Key Insights

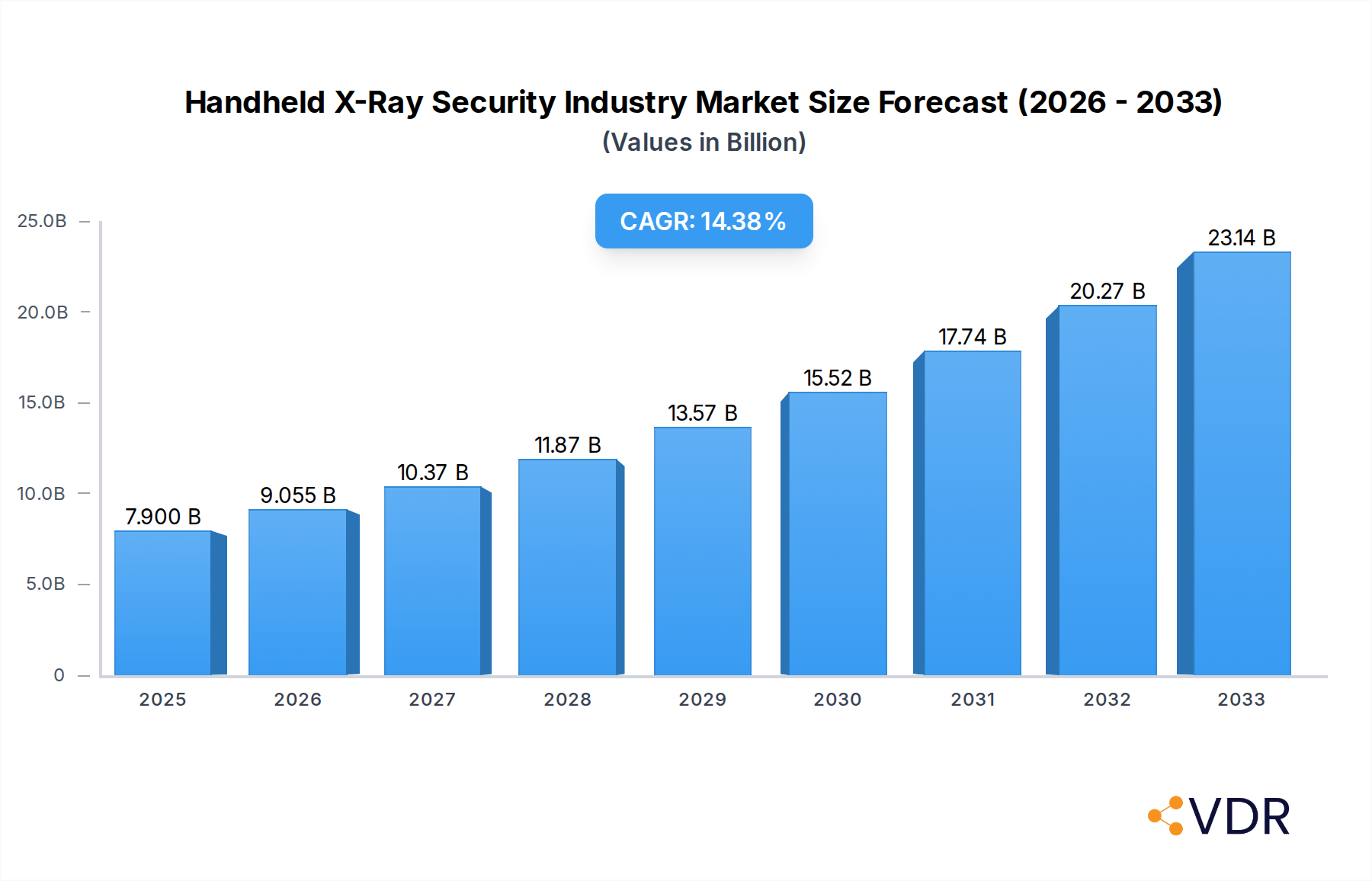

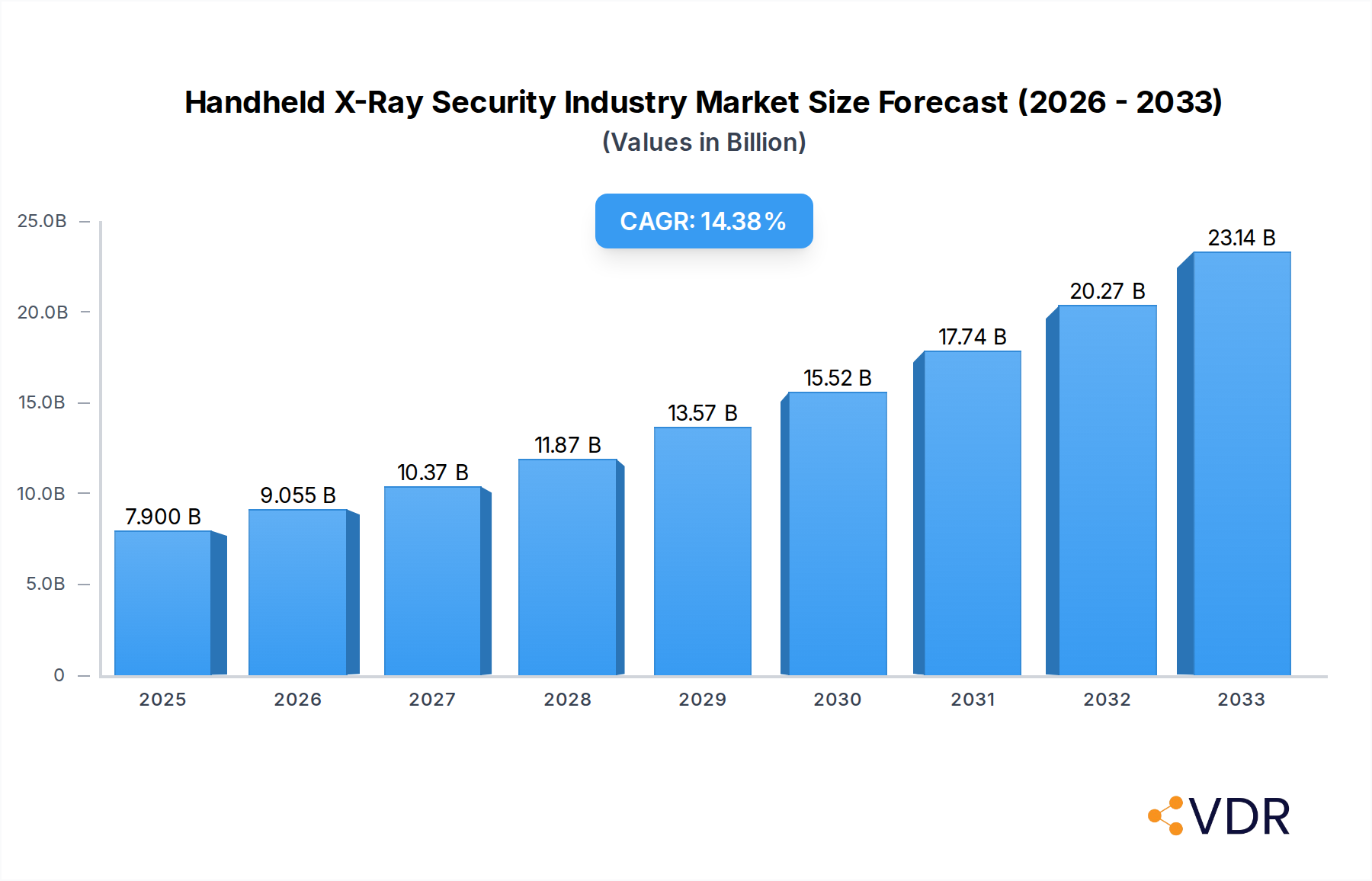

The global Handheld X-Ray Security market is poised for substantial expansion, projected to reach a significant $7.9 billion by 2025. This robust growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 14.71% during the forecast period of 2025-2033. The increasing need for advanced security screening solutions across diverse sectors, including customs and border protection, law enforcement, critical infrastructure, and military and defense, is a primary driver. The escalating threat landscape, coupled with evolving security protocols and the demand for portable, non-intrusive inspection technologies, fuels this market's upward momentum. Furthermore, technological advancements in X-ray imaging, leading to improved resolution, speed, and safety features, are making these devices more attractive to end-users. The ease of deployment and operational flexibility offered by handheld X-ray systems are also key contributors to their widespread adoption, particularly in dynamic and decentralized security environments.

Handheld X-Ray Security Industry Market Size (In Billion)

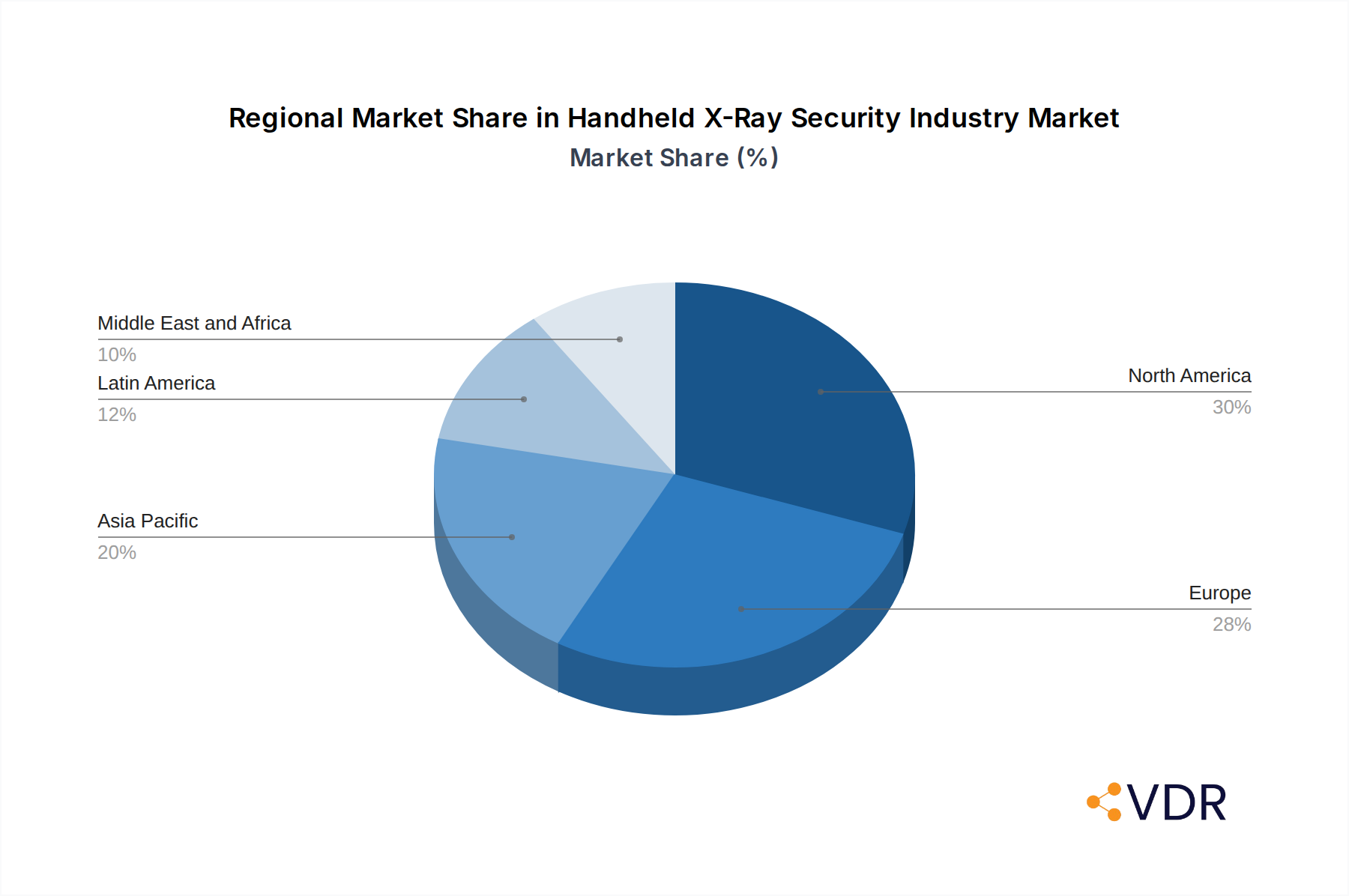

The market's dynamic is further shaped by several influential trends, including the integration of artificial intelligence for automated threat detection and the development of multi-modal imaging capabilities for enhanced threat identification. The increasing focus on rapid threat response and the need for efficient cargo and baggage inspection at various checkpoints are creating significant opportunities for market players. However, challenges such as the high initial cost of sophisticated equipment and stringent regulatory compliance requirements may present some restraints. Despite these, the consistent investment in research and development by leading companies like Rapiscan Systems, Smiths Detection, and American Science and Engineering, among others, is expected to introduce innovative products and solutions, further solidifying the market's growth. Geographical analysis indicates that North America and Europe are likely to maintain a significant market share due to established security infrastructure and consistent upgrades, while the Asia Pacific region is anticipated to witness rapid growth driven by increasing security investments and expanding trade activities.

Handheld X-Ray Security Industry Company Market Share

Report Description: Handheld X-Ray Security Industry – Market Dynamics, Growth Forecasts, and Competitive Landscape (2019–2033)

Unlock critical insights into the global Handheld X-Ray Security Industry with this comprehensive market research report. Spanning 2019–2033, with a base year of 2025, this study provides an in-depth analysis of market dynamics, growth trends, regional dominance, product innovations, key drivers, barriers, emerging opportunities, and growth accelerators. Essential for industry professionals, government agencies, and investors, this report offers a detailed breakdown of the parent and child markets, quantifying opportunities and strategic imperatives for success.

Handheld X-Ray Security Industry Market Dynamics & Structure

The global Handheld X-Ray Security Industry is characterized by moderate market concentration, with a few key players dominating specialized segments. Technological innovation is a primary driver, fueled by the constant need for enhanced threat detection capabilities and greater portability. Regulatory frameworks, particularly those governing security screening at borders and critical infrastructure, play a crucial role in shaping market demand. Competitive product substitutes, such as advanced metal detectors and trace detection systems, present a dynamic competitive landscape. End-user demographics are diverse, with significant adoption across law enforcement, customs and border protection, and military applications. Mergers and acquisitions (M&A) activity, while not at extreme levels, has occurred as larger companies seek to consolidate market share and expand their technology portfolios. Innovation barriers include the high cost of R&D for advanced imaging technologies and stringent certification processes.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized niche players.

- Technological Innovation Drivers: Increasing sophistication of threats, demand for real-time imaging, and miniaturization of X-ray components.

- Regulatory Frameworks: Stringent compliance requirements for security screening technologies by governmental bodies worldwide.

- Competitive Product Substitutes: Metal detectors, millimeter-wave scanners, and chemical/biological trace detection systems.

- End-User Demographics: High demand from government security agencies, private security firms, and transportation hubs.

- M&A Trends: Strategic acquisitions to gain access to new technologies and expand market reach.

- Innovation Barriers: High R&D investment, complex regulatory approvals, and the need for robust field testing.

Handheld X-Ray Security Industry Growth Trends & Insights

The Handheld X-Ray Security Industry is poised for significant expansion, driven by escalating global security concerns and advancements in imaging technology. The market size is projected to witness robust growth, with adoption rates of these portable scanning solutions steadily increasing across various end-user segments. Technological disruptions, such as the integration of artificial intelligence (AI) for automated threat detection and the development of more compact and energy-efficient X-ray sources, are revolutionizing the industry. Consumer behavior shifts are also contributing, with an increasing demand for rapid, on-the-spot threat assessment and the decentralization of security screening capabilities. From a historical perspective (2019–2024), the market has seen consistent growth, driven by increased homeland security investments and evolving threat landscapes. The base year of 2025 sets a strong foundation for future projections, with the forecast period (2025–2033) anticipating accelerated growth. The compound annual growth rate (CAGR) is expected to be substantial, reflecting the growing importance of these devices in modern security architectures. Market penetration is projected to deepen as the cost-effectiveness and operational advantages of handheld X-ray systems become more widely recognized by diverse end-users. This evolution is not merely about incremental improvements; it represents a paradigm shift towards more agile, responsive, and intelligent security screening.

Dominant Regions, Countries, or Segments in Handheld X-Ray Security Industry

The Customs and Border Protection (CBP) segment stands out as a dominant force driving growth within the Handheld X-Ray Security Industry. This is primarily due to the escalating global trade volumes, the persistent threat of illicit cargo, and the critical need for efficient and effective border control measures. Governments worldwide are investing heavily in advanced security technologies to safeguard national borders, inspect cargo, and prevent the smuggling of prohibited items, including weapons, drugs, and hazardous materials. The operational necessity for rapid, on-site inspection of parcels, vehicles, and individuals at entry points makes handheld X-ray devices indispensable. The market share within this segment is substantial, reflecting the continuous procurement cycles and the integration of these devices into routine border operations.

- Key Drivers in CBP Dominance:

- Increased Global Trade & Logistics: Growing volume of international trade necessitates robust inspection capabilities.

- Enhanced National Security Mandates: Government focus on preventing terrorism and smuggling.

- Technological Advancements: Development of more portable, user-friendly, and image-enhanced X-ray systems.

- Cost-Effectiveness: Handheld devices offer a more flexible and often more cost-effective solution compared to fixed, large-scale scanning infrastructure for certain applications.

- Adaptability: Ability to deploy quickly and efficiently at various points of inspection, including mobile operations.

The growth potential within the CBP segment remains high, fueled by ongoing technological innovation and the ever-evolving nature of security threats. Countries with extensive coastlines and land borders, coupled with robust economic activity, are significant contributors to this segment's market share. The adoption of next-generation handheld X-ray scanners with enhanced imaging algorithms and AI-powered threat recognition will further solidify CBP's dominance.

Handheld X-Ray Security Industry Product Landscape

The product landscape for handheld X-ray security devices is marked by continuous innovation, focusing on enhanced imaging resolution, portability, and user-friendliness. Modern devices offer sophisticated real-time X-ray imaging capabilities, allowing for the immediate detection of concealed objects, contraband, and explosives within parcels, luggage, and even within structural elements. Applications span a wide spectrum, from rapid cargo inspection and baggage screening at airports and seaports to on-site threat assessment by law enforcement and military personnel. Key performance metrics emphasize high penetration depth, excellent image clarity, and rapid scan times, often accompanied by advanced software for image manipulation and analysis. Unique selling propositions include battery longevity, ruggedized designs for harsh environments, and integrated wireless connectivity for data transfer. Technological advancements are centered on miniaturizing X-ray generators and detectors, improving radiation shielding, and developing intuitive user interfaces for minimal training requirements.

Key Drivers, Barriers & Challenges in Handheld X-Ray Security Industry

Key Drivers: The Handheld X-Ray Security Industry is propelled by a confluence of factors. Heightened global security threats, including terrorism and illicit trafficking, are a primary driver, necessitating advanced and portable detection solutions. Increasing investments in homeland security by governments worldwide directly translate into demand. Technological advancements, such as the development of more powerful, compact, and energy-efficient X-ray components, enable the creation of more effective and user-friendly devices. Furthermore, the growing need for rapid, on-site inspection capabilities across various sectors, from law enforcement to critical infrastructure protection, fuels market expansion.

Key Barriers & Challenges: The industry faces several significant barriers and challenges. The high cost of research and development for cutting-edge imaging technologies and sophisticated software can be a substantial hurdle. Stringent regulatory approval processes and the need to meet various international safety and performance standards can lead to extended product development cycles. Competitive pressures from alternative screening technologies, such as advanced metal detectors and millimeter-wave scanners, require continuous innovation. Supply chain disruptions for specialized electronic components can impact production timelines and costs. Moreover, ensuring adequate training and user proficiency for complex devices across diverse operational environments remains a logistical challenge.

Emerging Opportunities in Handheld X-Ray Security Industry

Emerging opportunities in the Handheld X-Ray Security Industry lie in the expansion into nascent markets and the development of innovative applications. The increasing focus on securing critical infrastructure beyond traditional targets, such as power grids, water treatment plants, and telecommunications hubs, presents a significant untapped market. Furthermore, the miniaturization of X-ray technology opens doors for integration into unmanned aerial vehicles (UAVs) for remote surveillance and inspection, creating a new class of aerial security solutions. Evolving consumer preferences for seamless and unobtrusive security experiences at public venues also drive demand for discreet and rapidly deployable handheld screening devices.

Growth Accelerators in the Handheld X-Ray Security Industry Industry

Several growth accelerators are poised to significantly boost the Handheld X-Ray Security Industry. Continuous technological breakthroughs, particularly in areas like advanced material science for X-ray generation and detection, and the integration of AI for automated threat identification, will enhance device capabilities and market appeal. Strategic partnerships between technology developers and established security solution providers will facilitate market penetration and broaden product distribution networks. Moreover, proactive market expansion strategies targeting emerging economies with growing security needs and government spending will unlock substantial growth potential. The development of cloud-based platforms for real-time data analysis and remote diagnostics will also enhance operational efficiency and foster customer loyalty.

Key Players Shaping the Handheld X-Ray Security Industry Market

- Gilardoni S.p.A.

- Astrophysic

- Rapiscan Systems

- Smiths Detection

- American Science and Engineering

- Heimann Systems

Notable Milestones in Handheld X-Ray Security Industry Sector

- March 2021: OSI Systems announced that its Security division was awarded an order valued at approximately USD 6 million from an international customer to provide Rapiscan 600 series baggage and parcel inspection (BPI) systems, related accessories, ongoing maintenance and support.

In-Depth Handheld X-Ray Security Industry Market Outlook

The future market outlook for the Handheld X-Ray Security Industry is exceptionally promising, driven by ongoing advancements and a persistent global demand for effective security solutions. Growth accelerators, including breakthroughs in AI-powered threat recognition and the development of more compact, energy-efficient systems, will significantly enhance the utility and adoption of these devices. Strategic partnerships between technology innovators and established security firms will further expand market reach and facilitate the integration of these solutions into comprehensive security frameworks. Proactive market expansion into emerging economies with escalating security concerns and governmental investment will unlock substantial new revenue streams. The continuous evolution of threats ensures a sustained need for adaptable and portable X-ray security technologies, positioning the industry for robust and prolonged growth.

Handheld X-Ray Security Industry Segmentation

-

1. End User

- 1.1. Customs and Border Protection

- 1.2. Law Enforcement

- 1.3. Critical Infrastructure

- 1.4. Military and Defense

- 1.5. Other End Users

Handheld X-Ray Security Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Handheld X-Ray Security Industry Regional Market Share

Geographic Coverage of Handheld X-Ray Security Industry

Handheld X-Ray Security Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Highly Efficient and Easy-to-use Scanning Systems

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concers; Increased Cyber Attacks

- 3.4. Market Trends

- 3.4.1. Customs and Border Protection is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Customs and Border Protection

- 5.1.2. Law Enforcement

- 5.1.3. Critical Infrastructure

- 5.1.4. Military and Defense

- 5.1.5. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Customs and Border Protection

- 6.1.2. Law Enforcement

- 6.1.3. Critical Infrastructure

- 6.1.4. Military and Defense

- 6.1.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Customs and Border Protection

- 7.1.2. Law Enforcement

- 7.1.3. Critical Infrastructure

- 7.1.4. Military and Defense

- 7.1.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Customs and Border Protection

- 8.1.2. Law Enforcement

- 8.1.3. Critical Infrastructure

- 8.1.4. Military and Defense

- 8.1.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Customs and Border Protection

- 9.1.2. Law Enforcement

- 9.1.3. Critical Infrastructure

- 9.1.4. Military and Defense

- 9.1.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Handheld X-Ray Security Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Customs and Border Protection

- 10.1.2. Law Enforcement

- 10.1.3. Critical Infrastructure

- 10.1.4. Military and Defense

- 10.1.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gilardoni S.p.A.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Astrophysic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rapiscan Systems

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Smiths Detection

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 American Science and Engineering

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Heimann Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Gilardoni S.p.A.

List of Figures

- Figure 1: Global Handheld X-Ray Security Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Handheld X-Ray Security Industry Revenue (billion), by End User 2025 & 2033

- Figure 3: North America Handheld X-Ray Security Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Handheld X-Ray Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Handheld X-Ray Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Handheld X-Ray Security Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: Europe Handheld X-Ray Security Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Handheld X-Ray Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Handheld X-Ray Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Handheld X-Ray Security Industry Revenue (billion), by End User 2025 & 2033

- Figure 11: Asia Pacific Handheld X-Ray Security Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Handheld X-Ray Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Handheld X-Ray Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Handheld X-Ray Security Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Latin America Handheld X-Ray Security Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Latin America Handheld X-Ray Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Handheld X-Ray Security Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Handheld X-Ray Security Industry Revenue (billion), by End User 2025 & 2033

- Figure 19: Middle East and Africa Handheld X-Ray Security Industry Revenue Share (%), by End User 2025 & 2033

- Figure 20: Middle East and Africa Handheld X-Ray Security Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Handheld X-Ray Security Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Handheld X-Ray Security Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global Handheld X-Ray Security Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Handheld X-Ray Security Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Handheld X-Ray Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Handheld X-Ray Security Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Handheld X-Ray Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Handheld X-Ray Security Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Handheld X-Ray Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Handheld X-Ray Security Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Handheld X-Ray Security Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Handheld X-Ray Security Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Handheld X-Ray Security Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Handheld X-Ray Security Industry?

The projected CAGR is approximately 14.71%.

2. Which companies are prominent players in the Handheld X-Ray Security Industry?

Key companies in the market include Gilardoni S.p.A. , Astrophysic, Rapiscan Systems , Smiths Detection, American Science and Engineering, Heimann Systems .

3. What are the main segments of the Handheld X-Ray Security Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Highly Efficient and Easy-to-use Scanning Systems.

6. What are the notable trends driving market growth?

Customs and Border Protection is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concers; Increased Cyber Attacks.

8. Can you provide examples of recent developments in the market?

March 2021 - OSI Systems announced that its Security division was awarded an order valued at approximately USD 6 million from an international customer to provide Rapiscan 600 series baggage and parcel inspection (BPI) systems, related accessories, ongoing maintenance and support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Handheld X-Ray Security Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Handheld X-Ray Security Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Handheld X-Ray Security Industry?

To stay informed about further developments, trends, and reports in the Handheld X-Ray Security Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence