Key Insights

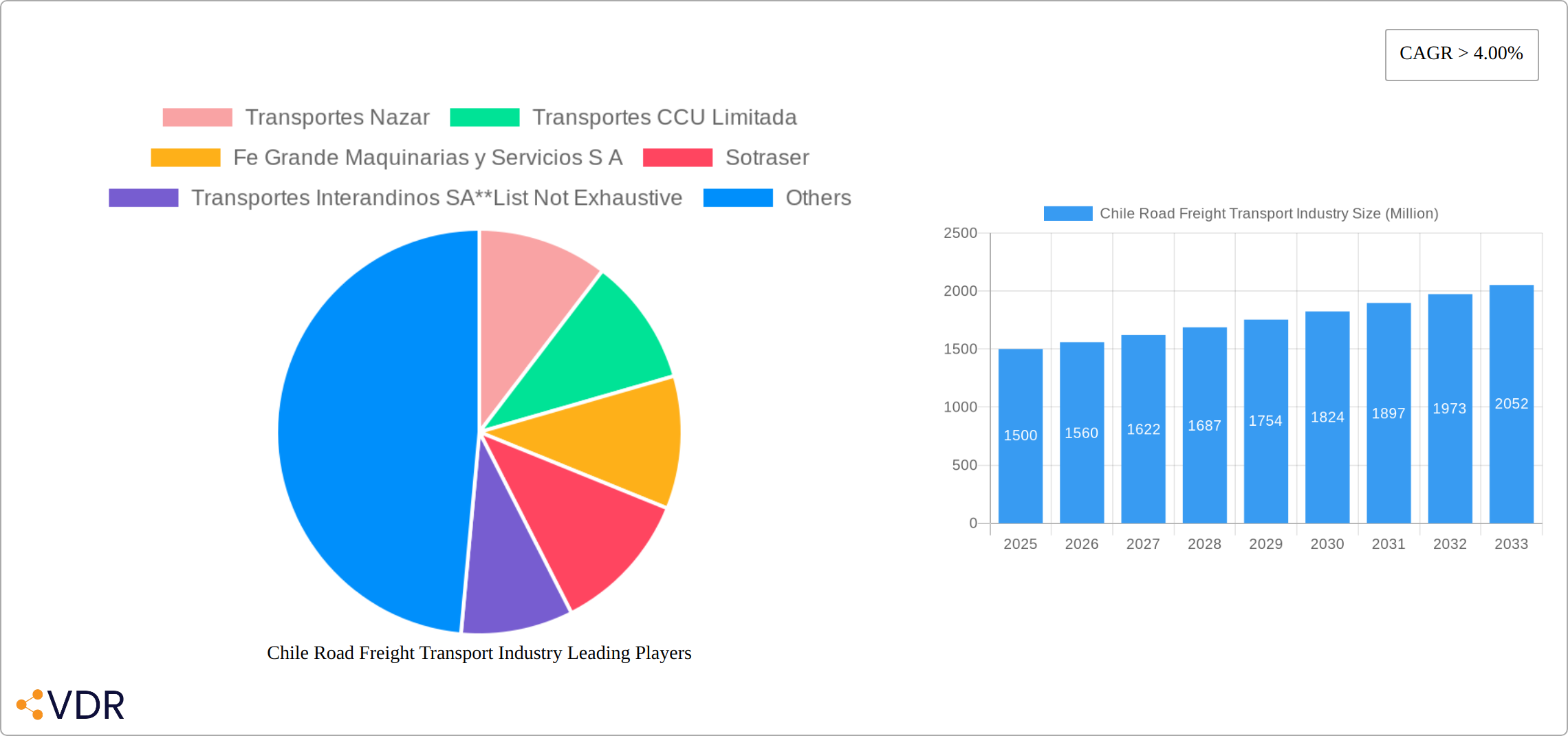

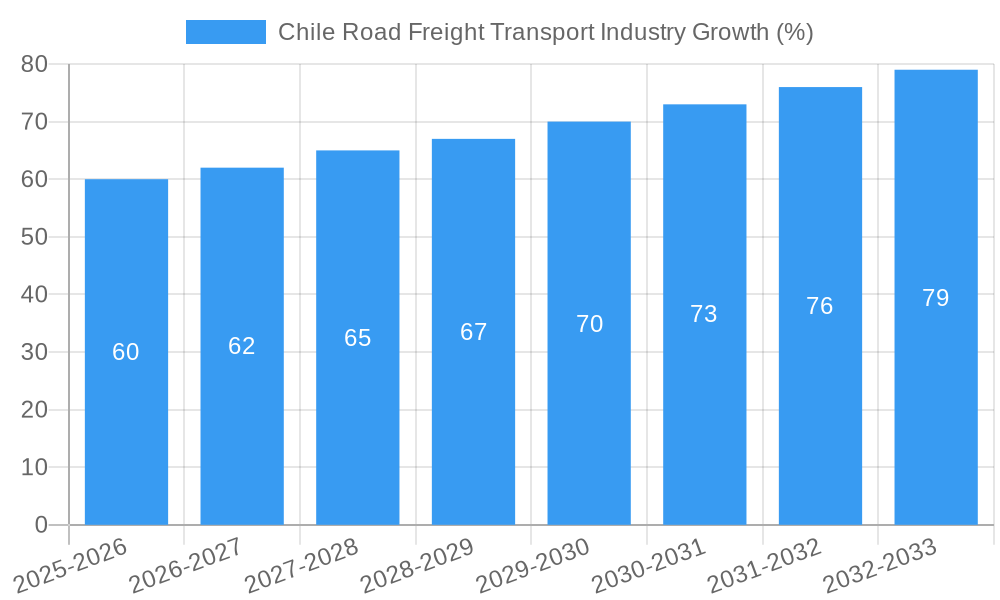

The Chilean road freight transport industry, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.00% through 2033. This expansion is driven by several key factors. Firstly, the increasing demand for efficient and reliable transportation solutions across various sectors, including manufacturing, automotive, oil and gas, mining, agriculture, construction, and pharmaceuticals, fuels market growth. The burgeoning e-commerce sector in Chile further contributes to the high volume of goods requiring road freight transport, stimulating demand. Government initiatives focused on infrastructure development and logistics improvements, while not explicitly detailed, likely play a significant supporting role. Furthermore, the ongoing expansion of Chile's mining and agricultural sectors creates a significant demand for transportation services, contributing to the industry's overall growth trajectory.

However, challenges persist. These likely include fluctuating fuel prices, which directly impact operational costs, and the potential for driver shortages given the competitive nature of the industry and the need for skilled professionals. Regulations concerning driver working conditions and vehicle maintenance standards also influence operational efficiency and cost. Competition among established players like Transportes Nazar, Transportes CCU Limitada, Fe Grande Maquinarias y Servicios S A, Sotraser, Transportes Interandinos SA, Andes Logistics de Chile S A, Transportes Tamarugal Limitada, Agunsa, Transportes Casablanca, and Logistica Linsa S A, and the potential entry of new players, could lead to price pressures. Despite these headwinds, the long-term outlook for the Chilean road freight transport industry remains positive, fueled by sustained economic growth and increased demand across various sectors. Segmentation analysis reveals significant activity across both domestic and international transport, highlighting the industry's diverse operational scope and its interconnectedness with the global economy.

Chile Road Freight Transport Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Chile road freight transport industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The report analyzes both parent market (Logistics and Transportation) and child market (Road Freight Transport).

Chile Road Freight Transport Industry Market Dynamics & Structure

The Chilean road freight transport market exhibits a moderately concentrated structure, with several major players vying for market share. Technological innovation, driven primarily by advancements in fleet management systems (telematics) and route optimization software, is reshaping the industry. Stringent regulatory frameworks, focused on safety and environmental compliance, influence operational costs and competitive landscapes. The industry faces competition from alternative modes of transport, notably rail and maritime, particularly for long-haul freight. The end-user demographics are diverse, with significant contributions from mining, manufacturing, and agriculture. M&A activity remains relatively low, with a predicted xx Million USD in deal volume over the forecast period (2025-2033), primarily driven by consolidation among smaller players.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on telematics, route optimization, and driver safety technologies. Barriers include high initial investment costs and integration challenges.

- Regulatory Framework: Stringent regulations on safety, environmental impact, and driver working conditions.

- Competitive Substitutes: Rail and maritime transport for long-haul routes pose significant competition.

- End-User Demographics: Mining, manufacturing, and agriculture constitute major end-user segments.

- M&A Trends: Low M&A activity with predicted xx Million USD in deal volume for 2025-2033.

Chile Road Freight Transport Industry Growth Trends & Insights

The Chilean road freight transport market is projected to experience steady growth over the forecast period. Driven by robust economic activity and rising domestic consumption, the market size is estimated at xx Million USD in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Technological advancements, particularly the adoption of GPS tracking and fleet management systems, are enhancing efficiency and reducing operational costs. Shifts in consumer behavior, such as increased e-commerce activity, are fueling demand for last-mile delivery services. However, challenges such as infrastructure limitations and fluctuating fuel prices pose potential risks. Market penetration of advanced logistics technologies remains relatively low but is expected to increase over the next decade.

Dominant Regions, Countries, or Segments in Chile Road Freight Transport Industry

The Santiago Metropolitan Region and its surrounding areas constitute the heart of Chile's road freight transport market, driven by a confluence of factors: high population density, substantial industrial activity, and a relatively well-developed road infrastructure network. While the domestic segment commands a larger market share compared to international transport, the latter is experiencing significant growth fueled by the increasing export of Chilean goods, particularly agricultural products, minerals, and processed foods. Within the domestic market, the mining and quarrying sector is a particularly significant consumer of road freight services, due to the substantial volume of raw materials and finished products requiring transportation. Other key end-user sectors include manufacturing, retail, and the burgeoning e-commerce industry.

- Key Drivers: Robust economic growth, particularly in mining and agriculture; expanding domestic consumption; the exponential rise of e-commerce; and increasing government investment in infrastructure development.

- Dominant Segments: Domestic transport (holding the largest market share); mining and quarrying; manufacturing and automotive; and retail and consumer goods.

- Growth Potential: Strategic expansion of road infrastructure in currently underserved regions presents significant opportunities for growth, particularly in northern and southern Chile, enhancing connectivity and accessibility for businesses operating in these areas.

Chile Road Freight Transport Industry Product Landscape

The industry offers a range of services, including full truckload (FTL), less-than-truckload (LTL), specialized transport (e.g., oversized cargo), and last-mile delivery. Recent innovations include the implementation of advanced telematics solutions for real-time tracking and route optimization. These technologies enhance delivery times, improve fuel efficiency, and strengthen supply chain visibility. The focus is on providing reliable, cost-effective, and environmentally responsible solutions to meet the evolving demands of diverse end-user sectors.

Key Drivers, Barriers & Challenges in Chile Road Freight Transport Industry

Key Drivers:

- Robust economic growth in key sectors (mining, agriculture).

- Rising e-commerce activity increasing demand for last-mile delivery.

- Government investments in infrastructure development.

Key Challenges and Restraints:

- Fluctuating fuel prices impacting operational costs.

- Limited road infrastructure in certain regions creating bottlenecks.

- Stringent regulations increasing compliance costs. This has resulted in a xx% increase in operational costs for many companies.

Emerging Opportunities in Chile Road Freight Transport Industry

- Growing demand for cold chain logistics and specialized transport for temperature-sensitive goods.

- Increasing adoption of sustainable transportation practices (e.g., electric vehicles).

- Expansion into underserved regional markets.

Growth Accelerators in the Chile Road Freight Transport Industry

Technological advancements in fleet management, route optimization, and supply chain visibility software are poised to drive substantial efficiency gains and cost reductions. Strategic partnerships between transport companies and technology providers can unlock new market opportunities. Expansion into e-commerce logistics and specialized transport services, coupled with focused investments in infrastructure upgrades, will solidify long-term growth.

Key Players Shaping the Chile Road Freight Transport Industry Market

- Transportes Nazar

- Transportes CCU Limitada

- Fe Grande Maquinarias y Servicios S A

- Sotraser

- Transportes Interandinos SA

- Andes Logistics de Chile S A

- Transportes Tamarugal Limitada

- Agunsa

- Transportes Casablanca

- Logistica Linsa S A

Notable Milestones in Chile Road Freight Transport Industry Sector

- November 2022: USD 70 million sustainability-linked loan granted to Agunsa by the IFC.

- February 2023: Agunsa successfully ships 400 electric buses via a novel bulk shipping solution.

In-Depth Chile Road Freight Transport Industry Market Outlook

The Chilean road freight transport industry is poised for sustained growth driven by economic expansion, technological innovation, and strategic investments in infrastructure. Opportunities abound in specialized transport, sustainable logistics, and e-commerce fulfillment. Companies that embrace technological advancements, prioritize sustainability, and focus on delivering efficient and reliable services will be well-positioned to capture significant market share in the years to come.

Chile Road Freight Transport Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. End-User

- 2.1. Manufacturing and Automotive)

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade

- 2.6. Pharmaceutical and Healthcare

- 2.7. Other End-Users

Chile Road Freight Transport Industry Segmentation By Geography

- 1. Chile

Chile Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Growth in the E-commerce Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive)

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade

- 5.2.6. Pharmaceutical and Healthcare

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Transportes Nazar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Transportes CCU Limitada

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fe Grande Maquinarias y Servicios S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sotraser

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Transportes Interandinos SA**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Andes Logistics de Chile S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Transportes Tamarugal Limitada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agunsa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Transportes Casablanca

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Logistica Linsa S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Transportes Nazar

List of Figures

- Figure 1: Chile Road Freight Transport Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Chile Road Freight Transport Industry Share (%) by Company 2024

List of Tables

- Table 1: Chile Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Chile Road Freight Transport Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 3: Chile Road Freight Transport Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Chile Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Chile Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Chile Road Freight Transport Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 7: Chile Road Freight Transport Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Chile Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Road Freight Transport Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Chile Road Freight Transport Industry?

Key companies in the market include Transportes Nazar, Transportes CCU Limitada, Fe Grande Maquinarias y Servicios S A, Sotraser, Transportes Interandinos SA**List Not Exhaustive, Andes Logistics de Chile S A, Transportes Tamarugal Limitada, Agunsa, Transportes Casablanca, Logistica Linsa S A.

3. What are the main segments of the Chile Road Freight Transport Industry?

The market segments include Destination, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Growth in the E-commerce Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

February 2023: Due to the lack of available spaces for RoRo ships, Agunsa's chartering area in China and Chile accepted the challenge and developed a comprehensive solution to ship 400 electric buses in five bulk ships on time through their POS subsidiary. For AGUNSA, this project is highly relevant since, in addition to providing a comprehensive solution to the client, it allows them to contribute to the electromobility process of the public transport system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Chile Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence