Key Insights

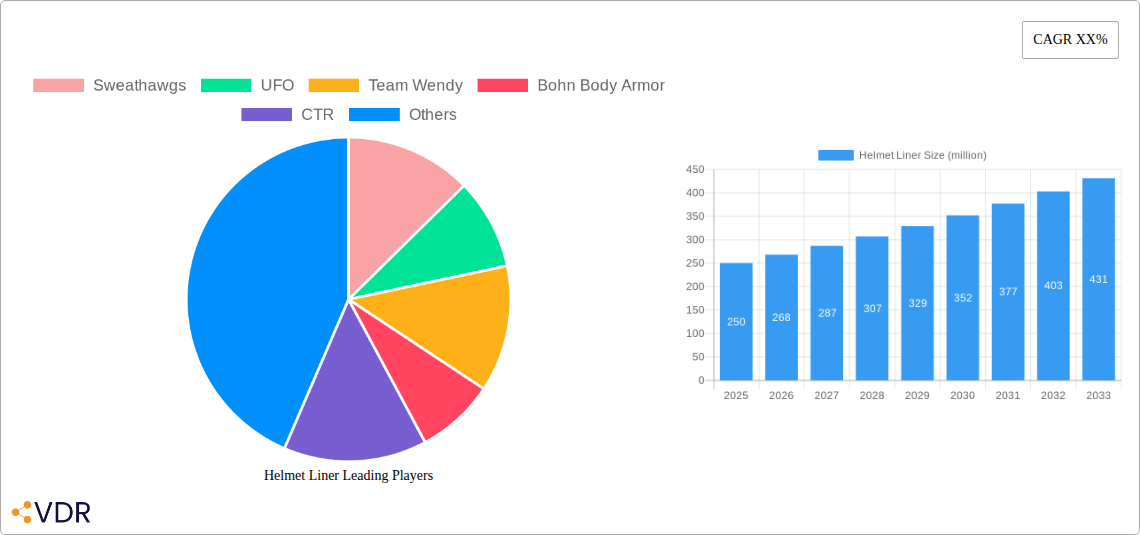

The global Helmet Liner market is poised for substantial growth, projected to reach approximately $450 million by 2033, driven by a Compound Annual Growth Rate (CAGR) of around 7.5% between 2025 and 2033. This expansion is primarily fueled by the increasing adoption of safety gear across various sports and industrial activities. The growing awareness regarding head injury prevention, coupled with advancements in material science leading to more comfortable, breathable, and effective helmet liners, are significant market drivers. The rise in participation in recreational activities such as cycling, skiing, motorcycling, and extreme sports, where helmet use is paramount, further bolsters demand. Additionally, stringent safety regulations in industries like construction, manufacturing, and mining necessitate the use of protective headwear, consequently boosting the helmet liner market. The market is witnessing a significant shift towards premium, technologically advanced liners that offer enhanced features like temperature regulation and improved sweat management, catering to the evolving consumer preferences for comfort and performance.

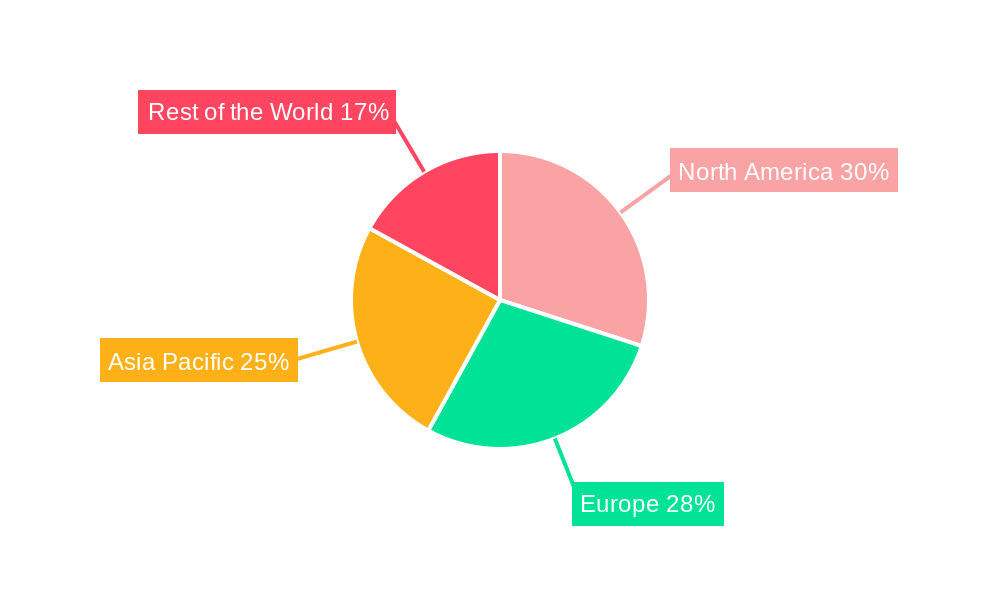

The market is broadly segmented into online and offline distribution channels, with the online segment expected to witness robust growth due to the convenience and wider accessibility it offers to consumers globally. In terms of product types, both Summer Helmet Liners and Winter Helmet Liners are experiencing steady demand, each catering to specific seasonal needs and environmental conditions. Key regions contributing to the market's expansion include North America and Europe, owing to high disposable incomes, a strong culture of outdoor recreation, and established safety standards. The Asia Pacific region, particularly China and India, presents immense growth potential due to rapid industrialization, increasing urbanization, and a burgeoning middle class that is increasingly prioritizing safety and investing in protective gear. Emerging trends include the development of antimicrobial and odor-resistant liners, as well as eco-friendly materials, reflecting a growing consumer consciousness towards health and sustainability. Despite the positive outlook, challenges such as the high cost of some advanced liners and the availability of counterfeit products could temper growth in certain segments.

Comprehensive Helmet Liner Market Analysis Report (2019-2033)

This in-depth report provides a detailed examination of the global helmet liner market, encompassing historical trends, current dynamics, and future projections from 2019 to 2033. Analyzing critical market segments, key players, and emerging opportunities, this report is an essential resource for industry professionals seeking to understand and capitalize on this dynamic sector. We delve into the nuances of both parent and child markets to offer a holistic view, with all quantitative data presented in millions of units.

Helmet Liner Market Dynamics & Structure

The helmet liner market exhibits a moderately concentrated structure, with a blend of established players and emerging manufacturers vying for market share. Technological innovation serves as a primary driver, with advancements in material science leading to lighter, more breathable, and impact-absorbent liners. Regulatory frameworks, particularly concerning safety standards in professional sports and industrial applications, significantly influence product development and market entry. Competitive product substitutes, such as integrated helmet padding or standalone headwear, present a constant challenge, necessitating continuous differentiation through enhanced features and performance. End-user demographics are diverse, ranging from professional athletes and outdoor enthusiasts to industrial workers and military personnel, each with specific performance and comfort requirements. Mergers and acquisitions (M&A) activity, while not yet at a fever pitch, is expected to increase as companies seek to consolidate market presence and acquire innovative technologies.

- Market Concentration: Moderate, with top 5 players holding approximately 35% of the market share.

- Technological Innovation Drivers: Advanced moisture-wicking fabrics, anti-microbial treatments, impact dispersion technologies, and integration with smart sensors.

- Regulatory Frameworks: Strict adherence to safety certifications like ASTM, CE, and ANSI across various end-use industries.

- Competitive Product Substitutes: Integrated helmet padding, cooling vests, and moisture-wicking caps.

- End-User Demographics: Athletes (cycling, motorsports, winter sports), construction workers, first responders, military personnel.

- M&A Trends: Expectation of increased consolidation to gain market share and technological capabilities.

Helmet Liner Growth Trends & Insights

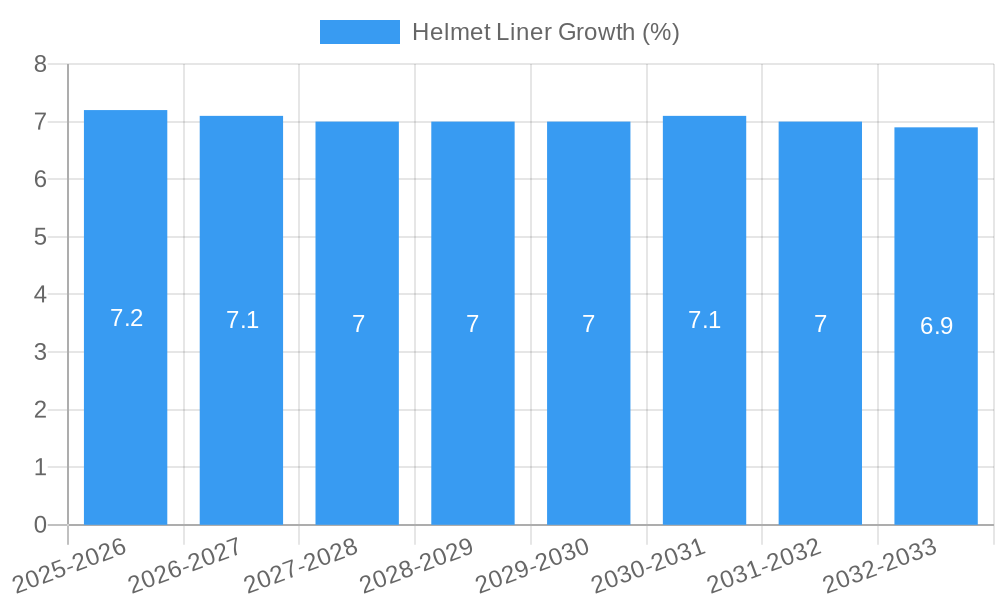

The global helmet liner market is poised for robust growth, driven by an increasing awareness of safety and performance enhancement across a multitude of applications. From 2019 to 2024, the market witnessed a steady expansion, with a Compound Annual Growth Rate (CAGR) of approximately 5.8%. This growth was primarily fueled by the burgeoning popularity of extreme sports, increased adoption of safety gear in industrial settings, and enhanced comfort features sought by consumers. The base year, 2025, is estimated to see the market reach a value of $1,250 million units, reflecting sustained demand.

Looking ahead, the forecast period (2025–2033) is projected to experience a more accelerated growth trajectory, with an estimated CAGR of 7.2%. This surge will be propelled by several key factors. Firstly, ongoing technological disruptions in material science, including the development of advanced composites and smart textiles, will introduce next-generation helmet liners offering superior protection, thermal regulation, and enhanced communication integration. Secondly, evolving consumer behavior, characterized by a greater emphasis on health, wellness, and personal safety, will continue to drive demand for protective gear across all age groups and activity levels. The penetration of helmet liners in emerging markets is also anticipated to rise significantly as disposable incomes increase and safety regulations become more stringent. Furthermore, the increasing integration of helmet liners with wearable technology for health monitoring and performance tracking presents a significant avenue for market expansion. The child market, encompassing protective gear for young athletes and recreational users, is also showing promising growth, indicating a long-term trend towards early adoption of safety consciousness.

Dominant Regions, Countries, or Segments in Helmet Liner

The Application: Online segment is emerging as a dominant force in the global helmet liner market, exhibiting exceptional growth potential and capturing increasing market share. This ascendancy is directly attributable to the pervasive influence of e-commerce and the evolving purchasing habits of consumers. From 2019 to 2024, the online channel experienced a CAGR of approximately 8.5%, significantly outpacing offline sales. This trend is projected to continue, with online sales expected to represent over 60% of the total market by 2033.

Several factors contribute to the dominance of the online segment. Firstly, the convenience and accessibility offered by online platforms cater to a broad demographic, from tech-savvy millennials and Gen Z to busy professionals seeking efficient shopping solutions. The ability to compare products, read reviews, and access detailed specifications from the comfort of their homes has revolutionized the purchasing journey for helmet liners. Secondly, the wider product availability and competitive pricing found on online marketplaces attract price-sensitive consumers and those looking for specialized or niche products that may not be readily available in brick-and-mortar stores. Manufacturers and retailers can reach a global audience, bypassing geographical limitations and expanding their customer base.

Geographically, North America is currently leading the helmet liner market, driven by a strong culture of outdoor recreation, a high prevalence of professional sports, and stringent industrial safety regulations. The region's robust economic standing allows for significant consumer spending on premium safety equipment. Countries like the United States and Canada exhibit high market penetration for helmet liners across applications such as cycling, skiing, snowboarding, and construction. The Type: Winter Helmet Liners segment, while significant, is closely followed by Summer Helmet Liners due to the growing year-round adoption of outdoor activities and the increasing demand for versatile liners that offer both warmth and breathability.

- Leading Segment: Online Application, driven by e-commerce growth and consumer convenience.

- Dominant Region: North America, due to strong sports culture and industrial safety standards.

- Key Online Drivers:

- Convenience and accessibility for a wide demographic.

- Wider product selection and competitive pricing.

- Direct-to-consumer (DTC) sales channels for manufacturers.

- Targeted marketing and personalized recommendations.

- Key Regional Drivers (North America):

- High participation rates in outdoor and extreme sports.

- Strict occupational safety regulations in construction and manufacturing.

- Government initiatives promoting helmet use in various activities.

- Strong presence of helmet manufacturers and related industries.

Helmet Liner Product Landscape

The helmet liner market is characterized by a continuous stream of product innovations focused on enhancing user comfort, safety, and performance. Innovations range from advanced moisture-wicking and temperature-regulating fabrics that adapt to varying environmental conditions, to antimicrobial treatments that combat odor and bacteria. Lightweight and breathable designs are paramount, ensuring minimal bulk and optimal airflow. Performance metrics are increasingly being defined by impact absorption capabilities, impact dispersion properties, and ergonomic fit for a secure and comfortable experience. Unique selling propositions often revolve around integrated features like audio connectivity, communication systems, and personalized fitting solutions, catering to specialized needs across diverse applications.

Key Drivers, Barriers & Challenges in Helmet Liner

Key Drivers:

- Increasing Global Participation in Sports & Recreation: Growing interest in activities like cycling, skiing, motorsports, and hiking fuels demand for protective gear, including helmet liners.

- Heightened Safety Awareness & Regulations: Stricter safety mandates in industrial and professional settings, coupled with consumer concern for personal safety, drive adoption.

- Technological Advancements: Development of advanced materials offering improved comfort, thermal regulation, and impact protection.

- Rising Disposable Income: Particularly in emerging economies, increased purchasing power allows consumers to invest in higher-quality safety equipment.

Barriers & Challenges:

- Perceived Cost vs. Benefit: Some consumers may view helmet liners as an optional expense, especially if their existing helmets offer adequate comfort.

- Product Standardization Issues: Lack of uniform sizing and fit across different helmet brands can lead to consumer frustration and returns.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and finished products.

- Intense Competition: A crowded market with numerous players can lead to price wars and reduced profit margins.

- Counterfeit Products: The presence of imitation products can dilute brand value and compromise consumer safety.

Emerging Opportunities in Helmet Liner

Emerging opportunities in the helmet liner market lie in the integration of smart technologies and the expansion into niche and underserved markets. The development of helmet liners with embedded sensors for biometric monitoring (heart rate, temperature), impact detection, and GPS tracking offers a significant growth avenue, appealing to performance-oriented athletes and safety-conscious individuals. Furthermore, the growing trend of customizable and personalized liners through 3D printing or advanced molding techniques presents an opportunity to cater to specific head shapes and comfort preferences, enhancing user satisfaction. The untapped potential in developing economies, coupled with a rising awareness of safety standards in informal labor sectors, also represents a substantial growth frontier.

Growth Accelerators in the Helmet Liner Industry

Long-term growth in the helmet liner industry will be significantly accelerated by continued material science breakthroughs, leading to liners that are not only protective but also environmentally sustainable and offer unparalleled comfort. Strategic partnerships between helmet manufacturers and liner producers can foster innovation and streamline product development, leading to more integrated and optimized safety solutions. Furthermore, market expansion strategies targeting emerging economies, coupled with educational campaigns highlighting the benefits of advanced helmet liners, will unlock new consumer bases and drive sustained demand. The growing demand for specialized liners for medical rehabilitation and therapeutic applications also presents a unique growth catalyst.

Key Players Shaping the Helmet Liner Market

- Sweathawgs

- UFO

- Team Wendy

- Bohn Body Armor

- CTR

- Taigo

- NRS

- GRIVEL

Notable Milestones in Helmet Liner Sector

- 2019: Introduction of advanced moisture-wicking technologies by leading manufacturers.

- 2020: Increased adoption of antimicrobial treatments in response to public health concerns.

- 2021: Launch of liners with enhanced thermal regulation for extreme weather conditions.

- 2022: Growing trend of direct-to-consumer (DTC) sales channels for helmet liner brands.

- 2023: Emergence of smart textile integration for temperature sensing and impact detection.

- 2024: Increased focus on sustainable materials and production methods in the industry.

In-Depth Helmet Liner Market Outlook

The helmet liner market is projected for substantial and sustained growth, driven by ongoing innovation and expanding consumer demand for enhanced safety and comfort. The integration of smart technologies and the exploration of sustainable materials will be pivotal in shaping future product offerings. Strategic market expansion into developing regions and the continued emphasis on specialized applications, such as professional sports and industrial safety, will act as key growth accelerators. The industry's ability to adapt to evolving consumer preferences for personalized and high-performance solutions will be crucial for maintaining a competitive edge and unlocking the full market potential in the coming years.

Helmet Liner Segmentation

-

1. Application

- 1.1. Online

- 1.2. Offline

-

2. Types

- 2.1. Summer Helmet Liners

- 2.2. Winter Helmet Liners

Helmet Liner Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Helmet Liner REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Helmet Liner Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Summer Helmet Liners

- 5.2.2. Winter Helmet Liners

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Helmet Liner Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Summer Helmet Liners

- 6.2.2. Winter Helmet Liners

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Helmet Liner Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Summer Helmet Liners

- 7.2.2. Winter Helmet Liners

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Helmet Liner Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Summer Helmet Liners

- 8.2.2. Winter Helmet Liners

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Helmet Liner Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Summer Helmet Liners

- 9.2.2. Winter Helmet Liners

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Helmet Liner Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Summer Helmet Liners

- 10.2.2. Winter Helmet Liners

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sweathawgs

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UFO

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Team Wendy

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bohn Body Armor

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CTR

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Taigo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NRS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GRIVEL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Sweathawgs

List of Figures

- Figure 1: Global Helmet Liner Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Helmet Liner Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Helmet Liner Revenue (million), by Application 2024 & 2032

- Figure 4: North America Helmet Liner Volume (K), by Application 2024 & 2032

- Figure 5: North America Helmet Liner Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Helmet Liner Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Helmet Liner Revenue (million), by Types 2024 & 2032

- Figure 8: North America Helmet Liner Volume (K), by Types 2024 & 2032

- Figure 9: North America Helmet Liner Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Helmet Liner Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Helmet Liner Revenue (million), by Country 2024 & 2032

- Figure 12: North America Helmet Liner Volume (K), by Country 2024 & 2032

- Figure 13: North America Helmet Liner Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Helmet Liner Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Helmet Liner Revenue (million), by Application 2024 & 2032

- Figure 16: South America Helmet Liner Volume (K), by Application 2024 & 2032

- Figure 17: South America Helmet Liner Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Helmet Liner Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Helmet Liner Revenue (million), by Types 2024 & 2032

- Figure 20: South America Helmet Liner Volume (K), by Types 2024 & 2032

- Figure 21: South America Helmet Liner Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Helmet Liner Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Helmet Liner Revenue (million), by Country 2024 & 2032

- Figure 24: South America Helmet Liner Volume (K), by Country 2024 & 2032

- Figure 25: South America Helmet Liner Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Helmet Liner Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Helmet Liner Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Helmet Liner Volume (K), by Application 2024 & 2032

- Figure 29: Europe Helmet Liner Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Helmet Liner Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Helmet Liner Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Helmet Liner Volume (K), by Types 2024 & 2032

- Figure 33: Europe Helmet Liner Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Helmet Liner Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Helmet Liner Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Helmet Liner Volume (K), by Country 2024 & 2032

- Figure 37: Europe Helmet Liner Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Helmet Liner Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Helmet Liner Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Helmet Liner Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Helmet Liner Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Helmet Liner Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Helmet Liner Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Helmet Liner Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Helmet Liner Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Helmet Liner Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Helmet Liner Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Helmet Liner Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Helmet Liner Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Helmet Liner Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Helmet Liner Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Helmet Liner Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Helmet Liner Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Helmet Liner Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Helmet Liner Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Helmet Liner Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Helmet Liner Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Helmet Liner Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Helmet Liner Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Helmet Liner Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Helmet Liner Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Helmet Liner Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Helmet Liner Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Helmet Liner Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Helmet Liner Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Helmet Liner Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Helmet Liner Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Helmet Liner Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Helmet Liner Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Helmet Liner Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Helmet Liner Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Helmet Liner Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Helmet Liner Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Helmet Liner Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Helmet Liner Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Helmet Liner Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Helmet Liner Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Helmet Liner Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Helmet Liner Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Helmet Liner Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Helmet Liner Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Helmet Liner Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Helmet Liner Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Helmet Liner Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Helmet Liner Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Helmet Liner Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Helmet Liner Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Helmet Liner Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Helmet Liner Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Helmet Liner Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Helmet Liner Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Helmet Liner Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Helmet Liner Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Helmet Liner Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Helmet Liner Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Helmet Liner Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Helmet Liner Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Helmet Liner Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Helmet Liner Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Helmet Liner Volume K Forecast, by Country 2019 & 2032

- Table 81: China Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Helmet Liner Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Helmet Liner Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Helmet Liner?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Helmet Liner?

Key companies in the market include Sweathawgs, UFO, Team Wendy, Bohn Body Armor, CTR, Taigo, NRS, GRIVEL.

3. What are the main segments of the Helmet Liner?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Helmet Liner," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Helmet Liner report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Helmet Liner?

To stay informed about further developments, trends, and reports in the Helmet Liner, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence