Key Insights

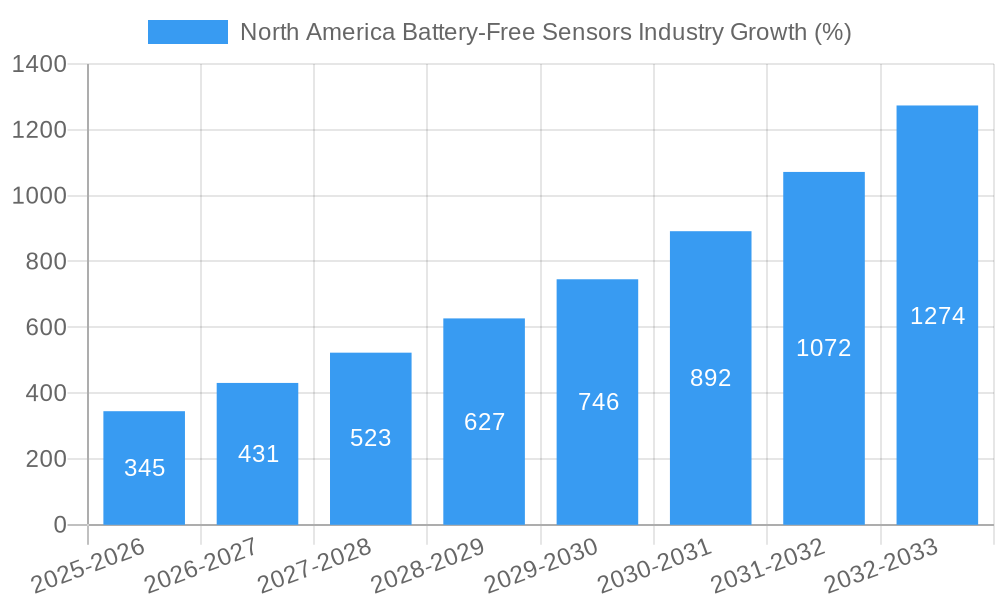

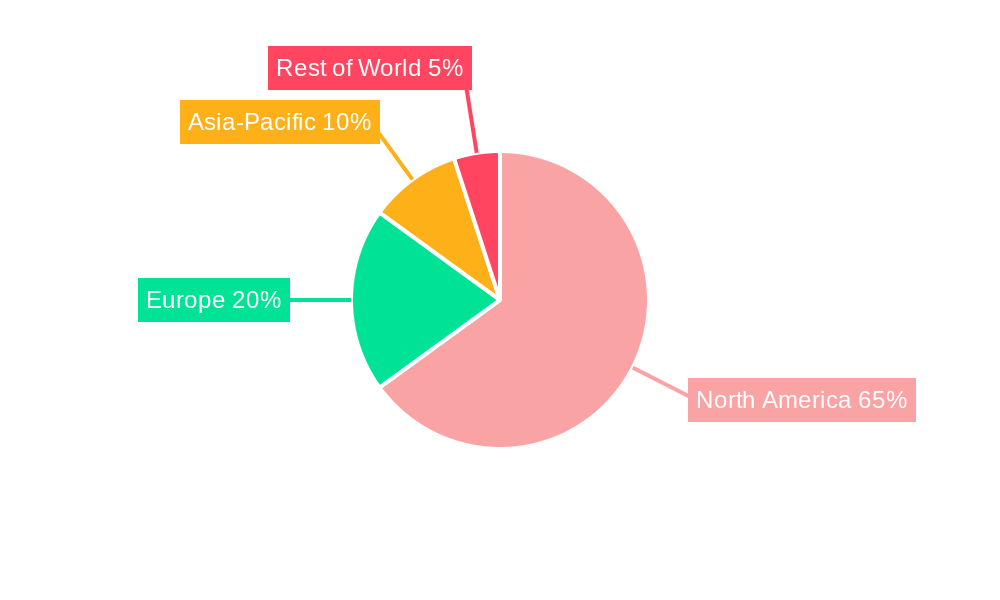

The North America battery-free sensor market is experiencing robust growth, driven by the increasing demand for energy-efficient, low-maintenance sensing solutions across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 23.40% from 2019 to 2024 indicates significant expansion, projected to continue into the forecast period (2025-2033). Key drivers include the burgeoning Internet of Things (IoT) ecosystem, the need for remote monitoring and data acquisition in various applications, and advancements in sensor technology enabling longer operational lifetimes without battery replacements. Specific application areas like automotive (advanced driver-assistance systems, predictive maintenance), healthcare (remote patient monitoring, wearable sensors), and industrial automation (predictive maintenance, process optimization) are key contributors to this growth. While the initial investment in battery-free sensor infrastructure may be higher, the long-term cost savings associated with eliminated battery replacements and reduced maintenance significantly outweigh the upfront expenses. Furthermore, the increasing availability of energy harvesting technologies, such as solar, piezoelectric, and vibration energy harvesting, further accelerates market adoption. The market segmentation reveals significant growth across sensor types, with pressure, temperature, and chemical/gas sensors leading the way. The United States holds the largest market share within North America, followed by Canada. However, we anticipate significant growth in both countries and Mexico within the broader North American market over the coming years.

The competitive landscape is marked by established players like Honeywell International Inc., ABB Ltd., and Texas Instruments Incorporated, alongside emerging companies specializing in specific sensor technologies. These companies are actively involved in research and development to enhance sensor performance, miniaturization, and energy harvesting capabilities. The market's expansion is however subject to certain restraints such as the higher initial cost of implementation compared to battery-powered solutions, the dependence on reliable energy harvesting methods, and potential challenges in data transmission from remote locations. Nevertheless, the substantial benefits in terms of cost-effectiveness, extended operational life, and reduced environmental impact will likely drive continued market growth and expansion across various applications and geographical regions within North America throughout the forecast period.

North America Battery-Free Sensors Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America battery-free sensors industry, covering market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The market is segmented by country (United States, Canada), sensor type (Pressure Sensor, Temperature Sensor, Chemical and Gas Sensor, Position and Proximity Sensor, Other Types), and end-user industry (Automotive, Healthcare, Aerospace and Defense, Energy and Power, Food and Beverage, Other End-user Industries).

North America Battery-Free Sensors Industry Market Dynamics & Structure

The North American battery-free sensors market is characterized by moderate concentration, with several major players and numerous smaller niche companies. Technological innovation, driven by advancements in energy harvesting and low-power electronics, is a key driver. Regulatory frameworks, particularly concerning data security and environmental compliance, play a significant role. Competitive pressure from wired sensor alternatives exists, but the benefits of battery-free sensors in terms of maintenance and cost reduction are increasingly compelling. The end-user demographics are diverse, encompassing various sectors with differing technological needs and adoption rates. M&A activity is moderate, with larger players strategically acquiring smaller companies to enhance their product portfolios and expand market reach.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller companies. The top 5 players hold approximately xx% market share in 2025 (estimated).

- Technological Innovation: Significant advancements in energy harvesting (e.g., piezoelectric, solar) and low-power electronics are driving market growth.

- Regulatory Landscape: Compliance with data security and environmental regulations is a key consideration.

- Competitive Substitutes: Wired sensors pose a competitive threat, but battery-free sensors offer advantages in terms of cost and maintenance.

- M&A Trends: Moderate M&A activity, with strategic acquisitions focused on expanding product portfolios and market penetration. xx M&A deals were recorded between 2019 and 2024.

- Innovation Barriers: High initial R&D costs and the complexities of integrating energy harvesting technologies can pose barriers to entry.

North America Battery-Free Sensors Industry Growth Trends & Insights

The North American battery-free sensors market exhibits robust growth, driven by the increasing demand for remote monitoring and automation across diverse industries. The market size is projected to reach xx million units by 2025, with a CAGR of xx% during the forecast period (2025-2033). Adoption rates are accelerating due to decreasing costs, enhanced reliability, and the rising need for low-maintenance solutions. Technological disruptions, such as advancements in wireless communication protocols and improved energy harvesting techniques, contribute to this growth. Consumer behavior shifts towards smart and connected devices further fuel market expansion.

(Note: This section would contain 600 words of detailed analysis leveraging specific data points and trends, expanding on the points above.)

Dominant Regions, Countries, or Segments in North America Battery-Free Sensors Industry

The United States dominates the North American battery-free sensors market, accounting for approximately xx% of the total market value in 2025 (estimated), followed by Canada. Within sensor types, pressure and temperature sensors hold the largest market share, driven by widespread applications in various industries. The healthcare sector demonstrates the strongest growth potential, due to increasing demand for remote patient monitoring and improved medical device capabilities.

- United States: Largest market share due to strong industrial base, advanced technological infrastructure, and high adoption rates across multiple sectors.

- Canada: Growing market, driven by government initiatives promoting technological innovation and industrial automation.

- Pressure Sensors: Highest demand driven by applications in industrial automation, building management, and healthcare.

- Temperature Sensors: High demand due to applications in food and beverage, healthcare, and industrial process monitoring.

- Healthcare: Fastest-growing end-user segment, driven by rising healthcare costs and the increasing adoption of remote patient monitoring solutions.

(Note: This section would contain 600 words of detailed analysis, expanding on the above bullet points and providing specific market share data and growth potential estimates for each segment and country.)

North America Battery-Free Sensors Industry Product Landscape

Battery-free sensors are characterized by a diverse range of products, each tailored to specific applications. Innovation is focused on enhancing energy harvesting efficiency, improving sensor accuracy, and extending operational lifespan. Miniaturization, improved wireless communication capabilities, and enhanced data processing are key features. Unique selling propositions include low maintenance, extended operational life, and enhanced safety in hazardous environments.

Key Drivers, Barriers & Challenges in North America Battery-Free Sensors Industry

Key Drivers: The rising adoption of IoT, the need for remote monitoring and automation in various industries, and the increasing demand for low-maintenance solutions significantly drive market growth. Government initiatives and funding for technological innovation also play a substantial role.

Key Challenges: High initial investment costs, the complexity of integrating energy harvesting technologies, and the need for robust data security protocols pose significant challenges. Supply chain disruptions and the lack of skilled workforce can also impact market growth. Competitive pressures from established players and the emergence of new entrants add further complexity.

Emerging Opportunities in North America Battery-Free Sensors Industry

Emerging opportunities include the integration of AI and machine learning for improved data analysis, the expansion into untapped market segments (e.g., smart agriculture, environmental monitoring), and the development of innovative sensor applications in areas like smart cities and industrial IoT.

Growth Accelerators in the North America Battery-Free Sensors Industry

Technological advancements in energy harvesting, improved sensor miniaturization, and enhanced wireless communication are key growth accelerators. Strategic partnerships between sensor manufacturers and end-user industries, coupled with government support for research and development, will further propel market expansion.

Key Players Shaping the North America Battery-Free Sensors Industry Market

- Honeywell International Inc

- ABB Ltd

- Monnit Corporation

- Emerson Electric Co

- Texas Instruments Incorporated

- Phoenix Sensors LLC

- Pasco Scientific

- Schneider Electric *List Not Exhaustive

Notable Milestones in North America Battery-Free Sensors Industry Sector

- March 2021: MIT researchers developed a wireless sensing and AI system for improved medication administration.

- January 2021: Swift Sensors launched a secure wireless vaccine storage monitoring system.

In-Depth North America Battery-Free Sensors Industry Market Outlook

The future of the North American battery-free sensors market is bright, with significant growth potential driven by technological advancements, increasing adoption across diverse sectors, and the emergence of new applications. Strategic partnerships, investments in R&D, and a focus on developing innovative solutions will be crucial for companies seeking to capitalize on the market opportunities.

North America Battery-Free Sensors Industry Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Chemical and Gas Sensor

- 1.4. Position and Proximity Sensor

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Energy and Power

- 2.5. Food and Beverage

- 2.6. Other End-user Industries

North America Battery-Free Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Battery-Free Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation)

- 3.3. Market Restrains

- 3.3.1. False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Chemical and Gas Sensor

- 5.1.4. Position and Proximity Sensor

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy and Power

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Monnit Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Emerson Electric Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Texas Instruments Incorporated

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Phoenix Sensors LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pasco Scientific

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Battery-Free Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Battery-Free Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Battery-Free Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Battery-Free Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Battery-Free Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: North America Battery-Free Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Battery-Free Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Battery-Free Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America Battery-Free Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: North America Battery-Free Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Battery-Free Sensors Industry?

The projected CAGR is approximately 23.40%.

2. Which companies are prominent players in the North America Battery-Free Sensors Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Monnit Corporation, Emerson Electric Co, Texas Instruments Incorporated, Phoenix Sensors LLC, Pasco Scientific, Schneider Electric*List Not Exhaustive.

3. What are the main segments of the North America Battery-Free Sensors Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation).

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems.

8. Can you provide examples of recent developments in the market?

March 2021 - MIT researchers have developed wireless sensing and AI system that could help improve patients' techniques with self-administered medications such as inhalers and insulin pens. The wireless sensors could detect errors in self-administered medication, ranging from swallowing pills and injecting insulin. According to MIT, users can install the system in their homes, and it can alert patients and caregivers to medication errors and potentially reduce unnecessary hospital visits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Battery-Free Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Battery-Free Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Battery-Free Sensors Industry?

To stay informed about further developments, trends, and reports in the North America Battery-Free Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence