Key Insights

The Middle East and Africa (MEA) alcoholic beverages market, valued at an estimated $X million in 2025, is projected to experience robust growth, driven by a rising disposable income, increasing urbanization, and a burgeoning tourism sector. The region's diverse cultural landscape presents both opportunities and challenges. While certain countries maintain strict regulations on alcohol consumption and distribution, others are witnessing a gradual liberalization, creating pockets of significant market expansion. The on-trade segment, encompassing restaurants, bars, and hotels, is expected to be a key driver, especially in areas with more relaxed regulations and a thriving hospitality industry. Growth will likely be concentrated in urban centers and tourist destinations, with premium segments like spirits and imported wines performing particularly well. However, factors such as religious and cultural sensitivities, along with existing excise duties and import tariffs, will continue to act as restraints, shaping the market's trajectory and distribution patterns. The competitive landscape is characterized by a mix of international giants and local players, reflecting varying market penetration strategies and product portfolios. Specific growth within sub-regions will depend on the pace of economic development, regulatory changes, and consumer preferences. Future analysis should focus on individual country profiles within MEA to gain a more nuanced understanding of the market dynamics.

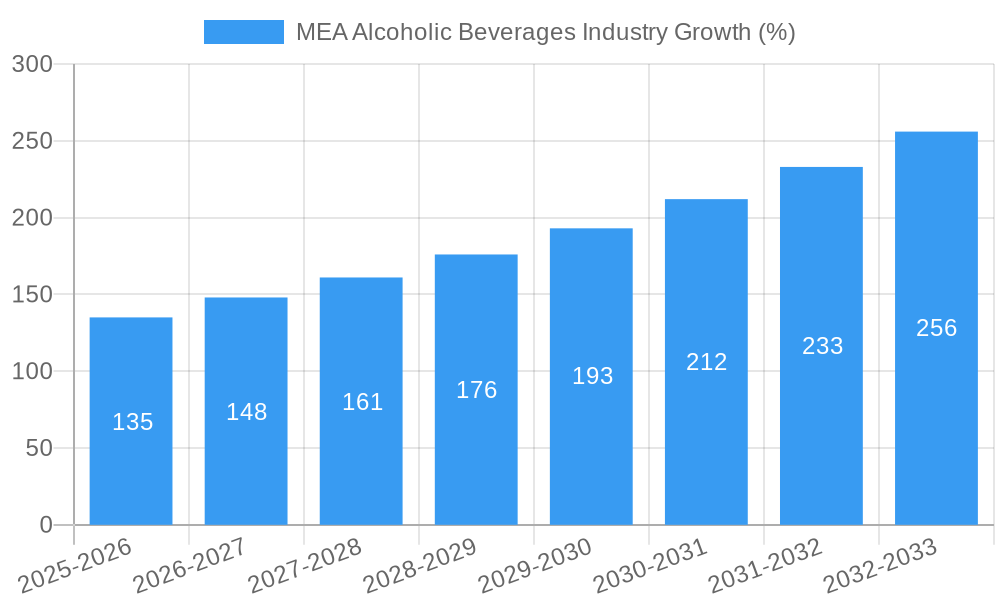

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) slightly lower than the global average, estimated around 8-9%, reflecting the specific socio-cultural factors within MEA. This moderate yet steady growth will be driven by factors including targeted marketing campaigns focusing on premiumization, innovative product launches catering to local tastes, and strategic partnerships between international brands and local distributors. Despite the restraints, the long-term outlook for the MEA alcoholic beverages market remains positive, indicating strong potential for businesses that navigate the region's unique regulatory environment and cultural nuances effectively. Furthermore, the development of responsible consumption campaigns will likely become increasingly crucial for sustained and ethical growth in the market. A focus on sustainability initiatives also presents a significant opportunity for brands to align with consumer preferences for environmentally conscious products.

MEA Alcoholic Beverages Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa (MEA) alcoholic beverages industry, covering the period 2019-2033. It offers invaluable insights into market dynamics, growth trends, key players, and emerging opportunities within this dynamic sector. The report segments the market by product type (Beer, Wine, Spirits) and distribution channel (On-trade, Off-trade), providing granular data for strategic decision-making.

MEA Alcoholic Beverages Industry Market Dynamics & Structure

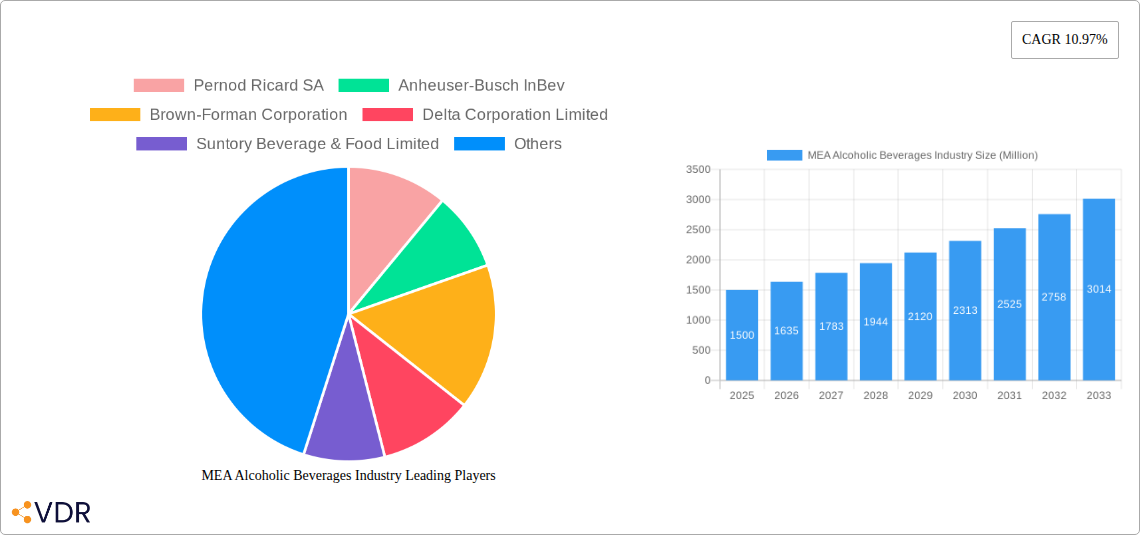

The MEA alcoholic beverages market is characterized by a moderate level of concentration, with several multinational corporations and regional players dominating various segments. Market share is fluid, influenced by consumer preferences, distribution networks, and regulatory changes. Technological innovation, though present, faces barriers such as infrastructure limitations and cultural sensitivities in certain regions. Regulatory frameworks vary significantly across countries, impacting pricing, distribution, and marketing strategies. The industry witnesses constant competition from non-alcoholic beverages and evolving consumer preferences towards healthier alternatives. M&A activity is relatively moderate, with larger players focusing on strategic acquisitions to expand their regional presence or product portfolio. The historical period (2019-2024) shows a xx Million units market value, with an estimated value of xx Million units in 2025.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Technological Innovation: Driven by improved brewing techniques, sustainable packaging, and digital marketing. Barriers include infrastructure gaps and cultural acceptance.

- Regulatory Framework: Diverse and complex across MEA countries, impacting pricing, distribution, and marketing.

- Competitive Substitutes: Non-alcoholic beverages, functional drinks, and ready-to-drink cocktails pose increasing competition.

- End-User Demographics: Growing young population and rising disposable incomes drive consumption, particularly in urban areas.

- M&A Trends: Moderate activity focused on market expansion and portfolio diversification. xx M&A deals recorded between 2019 and 2024.

MEA Alcoholic Beverages Industry Growth Trends & Insights

The MEA alcoholic beverages market exhibits significant growth potential, driven by factors such as increasing urbanization, rising disposable incomes, and changing consumer preferences. The market size has grown considerably over the past five years and is expected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a projected value of xx Million units by 2033. This growth is fueled by the increasing popularity of premium and craft beverages, as well as the expansion of distribution channels into previously underserved regions. Technological disruptions, such as e-commerce platforms and personalized marketing, are reshaping consumer behavior and impacting market dynamics. Changing consumer preferences, including a preference for healthier options and more diverse flavors, are creating new opportunities for innovation and product diversification.

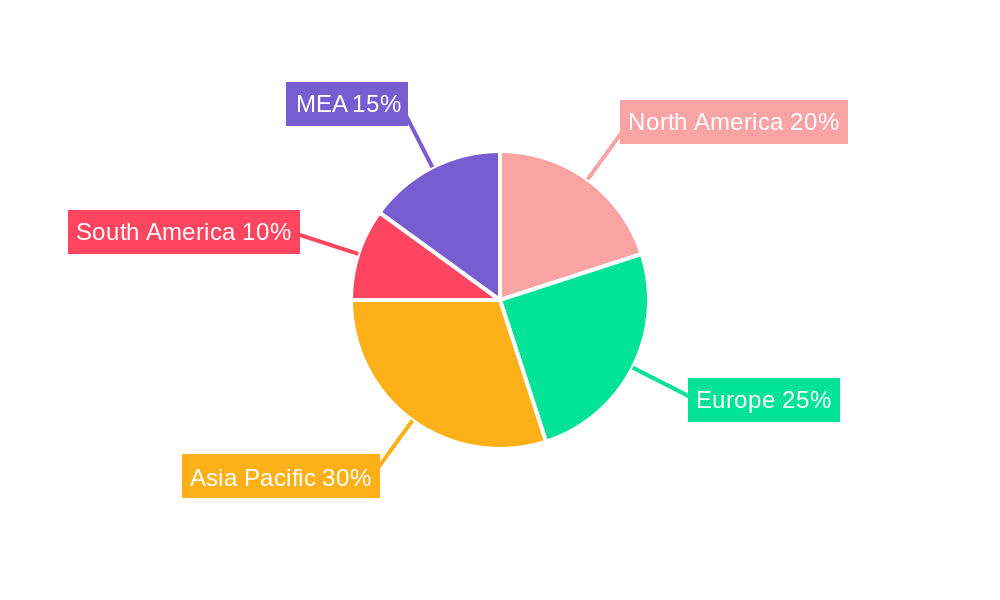

Dominant Regions, Countries, or Segments in MEA Alcoholic Beverages Industry

The MEA alcoholic beverage market is highly diverse, with specific regions exhibiting dominance based on various factors. While precise market share data requires deeper analysis, generally, countries like the UAE, South Africa, and Egypt are leading markets. Spirits are predicted to hold the largest market share by product type, followed by beer and then wine. The on-trade channel currently dominates distribution, although the off-trade segment is experiencing significant growth, driven by e-commerce penetration.

Key Growth Drivers:

- Economic Growth: Rising disposable incomes drive consumption.

- Tourism: Significant tourist influx boosts demand in key cities.

- Changing Consumer Preferences: Increasing demand for premium and craft products.

- Urbanization: Concentration of population in urban centers promotes consumption.

Dominant Regions/Countries: UAE, South Africa, and Egypt exhibit the highest market share and growth potential due to their strong economies, higher disposable incomes, and favourable regulatory environments. The contribution of the on-trade to the overall market is estimated at xx%, with a considerable growth predicted for off-trade sales in the forecast period.

MEA Alcoholic Beverages Industry Product Landscape

Product innovation is a key driver in the MEA alcoholic beverages market. Companies are constantly developing new products, flavors, and packaging formats to cater to evolving consumer preferences. Premiumization, craft beverages, and ready-to-drink (RTD) cocktails are key trends. Technological advancements are focusing on improving brewing and distilling techniques, enhancing shelf life, and reducing the environmental impact of production. Unique selling propositions often involve highlighting locally sourced ingredients, heritage, or unique flavor profiles that appeal to the sophisticated palates of consumers.

Key Drivers, Barriers & Challenges in MEA Alcoholic Beverages Industry

Key Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels consumption, particularly for premium products.

- Changing Lifestyle: Modern lifestyles with a growing young population and greater social interaction drives demand for alcoholic beverages.

- Tourism Growth: Tourists increase consumption, particularly in tourist hubs.

Challenges & Restraints:

- Regulatory Restrictions: Strict alcohol regulations vary significantly across countries, impacting market access and pricing.

- Cultural and Religious Factors: Religious restrictions and cultural norms in some regions limit consumption.

- Health Concerns: Growing awareness of health issues related to alcohol consumption is impacting demand. This has caused a xx% reduction in consumption in xx region, for instance.

Emerging Opportunities in MEA Alcoholic Beverages Industry

- Untapped Markets: Exploring underserved areas with rising disposable incomes.

- Premiumization: Highlighting luxury and craftsmanship to appeal to discerning consumers.

- Health-Conscious Options: Developing low-calorie, organic, or functional alcoholic beverages.

- E-commerce Growth: Leveraging online platforms to enhance accessibility and distribution.

Growth Accelerators in the MEA Alcoholic Beverages Industry

The MEA alcoholic beverage market's future growth will be fueled by sustained economic growth, rising disposable incomes across several countries, and the increasing popularity of premium and craft beverages. Strategic partnerships between local producers and international brands will also play a key role, enabling technology transfer and enhancing distribution networks. Government initiatives to promote responsible alcohol consumption, while managing potential health concerns, will create a stable regulatory environment, fostering sustainable long-term growth.

Key Players Shaping the MEA Alcoholic Beverages Industry Market

- Pernod Ricard SA

- Anheuser-Busch InBev

- Brown-Forman Corporation

- Delta Corporation Limited

- Suntory Beverage & Food Limited

- Refriango LDA

- Edward Snell & Co

- Molson Coors Beverage Company

- Heineken Holdings NV

- Diageo PLC

Notable Milestones in MEA Alcoholic Beverages Industry Sector

- October 2023: Diageo established a spirits business in West and Central Africa, launching Orijin, Captain Morgan Gold, Gordon’s Moringa, and Smirnoff brands. This expansion significantly impacts market penetration in a previously underserved region.

- March 2022: Diageo launched "Godawan Single Malt," a locally crafted artisanal whisky in Dubai, signifying investment in regional product development and premiumization.

- January 2022: Le Clos launched a limited-edition 50-year-old blended whisky, highlighting luxury and exclusivity in the market.

In-Depth MEA Alcoholic Beverages Industry Market Outlook

The MEA alcoholic beverages market is poised for robust growth over the next decade. Continued economic development, coupled with evolving consumer preferences towards premiumization and diversification, will drive market expansion. Strategic partnerships, technological advancements, and innovative product development will further fuel growth. Companies that focus on adapting to evolving consumer needs, navigating regulatory landscapes effectively, and embracing sustainable practices are best positioned to capitalize on the significant market opportunities.

MEA Alcoholic Beverages Industry Segmentation

-

1. Product Type

- 1.1. Beer

- 1.2. Wine

- 1.3. Spirits

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supemarkets/Hypermarkets

- 2.2.2. Specialty stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off-Trade Channels

-

3. Geography

- 3.1. South Africa

- 3.2. United Arab Emirates

- 3.3. Bahrain

- 3.4. Oman

- 3.5. Qatar

- 3.6. Rest of Middle East and Africa

MEA Alcoholic Beverages Industry Segmentation By Geography

- 1. South Africa

- 2. United Arab Emirates

- 3. Bahrain

- 4. Oman

- 5. Qatar

- 6. Rest of Middle East and Africa

MEA Alcoholic Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Preference for Low Alcohol by Volume (ABV); Tourism and Expat Communities Driving Consumption

- 3.3. Market Restrains

- 3.3.1. Government Regulatory Frameworks Limits Alcohol Consumption

- 3.4. Market Trends

- 3.4.1. Growing Preference for Low Alcohol by Volume (ABV)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beer

- 5.1.2. Wine

- 5.1.3. Spirits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supemarkets/Hypermarkets

- 5.2.2.2. Specialty stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off-Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. United Arab Emirates

- 5.3.3. Bahrain

- 5.3.4. Oman

- 5.3.5. Qatar

- 5.3.6. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. United Arab Emirates

- 5.4.3. Bahrain

- 5.4.4. Oman

- 5.4.5. Qatar

- 5.4.6. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beer

- 6.1.2. Wine

- 6.1.3. Spirits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supemarkets/Hypermarkets

- 6.2.2.2. Specialty stores

- 6.2.2.3. Online Retail Stores

- 6.2.2.4. Other Off-Trade Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. United Arab Emirates

- 6.3.3. Bahrain

- 6.3.4. Oman

- 6.3.5. Qatar

- 6.3.6. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beer

- 7.1.2. Wine

- 7.1.3. Spirits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supemarkets/Hypermarkets

- 7.2.2.2. Specialty stores

- 7.2.2.3. Online Retail Stores

- 7.2.2.4. Other Off-Trade Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. United Arab Emirates

- 7.3.3. Bahrain

- 7.3.4. Oman

- 7.3.5. Qatar

- 7.3.6. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Bahrain MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beer

- 8.1.2. Wine

- 8.1.3. Spirits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supemarkets/Hypermarkets

- 8.2.2.2. Specialty stores

- 8.2.2.3. Online Retail Stores

- 8.2.2.4. Other Off-Trade Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. United Arab Emirates

- 8.3.3. Bahrain

- 8.3.4. Oman

- 8.3.5. Qatar

- 8.3.6. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Oman MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Beer

- 9.1.2. Wine

- 9.1.3. Spirits

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supemarkets/Hypermarkets

- 9.2.2.2. Specialty stores

- 9.2.2.3. Online Retail Stores

- 9.2.2.4. Other Off-Trade Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. United Arab Emirates

- 9.3.3. Bahrain

- 9.3.4. Oman

- 9.3.5. Qatar

- 9.3.6. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Qatar MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Beer

- 10.1.2. Wine

- 10.1.3. Spirits

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supemarkets/Hypermarkets

- 10.2.2.2. Specialty stores

- 10.2.2.3. Online Retail Stores

- 10.2.2.4. Other Off-Trade Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. South Africa

- 10.3.2. United Arab Emirates

- 10.3.3. Bahrain

- 10.3.4. Oman

- 10.3.5. Qatar

- 10.3.6. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Middle East and Africa MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Beer

- 11.1.2. Wine

- 11.1.3. Spirits

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supemarkets/Hypermarkets

- 11.2.2.2. Specialty stores

- 11.2.2.3. Online Retail Stores

- 11.2.2.4. Other Off-Trade Channels

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. South Africa

- 11.3.2. United Arab Emirates

- 11.3.3. Bahrain

- 11.3.4. Oman

- 11.3.5. Qatar

- 11.3.6. Rest of Middle East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. North America MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. North America MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United States

- 16.1.2 Canada

- 16.1.3 Mexico

- 17. MEA MEA Alcoholic Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 Saudi Arabia

- 17.1.3 South Africa

- 17.1.4 Rest of Middle East and Africa

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Pernod Ricard SA

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Anheuser-Busch InBev

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Brown-Forman Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Delta Corporation Limited

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Suntory Beverage & Food Limited

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Refriango LDA

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Edward Snell & Co

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Molson Coors Beverage Company*List Not Exhaustive

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Heineken Holdings NV

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Diageo PLC

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Pernod Ricard SA

List of Figures

- Figure 1: Global MEA Alcoholic Beverages Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: South Africa MEA Alcoholic Beverages Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 15: South Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: South Africa MEA Alcoholic Beverages Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: South Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: South Africa MEA Alcoholic Beverages Industry Revenue (Million), by Geography 2024 & 2032

- Figure 19: South Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 20: South Africa MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: South Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: United Arab Emirates MEA Alcoholic Beverages Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: United Arab Emirates MEA Alcoholic Beverages Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: United Arab Emirates MEA Alcoholic Beverages Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: United Arab Emirates MEA Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: United Arab Emirates MEA Alcoholic Beverages Industry Revenue (Million), by Geography 2024 & 2032

- Figure 27: United Arab Emirates MEA Alcoholic Beverages Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 28: United Arab Emirates MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: United Arab Emirates MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Bahrain MEA Alcoholic Beverages Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Bahrain MEA Alcoholic Beverages Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Bahrain MEA Alcoholic Beverages Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Bahrain MEA Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Bahrain MEA Alcoholic Beverages Industry Revenue (Million), by Geography 2024 & 2032

- Figure 35: Bahrain MEA Alcoholic Beverages Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 36: Bahrain MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Bahrain MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Oman MEA Alcoholic Beverages Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 39: Oman MEA Alcoholic Beverages Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 40: Oman MEA Alcoholic Beverages Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 41: Oman MEA Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 42: Oman MEA Alcoholic Beverages Industry Revenue (Million), by Geography 2024 & 2032

- Figure 43: Oman MEA Alcoholic Beverages Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 44: Oman MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 45: Oman MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 46: Qatar MEA Alcoholic Beverages Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 47: Qatar MEA Alcoholic Beverages Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 48: Qatar MEA Alcoholic Beverages Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 49: Qatar MEA Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 50: Qatar MEA Alcoholic Beverages Industry Revenue (Million), by Geography 2024 & 2032

- Figure 51: Qatar MEA Alcoholic Beverages Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 52: Qatar MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 53: Qatar MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 55: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 56: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 57: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 58: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue (Million), by Geography 2024 & 2032

- Figure 59: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 60: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa MEA Alcoholic Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 52: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 53: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 56: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 57: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 58: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 60: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 61: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 62: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 64: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 65: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 66: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 68: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 69: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 70: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 71: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 72: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 73: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 74: Global MEA Alcoholic Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Alcoholic Beverages Industry?

The projected CAGR is approximately 10.97%.

2. Which companies are prominent players in the MEA Alcoholic Beverages Industry?

Key companies in the market include Pernod Ricard SA, Anheuser-Busch InBev, Brown-Forman Corporation, Delta Corporation Limited, Suntory Beverage & Food Limited, Refriango LDA, Edward Snell & Co, Molson Coors Beverage Company*List Not Exhaustive, Heineken Holdings NV, Diageo PLC.

3. What are the main segments of the MEA Alcoholic Beverages Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 135.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Preference for Low Alcohol by Volume (ABV); Tourism and Expat Communities Driving Consumption.

6. What are the notable trends driving market growth?

Growing Preference for Low Alcohol by Volume (ABV).

7. Are there any restraints impacting market growth?

Government Regulatory Frameworks Limits Alcohol Consumption.

8. Can you provide examples of recent developments in the market?

October 2023: Diageo established a spirits business in West and Central Africa, intending to introduce Orijin, Captain Morgan Gold, Gordon’s Moringa, and Smirnoff brands to this new region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Alcoholic Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Alcoholic Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Alcoholic Beverages Industry?

To stay informed about further developments, trends, and reports in the MEA Alcoholic Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence