Key Insights

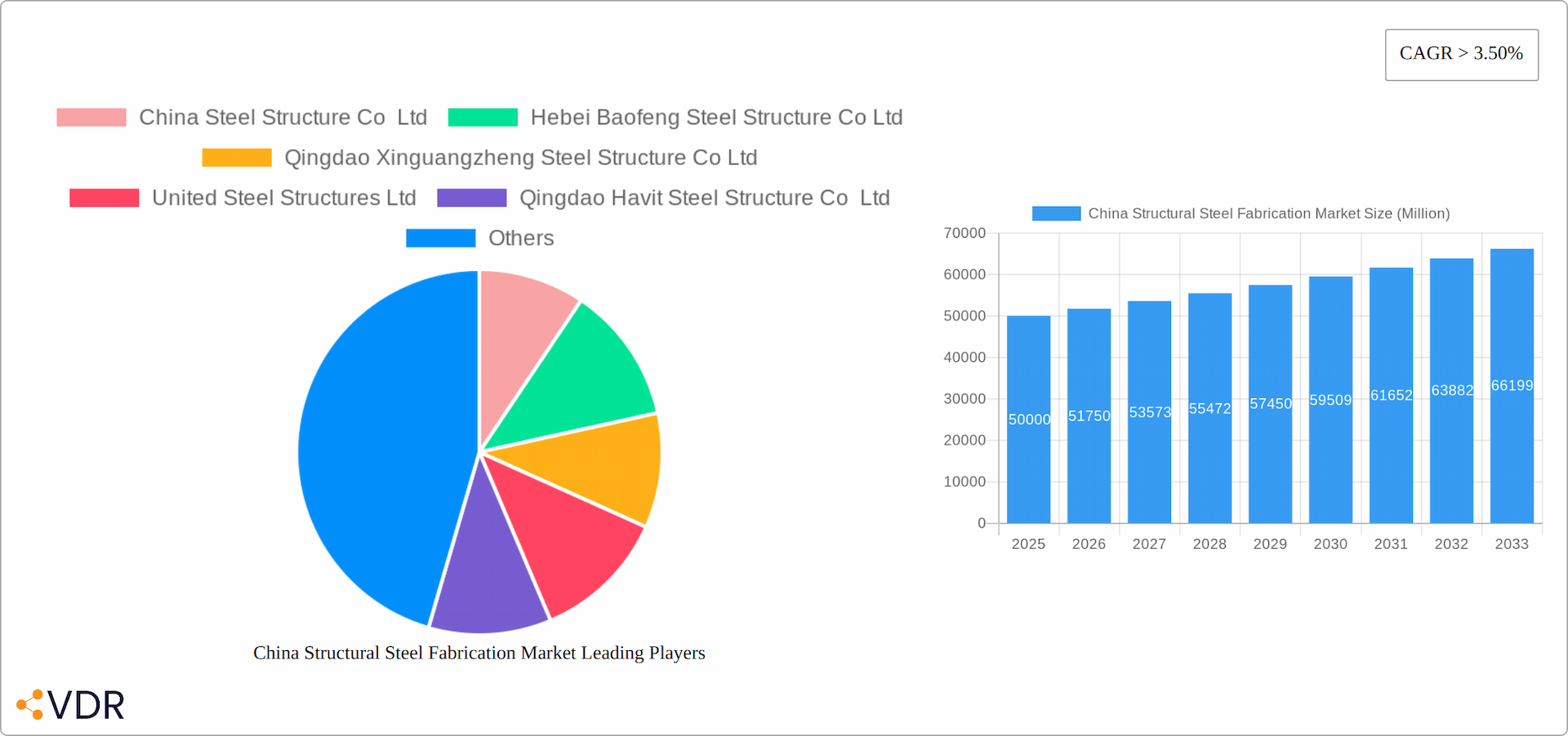

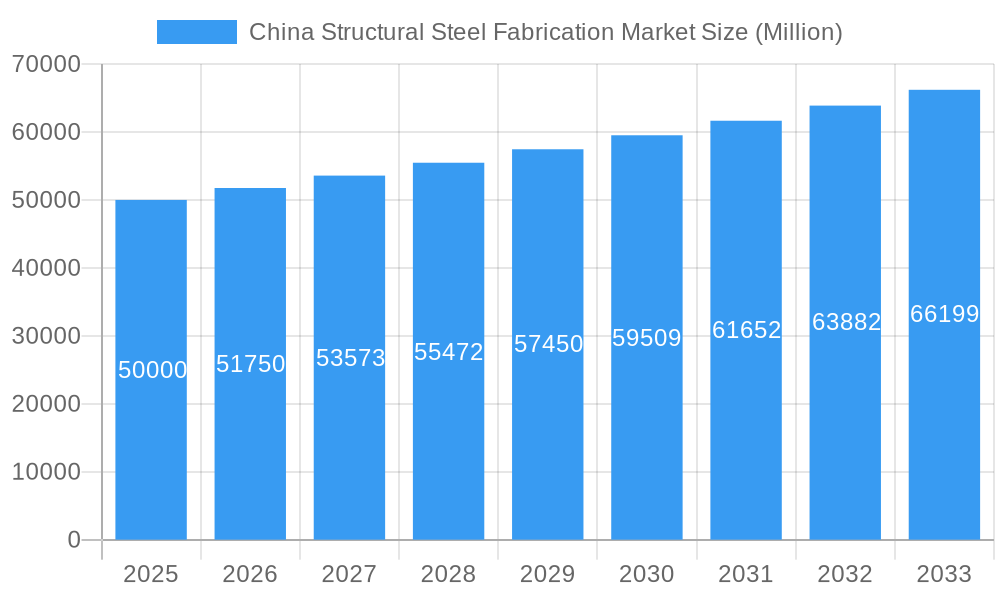

The China structural steel fabrication market is poised for significant expansion, propelled by extensive infrastructure development, including high-speed rail, bridges, and commercial facilities. Sustained government investment, urbanization, and industrialization are driving robust demand for steel structures. The market is projected to grow at a CAGR of 5.1%. Based on an estimated market size of 43.4 billion in the 2025 base year, the market is expected to see substantial growth through 2033. Key segments include construction (residential, commercial), industrial (manufacturing, warehousing), and infrastructure (transport, energy), reflecting the diverse applications of structural steel across China's economy.

China Structural Steel Fabrication Market Market Size (In Billion)

Intense competition characterizes the market, with leading domestic players such as China Steel Structure Co. Ltd, Hebei Baofeng Steel Structure Co. Ltd, and Qingdao Xinguangzheng Steel Structure Co. Ltd. These companies focus on competitive pricing and technological advancements to maintain market share. Despite potential challenges like fluctuating raw material costs and environmental regulations, the long-term outlook remains optimistic due to ongoing infrastructure projects and modernization initiatives. Future growth will be shaped by innovations in steel fabrication, the adoption of sustainable building practices, and evolving government policies on infrastructure spending and environmental standards. This dynamic market offers considerable opportunities for established and emerging companies.

China Structural Steel Fabrication Market Company Market Share

China Structural Steel Fabrication Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China structural steel fabrication market, encompassing market dynamics, growth trends, regional segmentation, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 (Base Year: 2025, Estimated Year: 2025). This analysis will be invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader China Steel Market, and the child market is specifically Structural Steel Fabrication. The market size is estimated to be xx Million units in 2025.

China Structural Steel Fabrication Market Dynamics & Structure

This section analyzes the intricate dynamics of the China structural steel fabrication market, providing a comprehensive overview of its structure and key influencing factors. Market concentration is moderate, with several large players alongside numerous smaller enterprises. Technological innovation, primarily focused on automation and improved fabrication techniques, is a key driver. Stringent regulatory frameworks concerning safety and environmental standards significantly impact market operations. The competitive landscape includes substitutes such as concrete and composite materials. End-user demographics encompass primarily construction and infrastructure projects, with increasing demand from renewable energy sectors.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on automation, digital fabrication (BIM integration), and advanced welding technologies.

- Regulatory Framework: Strict safety and environmental regulations influence production and material sourcing.

- Competitive Substitutes: Concrete, composite materials, and prefabricated building components.

- End-User Demographics: Construction (residential & commercial), infrastructure (bridges, railways), renewable energy (wind turbines, solar farms), and industrial facilities.

- M&A Trends: Significant activity observed, with notable deals (detailed in the "Notable Milestones" section) signaling consolidation within the market. Approximately xx M&A deals were recorded in the past five years, with an aggregate value of approximately xx Million units.

China Structural Steel Fabrication Market Growth Trends & Insights

The China structural steel fabrication market has experienced significant growth over the historical period (2019-2024), driven by robust infrastructure development and increasing urbanization. The market is projected to maintain steady growth during the forecast period (2025-2033), exhibiting a Compound Annual Growth Rate (CAGR) of xx% driven by government initiatives focused on infrastructure modernization, expansion of renewable energy projects, and ongoing industrialization. Technological advancements, including advanced manufacturing processes and design software, are further enhancing efficiency and pushing market growth. Consumer behavior, influenced by factors like aesthetics, durability, and sustainability, is also shaping market trends. Market penetration remains high in major urban centers but opportunities exist in rural areas and less-developed regions.

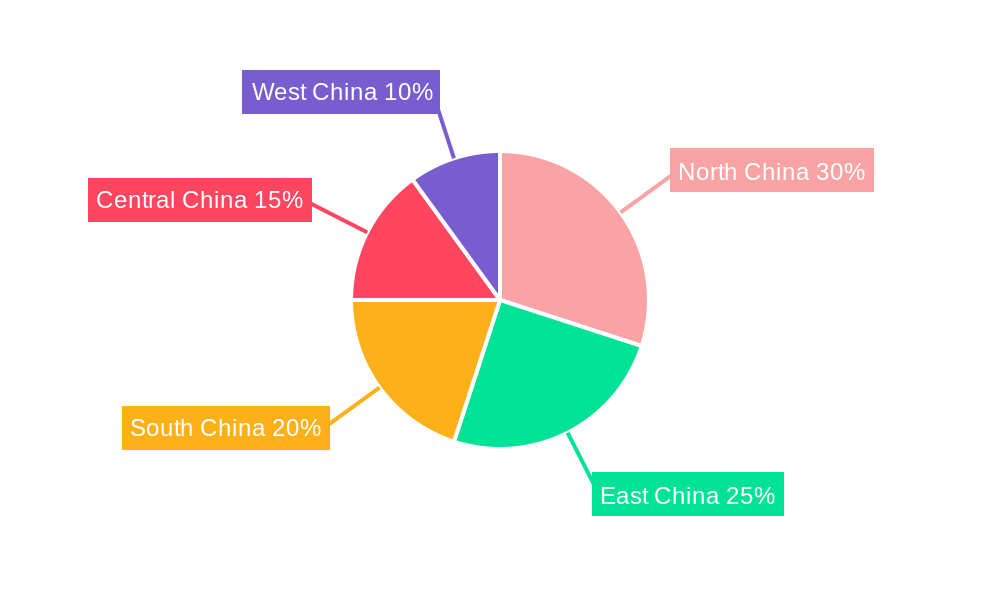

Dominant Regions, Countries, or Segments in China Structural Steel Fabrication Market

Coastal regions of China, particularly Guangdong, Jiangsu, and Shandong provinces, hold a dominant position in the structural steel fabrication market. This dominance stems from their robust industrial infrastructure, strategic proximity to major ports facilitating efficient import/export, and a high concentration of construction and manufacturing activities. These areas benefit significantly from supportive government policies promoting industrial growth, extensive transportation networks ensuring seamless logistics, and a skilled workforce capable of handling complex projects. The presence of large-scale steel mills within these regions further contributes to cost-effectiveness and streamlined supply chain management. Significant infrastructure projects, such as high-speed rail lines, expansive port developments, and large-scale construction endeavors, further fuel market dominance in these coastal areas. However, significant growth potential is also emerging in inland provinces as infrastructure investment continues its expansion across the country, opening new avenues for market players.

- Key Drivers: Government-led infrastructure investment (including the Belt and Road Initiative), rapid urbanization, robust construction activity, and advantageous proximity to both steel mills and key ports.

- Dominance Factors: Well-established industrial infrastructure, a skilled and readily available workforce, strategic geographic location, and easy access to crucial raw materials.

- Growth Potential: Inland provinces present substantial untapped opportunities as infrastructure development extends beyond coastal regions.

China Structural Steel Fabrication Market Product Landscape

The product landscape is characterized by a range of fabricated steel products, including beams, columns, trusses, and other structural components, tailored to diverse applications. Innovation focuses on high-strength steel alloys for improved load-bearing capacity, lighter-weight designs to reduce material costs, and prefabricated components for faster construction. Unique selling propositions involve enhanced durability, precise engineering, and sustainable manufacturing processes. Technological advancements are driving the adoption of digital fabrication techniques for improved accuracy and efficiency.

Key Drivers, Barriers & Challenges in China Structural Steel Fabrication Market

Key Drivers:

- Massive government investment in infrastructure projects, including the ambitious Belt and Road Initiative.

- Rapid urbanization and industrialization fueling an ever-increasing demand for construction materials, including structural steel.

- The burgeoning renewable energy sector's demand for steel in wind turbines, solar farms, and other renewable energy infrastructure.

- Government initiatives promoting sustainable and green construction practices.

Key Challenges:

- Significant volatility in steel prices directly impacting profitability and making long-term forecasting difficult.

- Increasingly stringent environmental regulations leading to higher operational costs and compliance burdens.

- Intense competition amongst numerous domestic and international players resulting in price wars and reduced profit margins, particularly for smaller firms. This competitive pressure is estimated to result in an annual loss of approximately xx Million units across the industry.

- Supply chain disruptions and inefficiencies impacting the availability of raw materials and leading to delays in project delivery.

- Shortage of skilled labor in certain regions.

Emerging Opportunities in China Structural Steel Fabrication Market

The market presents several compelling emerging opportunities. These include the expansion into prefabricated construction methods offering faster and more efficient building processes, the integration of smart building technologies enhancing building functionality and energy efficiency, and the development of more sustainable and eco-friendly steel fabrication techniques to meet growing environmental concerns. Untapped market potential exists in less-developed rural areas and smaller cities. Innovative applications such as modular buildings offering flexibility and scalability, and offshore structures for maritime and energy projects, are gaining significant traction. Furthermore, evolving consumer preferences for sustainable and aesthetically pleasing buildings are driving demand for innovative product designs and construction solutions.

Growth Accelerators in the China Structural Steel Fabrication Market Industry

Long-term growth is accelerated by technological advancements in steel fabrication (e.g., robotic welding, 3D printing), strategic partnerships between fabricators and construction companies, and government policies promoting sustainable construction practices. Expansion into new markets through international collaborations and the development of specialized products for niche applications will further fuel market growth.

Key Players Shaping the China Structural Steel Fabrication Market Market

- China Steel Structure Co Ltd

- Hebei Baofeng Steel Structure Co Ltd

- Qingdao Xinguangzheng Steel Structure Co Ltd

- United Steel Structures Ltd

- Qingdao Havit Steel Structure Co Ltd

- Huayin Group

- Qingdao Tailong Steel Structure Co Ltd

- Hongfeng Industrial Group

- Wuxi Chuxin Steel Structure Project Co Ltd

- Guangdong Dongji Intelligent Device Co Ltd

- Rizhao Steel Holding Group Co Ltd

- Dingli Steel Structure Co Ltd

Notable Milestones in China Structural Steel Fabrication Market Sector

- August 2022: China Baowu Steel Group's acquisition of a 51% stake in XinSteel for CNY 4.26 billion (USD 630 million) marked a significant step towards market consolidation and industry restructuring.

- December 2022: The subsequent acquisition of Sinosteel Group by China Baowu Steel Group further solidified its market dominance and expanded its international reach and influence.

- [Add other relevant milestones with dates and brief descriptions]

In-Depth China Structural Steel Fabrication Market Market Outlook

The China structural steel fabrication market exhibits strong potential for continued growth, driven by ongoing large-scale infrastructure development, rapid urbanization trends, and the expanding renewable energy sector. Strategic partnerships between domestic and international players, technological advancements in fabrication techniques, and continuous government support will further enhance market prospects. Significant opportunities exist in exploring and implementing sustainable fabrication practices, expanding into niche markets with specific needs, and leveraging digital technologies to optimize operational efficiency, enhance supply chain management, and improve customer service. The market is projected to reach xx Million units by 2033, demonstrating substantial growth potential in the coming decade. However, continued monitoring of fluctuating steel prices and evolving environmental regulations remains crucial for sustained success within this dynamic market.

China Structural Steel Fabrication Market Segmentation

-

1. Service

- 1.1. Metal Welding

- 1.2. Metal Forming

- 1.3. Metal Cutting

- 1.4. Metal Shearing

- 1.5. Metal Stamping

- 1.6. Machining

- 1.7. Metal Rolling

- 1.8. Others

-

2. Application

- 2.1. Construction

- 2.2. Automotive

- 2.3. Manufacturing

- 2.4. Energy & Power

- 2.5. Electronics

- 2.6. Defense & Aerospace

- 2.7. Others

China Structural Steel Fabrication Market Segmentation By Geography

- 1. China

China Structural Steel Fabrication Market Regional Market Share

Geographic Coverage of China Structural Steel Fabrication Market

China Structural Steel Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rising Demand for Prefabricated Buildings

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Structural Steel Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Metal Welding

- 5.1.2. Metal Forming

- 5.1.3. Metal Cutting

- 5.1.4. Metal Shearing

- 5.1.5. Metal Stamping

- 5.1.6. Machining

- 5.1.7. Metal Rolling

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Automotive

- 5.2.3. Manufacturing

- 5.2.4. Energy & Power

- 5.2.5. Electronics

- 5.2.6. Defense & Aerospace

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 China Steel Structure Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hebei Baofeng Steel Structure Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Qingdao Xinguangzheng Steel Structure Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Steel Structures Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Qingdao Havit Steel Structure Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huayin Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Qingdao Tailong Steel Structure Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hongfeng Industrial Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wuxi Chuxin Steel Structure Project Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Guangdong Dongji Intelligent Device Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rizhao Steel Holding Group Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dingli Steel Structure Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 China Steel Structure Co Ltd

List of Figures

- Figure 1: China Structural Steel Fabrication Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Structural Steel Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: China Structural Steel Fabrication Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: China Structural Steel Fabrication Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: China Structural Steel Fabrication Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Structural Steel Fabrication Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: China Structural Steel Fabrication Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: China Structural Steel Fabrication Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Structural Steel Fabrication Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the China Structural Steel Fabrication Market?

Key companies in the market include China Steel Structure Co Ltd, Hebei Baofeng Steel Structure Co Ltd, Qingdao Xinguangzheng Steel Structure Co Ltd, United Steel Structures Ltd, Qingdao Havit Steel Structure Co Ltd, Huayin Group, Qingdao Tailong Steel Structure Co Ltd, Hongfeng Industrial Group, Wuxi Chuxin Steel Structure Project Co Ltd, Guangdong Dongji Intelligent Device Co Ltd, Rizhao Steel Holding Group Co Ltd, Dingli Steel Structure Co Ltd.

3. What are the main segments of the China Structural Steel Fabrication Market?

The market segments include Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.4 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rising Demand for Prefabricated Buildings.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022; The world's largest iron and steel company China Baowu Steel Group, a state-owned enterprise, acquired a 51% stake in XinSteel, the biggest steelmaker in Jiangxi province. JunHe and Clifford Chance advised this CNY 4.26 billion (USD 630 million) deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Structural Steel Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Structural Steel Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Structural Steel Fabrication Market?

To stay informed about further developments, trends, and reports in the China Structural Steel Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence