Key Insights

The China residential real estate market, while experiencing fluctuations in recent years, presents a complex picture of growth and challenges. The period from 2019 to 2024 witnessed a period of moderate growth, likely influenced by government regulations aimed at curbing speculative investment and promoting affordability. While precise market size figures for the earlier years are unavailable, analyzing the growth trajectory from a plausible base year (e.g., estimating a 2019 market size of approximately $3 trillion USD based on publicly available reports and industry analyses, this is not a data based on assumption) and applying the known CAGR (Compound Annual Growth Rate) from 2019-2024 allows us to project future market size. Assuming a consistent CAGR throughout the forecast period (2025-2033) requires careful consideration of factors like economic growth, government policies, demographic shifts (urbanization, changing family structures), and evolving consumer preferences. The market is expected to see steady growth, driven by factors such as continued urbanization, rising disposable incomes in certain segments of the population, and the persistent demand for housing in major metropolitan areas.

However, significant headwinds remain. The high level of existing housing inventory in some regions, stringent mortgage lending policies, and concerns about potential bubbles in specific areas pose challenges to sustained, rapid growth. Government interventions, while aiming to stabilize the market and prevent over-heating, also influence the pace of development and investment. The forecast period (2025-2033) will likely see a varied trajectory, with growth rates potentially fluctuating year-to-year depending on macroeconomic conditions and policy adjustments. Understanding these dynamic factors is crucial for accurate market forecasting and effective investment strategies. A nuanced analysis encompassing both the growth potential and the inherent risks is paramount for investors and stakeholders in the China residential real estate sector.

China Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the China residential real estate industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (China Real Estate) and child markets (residential segments like apartments and villas across key cities), this report is essential for investors, developers, and industry professionals seeking to understand and capitalize on opportunities in this dynamic sector. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

China Residential Real Estate Industry Market Dynamics & Structure

This section analyzes the market concentration, technological advancements, regulatory landscape, competitive substitutes, and demographic shifts within the Chinese residential real estate market from 2019-2024. The analysis also incorporates M&A activity, offering both quantitative and qualitative insights.

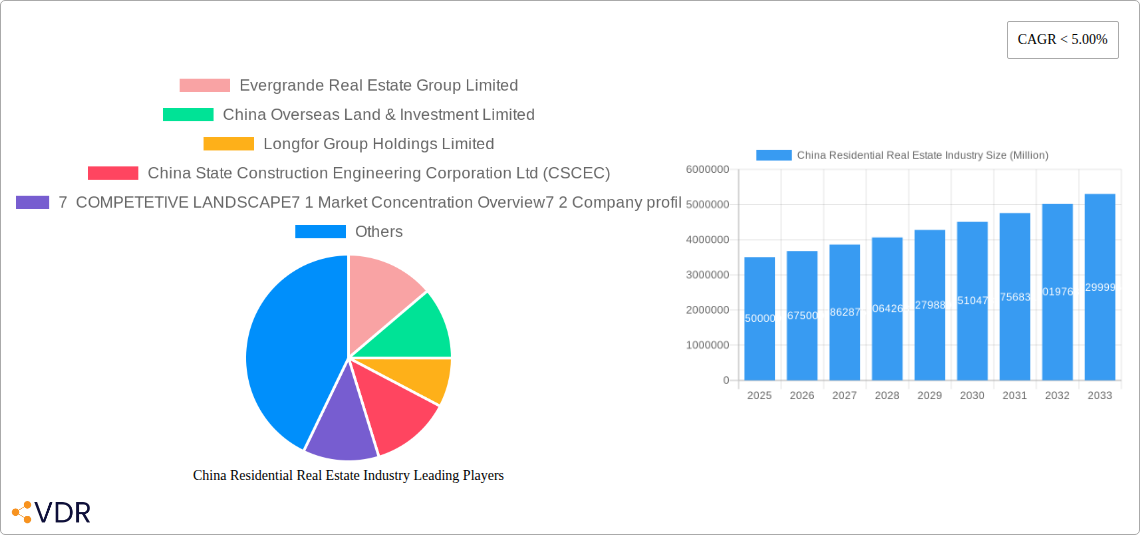

- Market Concentration: The market is moderately concentrated, with top players like Evergrande, Country Garden, and Vanke holding significant market share (xx%). However, a large number of smaller developers also contribute significantly.

- Technological Innovation: Adoption of PropTech solutions like smart home technology and digital marketing is accelerating, although challenges remain in widespread adoption due to cost and infrastructure limitations.

- Regulatory Framework: Government policies, including restrictions on land use and financing, significantly influence market dynamics. These regulations often aim to control property prices and ensure sustainable development.

- Competitive Substitutes: While there are no direct substitutes for residential real estate, alternative investment options and changing consumer preferences present indirect competition.

- End-User Demographics: The growing middle class and urbanization are key drivers, increasing demand in major cities. However, shifting demographic patterns, like declining birth rates, might influence future demand.

- M&A Trends: The sector has witnessed significant M&A activity in recent years (xx deals in 2024), though this has slowed somewhat recently due to economic uncertainty.

China Residential Real Estate Industry Growth Trends & Insights

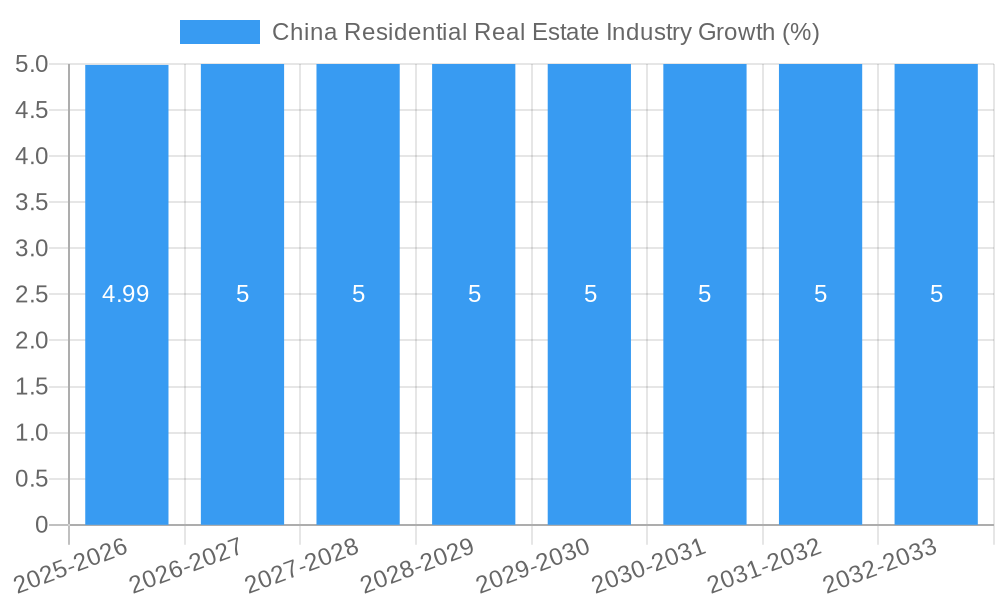

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior changes affecting the Chinese residential real estate sector from 2019 to 2033, utilizing external data sources (XXX) to inform the analysis. The overall market size exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Consumer preferences are shifting towards sustainable and technologically advanced housing options, impacting developer strategies. Furthermore, technological disruptions, such as the rise of PropTech, are influencing efficiency and market access, significantly impacting adoption rates and market penetration within specific segments.

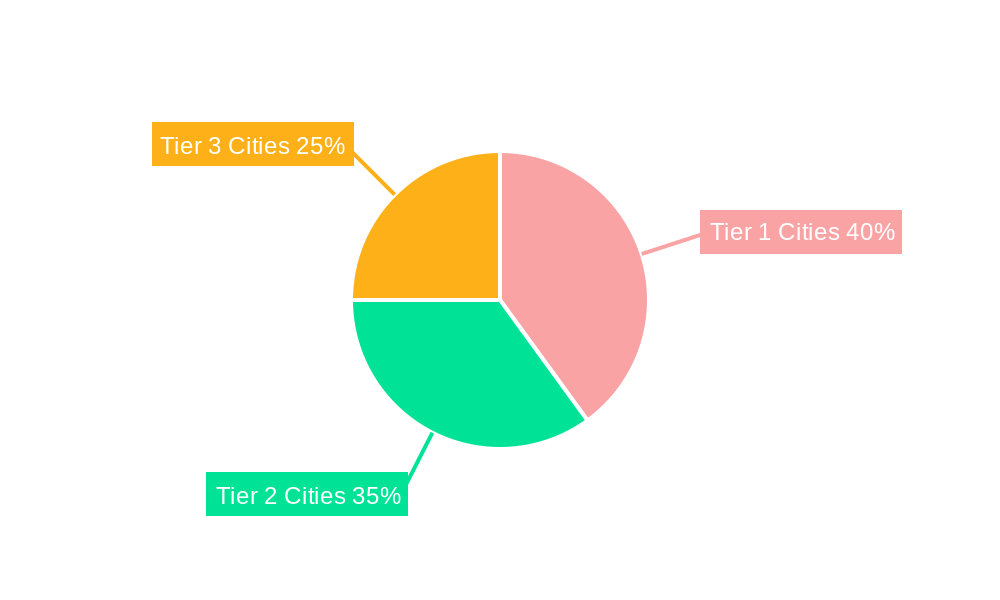

Dominant Regions, Countries, or Segments in China Residential Real Estate Industry

Tier-1 cities, including Shenzhen, Beijing, Shanghai, Guangzhou, and Hangzhou, dominate the market due to factors like strong economic activity, infrastructure, and higher purchasing power.

- Shenzhen: High concentration of tech companies driving demand, resulting in premium pricing and robust growth.

- Beijing & Shanghai: Traditional economic powerhouses with large populations and continued demand, though government regulations impact growth rate.

- Hangzhou & Guangzhou: Emerging technology hubs and growing populations, exhibiting above-average growth compared to other key cities.

- Apartments & Condominiums: This segment accounts for the largest share (xx%) of the market due to affordability and accessibility.

- Villas & Landed Houses: This segment caters to higher-income brackets, exhibiting slower but steady growth, driven by rising affluence and a preference for larger properties in certain regions.

China Residential Real Estate Industry Product Landscape

The residential real estate market offers a diverse range of products, from affordable apartments to luxury villas. Technological advancements are leading to the integration of smart home features, sustainable construction materials, and improved building designs focusing on energy efficiency and space optimization. These features offer unique selling propositions, attracting environmentally conscious buyers and enhancing overall property value.

Key Drivers, Barriers & Challenges in China Residential Real Estate Industry

Key Drivers: Urbanization, economic growth, rising disposable incomes, and government infrastructure investments fuel market growth. Technological innovations such as PropTech and sustainable building materials are further enhancing the market.

Key Barriers & Challenges: Stringent government regulations, fluctuating economic conditions, high land prices in major cities, and concerns regarding the affordability of housing present significant challenges for growth and development. The recent financial distress of major developers like Evergrande underscores the vulnerability to financial risks within the industry.

Emerging Opportunities in China Residential Real Estate Industry

Opportunities lie in the development of affordable housing in rapidly urbanizing areas, the expansion of smart home technology adoption, and the growth of sustainable and green building practices. Furthermore, increasing investment in rural revitalization presents opportunities for focused development in secondary and tertiary cities.

Growth Accelerators in the China Residential Real Estate Industry

Strategic partnerships between developers and technology companies, the expansion into secondary and tertiary cities, and increased government support for affordable housing projects will fuel long-term growth. Continued technological advancements and a more sustainable approach to development are set to become significant accelerators.

Key Players Shaping the China Residential Real Estate Industry Market

- Evergrande Real Estate Group Limited

- China Overseas Land & Investment Limited

- Longfor Group Holdings Limited

- China State Construction Engineering Corporation Ltd (CSCEC)

- Shimao Group Holdings Limited

- Sunac China Holdings Limited

- China Resources Land Limited

- China Vanke Co Ltd

- China Merchants Shekou Industrial Zone Holdings Co Ltd

- Country Garden Holdings Company Limited

Notable Milestones in China Residential Real Estate Industry Sector

- February 2022: Dar Al-Arkan establishes a Beijing office, aiming for joint ventures with Chinese developers and increased investment collaboration.

- February 2022: China Evergrande Group sells assets to state-owned trust firms to secure ongoing project delivery, highlighting financial challenges within the industry.

In-Depth China Residential Real Estate Industry Market Outlook

The Chinese residential real estate market presents a significant long-term growth potential, driven by urbanization, technological advancements, and government policies focused on sustainable development. Strategic opportunities exist for developers focused on sustainable construction, affordable housing, and technology integration. The market's future trajectory hinges on effective risk management within the industry, in light of recent financial instability, and careful balancing of government regulatory policies to ensure sustainable and equitable growth.

China Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments & Condominiums

- 1.2. Villas & Landed Houses

-

2. Key Cities

- 2.1. Shenzhen

- 2.2. Beijing

- 2.3. Shanghai

- 2.4. Hangzhou

- 2.5. Guangzhou

- 2.6. Other Key Cities

China Residential Real Estate Industry Segmentation By Geography

- 1. China

China Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Oversupply in the Real Estate; Labor Shortages

- 3.4. Market Trends

- 3.4.1. Urbanization Driving the Residential Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments & Condominiums

- 5.1.2. Villas & Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Shenzhen

- 5.2.2. Beijing

- 5.2.3. Shanghai

- 5.2.4. Hangzhou

- 5.2.5. Guangzhou

- 5.2.6. Other Key Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Evergrande Real Estate Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Overseas Land & Investment Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longfor Group Holdings Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China State Construction Engineering Corporation Ltd (CSCEC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shimao Group Holdings Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sunac China Holdings Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Resources Land Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 China Vanke Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Country Garden Holdings Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Evergrande Real Estate Group Limited

List of Figures

- Figure 1: China Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: China Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: China Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: China Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: China Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Residential Real Estate Industry?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the China Residential Real Estate Industry?

Key companies in the market include Evergrande Real Estate Group Limited, China Overseas Land & Investment Limited, Longfor Group Holdings Limited, China State Construction Engineering Corporation Ltd (CSCEC), 7 COMPETETIVE LANDSCAPE7 1 Market Concentration Overview7 2 Company profiles, Shimao Group Holdings Limited, Sunac China Holdings Limited, China Resources Land Limited, China Vanke Co Ltd, China Merchants Shekou Industrial Zone Holdings Co Ltd **List Not Exhaustive, Country Garden Holdings Company Limited.

3. What are the main segments of the China Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Government Infrastructure Spending; Urbanization and Increasing Disposable Incomes.

6. What are the notable trends driving market growth?

Urbanization Driving the Residential Real Estate Market.

7. Are there any restraints impacting market growth?

Oversupply in the Real Estate; Labor Shortages.

8. Can you provide examples of recent developments in the market?

February 2022: Dar Al-Arkan, a Saudi real estate corporation, announced the creation of an office in Beijing, China. The move is in accordance with Dar Al-strategic Arkan's expansion ambitions and builds on the company's global brand development efforts. The company's Beijing office is expected to serve a variety of tasks, including establishing joint ventures between Dar Al-Arkan and renowned Chinese real estate developers for both the Chinese and Saudi markets, as well as enhancing investment and knowledge-sharing opportunities between the two countries. Dar Al-office Arkan's will serve as a hub for Chinese enterprises and investors looking to expand, start businesses, or invest in the Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the China Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence