Key Insights

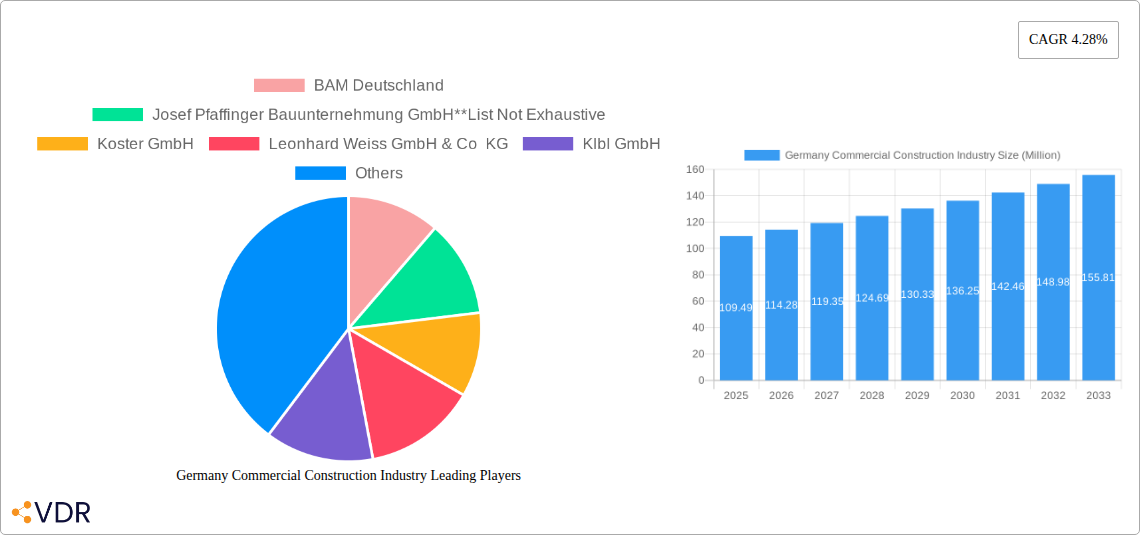

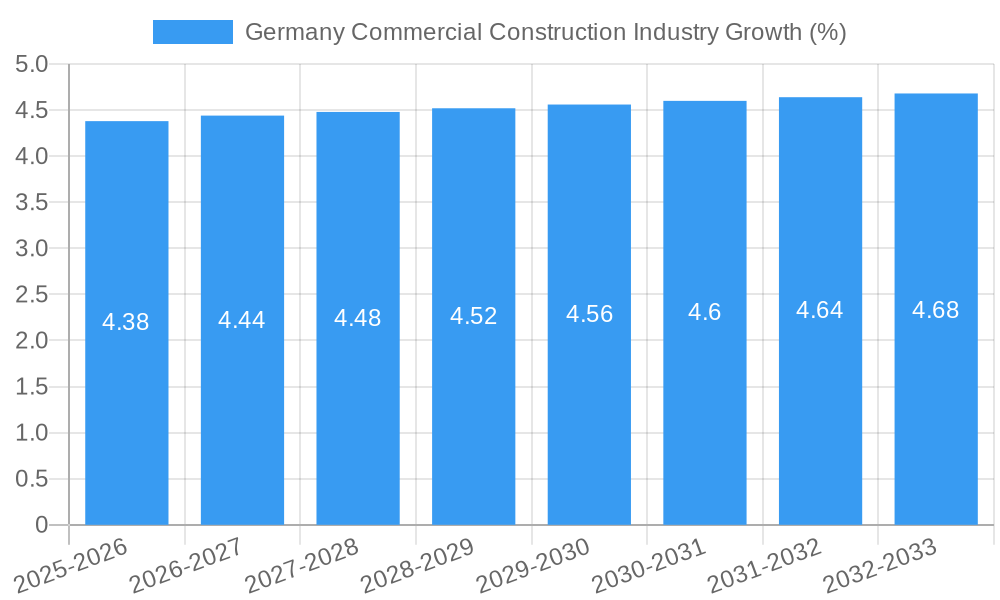

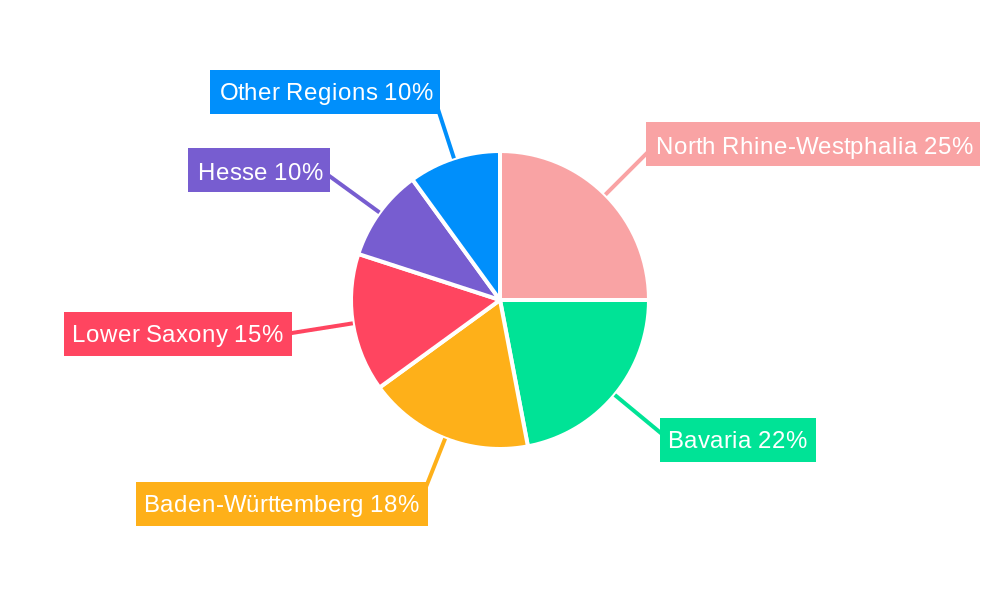

The German commercial construction industry, valued at €109.49 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.28% from 2025 to 2033. This growth is driven by several key factors. Firstly, a robust German economy, particularly in key sectors like technology and logistics, fuels demand for new office spaces and industrial facilities. Secondly, increasing urbanization and a growing population in major cities like Munich, Berlin, and Frankfurt necessitate the construction of new residential and commercial buildings. Thirdly, government initiatives promoting sustainable construction practices and energy efficiency are stimulating investment in eco-friendly building projects. The industry is segmented by building type, with office building construction, retail construction, and hospitality construction representing significant portions of the market. Leading companies like Strabag AG, BAM Deutschland, and others are key players, competing in a landscape characterized by both large multinational firms and smaller, regional contractors. However, challenges such as material cost fluctuations, skilled labor shortages, and potential economic slowdowns could temper growth in the coming years. Regional variations exist, with North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse being major contributors to the overall market.

The forecast period (2025-2033) anticipates continued expansion, though the rate may fluctuate slightly depending on macroeconomic conditions. The segment breakdown shows a diverse market, with the relative strength of each sector influenced by prevailing economic trends and investment patterns. For instance, a boom in e-commerce might positively impact retail construction, while a downturn in tourism could affect hospitality projects. Strategic collaborations, technological advancements (e.g., Building Information Modeling – BIM), and a focus on sustainability will likely shape the future competitive landscape. Monitoring these dynamic factors is crucial for predicting long-term growth and profitability in the German commercial construction sector.

Germany Commercial Construction Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Germany commercial construction industry, covering market dynamics, growth trends, key players, and future outlook from 2019 to 2033. The report utilizes data from the historical period (2019-2024), the base year (2025), and an estimated year (2025), to forecast market trends through 2033. This analysis delves into specific segments like office, retail, hospitality, and institutional construction, providing crucial insights for industry professionals, investors, and stakeholders.

Germany Commercial Construction Industry Market Dynamics & Structure

The German commercial construction market exhibits a moderately concentrated structure, with several large players dominating alongside a significant number of smaller firms. Market concentration is estimated at xx% in 2025, with the top 5 players holding approximately xx% market share. Technological innovation, particularly in sustainable building materials and construction methods (e.g., BIM, modular construction), is a key driver. However, high initial investment costs and a lack of skilled labor present challenges to widespread adoption. Stringent building codes and environmental regulations create a complex regulatory framework, influencing material choices and construction practices. The market witnesses competition from alternative building solutions, such as prefabricated structures and repurposed spaces. Demographic shifts, including urbanization and changing work patterns, impact demand for different commercial building types. M&A activity in the sector has seen xx deals valued at €xx million in the last 5 years, primarily driven by consolidation and expansion efforts.

- Market Concentration: xx% in 2025 (Top 5 players: xx%)

- Technological Drivers: BIM, modular construction, sustainable materials

- Regulatory Framework: Stringent building codes, environmental regulations

- Competitive Substitutes: Prefabricated structures, repurposed spaces

- End-User Demographics: Urbanization, changing work patterns

- M&A Activity: xx deals, €xx million (2020-2024)

Germany Commercial Construction Industry Growth Trends & Insights

The German commercial construction market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of €xx million in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching €xx million by 2033. Market penetration of sustainable building practices is gradually increasing, driven by both environmental concerns and government incentives. Technological disruptions, such as the introduction of advanced construction technologies and digital platforms like Schuttflix, are streamlining processes and improving efficiency. Consumer behavior shifts, including a preference for sustainable and smart buildings, are influencing demand and design. The market is expected to show resilience despite economic fluctuations, driven by continued investment in infrastructure and the need for modern commercial spaces.

Dominant Regions, Countries, or Segments in Germany Commercial Construction Industry

The Office Building Construction segment is the largest within the German Commercial Construction sector, accounting for approximately xx% of the market in 2025. This dominance stems from strong demand driven by the thriving German economy and the need for modern workspaces in major cities. Growth is fueled by factors such as increasing corporate investments, expanding tech sectors, and government initiatives to improve urban infrastructure.

- Key Drivers:

- Strong German economy

- Demand for modern workspaces

- Corporate investments

- Government infrastructure initiatives

- Dominance Factors:

- Largest segment by market share (xx%)

- High growth potential in major urban centers

- Strong demand across various sub-segments (e.g., co-working spaces)

Germany Commercial Construction Industry Product Landscape

The German commercial construction industry is characterized by a diverse product landscape encompassing a wide range of building materials, technologies, and construction methods. Innovation is evident in sustainable building materials like timber and recycled content, smart building technologies like IoT integration for energy efficiency, and advanced construction methods such as 3D printing and prefabrication. These advancements deliver enhanced durability, energy efficiency, and cost-effectiveness, contributing to increased building quality and project speed. Unique selling propositions increasingly focus on sustainability, smart technology integration, and tailored solutions for specific client needs.

Key Drivers, Barriers & Challenges in Germany Commercial Construction Industry

Key Drivers:

The German commercial construction market is propelled by a strong economy, increased investments in infrastructure projects, and growing demand for modern commercial buildings fueled by urbanisation and technological advancements. Government incentives for sustainable buildings further accelerate market growth.

Challenges & Restraints:

Key challenges include rising material costs (xx% increase in 2024 compared to 2019), skilled labor shortages, and supply chain disruptions causing project delays and cost overruns (estimated at an average of xx% per project in 2024). Furthermore, navigating the complex regulatory framework adds complexity and delays to construction projects. Increased competition from both domestic and international firms further presents a challenge.

Emerging Opportunities in Germany Commercial Construction Industry

Emerging opportunities lie in the increasing demand for sustainable and energy-efficient buildings, the integration of smart technologies, and the growing adoption of modular and prefabricated construction methods. Expansion into underserved markets, such as smaller cities and rural areas, also presents significant potential. Further opportunities exist in meeting the rising demand for specialized facilities like data centers and healthcare infrastructure.

Growth Accelerators in the Germany Commercial Construction Industry

Long-term growth will be driven by continuous technological innovation in construction materials and techniques, strategic partnerships between construction firms and technology providers, and expansion into new markets and building segments. Government initiatives promoting sustainable construction and urban regeneration will play a significant role in accelerating market growth. Improved supply chain efficiency and addressing the skilled labor shortage will further enhance market development.

Key Players Shaping the Germany Commercial Construction Industry Market

- BAM Deutschland

- Josef Pfaffinger Bauunternehmung GmbH

- Koster GmbH

- Leonhard Weiss GmbH & Co KG

- Klbl GmbH

- Strabag AG

- AUG PRIEN Bauunternehmung (GmbH & Co KG)

- Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- Gottlob Brodbeck GmbH & Co KG

- Dechant hoch- und ingenieurbau gmbh

Notable Milestones in Germany Commercial Construction Industry Sector

- August 2023: Schuttflix secures €45 million in funding, boosting digitalization in the construction supply chain.

- April 2023: Premier Inn's expansion into the German market with planned additions of 1,000-1,500 hotel rooms indicates growing hospitality sector investment.

In-Depth Germany Commercial Construction Industry Market Outlook

The German commercial construction industry is poised for continued growth driven by the robust economy, increasing urbanization, and the growing adoption of sustainable and innovative building solutions. Strategic partnerships, technological advancements, and government support will fuel market expansion, presenting significant opportunities for investors and industry players. Addressing challenges such as material costs and labor shortages will be crucial for realizing the industry's full potential.

Germany Commercial Construction Industry Segmentation

-

1. Type

- 1.1. Office Building Construction

- 1.2. Retail Construction

- 1.3. Hospitality Construction

- 1.4. Institutional Construction

- 1.5. Other Types

Germany Commercial Construction Industry Segmentation By Geography

- 1. Germany

Germany Commercial Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.28% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Green buildings is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office Building Construction

- 5.1.2. Retail Construction

- 5.1.3. Hospitality Construction

- 5.1.4. Institutional Construction

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North Rhine-Westphalia Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Commercial Construction Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BAM Deutschland

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Koster GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leonhard Weiss GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Klbl GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Strabag AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AUG PRIEN Bauunternehmung (GmbH & Co KG)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldbeck Ost GmbH Niederlassung Sachsen-Plauen

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gottlob Brodbeck GmbH & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dechant hoch- und ingenieurbau gmbh

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 BAM Deutschland

List of Figures

- Figure 1: Germany Commercial Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Commercial Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Germany Commercial Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North Rhine-Westphalia Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Bavaria Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Baden-Württemberg Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Lower Saxony Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Hesse Germany Commercial Construction Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Commercial Construction Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Germany Commercial Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Commercial Construction Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Germany Commercial Construction Industry?

Key companies in the market include BAM Deutschland, Josef Pfaffinger Bauunternehmung GmbH**List Not Exhaustive, Koster GmbH, Leonhard Weiss GmbH & Co KG, Klbl GmbH, Strabag AG, AUG PRIEN Bauunternehmung (GmbH & Co KG), Goldbeck Ost GmbH Niederlassung Sachsen-Plauen, Gottlob Brodbeck GmbH & Co KG, Dechant hoch- und ingenieurbau gmbh.

3. What are the main segments of the Germany Commercial Construction Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Increasing Investments in Green buildings is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2023: Gutersloh-based Schuttflix, a German digital marketplace and delivery platform for bulk construction supplies, announced that it had secured EUR 45 million (USD 47.37 million) in a fresh round of funding. Schuttflix says it will use the funds to enhance its technology, expand into new markets, diversify services, form partnerships, attract top talent, invest in marketing, prioritize customer support, and contribute to sustainability efforts in the construction sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Commercial Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Commercial Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Commercial Construction Industry?

To stay informed about further developments, trends, and reports in the Germany Commercial Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence