Key Insights

The Canadian metal fabrication equipment market is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 1.6%. The market size is estimated at $6.5 billion in the base year of 2025. This expansion is primarily driven by robust infrastructure development across sectors like construction and energy, increasing the demand for advanced metal fabrication technologies. Furthermore, widespread automation and the pursuit of enhanced manufacturing productivity and precision are key growth catalysts. Emerging trends include the integration of Industry 4.0 technologies, such as digital twins, AI-driven process optimization, and advanced robotics, into metal fabrication workflows. Despite challenges like supply chain volatility and fluctuating raw material costs, the market outlook remains optimistic. A competitive landscape featuring established players and specialized firms fosters continuous innovation. Market segmentation likely encompasses equipment types, application industries, and regional distribution within Canada. Ongoing investments in research and development, with a focus on sustainable and efficient technologies, will be vital for sustaining this growth trajectory.

Canada Metal Fabrication Equipment Industry Market Size (In Billion)

Government initiatives promoting domestic manufacturing and large-scale infrastructure projects are expected to further stimulate demand for high-quality metal fabrication equipment. Companies are strategically investing in integrated solutions and comprehensive customer support to strengthen their market positions. The prevalence of strategic partnerships and mergers & acquisitions underscores the industry's dynamism and potential for consolidation. To maintain a competitive edge, manufacturers must prioritize customization, digitalization, and superior after-sales services. The forecast period of 2025-2033 presents substantial opportunities for expansion, fueled by technological advancements and a growing preference for domestically sourced fabricated metal products across various industries.

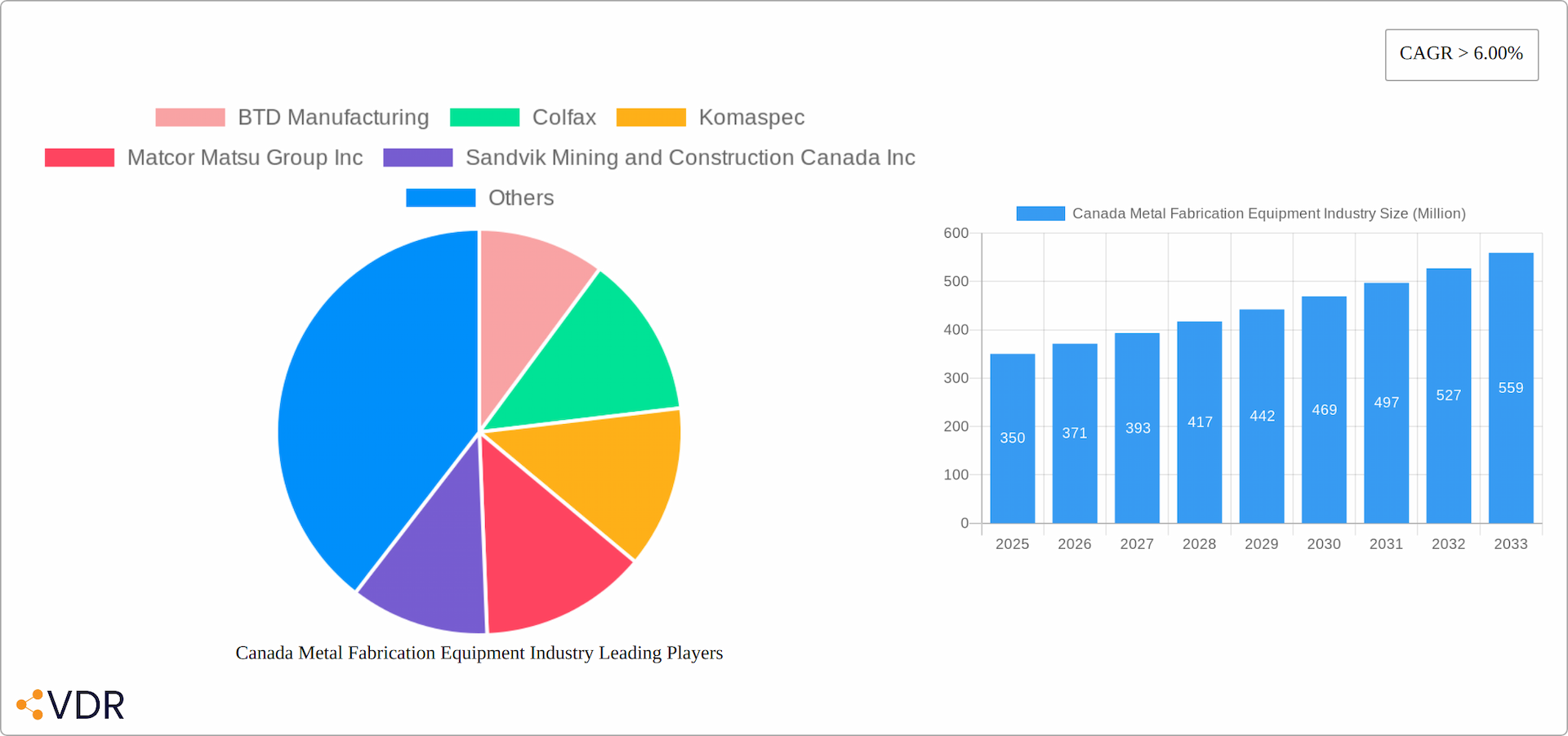

Canada Metal Fabrication Equipment Industry Company Market Share

Canada Metal Fabrication Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canadian metal fabrication equipment industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and stakeholders seeking insights into this dynamic sector.

Canada Metal Fabrication Equipment Industry Market Dynamics & Structure

This section analyzes the market concentration, technological advancements, regulatory landscape, competitive landscape, end-user demographics, and mergers and acquisitions (M&A) activity within the Canadian metal fabrication equipment industry. The market is moderately concentrated, with several key players holding significant market share, but a sizable number of smaller players also contributing. Technological innovation, driven by automation and digitalization, is a major factor. Stringent safety and environmental regulations influence manufacturing processes and equipment choices. The industry faces competition from substitute materials and technologies. The end-user base is diverse, encompassing various sectors such as automotive, construction, and aerospace. M&A activity has been moderate, with strategic acquisitions aimed at expanding market reach and capabilities.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Strong emphasis on automation (robotics, CNC machining), digitalization (Industry 4.0 technologies), and advanced materials (high-strength steels, composites).

- Regulatory Framework: Compliance with Canadian safety and environmental regulations significantly influences equipment choices and manufacturing processes.

- Competitive Substitutes: Increased competition from alternative materials (plastics, composites) and 3D printing technologies.

- End-User Demographics: Diverse end-user base including automotive (xx%), construction (xx%), aerospace (xx%), and other manufacturing sectors.

- M&A Trends: Moderate M&A activity observed in recent years, driven by strategic expansion and technological integration. xx M&A deals recorded between 2019 and 2024.

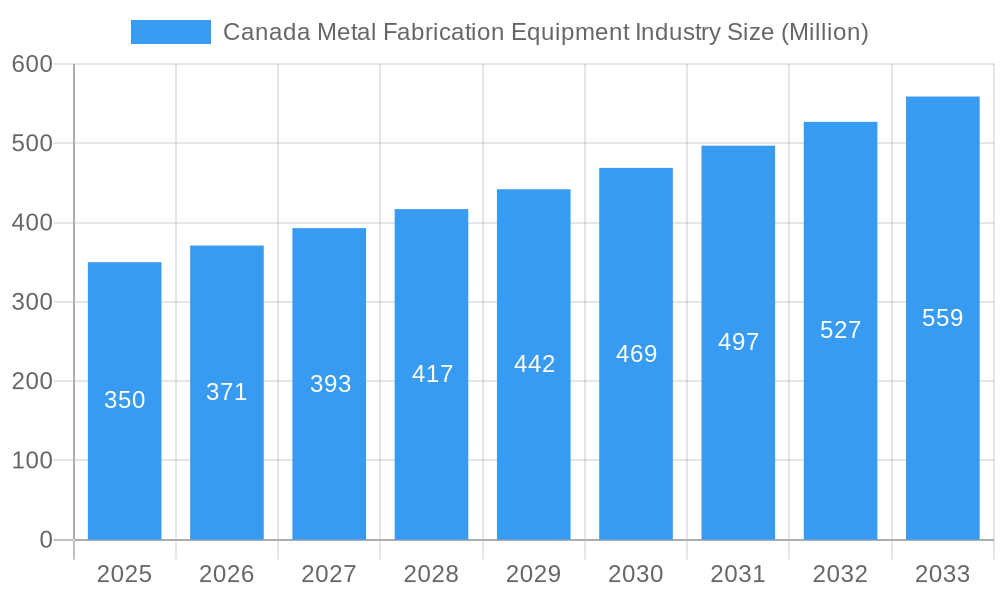

Canada Metal Fabrication Equipment Industry Growth Trends & Insights

The Canadian metal fabrication equipment industry is experiencing dynamic growth, shaped by evolving technological advancements and shifting consumer demands. From 2019 to 2024, the market exhibited steady expansion fueled by robust infrastructure development, the increasing adoption of industrial automation, and heightened demand from key sectors like automotive, construction, and energy. This period saw a significant increase in the utilization of advanced technologies such as laser cutting and robotic welding. The forecast period (2025-2033) anticipates continued growth, although at a potentially moderated rate, influenced by macroeconomic conditions and global economic uncertainties. However, technological disruptions, particularly the integration of additive manufacturing (3D printing) and the principles of Industry 4.0, are poised to significantly alter the industry landscape. Furthermore, a growing emphasis on sustainability is driving demand for more environmentally friendly and energy-efficient fabrication equipment.

- Market Size (2024): [Insert Updated Market Size Data in Million Units]

- Market Size Projection (2033): [Insert Updated Market Size Projection in Million Units]

- CAGR (2025-2033): [Insert Updated CAGR Percentage]

- Market Penetration of Advanced Technologies: Robotic welding and laser cutting are experiencing accelerated market penetration, driven by increased efficiency and precision demands. The adoption rate of these technologies is expected to further increase significantly over the forecast period.

- Technological Disruptions: Additive manufacturing offers substantial potential for customization and rapid prototyping, while Industry 4.0 technologies, encompassing data analytics and connected manufacturing, promise optimized production processes and improved overall efficiency. These advancements are reshaping traditional manufacturing paradigms.

- Consumer Behavior Shifts: The industry is witnessing a clear preference shift towards sustainable, energy-efficient, and digitally integrated equipment. This trend is being driven by environmental concerns and the pursuit of optimized operational efficiency.

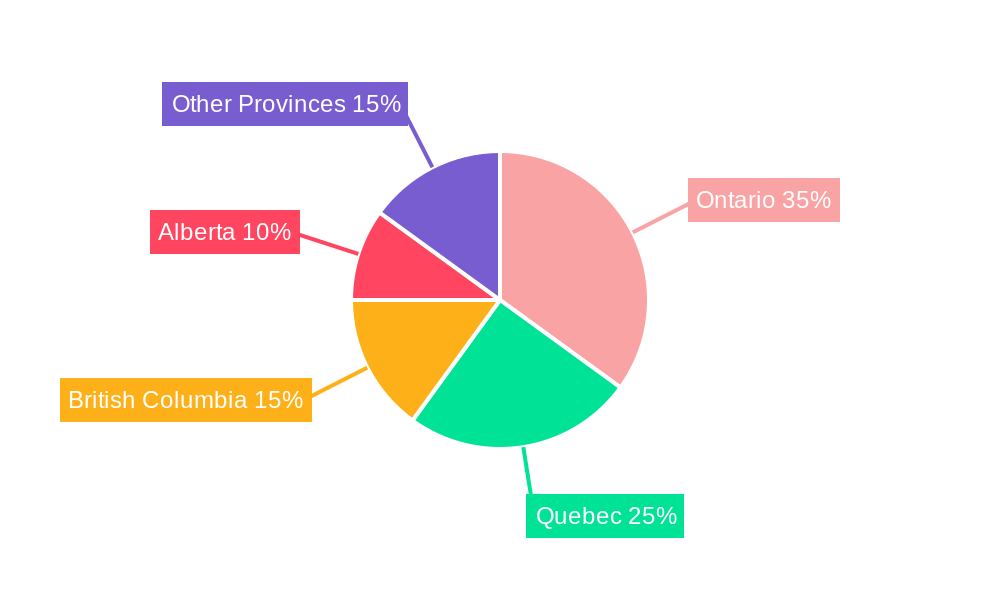

Dominant Regions, Countries, or Segments in Canada Metal Fabrication Equipment Industry

This section identifies the leading regions, countries, or segments driving growth within the Canadian metal fabrication equipment market. Ontario and Quebec are the dominant regions, benefiting from established manufacturing bases and robust industrial activity. Specific segments like automotive and construction equipment show high growth potential. Key drivers include government infrastructure investments, favorable economic policies supporting industrial growth, and a skilled workforce.

- Dominant Region: Ontario and Quebec account for approximately xx% of the total market.

- Key Drivers: Government investments in infrastructure projects (xx Million units annually), favorable economic policies promoting industrial growth, skilled labor force.

- Market Share: Ontario holds xx% and Quebec holds xx% market share.

- Growth Potential: Strong growth potential in segments such as automotive and construction equipment, driven by increasing demand and infrastructure development.

Canada Metal Fabrication Equipment Industry Product Landscape

The Canadian metal fabrication equipment market encompasses a wide array of machinery, including cutting-edge solutions for cutting, bending, forming, and welding. Continuous technological innovation has resulted in equipment characterized by enhanced automation, unparalleled precision, and significantly improved efficiency. Modern equipment incorporates sophisticated features such as CNC controls, seamless robotic integration, and advanced digital connectivity capabilities. Key selling points frequently include increased productivity, superior safety features, and substantial reductions in operational costs. The market is seeing a rise in modular and customizable systems to meet specific client needs.

Key Drivers, Barriers & Challenges in Canada Metal Fabrication Equipment Industry

Key Drivers:

- Increasing demand from key end-user industries (automotive, construction, aerospace).

- Government initiatives promoting industrial automation and technological advancements.

- Investments in infrastructure projects stimulating demand for fabrication equipment.

Key Challenges and Restraints:

- Supply chain disruptions and fluctuating raw material prices impacting production costs.

- Intense competition from foreign manufacturers and the adoption of substitute technologies.

- Stringent safety and environmental regulations increasing compliance costs. The impact is estimated at xx Million units annually in additional costs.

Emerging Opportunities in Canada Metal Fabrication Equipment Industry

- Lightweight Materials in Automotive: The automotive industry's ongoing pursuit of lightweight vehicles creates significant demand for specialized fabrication equipment capable of processing advanced materials like aluminum and composites.

- Sustainable Manufacturing: The increasing focus on environmental sustainability is driving demand for equipment that minimizes waste, reduces energy consumption, and employs eco-friendly processes.

- Niche Market Expansion: The industry is witnessing growth in niche sectors, such as medical device manufacturing and aerospace, requiring highly specialized and precise fabrication equipment.

- Government Initiatives & Funding: Government support for industrial automation and green technologies presents further opportunities for growth within the sector.

Growth Accelerators in the Canada Metal Fabrication Equipment Industry Industry

Technological breakthroughs in areas like laser cutting, robotic welding, and additive manufacturing are accelerating growth. Strategic partnerships between equipment manufacturers and end-users are fostering innovation and collaboration. Market expansion strategies, such as targeting new industries and export markets, further fuel growth.

Key Players Shaping the Canada Metal Fabrication Equipment Industry Market

- BTD Manufacturing

- Colfax

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc

- STANDARD IRON & WIRE WORKS INC

- TRUMPF Canada Inc

- Atlas Copco

- AMADA Canada

- DMG MORI Canada

- List Not Exhaustive

Notable Milestones in Canada Metal Fabrication Equipment Industry Sector

- February 2022: Arrow Machine and Fabrication Group's acquisition of Steelcraft significantly expanded its global reach and manufacturing capacity, highlighting industry consolidation trends.

- January 2022: AGI's acquisition of Eastern Fabricators strengthened its position within the food processing equipment sector, demonstrating the diversification occurring within the broader metal fabrication market.

- [Add more recent milestones and news with dates]

In-Depth Canada Metal Fabrication Equipment Industry Market Outlook

The Canadian metal fabrication equipment industry is poised for continued growth, driven by technological advancements, increasing industrial activity, and government support. Strategic partnerships and investments in automation will further enhance market competitiveness. Focus on sustainable manufacturing and emerging applications will open new opportunities for growth in the coming years. The market is expected to experience significant growth in the next decade, with considerable potential for innovation and expansion.

Canada Metal Fabrication Equipment Industry Segmentation

-

1. Service Type

- 1.1. Machining and Cutting

- 1.2. Forming

- 1.3. Welding

- 1.4. Other Service Type

-

2. Product Type

- 2.1. Automatic

- 2.2. Semi-automatic

- 2.3. Manual

-

3. End User Industry

- 3.1. Manufacturing

- 3.2. Power and Utilities

- 3.3. Construction

- 3.4. Oil and Gas

- 3.5. Other End-user Industries

Canada Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Canada

Canada Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Canada Metal Fabrication Equipment Industry

Canada Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Construction Industry Offers Immense Demand for the Metal Fabrication Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.2. Forming

- 5.1.3. Welding

- 5.1.4. Other Service Type

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Automatic

- 5.2.2. Semi-automatic

- 5.2.3. Manual

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Manufacturing

- 5.3.2. Power and Utilities

- 5.3.3. Construction

- 5.3.4. Oil and Gas

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BTD Manufacturing

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Komaspec

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Matcor Matsu Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandvik Mining and Construction Canada Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STANDARD IRON & WIRE WORKS INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF Canada Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlas Copco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMADA Canada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DMG MORI Canada**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BTD Manufacturing

List of Figures

- Figure 1: Canada Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Metal Fabrication Equipment Industry?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Canada Metal Fabrication Equipment Industry?

Key companies in the market include BTD Manufacturing, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc, STANDARD IRON & WIRE WORKS INC, TRUMPF Canada Inc, Atlas Copco, AMADA Canada, DMG MORI Canada**List Not Exhaustive.

3. What are the main segments of the Canada Metal Fabrication Equipment Industry?

The market segments include Service Type, Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Construction Industry Offers Immense Demand for the Metal Fabrication Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: Arrow Machine and Fabrication Group of Guelph, Ontario, announced the acquisition of Steelcraft, a Kitchener, Ontario, steel design, engineering, and fabrication firm. This acquisition expands Arrow's global customer base and manufacturing footprint. It also further promotes the company's strategy of partnering with leading operator-run machining and fabrication organizations to leverage their collective capabilities, solve customer problems, and develop deeper supply chain interactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Canada Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence