Key Insights

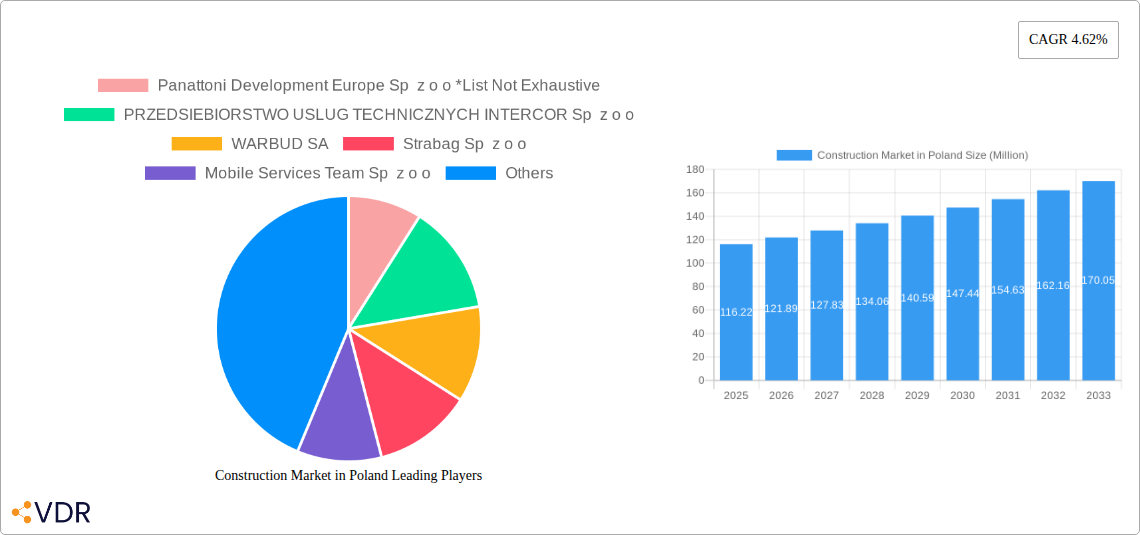

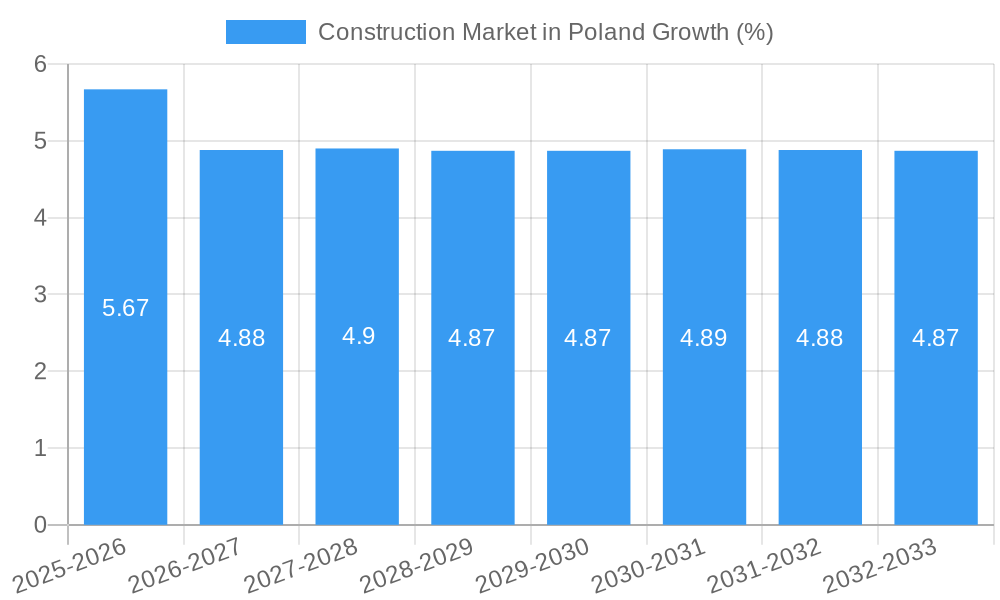

The Polish construction market, valued at €116.22 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.62% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, significant investments in infrastructure projects, including transportation networks and energy infrastructure upgrades, are stimulating considerable demand. Secondly, a growing residential sector, fueled by population growth and urbanization trends, contributes to substantial construction activity. Furthermore, the commercial real estate sector, particularly in major cities like Warsaw and Krakow, shows promising growth potential due to increased foreign investment and expansion of businesses. Government initiatives promoting sustainable building practices and energy efficiency are also shaping the market landscape, encouraging the adoption of greener technologies and materials. While rising material costs and labor shortages pose challenges, the overall outlook for the Polish construction market remains positive.

However, potential restraints exist. Fluctuations in the global economy and geopolitical instability can impact investor confidence and construction activity. Furthermore, securing skilled labor and managing supply chain disruptions remains crucial for sustained growth. The sector's segmentation, encompassing residential, commercial, industrial, infrastructure, and energy & utilities, presents diverse growth opportunities. Leading players such as Panattoni Development Europe, Warbud SA, Strabag Sp z o o, and Budimex SA are actively shaping the market, competing for major projects and influencing market dynamics. The forecast period (2025-2033) promises significant expansion, but strategic adaptation to external factors and efficient resource management will be key for sustained success within the Polish construction sector.

This in-depth report provides a comprehensive analysis of the Polish construction market, covering its dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. We delve into both parent and child markets, offering granular insights into various segments to empower strategic decision-making for industry professionals.

Construction Market in Poland Market Dynamics & Structure

The Polish construction market, valued at xx million in 2024, exhibits a moderately concentrated landscape, with several large players dominating various segments. Technological innovation, while present, faces barriers including a skills gap and resistance to adopting new methods among some contractors. The regulatory framework, while generally stable, undergoes periodic revisions impacting project timelines and costs. Substitutes are limited, primarily in the materials sector, where alternative building materials gain traction. End-user demographics show a rising demand for sustainable and energy-efficient buildings, driving the growth of green construction practices. M&A activity has been consistent, with xx deals recorded between 2019 and 2024, primarily driven by consolidation among smaller firms and expansion by larger players.

- Market Concentration: High in certain segments (e.g., large-scale infrastructure projects), moderate in others (e.g., residential construction).

- Technological Innovation: Adoption of Building Information Modeling (BIM) and prefabrication is increasing, but faces resistance due to high initial investment costs and lack of skilled labor.

- Regulatory Framework: Relatively stable but subject to change; new environmental regulations impact project costs.

- Competitive Product Substitutes: Limited, with increasing use of sustainable materials posing a challenge to traditional materials.

- End-User Demographics: Growing demand for energy-efficient buildings, smart homes, and sustainable urban development.

- M&A Trends: Consolidation among smaller firms, expansion strategies of major players, driven by market share gains and diversification.

Construction Market in Poland Growth Trends & Insights

The Polish construction market experienced fluctuating growth during the historical period (2019-2024), impacted by economic cycles and global events. However, a steady recovery is projected, with a Compound Annual Growth Rate (CAGR) of xx% anticipated during the forecast period (2025-2033), driven by investments in infrastructure, increased urbanization, and rising disposable incomes. Market penetration of green building technologies is also expected to increase significantly, reaching xx% by 2033. Technological disruptions, such as the wider adoption of 3D printing and advanced construction management software, are expected to transform productivity and efficiency. Consumer behavior is shifting towards sustainable and energy-efficient homes, driving demand for eco-friendly construction materials and techniques.

Dominant Regions, Countries, or Segments in Construction Market in Poland

The Industrial sector is currently the dominant segment, driven by strong FDI inflows, particularly in logistics and manufacturing. This is followed by the Residential and Infrastructure segments, which are significantly impacted by government investments and expanding urban populations.

- Key Drivers for Industrial Segment Dominance: Foreign direct investment (FDI) in manufacturing and logistics, increased demand for warehouse and industrial space.

- Key Drivers for Residential Segment Growth: Urbanization, rising disposable incomes, government support schemes for homeownership.

- Key Drivers for Infrastructure Segment Growth: EU funds allocated for infrastructure development, government initiatives for modernization of transport and utility networks.

Construction Market in Poland Product Landscape

The Polish construction market is characterized by a diverse product landscape, encompassing traditional and innovative building materials, equipment, and technologies. Recent years have witnessed significant advancements in sustainable building materials, prefabricated components, and construction management software. These innovations are improving efficiency, reducing construction timelines, and enhancing building quality and sustainability. Unique selling propositions frequently highlight cost-effectiveness, sustainability, and improved performance metrics such as energy efficiency and durability.

Key Drivers, Barriers & Challenges in Construction Market in Poland

Key Drivers:

- Robust economic growth, leading to increased investment in construction projects.

- Significant government investment in infrastructure projects, boosting public sector spending.

- Rising demand for housing fueled by urbanization and increasing population.

Key Challenges:

- Labor shortages, particularly for skilled tradespeople, causing project delays and cost overruns. (Impact: xx% increase in project costs in 2024)

- Rising material costs driven by global supply chain disruptions and inflation. (Impact: xx% increase in material costs in 2024)

- Stringent environmental regulations that may increase project complexity and costs.

Emerging Opportunities in Construction Market in Poland

- Growing demand for sustainable and energy-efficient buildings offering opportunities for green construction materials and technologies.

- Development of smart cities and infrastructure create opportunities for advanced technologies and integrated systems.

- Increased investment in renewable energy projects offers growth in specialized construction for solar, wind, and other renewable energy sources.

Growth Accelerators in the Construction Market in Poland Industry

Technological advancements in construction methods and materials, along with strategic partnerships between construction firms and technology providers, are crucial growth accelerators. Furthermore, expansion into underserved regions and diversification into new market segments, such as renewable energy infrastructure, promise significant growth potential for the Polish construction sector.

Key Players Shaping the Construction Market in Poland Market

- Panattoni Development Europe Sp z o o

- PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o

- WARBUD SA

- Strabag Sp z o o

- Mobile Services Team Sp z o o

- ERBUD SA

- EUROVIA POLSKA SA

- UNIBEP SA

- SKANSKA SA

- PORR SA

- TORPOL SA

- BUDIMEX SA

Notable Milestones in Construction Market in Poland Sector

- 2020: Launch of the national Green Building Program, promoting sustainable construction practices.

- 2021: Several major infrastructure projects commenced, fueled by EU funding.

- 2022: Significant increase in the use of prefabricated building components in residential projects.

- 2023: Several mergers and acquisitions activity among mid-sized construction companies.

In-Depth Construction Market in Poland Market Outlook

The Polish construction market is poised for continued growth, driven by strong domestic demand, government investments, and the increasing adoption of innovative technologies. Strategic partnerships, focus on sustainable practices, and effective management of labor shortages will be crucial for maximizing growth potential and achieving long-term success in this dynamic market. The market is projected to reach xx million by 2033.

Construction Market in Poland Segmentation

-

1. Sector

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Construction Market in Poland Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Market in Poland REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure.

- 3.3. Market Restrains

- 3.3.1. High cost of the construction projects; Limited space availability for new projects

- 3.4. Market Trends

- 3.4.1. Demand for Infrastructure to Boost the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1.4. Infrastructure

- 6.1.5. Energy and Utilities

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1.4. Infrastructure

- 7.1.5. Energy and Utilities

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1.4. Infrastructure

- 8.1.5. Energy and Utilities

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1.4. Infrastructure

- 9.1.5. Energy and Utilities

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Market in Poland Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1.4. Infrastructure

- 10.1.5. Energy and Utilities

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Panattoni Development Europe Sp z o o *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WARBUD SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Strabag Sp z o o

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mobile Services Team Sp z o o

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ERBUD SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EUROVIA POLSKA SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 UNIBEP SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SKANSKA SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PORR SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TORPOL SA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BUDIMEX SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Panattoni Development Europe Sp z o o *List Not Exhaustive

List of Figures

- Figure 1: Global Construction Market in Poland Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Poland Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 3: Poland Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 9: South America Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 10: South America Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 13: Europe Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 14: Europe Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 17: Middle East & Africa Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Middle East & Africa Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Construction Market in Poland Revenue (Million), by Sector 2024 & 2032

- Figure 21: Asia Pacific Construction Market in Poland Revenue Share (%), by Sector 2024 & 2032

- Figure 22: Asia Pacific Construction Market in Poland Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Construction Market in Poland Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Market in Poland Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 11: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 27: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Construction Market in Poland Revenue Million Forecast, by Sector 2019 & 2032

- Table 35: Global Construction Market in Poland Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Construction Market in Poland Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Market in Poland?

The projected CAGR is approximately 4.62%.

2. Which companies are prominent players in the Construction Market in Poland?

Key companies in the market include Panattoni Development Europe Sp z o o *List Not Exhaustive, PRZEDSIEBIORSTWO USLUG TECHNICZNYCH INTERCOR Sp z o o, WARBUD SA, Strabag Sp z o o, Mobile Services Team Sp z o o, ERBUD SA, EUROVIA POLSKA SA, UNIBEP SA, SKANSKA SA, PORR SA, TORPOL SA, BUDIMEX SA.

3. What are the main segments of the Construction Market in Poland?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 116.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Transportation Infrastructure is increasing in Netherlands; Growth in Travel and Tourism is driving the need for Transportation Infrastructure..

6. What are the notable trends driving market growth?

Demand for Infrastructure to Boost the Construction Sector.

7. Are there any restraints impacting market growth?

High cost of the construction projects; Limited space availability for new projects.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Market in Poland," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Market in Poland report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Market in Poland?

To stay informed about further developments, trends, and reports in the Construction Market in Poland, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence