Key Insights

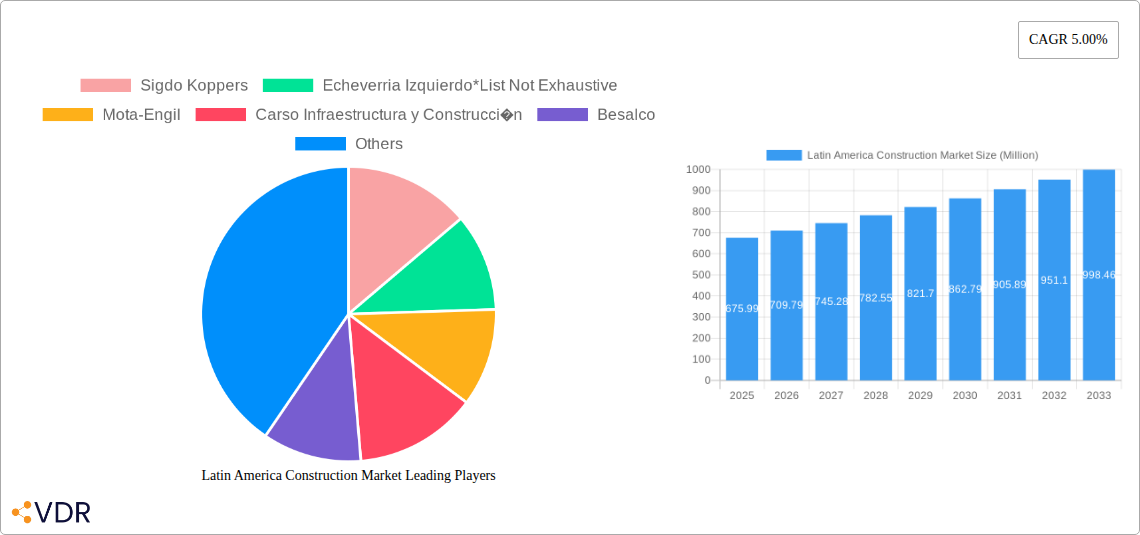

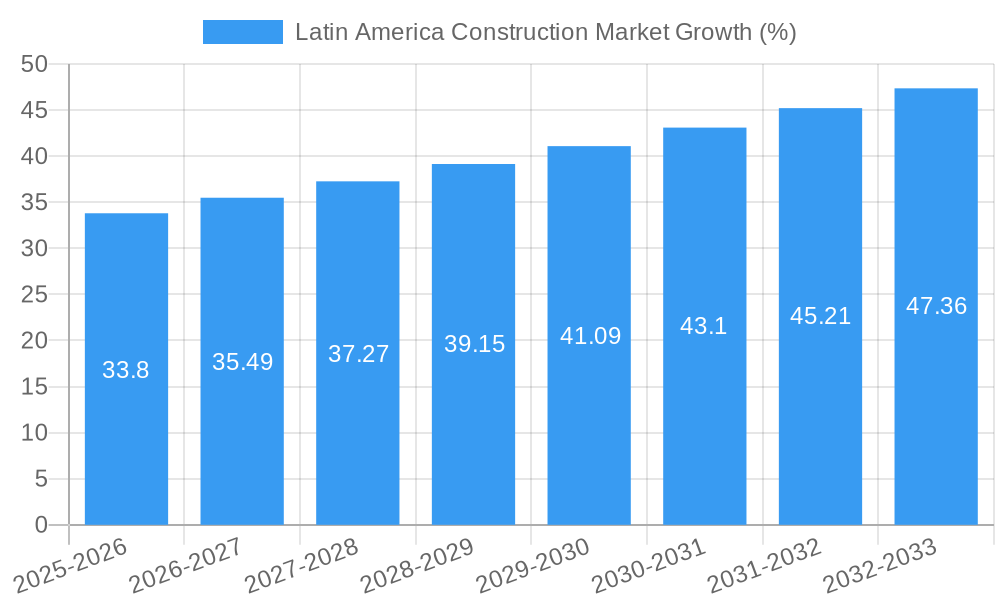

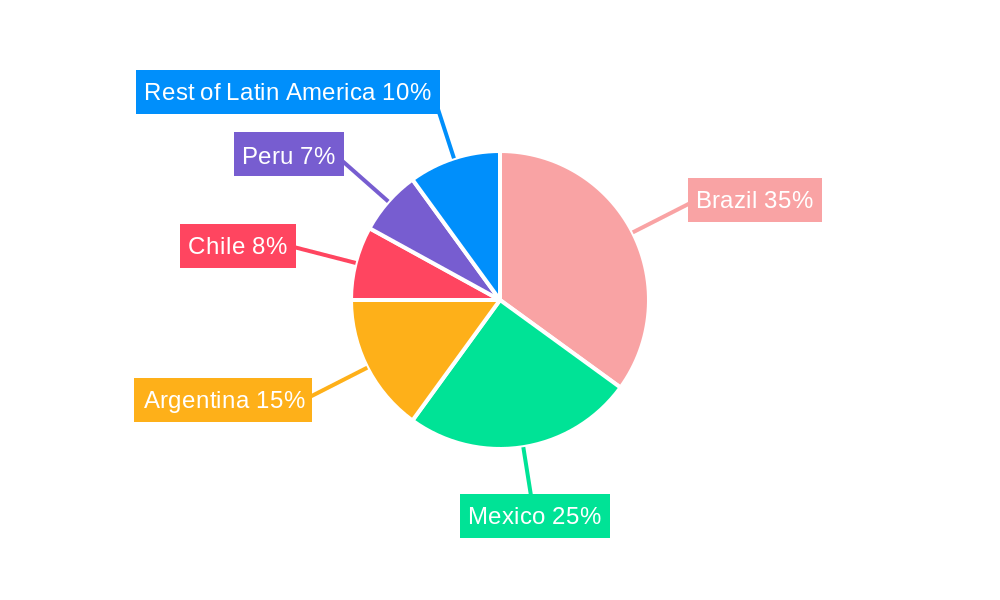

The Latin American construction market, valued at $675.99 million in 2025, is projected to experience robust growth, driven by significant infrastructure development initiatives across the region. Governments are investing heavily in projects aimed at improving transportation networks, expanding energy infrastructure, and bolstering residential and commercial real estate. Brazil, Mexico, and Argentina represent the largest national markets, fueled by population growth, urbanization, and increasing demand for better living standards. The market is segmented into residential, commercial, industrial, infrastructure, and energy & utilities sectors, each contributing to the overall growth trajectory. While economic fluctuations and material cost increases pose challenges, the long-term outlook remains positive, supported by consistent government spending and private sector investment. The rise of sustainable building practices and technological advancements in construction techniques further contribute to market dynamism.

Growth is expected to be propelled by several factors, including increasing government spending on infrastructure projects, a growing middle class with rising disposable incomes boosting demand for housing and commercial spaces, and ongoing efforts to modernize aging infrastructure. Key players like Sigdo Koppers, Echeverria Izquierdo, Mota-Engil, and others are well-positioned to benefit from these trends. However, challenges remain, including potential regulatory hurdles, labor shortages, and the need for continuous innovation to enhance efficiency and sustainability. The market's growth will likely be uneven across the region, with specific countries experiencing faster growth based on their economic performance and the pace of infrastructure investments. The forecast period of 2025-2033 suggests a continued upward trend, though the exact pace of growth will depend on macro-economic conditions and the successful implementation of key infrastructure programs.

Latin America Construction Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America construction market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals seeking to understand and capitalize on opportunities within this dynamic sector. The report analyzes the parent market of construction and delves into child markets such as residential, commercial, industrial, infrastructure, and energy & utilities construction. Market values are presented in millions of units.

Latin America Construction Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Latin American construction industry. We examine market concentration, identifying key players and their market share, as well as analyzing the impact of mergers and acquisitions (M&A) activity. The report also explores factors driving innovation and adoption of new technologies, regulatory frameworks impacting construction projects, and the influence of substitute products. End-user demographics and their evolving needs are also considered.

- Market Concentration: The Latin American construction market exhibits a moderately concentrated structure with several large players holding significant market share. (Specific market share percentages will be provided in the full report). xx% of the market is held by the top 5 players.

- Technological Innovation: Adoption of Building Information Modeling (BIM), prefabrication, and sustainable construction practices are gradually increasing, although challenges remain in terms of widespread adoption due to factors such as initial investment costs and lack of skilled labor.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American countries influence project timelines and costs. Streamlining regulations and improving transparency are key factors affecting market dynamics.

- M&A Activity: The construction sector in Latin America has witnessed significant M&A activity in recent years, driven by factors such as consolidation, expansion, and access to new technologies. (Specific M&A deal volumes and values will be provided in the full report.) XX major M&A deals were recorded between 2019 and 2024.

- Competitive Product Substitutes: The emergence of alternative construction materials and methods, such as modular construction, presents both opportunities and challenges to traditional players. The report analyzes the impact of these substitutes on market dynamics.

Latin America Construction Market Growth Trends & Insights

This section delves into the historical and projected growth of the Latin American construction market, providing a detailed analysis of market size evolution and key growth drivers. We examine adoption rates of new technologies, analyze technological disruptions impacting the market, and assess shifts in consumer behavior. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration will be detailed. The analysis uses proprietary data (XXX) to provide precise estimations and insights into market evolution.

(600-word analysis of market size evolution, adoption rates, technological disruptions, consumer behavior, CAGR, and market penetration will be provided in the full report).

Dominant Regions, Countries, or Segments in Latin America Construction Market

This section identifies the leading regions, countries, and segments within the Latin American construction market driving overall growth. We will analyze the factors contributing to the dominance of specific regions/segments, such as economic policies, infrastructure development, and population growth. Market share and growth potential will be examined for each segment (Residential, Commercial, Industrial, Infrastructure, Energy and Utilities).

- Key Drivers: (Specific drivers for each dominant region/segment will be listed in the full report, including, but not limited to, government infrastructure spending, urbanization rates, and private sector investment.)

- Dominance Factors: (Analysis of market share, growth potential, and competitive intensity for each dominant region/segment will be provided in the full report).

(600-word analysis of leading regions, countries, and segments will be provided in the full report)

Latin America Construction Market Product Landscape

This section provides an overview of product innovations, applications, and performance metrics within the Latin American construction market. The focus will be on highlighting unique selling propositions (USPs) and technological advancements that are shaping product development and market trends.

(100-150-word description of product innovations, applications, and performance metrics will be provided in the full report).

Key Drivers, Barriers & Challenges in Latin America Construction Market

This section outlines the key factors driving growth and the challenges hindering progress within the Latin American construction market.

Key Drivers: (150 words detailing technological advancements, economic factors, and supportive government policies will be included. Examples include increased government investment in infrastructure projects, growth of the tourism sector, and rising urbanization.)

Key Challenges and Restraints: (150 words analyzing supply chain disruptions, regulatory hurdles, and competitive pressures with quantifiable impacts will be included. Examples include material cost inflation, labor shortages, and project delays.)

Emerging Opportunities in Latin America Construction Market

This section highlights emerging trends and opportunities in the Latin American construction market. We explore untapped markets, innovative applications, and evolving consumer preferences that present potential for growth and expansion.

(150-word description of emerging trends and opportunities will be provided in the full report, including examples of sustainable construction, smart city initiatives, and growing demand for affordable housing)

Growth Accelerators in the Latin America Construction Market Industry

This section identifies the key factors that will drive long-term growth in the Latin American construction market. We emphasize technological advancements, strategic partnerships, and market expansion strategies that will create new opportunities for growth.

(150-word analysis of growth accelerators will be provided in the full report, including examples of technological breakthroughs, public-private partnerships, and regional economic expansion.)

Key Players Shaping the Latin America Construction Market Market

This section profiles key players in the Latin American construction market.

- Sigdo Koppers

- Echeverria Izquierdo

- Mota-Engil

- Carso Infraestructura y Construcción

- Besalco

- Techint Ingeniería y construcción

- MRV Engenharia

- Aenza (Graña y Montero)

- Sacyr

- SalfaCorp

(Further details on these companies, including market share and strategic initiatives, will be included in the full report.) List Not Exhaustive

Notable Milestones in Latin America Construction Market Sector

This section details significant developments in the Latin American construction market, highlighting their impact on market dynamics.

- May 2023: Holcim acquires PASA®, a leading roofing and waterproofing solutions producer in Mexico and Central America, with pro forma net sales of USD 38 million. This acquisition strengthens Holcim's regional presence and product portfolio.

- May 2023: Sika acquires MBCC Group, a leading global supplier of construction chemicals, creating a combined workforce of 33,000 experts and net sales exceeding USD 13.21 billion. This significantly impacts market share and competitive dynamics.

In-Depth Latin America Construction Market Market Outlook

This section summarizes the key growth accelerators identified in the report and provides an outlook on the future potential of the Latin American construction market. We focus on the strategic opportunities for market players and the long-term growth prospects for the industry.

(150-word summary of future market potential and strategic opportunities will be provided in the full report)

Latin America Construction Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Latin America Construction Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in residential construction driving the market; Development of hospitality infrastructure driving the market

- 3.3. Market Restrains

- 3.3.1. Limited access to financing; Shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increase in residential construction driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Sigdo Koppers

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Echeverria Izquierdo*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mota-Engil

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Carso Infraestructura y Construcci�n

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Besalco

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Techint Ingenier�a y construcci�n

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MRV Engenharia

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Aenza (Gra�a y Montero)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sacyr

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SalfaCorp

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Sigdo Koppers

List of Figures

- Figure 1: Latin America Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Latin America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Brazil Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Argentina Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Peru Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chile Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Latin America Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Latin America Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Latin America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Brazil Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Chile Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Colombia Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Venezuela Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Ecuador Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bolivia Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Paraguay Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Construction Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Latin America Construction Market?

Key companies in the market include Sigdo Koppers, Echeverria Izquierdo*List Not Exhaustive, Mota-Engil, Carso Infraestructura y Construcci�n, Besalco, Techint Ingenier�a y construcci�n, MRV Engenharia, Aenza (Gra�a y Montero), Sacyr, SalfaCorp.

3. What are the main segments of the Latin America Construction Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 675.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in residential construction driving the market; Development of hospitality infrastructure driving the market.

6. What are the notable trends driving market growth?

Increase in residential construction driving the market.

7. Are there any restraints impacting market growth?

Limited access to financing; Shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

May 2023: Holcim acquires PASA®, a leading roofing and waterproofing solutions producer in Mexico and Central America, with pro forma net sales of USD 38 million. As a leader in innovation, sustainability, and quality, PASA® expands Holcim’s roofing and waterproofing offer and strengthens its regional business footprint. By integrating the existing PASA® distribution network with waterproofing solutions from its GacoFlex product range, Holcim will deliver more customer value with an enhanced supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Construction Market?

To stay informed about further developments, trends, and reports in the Latin America Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence