Key Insights

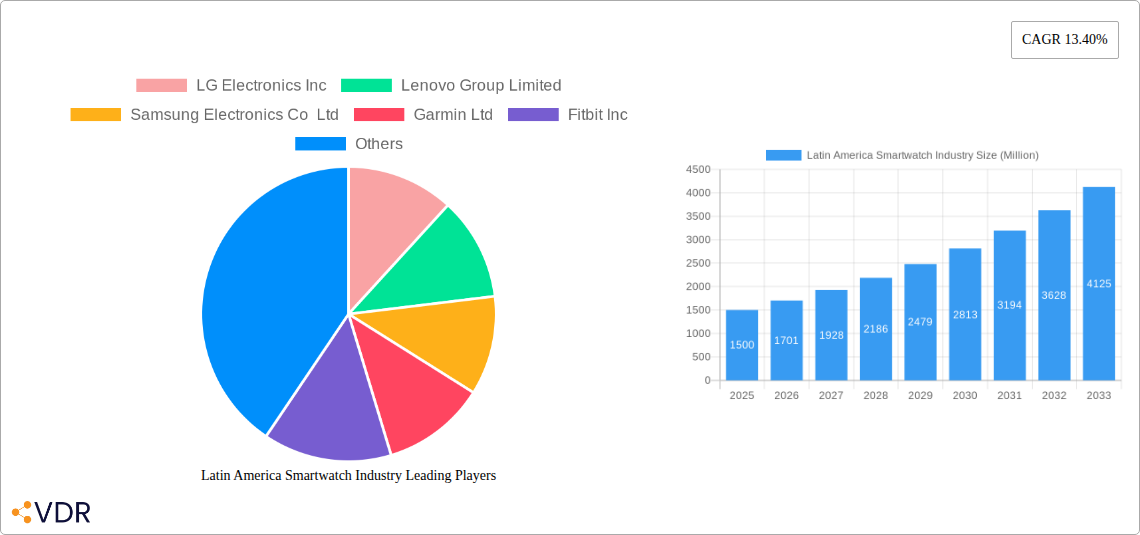

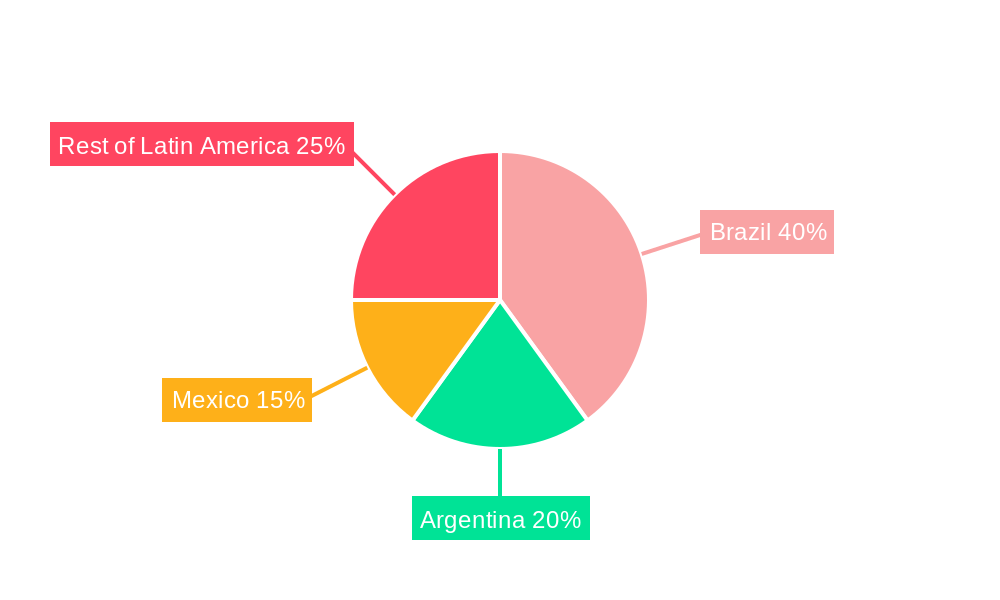

The Latin American smartwatch market, currently experiencing robust growth, is projected to reach a significant size by 2033. Driven by increasing smartphone penetration, rising disposable incomes, and a growing preference for fitness tracking and smart functionalities, the market demonstrates a Compound Annual Growth Rate (CAGR) of 13.40%. Key segments driving this expansion include AMOLED display smartwatches, those utilizing Android/Wear OS operating systems, and applications focused on personal assistance and health/fitness tracking. Brazil and Argentina represent the largest markets within the region, fueled by a young and tech-savvy population. However, challenges remain, including price sensitivity among consumers and the need for improved infrastructure supporting smartwatch functionalities like seamless connectivity. The competitive landscape is populated by major international players like Apple, Samsung, and Garmin, alongside emerging local brands vying for market share. The market's future hinges on technological advancements, such as improved battery life, enhanced health monitoring capabilities, and the expansion of payment and communication features integrated into smartwatches. This will likely lead to further market segmentation and specialization in the coming years. The continued development of affordable and feature-rich smartwatches will play a crucial role in driving adoption rates across diverse socioeconomic groups in Latin America.

The forecast period (2025-2033) anticipates substantial growth, fueled by factors such as increased urbanization, expanding e-commerce platforms facilitating smartwatch sales, and government initiatives promoting digitalization. While challenges persist in the form of economic fluctuations in some Latin American countries and the need to address digital literacy gaps, the overall outlook for the smartwatch market remains positive. Successful market players will need to tailor their strategies to address local preferences, pricing structures, and technological adoption rates, focusing on features and functionalities that resonate specifically with the Latin American consumer. This includes considerations for language support, payment integration with prevalent local systems, and addressing the unique health and fitness needs of the population.

Latin America Smartwatch Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America smartwatch industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base year and forecast extending to 2033. The report incorporates data from the historical period (2019-2024) and provides valuable insights for industry professionals, investors, and strategists. Millions of units are used throughout the report for all value estimations.

Latin America Smartwatch Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market segmentation within the Latin American smartwatch market. We examine market concentration, identifying dominant players and their respective market shares. The report explores innovation drivers, such as the development of advanced sensors and improved battery technology, and assesses the impact of regulatory frameworks on market growth. Furthermore, we analyze the influence of competitive product substitutes (e.g., fitness trackers) and evolving end-user demographics. Finally, we delve into the impact of mergers and acquisitions (M&A) activity on market consolidation. Market share data is currently unavailable and will be included in the full report. Predicted M&A activity volume is estimated at xx deals for the forecast period.

- Market Concentration: xx% controlled by top 5 players (2024).

- Technological Innovation: Focus on enhanced health tracking, longer battery life, and improved aesthetics.

- Regulatory Frameworks: Impact of data privacy regulations and product safety standards.

- Competitive Substitutes: Fitness trackers and basic activity monitors represent key competition.

- End-User Demographics: Growth driven by younger, tech-savvy consumers and increasing health awareness.

- M&A Trends: Consolidation expected through strategic acquisitions and partnerships. (xx deals predicted 2025-2033)

Latin America Smartwatch Industry Growth Trends & Insights

This section presents a detailed analysis of the Latin American smartwatch market's growth trajectory. We examine historical and projected market sizes (in million units), calculating the compound annual growth rate (CAGR) and analyzing market penetration rates across different segments and countries. We further explore factors influencing market growth, including technological disruptions, evolving consumer preferences, and shifts in purchasing behavior. The overall market is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period.

(This section will include 600 words of detailed analysis based on available data and market research.)

Dominant Regions, Countries, or Segments in Latin America Smartwatch Industry

This section identifies the leading regions, countries, and market segments within the Latin American smartwatch market. We analyze the factors driving growth in each dominant area, considering economic factors, infrastructure development, and consumer behavior. We will also analyze the market share and growth potential of each segment (Operating Systems, Display Types, Applications, and Countries).

- Leading Country: Brazil (predicted highest market share)

- Dominant Operating System: Android/Wear OS (predicted to maintain leadership)

- Fastest-Growing Segment: Sports Applications (predicted strong growth due to fitness trends)

(This section will include 600 words of detailed analysis based on available data and market research).

Latin America Smartwatch Industry Product Landscape

The smartwatch market in Latin America is witnessing a surge in product innovation, with manufacturers introducing devices featuring advanced health tracking capabilities, longer battery life, and stylish designs. Key features include enhanced fitness tracking, integrated GPS, contactless payment options, and improved water resistance. The focus is on creating devices that are not only functional but also fashionable and seamlessly integrated into consumers' daily lives. Unique selling propositions (USPs) include specialized features catered to specific sports or health conditions.

Key Drivers, Barriers & Challenges in Latin America Smartwatch Industry

Key Drivers:

- Increasing smartphone penetration and internet access.

- Growing health consciousness and fitness trends.

- Affordable smartwatch models entering the market.

- Advancements in technology, leading to improved functionality and longer battery life.

Key Barriers & Challenges:

- High initial cost of smartwatches compared to basic wearables.

- Limited availability of local repair and service networks.

- Concerns about data privacy and security.

- Competition from established players and new entrants.

Emerging Opportunities in Latin America Smartwatch Industry

- Expansion into rural markets with affordable and durable devices.

- Development of region-specific health monitoring applications.

- Increased focus on payment integrations and mobile commerce.

- Strategic partnerships with local telecom operators and retailers.

Growth Accelerators in the Latin America Smartwatch Industry Industry

The Latin American smartwatch market is poised for robust growth fueled by technological advancements, such as more power-efficient processors and advanced sensors, improving battery life and functionality. Strategic partnerships between technology companies and healthcare providers will drive the adoption of smartwatches for health monitoring and remote patient care. Expansion into untapped markets through affordable pricing strategies and targeted marketing campaigns will further accelerate market growth.

Key Players Shaping the Latin America Smartwatch Industry Market

- LG Electronics Inc

- Lenovo Group Limited

- Samsung Electronics Co Ltd

- Garmin Ltd

- Fitbit Inc

- Huawei Technologies Co Ltd

- Fossil Group Inc

- Apple Inc

- Polar Electro OY

- Sony Corporation

Notable Milestones in Latin America Smartwatch Industry Sector

- January 2022: Fossil and Razer collaborated on a smartwatch, expanding design options.

- May 2022: Google launched the Pixel Watch, integrating Wear OS and Fitbit health features.

- May 2022: Huawei launched several new wearables, enhancing its product portfolio.

- July 2022: Qualcomm announced new Snapdragon wearable platforms, focusing on power efficiency.

- August 2022: Samsung launched the Galaxy Watch5 and Watch5 Pro, enhancing fitness features.

In-Depth Latin America Smartwatch Industry Market Outlook

The Latin American smartwatch market exhibits significant long-term growth potential driven by increasing smartphone penetration, rising disposable incomes, and a growing health-conscious population. Strategic partnerships and investments in research and development will further propel innovation and product diversification. Expansion into untapped rural markets through affordable models and targeted marketing efforts represents a key opportunity for market expansion and growth acceleration.

Latin America Smartwatch Industry Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

Latin America Smartwatch Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Smartwatch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 augmented With Security Risks

- 3.4. Market Trends

- 3.4.1. Medical and Fitness to Account for a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. Brazil Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Smartwatch Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 LG Electronics Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Lenovo Group Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Samsung Electronics Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Garmin Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fitbit Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Huawei Technologies Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fossil Group Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Apple Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Polar Electro OY

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 LG Electronics Inc

List of Figures

- Figure 1: Latin America Smartwatch Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Smartwatch Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Smartwatch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Smartwatch Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Latin America Smartwatch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 4: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2019 & 2032

- Table 5: Latin America Smartwatch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 6: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2019 & 2032

- Table 7: Latin America Smartwatch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Latin America Smartwatch Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America Smartwatch Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Latin America Smartwatch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Latin America Smartwatch Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Argentina Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Peru Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Chile Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Chile Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Latin America Smartwatch Industry Revenue Million Forecast, by Operating Systems 2019 & 2032

- Table 26: Latin America Smartwatch Industry Volume K Unit Forecast, by Operating Systems 2019 & 2032

- Table 27: Latin America Smartwatch Industry Revenue Million Forecast, by Display Type 2019 & 2032

- Table 28: Latin America Smartwatch Industry Volume K Unit Forecast, by Display Type 2019 & 2032

- Table 29: Latin America Smartwatch Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Latin America Smartwatch Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 31: Latin America Smartwatch Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Latin America Smartwatch Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Brazil Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Brazil Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Argentina Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Chile Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Chile Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Colombia Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Mexico Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Peru Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Venezuela Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Ecuador Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Bolivia Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Paraguay Latin America Smartwatch Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay Latin America Smartwatch Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Smartwatch Industry?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Latin America Smartwatch Industry?

Key companies in the market include LG Electronics Inc, Lenovo Group Limited, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Polar Electro OY, Sony Corporation.

3. What are the main segments of the Latin America Smartwatch Industry?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer.

6. What are the notable trends driving market growth?

Medical and Fitness to Account for a Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. augmented With Security Risks.

8. Can you provide examples of recent developments in the market?

August 2022 : Samsung Electronics Co., Ltd. unveiled the Galaxy Watch5 and Galaxy Watch5 Pro, which will help shape fitness and wellness behaviors through intelligent insights, sophisticated features, and significantly more robust capabilities. The Galaxy Watch5 improves aspects that users depend on daily, while the Galaxy Watch5 Pro, the new introduction to the Galaxy Watch series, is Samsung's most robust and feature-packed wristwatch ever.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Smartwatch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Smartwatch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Smartwatch Industry?

To stay informed about further developments, trends, and reports in the Latin America Smartwatch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence