Key Insights

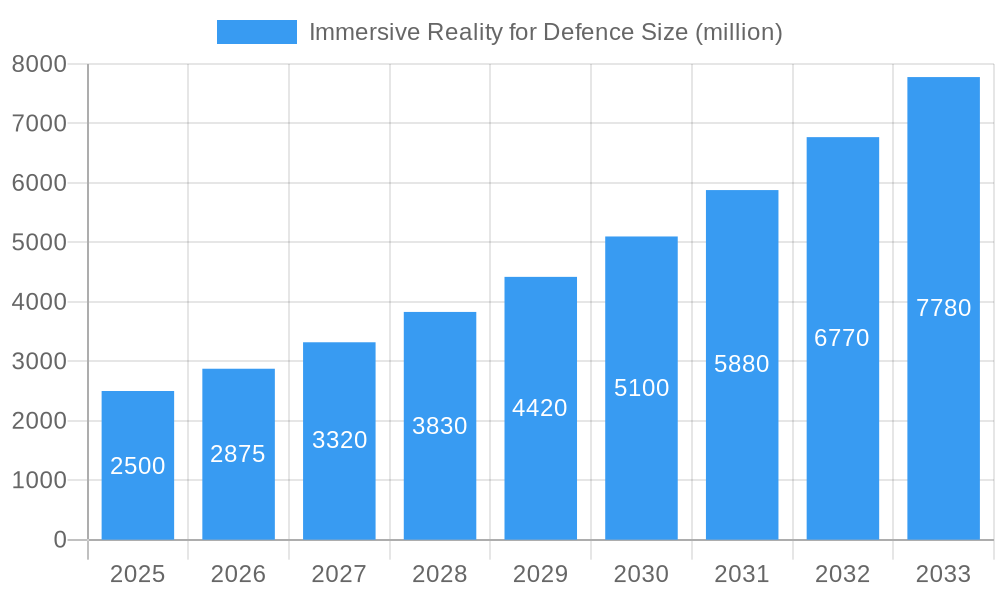

The Immersive Reality (IR) market for defense is poised for significant expansion, driven by the escalating demand for advanced training simulations, mission rehearsal, and superior situational awareness. The market, valued at $2.71 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.1%, reaching an estimated $8 billion by 2033. This growth trajectory is underpinned by several critical factors: the increasing integration of Virtual Reality (VR) and Augmented Reality (AR) for realistic soldier training, the pursuit of more efficient and cost-effective training methodologies, and the imperative for enhanced interoperability across defense systems. The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) into IR platforms is further augmenting simulation realism and efficacy, accelerating adoption within the defense sector. Leading industry players are making substantial R&D investments in sophisticated IR solutions for specialized defense applications.

Immersive Reality for Defence Market Size (In Billion)

Despite the promising outlook, certain challenges persist. High upfront investment costs for IR technology implementation and the requirement for specialized technical expertise may impede broader adoption, particularly for smaller defense entities. Ensuring robust data security and privacy for sensitive military operations is paramount and critical for sustained market growth. The establishment of standardized interfaces and protocols is also essential to foster seamless interoperability between diverse IR systems from multiple vendors. Nevertheless, the long-term prospects for IR in defense remain exceptionally strong, propelled by ongoing technological innovation and a growing recognition of its strategic importance in augmenting training, operational efficiency, and overall military preparedness.

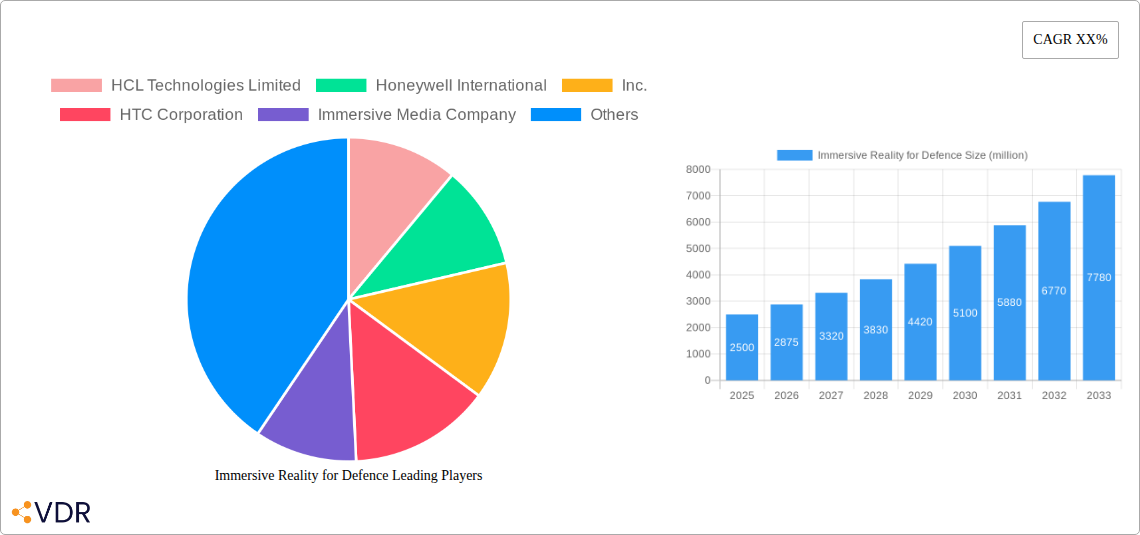

Immersive Reality for Defence Company Market Share

Immersive Reality for Defence Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Immersive Reality (IR) for Defence market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The total market size in 2025 is estimated at $XX billion.

Immersive Reality for Defence Market Dynamics & Structure

The Immersive Reality for Defence market is characterized by moderate concentration, with a few major players holding significant market share, but a large number of niche players also contributing significantly. Technological innovation, driven by advancements in VR/AR hardware, software, and AI integration, is a key driver. Stringent regulatory frameworks concerning data security and system reliability influence market growth. The market faces competition from traditional simulation and training methods, though IR solutions offer superior engagement and realism. The end-user demographics primarily consist of military personnel, defence contractors, and government agencies. M&A activity within the sector is moderate, with approximately xx deals recorded in the historical period (2019-2024), primarily focused on technology acquisition and market expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: Advancements in VR/AR headsets, haptic feedback systems, and AI-powered training scenarios.

- Regulatory Frameworks: Stringent cybersecurity standards and compliance requirements for sensitive data.

- Competitive Substitutes: Traditional simulation technologies and physical training exercises.

- End-User Demographics: Primarily military personnel, defence contractors, and government agencies.

- M&A Trends: xx deals recorded between 2019-2024, focusing on technology acquisition and market expansion.

Immersive Reality for Defence Growth Trends & Insights

The global Immersive Reality for Defence market experienced substantial growth during the historical period (2019-2024), driven by increasing defence budgets, the need for enhanced training capabilities, and the rising adoption of advanced simulation technologies. The market is expected to maintain a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of $XX billion by 2033. This growth is fueled by technological advancements such as high-fidelity graphics, improved haptic feedback, and the integration of AI for more realistic and adaptable training scenarios. The increasing adoption of cloud-based solutions is further enhancing accessibility and scalability. Market penetration in the defence sector is currently at xx%, projected to reach xx% by 2033.

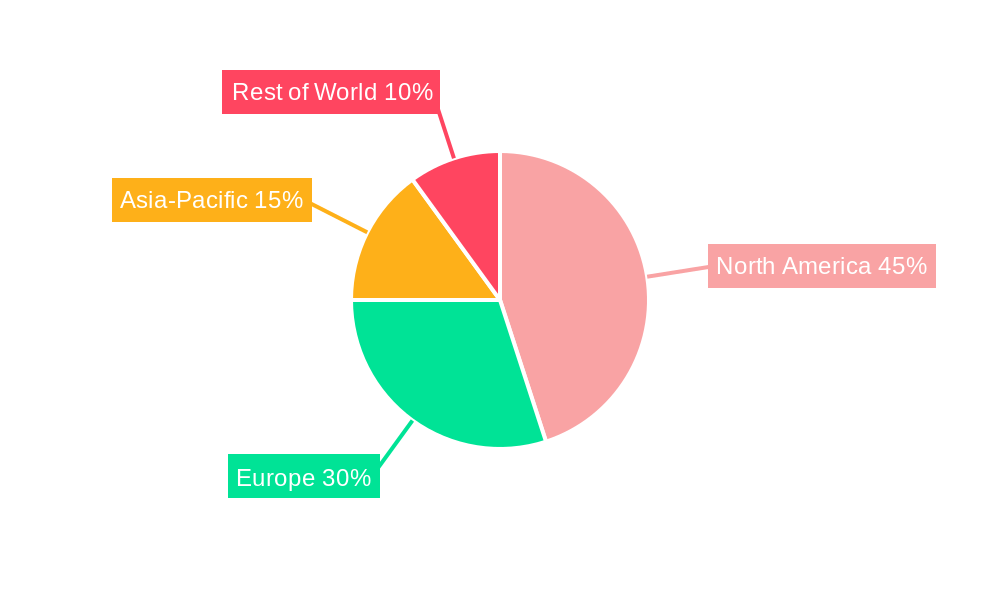

Dominant Regions, Countries, or Segments in Immersive Reality for Defence

North America currently dominates the Immersive Reality for Defence market, holding the largest market share in 2025 due to high defence spending, technological advancements, and the presence of major players. Europe follows closely, driven by increasing investments in defence modernization and a focus on enhancing military training effectiveness. The Asia-Pacific region is expected to witness significant growth during the forecast period, fueled by rising defence budgets and the adoption of advanced technologies.

- North America: High defence spending, strong technological base, presence of major players.

- Europe: Investments in defence modernization, focus on improving training effectiveness.

- Asia-Pacific: Rising defence budgets, adoption of advanced technologies, increasing military expenditure.

Immersive Reality for Defence Product Landscape

The Immersive Reality for Defence market encompasses a wide range of products, including VR headsets, AR glasses, haptic suits, and simulation software. Key product innovations focus on improving visual fidelity, enhancing haptic feedback, and integrating AI for more realistic training scenarios. Unique selling propositions include improved situational awareness, enhanced training efficiency, and reduced training costs. Technological advancements are primarily driven by improvements in computing power, display technology, and sensor integration.

Key Drivers, Barriers & Challenges in Immersive Reality for Defence

Key Drivers: Increased defence budgets globally, demand for enhanced training effectiveness, technological advancements in VR/AR and AI, need for realistic combat simulations.

Key Challenges: High initial investment costs, concerns about cybersecurity and data security, integration with existing legacy systems, the need for specialized expertise to develop and operate IR solutions, supply chain disruptions potentially impacting the availability of critical components. These challenges could negatively impact the market growth by approximately xx% by 2033 if not adequately addressed.

Emerging Opportunities in Immersive Reality for Defence

Untapped market segments include the use of IR for maintenance and repair training, the development of more sophisticated AI-driven training scenarios, and exploration of applications in intelligence gathering and mission planning. Opportunities also exist in the development of affordable, portable, and user-friendly IR systems for smaller defence organizations. The market has the potential to expand greatly through the adoption of mixed reality (MR) technology.

Growth Accelerators in the Immersive Reality for Defence Industry

Strategic partnerships between technology providers and defence contractors will expedite the adoption of IR solutions. Technological breakthroughs in areas such as haptic feedback, eye tracking, and AI will improve training realism and effectiveness. Expanding the application of IR beyond military training to areas like maintenance, logistics, and mission planning will unlock new growth opportunities.

Key Players Shaping the Immersive Reality for Defence Market

- HCL Technologies Limited

- Honeywell International, Inc.

- HTC Corporation

- Immersive Media Company

- CM Labs Simulations Inc.

- EON Reality, Inc.

- FAAC Incorporated

- Google, LLC

- NCTech Limited

- Oculus

- Samsung Group

- Sony Corporation

- SimX

- Thales Group

- VRgineers, Inc.

- Varjo

- Acer Inc.

- Atheer, Inc.

- Carl Zeiss AG

- Magic Leap, Inc.

- HTX Labs

- Indra Sistemas, SA.

- Lockheed Martin

- Red Six Aerospace, Inc.

Notable Milestones in Immersive Reality for Defence Sector

- 2020: Lockheed Martin launches a new VR training system for F-35 pilots.

- 2021: Thales Group partners with a VR technology provider to develop a new immersive training platform for soldiers.

- 2022: Several mergers and acquisitions occur within the sector, consolidating market share.

- 2023: Google introduces new AI-powered training simulations for defence applications.

- 2024: The use of AR glasses for field maintenance and repair gains traction.

In-Depth Immersive Reality for Defence Market Outlook

The Immersive Reality for Defence market is poised for continued growth, driven by technological advancements, increased defence spending, and the growing adoption of IR solutions across various defence applications. Strategic partnerships, new product innovations, and expansion into untapped markets will further accelerate market growth. The potential for integrating AI and machine learning into immersive training scenarios presents significant opportunities for improvement in realism and effectiveness of training programs, further driving the market.

Immersive Reality for Defence Segmentation

-

1. Application

- 1.1. 3D Modeling

- 1.2. Simulation and Training

- 1.3. Maintenance and Monitoring

- 1.4. Situational Awareness

-

2. Types

- 2.1. Augmented Reality

- 2.2. Virtual Reality

- 2.3. Mixed Reality

Immersive Reality for Defence Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Immersive Reality for Defence Regional Market Share

Geographic Coverage of Immersive Reality for Defence

Immersive Reality for Defence REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Immersive Reality for Defence Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. 3D Modeling

- 5.1.2. Simulation and Training

- 5.1.3. Maintenance and Monitoring

- 5.1.4. Situational Awareness

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Augmented Reality

- 5.2.2. Virtual Reality

- 5.2.3. Mixed Reality

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Immersive Reality for Defence Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. 3D Modeling

- 6.1.2. Simulation and Training

- 6.1.3. Maintenance and Monitoring

- 6.1.4. Situational Awareness

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Augmented Reality

- 6.2.2. Virtual Reality

- 6.2.3. Mixed Reality

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Immersive Reality for Defence Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. 3D Modeling

- 7.1.2. Simulation and Training

- 7.1.3. Maintenance and Monitoring

- 7.1.4. Situational Awareness

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Augmented Reality

- 7.2.2. Virtual Reality

- 7.2.3. Mixed Reality

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Immersive Reality for Defence Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. 3D Modeling

- 8.1.2. Simulation and Training

- 8.1.3. Maintenance and Monitoring

- 8.1.4. Situational Awareness

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Augmented Reality

- 8.2.2. Virtual Reality

- 8.2.3. Mixed Reality

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Immersive Reality for Defence Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. 3D Modeling

- 9.1.2. Simulation and Training

- 9.1.3. Maintenance and Monitoring

- 9.1.4. Situational Awareness

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Augmented Reality

- 9.2.2. Virtual Reality

- 9.2.3. Mixed Reality

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Immersive Reality for Defence Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. 3D Modeling

- 10.1.2. Simulation and Training

- 10.1.3. Maintenance and Monitoring

- 10.1.4. Situational Awareness

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Augmented Reality

- 10.2.2. Virtual Reality

- 10.2.3. Mixed Reality

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 HCL Technologies Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HTC Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Immersive Media Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CM Labs Simulations Inc.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EON Reality

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FAAC Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Google

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 NCTech Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Oculus

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Samsung Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sony Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SimX

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Thales Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 VRgineers

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Inc.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Varjo

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Acer Inc.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Atheer

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Inc.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Carl Zeiss AG

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Magic Leap

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Inc.

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 HTX Labs

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Indra Sistemas

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 SA.

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Lockheed Martin

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Red Six Aerospace

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Inc.

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.1 HCL Technologies Limited

List of Figures

- Figure 1: Global Immersive Reality for Defence Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Immersive Reality for Defence Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Immersive Reality for Defence Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Immersive Reality for Defence Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Immersive Reality for Defence Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Immersive Reality for Defence Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Immersive Reality for Defence Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Immersive Reality for Defence Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Immersive Reality for Defence Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Immersive Reality for Defence Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Immersive Reality for Defence Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Immersive Reality for Defence Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Immersive Reality for Defence Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Immersive Reality for Defence Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Immersive Reality for Defence Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Immersive Reality for Defence Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Immersive Reality for Defence Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Immersive Reality for Defence Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Immersive Reality for Defence Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Immersive Reality for Defence Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Immersive Reality for Defence Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Immersive Reality for Defence Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Immersive Reality for Defence Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Immersive Reality for Defence Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Immersive Reality for Defence Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Immersive Reality for Defence Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Immersive Reality for Defence Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Immersive Reality for Defence Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Immersive Reality for Defence Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Immersive Reality for Defence Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Immersive Reality for Defence Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Immersive Reality for Defence Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Immersive Reality for Defence Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Immersive Reality for Defence Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Immersive Reality for Defence Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Immersive Reality for Defence Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Immersive Reality for Defence Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Immersive Reality for Defence Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Immersive Reality for Defence Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Immersive Reality for Defence Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Immersive Reality for Defence Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Immersive Reality for Defence Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Immersive Reality for Defence Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Immersive Reality for Defence Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Immersive Reality for Defence Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Immersive Reality for Defence Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Immersive Reality for Defence Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Immersive Reality for Defence Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Immersive Reality for Defence Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Immersive Reality for Defence Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Immersive Reality for Defence?

The projected CAGR is approximately 16.1%.

2. Which companies are prominent players in the Immersive Reality for Defence?

Key companies in the market include HCL Technologies Limited, Honeywell International, Inc., HTC Corporation, Immersive Media Company, CM Labs Simulations Inc., EON Reality, Inc., FAAC Incorporated, Google, LLC, NCTech Limited, Oculus, Samsung Group, Sony Corporation, SimX, Thales Group, VRgineers, Inc., Varjo, Acer Inc., Atheer, Inc., Carl Zeiss AG, Magic Leap, Inc., HTX Labs, Indra Sistemas, SA., Lockheed Martin, Red Six Aerospace, Inc..

3. What are the main segments of the Immersive Reality for Defence?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.71 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Immersive Reality for Defence," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Immersive Reality for Defence report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Immersive Reality for Defence?

To stay informed about further developments, trends, and reports in the Immersive Reality for Defence, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence