Key Insights

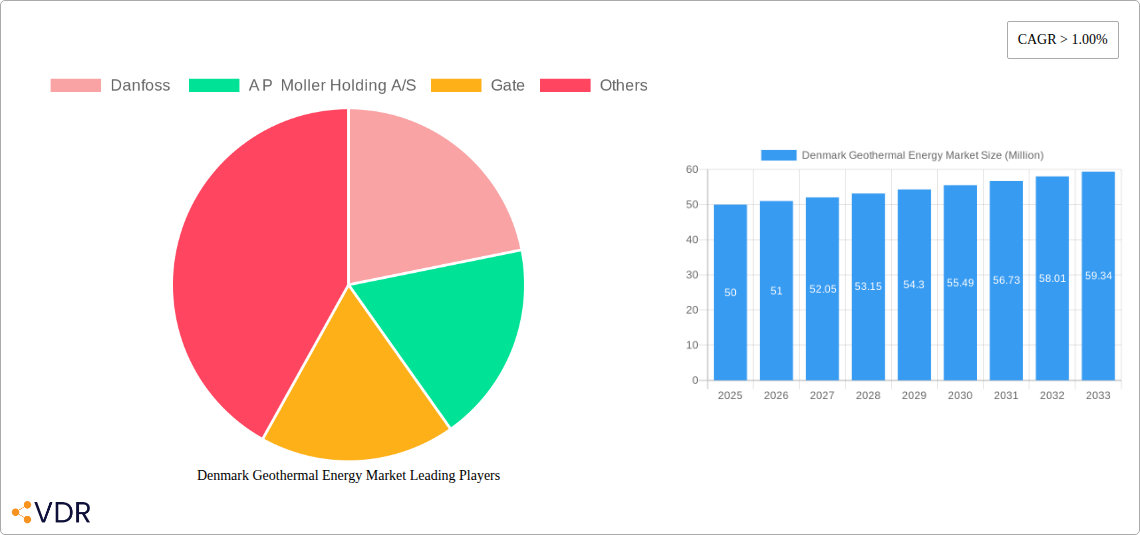

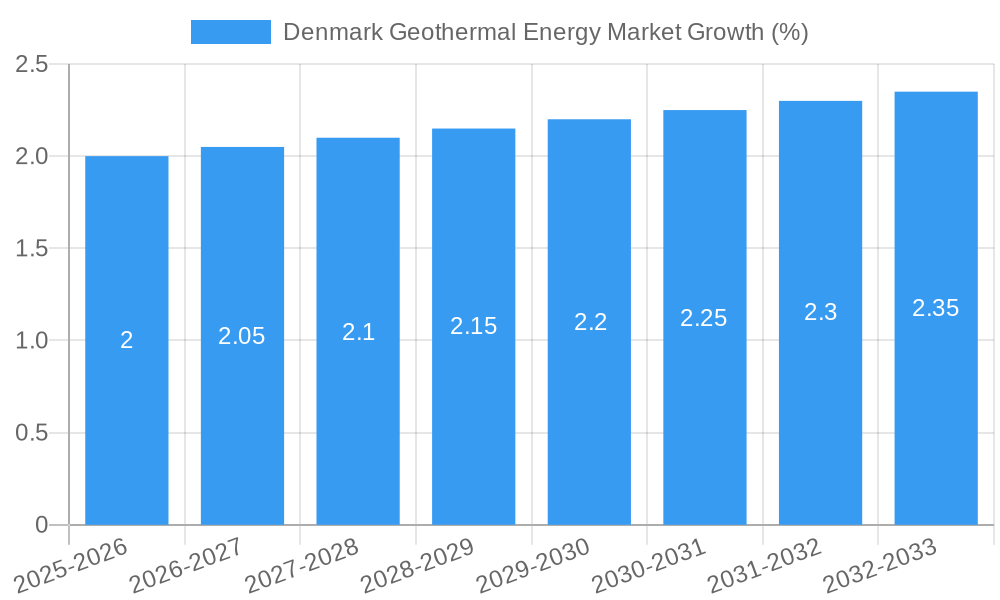

The Denmark geothermal energy market, while currently relatively small, exhibits significant growth potential driven by increasing government support for renewable energy sources and the nation's commitment to carbon neutrality. The market's compound annual growth rate (CAGR) exceeding 1.00% indicates a steady upward trajectory, though precise figures require further investigation into the specific market size (XX million) provided. This growth is fueled by advancements in geothermal technology, making it more cost-effective and accessible for various applications. Key market segments include geothermal energy utilization in electric vehicles, energy storage solutions (particularly battery types like lithium-ion and flow batteries which are seeing increased adoption globally, implying a similar trend in Denmark), and potentially consumer electronics (though this segment may be smaller in Denmark compared to other regions). Constraints on market growth could include initial high capital investment costs associated with geothermal energy projects, the need for suitable geological conditions, and potential regulatory hurdles. Major players like Danfoss, A P Moller Holding A/S, and Gate are likely to shape the market's future development through innovation and investment. Given Denmark's strong commitment to renewable energy and its existing infrastructure, the market is poised for expansion over the forecast period (2025-2033). Further analysis would benefit from detailed data on the specific market size and a breakdown of the contribution of each segment to better understand the market dynamics. The presence of companies like Danfoss, already a significant player in renewable energy technologies, suggests a strong potential for domestic growth.

The analysis suggests a considerable opportunity for market expansion, particularly within the energy storage and electric vehicle segments. The relatively small market size, coupled with the positive CAGR, indicates that even a modest increase in market penetration can lead to substantial growth in absolute terms. Further research into government incentives, technological advancements, and the competitiveness of geothermal energy compared to other renewable energy sources in Denmark is crucial for a more precise market projection. The involvement of established players like Danfoss and A P Moller Holding A/S suggests a market with robust investment and a strong likelihood of sustained growth through technological innovation and strategic partnerships. The focus on different battery types highlights the market's dependence on technological innovation in energy storage, offering a path towards further expansion.

Denmark Geothermal Energy Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Denmark Geothermal Energy Market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by Battery Type and Electrolyte Type (Lead Acid, Gel Electrolyte, Lithium-ion, Liquid Electrolyte, Flow Battery, Zinc Bromide, and Other Battery Types and Electrolyte Types) and End User (Electric Vehicle, Energy Storage, Consumer Electronics, and Other End Users). The report offers invaluable insights for industry professionals, investors, and policymakers seeking to understand and capitalize on the opportunities within this burgeoning market.

Denmark Geothermal Energy Market Market Dynamics & Structure

The Denmark geothermal energy market is characterized by moderate concentration, with key players such as Danfoss, A.P. Moller Holding A/S, and Gate holding significant market share (estimated at xx%, xx%, and xx%, respectively, in 2025). Technological innovation, driven by advancements in drilling techniques and energy storage solutions, is a key driver. The regulatory framework, supportive of renewable energy initiatives, further propels market growth. However, high initial investment costs and potential geological risks pose challenges. Competition from established energy sources like natural gas and wind power also impacts market penetration. M&A activity remains relatively low, with only xx deals recorded between 2019 and 2024, suggesting a potential for consolidation in the coming years.

- Market Concentration: Moderate, with a few dominant players.

- Technological Innovation: Significant advancements in drilling and energy storage.

- Regulatory Framework: Supportive of renewable energy development.

- Competitive Substitutes: Natural gas, wind power.

- M&A Activity: Low, with potential for future consolidation.

- Innovation Barriers: High initial investment costs, geological risks.

Denmark Geothermal Energy Market Growth Trends & Insights

The Denmark geothermal energy market experienced steady growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. Market size reached xx million units in 2024. Driven by increasing government incentives, rising energy prices, and growing environmental concerns, the market is projected to maintain strong growth during the forecast period (2025-2033), achieving a CAGR of xx% and reaching xx million units by 2033. Technological advancements, particularly in heat pump technology and geothermal energy storage, are further accelerating market adoption. Consumer awareness of the environmental benefits of geothermal energy is also contributing to increased demand. Market penetration remains relatively low, currently estimated at xx% in 2025, but is expected to increase significantly in the coming years due to substantial investments and supportive government policies.

Dominant Regions, Countries, or Segments in Denmark Geothermal Energy Market

The geothermal energy market in Denmark is largely driven by the energy storage sector, which accounted for approximately xx% of the total market in 2025. The growing demand for renewable energy sources and the need for reliable energy storage solutions contribute to its dominance. Furthermore, the increasing adoption of electric vehicles (EVs) is anticipated to drive significant growth in the coming years. The regions of Jutland and Zealand are expected to be the leading regions in terms of geothermal energy adoption, thanks to favorable geological conditions and existing infrastructure.

- Dominant Segment: Energy Storage.

- Key Drivers: Government incentives, rising energy prices, environmental concerns.

- Leading Regions: Jutland, Zealand.

- Growth Potential: High, driven by EV adoption and renewable energy targets.

Denmark Geothermal Energy Market Product Landscape

The Denmark geothermal energy market features a range of technologies, including direct-use applications like geothermal heating and electricity generation using binary cycle power plants. Recent innovations focus on improving drilling efficiency, enhancing energy extraction, and developing advanced heat pump systems. The unique selling propositions include reliable energy supply, reduced carbon emissions, and long-term cost savings.

Key Drivers, Barriers & Challenges in Denmark Geothermal Energy Market

Key Drivers:

- Increasing government support for renewable energy.

- Rising energy prices and energy security concerns.

- Growing environmental awareness and commitment to reducing carbon emissions.

Key Challenges:

- High initial investment costs associated with geothermal exploration and development.

- Potential geological risks and uncertainties related to geothermal resource assessment.

- Limited availability of skilled labor and expertise in geothermal technologies. This results in an estimated xx% increase in project costs compared to other renewable energies.

Emerging Opportunities in Denmark Geothermal Energy Market

Emerging opportunities lie in exploring untapped geothermal resources, expanding geothermal heating applications in urban areas, and integrating geothermal energy into smart grids. The development of innovative geothermal energy storage solutions will also create new market opportunities. Furthermore, the growing demand for sustainable and resilient energy systems will open up new avenues for geothermal energy deployment.

Growth Accelerators in the Denmark Geothermal Energy Market Industry

Technological advancements in drilling techniques, enhanced energy extraction technologies, and improved heat pump systems are accelerating market growth. Strategic partnerships between geothermal developers, energy companies, and government agencies are fostering innovation and investment. Government policies and financial incentives are creating a favorable environment for geothermal energy adoption. The expansion of district heating networks across Denmark offers substantial opportunities for geothermal energy integration.

Key Players Shaping the Denmark Geothermal Energy Market Market

- Danfoss

- A.P. Moller Holding A/S

- Gate

Notable Milestones in Denmark Geothermal Energy Market Sector

- December 2022: Innargi and Fors agree to investigate geothermal heating in Holbaek, aiming for delivery by the end of 2026.

- January 2022: ATP plans to invest in a large geothermal plant in Aarhus, to be built by a subsidiary of AP Moller.

In-Depth Denmark Geothermal Energy Market Market Outlook

The Denmark geothermal energy market exhibits significant long-term growth potential, driven by increasing renewable energy targets, supportive government policies, and technological advancements. Strategic partnerships and investments in research and development will further propel market expansion. The integration of geothermal energy into existing and new infrastructure presents numerous opportunities for growth, leading to a substantial increase in market size and a wider adoption of this sustainable energy source in the coming years.

Denmark Geothermal Energy Market Segmentation

-

1. Type

- 1.1. Deep Geothermal Systems

- 1.2. Shallow Geothermal Systems

-

2. Application

- 2.1. Electricity Generation

- 2.2. Direct Heating

- 2.3. Heat Pumps

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Denmark Geothermal Energy Market Segmentation By Geography

- 1. Denmark

Denmark Geothermal Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Geothermal energy is increasingly integrated into Denmark's district heating systems

- 3.2.2 providing a sustainable and efficient heating solution. The development of 5th generation district heating and cooling grids based on borehole heat exchangers and aquifers is a notable trend

- 3.2.3 enhancing the attractiveness of shallow geothermal resources.

- 3.3. Market Restrains

- 3.3.1 The upfront capital required for geothermal energy projects

- 3.3.2 including exploration

- 3.3.3 drilling

- 3.3.4 and plant construction

- 3.3.5 can be substantial. This financial barrier may deter potential investors and slow the adoption of geothermal energy

- 3.4. Market Trends

- 3.4.1 Denmark is leveraging its existing district heating infrastructure to incorporate geothermal energy. This integration allows for efficient heat distribution and reduces reliance on fossil fuels

- 3.4.2 aligning with the country's sustainability objectives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Denmark Geothermal Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Deep Geothermal Systems

- 5.1.2. Shallow Geothermal Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electricity Generation

- 5.2.2. Direct Heating

- 5.2.3. Heat Pumps

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Denmark

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Danfoss

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 A P Moller Holding A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gate

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.1 Danfoss

List of Figures

- Figure 1: Denmark Geothermal Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Denmark Geothermal Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Denmark Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Denmark Geothermal Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Denmark Geothermal Energy Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Denmark Geothermal Energy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Denmark Geothermal Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Denmark Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Denmark Geothermal Energy Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Denmark Geothermal Energy Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Denmark Geothermal Energy Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Denmark Geothermal Energy Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Denmark Geothermal Energy Market?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the Denmark Geothermal Energy Market?

Key companies in the market include Danfoss , A P Moller Holding A/S, Gate.

3. What are the main segments of the Denmark Geothermal Energy Market?

The market segments include Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Geothermal energy is increasingly integrated into Denmark's district heating systems. providing a sustainable and efficient heating solution. The development of 5th generation district heating and cooling grids based on borehole heat exchangers and aquifers is a notable trend. enhancing the attractiveness of shallow geothermal resources..

6. What are the notable trends driving market growth?

Denmark is leveraging its existing district heating infrastructure to incorporate geothermal energy. This integration allows for efficient heat distribution and reduces reliance on fossil fuels. aligning with the country's sustainability objectives.

7. Are there any restraints impacting market growth?

The upfront capital required for geothermal energy projects. including exploration. drilling. and plant construction. can be substantial. This financial barrier may deter potential investors and slow the adoption of geothermal energy.

8. Can you provide examples of recent developments in the market?

December 2022: The Danish geothermal developer Innargi has entered into an agreement with Fors to investigate the possibility of geothermal heating in the Danish city of Holbaek. Innargi has indicated that the geothermal heat will be delivered in conjunction with the expansion of the district heating network in Holbaek by the end of 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Denmark Geothermal Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Denmark Geothermal Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Denmark Geothermal Energy Market?

To stay informed about further developments, trends, and reports in the Denmark Geothermal Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence