Key Insights

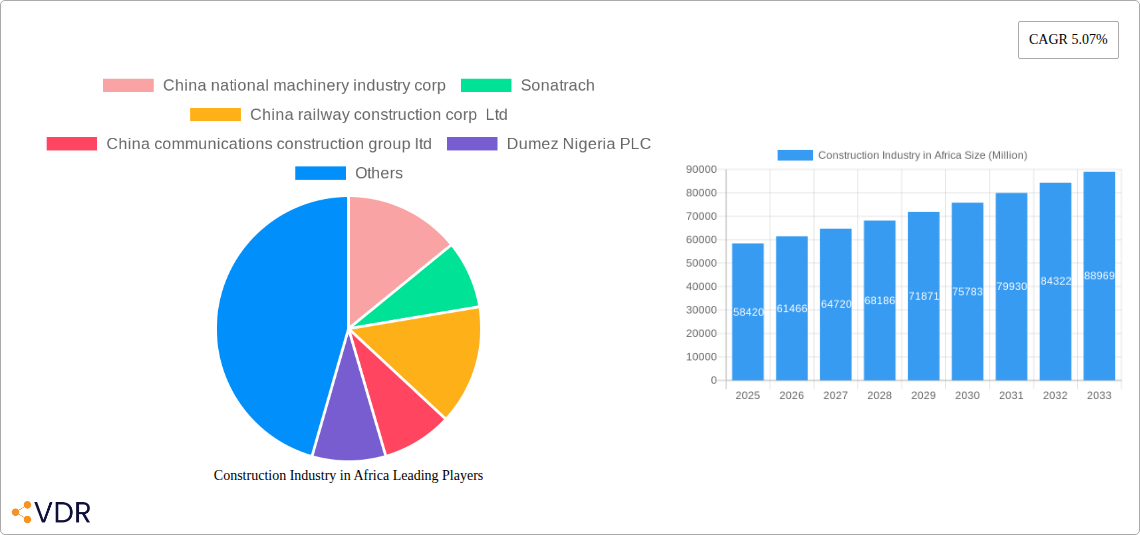

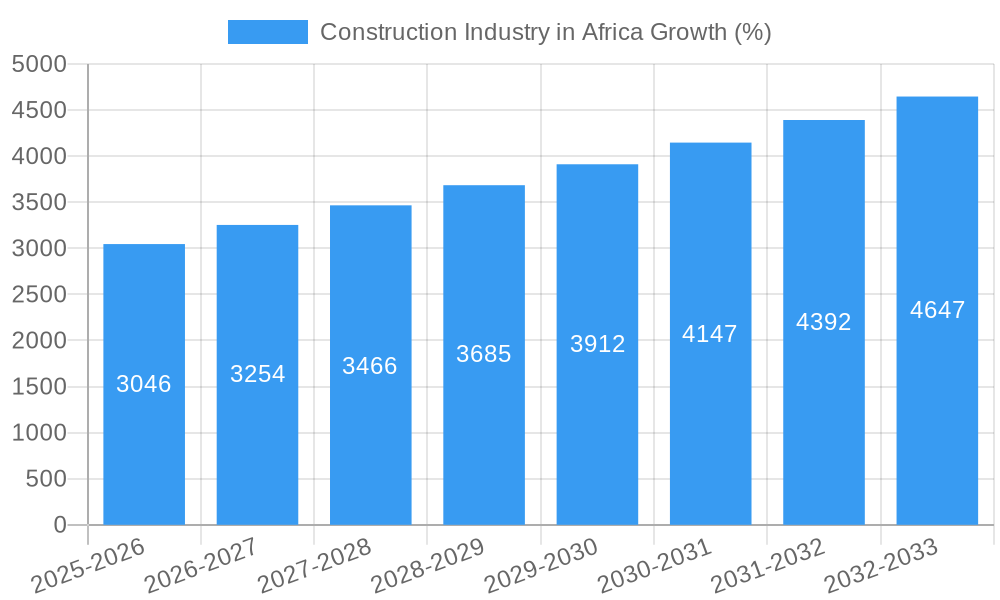

The African construction industry, valued at $58.42 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.07% from 2025 to 2033. This expansion is fueled by several key drivers. Significant infrastructure development projects across the continent, particularly in transportation (roads, railways, ports), energy (renewable and conventional power generation), and utilities (water and sanitation), are creating substantial demand. Rapid urbanization and population growth are further stimulating the residential construction sector, particularly in major cities and burgeoning economic hubs. Government initiatives focused on improving housing affordability and promoting sustainable construction practices are also contributing to market growth. However, challenges remain. Economic volatility in certain regions, coupled with potential supply chain disruptions and skilled labor shortages, pose constraints to the industry's consistent expansion. The commercial construction segment, while experiencing growth, is susceptible to fluctuations in business confidence and investment cycles. The varied regulatory landscapes across different African nations also present a complex operating environment for companies. The segmentation of the market reveals significant opportunities within different sectors and construction types. The infrastructure sector is expected to see strong growth, driven by government investment in transportation networks and energy projects, while the residential sector will experience consistent demand. New constructions represent a considerable portion of the market share, while additions and demolition projects will experience moderate growth rates over the forecast period. Key players, including multinational corporations and local construction companies, are actively competing for market share, navigating both the opportunities and challenges prevalent in the African construction landscape. Growth in the coming years will largely depend on consistent political stability, economic growth, and effective implementation of infrastructure projects.

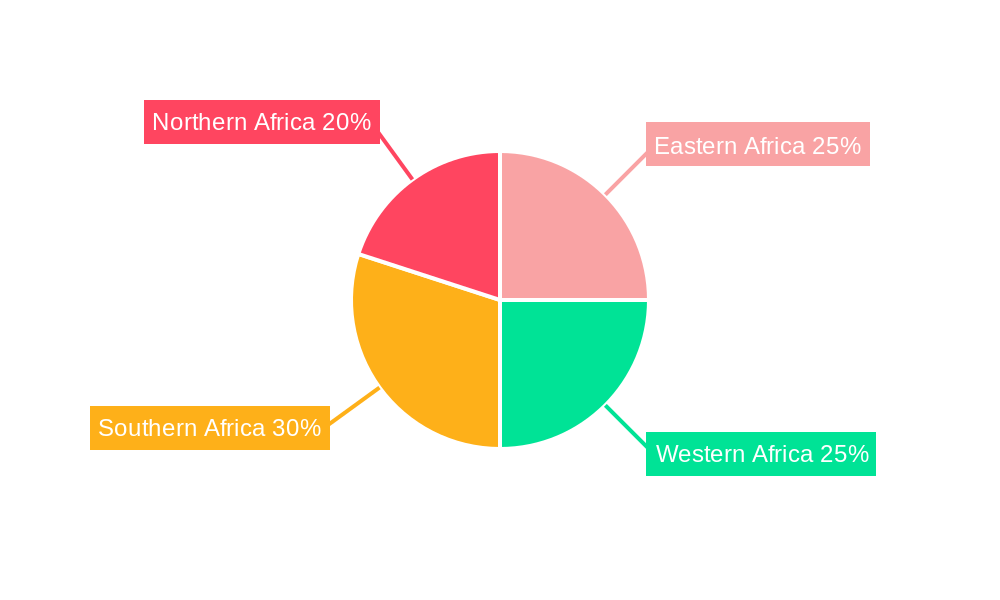

The regional breakdown reveals considerable variation in market dynamics. South Africa, with its relatively developed economy and infrastructure, commands a larger market share. However, significant growth potential exists in other regions, particularly in East and West Africa, where substantial infrastructure development is underway. This presents opportunities for both international and local companies to invest and expand their operations. Specific country profiles will show differing levels of growth driven by government policies, economic development, and availability of funding. While the industry faces hurdles, the long-term outlook for the African construction sector remains positive, underpinned by a growing population, increasing urbanization, and the continent's commitment to improving its infrastructure and overall economic development.

This comprehensive report provides an in-depth analysis of the African construction industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. It covers market dynamics, growth trends, key players, and future opportunities across various segments and regions, using data from 2019 to 2024 (historical period), with projections through 2033. The base year for this report is 2025, and estimations are provided for the same year.

Construction Industry in Africa Market Dynamics & Structure

The African construction market, valued at xx Million in 2024, exhibits a dynamic landscape shaped by diverse factors. Market concentration varies significantly across regions, with some dominated by a few large players while others boast a more fragmented structure. Technological advancements, particularly in building information modeling (BIM) and prefabrication, are steadily gaining traction, though adoption rates differ based on infrastructure availability and technological literacy. Regulatory frameworks vary widely across nations, impacting project timelines and costs. Competition from substitute materials and construction methods, coupled with evolving end-user preferences and demographics, further shapes the market. Mergers and acquisitions (M&A) activity, though relatively less frequent compared to developed markets, plays a vital role in shaping market consolidation and technological transfer.

- Market Concentration: Highly fragmented in many areas, with some regional dominance by large multinational firms.

- Technological Innovation: Gradual adoption of BIM and prefabrication, hindered by infrastructure limitations and skills gaps.

- Regulatory Landscape: Varied across countries, impacting project approvals and execution.

- M&A Activity: Moderate level, driven by strategic expansion and technological integration. XX deals recorded in the period 2019-2024.

- Competitive Substitutes: Growing use of alternative materials and sustainable construction practices.

- End-User Demographics: Shifting urban demographics fuel demand for residential and commercial construction.

Construction Industry in Africa Growth Trends & Insights

The African construction market has witnessed significant growth over the past five years, driven by robust economic expansion, urbanization, and increasing infrastructure investment. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, reaching a market value of xx Million in 2024. This growth is expected to continue, albeit at a slightly moderated pace, during the forecast period (2025-2033). Factors such as increasing government spending on infrastructure projects, rapid urbanization, and growing demand for commercial and residential spaces are key drivers. However, challenges like economic volatility, political instability, and infrastructure limitations in certain regions could impact growth trajectory. Market penetration of technologically advanced construction methods is gradually increasing, albeit at a slower pace compared to other global regions. The rising adoption of sustainable building materials and green construction practices is also observed. Consumer behaviour is shifting toward high-quality, affordable housing and sustainable infrastructure projects.

Dominant Regions, Countries, or Segments in Construction Industry in Africa

Significant variations exist in growth across African regions and construction sectors. The Infrastructure (Transportation) Construction segment consistently leads, fuelled by extensive government investments in road, rail, and airport development projects. Within regions, Southern and Northern Africa often show stronger growth due to substantial infrastructure development initiatives. However, Eastern and Western Africa exhibit promising potential given the burgeoning urban populations and ongoing development plans. New construction continues to dominate, though the additions segment is also experiencing growth, driven by expansion and renovation projects.

- Leading Sector: Infrastructure (Transportation) Construction

- Fastest-Growing Region: xx (predicted based on current trends and investment)

- Key Growth Drivers: Government infrastructure projects, urbanization, rising middle class, and FDI.

- Dominant Countries: Nigeria, South Africa, Egypt (and others showing significant growth)

Construction Industry in Africa Product Landscape

The construction product landscape is evolving with a focus on sustainable, high-performance materials and technologies. Innovations in prefabrication, modular construction, and 3D printing are gaining traction, although adoption remains limited. The market is characterized by both traditional and modern construction techniques, with a growing emphasis on improving efficiency, reducing costs, and enhancing sustainability. Many players are focusing on developing products with unique selling propositions that meet local environmental and economic demands. Technological advancements are focused on reducing the environmental impact of construction projects, such as energy-efficient building designs and use of recycled materials.

Key Drivers, Barriers & Challenges in Construction Industry in Africa

Key Drivers: Increasing urbanization, government infrastructure investments, rising foreign direct investment (FDI), and growing middle class disposable income all significantly drive market growth.

Key Challenges & Restraints: Political instability in some regions, inadequate infrastructure (particularly energy and transport), skills shortages, corruption, and fluctuating commodity prices pose significant challenges, resulting in project delays and cost overruns. Supply chain disruptions have impacted project timelines and budgets. These hurdles have, on average, resulted in a xx% increase in project costs over the last 5 years.

Emerging Opportunities in Construction Industry in Africa

Significant opportunities exist in sustainable construction, affordable housing projects, and the development of smart cities. Untapped markets in rural areas and a growing demand for technologically advanced construction methods present lucrative prospects. The increasing focus on renewable energy projects is creating new opportunities in the energy and utilities construction sector.

Growth Accelerators in the Construction Industry in Africa Industry

Long-term growth is fueled by ongoing investments in infrastructure development, coupled with technological advancements leading to increased efficiency and productivity. Strategic partnerships between international and local companies are fostering knowledge transfer and capacity building. Initiatives focused on addressing skills gaps and promoting sustainable construction practices will further accelerate market expansion.

Key Players Shaping the Construction Industry in Africa Market

- China Communications Construction Group Ltd

- China Railway Construction Corporation Limited

- China National Machinery Industry Corporation

- Sonatrach

- Dumez Nigeria PLC

- TechnipFMC

- Sikhumba Construction (Pty) Ltd

- General Nile Company For Roads & Bridges

- Vinci

- Bouygues

- List Not Exhaustive

Notable Milestones in Construction Industry in Africa Sector

- December 2023: Scatec ASA completes the first 60 MW phase of the Mmadinare Solar Complex in Botswana, signaling a significant step in renewable energy infrastructure development.

- November 2023: Teraco expands its Durban data center, reflecting growing demand for digital infrastructure in South Africa.

In-Depth Construction Industry in Africa Market Outlook

The African construction industry's future is bright, with sustained growth driven by urbanization, infrastructure investment, and technological innovation. Strategic focus on sustainable practices, skills development, and addressing regulatory challenges will unlock substantial opportunities. The market is poised for significant expansion, presenting attractive prospects for both established players and new entrants. The projected market value in 2033 is estimated at xx Million, indicating a promising long-term outlook.

Construction Industry in Africa Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition

- 2.3. New Constructions

Construction Industry in Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid urbanization driving the market4.; Economic development

- 3.3. Market Restrains

- 3.3.1. 4.; Political and Regulatory challenges4.; Skills and Labor Shortages

- 3.4. Market Trends

- 3.4.1. Infrastructure construction projects driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition

- 5.2.3. New Constructions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.2. Market Analysis, Insights and Forecast - by Construction Type

- 6.2.1. Additions

- 6.2.2. Demolition

- 6.2.3. New Constructions

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.2. Market Analysis, Insights and Forecast - by Construction Type

- 7.2.1. Additions

- 7.2.2. Demolition

- 7.2.3. New Constructions

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.2. Market Analysis, Insights and Forecast - by Construction Type

- 8.2.1. Additions

- 8.2.2. Demolition

- 8.2.3. New Constructions

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.2. Market Analysis, Insights and Forecast - by Construction Type

- 9.2.1. Additions

- 9.2.2. Demolition

- 9.2.3. New Constructions

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.2. Market Analysis, Insights and Forecast - by Construction Type

- 10.2.1. Additions

- 10.2.2. Demolition

- 10.2.3. New Constructions

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. South Africa Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 12. Sudan Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 13. Uganda Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 14. Tanzania Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 15. Kenya Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Africa Construction Industry in Africa Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 China national machinery industry corp

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Sonatrach

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 China railway construction corp Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 China communications construction group ltd

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Dumez Nigeria PLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 TechnipFMC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sikhumba Construction (Pty) Ltd

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 General Nile Company For Roads & Bridges

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Vinci

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Bouygues**List Not Exhaustive

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 China national machinery industry corp

List of Figures

- Figure 1: Global Construction Industry in Africa Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Africa Construction Industry in Africa Revenue (Million), by Country 2024 & 2032

- Figure 3: Africa Construction Industry in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Industry in Africa Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Industry in Africa Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Industry in Africa Revenue (Million), by Construction Type 2024 & 2032

- Figure 7: North America Construction Industry in Africa Revenue Share (%), by Construction Type 2024 & 2032

- Figure 8: North America Construction Industry in Africa Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Construction Industry in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Construction Industry in Africa Revenue (Million), by Sector 2024 & 2032

- Figure 11: South America Construction Industry in Africa Revenue Share (%), by Sector 2024 & 2032

- Figure 12: South America Construction Industry in Africa Revenue (Million), by Construction Type 2024 & 2032

- Figure 13: South America Construction Industry in Africa Revenue Share (%), by Construction Type 2024 & 2032

- Figure 14: South America Construction Industry in Africa Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Construction Industry in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Construction Industry in Africa Revenue (Million), by Sector 2024 & 2032

- Figure 17: Europe Construction Industry in Africa Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Europe Construction Industry in Africa Revenue (Million), by Construction Type 2024 & 2032

- Figure 19: Europe Construction Industry in Africa Revenue Share (%), by Construction Type 2024 & 2032

- Figure 20: Europe Construction Industry in Africa Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Construction Industry in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Construction Industry in Africa Revenue (Million), by Sector 2024 & 2032

- Figure 23: Middle East & Africa Construction Industry in Africa Revenue Share (%), by Sector 2024 & 2032

- Figure 24: Middle East & Africa Construction Industry in Africa Revenue (Million), by Construction Type 2024 & 2032

- Figure 25: Middle East & Africa Construction Industry in Africa Revenue Share (%), by Construction Type 2024 & 2032

- Figure 26: Middle East & Africa Construction Industry in Africa Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Construction Industry in Africa Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Construction Industry in Africa Revenue (Million), by Sector 2024 & 2032

- Figure 29: Asia Pacific Construction Industry in Africa Revenue Share (%), by Sector 2024 & 2032

- Figure 30: Asia Pacific Construction Industry in Africa Revenue (Million), by Construction Type 2024 & 2032

- Figure 31: Asia Pacific Construction Industry in Africa Revenue Share (%), by Construction Type 2024 & 2032

- Figure 32: Asia Pacific Construction Industry in Africa Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Construction Industry in Africa Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Industry in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: Global Construction Industry in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Construction Industry in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 14: Global Construction Industry in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 20: Global Construction Industry in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2019 & 2032

- Table 25: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 26: Global Construction Industry in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 27: United Kingdom Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: France Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Italy Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Spain Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Russia Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Benelux Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Nordics Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of Europe Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2019 & 2032

- Table 37: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 38: Global Construction Industry in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Turkey Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Israel Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: GCC Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: North Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East & Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2019 & 2032

- Table 46: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 47: Global Construction Industry in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Construction Industry in Africa Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Africa?

The projected CAGR is approximately 5.07%.

2. Which companies are prominent players in the Construction Industry in Africa?

Key companies in the market include China national machinery industry corp, Sonatrach, China railway construction corp Ltd, China communications construction group ltd, Dumez Nigeria PLC, TechnipFMC, Sikhumba Construction (Pty) Ltd, General Nile Company For Roads & Bridges, Vinci, Bouygues**List Not Exhaustive.

3. What are the main segments of the Construction Industry in Africa?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 58.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid urbanization driving the market4.; Economic development.

6. What are the notable trends driving market growth?

Infrastructure construction projects driving the market.

7. Are there any restraints impacting market growth?

4.; Political and Regulatory challenges4.; Skills and Labor Shortages.

8. Can you provide examples of recent developments in the market?

December 2023: Leading renewable energy provider Scatec ASA closed the first 60 MW of the Mmadinare 120 MW Solar Complex and is on track for the start of construction of the first utility-scale solar project in Botswana.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Africa?

To stay informed about further developments, trends, and reports in the Construction Industry in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence