Key Insights

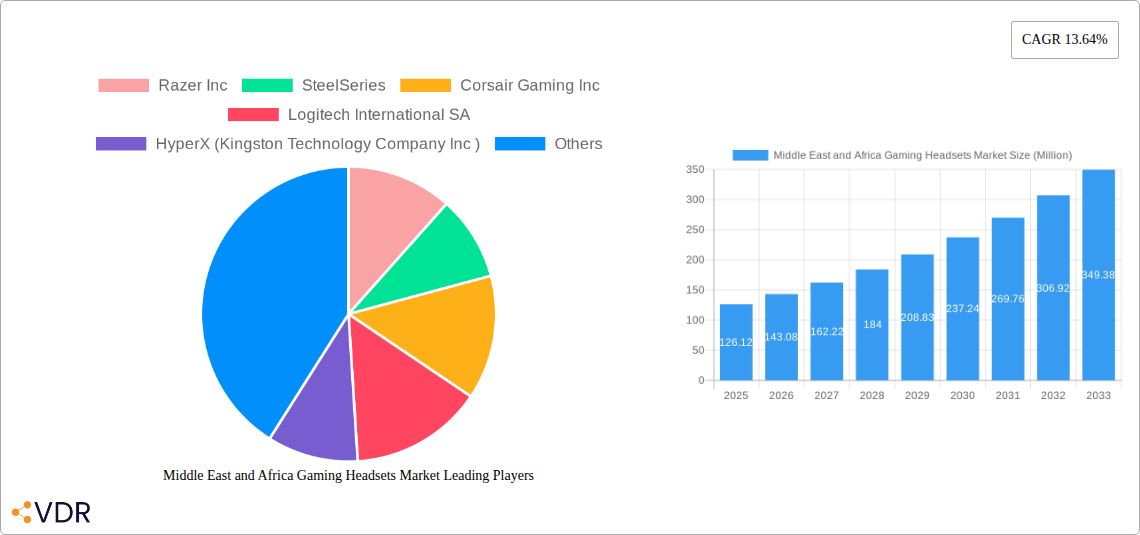

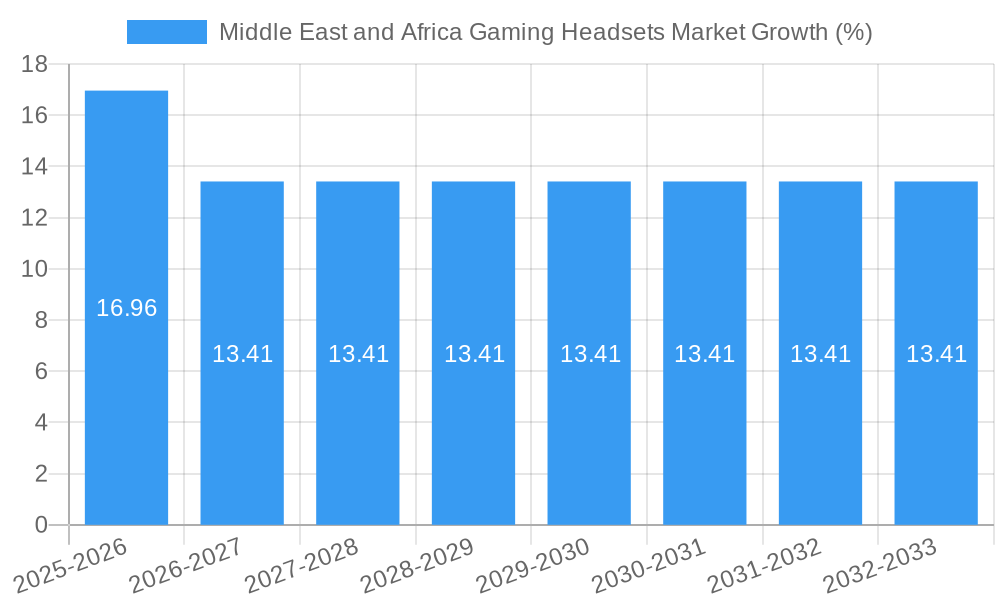

The Middle East and Africa (MEA) gaming headset market, valued at $126.12 million in 2025, is projected to experience robust growth, driven by the rising popularity of esports, increasing smartphone penetration, and a burgeoning gaming community across the region. The market's Compound Annual Growth Rate (CAGR) of 13.64% from 2025 to 2033 indicates significant expansion potential. Key growth drivers include the increasing affordability of gaming hardware, the rising adoption of cloud gaming services, and a preference for immersive gaming experiences among younger demographics. While challenges such as inconsistent internet infrastructure in certain areas and fluctuating economic conditions exist, the overall market outlook remains positive. The competitive landscape comprises both established international brands like Razer, SteelSeries, Corsair, Logitech, and HyperX, and regional players catering to local preferences. The market segmentation, while not explicitly provided, likely includes categories based on headset type (wired, wireless, virtual reality), price point (budget, mid-range, premium), and platform compatibility (PC, consoles, mobile). Future growth will hinge on continued investment in infrastructure improvements, the introduction of innovative headset technologies (like improved audio quality and haptic feedback), and targeted marketing campaigns that capitalize on the growing passion for gaming within the MEA region.

The sustained growth trajectory will be influenced by several factors. The increasing adoption of high-speed internet connectivity across the region is expected to significantly improve online gaming experiences, fueling the demand for premium gaming headsets. Moreover, the rising number of gaming tournaments and esports events will further boost the market by generating increased consumer interest and awareness. However, potential challenges such as price sensitivity among consumers and competition from cheaper, less sophisticated alternatives will need to be addressed by market players. Strategic partnerships with telecommunications providers and game developers will be crucial to enhance market penetration and create a more robust ecosystem. The market's future will be shaped by the interplay of technological advancements, economic factors, and the evolution of the gaming culture within the MEA region.

Middle East & Africa Gaming Headsets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa (MEA) gaming headsets market, covering market dynamics, growth trends, key players, and future outlook. The report is meticulously researched, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a focus on the parent market (Gaming Accessories) and child market (Gaming Headsets), this report leverages data from 2019-2024 (Historical Period), with estimations for 2025 (Estimated Year) and forecasts extending to 2033 (Forecast Period). The base year for this analysis is 2025. The report encompasses detailed analyses across various segments and key players, including Razer Inc, SteelSeries, Corsair Gaming Inc, Logitech International SA, HyperX (Kingston Technology Company Inc), Turtle Beach Corporation, ASTRO Gaming (Logitech), Sony Interactive Entertainment Inc, and Cooler Master Technology Inc. The market size is presented in Million units.

Middle East and Africa Gaming Headsets Market Dynamics & Structure

The MEA gaming headsets market is characterized by moderate concentration, with a few dominant players and several emerging brands vying for market share. Technological innovation, particularly in audio quality, comfort, and connectivity (e.g., wireless technologies like Bluetooth 5.0 and low-latency options), is a key driver. Regulatory frameworks concerning electronic product safety and consumer protection influence market practices. Competitive product substitutes, such as earbuds and speaker systems, exert some pressure, particularly in the budget segment. End-user demographics show a significant skew towards younger age groups (16-35 years), with a growing female gamer segment. M&A activity remains relatively low compared to more mature markets, with only xx deals recorded in the historical period, representing approximately xx% of the market value.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on enhanced audio fidelity, noise cancellation, comfort features (lightweight designs, adjustable headbands), and improved wireless connectivity.

- Regulatory Frameworks: Compliance with regional safety and quality standards (e.g., GCC standards) is crucial.

- Competitive Substitutes: Earbuds and speaker systems pose competitive challenges in the budget-conscious segment.

- End-User Demographics: Primarily 16-35 years old, with increasing female participation.

- M&A Trends: Relatively low activity historically, with xx deals completed between 2019-2024.

Middle East and Africa Gaming Headsets Market Growth Trends & Insights

The MEA gaming headsets market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching xx million units in 2024. This growth is fueled by rising smartphone penetration, increasing internet access, and a burgeoning esports scene. The market penetration rate currently stands at xx% and is projected to reach xx% by 2033. Technological disruptions, such as the adoption of virtual reality (VR) and augmented reality (AR) gaming, are expected to further drive demand for specialized headsets. Shifting consumer preferences towards premium features, such as advanced noise cancellation and personalized audio profiles, also contribute to market expansion. The forecast period (2025-2033) projects a CAGR of xx%, indicating strong growth potential driven by the increasing affordability of gaming PCs and consoles, coupled with the growth of mobile gaming.

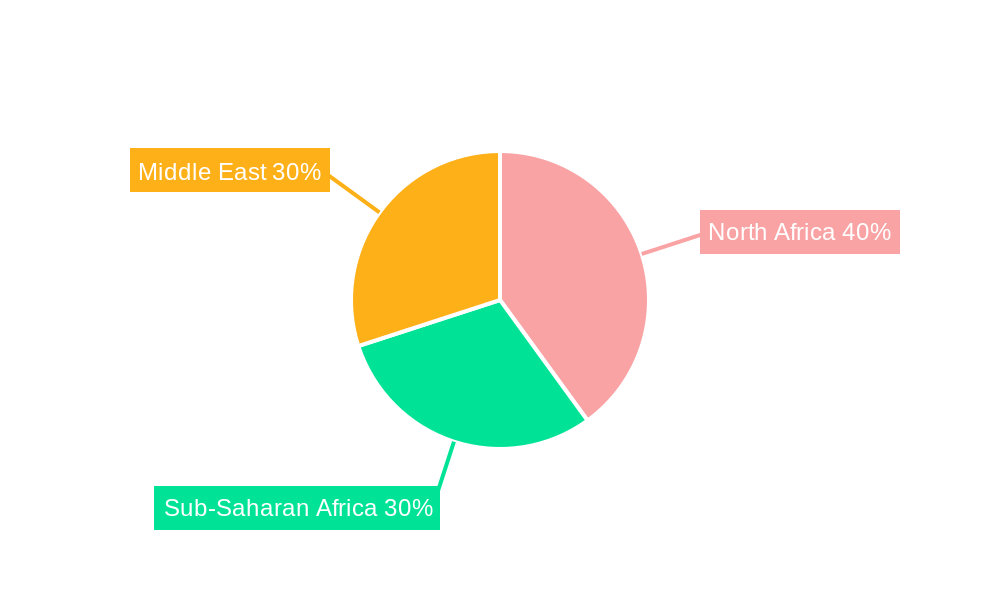

Dominant Regions, Countries, or Segments in Middle East and Africa Gaming Headsets Market

The GCC region (UAE, Saudi Arabia) currently dominates the MEA gaming headsets market, accounting for approximately xx% of the total market value in 2025. This dominance is primarily due to higher disposable incomes, advanced digital infrastructure, and a strong gaming culture. South Africa also exhibits significant growth potential, driven by a large youth population and rising mobile gaming adoption. The high-end segment (premium features, advanced technologies) is the fastest-growing segment, representing xx% of total sales in 2025.

- Key Drivers in GCC: High disposable incomes, advanced digital infrastructure, strong gaming culture.

- Key Drivers in South Africa: Large youth population, rising mobile gaming adoption, increasing affordability of gaming devices.

- High-End Segment Dominance: Driven by consumer preference for premium features and improved gaming experience.

Middle East and Africa Gaming Headsets Market Product Landscape

The MEA gaming headsets market showcases a diverse range of products, from budget-friendly wired options to premium wireless headsets with advanced noise cancellation and surround sound capabilities. Innovations focus on improving comfort, ergonomics, and integration with gaming platforms. Features like customizable EQ settings, detachable microphones, and RGB lighting enhance the overall user experience. Technological advancements in audio processing and wireless transmission technologies are key differentiators.

Key Drivers, Barriers & Challenges in Middle East and Africa Gaming Headsets Market

Key Drivers: The primary drivers include the rising popularity of esports, increasing smartphone penetration, expanding internet access, and the introduction of new gaming consoles. Government initiatives promoting digital literacy and technological advancements also play a significant role.

Key Challenges: Challenges include the price sensitivity of consumers in certain regions, counterfeiting of products, and supply chain disruptions which could affect availability and pricing, impacting market growth by approximately xx% in 2025. Regulatory hurdles in certain countries and limited awareness of advanced features in less developed areas also pose constraints.

Emerging Opportunities in Middle East and Africa Gaming Headsets Market

Emerging opportunities lie in tapping into untapped markets in sub-Saharan Africa, catering to the growing demand for affordable, yet high-quality headsets. Development of headsets specifically designed for mobile gaming, VR/AR integration, and incorporating features tailored to specific regional preferences (language support, design aesthetics) can unlock significant growth potential.

Growth Accelerators in the Middle East and Africa Gaming Headsets Market Industry

Long-term growth will be fueled by technological breakthroughs in audio and connectivity technologies, strategic partnerships between gaming hardware manufacturers and telecom companies, and expansion into new markets within Africa. Increased investment in esports infrastructure and initiatives to foster a thriving gaming community will further accelerate market expansion.

Key Players Shaping the Middle East and Africa Gaming Headsets Market Market

- Razer Inc (Razer)

- SteelSeries (SteelSeries)

- Corsair Gaming Inc (Corsair)

- Logitech International SA (Logitech)

- HyperX (Kingston Technology Company Inc)

- Turtle Beach Corporation (Turtle Beach)

- ASTRO Gaming (Logitech)

- Sony Interactive Entertainment Inc (Sony)

- Cooler Master Technology Inc (Cooler Master)

Notable Milestones in Middle East and Africa Gaming Headsets Market Sector

- October 2023: EKSA’s participation in GITEX 2023 showcased its commitment to high-quality gaming headsets in the MEA market.

- August 2024: Sony’s partnership with the NFL to create official NFL headsets for coach-to-coach communication marks a significant development in the professional sports and technology integration, potentially impacting the demand for high-performance headsets.

In-Depth Middle East and Africa Gaming Headsets Market Market Outlook

The MEA gaming headsets market presents strong growth prospects over the next decade. Continued technological advancements, rising disposable incomes, expanding internet penetration, and increasing adoption of esports will drive market expansion. Strategic partnerships, product diversification, and tapping into untapped regional markets will be crucial for players aiming to capture significant market share. The market's future is bright, with significant potential for growth and innovation.

Middle East and Africa Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Middle East and Africa Gaming Headsets Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1 Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms

- 3.3.2 such as E-sports Betting and Fantasy Sites

- 3.4. Market Trends

- 3.4.1. Retail Sales Channel Augment the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Razer Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SteelSeries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corsair Gaming Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Logitech International SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HyperX (Kingston Technology Company Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Turtle Beach Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ASTRO Gaming (Logitech)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sony Interactive Entertainment Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cooler Master Technology Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Razer Inc

List of Figures

- Figure 1: Middle East and Africa Gaming Headsets Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Gaming Headsets Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Connectivity 2019 & 2032

- Table 6: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Connectivity 2019 & 2032

- Table 7: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Connectivity 2019 & 2032

- Table 14: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Connectivity 2019 & 2032

- Table 15: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: Middle East and Africa Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Middle East and Africa Gaming Headsets Market Volume Million Forecast, by Country 2019 & 2032

- Table 19: Saudi Arabia Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Saudi Arabia Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: United Arab Emirates Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Israel Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Israel Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Qatar Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Qatar Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Kuwait Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Kuwait Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Oman Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Oman Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Bahrain Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Bahrain Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 33: Jordan Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Jordan Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Lebanon Middle East and Africa Gaming Headsets Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Lebanon Middle East and Africa Gaming Headsets Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Gaming Headsets Market?

The projected CAGR is approximately 13.64%.

2. Which companies are prominent players in the Middle East and Africa Gaming Headsets Market?

Key companies in the market include Razer Inc, SteelSeries, Corsair Gaming Inc, Logitech International SA, HyperX (Kingston Technology Company Inc ), Turtle Beach Corporation, ASTRO Gaming (Logitech), Sony Interactive Entertainment Inc, Cooler Master Technology Inc.

3. What are the main segments of the Middle East and Africa Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Retail Sales Channel Augment the Market's Growth.

7. Are there any restraints impacting market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

8. Can you provide examples of recent developments in the market?

August 2024 - In UAE, Sony introduced a partnership with the National Football League, which names Sony as an official technology partner of the NFL, along with the new official headphones of the NFL. The NFL and Sony will work closely to create this new headset supporting coach-to-coach communication on the field. These will be powered by Verizon Business’ Managed Private Wireless Solution running on Verizon’s reliable 5G network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence