Key Insights

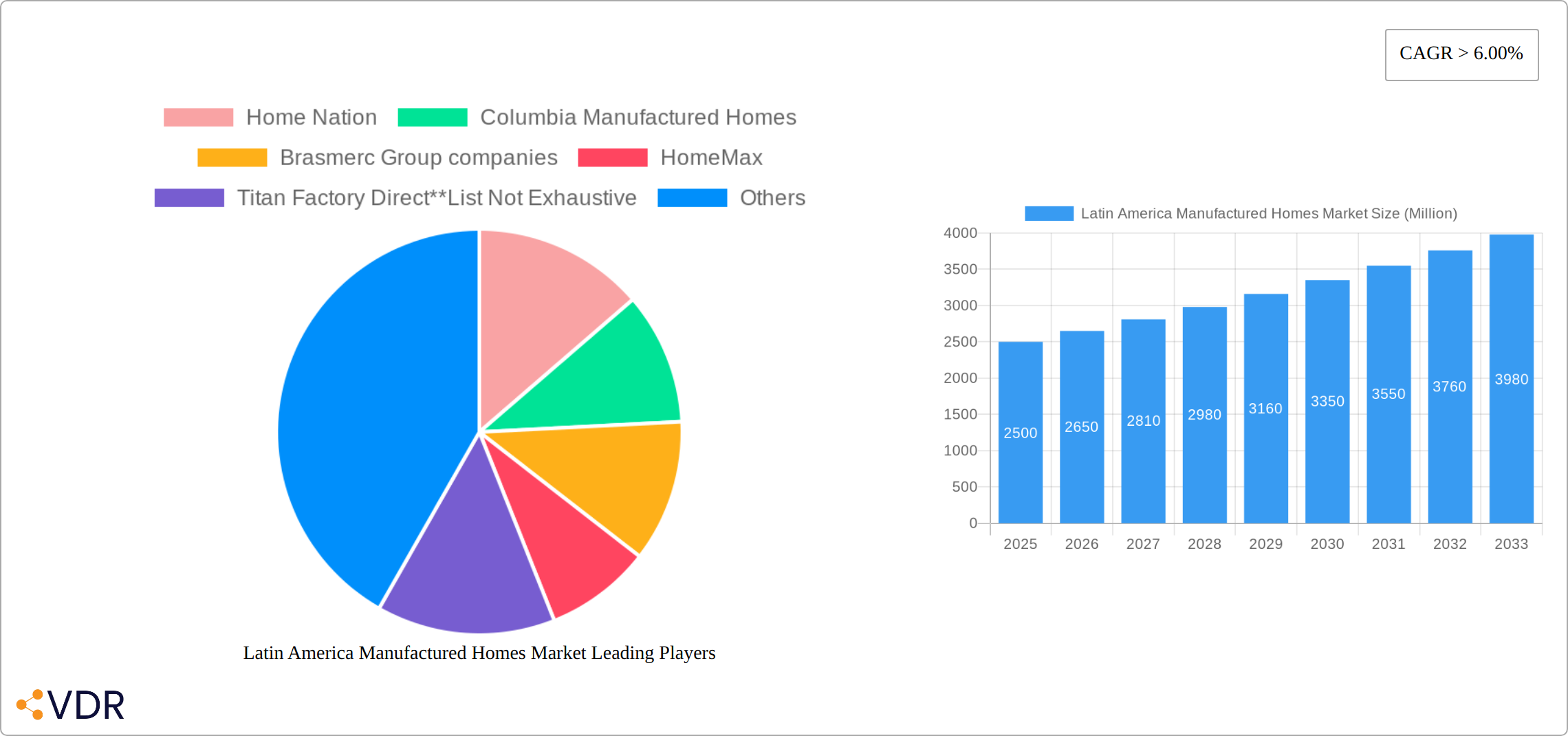

The Latin American manufactured homes market is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for affordable housing solutions. The market's compound annual growth rate (CAGR) exceeding 6.00% indicates significant expansion over the forecast period (2025-2033). Brazil, Mexico, and Argentina represent the largest national markets within the region, reflecting their substantial populations and developing economies. The preference for single-family units currently dominates the market, though multiple-family manufactured homes are expected to see increased demand as urbanization and rental markets expand. Key players, such as Home Nation, Columbia Manufactured Homes, and Brasmerc Group, are actively shaping market dynamics through innovation in design, materials, and construction techniques. However, challenges remain. Economic instability in certain Latin American countries, fluctuating raw material prices, and stringent building regulations can act as restraints on market growth. Nevertheless, the long-term outlook remains positive, fueled by ongoing infrastructure development and government initiatives aimed at providing affordable housing options.

The projected market size for 2025 is estimated at $2.5 Billion (based on a reasonable assumption considering the CAGR and regional market dynamics). This figure is anticipated to increase steadily throughout the forecast period, reaching an estimated $4 Billion by 2030. Market segmentation by type (single-family vs. multiple-family) and geography (Brazil, Mexico, Argentina, and the Rest of Latin America) provides crucial insights for targeted investment strategies. Competitive analysis reveals a mix of established players and emerging companies, highlighting the potential for both consolidation and disruptive innovation. Further research into specific government policies and infrastructure projects will refine market projections and identify potential growth opportunities within the individual countries. The market’s future success hinges on addressing affordability concerns, overcoming regulatory hurdles, and adapting to evolving consumer preferences.

This comprehensive report provides a detailed analysis of the Latin America manufactured homes market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and anyone seeking to understand the complexities and opportunities within this dynamic sector. The market is segmented by type (single-family and multiple-family) and by country (Brazil, Mexico, Argentina, and Rest of Latin America). The report projects a market size of xx million units by 2033.

Latin America Manufactured Homes Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Latin American manufactured homes market. The market is characterized by a moderate level of concentration, with key players such as Home Nation, Columbia Manufactured Homes, Brasmerc Group companies, HomeMax, Titan Factory Direct, Casas Brazil, DRM Investments LTD, Columbia Discount Homes, CC's Modular & Manufactured Homes, and Clayton Homes competing for market share. However, the market also features several smaller, regional players.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding an estimated xx% market share in 2025.

- Technological Innovation: Technological advancements, such as prefabrication techniques and sustainable building materials, are driving efficiency and affordability. However, the adoption rate varies across countries due to infrastructural limitations and regulatory complexities.

- Regulatory Frameworks: Building codes and zoning regulations vary significantly across Latin American countries, creating challenges for standardization and market expansion. Streamlining regulatory processes is a crucial factor for future growth.

- Competitive Product Substitutes: Traditional construction remains a major competitor, particularly in higher-income segments. However, the affordability and speed of construction offered by manufactured homes provide a significant advantage in certain markets.

- End-User Demographics: The target demographic is primarily comprised of middle-income families seeking affordable housing options. Growth is driven by urbanization, population growth, and increasing demand for affordable housing solutions.

- M&A Trends: Recent mergers and acquisitions, such as Cavco Industries’ acquisition of Solitaire Homes, indicate a trend toward consolidation within the sector. The total M&A deal volume in the sector between 2019 and 2024 was estimated at xx deals.

Latin America Manufactured Homes Market Growth Trends & Insights

The Latin America manufactured homes market has witnessed considerable growth over the past five years, driven by factors such as increasing urbanization, rising disposable incomes, and government initiatives promoting affordable housing. The market size expanded from xx million units in 2019 to xx million units in 2024, exhibiting a CAGR of xx%. This growth is expected to continue, with a projected CAGR of xx% during the forecast period (2025-2033), leading to an estimated market size of xx million units by 2033. Technological advancements, including the adoption of modular construction techniques and sustainable materials, are further fueling market expansion. Changing consumer preferences, such as a greater preference for energy-efficient and customizable homes, are also significant growth drivers. Market penetration remains relatively low in several countries, suggesting significant untapped potential.

Dominant Regions, Countries, or Segments in Latin America Manufactured Homes Market

Brazil and Mexico represent the largest markets within Latin America, accounting for approximately xx% and xx% of the total market share in 2025, respectively. This dominance is primarily due to their larger populations, higher urbanization rates, and relatively more developed infrastructure compared to other countries in the region. The single-family segment is currently the most dominant, representing xx% of the total market. However, growth in the multiple-family segment is expected to accelerate during the forecast period, driven by increasing demand for affordable multi-unit housing complexes in urban areas.

- Key Drivers for Brazil and Mexico:

- Large and growing populations.

- High urbanization rates.

- Government initiatives promoting affordable housing.

- Relatively well-developed infrastructure (compared to other Latin American countries).

- Growth Potential in Other Countries:

- Argentina, Chile, and Colombia show significant growth potential driven by increasing demand for affordable housing.

Latin America Manufactured Homes Market Product Landscape

The Latin America manufactured homes market offers a diverse range of products catering to various needs and budgets. Innovations focus on improving energy efficiency, incorporating sustainable materials, and enhancing customization options. Prefabrication techniques allow for faster construction times and reduced costs, while advancements in building materials contribute to durability and improved aesthetic appeal. Unique selling propositions include affordability, speed of construction, and the ability to customize designs to meet specific requirements.

Key Drivers, Barriers & Challenges in Latin America Manufactured Homes Market

Key Drivers:

- Affordable Housing Needs: The significant demand for affordable housing in rapidly urbanizing areas is the primary driver.

- Faster Construction Times: Manufactured homes offer significantly faster construction compared to traditional methods.

- Government Initiatives: Government programs and subsidies aimed at promoting affordable housing are boosting market growth.

Challenges & Restraints:

- Regulatory Hurdles: Varying building codes and zoning regulations across countries create significant complexities.

- Supply Chain Issues: Disruptions in the supply chain can impact affordability and project timelines.

- Financing Limitations: Access to affordable financing remains a challenge for many potential homebuyers. This limits market expansion in lower-income brackets.

Emerging Opportunities in Latin America Manufactured Homes Market

Significant opportunities exist in expanding into underserved markets, developing innovative product designs incorporating sustainable materials, and offering customizable options. Targeting specific consumer needs, such as eco-friendly options or homes designed for specific climates, can open up new growth avenues. Furthermore, exploring partnerships with developers to create large-scale housing projects can significantly increase market penetration.

Growth Accelerators in the Latin America Manufactured Homes Market Industry

Technological advancements, strategic partnerships with developers and government entities, and market expansion into new geographic areas are key accelerators for growth. Increased adoption of prefabrication technologies, coupled with the exploration of sustainable building materials, will further enhance the affordability and appeal of manufactured homes.

Key Players Shaping the Latin America Manufactured Homes Market Market

- Home Nation

- Columbia Manufactured Homes

- Brasmerc Group companies

- HomeMax

- Titan Factory Direct

- Casas Brazil

- DRM Investments LTD

- Columbia Discount Homes

- CC's Modular & Manufactured Homes

- Clayton Homes

Notable Milestones in Latin America Manufactured Homes Market Sector

- August 2022: Vessel, a subsidiary of Weisu, announces plans to establish a manufacturing plant in Nuevo Leon, Mexico, with expansion plans to Colombia, Ecuador, Argentina, Peru, and Brazil.

- January 2023: Cavco Industries acquires Solitaire Homes, expanding its presence in the Mexican market.

In-Depth Latin America Manufactured Homes Market Market Outlook

The Latin America manufactured homes market presents a compelling growth trajectory fueled by robust demand for affordable housing. Strategic investments in technological upgrades, sustainable construction practices, and partnerships with government agencies will shape the future of the industry. Expanding into untapped markets and diversifying product offerings are crucial for long-term success. The market is poised for substantial growth, presenting lucrative opportunities for both established players and new entrants.

Latin America Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multiple Family

-

2. Countries

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Argentina

- 2.4. Rest of Latin America

Latin America Manufactured Homes Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Low Construction Cost Propels the Demand for Manufactured Homes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multiple Family

- 5.2. Market Analysis, Insights and Forecast - by Countries

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Argentina

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Home Nation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Columbia Manufactured Homes

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Brasmerc Group companies

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HomeMax

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Titan Factory Direct**List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Casas Brazil

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 DRM Investments LTD

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Columbia Discount Homes

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CC's Modular & Manufactured Homes

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Clayton Homes

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Home Nation

List of Figures

- Figure 1: Latin America Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Manufactured Homes Market Revenue Million Forecast, by Countries 2019 & 2032

- Table 4: Latin America Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Latin America Manufactured Homes Market Revenue Million Forecast, by Countries 2019 & 2032

- Table 14: Latin America Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Manufactured Homes Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Latin America Manufactured Homes Market?

Key companies in the market include Home Nation, Columbia Manufactured Homes, Brasmerc Group companies, HomeMax, Titan Factory Direct**List Not Exhaustive, Casas Brazil, DRM Investments LTD, Columbia Discount Homes, CC's Modular & Manufactured Homes, Clayton Homes.

3. What are the main segments of the Latin America Manufactured Homes Market?

The market segments include Type, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Low Construction Cost Propels the Demand for Manufactured Homes.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

January 2023 - Cavco Industries (producers of manufactured and modular homes in the United States) announced that it has completed the acquisition of manufactured home builder and retailer, Solitaire Homes. Solitaire Homes operates manufacturing facilities in New Mexico, Oklahoma, and Mexico, with retail locations across New Mexico, Oklahoma, and Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Latin America Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence