Key Insights

The Italian Metal Processing Equipment market, projected for robust growth, presents a significant investment opportunity. Driven by sustained demand from the automotive, aerospace, and construction sectors, advanced metal fabrication technologies are essential. The industry is actively embracing automation, particularly in welding and cutting, with a notable shift towards robotics and digital solutions to enhance efficiency and precision. Despite potential challenges from supply chain volatility and raw material price fluctuations, the market demonstrates resilience. Leading companies are investing in R&D, focusing on innovations like additive manufacturing and laser processing. The market comprises diverse equipment types, including CNC machines, laser cutters, and presses, alongside application-specific solutions for various industries.

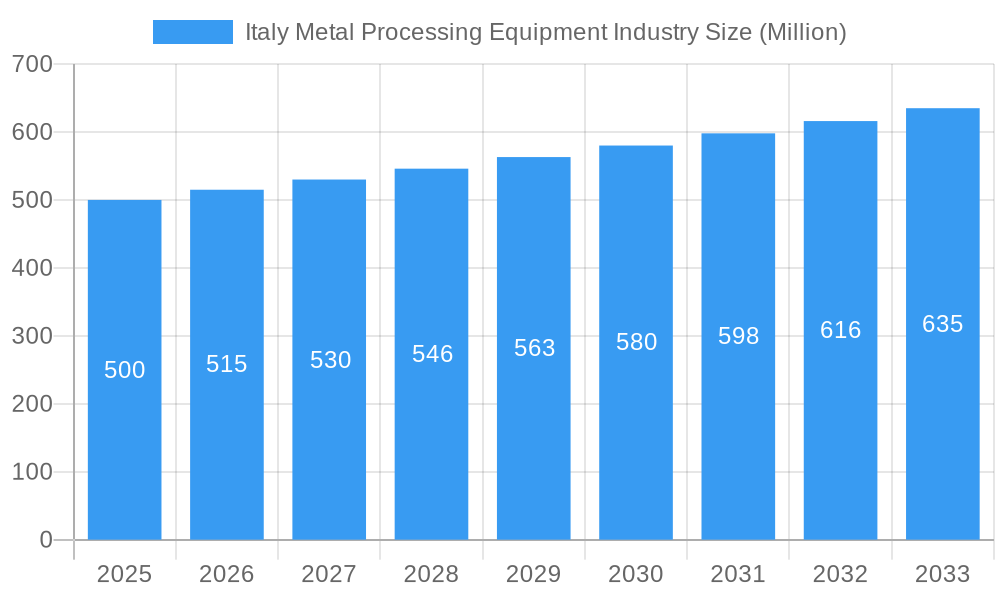

Italy Metal Processing Equipment Industry Market Size (In Billion)

The estimated market size in the base year 2024 is 1.8 billion. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 1.941%, reaching an estimated market size of 1.8 billion by 2024. Italy's skilled workforce and established manufacturing infrastructure provide a strong foundation for this growth. However, intense global competition and the imperative for ongoing technological upgrades necessitate strategic focus on niche applications and specialized solutions. Market demand is anticipated to be concentrated in Italy's industrialized northern regions, leveraging their advanced manufacturing capabilities. The forecast period, 2024-2033, is expected to witness continued expansion, fueled by infrastructure investments, technological advancements, and increasing demand for high-precision metal components across key sectors.

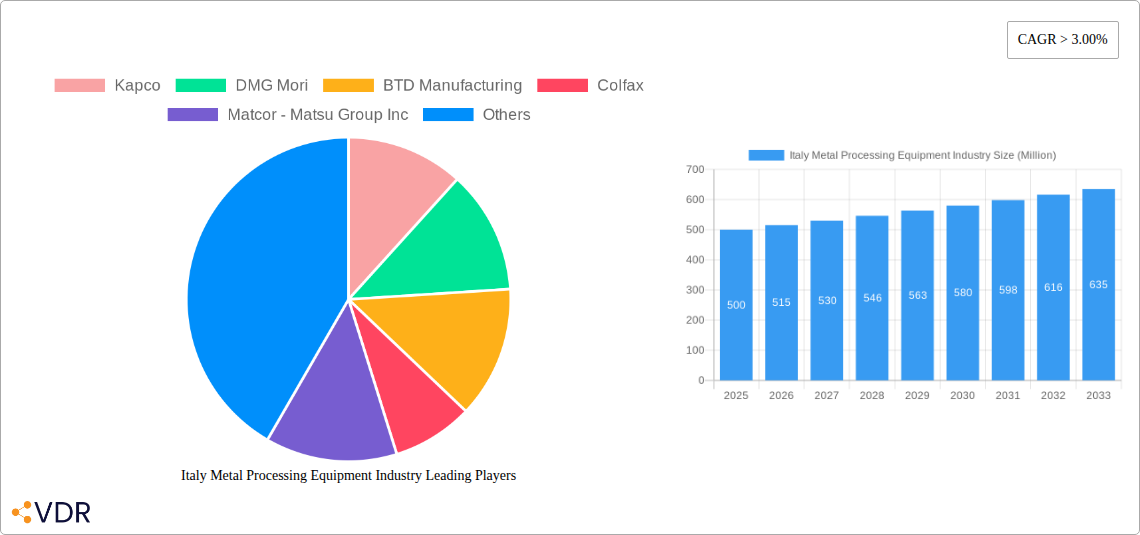

Italy Metal Processing Equipment Industry Company Market Share

Italy Metal Processing Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Italy metal processing equipment industry, covering market dynamics, growth trends, key players, and future outlook. The report focuses on the parent market of industrial machinery and the child market of metal processing equipment within Italy, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 as the base and estimated year.

Italy Metal Processing Equipment Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive substitutes, end-user demographics, and M&A activities within the Italian metal processing equipment sector. The market is characterized by a mix of large multinational corporations and smaller specialized companies. Market concentration is moderate, with the top 5 players holding an estimated xx% market share in 2025.

- Market Concentration: Moderate, top 5 players holding xx% market share (2025).

- Technological Innovation: Driven by automation, Industry 4.0 technologies, and advanced materials processing. Barriers to innovation include high R&D costs and integration complexities.

- Regulatory Framework: Compliant with EU regulations on safety, emissions, and environmental standards.

- Competitive Substitutes: Limited direct substitutes, but alternative manufacturing processes (e.g., 3D printing) pose indirect competition.

- End-User Demographics: Primarily automotive, aerospace, construction, and energy sectors. Growing demand from renewable energy and e-mobility sectors.

- M&A Trends: Significant activity observed, driven by consolidation and expansion into new technologies. The number of M&A deals in the period 2019-2024 totaled approximately xx.

Italy Metal Processing Equipment Industry Growth Trends & Insights

The Italian metal processing equipment market has experienced [XXX] growth over the historical period (2019-2024). This growth is attributed to factors such as increasing industrial automation, rising demand from key end-use sectors, and government initiatives promoting technological upgrades. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Market penetration of advanced technologies like laser cutting and robotics is expected to increase significantly, driven by improvements in efficiency and cost-effectiveness.

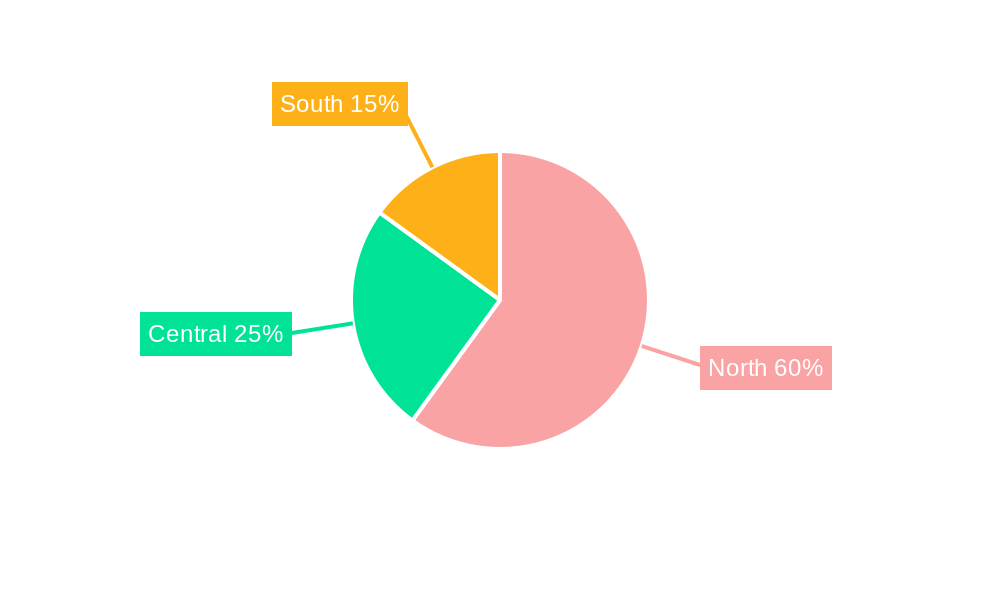

Dominant Regions, Countries, or Segments in Italy Metal Processing Equipment Industry

Northern Italy, particularly regions like Lombardy and Piedmont, dominates the Italian metal processing equipment market due to a high concentration of manufacturing industries and advanced infrastructure. The automotive and machinery sectors are key drivers of growth in these regions.

- Key Drivers: Strong industrial base, skilled workforce, advanced infrastructure, government support for industrial development.

- Dominance Factors: High concentration of manufacturing industries, proximity to key supply chains, established expertise in metal processing.

- Growth Potential: Continued expansion in automotive and renewable energy sectors offers significant growth opportunities. Market share of Northern Italy is estimated at xx% in 2025.

Italy Metal Processing Equipment Industry Product Landscape

The Italian metal processing equipment market offers a diverse range of products, including cutting, bending, forming, welding, and finishing machinery. Recent innovations focus on increased automation, improved precision, and enhanced efficiency. Key features include advanced control systems, intelligent sensors, and integration with Industry 4.0 technologies. Unique selling propositions often include customized solutions, high-quality components, and excellent after-sales support.

Key Drivers, Barriers & Challenges in Italy Metal Processing Equipment Industry

Key Drivers:

- Increasing automation in manufacturing processes.

- Growing demand from key sectors like automotive and renewable energy.

- Government incentives for technological upgrades and sustainable manufacturing.

Challenges & Restraints:

- High initial investment costs for advanced equipment.

- Skilled labor shortages in certain areas.

- Global economic uncertainty and supply chain disruptions can impact demand and profitability. The impact of supply chain disruptions in 2022 was estimated at xx Million in lost revenue for the industry.

Emerging Opportunities in Italy Metal Processing Equipment Industry

- Growing demand for lightweight materials in automotive and aerospace sectors.

- Increasing adoption of additive manufacturing (3D printing) for prototyping and production.

- Expansion into niche markets, such as medical device manufacturing and personalized medicine.

Growth Accelerators in the Italy Metal Processing Equipment Industry

Technological breakthroughs in automation, robotics, and AI are significantly accelerating market growth. Strategic partnerships between equipment manufacturers and end-users are fostering innovation and driving demand for customized solutions. Expansion into new markets and diversification of product portfolios are key strategies for long-term growth.

Key Players Shaping the Italy Metal Processing Equipment Market

- Kapco

- DMG Mori

- BTD Manufacturing

- Colfax

- Matcor - Matsu Group Inc

- Standard Iron and Wire Works

- TRUMPF

- Bystronic Laser AG

- List Not Exhaustive

Notable Milestones in Italy Metal Processing Equipment Industry Sector

- August 2022: Acquisition of the Italian Sovema Group by Schuler (ANDRITZ). This significantly expands the market for battery cell production equipment.

- June 2022: Acquisition of Chicago Elite Manufacturing Technologies by CGI Automated Manufacturing. This highlights the consolidation trend and focus on automated solutions.

In-Depth Italy Metal Processing Equipment Industry Market Outlook

The Italian metal processing equipment market is poised for continued growth, driven by technological advancements, increasing industrial automation, and demand from key sectors. Strategic investments in R&D, collaborations with technology providers, and expansion into high-growth markets will be crucial for companies to capitalize on future opportunities. The market's long-term potential is significant, particularly in sectors such as renewable energy and e-mobility.

Italy Metal Processing Equipment Industry Segmentation

-

1. Product Type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. Equipment Type

- 2.1. Cutting

- 2.2. Machining

- 2.3. Forming

- 2.4. Welding

- 2.5. Other Equipment Types

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Manufacturing

- 3.3. Power and Utilities

- 3.4. Construction

- 3.5. Other End-user Industries

Italy Metal Processing Equipment Industry Segmentation By Geography

- 1. Italy

Italy Metal Processing Equipment Industry Regional Market Share

Geographic Coverage of Italy Metal Processing Equipment Industry

Italy Metal Processing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.941% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing Production is the Key Trend Driving Demand Generation in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Metal Processing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Cutting

- 5.2.2. Machining

- 5.2.3. Forming

- 5.2.4. Welding

- 5.2.5. Other Equipment Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Manufacturing

- 5.3.3. Power and Utilities

- 5.3.4. Construction

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DMG Mori

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BTD Manufacturing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colfax

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Matcor - Matsu Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Standard Iron and Wire Works

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bystronic Laser AG**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kapco

List of Figures

- Figure 1: Italy Metal Processing Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Metal Processing Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 3: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 7: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Metal Processing Equipment Industry?

The projected CAGR is approximately 1.941%.

2. Which companies are prominent players in the Italy Metal Processing Equipment Industry?

Key companies in the market include Kapco, DMG Mori, BTD Manufacturing, Colfax, Matcor - Matsu Group Inc, Standard Iron and Wire Works, TRUMPF, Bystronic Laser AG**List Not Exhaustive.

3. What are the main segments of the Italy Metal Processing Equipment Industry?

The market segments include Product Type, Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing Production is the Key Trend Driving Demand Generation in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: The Italian Sovema Group was acquired by Schuler, a part of the global technology group ANDRITZ, enabling it to become a leading systems supplier of battery cell production solutions for the automobile industry and other markets. In collaboration with Sovema, Schuler will create the tools required to outfit gigafactories for the mass manufacture of lithium-ion batteries, whose widespread availability is crucial for the commercial viability of eco-friendly e-mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Metal Processing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Metal Processing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Metal Processing Equipment Industry?

To stay informed about further developments, trends, and reports in the Italy Metal Processing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence