Key Insights

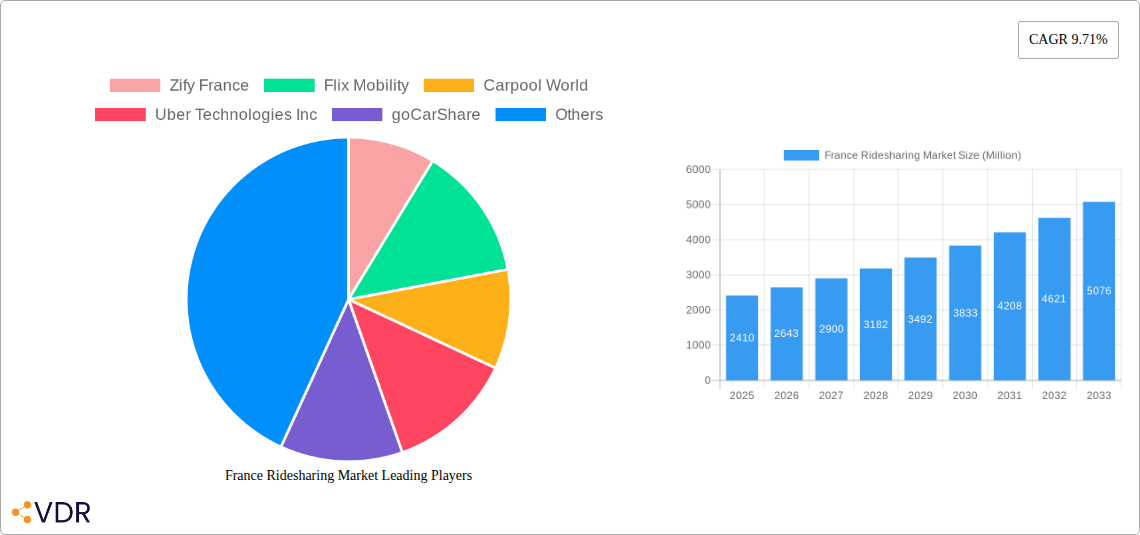

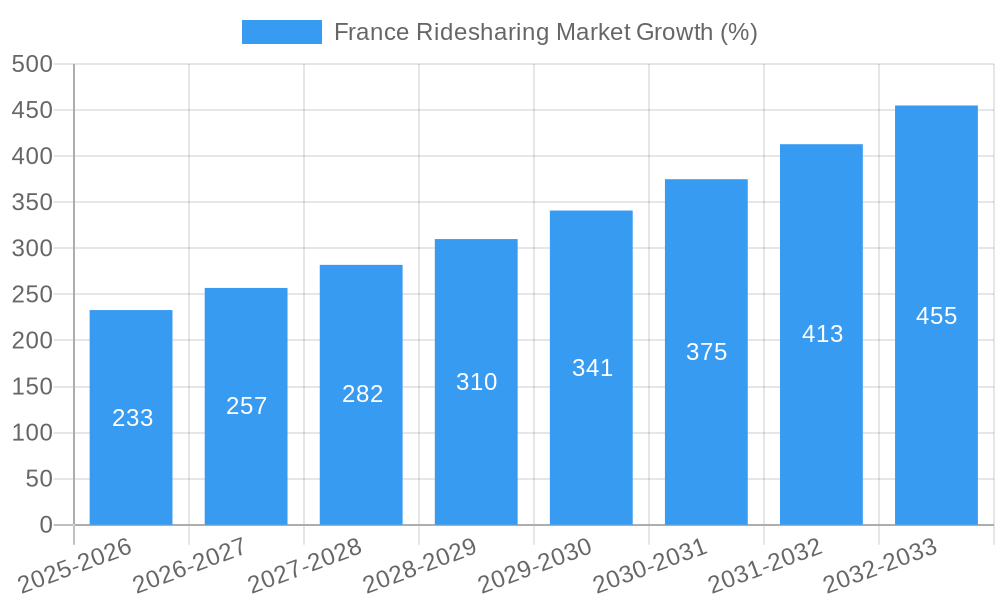

The French ridesharing market, valued at €2.41 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.71% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization in France leads to higher demand for convenient and affordable transportation alternatives, especially within and between major cities. Furthermore, rising fuel prices and environmental concerns are driving consumers towards shared mobility options, reducing individual car ownership. The increasing adoption of smartphones and readily available mobile applications further enhances the accessibility and convenience of ridesharing services. The market is segmented by membership type (fixed, dynamic, and corporate), catering to diverse user needs and preferences. Competition is fierce, with established players like Uber Technologies Inc and BlaBlaCar vying for market share alongside local companies such as Zify France, Flix Mobility, Carpool World, goCarShare, and Mobicoop (Roulexmalin). These companies continuously innovate, introducing new features and pricing models to attract and retain customers.

Despite this positive outlook, certain challenges remain. Regulatory hurdles and concerns regarding driver safety and employment status persist. Fluctuations in fuel prices can also impact operational costs and profitability for ridesharing companies. Moreover, increasing competition could lead to price wars and reduced profit margins. However, the overall market trajectory suggests a continued upward trend, with the potential for significant expansion driven by technological advancements, evolving consumer preferences, and strategic partnerships within the industry. Strategic collaborations between ridesharing platforms and public transportation systems could further enhance the market's growth by creating a seamless and integrated multimodal transport network.

This in-depth report provides a comprehensive analysis of the France Ridesharing Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a focus on key segments like Fixed, Dynamic, and Corporate memberships, this report is an essential resource for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year.

France Ridesharing Market Dynamics & Structure

The French ridesharing market is characterized by a blend of established international players and agile local startups. Market concentration is moderate, with Uber Technologies Inc, BlaBlaCar, and FlixMobility holding significant shares, while smaller players like Zify France, goCarShare, and Mobicoop (Roulexmalin) compete for niche segments. Technological innovation, particularly in autonomous vehicle technology and mobile app development, is a key driver, yet regulatory hurdles and data privacy concerns pose significant challenges. The market is also susceptible to economic fluctuations and fuel price volatility. The parent market is the broader transportation sector in France, while the child market encompasses various ride-sharing services including carpooling, ride-hailing, and corporate transportation. Recent M&A activity, such as BlaBlaCar's acquisition of Klaxit, signifies consolidation and a push for market dominance.

- Market Concentration: Moderate, with top 3 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on autonomous vehicles, improved app functionality, and enhanced safety features.

- Regulatory Framework: Stringent regulations regarding licensing, data protection, and driver employment.

- Competitive Substitutes: Public transportation, personal vehicle ownership.

- End-User Demographics: Primarily urban populations, with varying levels of adoption across age groups and income levels.

- M&A Trends: Increasing consolidation through acquisitions and mergers, aiming to expand market reach and service offerings. Deal volume estimated at xx deals in 2024.

France Ridesharing Market Growth Trends & Insights

The French ridesharing market has experienced significant growth over the past five years, driven by increasing urbanization, rising disposable incomes, and the convenience offered by ride-hailing and carpooling apps. The market size reached xx Million units in 2024 and is projected to grow at a CAGR of xx% during 2025-2033, reaching xx Million units by 2033. This growth is fueled by continuous technological improvements, expanding service offerings, and increasing consumer preference for on-demand transportation. Market penetration is currently at xx% and expected to rise to xx% by 2033. Changing consumer behavior, such as a decreased reliance on personal vehicle ownership amongst younger demographics, further contributes to the market's expansion. Technological disruptions, including the potential integration of autonomous vehicles, will reshape the landscape in the coming years.

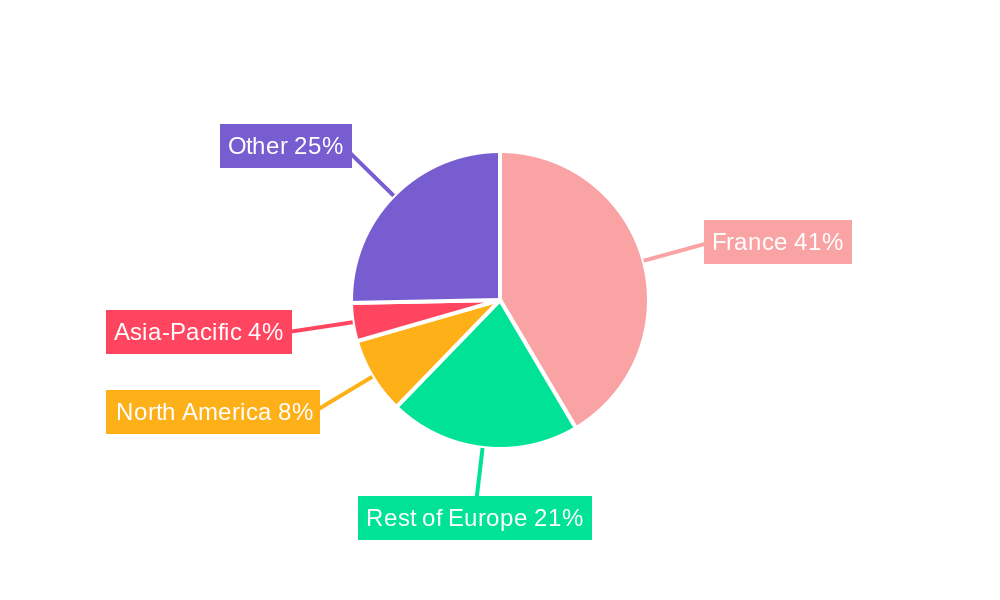

Dominant Regions, Countries, or Segments in France Ridesharing Market

The Paris region and other major metropolitan areas are the dominant segments within the French ridesharing market, driven by high population density and robust demand for efficient transportation. Within membership types, the Dynamic segment holds the largest market share, accounting for xx% in 2024, due to its flexibility and affordability. However, the Corporate segment demonstrates the highest growth potential, projected at a CAGR of xx% during the forecast period, fueled by increasing corporate adoption of ride-sharing services for employee transportation and client conveyance.

- Key Drivers:

- High population density in urban centers.

- Strong demand for convenient and affordable transportation options.

- Government initiatives supporting sustainable transportation solutions.

- Growing preference for shared mobility among younger generations.

- Dominance Factors:

- High concentration of users and service providers in major cities.

- Developed infrastructure supporting ride-sharing operations.

- Favorable regulatory environment in specific regions.

- Strong marketing and branding strategies by major players.

France Ridesharing Market Product Landscape

The French ridesharing market offers a diverse range of products, from basic ride-hailing services to sophisticated carpooling platforms with advanced features like ride-sharing, route optimization, and payment integration. Innovations focus on enhancing user experience through improved app design, personalized recommendations, and enhanced safety measures. The integration of real-time traffic data and dynamic pricing algorithms further optimizes service delivery. Unique selling propositions include premium ride options, loyalty programs, and corporate solutions tailored to specific business needs. Technological advancements such as the potential for driverless vehicles represent a significant leap forward.

Key Drivers, Barriers & Challenges in France Ridesharing Market

Key Drivers:

The market is propelled by increasing urbanization, the convenience of on-demand transportation, and growing environmental concerns promoting shared mobility. Technological advancements, such as the development of autonomous vehicles, contribute significantly. Government support for sustainable transportation also plays a vital role.

Challenges:

Regulatory uncertainty regarding driver classification and labor laws is a major hurdle. Competition from existing public transport and the high cost of operating in urban areas add pressure. Fluctuations in fuel prices, security concerns, and public perception related to safety and reliability pose further challenges.

Emerging Opportunities in France Ridesharing Market

Untapped opportunities lie in expanding services to smaller cities and rural areas, catering to specific demographic needs (e.g., elderly or disabled individuals), and developing integrated mobility solutions that combine ride-sharing with public transportation. The potential for integrating autonomous vehicles offers significant growth potential, while exploring partnerships with local businesses and tourism sectors provides additional avenues for expansion.

Growth Accelerators in the France Ridesharing Market Industry

Long-term growth is fueled by technological advancements such as autonomous vehicles and improved app functionality, strategic partnerships to expand service offerings and reach new markets, and the ongoing trend toward sustainable transportation solutions. Government initiatives supporting electric vehicle adoption and ride-sharing infrastructure also provide significant catalysts for growth.

Key Players Shaping the France Ridesharing Market Market

- Zify France

- FlixMobility

- Carpool World

- Uber Technologies Inc

- goCarShare

- Bla bla Car

- Mobicoop (Roulexmalin)

Notable Milestones in France Ridesharing Market Sector

- March 2023: BlaBlaCar acquires Klaxit, expanding its carpooling services.

- June 2023: Uber announces plans to introduce video ads in its app within France.

- July 2023: Michelin tests airless tires on French postal vans, potentially impacting autonomous ride-sharing vehicles.

In-Depth France Ridesharing Market Market Outlook

- March 2023: BlaBlaCar acquires Klaxit, expanding its carpooling services.

- June 2023: Uber announces plans to introduce video ads in its app within France.

- July 2023: Michelin tests airless tires on French postal vans, potentially impacting autonomous ride-sharing vehicles.

In-Depth France Ridesharing Market Market Outlook

The French ridesharing market holds substantial future potential, driven by continued technological innovation, evolving consumer preferences, and supportive government policies. Strategic partnerships and expansions into new markets will play crucial roles in shaping the market landscape. The integration of autonomous vehicles presents a transformative opportunity that will redefine the industry in the coming decade. The market is poised for sustained growth, driven by the ongoing trend towards shared mobility and the increasing demand for efficient and affordable transportation solutions.

France Ridesharing Market Segmentation

-

1. Membership Type

- 1.1. Fixed

- 1.2. Dynamic

- 1.3. Corporate

France Ridesharing Market Segmentation By Geography

- 1. France

France Ridesharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.71% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. France is Widely Considered to be the First Adopters of Ridesharing among major Countries in Europe; Growing Cost of Vehicle Ownership; Socio-economic and Demographic Factors are Highly Favorable to Ridesharing as the French Public is known to Rely on Shared Transport Services as one of the Key Modes of Travel; Incentives Provided by Local Agencies to Passengers and Riders of Ridesharing to Promote Development of Alternative Modes of Transport mainly Driven by Frequent Strikes by Local Train Employee Bodies; Rise in Demand for Carpool and Bike Pool Services

- 3.3. Market Restrains

- 3.3.1. Last mile connectivity remains a concern as compared to other models; Operational challenges for operators due to the dynamic nature of the industry and increasing investments in the ride hailing industry

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Carpool and Bike Pool Services is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Ridesharing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 5.1.1. Fixed

- 5.1.2. Dynamic

- 5.1.3. Corporate

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Membership Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zify France

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Flix Mobility

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carpool World

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uber Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 goCarShare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bla bla Car

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mobicoop (Roulexmalin)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Zify France

List of Figures

- Figure 1: France Ridesharing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Ridesharing Market Share (%) by Company 2024

List of Tables

- Table 1: France Ridesharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Ridesharing Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: France Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 4: France Ridesharing Market Volume K Unit Forecast, by Membership Type 2019 & 2032

- Table 5: France Ridesharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: France Ridesharing Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: France Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: France Ridesharing Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: France Ridesharing Market Revenue Million Forecast, by Membership Type 2019 & 2032

- Table 10: France Ridesharing Market Volume K Unit Forecast, by Membership Type 2019 & 2032

- Table 11: France Ridesharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: France Ridesharing Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Ridesharing Market?

The projected CAGR is approximately 9.71%.

2. Which companies are prominent players in the France Ridesharing Market?

Key companies in the market include Zify France, Flix Mobility, Carpool World, Uber Technologies Inc, goCarShare, Bla bla Car, Mobicoop (Roulexmalin).

3. What are the main segments of the France Ridesharing Market?

The market segments include Membership Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.41 Million as of 2022.

5. What are some drivers contributing to market growth?

France is Widely Considered to be the First Adopters of Ridesharing among major Countries in Europe; Growing Cost of Vehicle Ownership; Socio-economic and Demographic Factors are Highly Favorable to Ridesharing as the French Public is known to Rely on Shared Transport Services as one of the Key Modes of Travel; Incentives Provided by Local Agencies to Passengers and Riders of Ridesharing to Promote Development of Alternative Modes of Transport mainly Driven by Frequent Strikes by Local Train Employee Bodies; Rise in Demand for Carpool and Bike Pool Services.

6. What are the notable trends driving market growth?

Rise in Demand for Carpool and Bike Pool Services is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Last mile connectivity remains a concern as compared to other models; Operational challenges for operators due to the dynamic nature of the industry and increasing investments in the ride hailing industry.

8. Can you provide examples of recent developments in the market?

July 2023 - Michelin will test airless tires on French postal vans, providing more real-world experience with tire designs that could benefit EVs. Airless tires also aren't susceptible to punctures, in turn eliminating the need to change flats. That could also make them ideal for autonomous vehicles operating in ride-sharing services without human drivers onboard.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Ridesharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Ridesharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Ridesharing Market?

To stay informed about further developments, trends, and reports in the France Ridesharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence