Key Insights

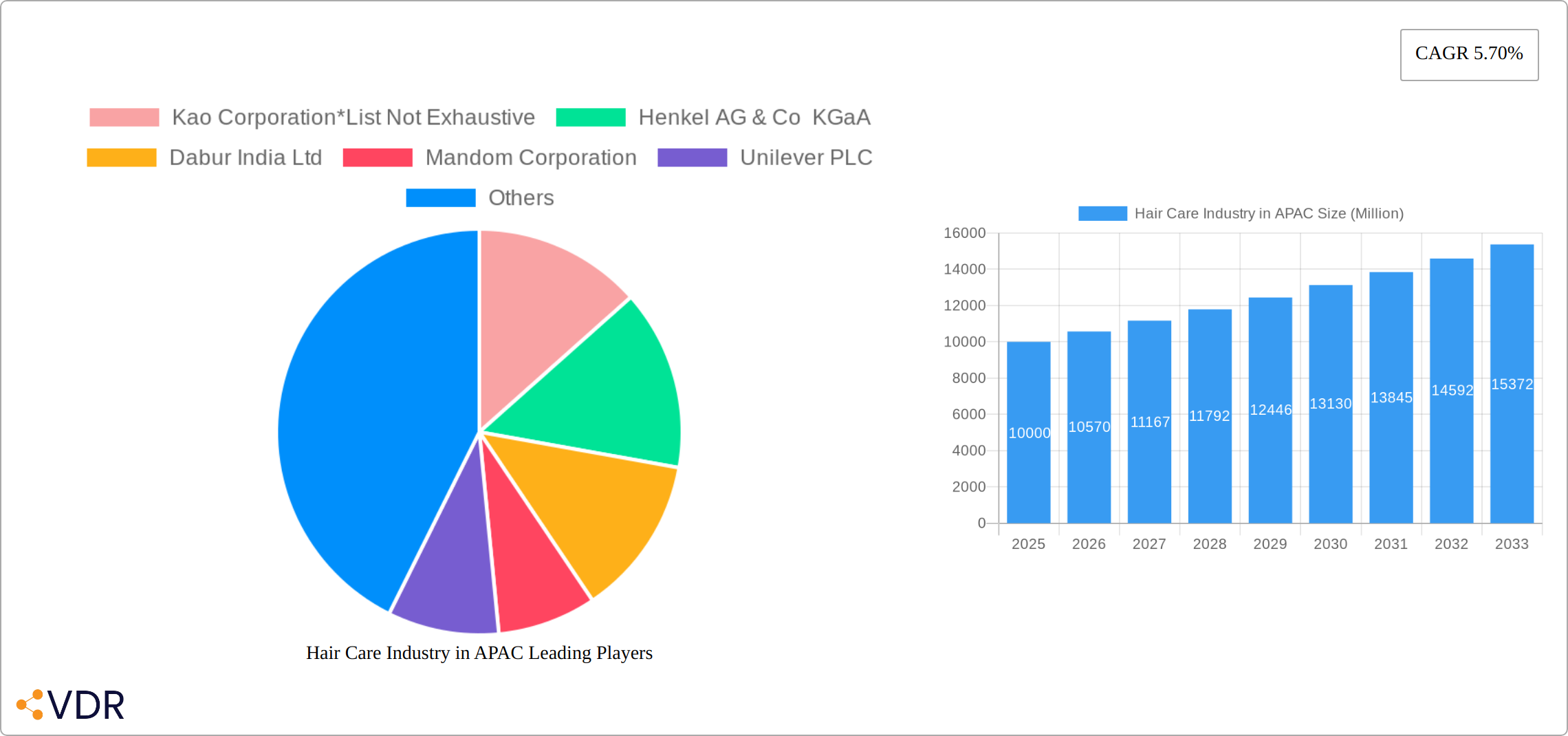

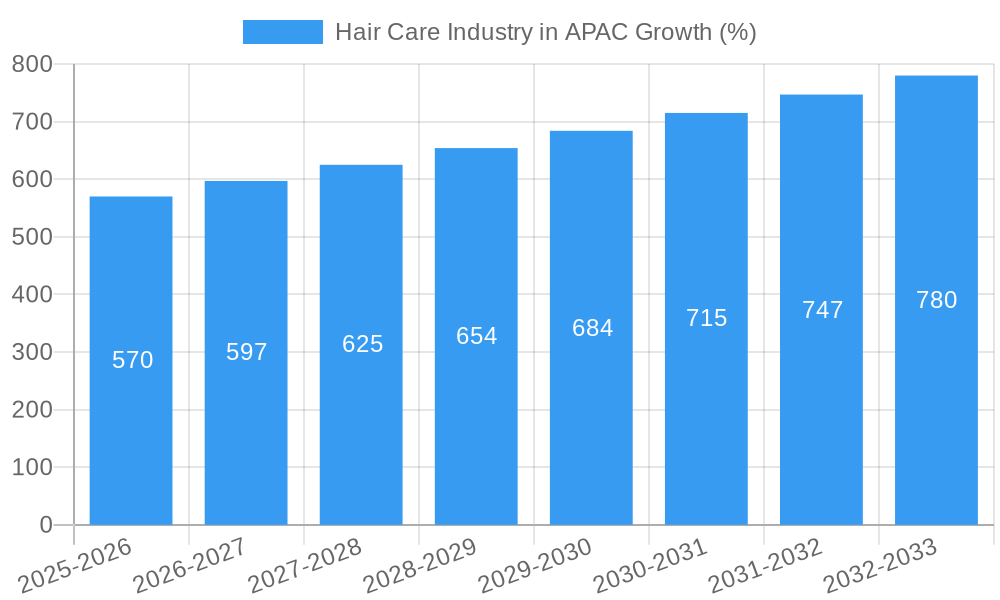

The Asia-Pacific (APAC) hair care market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.70% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across the region, particularly in burgeoning economies like India and China, are empowering consumers to invest more in premium hair care products. Furthermore, increasing awareness of hair health and the growing popularity of natural and organic hair care formulations are significantly impacting consumer choices. The shift towards online retail channels offers convenience and wider product access, bolstering market growth. Specific product segments like hair oils and shampoos are expected to lead the growth, driven by strong demand for effective hair solutions. However, the market faces some constraints. Fluctuating raw material prices and intense competition among established and emerging players pose challenges. Moreover, varying consumer preferences across diverse APAC markets necessitate tailored product offerings and marketing strategies. The segmentation within the APAC hair care market is significant; supermarkets and hypermarkets dominate distribution, followed by specialty stores and the rapidly expanding online retail sector. Leading players like Kao Corporation, Unilever PLC, and L'Oréal SA are leveraging their established brands and strong distribution networks to maintain market share, while smaller, niche brands are focusing on specialized products catering to particular consumer needs.

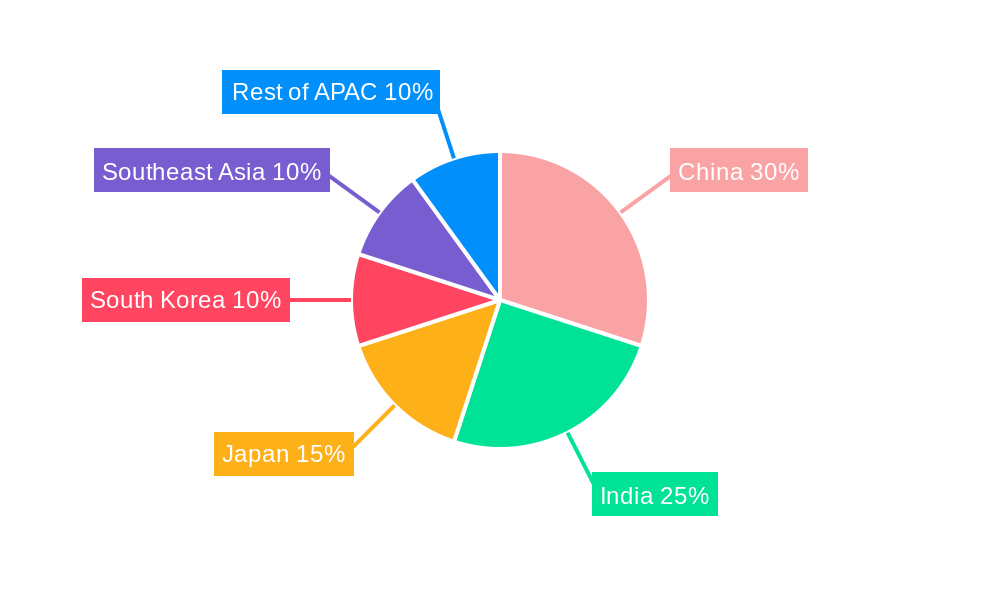

The projected market size for 2033 can be estimated by applying the CAGR to the 2025 value. Given the 5.70% CAGR and assuming a 2025 market size of $XX million (this value needs to be provided to calculate the 2033 size precisely), the market is poised for substantial expansion by 2033. Regional variations within APAC are also noteworthy. Countries such as China, India, and Japan are key contributors to market growth, owing to their large populations and expanding middle classes. However, other markets, like Southeast Asia, present significant growth opportunities as consumer awareness and disposable income continue to rise. This suggests a diversified approach to market penetration is necessary for success within the APAC hair care sector. The competitive landscape is dynamic, with both global giants and local players vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns.

Hair Care Industry in APAC: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Hair Care industry in the Asia-Pacific (APAC) region, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth trends, key players, and future opportunities, empowering businesses to make informed strategic decisions. The report uses 2025 as the base year and provides forecasts until 2033, with historical data spanning 2019-2024. Market values are presented in million units.

Hair Care Industry in APAC Market Dynamics & Structure

The APAC hair care market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with several multinational players alongside a significant number of regional and local brands. Technological innovation, particularly in natural and organic formulations, plays a key role, while regulatory frameworks concerning ingredients and labeling vary across countries. Competitive pressures stem from substitute products like homemade remedies and the emergence of direct-to-consumer brands. The demographic landscape, marked by a growing young population and increasing disposable incomes in several nations, significantly impacts demand. M&A activity has been relatively steady, with larger companies strategically acquiring smaller, specialized brands to expand their product portfolios.

- Market Concentration: Moderately concentrated, with a mix of global and regional players. The top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: Focus on natural ingredients, sustainable packaging, and personalized hair care solutions.

- Regulatory Landscape: Varied across countries, impacting product formulation and labeling requirements.

- Competitive Substitutes: Homemade remedies and emerging direct-to-consumer brands pose challenges.

- End-User Demographics: Growing young population and rising disposable incomes fuel demand.

- M&A Trends: Strategic acquisitions by larger players to expand product portfolios and market reach. Approximate xx M&A deals annually in the historical period.

Hair Care Industry in APAC Growth Trends & Insights

The APAC hair care market experienced significant growth during the historical period (2019-2024). Driven by increasing disposable incomes, rising awareness of hair health, and the influence of social media, the market witnessed a Compound Annual Growth Rate (CAGR) of xx% during this period. This growth is further propelled by the expanding adoption of premium and specialized hair care products, particularly in urban areas. Technological disruptions, such as the introduction of innovative formulations and personalized solutions, are reshaping consumer preferences and creating new market segments. Consumer behavior is shifting towards natural and organic products, sustainably sourced ingredients, and greater transparency in product information. Market penetration for premium hair care products is increasing at a CAGR of xx% , while overall market penetration is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Hair Care Industry in APAC

Within the APAC region, China and India emerged as the dominant markets for hair care products, fueled by large populations, rapidly expanding middle classes, and increasing consumer spending on personal care. The shampoo segment holds the largest market share within product types, followed by hair conditioners and hair oils. In terms of distribution channels, supermarkets/hypermarkets hold the dominant share, followed by specialty stores and a rapidly growing online retail segment. Key factors driving regional growth include robust economic policies encouraging consumer spending, expanding retail infrastructure supporting wider product availability, and rising awareness regarding hair health and beauty among consumers.

- Leading Regions: China and India drive the market's growth.

- Leading Product Type: Shampoo (xx million units in 2025) followed by conditioners (xx million units in 2025)

- Leading Distribution Channel: Supermarkets/Hypermarkets (xx million units in 2025) followed by online retail (xx million units in 2025).

- Growth Drivers: Rising disposable incomes, expanding retail infrastructure, and increasing consumer awareness.

Hair Care Industry in APAC Product Landscape

The APAC hair care market displays a diverse product landscape, featuring traditional and innovative formulations. Products cater to a wide range of hair types and concerns, with an increasing focus on natural and organic ingredients, personalized solutions, and sustainable packaging. Recent innovations include waterless shampoos, scalp care products, and hair treatments infused with technologically advanced ingredients. These products frequently highlight unique selling propositions such as natural origin, specific hair type targeting, and convenient application methods. The market is also witnessing growth in products catering to specific ethnic hair types, reflecting the diverse population of the APAC region.

Key Drivers, Barriers & Challenges in Hair Care Industry in APAC

Key drivers include rising disposable incomes, expanding middle class, increasing awareness of hair care, and growing demand for premium and specialized hair care products. Technological advancements are also driving innovation in product formulation, packaging, and distribution. Favorable government policies promoting domestic manufacturing and consumption contribute positively to market growth.

Challenges include price volatility of raw materials, intense competition among both domestic and international brands, and evolving consumer preferences. Stringent regulatory requirements in some countries might present hurdles for certain products. Supply chain disruptions can affect production and distribution, while counterfeiting poses a significant threat.

Emerging Opportunities in Hair Care Industry in APAC

Significant untapped potential exists within the market for niche hair care products catering to specialized needs, such as color-safe shampoos, natural hair treatments, and products specifically designed for different ethnic hair types. The rise of e-commerce presents an opportunity to reach wider consumer base and deliver personalized shopping experience. The growing focus on sustainability and eco-friendly practices presents chances to promote products with environmentally friendly formulations and packaging.

Growth Accelerators in the Hair Care Industry in APAC Industry

Strategic partnerships and collaborations between brands and technology companies are driving innovation and efficiency across the value chain. Technological breakthroughs in product formulation and packaging can improve product quality and extend shelf life. Market expansion strategies, such as entering new markets or reaching previously untapped consumer segments, are key to accelerating long-term growth.

Key Players Shaping the Hair Care Industry in APAC Market

- Kao Corporation

- Henkel AG & Co KGaA

- Dabur India Ltd

- Mandom Corporation

- Unilever PLC

- L'Oreal SA

- Marico Limited

- The Procter & Gamble Company

- Hoyu Co Ltd

- Bajaj Consumer Care Ltd

Notable Milestones in Hair Care Industry in APAC Sector

- April 2022: Kao launched a waterless dry shampoo sheet.

- February 2022: Dabur India Ltd launched Virgin Coconut Oil.

- March 2021: Dabur India launched a premium shampoo line under the Dabur Vatika Select brand.

In-Depth Hair Care Industry in APAC Market Outlook

The future of the APAC hair care market is bright, with sustained growth projected over the forecast period (2025-2033). The ongoing rise of disposable incomes, increased consumer awareness, and continuous innovation within the industry will drive strong market expansion. Strategic partnerships, technological advancements, and effective market expansion strategies are crucial for companies to capitalize on the significant growth opportunities.

Hair Care Industry in APAC Segmentation

-

1. Product Type

- 1.1. Colorant

- 1.2. Hair Spray

- 1.3. Conditioner

- 1.4. Styling Gel

- 1.5. Hair Oil

- 1.6. Shampoo

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Speciality Stores

- 2.3. Online Retail Stores

- 2.4. Pharmacy and Drug Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Japan

- 3.2. China

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Hair Care Industry in APAC Segmentation By Geography

- 1. Japan

- 2. China

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Hair Care Industry in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure

- 3.3. Market Restrains

- 3.3.1. Prevalence of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic/Herbal Hair Care Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Colorant

- 5.1.2. Hair Spray

- 5.1.3. Conditioner

- 5.1.4. Styling Gel

- 5.1.5. Hair Oil

- 5.1.6. Shampoo

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Speciality Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Pharmacy and Drug Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.4.2. China

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Japan Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Colorant

- 6.1.2. Hair Spray

- 6.1.3. Conditioner

- 6.1.4. Styling Gel

- 6.1.5. Hair Oil

- 6.1.6. Shampoo

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Speciality Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Pharmacy and Drug Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Japan

- 6.3.2. China

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. China Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Colorant

- 7.1.2. Hair Spray

- 7.1.3. Conditioner

- 7.1.4. Styling Gel

- 7.1.5. Hair Oil

- 7.1.6. Shampoo

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Speciality Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Pharmacy and Drug Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Japan

- 7.3.2. China

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Colorant

- 8.1.2. Hair Spray

- 8.1.3. Conditioner

- 8.1.4. Styling Gel

- 8.1.5. Hair Oil

- 8.1.6. Shampoo

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Speciality Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Pharmacy and Drug Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Japan

- 8.3.2. China

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Colorant

- 9.1.2. Hair Spray

- 9.1.3. Conditioner

- 9.1.4. Styling Gel

- 9.1.5. Hair Oil

- 9.1.6. Shampoo

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Speciality Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Pharmacy and Drug Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Japan

- 9.3.2. China

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Colorant

- 10.1.2. Hair Spray

- 10.1.3. Conditioner

- 10.1.4. Styling Gel

- 10.1.5. Hair Oil

- 10.1.6. Shampoo

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Speciality Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Pharmacy and Drug Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Japan

- 10.3.2. China

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. China Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 12. Japan Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 13. India Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 15. Southeast Asia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 16. Australia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 17. Indonesia Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 18. Phillipes Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 19. Singapore Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 20. Thailandc Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 21. Rest of Asia Pacific Hair Care Industry in APAC Analysis, Insights and Forecast, 2019-2031

- 22. Competitive Analysis

- 22.1. Market Share Analysis 2024

- 22.2. Company Profiles

- 22.2.1 Kao Corporation*List Not Exhaustive

- 22.2.1.1. Overview

- 22.2.1.2. Products

- 22.2.1.3. SWOT Analysis

- 22.2.1.4. Recent Developments

- 22.2.1.5. Financials (Based on Availability)

- 22.2.2 Henkel AG & Co KGaA

- 22.2.2.1. Overview

- 22.2.2.2. Products

- 22.2.2.3. SWOT Analysis

- 22.2.2.4. Recent Developments

- 22.2.2.5. Financials (Based on Availability)

- 22.2.3 Dabur India Ltd

- 22.2.3.1. Overview

- 22.2.3.2. Products

- 22.2.3.3. SWOT Analysis

- 22.2.3.4. Recent Developments

- 22.2.3.5. Financials (Based on Availability)

- 22.2.4 Mandom Corporation

- 22.2.4.1. Overview

- 22.2.4.2. Products

- 22.2.4.3. SWOT Analysis

- 22.2.4.4. Recent Developments

- 22.2.4.5. Financials (Based on Availability)

- 22.2.5 Unilever PLC

- 22.2.5.1. Overview

- 22.2.5.2. Products

- 22.2.5.3. SWOT Analysis

- 22.2.5.4. Recent Developments

- 22.2.5.5. Financials (Based on Availability)

- 22.2.6 L'Oreal SA

- 22.2.6.1. Overview

- 22.2.6.2. Products

- 22.2.6.3. SWOT Analysis

- 22.2.6.4. Recent Developments

- 22.2.6.5. Financials (Based on Availability)

- 22.2.7 Marico Limited

- 22.2.7.1. Overview

- 22.2.7.2. Products

- 22.2.7.3. SWOT Analysis

- 22.2.7.4. Recent Developments

- 22.2.7.5. Financials (Based on Availability)

- 22.2.8 The Procter & Gamble Company

- 22.2.8.1. Overview

- 22.2.8.2. Products

- 22.2.8.3. SWOT Analysis

- 22.2.8.4. Recent Developments

- 22.2.8.5. Financials (Based on Availability)

- 22.2.9 Hoyu Co Ltd

- 22.2.9.1. Overview

- 22.2.9.2. Products

- 22.2.9.3. SWOT Analysis

- 22.2.9.4. Recent Developments

- 22.2.9.5. Financials (Based on Availability)

- 22.2.10 Bajaj Consumer Care Ltd

- 22.2.10.1. Overview

- 22.2.10.2. Products

- 22.2.10.3. SWOT Analysis

- 22.2.10.4. Recent Developments

- 22.2.10.5. Financials (Based on Availability)

- 22.2.1 Kao Corporation*List Not Exhaustive

List of Figures

- Figure 1: Hair Care Industry in APAC Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Hair Care Industry in APAC Share (%) by Company 2024

List of Tables

- Table 1: Hair Care Industry in APAC Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Hair Care Industry in APAC Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Southeast Asia Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Indonesia Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Phillipes Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Singapore Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Thailandc Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Hair Care Industry in APAC Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Hair Care Industry in APAC Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Hair Care Industry in APAC Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Hair Care Industry in APAC Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Hair Care Industry in APAC Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hair Care Industry in APAC?

The projected CAGR is approximately 5.70%.

2. Which companies are prominent players in the Hair Care Industry in APAC?

Key companies in the market include Kao Corporation*List Not Exhaustive, Henkel AG & Co KGaA, Dabur India Ltd, Mandom Corporation, Unilever PLC, L'Oreal SA, Marico Limited, The Procter & Gamble Company, Hoyu Co Ltd, Bajaj Consumer Care Ltd.

3. What are the main segments of the Hair Care Industry in APAC?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure.

6. What are the notable trends driving market growth?

Increasing Demand for Organic/Herbal Hair Care Products.

7. Are there any restraints impacting market growth?

Prevalence of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

In April 2022, Kao launched a waterless dry shampoo sheet that was originally created for use in space. In response to the rising need for portable dry shampoos, Merit launched waterless dry shampoo, which included a shampoo sheet design originally created for use in space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hair Care Industry in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hair Care Industry in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hair Care Industry in APAC?

To stay informed about further developments, trends, and reports in the Hair Care Industry in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence