Key Insights

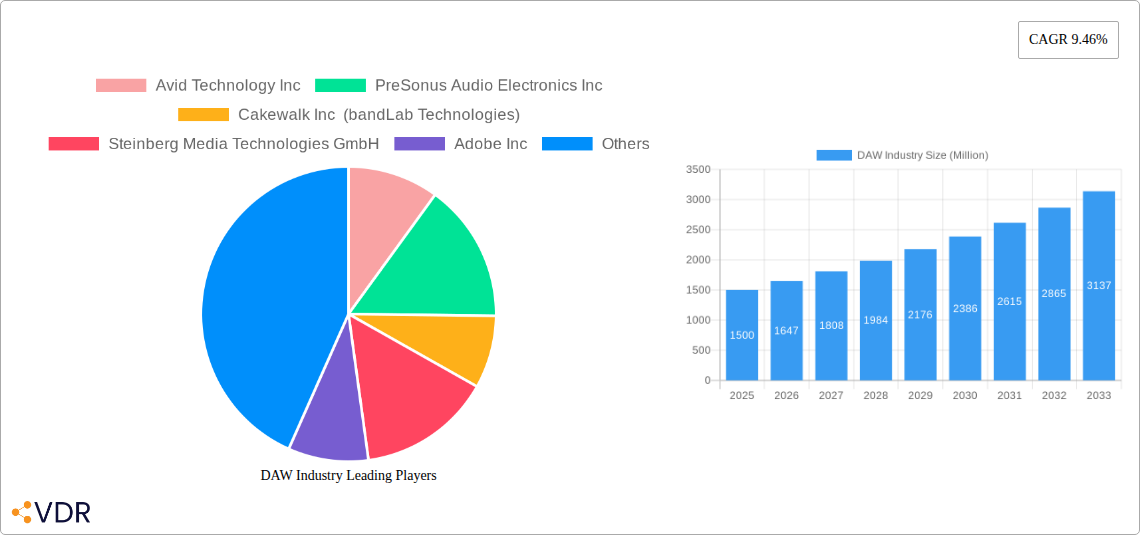

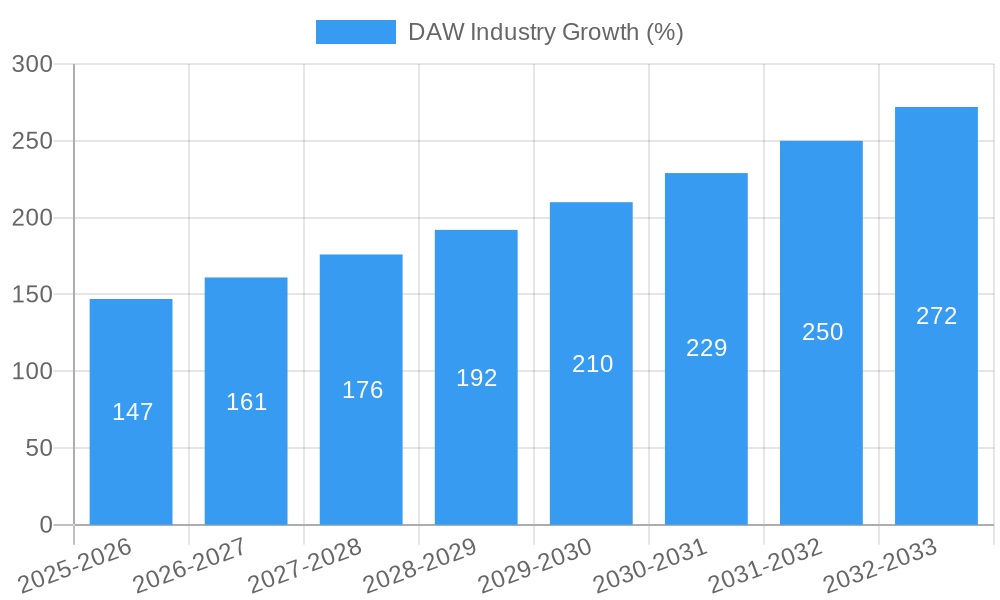

The Digital Audio Workstation (DAW) market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.46% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing affordability and accessibility of high-performance computers and improved internet connectivity have democratized music production, empowering both professional and amateur musicians. Furthermore, the rising popularity of online music distribution platforms and the growing demand for high-quality audio content across various media (podcasting, film, gaming) are significantly boosting market demand. The prevalence of subscription-based DAW software models also contributes to wider adoption, making professional-grade tools accessible to a broader user base. However, the market faces challenges, including the emergence of free or open-source alternatives and the need for continuous software updates to maintain compatibility with evolving hardware and technological advancements.

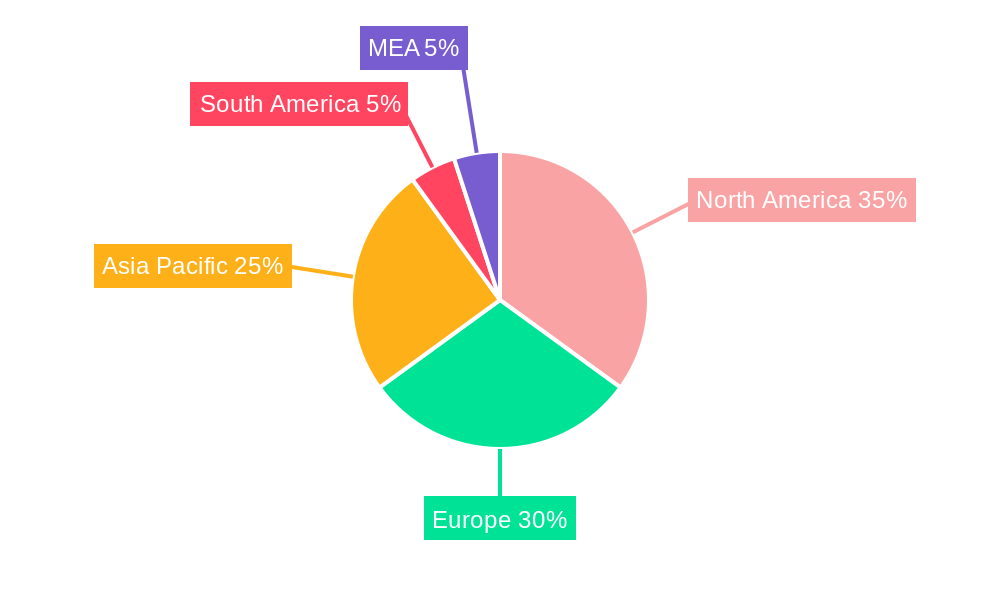

Segment-wise, the professional/audio engineer and mixer segment currently dominates the market, driven by the need for sophisticated tools and precise control over audio production. However, the electronic musician and music school segments are demonstrating rapid growth, reflecting the increasing popularity of electronic music genres and the incorporation of DAWs into music education curricula. Geographically, North America and Europe currently hold the largest market shares, owing to established music industries and a high concentration of professional users. However, the Asia-Pacific region is exhibiting significant growth potential, fueled by rising disposable incomes, increasing internet penetration, and a burgeoning music scene. Key players in the market, such as Avid Technology, PreSonus, Steinberg, and Adobe, are constantly innovating to maintain their competitive edge through feature enhancements, collaborations, and strategic acquisitions. The market's future trajectory will likely be shaped by advancements in Artificial Intelligence (AI)-powered features within DAWs, enhancing workflow efficiency and creative possibilities. This will drive further market growth and necessitate continuous adaptation from existing and new market entrants.

DAW Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Digital Audio Workstation (DAW) industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and anyone seeking to understand the evolving landscape of music production and audio engineering. The report focuses on parent market (Professional Audio Software) and child market (DAW Software).

DAW Industry Market Dynamics & Structure

The DAW industry is characterized by a moderately concentrated market with key players like Avid Technology, PreSonus, Steinberg, and Adobe holding significant market share. Technological innovation, driven by advancements in AI, cloud computing, and immersive audio, is a major growth driver. Regulatory frameworks concerning copyright and intellectual property rights play a significant role. Competitive substitutes include simpler audio editing software and online collaborative platforms. End-user demographics are diverse, spanning professional audio engineers, electronic musicians, music studios, and educational institutions. M&A activity has been moderate in recent years, with a few strategic acquisitions aimed at expanding product portfolios and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: AI-powered features, cloud-based DAWs, and immersive audio technologies are driving innovation.

- Regulatory Framework: Copyright and intellectual property regulations impact software distribution and usage.

- Competitive Substitutes: Simpler audio editors and online collaborative platforms pose competitive threats.

- End-User Demographics: Professionals, hobbyists, educational institutions, and music studios represent diverse user segments.

- M&A Trends: Moderate M&A activity, focusing on technological expansion and market consolidation (xx deals between 2019-2024, totaling approximately $xx million).

DAW Industry Growth Trends & Insights

The global DAW market experienced significant growth during the historical period (2019-2024), driven by increasing music production and audio editing needs across various sectors. The market size reached approximately $xx million in 2024, exhibiting a CAGR of xx% during this period. Adoption rates are high among professionals, while consumer adoption is steadily increasing. Technological disruptions, such as cloud-based DAWs and AI-powered features, are transforming user experience and workflow efficiency. Shifts in consumer behavior, including increased demand for collaborative tools and subscription-based services, are reshaping the market landscape. The forecast period (2025-2033) is projected to witness continued growth, driven by technological advancements and expanding market penetration, especially in emerging economies. We predict a CAGR of xx% for the forecast period, reaching a market size of $xx million by 2033.

Dominant Regions, Countries, or Segments in DAW Industry

North America and Europe currently dominate the DAW market, driven by a strong presence of established players, high levels of technological adoption, and a well-developed music industry infrastructure. However, Asia-Pacific is emerging as a high-growth region due to rising disposable incomes, increasing internet penetration, and a burgeoning music scene.

Operating Systems: Windows currently holds the largest market share, followed by Mac OS, with "Other Operating Systems" representing a smaller but growing segment.

End Users: Professional audio engineers and mixers constitute the largest segment, followed by electronic musicians and music studios. Music schools are a significant segment for educational licensing.

- North America: High market penetration, strong industry presence, significant user base, and technological advancements.

- Europe: Well-established music industry, high levels of technological adoption, and significant user base.

- Asia-Pacific: Rapid growth potential driven by rising disposable incomes and expanding music scenes.

- Professional/Audio Engineers and Mixers: Highest demand and market share due to professional workflows.

- Electronic Musicians: Rapidly growing segment, driven by digital music production's increasing popularity.

DAW Industry Product Landscape

The DAW industry offers a diverse range of products, from sophisticated professional tools with advanced features to simpler, user-friendly options for beginners. Key product innovations include AI-powered mixing and mastering tools, cloud-based collaboration features, and immersive audio support. Performance metrics focus on latency, processing power, and user interface intuitiveness. Unique selling propositions include specialized plugins, integrations with other industry software, and ease of use. Technological advancements are driving improved audio quality, streamlined workflows, and increased accessibility.

Key Drivers, Barriers & Challenges in DAW Industry

Key Drivers:

- Increasing demand for high-quality audio production across various sectors.

- Advancements in AI and machine learning technologies enabling automated processes.

- Growing popularity of digital music creation and distribution platforms.

- Rise in online music education and collaborative platforms.

Challenges & Restraints:

- High initial investment costs for professional-grade DAW software and hardware.

- Competition from free or low-cost alternatives.

- Complex software interfaces that can be challenging for beginners.

- Concerns related to software piracy and copyright infringement. This resulted in a xx% loss in revenue in 2024.

Emerging Opportunities in DAW Industry

- Expansion into emerging markets with increasing internet penetration and music consumption.

- Development of AI-powered tools to further streamline music production workflows.

- Integration with virtual and augmented reality technologies for immersive experiences.

- Focus on creating user-friendly DAWs for beginners and hobbyists.

Growth Accelerators in the DAW Industry

Technological advancements, particularly in AI and cloud computing, are key growth accelerators. Strategic partnerships between DAW developers and hardware manufacturers are further boosting market growth. Expansion into new markets and vertical industries, such as gaming and podcasts, present significant growth opportunities.

Key Players Shaping the DAW Industry Market

- Avid Technology Inc

- PreSonus Audio Electronics Inc

- Cakewalk Inc (bandLab Technologies)

- Steinberg Media Technologies GmbH

- Adobe Inc

- Native Instruments GmbH

- MAGIX Software GmbH

- Apple Inc

- Harrison Consoles Inc

Notable Milestones in DAW Industry Sector

- August 2022: Spotify's Soundtrap introduces live collaboration, auto-save, and comments features, enhancing remote collaboration capabilities.

- April 2023: Audio Design Desk launches version 2.0, featuring a streamlined UI, automated mixing, and stem separation, along with the Makr.ai marketplace.

- April 2023: Avid introduces the MTRX II and MTRX Thunderbolt 3 module, improving post-production audio capabilities.

- June 2023: Triton Digital and Basis Technologies collaborate to streamline audio advertising across various platforms.

In-Depth DAW Industry Market Outlook

The future of the DAW industry is bright, driven by continuous technological innovation and expanding market penetration. The increasing accessibility of DAW software, coupled with the growing popularity of music creation and consumption, will further fuel market growth. Strategic partnerships, acquisitions, and the development of innovative features will shape the competitive landscape. The focus on cloud-based solutions, AI-powered tools, and immersive audio experiences will drive the next wave of innovation. The market is poised for strong growth in the coming years, presenting significant opportunities for established players and new entrants alike.

DAW Industry Segmentation

-

1. Operating System

- 1.1. Mac

- 1.2. Windows

- 1.3. Other Operating Systems

-

2. End User

- 2.1. Professional/Audio Engineers and Mixers

- 2.2. Electronic Musicians

- 2.3. Music Studios

- 2.4. Music Schools

- 2.5. Other End Users

DAW Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

DAW Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for High Definition Video and Audio; Increased Use of Technology in Audio and Video Making

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices

- 3.4. Market Trends

- 3.4.1. MAC Operating System is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global DAW Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 5.1.1. Mac

- 5.1.2. Windows

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Professional/Audio Engineers and Mixers

- 5.2.2. Electronic Musicians

- 5.2.3. Music Studios

- 5.2.4. Music Schools

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operating System

- 6. North America DAW Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 6.1.1. Mac

- 6.1.2. Windows

- 6.1.3. Other Operating Systems

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Professional/Audio Engineers and Mixers

- 6.2.2. Electronic Musicians

- 6.2.3. Music Studios

- 6.2.4. Music Schools

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Operating System

- 7. Europe DAW Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 7.1.1. Mac

- 7.1.2. Windows

- 7.1.3. Other Operating Systems

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Professional/Audio Engineers and Mixers

- 7.2.2. Electronic Musicians

- 7.2.3. Music Studios

- 7.2.4. Music Schools

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Operating System

- 8. Asia DAW Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 8.1.1. Mac

- 8.1.2. Windows

- 8.1.3. Other Operating Systems

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Professional/Audio Engineers and Mixers

- 8.2.2. Electronic Musicians

- 8.2.3. Music Studios

- 8.2.4. Music Schools

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Operating System

- 9. Latin America DAW Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 9.1.1. Mac

- 9.1.2. Windows

- 9.1.3. Other Operating Systems

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Professional/Audio Engineers and Mixers

- 9.2.2. Electronic Musicians

- 9.2.3. Music Studios

- 9.2.4. Music Schools

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Operating System

- 10. Middle East and Africa DAW Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 10.1.1. Mac

- 10.1.2. Windows

- 10.1.3. Other Operating Systems

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Professional/Audio Engineers and Mixers

- 10.2.2. Electronic Musicians

- 10.2.3. Music Studios

- 10.2.4. Music Schools

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Operating System

- 11. North America DAW Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe DAW Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific DAW Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America DAW Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA DAW Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Avid Technology Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 PreSonus Audio Electronics Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Cakewalk Inc (bandLab Technologies)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Steinberg Media Technologies GmbH

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Adobe Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Native Instruments GmbH

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 MAGIX Software GmbH

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Apple Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Harrison Consoles Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Avid Technology Inc

List of Figures

- Figure 1: Global DAW Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America DAW Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 13: North America DAW Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 14: North America DAW Industry Revenue (Million), by End User 2024 & 2032

- Figure 15: North America DAW Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe DAW Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 19: Europe DAW Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 20: Europe DAW Industry Revenue (Million), by End User 2024 & 2032

- Figure 21: Europe DAW Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia DAW Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 25: Asia DAW Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 26: Asia DAW Industry Revenue (Million), by End User 2024 & 2032

- Figure 27: Asia DAW Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America DAW Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 31: Latin America DAW Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 32: Latin America DAW Industry Revenue (Million), by End User 2024 & 2032

- Figure 33: Latin America DAW Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Latin America DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America DAW Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa DAW Industry Revenue (Million), by Operating System 2024 & 2032

- Figure 37: Middle East and Africa DAW Industry Revenue Share (%), by Operating System 2024 & 2032

- Figure 38: Middle East and Africa DAW Industry Revenue (Million), by End User 2024 & 2032

- Figure 39: Middle East and Africa DAW Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Middle East and Africa DAW Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa DAW Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global DAW Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global DAW Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 3: Global DAW Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global DAW Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United Arab Emirates DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Saudi Arabia DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East and Africa DAW Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global DAW Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 47: Global DAW Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global DAW Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 50: Global DAW Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 51: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global DAW Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 53: Global DAW Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 54: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global DAW Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 56: Global DAW Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 57: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global DAW Industry Revenue Million Forecast, by Operating System 2019 & 2032

- Table 59: Global DAW Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 60: Global DAW Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the DAW Industry?

The projected CAGR is approximately 9.46%.

2. Which companies are prominent players in the DAW Industry?

Key companies in the market include Avid Technology Inc, PreSonus Audio Electronics Inc, Cakewalk Inc (bandLab Technologies), Steinberg Media Technologies GmbH, Adobe Inc, Native Instruments GmbH, MAGIX Software GmbH, Apple Inc, Harrison Consoles Inc.

3. What are the main segments of the DAW Industry?

The market segments include Operating System, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for High Definition Video and Audio; Increased Use of Technology in Audio and Video Making.

6. What are the notable trends driving market growth?

MAC Operating System is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Standardization of Communication Protocol across Different Platforms; Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices.

8. Can you provide examples of recent developments in the market?

April 2023: AVID introduced Tools MTRX II and MTRX Thunderbolt 3 module, specifically designed for post-production users to enhance audio capabilities to get the prime sound possible. MTRX II empowers users with greater IO capacity, routing, and immersive monitoring flexibility. It allows capturing tools and software-based workflows, providing flexibility and expandability than MTRX.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "DAW Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the DAW Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the DAW Industry?

To stay informed about further developments, trends, and reports in the DAW Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence