Key Insights

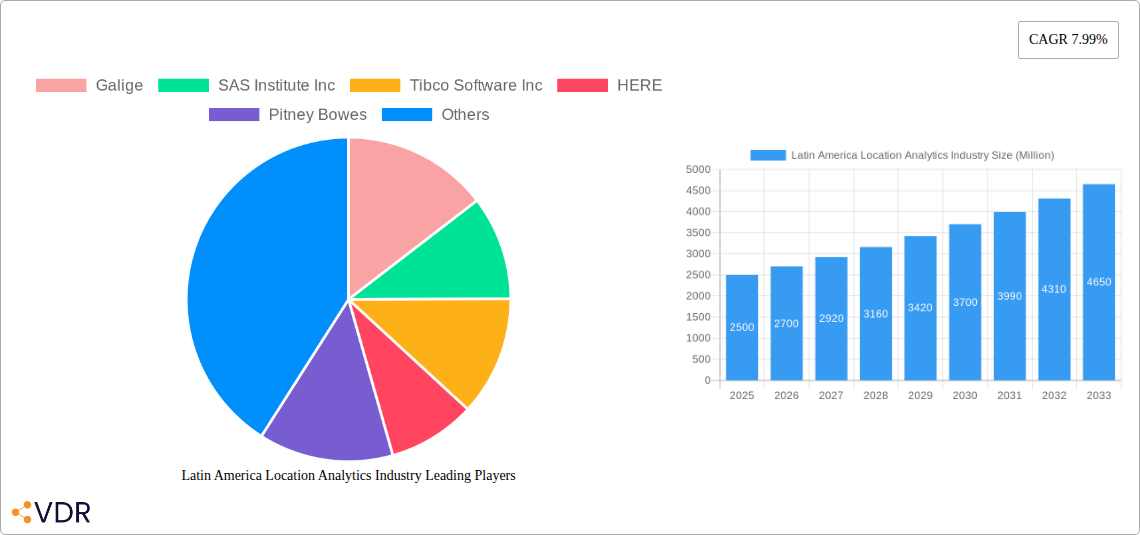

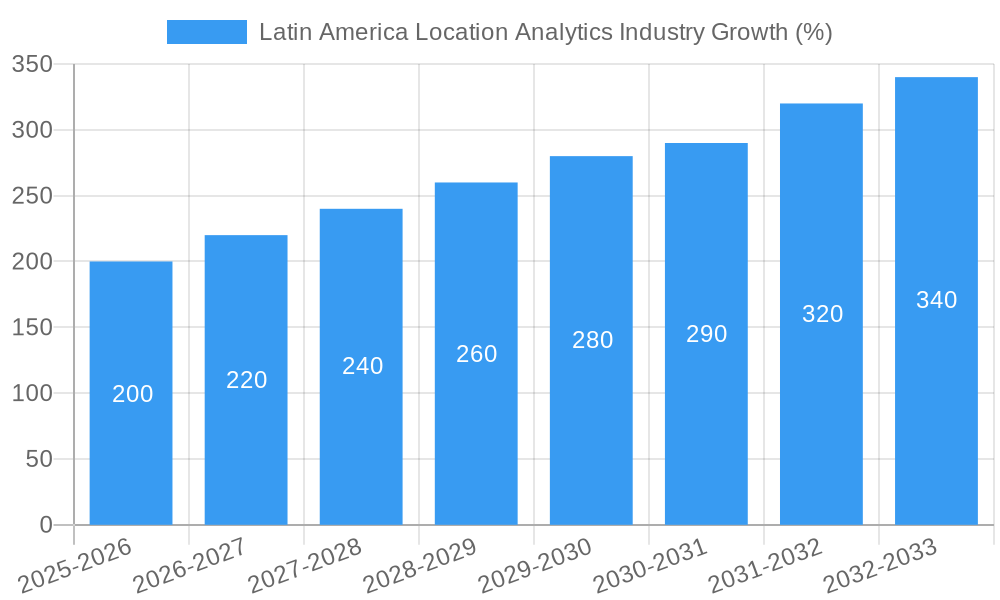

The Latin American location analytics market is experiencing robust growth, projected to reach a significant market size by 2033. Driven by increasing adoption of IoT devices, the expanding digital infrastructure, and the burgeoning need for efficient resource management across sectors like retail, manufacturing, and healthcare, the market exhibits a Compound Annual Growth Rate (CAGR) of 7.99% from 2019-2033. Key application areas driving this growth include remote monitoring, asset management, and facility management. The software component holds a significant market share due to increasing demand for advanced analytics capabilities. Growth is further fueled by the increasing adoption of on-demand deployment models, which offer scalability and cost-effectiveness. While the market faces some restraints such as data privacy concerns and the need for skilled professionals, the overall positive trends in digital transformation across Latin America are expected to outweigh these challenges. Specific countries like Brazil, Mexico, and Argentina are leading the market, owing to their advanced technological infrastructure and larger economies. The expanding government initiatives towards smart cities and infrastructure projects further stimulate market expansion. Within the end-user verticals, retail and manufacturing sectors are currently showing the highest adoption rates, with healthcare and energy gradually increasing their engagement with location analytics solutions.

The diverse applications of location analytics across various sectors in Latin America are creating a dynamic market landscape. The adoption of location intelligence is expanding beyond traditional uses, integrating with other technologies like AI and machine learning to provide more sophisticated insights. This leads to improved operational efficiency, better decision-making, and enhanced customer experience. Growth in the indoor location analytics segment is also significant, driven by the increasing adoption of location-based services within shopping malls, hospitals, and other indoor spaces. Companies are investing heavily in developing advanced location analytics solutions tailored to the specific needs of Latin American businesses. This includes localization of software and services to cater to the specific linguistic and cultural contexts. The competitive landscape is characterized by a mix of global and regional players, fostering innovation and driving the market towards greater maturity. The overall outlook for the Latin American location analytics market remains highly optimistic, with substantial growth potential in the coming years.

Latin America Location Analytics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America location analytics market, encompassing market size, growth trends, key players, and future outlook. It covers the parent market of Location Analytics and the child markets segmented by application, component, end-user vertical, location, and deployment model. The report utilizes data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), with an estimated year of 2025. The total market value is predicted to reach xx Million by 2033.

Latin America Location Analytics Industry Market Dynamics & Structure

The Latin American location analytics market is characterized by a moderately fragmented landscape, with several major players competing alongside numerous smaller niche providers. Market concentration is relatively low, with no single company holding a dominant share. However, the presence of global giants like Microsoft and SAP indicates potential for future consolidation through mergers and acquisitions (M&A). Technological innovation, particularly in areas like AI, IoT, and 5G, is a major driver, but adoption is influenced by factors such as digital infrastructure availability and data privacy regulations. Regulatory frameworks vary across countries, presenting both opportunities and challenges. Substitutes include traditional mapping and GIS technologies, but the increasing sophistication and cost-effectiveness of location analytics solutions are favoring their adoption. End-user demographics are shifting towards higher digital literacy and increasing demand for data-driven decision-making.

- Market Concentration: Moderately Fragmented; Top 5 players hold approximately xx% market share (2025).

- M&A Activity: An average of xx M&A deals per year were observed in the historical period. This is expected to increase to xx deals annually during the forecast period.

- Technological Innovation: Strong growth drivers include AI-powered analytics, improved geospatial data, and enhanced IoT integration.

- Regulatory Landscape: Varying data privacy laws across countries present both opportunities and challenges.

Latin America Location Analytics Industry Growth Trends & Insights

The Latin America location analytics market is experiencing robust growth, driven by increasing adoption across diverse sectors. Market size expanded from xx Million in 2019 to xx Million in 2024, representing a CAGR of xx%. This growth is fueled by the rising availability of location data, improving mobile penetration rates, and the increasing need for businesses to understand and optimize their physical presence and operations. Technological advancements in cloud computing, big data analytics, and machine learning are accelerating market penetration, while shifts in consumer behavior—including increased use of location-based services and higher expectation for personalized experiences—further enhance market demand. The market is projected to continue its strong growth trajectory, reaching xx Million by 2033, with a forecast CAGR of xx%. This growth is expected to be further driven by increased investment in digital infrastructure and rising government initiatives focused on smart cities and digital transformation.

Dominant Regions, Countries, or Segments in Latin America Location Analytics Industry

Brazil and Mexico dominate the Latin American location analytics market, accounting for approximately xx% and xx% of the total market value in 2025 respectively. This dominance stems from their larger economies, advanced digital infrastructure, and high adoption rates across various sectors. The significant growth potential of these markets, coupled with increasing investments in digitalization and smart city initiatives, make them attractive for location analytics providers. Within segments, the strongest growth is observed in Remote Monitoring (xx Million in 2025) driven by increasing adoption across sectors including healthcare and energy, followed by Asset Management (xx Million in 2025) and Facility Management (xx Million in 2025). Software accounts for the largest market share in the component segment (xx Million in 2025) due to its flexibility and scalability, while the services segment is expected to experience the highest growth rate over the forecast period.

- Key Drivers (Brazil & Mexico): Strong economies, advanced digital infrastructure, government initiatives supporting digital transformation.

- High Growth Segments: Remote Monitoring, Asset Management, Software component.

- Market Share Breakdown (2025): Brazil (xx%), Mexico (xx%), Other Countries (xx%).

Latin America Location Analytics Industry Product Landscape

Location analytics solutions in Latin America are increasingly incorporating advanced technologies such as AI and machine learning to improve accuracy, efficiency, and insights. Products are tailored to diverse applications, including real-time tracking, predictive analytics, and risk assessment. Unique selling propositions often focus on addressing specific regional needs and integrating with existing systems. Key advancements include the seamless integration of location data with other business information, enabling a holistic view of operations.

Key Drivers, Barriers & Challenges in Latin America Location Analytics Industry

Key Drivers: Government initiatives promoting digitalization and smart city development, growing adoption of IoT and 5G networks, increasing demand for data-driven decision-making across sectors.

Challenges: Data privacy concerns and regulations; uneven digital infrastructure across the region; lack of skilled workforce in data analytics; high implementation costs for smaller businesses. Addressing these hurdles will require collaborative efforts between governments, businesses, and technology providers.

Emerging Opportunities in Latin America Location Analytics Industry

Untapped market opportunities exist within the agriculture and logistics sectors, where location analytics can significantly improve efficiency and yield. The development of innovative applications, such as precision agriculture and supply chain optimization tools, is creating promising avenues for growth. Evolving consumer preferences for personalized experiences and increased adoption of location-based services are further bolstering the market.

Growth Accelerators in the Latin America Location Analytics Industry Industry

Technological advancements, particularly in AI, big data, and cloud computing, are fundamentally reshaping the location analytics landscape. Strategic partnerships between technology providers and industry-specific businesses are driving innovation and expanding market reach. Government initiatives supporting digital transformation and investment in digital infrastructure are fueling adoption across various sectors.

Key Players Shaping the Latin America Location Analytics Industry Market

- Galige

- SAS Institute Inc

- Tibco Software Inc

- HERE

- Pitney Bowes

- Microsoft Corporation

- ESRI (Environmental Systems Research Institute)

- Oracle Corporation

- Cisco Systems

- SAP SE

Notable Milestones in Latin America Location Analytics Industry Sector

- November 2022: Launch of Brazil's largest remote sensing project to combat illegal activities in the Amazon, demonstrating the increasing use of location analytics for public safety and environmental monitoring.

- February 2023: Liberty Latin America's collaboration with Ribbon Communications for improved network monitoring and fraud control, highlighting the application of location analytics in telecommunications.

In-Depth Latin America Location Analytics Industry Market Outlook

The Latin American location analytics market is poised for significant growth in the coming years, driven by accelerating digital transformation, rising adoption across diverse sectors, and continuous technological advancements. Strategic opportunities exist for companies to focus on niche applications, develop tailored solutions for specific regional needs, and build strong partnerships with local businesses to expand their market reach. The market's future potential is considerable, offering substantial returns for investors and innovative providers.

Latin America Location Analytics Industry Segmentation

-

1. Location

- 1.1. Outdoor

- 1.2. Indoor

-

2. Deployment Model

- 2.1. On-premise

- 2.2. On-demand

-

3. Application

- 3.1. Remote Monitoring

- 3.2. Asset Management

- 3.3. Facility Management

-

4. Component

- 4.1. Software

- 4.2. Services

-

5. End-user Verticals

- 5.1. Retail

- 5.2. Manufacturing

- 5.3. Healthcare

- 5.4. Government

- 5.5. Energy and Power

- 5.6. Other Verticals

-

6. Geography

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Mexico

Latin America Location Analytics Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Mexico

Latin America Location Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Retail Market; Increasing Adoption of Analytical Business Intelligence and Geographical Information Systems Technology; Increasing Usage of IoT

- 3.3. Market Restrains

- 3.3.1 Concerns over Security and Privacy; Systems are Error-prone - In Cases like Incomplete Business Information

- 3.3.2 Out-of-date Information

- 3.3.3 and Limitation of Place Databases

- 3.4. Market Trends

- 3.4.1. Technological Advances in Various Industries Play a Vital Role

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Outdoor

- 5.1.2. Indoor

- 5.2. Market Analysis, Insights and Forecast - by Deployment Model

- 5.2.1. On-premise

- 5.2.2. On-demand

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Remote Monitoring

- 5.3.2. Asset Management

- 5.3.3. Facility Management

- 5.4. Market Analysis, Insights and Forecast - by Component

- 5.4.1. Software

- 5.4.2. Services

- 5.5. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.5.1. Retail

- 5.5.2. Manufacturing

- 5.5.3. Healthcare

- 5.5.4. Government

- 5.5.5. Energy and Power

- 5.5.6. Other Verticals

- 5.6. Market Analysis, Insights and Forecast - by Geography

- 5.6.1. Brazil

- 5.6.2. Argentina

- 5.6.3. Mexico

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. Brazil Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Location Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Galige

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAS Institute Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Tibco Software Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HERE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Pitney Bowes

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ESRI (Environmental Systems Research Institute)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Oracle Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cisco Systems

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SAP SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Galige

List of Figures

- Figure 1: Latin America Location Analytics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Location Analytics Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Location Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Location Analytics Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 3: Latin America Location Analytics Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 4: Latin America Location Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Latin America Location Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 6: Latin America Location Analytics Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 7: Latin America Location Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Latin America Location Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Latin America Location Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Argentina Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Peru Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Chile Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Latin America Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Latin America Location Analytics Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Latin America Location Analytics Industry Revenue Million Forecast, by Deployment Model 2019 & 2032

- Table 18: Latin America Location Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Latin America Location Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 20: Latin America Location Analytics Industry Revenue Million Forecast, by End-user Verticals 2019 & 2032

- Table 21: Latin America Location Analytics Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Latin America Location Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico Latin America Location Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Location Analytics Industry?

The projected CAGR is approximately 7.99%.

2. Which companies are prominent players in the Latin America Location Analytics Industry?

Key companies in the market include Galige, SAS Institute Inc, Tibco Software Inc, HERE, Pitney Bowes, Microsoft Corporation, ESRI (Environmental Systems Research Institute), Oracle Corporation, Cisco Systems, SAP SE.

3. What are the main segments of the Latin America Location Analytics Industry?

The market segments include Location, Deployment Model, Application, Component, End-user Verticals, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Retail Market; Increasing Adoption of Analytical Business Intelligence and Geographical Information Systems Technology; Increasing Usage of IoT.

6. What are the notable trends driving market growth?

Technological Advances in Various Industries Play a Vital Role.

7. Are there any restraints impacting market growth?

Concerns over Security and Privacy; Systems are Error-prone - In Cases like Incomplete Business Information. Out-of-date Information. and Limitation of Place Databases.

8. Can you provide examples of recent developments in the market?

February 2023: To learn more about its network behavior and improve its business performance, Liberty Latin America collaborated with Ribbon Communications Inc. With automated fraud control and centralized network monitoring, Liberty Latin America's network will perform better in KPIs and keep its customers safer as a result of the addition of Ribbon's expertise.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Location Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Location Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Location Analytics Industry?

To stay informed about further developments, trends, and reports in the Latin America Location Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence