Key Insights

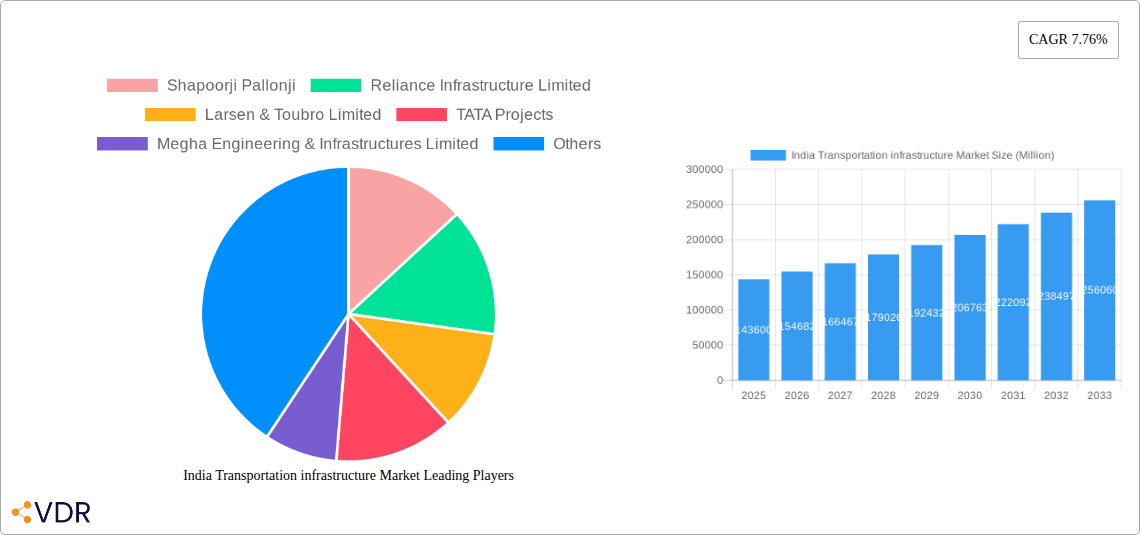

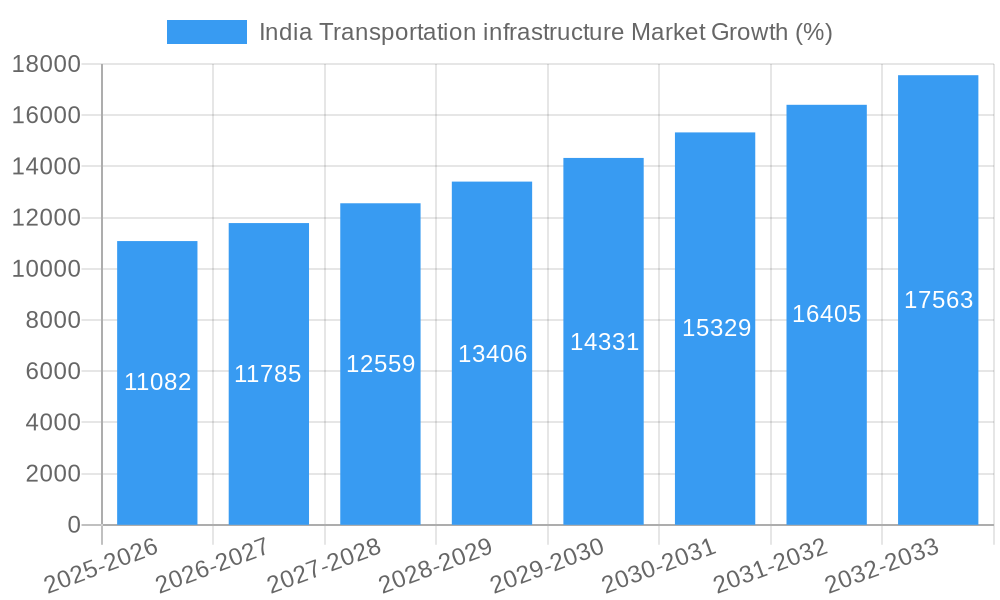

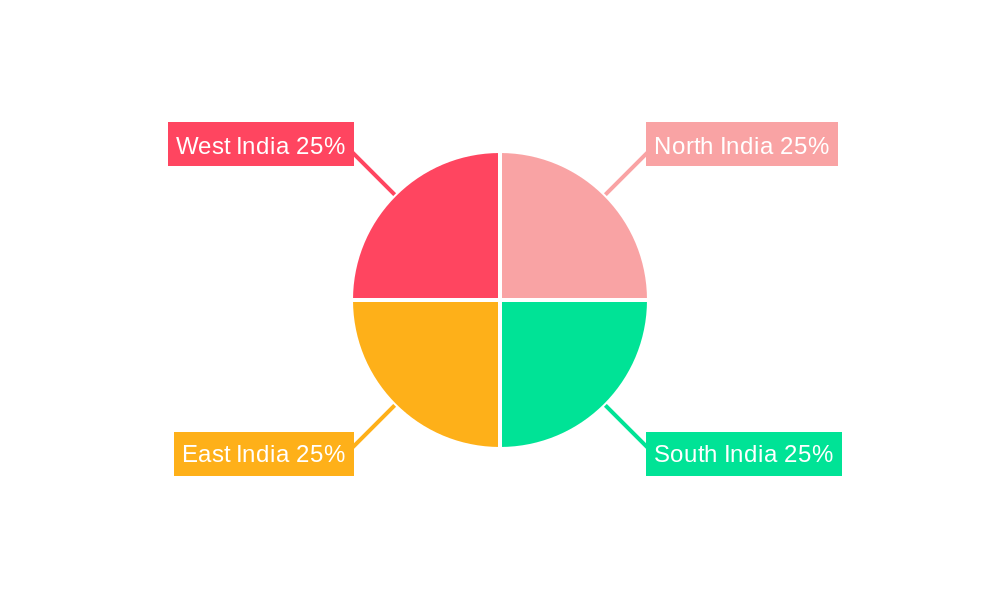

The Indian transportation infrastructure market is experiencing robust growth, projected to reach a substantial size, driven by increasing urbanization, rising disposable incomes, and the government's significant investments in infrastructure development projects. The market's Compound Annual Growth Rate (CAGR) of 7.76% from 2019 to 2024 indicates a strong upward trajectory. This growth is fueled by a surge in demand for efficient transportation networks across all segments – roadways, railways, airways, and ports & inland waterways – to support both urban and rural areas. The expansion of national highways, the modernization of railways, and the development of new airports and port facilities are key factors contributing to this positive trend. Leading players like Shapoorji Pallonji, Larsen & Toubro, and Reliance Infrastructure are capitalizing on these opportunities, showcasing the market's attractiveness for both domestic and international investors. However, challenges such as land acquisition issues, regulatory hurdles, and environmental concerns remain potential restraints to market expansion. Despite these challenges, the overall outlook for the Indian transportation infrastructure market remains optimistic, driven by continued government support and the increasing demand for efficient and reliable transportation systems to cater to a growing and increasingly mobile population. The market segmentation, with a focus on both urban and rural applications across different modes of transportation, provides diverse avenues for growth and investment across various geographical regions of India. By 2033, the market is expected to continue its robust expansion, reflecting the nation's commitment to modernization and infrastructure development. The regional breakdown (North, South, East, and West India) further underscores the market's potential for localized growth initiatives and targeted investments.

The consistent growth in the market over the past years indicates a strong future outlook. Government initiatives like the Bharatmala project significantly bolster the road infrastructure sector. The development of high-speed rail corridors and improved air connectivity further reinforces this growth narrative. While challenges related to environmental impact assessments and project execution timelines persist, the long-term benefits of a well-developed transportation infrastructure are undeniable for the Indian economy. The continued focus on private sector participation, alongside public investments, presents opportunities for innovation and technological advancements within the sector, driving efficiency and sustainability in the years to come. The market is expected to witness increased adoption of advanced technologies like smart traffic management systems and sustainable construction practices, creating new avenues for specialized companies and expertise.

India Transportation Infrastructure Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Transportation Infrastructure market, encompassing market dynamics, growth trends, regional dominance, product landscape, key challenges, emerging opportunities, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by application (Urban, Rural) and type (Roadways, Railways, Airways, Ports and Inland Waterways), offering granular insights for strategic decision-making. Market values are presented in million units.

India Transportation Infrastructure Market Dynamics & Structure

The Indian transportation infrastructure market is characterized by a dynamic interplay of factors influencing its growth and structure. Market concentration is moderately high, with a few large players like Larsen & Toubro Limited and Shapoorji Pallonji holding significant market share, though numerous smaller companies contribute significantly. Technological innovation, driven by the need for efficient and sustainable solutions, is a key driver. Government regulations, including infrastructure development initiatives and environmental standards, play a crucial role in shaping the market. Competitive product substitutes, such as improved public transport systems, impact market growth, along with evolving end-user demographics (increasing urbanization and rising middle class). Mergers and acquisitions (M&A) activity remains a feature, with larger companies seeking to expand their reach and expertise.

- Market Concentration: Moderately high, with top 10 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on smart infrastructure, automation, and sustainable materials.

- Regulatory Framework: Government policies promoting infrastructure development and PPP models.

- Competitive Substitutes: Increased adoption of public transport and alternative modes of transportation.

- M&A Trends: Consolidation expected, with xx M&A deals anticipated in the forecast period.

- Innovation Barriers: High initial investment costs, lack of skilled labor, and regulatory complexities.

India Transportation Infrastructure Market Growth Trends & Insights

The Indian transportation infrastructure market is experiencing robust growth, driven by increasing government investments, rapid urbanization, and economic expansion. The market size witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by the increasing adoption of advanced technologies like intelligent transportation systems and the development of new infrastructure projects. Consumer behavior is shifting towards a preference for efficient, sustainable, and technologically advanced transportation solutions. Technological disruptions are transforming the industry, with the adoption of automation, digitalization, and data analytics influencing operational efficiency and service delivery.

Dominant Regions, Countries, or Segments in India Transportation Infrastructure Market

The Roadways segment dominates the Indian transportation infrastructure market, accounting for approximately xx% of the total market share in 2024. This dominance is attributed to the extensive network of roads and highways across the country, catering to both urban and rural needs. Urban areas show higher growth potential due to increasing population density and demand for efficient transportation systems. Key drivers for the roadways sector include government initiatives such as the Bharatmala Pariyojana, aimed at improving national highway connectivity.

- Roadways: Largest segment by market share (xx%), driven by government investments and increasing urbanization.

- Urban Applications: Higher growth potential due to increased population density and infrastructure needs.

- Rural Applications: Growth driven by government initiatives to improve rural connectivity.

- Railways: Significant growth potential driven by ongoing modernization and expansion projects.

- Airways: Growth supported by increasing air travel demand, but limited by airport capacity constraints.

- Ports and Inland Waterways: Potential for significant expansion, focusing on improved efficiency and connectivity.

India Transportation Infrastructure Market Product Landscape

The market showcases a diverse range of products, including high-speed rail technologies, smart traffic management systems, improved road construction materials, and sustainable transportation solutions. These innovations focus on enhancing efficiency, safety, and sustainability across all transportation modes. Unique selling propositions include reduced operational costs, improved infrastructure durability, and integration of intelligent transportation systems. Technological advancements include the use of advanced materials, automation, and data analytics for optimized operations and improved service delivery.

Key Drivers, Barriers & Challenges in India Transportation Infrastructure Market

Key Drivers: Government initiatives like Bharatmala Pariyojana, increasing urbanization, rising disposable incomes, and technological advancements fuel market growth.

Challenges: Land acquisition issues, funding constraints, environmental regulations, and coordination complexities pose significant hurdles. Supply chain disruptions, particularly during the pandemic, impacted project timelines and costs. Regulatory hurdles, including obtaining necessary approvals and permits, can cause significant delays. Intense competition among players puts pressure on pricing and profitability.

Emerging Opportunities in India Transportation Infrastructure Market

Untapped markets in rural areas and the potential for public-private partnerships (PPPs) to finance large-scale projects offer promising opportunities. Innovative applications of technology, like AI-powered traffic management systems and autonomous vehicles, promise to revolutionize the transportation sector. Evolving consumer preferences for eco-friendly and smart transportation options create new market niches.

Growth Accelerators in the India Transportation Infrastructure Market Industry

Technological breakthroughs like advanced construction materials, automation, and intelligent transportation systems are crucial growth catalysts. Strategic partnerships between public and private sectors are facilitating project financing and implementation. Expansion into under-served rural areas, promoting sustainable transportation solutions, and integration of multimodal transportation systems will fuel long-term growth.

Key Players Shaping the India Transportation Infrastructure Market Market

- Shapoorji Pallonji

- Reliance Infrastructure Limited

- Larsen & Toubro Limited

- TATA Projects

- Megha Engineering & Infrastructures Limited

- Dilip Buildcon Limited

- KEC International Limited

- Eagle Infra India Ltd

- Hindustan Construction Company Limited

- IRB Infrastructure Developers Ltd

- 63 Other Companies

Notable Milestones in India Transportation Infrastructure Market Sector

- February 2024: Larsen & Toubro wins contracts for a 75 MW floating solar power plant and a 12-21 km bridge in Assam, highlighting its expansion in renewable energy and large-scale infrastructure projects. This demonstrates the increasing integration of renewable energy into transportation infrastructure and the focus on large-scale projects.

In-Depth India Transportation infrastructure Market Market Outlook

The future of the Indian transportation infrastructure market is bright, fueled by sustained government investment, technological innovation, and a growing demand for efficient and sustainable transport solutions. Strategic opportunities lie in expanding into underserved regions, adopting advanced technologies, and fostering public-private partnerships. The market's potential for growth is significant, with continued expansion expected across all segments.

India Transportation infrastructure Market Segmentation

-

1. Application

- 1.1. Urban

- 1.2. Rural

-

2. Type

- 2.1. Roadways

- 2.2. Railways

- 2.3. Airways

- 2.4. Ports and Inland Waterways

India Transportation infrastructure Market Segmentation By Geography

- 1. India

India Transportation infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Government Initiatives and Policies

- 3.2.2 such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1 Construction of Roads

- 3.4.2 Bridges

- 3.4.3 and Highways Under Government Initiatives to Promote Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Urban

- 5.1.2. Rural

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Roadways

- 5.2.2. Railways

- 5.2.3. Airways

- 5.2.4. Ports and Inland Waterways

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Transportation infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shapoorji Pallonji

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Reliance Infrastructure Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Larsen & Toubro Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TATA Projects

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Megha Engineering & Infrastructures Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Dilip Buildcon Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 KEC International Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eagle Infra India Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hindustan Construction Company Limited**List Not Exhaustive 6 3 Other Companie

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 IRB Infrastructure Developers Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Shapoorji Pallonji

List of Figures

- Figure 1: India Transportation infrastructure Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Transportation infrastructure Market Share (%) by Company 2024

List of Tables

- Table 1: India Transportation infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Transportation infrastructure Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: India Transportation infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Transportation infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Transportation infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Transportation infrastructure Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Transportation infrastructure Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: India Transportation infrastructure Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Transportation infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Transportation infrastructure Market?

The projected CAGR is approximately 7.76%.

2. Which companies are prominent players in the India Transportation infrastructure Market?

Key companies in the market include Shapoorji Pallonji, Reliance Infrastructure Limited, Larsen & Toubro Limited, TATA Projects, Megha Engineering & Infrastructures Limited, Dilip Buildcon Limited, KEC International Limited, Eagle Infra India Ltd, Hindustan Construction Company Limited**List Not Exhaustive 6 3 Other Companie, IRB Infrastructure Developers Ltd.

3. What are the main segments of the India Transportation infrastructure Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 143.60 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives and Policies. such as "Make in India" and "BharatMala"4.; Indian Cities Planning and Implementing Metro Rail Systems to Address Urban Congestion and Improve Public Transportation.

6. What are the notable trends driving market growth?

Construction of Roads. Bridges. and Highways Under Government Initiatives to Promote Market Growth.

7. Are there any restraints impacting market growth?

4.; Bureaucratic Delays in Project Approvals4.; Shortage of Skilled Labors Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: The Power Transmission & Distribution division of Larsen and Toubro won several contracts in India and the Middle East. The company acquired a contract to construct a 75 MW floating solar power plant at the Panchet Dam. This plant is part of the Ultra Mega Renewable Power Park, which is being built on the Damodar Valley Corporation reservoirs in the states of Jharkhand and West Bengal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Transportation infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Transportation infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Transportation infrastructure Market?

To stay informed about further developments, trends, and reports in the India Transportation infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence