Key Insights

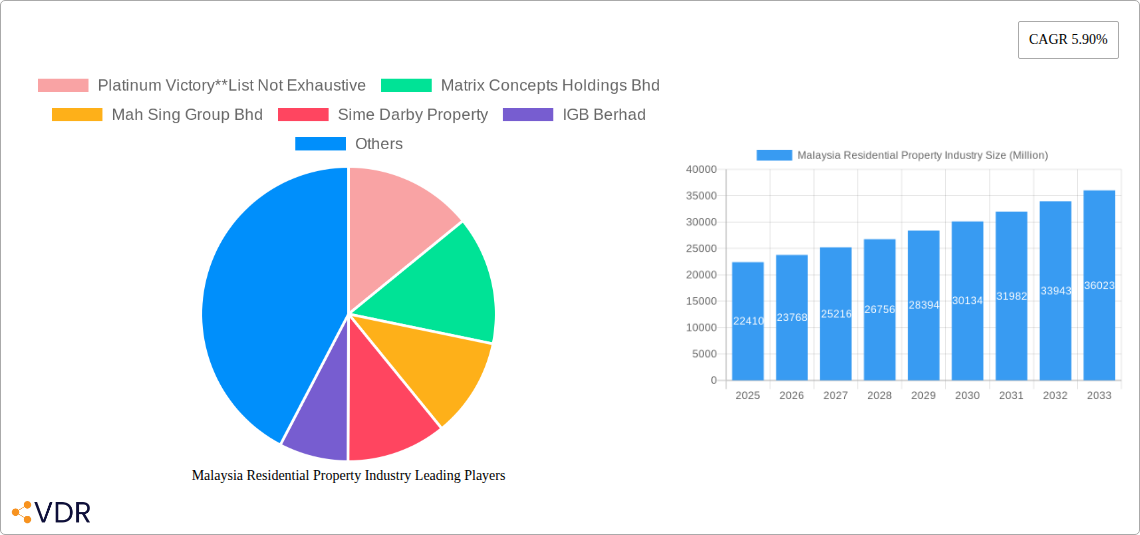

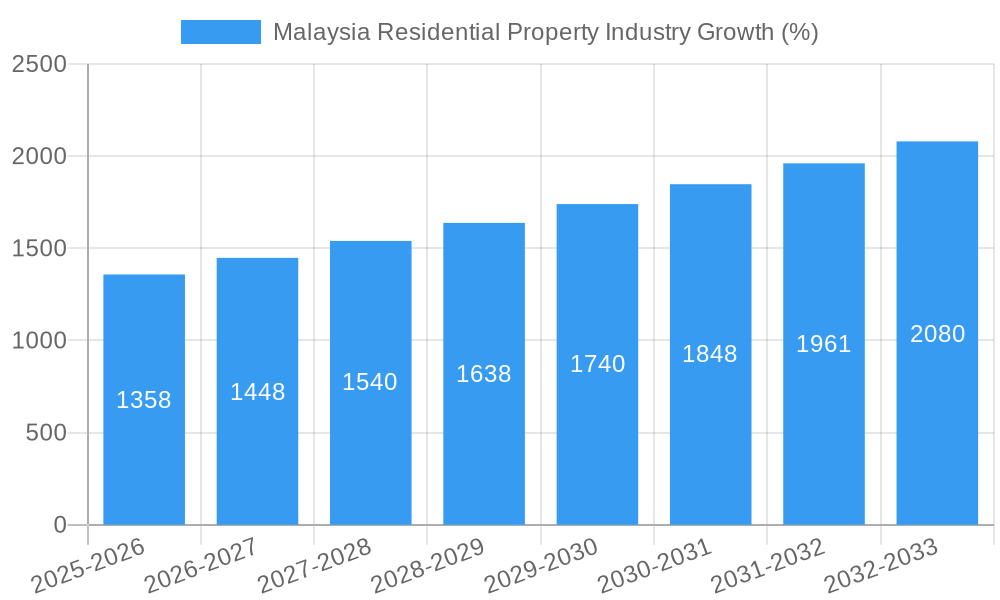

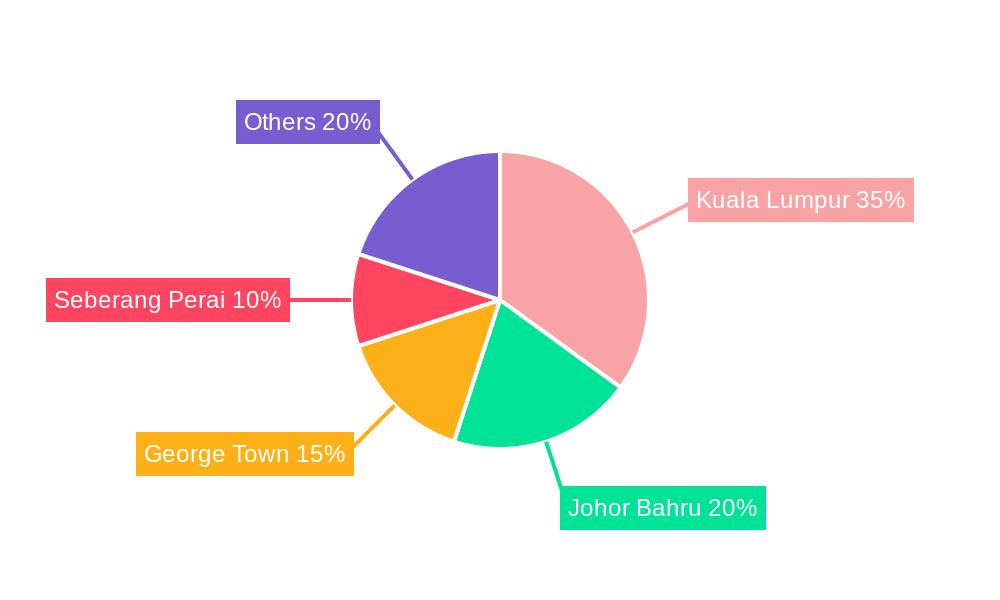

The Malaysian residential property market, valued at RM 22.41 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a growing population and increasing urbanization, particularly in major cities like Kuala Lumpur, Johor Bahru, George Town, and Seberang Perai, fuel consistent demand for housing. Secondly, government initiatives aimed at affordable housing and infrastructure development contribute positively to market momentum. Furthermore, economic growth and rising disposable incomes empower more Malaysians to invest in residential properties, boosting market activity across various segments, including apartments and condominiums, landed houses, and villas. However, challenges remain. Rising construction costs and interest rates pose potential headwinds, potentially impacting affordability and slowing down market growth in certain segments. Competition among established developers like Sime Darby Property, SP Setia, IGB Berhad, and others also shapes market dynamics.

The forecast period (2025-2033) will likely witness a shift in demand towards specific property types and locations. While apartments and condominiums remain popular in urban centers due to affordability and convenience, the demand for landed properties like houses and villas is expected to persist in suburban areas, fueled by preferences for spacious living and a desire for greater privacy. Geographical variations in market performance are anticipated, with Kuala Lumpur and Johor Bahru likely to continue as leading markets due to their strong economic activity and infrastructure development. Strategic planning by developers addressing affordability concerns, sustainable construction practices, and evolving consumer preferences will be crucial for navigating the market successfully during this period. Careful consideration of interest rate fluctuations and regulatory changes will be vital in predicting precise market performance within the forecast period.

Malaysia Residential Property Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Malaysian residential property market, covering historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It examines market dynamics, growth trends, key players, and emerging opportunities within the residential property sector, focusing on both parent and child markets for a granular understanding. This report is an invaluable resource for investors, developers, industry professionals, and anyone seeking to understand the complexities and future potential of the Malaysian residential property market.

Malaysia Residential Property Industry Market Dynamics & Structure

This section analyzes the Malaysian residential property market's structure, focusing on market concentration, technological advancements, regulatory influences, competitive forces, end-user demographics, and merger & acquisition (M&A) activity. The Malaysian residential property market, valued at xx Million units in 2024, demonstrates a moderately concentrated landscape with several prominent players holding significant market share.

- Market Concentration: The top 10 developers collectively control approximately 40% of the market, with the remaining share distributed among numerous smaller players.

- Technological Innovation: Adoption of PropTech solutions, including virtual tours and online property portals, is gradually increasing but faces barriers such as digital literacy and trust among consumers.

- Regulatory Framework: Government policies such as affordable housing initiatives and loan regulations significantly influence market dynamics. Recent changes have aimed to improve market transparency and accessibility.

- Competitive Product Substitutes: The availability of rental properties and alternative housing options creates competitive pressure in certain segments.

- End-User Demographics: A growing young population, increasing urbanization, and shifting preferences toward specific property types (e.g., high-rise apartments in major cities) are shaping market demand.

- M&A Trends: The recent acquisition of iProperty Malaysia by PropertyGuru Group exemplifies a trend toward consolidation within the real estate technology sector. In the period 2019-2024, an estimated xx M&A deals took place in the Malaysian residential property market.

Malaysia Residential Property Industry Growth Trends & Insights

This section provides a detailed analysis of the Malaysian residential property market's growth trajectory, utilizing comprehensive data and insights. The market exhibited [mention specific growth pattern from XXX source- e.g., fluctuating growth, steady growth, etc.] during the historical period (2019-2024). Market size is projected to reach xx Million units by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors including:

- Increasing Urbanization: The continuous migration from rural areas to cities fuels the demand for residential properties.

- Economic Growth: Continued economic expansion, although susceptible to global fluctuations, is a major catalyst for market growth.

- Infrastructure Development: Government investments in infrastructure, including transportation and utilities, improve property values and desirability.

- Changing Consumer Preferences: Growing demand for modern amenities, sustainable features, and technologically advanced homes influences the development and sales of properties.

Dominant Regions, Countries, or Segments in Malaysia Residential Property Industry

Kuala Lumpur remains the dominant region, capturing the largest market share (estimated at xx%) of the Malaysian residential property market. This dominance stems from factors such as its high concentration of employment opportunities, well-developed infrastructure, and established lifestyle amenities. However, other key cities and segments also show significant growth potential.

By Type: Apartments and Condominiums, driven by higher population density and affordability, dominate the market with an estimated xx% market share in 2025. Landed Houses and Villas, while representing a smaller share (xx%), exhibit substantial growth in affluent suburbs.

By Key Cities: Kuala Lumpur maintains its leadership, followed by Johor Bahru, benefiting from its proximity to Singapore and industrial growth. Seberang Perai and George Town exhibit moderate growth driven by local economic activities and tourism.

Key Drivers: Strong economic growth in Kuala Lumpur, ongoing infrastructure development in Johor Bahru, and government initiatives to enhance affordable housing in other regions drive market growth.

Malaysia Residential Property Industry Product Landscape

The Malaysian residential property market offers a diverse range of products catering to various needs and budgets. From affordable high-rise apartments to luxury landed properties, developers are constantly innovating to meet evolving consumer preferences. Smart home technology integration, sustainable building materials, and improved security features are increasingly common. These advancements enhance property value and appeal, while addressing environmental concerns and improving quality of life for residents.

Key Drivers, Barriers & Challenges in Malaysia Residential Property Industry

Key Drivers: Strong economic growth, increasing urbanization, supportive government policies (like the Home Ownership Campaign), and rising disposable incomes are key drivers. Technological advancements in construction and marketing further fuel growth.

Key Challenges: High land prices, stringent regulatory approvals, fluctuating interest rates, and competition from established players can create significant barriers. Supply chain disruptions and material price volatility further affect profitability. The market also faces challenges related to affordability and access to financing for first-time homebuyers.

Emerging Opportunities in Malaysia Residential Property Industry

The Malaysian residential property market presents several emerging opportunities, including:

- Affordable Housing: Meeting the growing demand for affordable homes in rapidly expanding cities holds immense potential.

- Sustainable Development: Building environmentally friendly and energy-efficient homes caters to growing environmental awareness among buyers.

- Technology Integration: Adoption of smart home technology and PropTech solutions can enhance the user experience and property value.

- Transit-Oriented Development: Building residential projects near public transport hubs appeals to eco-conscious and environmentally aware buyers.

Growth Accelerators in the Malaysia Residential Property Industry

Technological advancements in construction techniques, the strategic partnerships between developers and technology firms, and the expansion of affordable housing initiatives all contribute to sustained market growth. Foreign direct investment and improved infrastructure are also key growth catalysts.

Key Players Shaping the Malaysia Residential Property Industry Market

- Platinum Victory

- Matrix Concepts Holdings Bhd

- Mah Sing Group Bhd

- Sime Darby Property

- IGB Berhad

- IOI Properties

- Glomac Bhd

- S P Setia

- UEM Sunrise

- Eco World Development Group Berhad

Notable Milestones in Malaysia Residential Property Industry Sector

- December 2022: PropertyGuru Group's acquisition of iProperty Malaysia signals consolidation within the PropTech sector, potentially enhancing market efficiency and consumer reach.

- April 2022: Knight Frank Malaysia's acquisition of Property Hub Sdn Bhd. expands its market presence, indicating growing investor confidence in the residential market.

In-Depth Malaysia Residential Property Industry Market Outlook

The Malaysian residential property market is poised for continued growth, driven by strong fundamentals and emerging opportunities. Strategic investments in sustainable development, technology integration, and affordable housing will be crucial for long-term success. Focus on meeting the diverse needs of a growing population, particularly within rapidly urbanizing areas, will unlock further market potential. The sector’s trajectory indicates a positive outlook, with the potential for significant expansion across various segments and geographical locations.

Malaysia Residential Property Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Kuala Lumpur

- 2.2. Seberang Perai

- 2.3. George Town

- 2.4. Johor Bahru

Malaysia Residential Property Industry Segmentation By Geography

- 1. Malaysia

Malaysia Residential Property Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Residential Property Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Kuala Lumpur

- 5.2.2. Seberang Perai

- 5.2.3. George Town

- 5.2.4. Johor Bahru

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Platinum Victory**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Matrix Concepts Holdings Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mah Sing Group Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sime Darby Property

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IGB Berhad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IOI Properties

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glomac Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 S P Setia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UEM Sunrise

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eco World Development Group Berhad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Platinum Victory**List Not Exhaustive

List of Figures

- Figure 1: Malaysia Residential Property Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Residential Property Industry Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Residential Property Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Malaysia Residential Property Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Residential Property Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Malaysia Residential Property Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Residential Property Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Malaysia Residential Property Industry?

Key companies in the market include Platinum Victory**List Not Exhaustive, Matrix Concepts Holdings Bhd, Mah Sing Group Bhd, Sime Darby Property, IGB Berhad, IOI Properties, Glomac Bhd, S P Setia, UEM Sunrise, Eco World Development Group Berhad.

3. What are the main segments of the Malaysia Residential Property Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2022: The south-east Asian real estate technology company, The PropertyGuru Group, has finalized the acquisition of iProperty Malaysia. Given that two brands (PropertyGuru and iProperty) are merging, they currently have a huge duty. The acquisition enables them to concentrate on what they believe is necessary to support their clients, and they aim to provide them with even more value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Residential Property Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Residential Property Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Residential Property Industry?

To stay informed about further developments, trends, and reports in the Malaysia Residential Property Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence