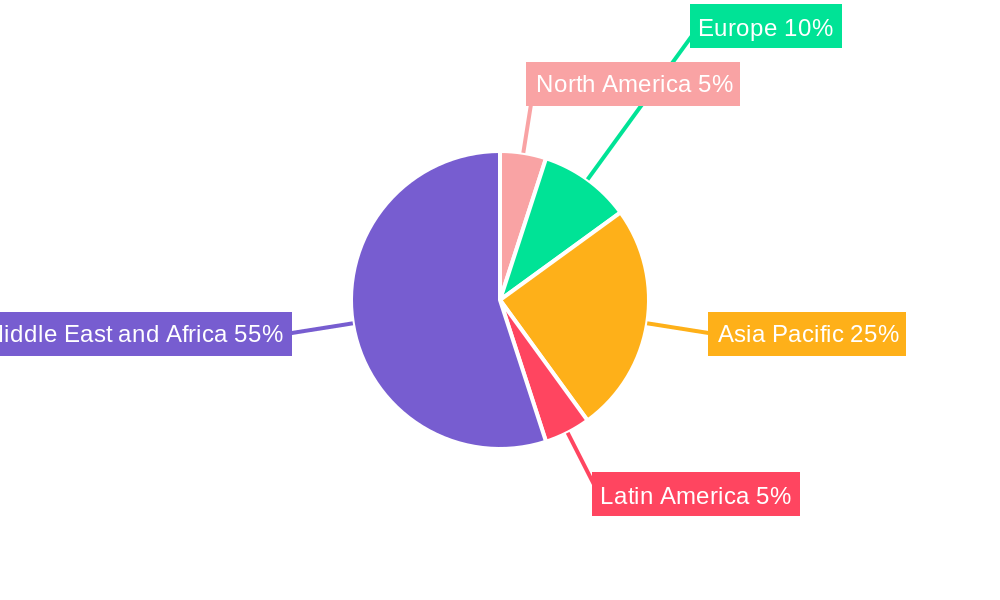

The market segmentation reveals a strong presence of Managed Cloud Services, driven by the region's accelerating cloud adoption. Managed Security Services are also witnessing significant growth due to the increasing cyber threats. Within the end-user verticals, the IT & Telecom sector holds a major market share, followed by BFSI. However, other sectors like Healthcare and Government are demonstrating substantial growth potential, indicating a broadening market reach. Geographical distribution showcases Saudi Arabia and the UAE as the leading markets, followed by Qatar and other GCC countries, highlighting the significant regional disparities in market penetration and adoption rates. This dynamic environment presents both opportunities and challenges for existing and new entrants, requiring strategic planning and adaptability to leverage the growth potential.

GCC Managed Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the GCC Managed Services Market, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (IT Services) and child market segments like Managed Cloud Services and Managed Security Services, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The market size is presented in million units.

GCC Managed Services Market Market Dynamics & Structure

The GCC Managed Services market is experiencing significant growth driven by increasing digital transformation initiatives across various sectors. Market concentration is moderate, with several large players and a growing number of smaller niche providers. Technological innovation, particularly in areas like AI and cloud computing, is a key driver. Regulatory frameworks, while evolving, generally support market growth. Competitive substitutes, such as in-house IT teams, are increasingly challenged by the cost-effectiveness and expertise of managed service providers (MSPs). End-user demographics are shifting towards greater reliance on outsourced IT services. M&A activity is moderate, with larger players strategically acquiring smaller firms to expand their service offerings and market reach.

- Market Concentration: Moderate, with a few dominant players and numerous smaller MSPs.

- Technological Innovation: AI, cloud computing, and automation are key drivers, increasing efficiency and reducing costs.

- Regulatory Framework: Supportive of digital transformation and outsourcing, with ongoing evolution.

- Competitive Substitutes: In-house IT teams face increasing pressure from the efficiency and specialization of MSPs.

- M&A Activity: Moderate levels of mergers and acquisitions to expand service portfolios and market share. XX M&A deals were recorded between 2019-2024, with a projected xx deals for 2025-2033.

- End-user Demographics: Increasing demand from BFSI, IT & Telecom, and Government sectors.

GCC Managed Services Market Growth Trends & Insights

The GCC Managed Services market exhibits strong growth, fueled by the region's rapid digital transformation and increasing adoption of cloud technologies. Market size grew from xx million in 2019 to xx million in 2024, registering a CAGR of xx%. This growth trajectory is expected to continue, reaching xx million by 2033, with a forecasted CAGR of xx% during 2025-2033. The adoption rate of managed services is accelerating across all segments, driven by factors like rising cybersecurity threats and the need for improved IT infrastructure efficiency. Technological disruptions, such as the emergence of serverless computing and edge computing, are creating new opportunities for MSPs. Consumer behavior shifts are reflecting a preference for flexible and scalable IT solutions, aligning perfectly with the offerings of managed service providers. Market penetration is increasing across all end-user verticals, particularly in BFSI and Government sectors.

Dominant Regions, Countries, or Segments in GCC Managed Services Market

The UAE and Saudi Arabia are the leading markets within the GCC, accounting for xx% and xx% of the total market share respectively in 2024. This dominance is attributed to their advanced digital infrastructure, robust economies, and significant investments in technology. The Managed Cloud Services segment exhibits the highest growth rate, driven by the increasing adoption of cloud-based solutions across all industries. The BFSI and IT & Telecom sectors represent the largest end-user verticals due to their high reliance on reliable and secure IT infrastructure. Qatar and other GCC countries are experiencing steady growth, driven by government initiatives and increasing private sector investment in digital transformation.

- Key Drivers in UAE & Saudi Arabia: Advanced digital infrastructure, strong economic growth, and significant government investments in technology.

- Key Drivers in Managed Cloud Services Segment: Growing adoption of cloud-based solutions, enhanced scalability, and cost-effectiveness.

- Key Drivers in BFSI & IT & Telecom Sectors: High dependence on secure and reliable IT infrastructure, continuous operations, and data security needs.

GCC Managed Services Market Product Landscape

The GCC Managed Services market offers a diverse range of products, including Managed Infrastructure Services, Managed Hosting Services, Managed Security Services, Managed Cloud Services, and Disaster Recovery & Business Continuity Services. Innovation is focused on enhancing security, automation, and scalability. Key performance metrics include uptime, service level agreements (SLAs), and customer satisfaction. Many providers are differentiating themselves through specialized expertise in specific industry verticals and by offering integrated solutions that combine multiple service offerings. Advanced analytics and AI are increasingly being incorporated to improve service delivery and predictive maintenance.

Key Drivers, Barriers & Challenges in GCC Managed Services Market

Key Drivers:

- Increasing digital transformation initiatives across all sectors.

- Growing demand for enhanced security and data protection.

- Need for improved IT infrastructure efficiency and scalability.

- Rising adoption of cloud-based solutions.

Key Challenges & Restraints:

- Intense competition among numerous providers.

- Security concerns related to cloud computing and data breaches.

- Skill gaps in the IT workforce, hindering service delivery.

- Regulatory compliance and data privacy concerns.

Emerging Opportunities in GCC Managed Services Market

- Growing demand for managed security services due to increasing cybersecurity threats.

- Expansion into niche markets, such as IoT managed services and AI-powered solutions.

- Adoption of hybrid cloud models combining on-premise and cloud-based infrastructure.

- Increased focus on managed services for SMBs and start-ups.

Growth Accelerators in the GCC Managed Services Market Industry

The GCC Managed Services market is poised for continued growth, fueled by several key catalysts. Technological advancements, particularly in AI and automation, are significantly improving service delivery efficiency and scalability. Strategic partnerships between MSPs and technology vendors are driving the development of innovative solutions tailored to specific customer needs. Government initiatives promoting digital transformation and investments in digital infrastructure are creating a conducive environment for market expansion. Furthermore, the increasing awareness of cybersecurity threats is boosting demand for managed security services, representing a significant growth opportunity.

Key Players Shaping the GCC Managed Services Market Market

- IBM Corporation

- Saudi Telecom Company

- Diyar United Group

- Etihad Etisalat Co (Mobily)

- Ooredoo Group

- EITC Group (du)

- ACS Group

- AGC Networks (An ESSAR Company)

- Emitac

- MEEZA Group

- HP Middle East

- Wipro Group

Notable Milestones in GCC Managed Services Market Sector

- July 2022: Cisco launched a new Webex Wholesale Route-to-Market (RTM) for service providers, enhancing managed service delivery options for SMBs.

- May 2022: Fujitsu partnered with AWS to accelerate digital transformation in the financial and retail sectors, offering new services via the AWS Marketplace.

- February 2023: Du (EITC) and Ericsson announced a strategic partnership leveraging AI to transform Du's IT operations, improving efficiency and agility.

In-Depth GCC Managed Services Market Market Outlook

The GCC Managed Services market is projected to experience robust growth over the forecast period (2025-2033), driven by sustained demand for cloud-based services, enhanced security measures, and ongoing digital transformation initiatives across various sectors. Strategic partnerships, technological innovations, and favorable government policies will further fuel market expansion. Opportunities abound for MSPs offering specialized solutions tailored to specific industry verticals and those leveraging AI and automation to improve service delivery and customer experience. The market's future potential remains significant, promising lucrative returns for both established players and emerging entrants.

GCC Managed Services Market Segmentation

-

1. Type

- 1.1. Managed Infrastructure Services

- 1.2. Managed Hosting Services

- 1.3. Managed Security Services

- 1.4. Managed Cloud Services

- 1.5. Disaster Recovery & Business Continuity Services

-

2. End-user Vertical

- 2.1. IT & Telecom

- 2.2. BFSI

- 2.3. Oil & Gas

- 2.4. Healthcare

- 2.5. Government

- 2.6. Other

GCC Managed Services Market Segmentation By Geography

- 1. Africa

GCC Managed Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Outsourcing of Noncore Operations in the BFSI and Retail Sector; Trend Toward Commoditization of Services and Growing Competition among MSPs; Growing Demand towards Managed Hosting Services to boost the market

- 3.3. Market Restrains

- 3.3.1. Integration and Regulatory Issues and Reliability Concerns

- 3.4. Market Trends

- 3.4.1. Managed Hosting Services expected to grow significantly over the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Managed Infrastructure Services

- 5.1.2. Managed Hosting Services

- 5.1.3. Managed Security Services

- 5.1.4. Managed Cloud Services

- 5.1.5. Disaster Recovery & Business Continuity Services

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. IT & Telecom

- 5.2.2. BFSI

- 5.2.3. Oil & Gas

- 5.2.4. Healthcare

- 5.2.5. Government

- 5.2.6. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa GCC Managed Services Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saudi Telecom Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Diyar United Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Etihad Etisalat Co (Mobily)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ooredoo Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EITC Group (du)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACS Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AGC Networks (An ESSAR Company)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Emitac

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MEEZA Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HP Middle East

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wipro Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 IBM Corporation

List of Figures

- Figure 1: Global GCC Managed Services Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Africa GCC Managed Services Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Africa GCC Managed Services Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Africa GCC Managed Services Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: Africa GCC Managed Services Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: Africa GCC Managed Services Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Africa GCC Managed Services Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GCC Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global GCC Managed Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global GCC Managed Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global GCC Managed Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: GCC Managed Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global GCC Managed Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global GCC Managed Services Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global GCC Managed Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Managed Services Market?

The projected CAGR is approximately 8.96%.

2. Which companies are prominent players in the GCC Managed Services Market?

Key companies in the market include IBM Corporation, Saudi Telecom Company, Diyar United Group, Etihad Etisalat Co (Mobily), Ooredoo Group, EITC Group (du), ACS Group, AGC Networks (An ESSAR Company), Emitac, MEEZA Group, HP Middle East, Wipro Group.

3. What are the main segments of the GCC Managed Services Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Outsourcing of Noncore Operations in the BFSI and Retail Sector; Trend Toward Commoditization of Services and Growing Competition among MSPs; Growing Demand towards Managed Hosting Services to boost the market.

6. What are the notable trends driving market growth?

Managed Hosting Services expected to grow significantly over the forecast period.

7. Are there any restraints impacting market growth?

Integration and Regulatory Issues and Reliability Concerns.

8. Can you provide examples of recent developments in the market?

February 2023: Du, from Emirates Integrated Telecommunications Company (EITC), and Ericsson announced a strategic partnership at Mobile World Congress 2023 to transform Du's Information Technology (IT) operations. In order to improve quality, unlock efficiencies, and increase agility, Du will use the services of Ericsson's Artificial Intelligence AI and Business and Operations Support Systems. A significant step forward in the Digital Transformation Programme of Du will be achieved through this partnership.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Managed Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Managed Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Managed Services Market?

To stay informed about further developments, trends, and reports in the GCC Managed Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence