Key Insights

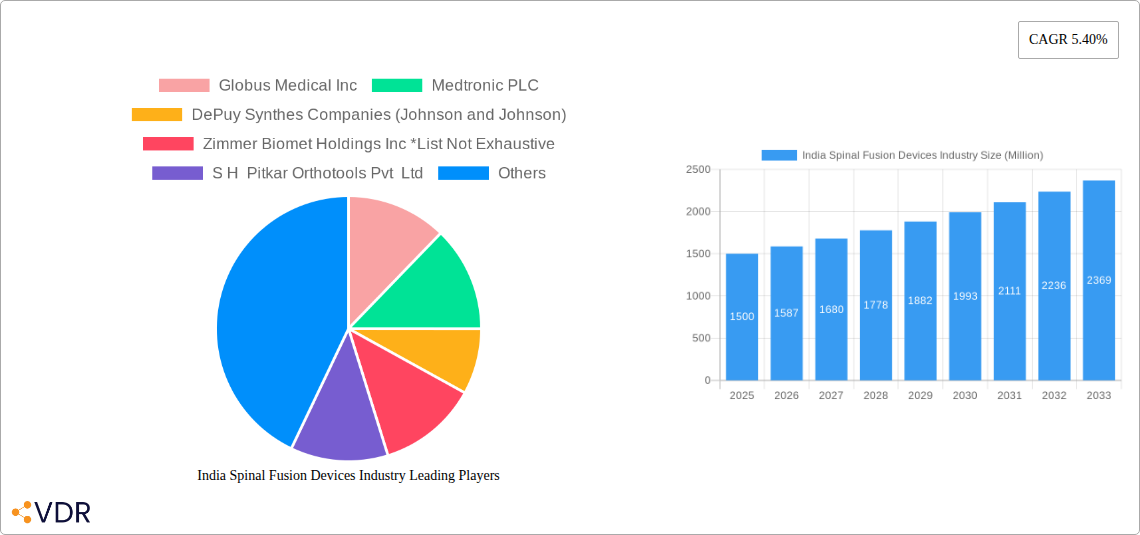

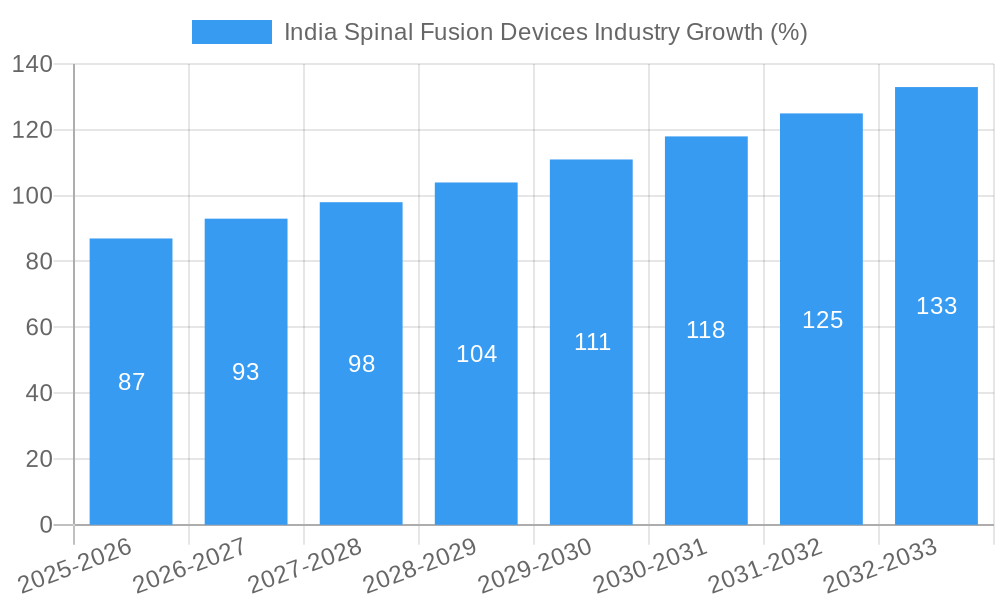

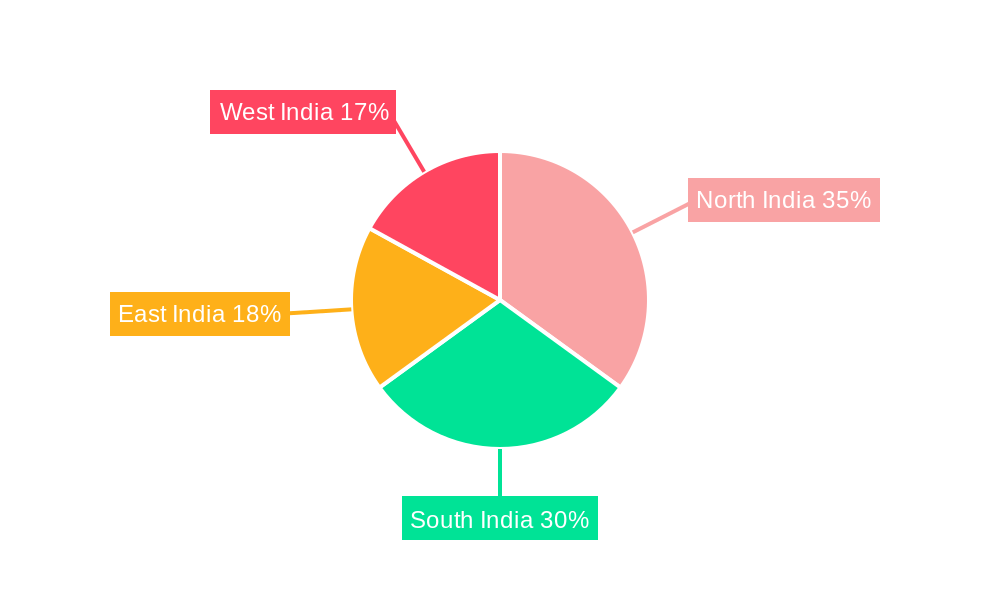

The India spinal fusion devices market, valued at approximately ₹XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.40% from 2025 to 2033. This expansion is driven by several key factors. The rising prevalence of degenerative spine diseases, such as osteoarthritis and spinal stenosis, coupled with an aging population, significantly fuels the demand for spinal fusion procedures. Furthermore, increasing awareness about minimally invasive spine surgery (MISS) techniques, offering faster recovery times and reduced hospital stays, contributes to market growth. Technological advancements in implant design, leading to improved biocompatibility and efficacy, also play a crucial role. The market is segmented by device type (cervical, thoracic, lumbar fusion devices) and surgical approach (open and minimally invasive). While the lumbar fusion segment currently dominates due to higher incidence of lumbar-related spinal disorders, the minimally invasive surgery segment is expected to witness faster growth owing to its advantages. Competition in the market is intense, with major players like Globus Medical Inc., Medtronic PLC, DePuy Synthes (Johnson & Johnson), Zimmer Biomet, and several domestic companies vying for market share. Regional variations exist, with North and South India likely representing larger portions of the market due to higher population density and better healthcare infrastructure. However, improved access to healthcare in other regions is expected to drive growth across all areas of India in the coming years.

Challenges remain, including high procedure costs that limit access for a significant portion of the population, and the need for skilled surgeons trained in advanced surgical techniques. Despite these challenges, the long-term outlook for the India spinal fusion devices market remains positive, supported by continued growth in the geriatric population, rising healthcare expenditure, and government initiatives promoting healthcare access and quality. The market will likely see further consolidation, with strategic partnerships and acquisitions among existing players being a prevalent trend. Growth will be significantly influenced by the success of initiatives to raise awareness of MISS and the affordability of these advanced procedures.

India Spinal Fusion Devices Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the India spinal fusion devices market, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report uses data from the historical period (2019-2024), base year (2025), and projects the market’s trajectory through the forecast period (2025-2033). The total market size is estimated in Million units.

India Spinal Fusion Devices Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Indian spinal fusion devices market. The market is characterized by a moderate level of concentration, with key players holding significant market share. However, the presence of several domestic players creates a dynamic competitive environment.

- Market Concentration: xx% market share held by top 5 players (2025). This indicates a moderately consolidated market with opportunities for both established players and new entrants.

- Technological Innovation: The market is driven by innovations in minimally invasive surgical techniques, biocompatible materials, and advanced implants. However, high R&D costs and regulatory hurdles present significant barriers to innovation.

- Regulatory Framework: The regulatory landscape is evolving, with a focus on enhancing product safety and efficacy. This necessitates stringent compliance requirements for manufacturers.

- Competitive Substitutes: Conservative treatment options and alternative surgical procedures pose competitive pressure on the spinal fusion devices market.

- End-User Demographics: The aging population and increasing prevalence of spinal disorders are key drivers of market growth. This is further amplified by rising disposable incomes and improved healthcare access in urban areas.

- M&A Trends: The past five years have witnessed xx M&A deals in the Indian medical devices sector, indicating a growing interest in consolidation and expansion within the market. This trend is expected to continue, driven by the need to expand product portfolios and access new technologies.

India Spinal Fusion Devices Industry Growth Trends & Insights

The Indian spinal fusion devices market is experiencing significant growth, driven by factors such as rising prevalence of spinal disorders, increasing awareness about minimally invasive surgical techniques, and improving healthcare infrastructure. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033).

[Insert 600-word analysis here leveraging XXX data source – this should include detailed information on market size evolution across different segments, adoption rates of minimally invasive techniques, and changes in consumer behavior. Provide specific data points like CAGR, market penetration rates, and projections for different segments.]

Dominant Regions, Countries, or Segments in India Spinal Fusion Devices Industry

The Lumbar Fusion Device segment currently dominates the market, accounting for xx% of the total market share in 2025. This is followed by Cervical Fusion Device and Thoracic Fusion Device segments. Minimally Invasive Spine Surgery is witnessing faster growth compared to Open Spine Surgery. Urban areas show higher market penetration than rural areas.

- Key Drivers for Lumbar Fusion Device Segment Dominance:

- Higher prevalence of lumbar degenerative diseases.

- Growing adoption of minimally invasive techniques for lumbar fusion.

- Increased awareness among patients and healthcare professionals.

- Geographic Dominance: Major metropolitan cities like Mumbai, Delhi, Bengaluru, and Chennai demonstrate higher market concentration due to better healthcare infrastructure and higher prevalence of spinal disorders.

[Insert 600-word analysis here, including detailed market share data and growth projections for each segment and region. Explain factors behind dominance, such as higher prevalence rates, better healthcare infrastructure, economic factors, and government initiatives.]

India Spinal Fusion Devices Industry Product Landscape

The Indian spinal fusion devices market offers a wide range of products catering to diverse surgical needs. Innovations focus on improved biocompatibility, enhanced stability, and minimally invasive designs. Companies are increasingly focusing on developing products with superior osseointegration properties and reduced complication rates. The trend towards personalized medicine is also driving the development of customized implants and surgical techniques.

Key Drivers, Barriers & Challenges in India Spinal Fusion Devices Industry

Key Drivers:

- Rising prevalence of spinal disorders (e.g., degenerative disc disease, scoliosis, spondylolisthesis).

- Increasing adoption of minimally invasive spine surgery (MISS).

- Growing awareness among patients and healthcare professionals.

- Government initiatives promoting healthcare infrastructure development.

Challenges and Restraints:

- High cost of advanced spinal fusion devices limiting accessibility.

- Stringent regulatory requirements and approval processes.

- Limited reimbursement coverage by insurance providers.

- Competition from traditional surgical methods and conservative treatment options.

Emerging Opportunities in India Spinal Fusion Devices Industry

- Untapped Rural Markets: Expanding market penetration in rural areas through public-private partnerships and affordable solutions.

- Technological Advancements: Developing innovative products utilizing AI, 3D printing, and smart implants.

- Focus on Patient-Specific Solutions: Tailoring implants to meet individual patient needs.

- Growth in Private Healthcare: Expanding partnerships with private hospitals to increase market reach.

Growth Accelerators in the India Spinal Fusion Devices Industry

Technological breakthroughs in biomaterials, minimally invasive surgical techniques, and implant design are significant growth drivers. Strategic collaborations between domestic and multinational companies are facilitating technology transfer and market expansion. Government policies promoting medical device manufacturing and healthcare infrastructure development further accelerate market growth.

Key Players Shaping the India Spinal Fusion Devices Market

- Globus Medical Inc

- Medtronic PLC

- DePuy Synthes Companies (Johnson and Johnson)

- Zimmer Biomet Holdings Inc

- S H Pitkar Orthotools Pvt Ltd

- Matrix Meditec Pvt Ltd

Notable Milestones in India Spinal Fusion Devices Industry Sector

- 2020: Launch of a new minimally invasive spinal fusion system by a leading multinational company.

- 2022: Acquisition of a domestic spinal implant manufacturer by a global player.

- 2023: Approval of a novel biomaterial for spinal fusion applications by the regulatory authority.

[Include further significant milestones with dates and brief descriptions of their impact.]

In-Depth India Spinal Fusion Devices Industry Market Outlook

The Indian spinal fusion devices market exhibits significant long-term growth potential, driven by favorable demographic trends, technological advancements, and rising healthcare expenditure. Strategic partnerships, focus on innovation, and expansion into underserved markets will be crucial for players to capitalize on future opportunities. The market is poised for robust growth, with opportunities for both established players and new entrants. Continued focus on minimally invasive techniques and customized solutions will shape the market in the coming years.

India Spinal Fusion Devices Industry Segmentation

-

1. Type

- 1.1. Cervical Fusion Device

- 1.2. Thoracic Fusion Device

- 1.3. Lumbar Fusion Device

-

2. Surgery

- 2.1. Open Spine Surgery

- 2.2. Minimally Invasive Spine Surgery

India Spinal Fusion Devices Industry Segmentation By Geography

- 1. India

India Spinal Fusion Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Aging Population in India; Rising Incidences and Prevalence of Spinal Problems; Rising Medical Tourism

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Issues; Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. Minimally Invasive Spine Surgery is Expected to Register a Healthy Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cervical Fusion Device

- 5.1.2. Thoracic Fusion Device

- 5.1.3. Lumbar Fusion Device

- 5.2. Market Analysis, Insights and Forecast - by Surgery

- 5.2.1. Open Spine Surgery

- 5.2.2. Minimally Invasive Spine Surgery

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Spinal Fusion Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Globus Medical Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Medtronic PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DePuy Synthes Companies (Johnson and Johnson)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Zimmer Biomet Holdings Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 S H Pitkar Orthotools Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Matrix Meditec Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Globus Medical Inc

List of Figures

- Figure 1: India Spinal Fusion Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Spinal Fusion Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: India Spinal Fusion Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Spinal Fusion Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Spinal Fusion Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Spinal Fusion Devices Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 5: India Spinal Fusion Devices Industry Revenue Million Forecast, by Surgery 2019 & 2032

- Table 6: India Spinal Fusion Devices Industry Volume K Units Forecast, by Surgery 2019 & 2032

- Table 7: India Spinal Fusion Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Spinal Fusion Devices Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 9: India Spinal Fusion Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Spinal Fusion Devices Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 11: North India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: South India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: East India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: West India India Spinal Fusion Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Spinal Fusion Devices Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: India Spinal Fusion Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: India Spinal Fusion Devices Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 21: India Spinal Fusion Devices Industry Revenue Million Forecast, by Surgery 2019 & 2032

- Table 22: India Spinal Fusion Devices Industry Volume K Units Forecast, by Surgery 2019 & 2032

- Table 23: India Spinal Fusion Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Spinal Fusion Devices Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Spinal Fusion Devices Industry?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the India Spinal Fusion Devices Industry?

Key companies in the market include Globus Medical Inc, Medtronic PLC, DePuy Synthes Companies (Johnson and Johnson), Zimmer Biomet Holdings Inc *List Not Exhaustive, S H Pitkar Orthotools Pvt Ltd, Matrix Meditec Pvt Ltd.

3. What are the main segments of the India Spinal Fusion Devices Industry?

The market segments include Type, Surgery.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Aging Population in India; Rising Incidences and Prevalence of Spinal Problems; Rising Medical Tourism.

6. What are the notable trends driving market growth?

Minimally Invasive Spine Surgery is Expected to Register a Healthy Growth Rate.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Issues; Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Spinal Fusion Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Spinal Fusion Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Spinal Fusion Devices Industry?

To stay informed about further developments, trends, and reports in the India Spinal Fusion Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence