Key Insights

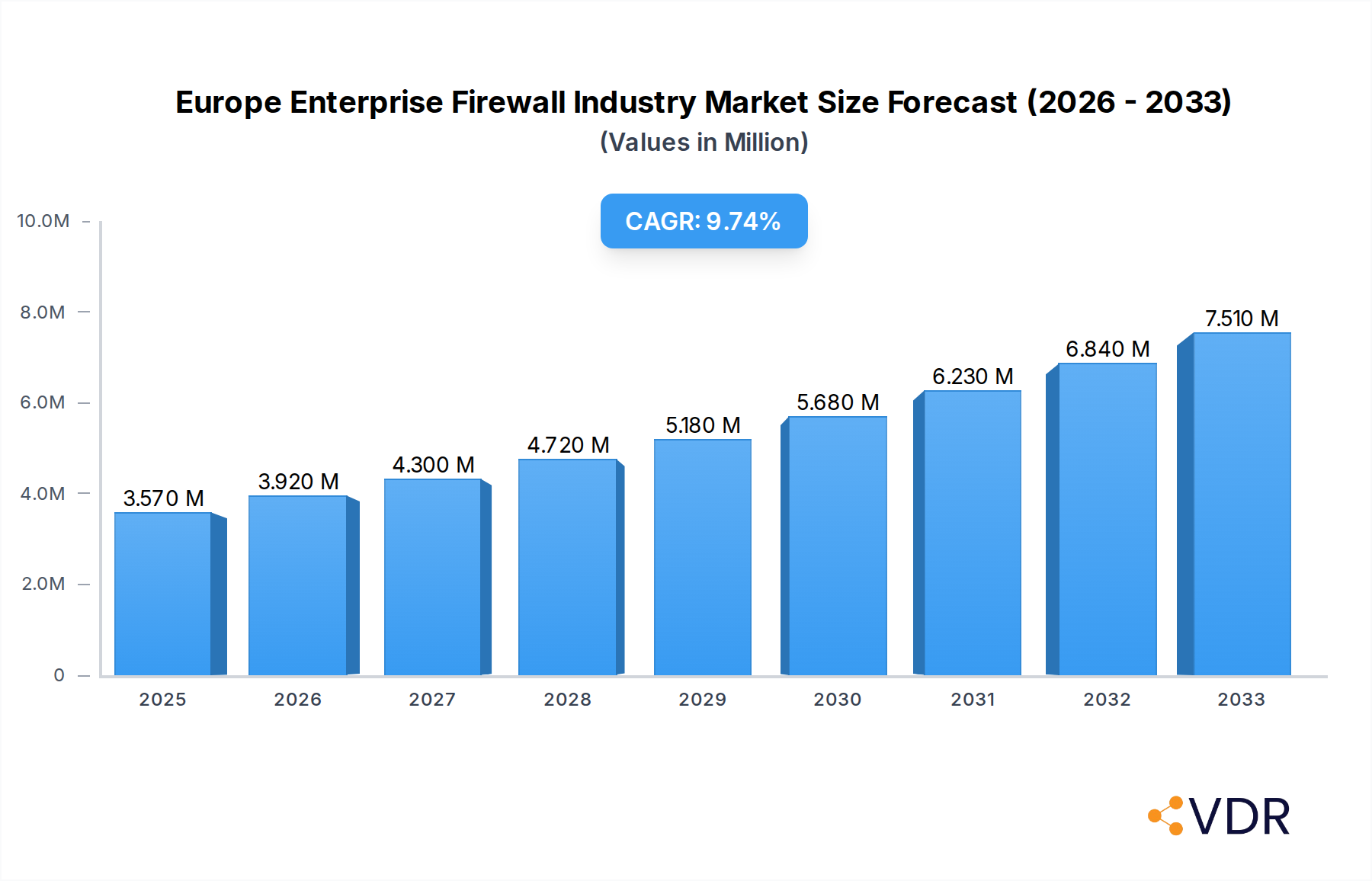

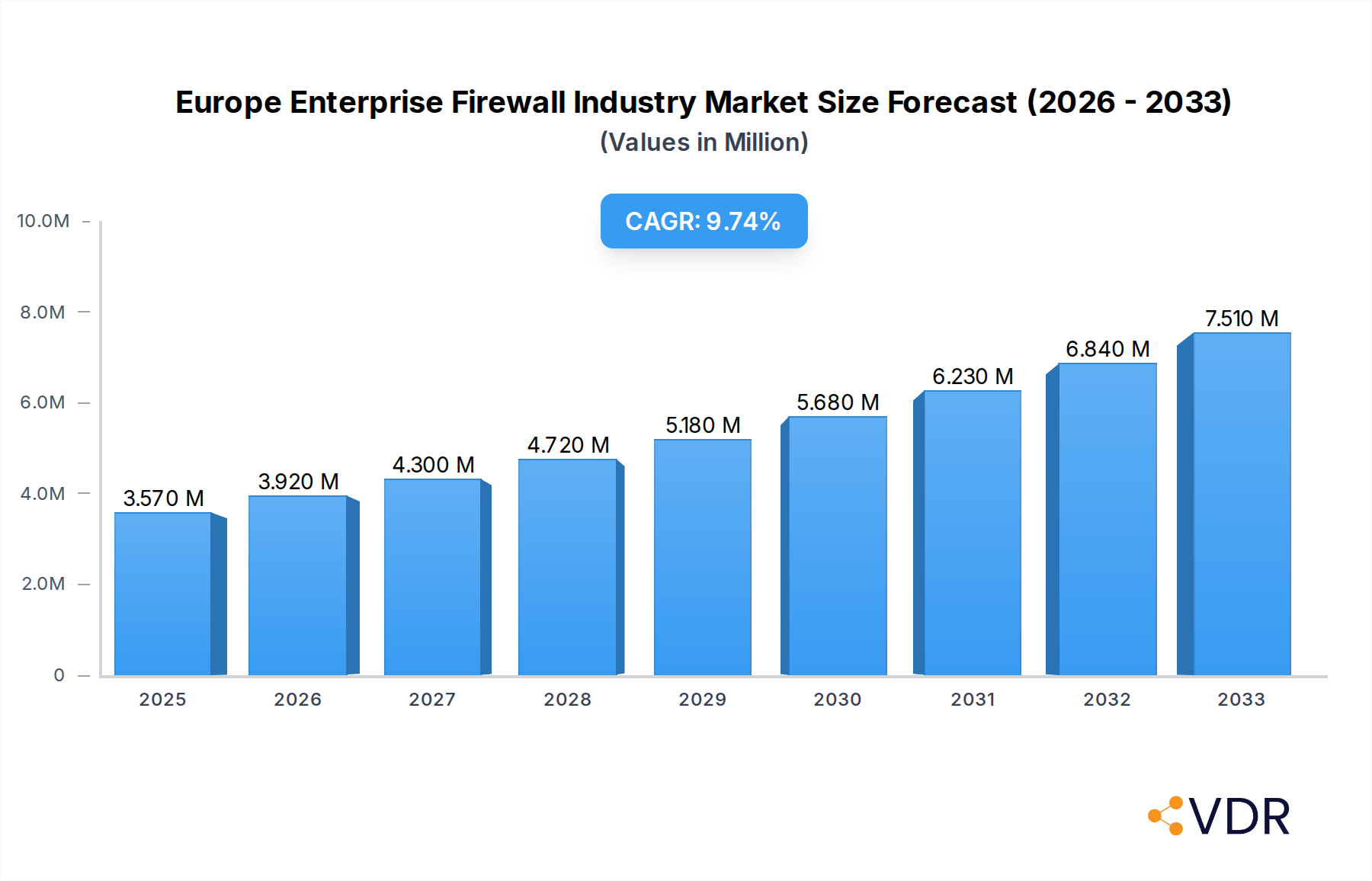

The European enterprise firewall market is poised for robust expansion, projected to reach a valuation of 3.57 Million by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.95%, indicating a dynamic and expanding sector throughout the forecast period of 2025-2033. Key drivers fueling this surge include the escalating sophistication and frequency of cyber threats, the increasing adoption of cloud-based solutions, and the continuous evolution of network infrastructures. Organizations across critical verticals such as healthcare, financial services, and manufacturing are prioritizing advanced security measures to safeguard sensitive data and maintain operational continuity in an increasingly digital landscape. The demand for comprehensive network protection solutions that offer robust threat detection, prevention, and response capabilities will remain paramount.

Europe Enterprise Firewall Industry Market Size (In Million)

The market's trajectory is further shaped by emerging trends like the integration of artificial intelligence and machine learning into firewall technologies for predictive threat analysis and automated response mechanisms. The growing adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) also necessitates agile and scalable firewall solutions that can seamlessly integrate into these modern network architectures. While the market benefits from strong demand, certain restraints, such as budget constraints for some smaller organizations and the complexity of managing advanced security solutions, may present challenges. However, the overarching need for enhanced cybersecurity, coupled with innovation in firewall technology, will continue to drive significant market growth and investment across Europe.

Europe Enterprise Firewall Industry Company Market Share

Europe Enterprise Firewall Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

Unlock critical insights into the burgeoning Europe Enterprise Firewall market. This comprehensive report delivers an in-depth analysis of market dynamics, growth trajectories, and strategic opportunities from 2019 to 2033. With a focus on key segments including on-premises and cloud deployments, hardware, software, and services solutions, and catering to both small to medium and large organizations across vital end-user verticals like Healthcare, Manufacturing, Government, Retail, Education, and Financial Services, this report is an indispensable resource for industry stakeholders seeking to navigate and capitalize on this evolving landscape. Discover market share, technological innovations, regulatory impacts, and competitive strategies shaping the future of enterprise firewall security in Europe.

Europe Enterprise Firewall Industry Market Dynamics & Structure

The Europe enterprise firewall industry exhibits a moderately concentrated market structure, driven by a handful of dominant players alongside a growing cohort of specialized vendors. Technological innovation remains a primary catalyst, with advancements in AI-driven threat detection, zero-trust architectures, and cloud-native firewall solutions continuously reshaping the competitive landscape. Regulatory frameworks, particularly stringent data privacy laws like GDPR, are significantly influencing product development and market adoption, mandating robust security postures. Competitive product substitutes, while present in broader cybersecurity solutions, are largely integrated or complementary to core firewall functionalities. End-user demographics are increasingly diverse, with a rising demand for scalable, adaptable solutions from small to medium organizations, while large enterprises prioritize advanced threat prevention and centralized management. Mergers and acquisitions (M&A) activity, though not at a frenetic pace, serves to consolidate market share and expand technological capabilities. For instance, in the historical period, the market saw key acquisitions aimed at bolstering cloud security offerings. Barriers to innovation include the high cost of R&D for cutting-edge technologies and the complex integration requirements for legacy IT infrastructure. The market's growth is underpinned by substantial investments in cybersecurity by European businesses and government entities, aiming to protect critical infrastructure and sensitive data.

- Market Concentration: Dominated by key players like Check Point Software Technologies, Fortinet Inc., and Cisco Systems Inc., with emerging contenders like Palo Alto Networks gaining significant traction.

- Technological Innovation Drivers: Rise of AI and machine learning for advanced threat detection, adoption of zero-trust security models, and increasing demand for cloud-based firewall solutions.

- Regulatory Frameworks: GDPR and NIS2 Directive compliance are paramount, driving demand for advanced security features and audit capabilities.

- Competitive Product Substitutes: Integrated security platforms and next-generation security services offer alternative or complementary protection layers.

- End-User Demographics: Growing demand from SMEs for cost-effective, managed firewall solutions and from large enterprises for highly sophisticated, customizable deployments.

- M&A Trends: Strategic acquisitions focused on expanding cloud security portfolios and incorporating advanced threat intelligence capabilities.

- Innovation Barriers: High R&D investment, complex integration challenges with existing IT infrastructures, and a shortage of skilled cybersecurity professionals.

Europe Enterprise Firewall Industry Growth Trends & Insights

The Europe enterprise firewall market is poised for robust expansion, driven by an escalating threat landscape and increasing digitalization across all sectors. The market size is projected to witness significant growth, with a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period of 2025–2033. This upward trajectory is fueled by heightened awareness of sophisticated cyber threats, including ransomware attacks and advanced persistent threats (APTs), compelling organizations to invest in more advanced firewall solutions. Adoption rates for cloud-based firewalls are rapidly accelerating, reflecting the shift towards hybrid and multi-cloud environments and the need for consistent security policies across distributed infrastructures. Technological disruptions, such as the integration of AI and machine learning for predictive threat analysis and automated incident response, are enhancing firewall efficacy and driving market demand. Consumer behavior shifts, particularly the increasing reliance on remote work and the proliferation of IoT devices, necessitate more granular control and pervasive security, which enterprise firewalls are designed to provide. The market penetration of next-generation firewalls (NGFWs) is nearing saturation in large enterprises, but significant growth opportunities exist in the SMB segment and in the adoption of specialized firewall services. The historical period (2019–2024) laid a strong foundation, with consistent investment in traditional firewall technologies and the nascent adoption of cloud-centric solutions. The base year, 2025, marks a pivotal point where cloud and integrated security solutions are becoming standard. The estimated market size for 2025 is projected to be around $10.2 billion units, indicating a mature yet rapidly evolving market.

Dominant Regions, Countries, or Segments in Europe Enterprise Firewall Industry

Within the Europe enterprise firewall industry, the Cloud segment for Type of Deployment is emerging as a dominant growth driver, alongside Software and Services as key Solution types. The Large Organizations segment for Size of the Organization consistently represents the largest market share due to their higher security budgets and more complex network infrastructures. Geographically, Western Europe, encompassing countries like Germany, the UK, France, and the Netherlands, continues to dominate due to established economic strength, high digital adoption rates, and stringent regulatory compliance requirements.

- Dominant Deployment Type: Cloud deployments are experiencing rapid expansion due to the flexibility, scalability, and ease of management they offer for distributed workforces and hybrid cloud environments.

- Dominant Solution Type: While Hardware firewalls remain crucial for on-premises security, the demand for Software-based firewalls and integrated Security-as-a-Service (SaaS) solutions is surging. Services, including managed firewall services and threat intelligence feeds, are increasingly critical for ongoing security posture management.

- Dominant Organization Size: Large organizations are the primary revenue generators, investing heavily in advanced threat prevention, next-generation firewalls, and comprehensive security management platforms. However, Small to Medium Organizations represent a significant growth opportunity, particularly with the adoption of cloud-based and managed firewall solutions.

- Dominant End-User Verticals: The Financial Services sector consistently leads in firewall adoption and investment due to the highly sensitive nature of data and the stringent regulatory environment. Government and Healthcare sectors are also major spenders, driven by national security concerns and the need to protect critical patient data.

- Leading Regions/Countries: Western European nations are at the forefront, driven by robust economic conditions, advanced technological infrastructure, and proactive cybersecurity policies. Countries like Germany and the UK are particularly influential due to their large enterprise bases and strong regulatory enforcement.

Europe Enterprise Firewall Industry Product Landscape

The Europe enterprise firewall product landscape is characterized by a rapid evolution towards intelligent, integrated, and cloud-native solutions. Modern enterprise firewalls offer advanced capabilities beyond traditional port and protocol filtering, including deep packet inspection, intrusion prevention systems (IPS), application control, and sophisticated malware detection engines powered by artificial intelligence and machine learning. Product innovations are heavily focused on Zero Trust Network Access (ZTNA) integration, offering granular access control and continuous verification of user and device trust. Cloud-based firewall services (FWaaS) are gaining prominence, providing centralized management, seamless scalability, and consistent security policies across hybrid and multi-cloud environments. Performance metrics are increasingly scrutinized, with emphasis on low latency, high throughput, and efficient resource utilization to avoid impacting network performance. Unique selling propositions include integrated threat intelligence, automated threat response, and user-friendly management consoles designed to reduce operational complexity. The market is witnessing a shift from standalone hardware appliances to more flexible software-defined solutions and comprehensive security platforms.

Key Drivers, Barriers & Challenges in Europe Enterprise Firewall Industry

The Europe enterprise firewall industry is propelled by a confluence of critical drivers, while simultaneously grappling with significant barriers and challenges.

Key Drivers:

- Escalating Cyber Threat Landscape: The increasing sophistication and frequency of cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs), are forcing organizations to fortify their defenses with advanced firewall technologies.

- Digital Transformation and Cloud Adoption: The widespread migration to cloud environments and the adoption of digital technologies necessitate robust and scalable firewall solutions capable of securing distributed networks and hybrid infrastructures.

- Stringent Regulatory Compliance: Evolving data privacy regulations, such as GDPR and the upcoming NIS2 Directive, mandate strong security measures, driving investment in compliant firewall solutions.

- Remote Workforce Expansion: The sustained trend of remote and hybrid work models requires enhanced network security and granular access control, positioning firewalls as essential components of modern IT infrastructure.

Barriers & Challenges:

- Talent Shortage in Cybersecurity: A significant skills gap in cybersecurity professionals limits the effective deployment, management, and optimization of advanced firewall solutions, particularly for SMEs.

- Integration Complexity with Legacy Systems: Integrating new firewall technologies with existing, often outdated, IT infrastructures can be complex, costly, and time-consuming, hindering adoption rates.

- Budgetary Constraints for SMEs: While large enterprises have substantial security budgets, Small to Medium Organizations often face financial limitations, making it challenging to invest in premium firewall solutions and ongoing services.

- Evolving Threat Sophistication: The continuous evolution of cyber threats necessitates ongoing updates and adaptations of firewall technologies, creating a perpetual arms race that can strain resources and development cycles. The financial impact of a major breach can be in the millions of units for large enterprises.

Emerging Opportunities in Europe Enterprise Firewall Industry

The Europe enterprise firewall market presents several promising emerging opportunities for growth and innovation. The increasing adoption of IoT devices across industries like manufacturing and healthcare creates a demand for specialized firewall solutions capable of securing a vast and diverse array of connected endpoints. The expanding market for Secure Access Service Edge (SASE) frameworks presents a significant opportunity for firewall vendors to integrate their offerings into comprehensive cloud-delivered security platforms. Furthermore, the rising demand for managed security services, particularly among SMEs, offers a lucrative avenue for providers to offer bundled firewall solutions with expert oversight and ongoing support. The focus on AI-driven security analytics and automated threat remediation within firewalls is another area ripe for development and market penetration, promising proactive defense mechanisms.

Growth Accelerators in the Europe Enterprise Firewall Industry Industry

Several key catalysts are accelerating the growth of the Europe enterprise firewall industry. Technological advancements in AI and machine learning are enabling firewalls to become more proactive, intelligent, and adaptive to novel threats. Strategic partnerships between firewall vendors and cloud providers are crucial for seamless integration and enhanced security for cloud-native applications. The growing emphasis on Zero Trust Architecture adoption across enterprises is a significant growth accelerator, pushing the demand for granular control and continuous verification capabilities inherent in modern firewalls. Furthermore, the increasing prevalence of cybersecurity awareness programs and compliance mandates across various European countries are driving the need for robust firewall solutions, fostering a more secure digital ecosystem.

Key Players Shaping the Europe Enterprise Firewall Industry Market

- Check Point Software Technologies

- Fortinet Inc.

- Cisco Systems Inc.

- The Hewlett-Packard Company

- Juniper Networks

- WatchGuard Technologies

- Dell Inc.

- Netasq SA

- Palo Alto Networks

- McAfee (Intel Security Group)

- Sophos Group PLC

- SonicWall Inc.

- Huawei Technologies Inc.

Notable Milestones in Europe Enterprise Firewall Industry Sector

- June 2023: SonicWall launched monthly firewall security services packages available for authorized Managed Service Providers (MSPs) and Managed Security Service Providers (MSSPs). The Capture Advanced Threat Protection (ATP) sandbox service, the patented Real-Time Deep Memory Inspection (RTDMI), intrusion prevention and application control, content filtering and reporting capabilities, as well as several other essential firewall security services, are all included in the SonicWall protection suites. This initiative significantly bolstered the service offerings for managed security providers, extending advanced protection to a wider range of businesses.

- January 2023: ThriveDX, a cybersecurity and digital skills training provider, announced launching a road tour across Europe from January to February 2023 to address the industry's talent scarcity, skills gap, lack of diversity, and lack of inclusion in the field of cybersecurity by introducing the company's innovative human factor security solutions to Exclusive Networks' community of more than 25,000 partners. The business has announced its plans to collaborate with thousands of its current and potential European partners and clients to build a human firewall throughout each of its enterprises. This collaboration aimed to build a stronger human firewall across organizations, tackling a critical challenge in the cybersecurity ecosystem.

In-Depth Europe Enterprise Firewall Industry Market Outlook

The future outlook for the Europe enterprise firewall industry is exceptionally promising, characterized by continuous innovation and expanding market reach. Growth accelerators such as the pervasive adoption of cloud-native security solutions and the integration of AI for predictive threat intelligence will further solidify the market's expansion. The increasing regulatory focus on cybersecurity across all member states will continue to drive demand for advanced and compliant firewall technologies. Strategic alliances between technology providers and the proliferation of managed security services will democratize access to robust firewall protection, particularly for SMEs. The market is expected to witness sustained double-digit growth, driven by the imperative to protect increasingly complex and distributed digital infrastructures from evolving cyber threats.

Europe Enterprise Firewall Industry Segmentation

-

1. Type of Deployment

- 1.1. On-premises

- 1.2. Cloud

-

2. Solution

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Size of the Organization

- 3.1. Small to Medium Organizations

- 3.2. Large Organizations

-

4. End-User Verticals

- 4.1. Healthcare

- 4.2. Manufacturing

- 4.3. Government

- 4.4. Retail

- 4.5. Education

- 4.6. Financial Services

- 4.7. Other End-User Verticals

Europe Enterprise Firewall Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Enterprise Firewall Industry Regional Market Share

Geographic Coverage of Europe Enterprise Firewall Industry

Europe Enterprise Firewall Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing adoption of Cloud Services among Enterprises; Developing Cyber Threat Environment; Increasing Awareness of Data Privacy and Consequences of Data Breaches

- 3.3. Market Restrains

- 3.3.1. Difficulty in Integrating Firewalls with Existing Network Infrastructure; Complexity of Deploying and Managing Firewalls due to Limited Expertise

- 3.4. Market Trends

- 3.4.1. Increasing adoption of Cloud Services among Enterprises to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Enterprise Firewall Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 5.1.1. On-premises

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Solution

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Size of the Organization

- 5.3.1. Small to Medium Organizations

- 5.3.2. Large Organizations

- 5.4. Market Analysis, Insights and Forecast - by End-User Verticals

- 5.4.1. Healthcare

- 5.4.2. Manufacturing

- 5.4.3. Government

- 5.4.4. Retail

- 5.4.5. Education

- 5.4.6. Financial Services

- 5.4.7. Other End-User Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Deployment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Check Point Software Technologies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fortinet Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cisco Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Hewlett-Packard Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Juniper Networks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WatchGuard Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dell Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Netasq SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Palo Alto Networks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 McAfee (Intel Security Group)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sophos Group PLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SonicWall Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Huawei Technologies Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Check Point Software Technologies

List of Figures

- Figure 1: Europe Enterprise Firewall Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Enterprise Firewall Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Enterprise Firewall Industry Revenue Million Forecast, by Type of Deployment 2020 & 2033

- Table 2: Europe Enterprise Firewall Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 3: Europe Enterprise Firewall Industry Revenue Million Forecast, by Size of the Organization 2020 & 2033

- Table 4: Europe Enterprise Firewall Industry Revenue Million Forecast, by End-User Verticals 2020 & 2033

- Table 5: Europe Enterprise Firewall Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Enterprise Firewall Industry Revenue Million Forecast, by Type of Deployment 2020 & 2033

- Table 7: Europe Enterprise Firewall Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 8: Europe Enterprise Firewall Industry Revenue Million Forecast, by Size of the Organization 2020 & 2033

- Table 9: Europe Enterprise Firewall Industry Revenue Million Forecast, by End-User Verticals 2020 & 2033

- Table 10: Europe Enterprise Firewall Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Enterprise Firewall Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Enterprise Firewall Industry?

The projected CAGR is approximately 9.95%.

2. Which companies are prominent players in the Europe Enterprise Firewall Industry?

Key companies in the market include Check Point Software Technologies, Fortinet Inc, Cisco Systems Inc, The Hewlett-Packard Company, Juniper Networks, WatchGuard Technologies, Dell Inc, Netasq SA, Palo Alto Networks, McAfee (Intel Security Group), Sophos Group PLC, SonicWall Inc, Huawei Technologies Inc.

3. What are the main segments of the Europe Enterprise Firewall Industry?

The market segments include Type of Deployment, Solution, Size of the Organization, End-User Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing adoption of Cloud Services among Enterprises; Developing Cyber Threat Environment; Increasing Awareness of Data Privacy and Consequences of Data Breaches.

6. What are the notable trends driving market growth?

Increasing adoption of Cloud Services among Enterprises to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Difficulty in Integrating Firewalls with Existing Network Infrastructure; Complexity of Deploying and Managing Firewalls due to Limited Expertise.

8. Can you provide examples of recent developments in the market?

June 2023: SonicWall launched monthly firewall security services packages available for authorized Managed Service Providers (MSPs) and Managed Security Service Providers (MSSPs). The Capture Advanced Threat Protection (ATP) sandbox service, the patented Real-Time Deep Memory Inspection (RTDMI), intrusion prevention and application control, content filtering and reporting capabilities, as well as several other essential firewall security services, are all included in the SonicWall protection suites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Enterprise Firewall Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Enterprise Firewall Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Enterprise Firewall Industry?

To stay informed about further developments, trends, and reports in the Europe Enterprise Firewall Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence