Key Insights

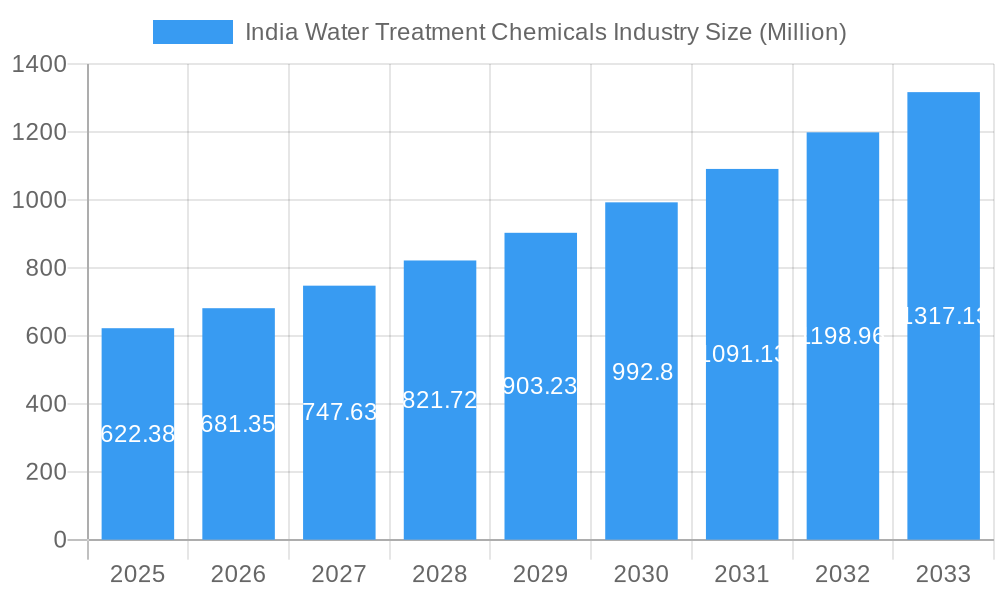

The India water treatment chemicals market is experiencing robust growth, projected to reach \$622.38 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 9% from 2025 to 2033. This expansion is fueled by several key factors. Increasing industrialization and urbanization are driving higher water consumption and consequently, a greater demand for effective water treatment solutions. Stringent government regulations aimed at improving water quality and minimizing environmental impact are further stimulating market growth. The rising prevalence of waterborne diseases is also contributing to increased investment in water purification technologies, creating a significant demand for associated chemicals. Furthermore, the growing awareness among consumers regarding the importance of safe drinking water is positively impacting the market. The market is segmented by chemical type (coagulants, flocculants, disinfectants, etc.), application (municipal, industrial, etc.), and region. Leading players such as Dow, Ecolab (Nalco), and Solvay are leveraging their technological expertise and established distribution networks to capture significant market share. However, challenges remain, including price volatility of raw materials and the potential for regulatory changes.

India Water Treatment Chemicals Industry Market Size (In Million)

The competitive landscape is characterized by a mix of multinational corporations and domestic players. Multinationals bring advanced technologies and established brands, while domestic companies benefit from local knowledge and cost advantages. Future growth will be driven by technological advancements in water treatment processes, a shift toward sustainable and eco-friendly chemical solutions, and increasing public-private partnerships in water infrastructure development. The market is expected to see continued consolidation, with larger players acquiring smaller companies to enhance their product portfolios and market reach. Growth will also be influenced by the adoption of innovative technologies such as membrane filtration and advanced oxidation processes, which rely on specific chemical treatments. Therefore, companies focusing on research and development of innovative and sustainable water treatment chemicals are poised for significant success in the coming years.

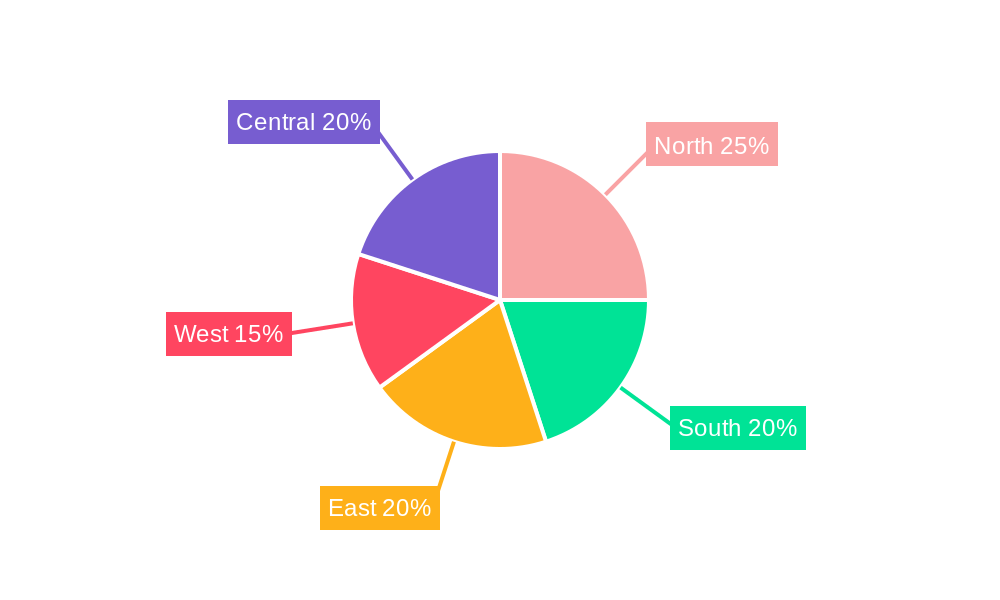

India Water Treatment Chemicals Industry Company Market Share

India Water Treatment Chemicals Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report offers an in-depth analysis of the India water treatment chemicals market, providing invaluable insights for industry professionals, investors, and strategic decision-makers. With a study period spanning 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033, Historical Period: 2019-2024), this report meticulously examines market dynamics, growth trends, key players, and emerging opportunities within this vital sector. The report quantifies the market in Million units.

India Water Treatment Chemicals Industry Market Dynamics & Structure

The Indian water treatment chemicals market is characterized by a dynamic and evolving landscape, featuring a balanced interplay between established multinational corporations and agile domestic players. A significant driving force behind this evolution is the relentless pursuit of technological innovation, geared towards developing more efficient, sustainable, and cost-effective water treatment solutions. This is further amplified by increasingly stringent government regulations, mandated by bodies like the Central Pollution Control Board (CPCB) and state pollution control boards, which are actively shaping the demand for advanced and compliant chemical treatments. While membrane filtration and other advanced separation technologies present competitive alternatives, they also spur innovation and cost optimization within the chemical treatment segment. The end-user base is exceptionally diverse, encompassing critical industrial sectors such as power generation and manufacturing, alongside essential municipal water supply and sanitation, and a broad spectrum of commercial applications. Mergers and acquisitions (M&A) activity, while moderate, signifies a strategic push for consolidation, synergy realization, and market expansion as key players seek to strengthen their competitive positions.

- Market Concentration: The market exhibits moderate concentration, with the top 5 players collectively holding approximately 45-55% of the market share in 2024, indicating a competitive yet consolidated environment.

- Technological Innovation: A strong emphasis is placed on developing and deploying advanced oxidation processes (AOPs), next-generation membrane-compatible chemicals, and integrating AI and IoT for real-time monitoring and predictive optimization of treatment efficacy.

- Regulatory Framework: The market is significantly influenced by robust regulations from the Central Pollution Control Board (CPCB) and state pollution control boards, focusing on effluent discharge standards, drinking water quality, and industrial wastewater management.

- Competitive Substitutes: Key competitive substitutes include advanced membrane filtration systems (RO, UF, NF), UV disinfection, ozonation, and other emerging physical and biological treatment technologies, driving chemical manufacturers to enhance performance and value.

- End-User Demographics: The market serves a wide array of end-users, including major industrial consumers (power generation, petrochemicals, pharmaceuticals, textiles, food & beverage), municipal water treatment facilities, and commercial establishments (hospitals, hotels, educational institutions).

- M&A Trends: Moderate M&A activity is observed, with an estimated 15-25 significant deals recorded between 2019-2024, reflecting strategic acquisitions for technology integration, market access, and portfolio expansion.

India Water Treatment Chemicals Industry Growth Trends & Insights

The Indian water treatment chemicals market has witnessed robust growth over the historical period (2019-2024), driven by factors such as increasing industrialization, urbanization, and rising concerns about water scarcity and pollution. The market size expanded from xx Million units in 2019 to xx Million units in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological disruptions, particularly the adoption of advanced treatment technologies and digitalization, are further accelerating market growth. Shifting consumer preferences towards environmentally friendly and sustainable solutions are also influencing market trends. Market penetration of advanced technologies remains relatively low, indicating significant untapped potential.

Dominant Regions, Countries, or Segments in India Water Treatment Chemicals Industry

The industrial segment currently dominates the Indian water treatment chemicals market, fueled by the growth of various manufacturing industries. Southern and Western India are the leading regions due to higher industrial concentration and stricter environmental regulations. Government initiatives promoting industrial water management further contribute to growth in these regions. Key drivers include expanding industrial capacity, rising awareness of water pollution control, and investments in infrastructure development.

- Key Drivers: Government regulations, industrial growth, infrastructure development, and increasing water scarcity.

- Dominant Regions: Southern and Western India.

- Dominant Segment: Industrial water treatment.

- Growth Potential: Significant potential in the municipal and commercial segments.

India Water Treatment Chemicals Industry Product Landscape

The Indian water treatment chemicals market boasts a comprehensive product portfolio designed to address diverse water quality challenges. This includes essential chemicals such as coagulants and flocculants for solid-liquid separation, disinfectants for microbial control, corrosion and scale inhibitors to protect infrastructure, pH adjusters, biocides, and specialized treatment agents. Recent product development is strongly aligned with sustainability imperatives, focusing on highly efficient formulations that minimize chemical dosage, reduce sludge generation, and exhibit lower environmental toxicity. The adoption of bio-based and biodegradable chemicals, alongside advanced formulations utilizing nanotechnology and smart release mechanisms, is a growing trend. Key performance indicators (KPIs) meticulously tracked by users include purification efficiency, reduction in contaminants, chemical consumption rates, operational cost-effectiveness, and compliance with environmental standards. Unique selling propositions (USPs) are increasingly centered around providing tailored, application-specific solutions, offering robust technical support and expertise, ensuring consistent product quality, and maintaining reliable, resilient supply chains that meet the demands of a rapidly growing economy.

Key Drivers, Barriers & Challenges in India Water Treatment Chemicals Industry

Key Drivers: The market is propelled by a confluence of powerful factors, including the relentless pace of industrialization and urbanization, which escalates water demand and wastewater generation. Stringent environmental regulations and a growing societal awareness of water pollution are compelling industries and municipalities to invest in effective treatment solutions. The intensifying challenge of water scarcity, exacerbated by climate change and population growth, is a significant catalyst for water reuse and advanced treatment. Furthermore, proactive government initiatives focused on water conservation, river rejuvenation (e.g., Namami Gange), and the expansion of wastewater treatment infrastructure are creating substantial market opportunities.

Challenges: The industry grapples with several inherent challenges. Volatility in the prices of key raw materials, often linked to global petrochemical markets, can impact profitability and pricing strategies. Supply chain disruptions, whether due to logistical complexities, geopolitical events, or natural disasters, pose a constant threat to timely delivery. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization. The need for regular technological upgrades to meet evolving treatment standards and the complex regulatory landscape, including ensuring product safety and compliance across various jurisdictions, present ongoing hurdles. A significant challenge remains the inconsistent enforcement of environmental regulations across different states, which can create an uneven playing field and impede market growth.

Emerging Opportunities in India Water Treatment Chemicals Industry

Emerging opportunities lie in untapped markets, such as the rural sector and small-scale industries. The increasing adoption of advanced oxidation processes (AOPs) and membrane filtration technologies offers significant growth potential. Furthermore, the development of sustainable and environmentally friendly water treatment solutions aligns with global sustainability goals.

Growth Accelerators in the India Water Treatment Chemicals Industry

Several factors are poised to significantly accelerate growth within the India Water Treatment Chemicals Industry. Technological advancements, particularly in areas like digital water management, real-time monitoring, and the development of highly efficient and environmentally benign chemical formulations, are critical. Strategic partnerships and collaborations between chemical manufacturers, water treatment equipment providers, and system integrators are fostering the development of comprehensive, end-to-end solutions. Furthermore, strategic expansion into untapped or underserved markets, especially in semi-urban and rural areas where access to safe water and proper sanitation is still a concern, presents immense growth potential. Increased government support, manifesting through subsidies, tax incentives, and dedicated funding for water infrastructure development projects, acts as a powerful catalyst, encouraging greater adoption of advanced water treatment technologies and chemicals.

Key Players Shaping the India Water Treatment Chemicals Industry Market

- Chembond Chemicals Limited

- Chemtex Speciality Limited

- Dow (Dow)

- Ecolab (Nalco) (Ecolab)

- ION EXCHANGE (ION EXCHANGE)

- Lonza (Lonza)

- Nouryon (Nouryon)

- SicagenChem

- SNF (SNF)

- Solenis (Solenis)

- Solvay (Solvay)

- Thermax Limited (Thermax Limited)

- VASU CHEMICALS LLP

Notable Milestones in India Water Treatment Chemicals Industry Sector

- February 2024: Thermax Group acquires a 51% stake in TSA Process Equipments, expanding its high-purity water treatment solutions offerings.

- October 2023: WABAG Group partners with Pani Energy Inc. to leverage AI for optimized water treatment plant operations.

- September 2022: Toray Industries Inc. opens a water research center in Chennai, boosting R&D in membrane technology.

In-Depth India Water Treatment Chemicals Industry Market Outlook

The outlook for the Indian Water Treatment Chemicals Market is overwhelmingly positive, projecting a trajectory of sustained and robust growth in the coming years. This optimism is firmly grounded in the ongoing advancements in water treatment technologies, the unwavering commitment to supportive government policies and initiatives aimed at improving water security and environmental protection, and the consistently rising demand across all major sectors. The strategic imperative for players will be to capitalize on these trends through increased investments in research and development (R&D) to foster cutting-edge solutions, the forging of strategic alliances to broaden market reach and technological capabilities, and the astute expansion into emerging market segments and niche applications. A defining characteristic of the future market will be the escalating emphasis on developing and deploying sustainable, eco-friendly, and circular economy-aligned water treatment solutions, which will undoubtedly create significant new avenues for innovation and leadership for forward-thinking companies.

India Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides and Disinfectants

- 1.2. Coagulants and Flocculants

- 1.3. Corrosion and Scale Inhibitors

- 1.4. Defoamers and Defoaming Agents

- 1.5. pH Adjuster and Softener

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Oil and Gas

- 2.3. Chemical Manufacturing (including Petrochemicals)

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Pulp and Paper

- 2.7. Other End-user Industries

India Water Treatment Chemicals Industry Segmentation By Geography

- 1. India

India Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of India Water Treatment Chemicals Industry

India Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Corrosion and Scale Inhibitors Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides and Disinfectants

- 5.1.2. Coagulants and Flocculants

- 5.1.3. Corrosion and Scale Inhibitors

- 5.1.4. Defoamers and Defoaming Agents

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufacturing (including Petrochemicals)

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Pulp and Paper

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chembond Chemicals Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemtex Speciality Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecolab (Nalco)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ION EXCHANGE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lonza

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nouryon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SicagenChem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SNF

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Solenis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Solvay

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Thermax Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VASU CHEMICALS LLP*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Chembond Chemicals Limited

List of Figures

- Figure 1: India Water Treatment Chemicals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: India Water Treatment Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Water Treatment Chemicals Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: India Water Treatment Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Water Treatment Chemicals Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Water Treatment Chemicals Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the India Water Treatment Chemicals Industry?

Key companies in the market include Chembond Chemicals Limited, Chemtex Speciality Limited, Dow, Ecolab (Nalco), ION EXCHANGE, Lonza, Nouryon, SicagenChem, SNF, Solenis, Solvay, Thermax Limited, VASU CHEMICALS LLP*List Not Exhaustive.

3. What are the main segments of the India Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 622.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Corrosion and Scale Inhibitors Segment.

7. Are there any restraints impacting market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

8. Can you provide examples of recent developments in the market?

February 2024: Thermax Group signs an agreement to acquire a 51% stake in TSA Process Equipments to offer a one-stop solution for high-purity water requirements of its customers in sectors such as pharma, biopharma, personal care, and food and beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the India Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence