Key Insights

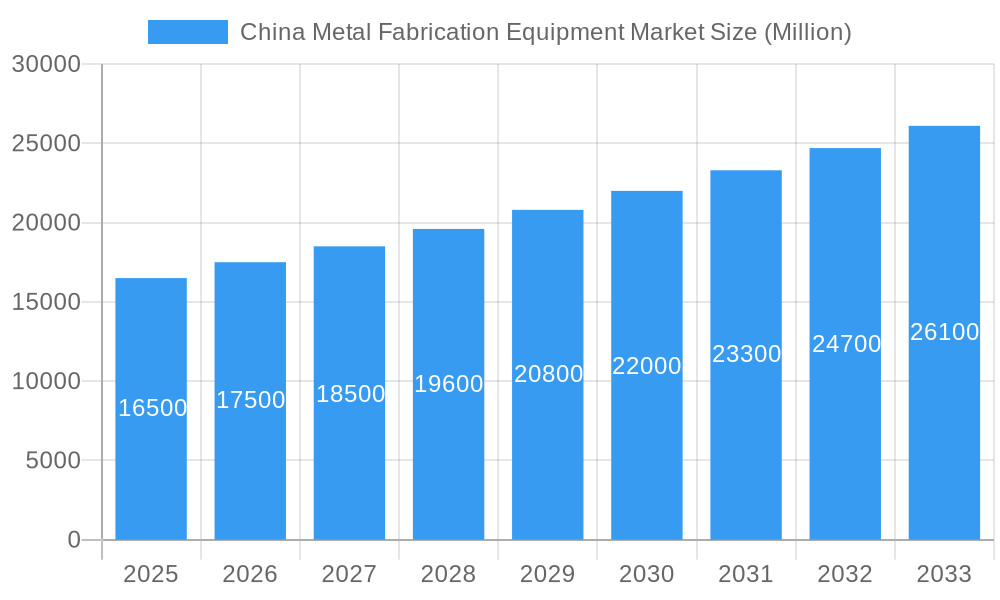

The China metal fabrication equipment market is experiencing robust growth, driven by the nation's expanding manufacturing sector and significant investments in infrastructure projects. The period from 2019 to 2024 witnessed considerable expansion, laying a strong foundation for continued growth through 2033. While precise market size figures for the historical period are unavailable, the available data indicates a substantial market. Considering the significant industrialization and urbanization efforts within China, coupled with government initiatives supporting advanced manufacturing, a conservative estimate places the market size in 2024 around $15 billion USD. This is based on observed growth in related sectors and reports of increasing adoption of automated and advanced fabrication technologies. The forecast period (2025-2033) anticipates sustained growth fueled by increasing demand from diverse end-use industries such as automotive, construction, and electronics. The consistent modernization and automation efforts within Chinese manufacturing will significantly contribute to market expansion. A projected Compound Annual Growth Rate (CAGR) of 6% for the forecast period seems plausible given the ongoing industrial development and investments in technology upgrades. This rate suggests a steady and reliable growth trajectory for the market, with the market size potentially exceeding $25 billion USD by 2033.

China Metal Fabrication Equipment Market Market Size (In Billion)

The market's growth is influenced by several key factors. The government's "Made in China 2025" initiative significantly boosts the adoption of advanced manufacturing technologies. This includes an increased demand for sophisticated metal fabrication equipment, such as CNC machines, laser cutting systems, and robotic welding equipment. Moreover, the growing automotive and construction sectors within China are key drivers, requiring substantial quantities of fabricated metal components. Competition among domestic and international manufacturers is intensifying, leading to technological advancements and price competitiveness. This further promotes market expansion and accessibility for various industry players. Challenges include maintaining consistent supply chains and managing fluctuating raw material prices, factors that need to be accounted for in strategic market planning.

China Metal Fabrication Equipment Market Company Market Share

China Metal Fabrication Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Metal Fabrication Equipment market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, regional performance, key players, and future outlook, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating both qualitative and quantitative data, to deliver a clear and actionable understanding of this dynamic market. With a focus on parent markets (machinery manufacturing) and child markets (automotive, construction, etc.), this report offers granular detail and market segmentation for maximum relevance. The base year for this report is 2025, with an estimated year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The total market size is projected to reach xx Million units by 2033.

China Metal Fabrication Equipment Market Market Dynamics & Structure

The China Metal Fabrication Equipment market is characterized by a complex interplay of factors influencing its growth trajectory. Market concentration is relatively high, with a few major players holding significant market share. Technological innovation, particularly in automation and digitalization, is a key driver, alongside government regulations promoting industrial upgrades and sustainable manufacturing. Competitive substitutes, such as 3D printing and additive manufacturing, are emerging but currently represent a relatively small portion of the market. The end-user demographics are diverse, spanning across various industries, including automotive, construction, electronics, and energy. The past five years have witnessed a moderate level of mergers and acquisitions (M&A) activity, primarily focused on consolidation and expansion into new segments.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Adoption of AI-powered systems and robotic automation is driving productivity gains.

- Regulatory Framework: Government policies supporting advanced manufacturing and "Made in China 2025" initiatives fuel market expansion.

- Competitive Substitutes: The threat from additive manufacturing is currently low (xx% market share in 2025), but it warrants monitoring for long-term implications.

- M&A Activity: An average of xx M&A deals were recorded annually during the period 2019-2024.

- Innovation Barriers: High initial investment costs and a skills gap in operating advanced equipment pose significant challenges.

China Metal Fabrication Equipment Market Growth Trends & Insights

The China Metal Fabrication Equipment market has experienced significant growth over the past five years, driven by a combination of factors. The market size witnessed a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, reaching xx Million units in 2024. This growth is attributable to several key factors, including rising industrial output, infrastructure development, and increasing automation across various sectors. The adoption rate of advanced metal fabrication equipment is gradually increasing, fueled by rising labor costs and the need for enhanced productivity and precision. Technological disruptions, especially the integration of IoT and AI capabilities, are transforming the market landscape. Consumer behavior shifts are towards greater demand for customized and high-quality products, which drives the need for sophisticated fabrication equipment. Market penetration of advanced technologies is expected to increase from xx% in 2025 to xx% by 2033.

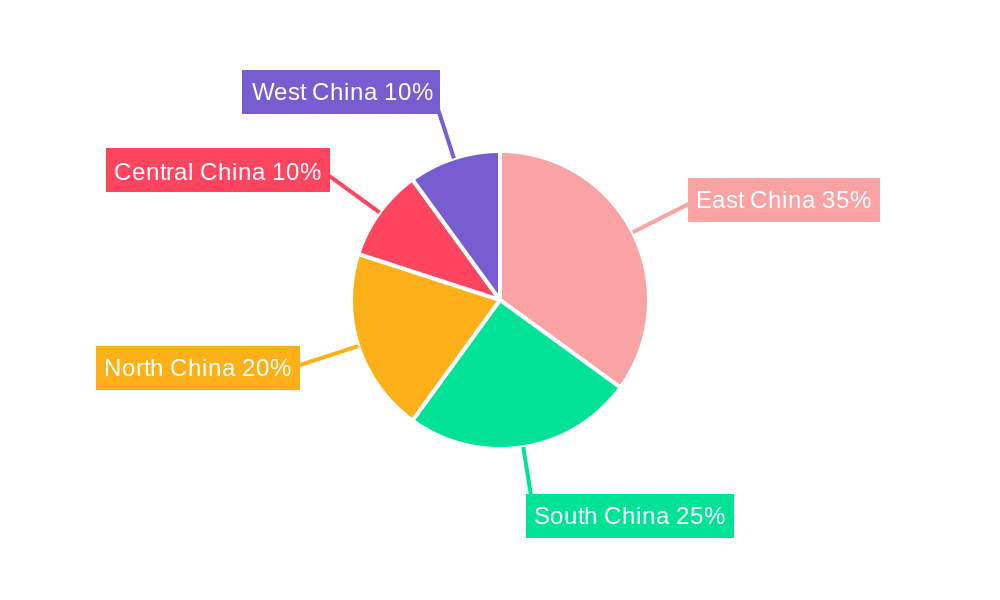

Dominant Regions, Countries, or Segments in China Metal Fabrication Equipment Market

The coastal regions of China, particularly Guangdong, Jiangsu, and Zhejiang provinces, dominate the metal fabrication equipment market. This dominance stems from several key factors. These regions boast a high concentration of manufacturing industries, strong infrastructure networks, and a favorable investment climate. Government policies supporting economic development and industrial upgrades also play a crucial role. Market share within these regions is expected to remain high, with consistent growth anticipated due to ongoing infrastructure projects and industrial expansion.

- Key Drivers:

- Strong industrial base

- Well-developed infrastructure

- Favorable government policies

- Proximity to major ports and transportation networks

- Dominance Factors:

- High concentration of manufacturing industries

- Significant investments in infrastructure

- Access to skilled labor

- Supportive government policies

China Metal Fabrication Equipment Market Product Landscape

The China Metal Fabrication Equipment market offers a diverse range of products, including laser cutting machines, CNC machining centers, press brakes, and welding robots. Recent innovations focus on enhancing precision, speed, and automation. Key features include advanced control systems, integrated software solutions, and improved material handling capabilities. Unique selling propositions often involve energy efficiency, ease of use, and reduced maintenance requirements. Technological advancements are rapidly pushing the boundaries of what's possible in terms of accuracy, complexity, and throughput.

Key Drivers, Barriers & Challenges in China Metal Fabrication Equipment Market

Key Drivers:

The market is primarily driven by the rapid growth of China's manufacturing sector, coupled with increasing investments in infrastructure development and automation technologies. Government initiatives such as "Made in China 2025" are also significantly influencing the adoption of advanced fabrication equipment. The growing demand for high-quality, customized products across various end-use industries further propels market expansion.

Key Barriers and Challenges:

Significant barriers to market growth include high initial investment costs associated with advanced equipment, the need for skilled labor to operate these technologies, and intense competition from both domestic and international players. Supply chain disruptions, especially those related to crucial components, can also impact market dynamics. Regulatory hurdles and environmental regulations add complexity and potentially increase operational costs.

Emerging Opportunities in China Metal Fabrication Equipment Market

Emerging opportunities include the growing demand for customized manufacturing solutions, the expansion of the e-commerce sector (requiring specialized packaging and logistics equipment), and the increasing adoption of additive manufacturing techniques. Untapped markets exist within niche sectors, such as aerospace and medical device manufacturing. The integration of artificial intelligence and machine learning capabilities into fabrication equipment represents a major growth opportunity.

Growth Accelerators in the China Metal Fabrication Equipment Market Industry

Long-term growth in the China Metal Fabrication Equipment market will be fueled by several factors, including technological breakthroughs in areas such as laser technology and robotics, strategic partnerships between equipment manufacturers and end-users, and market expansion strategies targeting emerging industries. Continued government support for technological innovation and industrial upgrades will also play a crucial role in maintaining the positive growth trajectory.

Key Players Shaping the China Metal Fabrication Equipment Market Market

- Coherent

- Colfax

- Nissan Tanaka

- Yamazaki Mazak

- Schuler

- GF Machining Solutions

- TRUMPF

- Emag

- AMADA

- DMG MORI Seiki

- List Not Exhaustive

Notable Milestones in China Metal Fabrication Equipment Market Sector

- 2020: Introduction of several new high-precision laser cutting machines by leading manufacturers.

- 2021: Government initiatives to promote the adoption of automation and digitalization in manufacturing.

- 2022: A significant increase in M&A activity, with several large-scale mergers and acquisitions within the industry.

- 2023: Launch of several innovative robotic welding systems by major players.

- 2024: Focus on sustainable manufacturing practices and environmentally friendly equipment.

In-Depth China Metal Fabrication Equipment Market Market Outlook

The China Metal Fabrication Equipment market is poised for sustained growth in the coming years, driven by ongoing industrial expansion, technological innovation, and continued government support. Strategic opportunities for market participants include focusing on high-value-added products, investing in R&D to develop advanced technologies, and building strategic partnerships with key players across various industries. The long-term outlook for this market is positive, with significant potential for growth and expansion.

China Metal Fabrication Equipment Market Segmentation

-

1. Product type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Automotive and Aviation

- 2.3. Power Plants

- 2.4. Chemicals and Mining

- 2.5. Construction

- 2.6. Other End-user Industries

China Metal Fabrication Equipment Market Segmentation By Geography

- 1. China

China Metal Fabrication Equipment Market Regional Market Share

Geographic Coverage of China Metal Fabrication Equipment Market

China Metal Fabrication Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Metal Cutting Equipment Pose Huge Potential in the Present Scenario

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Metal Fabrication Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Automotive and Aviation

- 5.2.3. Power Plants

- 5.2.4. Chemicals and Mining

- 5.2.5. Construction

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6 COMPETITIVE LANDSCAPE 6 1 Market Concentration 6 2 Company profiles

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Coherent

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colfax

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nissan Tanaka

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yamazaki Mazak

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schuler

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GF Machining Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TRUMPF

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emag

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AMADA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DMG MORI Seiki*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 6 COMPETITIVE LANDSCAPE 6 1 Market Concentration 6 2 Company profiles

List of Figures

- Figure 1: China Metal Fabrication Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Metal Fabrication Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Metal Fabrication Equipment Market Revenue Million Forecast, by Product type 2020 & 2033

- Table 2: China Metal Fabrication Equipment Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: China Metal Fabrication Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Metal Fabrication Equipment Market Revenue Million Forecast, by Product type 2020 & 2033

- Table 5: China Metal Fabrication Equipment Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: China Metal Fabrication Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Metal Fabrication Equipment Market?

The projected CAGR is approximately < 2.00%.

2. Which companies are prominent players in the China Metal Fabrication Equipment Market?

Key companies in the market include 6 COMPETITIVE LANDSCAPE 6 1 Market Concentration 6 2 Company profiles, Coherent, Colfax, Nissan Tanaka, Yamazaki Mazak, Schuler, GF Machining Solutions, TRUMPF, Emag, AMADA, DMG MORI Seiki*List Not Exhaustive.

3. What are the main segments of the China Metal Fabrication Equipment Market?

The market segments include Product type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Metal Cutting Equipment Pose Huge Potential in the Present Scenario.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Metal Fabrication Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Metal Fabrication Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Metal Fabrication Equipment Market?

To stay informed about further developments, trends, and reports in the China Metal Fabrication Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence