Key Insights

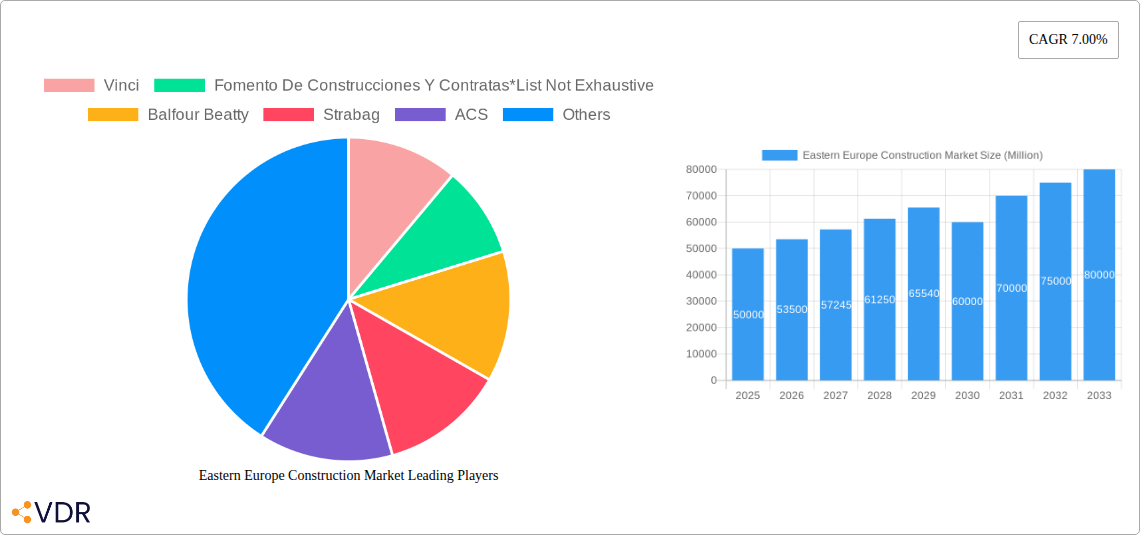

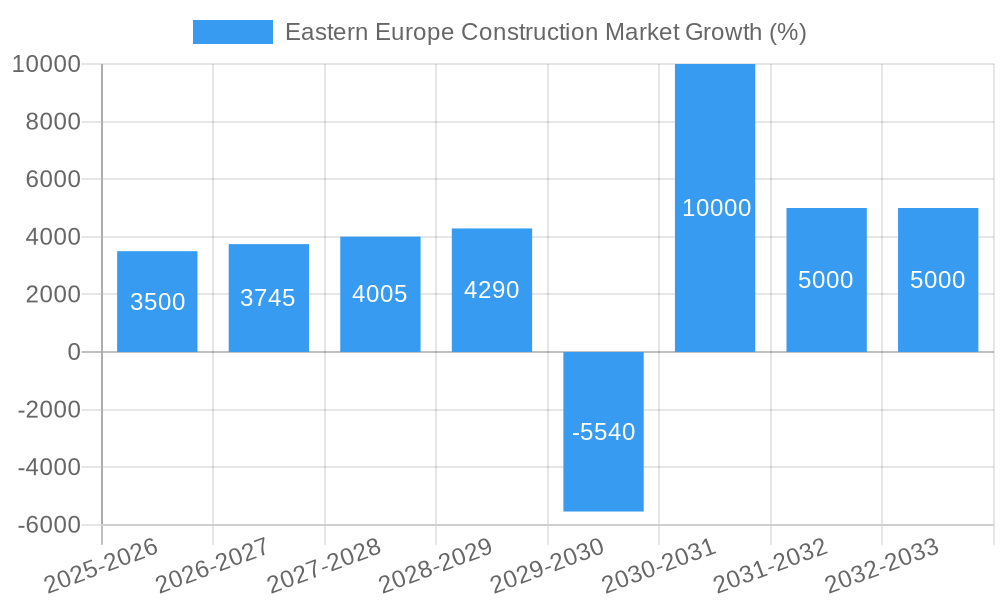

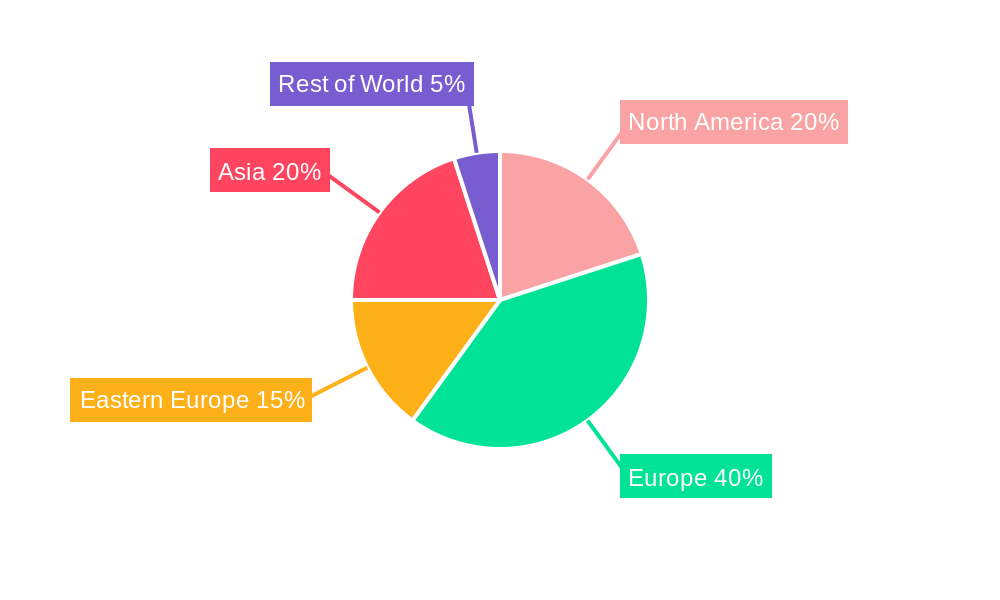

The Eastern European construction market, while lacking precise figures in the provided data, exhibits significant growth potential mirroring global trends. Considering a 7% CAGR (Compound Annual Growth Rate) for a broader region and factoring in Eastern Europe's robust infrastructure development needs and increasing urbanization, a conservative estimate places the 2025 market size at approximately $50 billion (USD). This is based on extrapolation from Western European markets of comparable size and projected growth trajectories, coupled with regional economic forecasts and construction activity indicators. Key drivers include substantial government investments in infrastructure projects (roads, railways, energy grids), a growing population in many Eastern European nations stimulating residential construction, and increasing private sector investments in commercial and industrial real estate. Trends such as sustainable construction practices (green building materials, energy efficiency) and the adoption of advanced technologies (BIM, prefabrication) are gaining momentum, shaping the future of the industry. However, challenges such as geopolitical instability in certain regions, potential labor shortages, and fluctuating material prices act as restraints, impacting overall market growth and profitability for construction companies. The segmentation mirrors Western trends, with infrastructure (transportation) and residential sectors expected to be the largest contributors to market value, followed by commercial and industrial projects. Leading companies, though potentially not the global giants listed in the provided data, will include regionally significant players specializing in specific aspects of construction, creating a competitive landscape with potential for both consolidation and expansion.

The forecast period of 2025-2033 anticipates continued expansion for the Eastern European construction market. While unpredictable events could impact the CAGR, the underlying drivers mentioned above suggest sustained growth. The market's future trajectory is directly linked to regional economic performance, policy support for infrastructure development, and the ability of construction companies to adapt to emerging technological advancements and maintain consistent productivity amidst supply chain fluctuations. Further analysis incorporating specific country-level data within Eastern Europe would provide a more granular understanding of market dynamics and opportunities within distinct segments.

Eastern Europe Construction Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Eastern Europe construction market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth trends, key players, and emerging opportunities, enabling industry professionals to make informed strategic decisions. The report segments the market by sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities) and offers a granular view of the parent market and its various child segments, delivering actionable intelligence for maximizing investment returns. The total market size in 2025 is estimated at xx Million.

Eastern Europe Construction Market Dynamics & Structure

This section analyzes the Eastern European construction market's structure, examining market concentration, technological innovation, regulatory landscapes, competitive dynamics, end-user demographics, and mergers & acquisitions (M&A) activity. The study period covers 2019-2024 (historical period) and forecasts the period 2025-2033 (forecast period) with 2025 as the base year.

Market Concentration: The Eastern European construction market exhibits a moderately concentrated structure, with several large multinational players and several local companies vying for market share. The top five players (Vinci, Strabag, ACS, Skanska, and Bouygues) collectively held an estimated 35% market share in 2024, with several regional players holding smaller but still significant regional shares.

Technological Innovation: Adoption of Building Information Modeling (BIM), prefabrication techniques, and sustainable construction materials are gradually increasing, although uptake varies across regions. Barriers include high initial investment costs, lack of skilled workforce, and resistance to change among established players.

Regulatory Framework: Regulatory variations across countries influence project timelines and costs. Harmonization efforts within the EU are improving consistency, yet local regulations still create unique challenges.

Competitive Product Substitutes: The absence of strong substitutes within the core construction market keeps pressure on innovation. The main competition comes from alternative construction techniques such as 3D-printing.

End-User Demographics: The growing urbanization in major cities drives demand for residential and commercial construction, while expanding transport networks fuel infrastructure development, this factor alone represents an estimated xx Million increase in market value by 2033.

M&A Trends: The historical period (2019-2024) witnessed xx M&A deals, primarily focused on consolidating regional players and expanding into new markets. This consolidation is predicted to lead to fewer but more powerful players in the next decade, influencing pricing and project development.

Eastern Europe Construction Market Growth Trends & Insights

The Eastern European construction market witnessed significant growth during 2019-2024, driven by increasing investment in infrastructure projects and rising urbanization in major cities. The total market size grew from xx Million in 2019 to xx Million in 2024 and is projected to reach xx Million by 2033 with a Compound Annual Growth Rate (CAGR) of x%. This growth is influenced by various factors, including governmental initiatives for infrastructure upgrades, sustained growth in the private residential and commercial markets, and increasing adoption of sustainable building practices.

Technological disruptions such as the integration of BIM, modular construction, and advanced materials are further accelerating market growth. Consumer behavior shifts towards energy efficiency and sustainable living contribute significantly to sustainable construction projects’ increased demand. While the global economic climate will inevitably influence market growth, several resilient economic indicators, such as steady population growth and increasing incomes, point towards continued market expansion throughout the forecast period.

Dominant Regions, Countries, or Segments in Eastern Europe Construction Market

Poland, followed by the Czech Republic, remain the leading national markets within the Eastern European construction sector. The Infrastructure (Transportation) segment is expected to dominate the forecast period (2025-2033), driven primarily by EU-funded projects and national government initiatives to modernize transportation networks. This segment’s expected market size by 2033 is xx Million.

Key Drivers in Poland: Substantial EU funding for infrastructure projects, strong governmental support for construction, and a large and growing population drive Poland's dominance.

Key Drivers in Czech Republic: Robust economic growth, increasing investments in real estate, and a supportive regulatory environment.

Infrastructure (Transportation) Segment Dominance: Massive investments in road, rail, and airport upgrades are contributing to this segment's significant growth. This segment is also characterized by high barriers to entry, and this has led to an oligopolistic structure.

Residential Segment Growth: While not as dominant as infrastructure, residential construction shows steady growth driven by urbanization and population increases, especially in major cities within Poland and other Central European countries.

Eastern Europe Construction Market Product Landscape

The Eastern European construction market is characterized by a gradual shift towards advanced materials, prefabricated components, and sustainable construction methods. Technological advancements such as BIM and 3D printing are slowly being adopted, enhancing design efficiency and potentially reducing construction times. These innovations help improve building quality, reduce material waste, and meet increasing demands for environmentally friendly construction. The use of such methods represents an estimated xx% increase in construction productivity by 2033.

Key Drivers, Barriers & Challenges in Eastern Europe Construction Market

Key Drivers: Government investments in infrastructure development, urbanization, and increasing private sector investments represent powerful drivers for market growth. Furthermore, ongoing EU funding for infrastructure projects supports robust market expansion, while increasing demand for energy-efficient and sustainable buildings is further boosting the market.

Key Challenges: Skilled labor shortages, fluctuating material costs, and bureaucratic hurdles in obtaining permits pose significant challenges. Supply chain disruptions due to geopolitical instability and the war in Ukraine have also created considerable pressure on project timelines and costs. The impact is estimated at xx Million in delays and cost overruns in 2024.

Emerging Opportunities in Eastern Europe Construction Market

The market presents significant opportunities in green building technologies, adoption of advanced construction methods, and specialized construction for renewable energy projects. Untapped potential exists in rural areas needing infrastructure improvements. Meeting rising demands for affordable housing offers substantial opportunities, and the potential for increased foreign investment in sustainable development further boosts the outlook for this market.

Growth Accelerators in the Eastern Europe Construction Market Industry

Long-term growth hinges on continued government support for infrastructure development, streamlining bureaucratic procedures, and fostering the growth of a skilled workforce through targeted training programs. Strategic partnerships between international and local companies can facilitate technological transfer and promote innovation. Market expansion into less-developed regions and focus on affordable housing can substantially boost the growth trajectory over the coming decade.

Key Players Shaping the Eastern Europe Construction Market Market

- Vinci

- Fomento De Construcciones Y Contratas

- Balfour Beatty

- Strabag

- ACS

- Royal Bam Group NV

- Bouygues

- Eiffage

- Skanska

- Acciona

Notable Milestones in Eastern Europe Construction Market Sector

- 2021, Q3: Launch of a large-scale sustainable housing project in Warsaw, Poland, showcasing prefabricated construction methods.

- 2022, Q4: Several significant infrastructure projects in the Czech Republic received EU funding, boosting market activity.

- 2023, Q1: A major merger between two regional construction companies in Romania.

In-Depth Eastern Europe Construction Market Outlook

The Eastern European construction market shows considerable potential for long-term growth, driven by sustained infrastructure development, increasing urbanization, and a growing focus on sustainable construction. Strategic opportunities exist for companies willing to invest in innovation, overcome labor shortages, and navigate the challenges posed by geopolitical instability. Government support, streamlining regulations, and fostering strategic partnerships will be crucial in unlocking the region's full construction market potential.

Eastern Europe Construction Market Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastruture (Transportation)

- 1.5. Energy and Utilities

Eastern Europe Construction Market Segmentation By Geography

- 1. Romania

- 2. Hungary

- 3. Croatia

- 4. Ukraine

- 5. Bulgaria

- 6. Rest of Eastern Europe

Eastern Europe Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and Infrastructure Development; Sustainable Construction Practices

- 3.3. Market Restrains

- 3.3.1. Labor Shortages and Costs

- 3.4. Market Trends

- 3.4.1. Increase in Residential Building Permits in Romania

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastruture (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Romania

- 5.2.2. Hungary

- 5.2.3. Croatia

- 5.2.4. Ukraine

- 5.2.5. Bulgaria

- 5.2.6. Rest of Eastern Europe

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Romania Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastruture (Transportation)

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Hungary Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastruture (Transportation)

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Croatia Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastruture (Transportation)

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Ukraine Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastruture (Transportation)

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Bulgaria Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastruture (Transportation)

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Rest of Eastern Europe Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Sector

- 11.1.1. Residential

- 11.1.2. Commercial

- 11.1.3. Industrial

- 11.1.4. Infrastruture (Transportation)

- 11.1.5. Energy and Utilities

- 11.1. Market Analysis, Insights and Forecast - by Sector

- 12. Germany Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 13. France Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Eastern Europe Construction Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Vinci

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Fomento De Construcciones Y Contratas*List Not Exhaustive

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Balfour Beatty

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Strabag

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 ACS

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Royal Bam Group NV

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Bouygues

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Eiffage

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Skanska

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Acciona

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Vinci

List of Figures

- Figure 1: Eastern Europe Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Eastern Europe Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Eastern Europe Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Eastern Europe Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Eastern Europe Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 15: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 17: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 21: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Eastern Europe Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 23: Eastern Europe Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eastern Europe Construction Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Eastern Europe Construction Market?

Key companies in the market include Vinci, Fomento De Construcciones Y Contratas*List Not Exhaustive, Balfour Beatty, Strabag, ACS, Royal Bam Group NV, Bouygues, Eiffage, Skanska, Acciona.

3. What are the main segments of the Eastern Europe Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and Infrastructure Development; Sustainable Construction Practices.

6. What are the notable trends driving market growth?

Increase in Residential Building Permits in Romania:.

7. Are there any restraints impacting market growth?

Labor Shortages and Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eastern Europe Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eastern Europe Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eastern Europe Construction Market?

To stay informed about further developments, trends, and reports in the Eastern Europe Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence