Key Insights

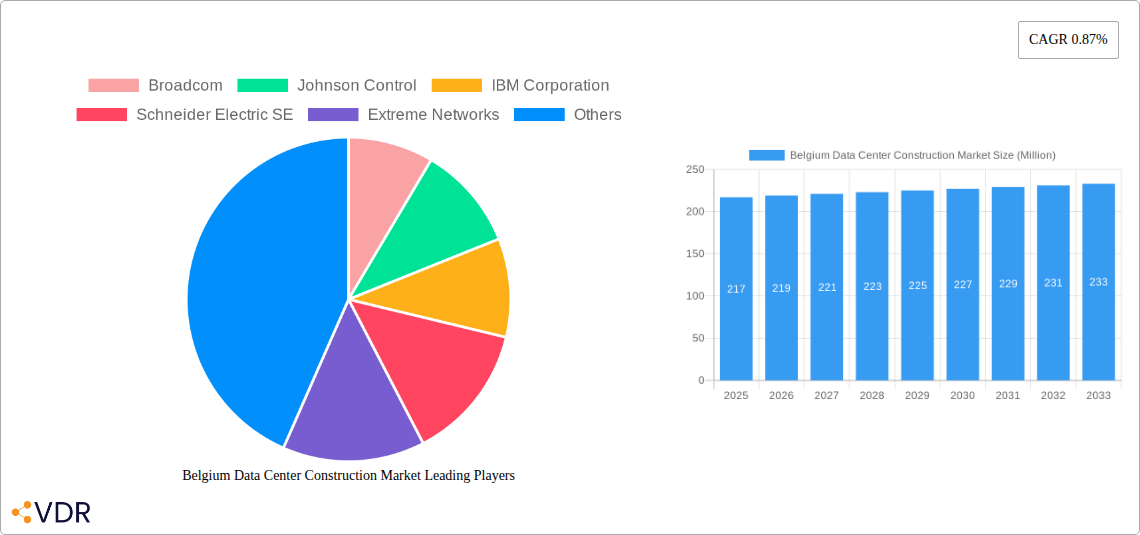

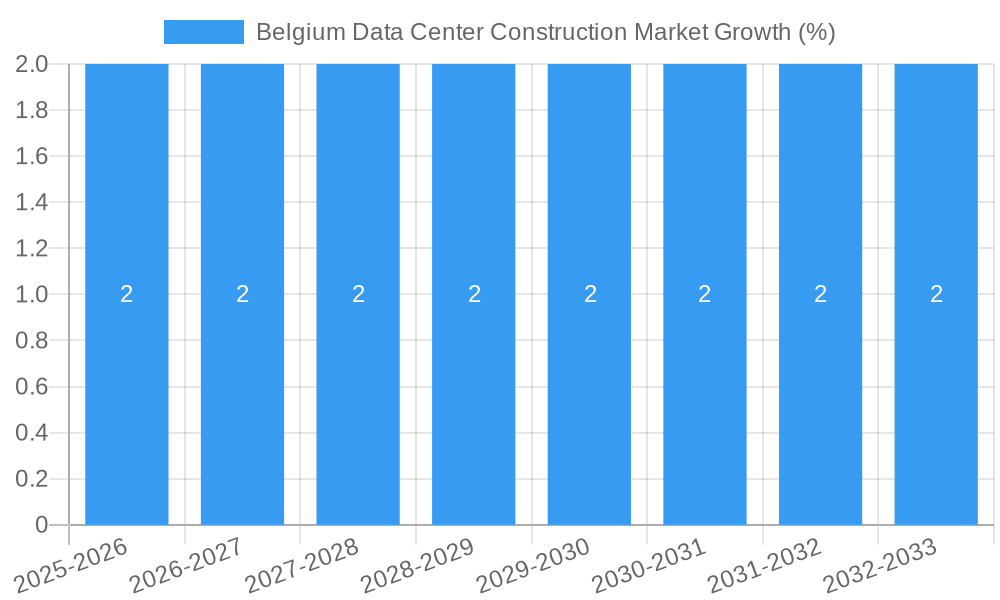

The Belgium data center construction market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of 0.87%, reveals a steady expansion driven by several key factors. The increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) within sectors like IT & Telecommunications, BFSI (Banking, Financial Services, and Insurance), and the government is fueling demand for robust data center infrastructure. Furthermore, Belgium's strategic location in Europe and its robust digital infrastructure make it an attractive hub for data center operations, further stimulating market growth. While the precise market size for 2025 is not provided, considering a hypothetical market size of €200 million in 2019 and applying the 0.87% CAGR, a reasonable estimate for 2025 would be approximately €217 million. Growth is anticipated to continue throughout the forecast period (2025-2033), though at a similar pace. The market is segmented by end-user (IT & Telecommunications, BFSI, Government, Healthcare, Other) and infrastructure type (Electrical, Mechanical, and Other), reflecting diverse needs and investment patterns. Major players like Broadcom, Johnson Controls, IBM, Schneider Electric, and Cisco Systems are shaping the market through technological advancements and competitive offerings. Despite the positive outlook, potential restraints like high construction costs and energy consumption associated with data centers could moderate the market's growth trajectory.

The market's steady growth indicates a continued investment in digital infrastructure within Belgium. The relatively low CAGR suggests a mature market with established players; however, opportunities for growth exist through innovative solutions addressing energy efficiency and sustainable practices within data center construction. The segmentation indicates varying levels of investment across end-user sectors, with IT & Telecommunications likely dominating the market share. Understanding the specific growth trends within each segment is crucial for informed investment and strategic planning by both existing and prospective market entrants. The presence of global giants alongside local contractors illustrates a competitive landscape requiring strategic partnerships and differentiation to thrive. The forecast period presents potential for consolidation within the sector as companies seek to optimize their position within this evolving market.

Belgium Data Center Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Belgium data center construction market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, utilizing 2025 as the base year and estimated year. The report segments the market by end-user (IT & Telecommunication, BFSI, Government, Healthcare, Other End Users) and infrastructure (Electrical Infrastructure, Other Electrical Infrastructures, Mechanical Infrastructure, Other Mechanical Infrastructures, Other Infrastructures), providing granular data and analysis. Key players such as Broadcom, Johnson Control, IBM Corporation, Schneider Electric SE, Extreme Networks, DPR CONSTRUCTION INC, Cisco Systems, AECOM, Caterpillar, NTT Ltd, and Fortis Construction Inc. are profiled, highlighting their contributions to market growth. The report's value is expressed in Million units.

Belgium Data Center Construction Market Dynamics & Structure

The Belgium data center construction market is characterized by moderate concentration, with a few dominant players alongside numerous smaller, specialized firms. Technological innovation, particularly in areas like AI-powered cooling systems and sustainable energy solutions, is a key driver. Stringent regulatory frameworks concerning energy efficiency and data security influence construction practices. While cloud computing presents a competitive substitute, the demand for on-premise data centers remains strong, driven by data sovereignty concerns and latency requirements. The market witnesses frequent M&A activity, reflecting consolidation and expansion strategies.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: Advancements in modular data center designs and AI-driven energy management are driving efficiency and cost optimization.

- Regulatory Framework: Strict regulations on energy consumption and data protection are shaping construction standards and driving investment in sustainable technologies.

- Competitive Substitutes: Cloud services offer competition, but on-premise data centers remain crucial for latency-sensitive applications and data security.

- M&A Activity: The historical period (2019-2024) saw an average of xx M&A deals annually, indicating ongoing consolidation. This trend is projected to continue.

- End-User Demographics: The IT & Telecommunication sector is the largest end-user, followed by BFSI and Government sectors.

Belgium Data Center Construction Market Growth Trends & Insights

The Belgium data center construction market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to increasing data volumes, digital transformation initiatives across sectors, and the rising adoption of cloud computing and edge computing. However, the market is expected to witness a surge in growth in the forecast period (2025-2033), driven by government initiatives to promote digital infrastructure and increased investments from both domestic and international players. Market penetration is expected to reach xx% by 2033. Technological disruptions, such as the adoption of prefabricated modular data centers, are accelerating construction timelines and reducing costs. Consumer behavior shifts toward digital services further fuel this market expansion. The estimated market size in 2025 is xx Million, projected to reach xx Million by 2033.

Dominant Regions, Countries, or Segments in Belgium Data Center Construction Market

The Flanders region of Belgium currently dominates the data center construction market, driven by its robust digital infrastructure and strategic location in Europe. Antwerp and Brussels are key hubs, attracting significant investments. Within end-user segments, IT & Telecommunication is the most dominant, accounting for approximately xx% of the market in 2025, followed by BFSI at xx%. In terms of infrastructure, Electrical Infrastructure dominates, representing xx% of total construction spending.

- Key Drivers:

- Strong government support for digital infrastructure development.

- Strategic location within Europe, attracting international investments.

- Growing demand for data storage and processing capacity across industries.

- Dominance Factors:

- Existing robust digital infrastructure and connectivity.

- Skilled workforce and supportive regulatory environment.

- Proximity to key European markets.

- High growth potential in the IT & Telecommunication and BFSI sectors.

Belgium Data Center Construction Market Product Landscape

The market offers a range of products, including traditional brick-and-mortar data centers and increasingly popular modular and prefabricated data centers. These products are tailored to specific end-user needs, focusing on energy efficiency, security, scalability, and resilience. Technological advancements in cooling systems, power distribution units (PDUs), and security systems are key differentiators. Unique selling propositions often involve sustainability features, optimized energy consumption, and robust disaster recovery capabilities.

Key Drivers, Barriers & Challenges in Belgium Data Center Construction Market

Key Drivers: Increasing data generation across sectors, government initiatives promoting digitalization, and favorable regulatory environments are key drivers. The growing need for low-latency applications, coupled with robust cybersecurity requirements, fuels market expansion.

Key Challenges and Restraints: Supply chain disruptions, particularly related to crucial components like semiconductors and specialized cooling equipment, impact project timelines and costs. Stringent regulatory approvals and environmental impact assessments can lead to delays. Intense competition among established and emerging players also presents a challenge. The estimated cost impact of these challenges in 2025 is approximately xx Million.

Emerging Opportunities in Belgium Data Center Construction Market

Emerging opportunities lie in the adoption of sustainable and energy-efficient technologies, expansion into edge computing infrastructure, and the development of specialized data centers for specific industries like healthcare and finance. Untapped potential exists in smaller towns and regions, providing opportunities for regional expansion and diversification. The growing adoption of hyperscale data centers also presents significant growth avenues.

Growth Accelerators in the Belgium Data Center Construction Market Industry

Long-term growth will be accelerated by strategic partnerships between data center developers, technology providers, and energy companies. Technological advancements in AI-driven energy management, optimized cooling systems, and secure infrastructure will be crucial. Government incentives for sustainable data center construction and investment in digital infrastructure will further stimulate market expansion.

Key Players Shaping the Belgium Data Center Construction Market Market

- Broadcom

- Johnson Control

- IBM Corporation

- Schneider Electric SE

- Extreme Networks

- DPR CONSTRUCTION INC

- Cisco Systems

- AECOM

- Caterpillar

- NTT Ltd

- Fortis Construction Inc

Notable Milestones in Belgium Data Center Construction Market Sector

- January 2022: Belgian infrastructure investment firm TINC invested in Datacenter United, funding its acquisition of DC Star, expanding Datacenter United's data center portfolio to six. This signifies increased consolidation and capacity within the Belgian market.

- November 2021: Colt Data Centre Services (DCS) sold 12 colocation sites across Europe to AtlasEdge Data Centres, including a Belgium facility. This highlights the ongoing market consolidation and strategic shifts within the industry.

In-Depth Belgium Data Center Construction Market Market Outlook

The Belgium data center construction market presents substantial long-term growth potential, driven by technological advancements, supportive government policies, and the increasing digitalization across various sectors. Strategic opportunities exist in sustainable infrastructure development, edge computing deployments, and specialized data center solutions. The market is poised for sustained growth, with significant investment opportunities for both established players and new entrants.

Belgium Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Electrical Infrastructure

- 1.1.1. UPS Systems

- 1.1.2. Other Electrical Infrastructures

-

1.2. Mechanical Infrastructure

- 1.2.1. Cooling Systems

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructures

- 1.3. Other Infrastructures

-

1.1. Electrical Infrastructure

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Healthcare

- 2.5. Other End Users

Belgium Data Center Construction Market Segmentation By Geography

- 1. Belgium

Belgium Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 9.1 5G Developments Fuelling Data Center Investments9.2 Growing Cloud Servce adoption9.3 Green Data Centers rising awarness of Carbon-Neutrality leading to Infrastructure upgrades

- 3.3. Market Restrains

- 3.3.1. 10.1 Security Challenges Impacting Growth of Data Centers

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Electrical Infrastructure

- 5.1.1.1. UPS Systems

- 5.1.1.2. Other Electrical Infrastructures

- 5.1.2. Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructures

- 5.1.3. Other Infrastructures

- 5.1.1. Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Healthcare

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Broadcom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Control

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Extreme Networks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DPR CONSTRUCTION INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AECOM

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caterpillar

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NTT Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Fortis ConstructionInc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Broadcom

List of Figures

- Figure 1: Belgium Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Belgium Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 3: Belgium Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Belgium Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Belgium Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Belgium Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 7: Belgium Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Belgium Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Data Center Construction Market?

The projected CAGR is approximately 0.87%.

2. Which companies are prominent players in the Belgium Data Center Construction Market?

Key companies in the market include Broadcom, Johnson Control, IBM Corporation, Schneider Electric SE, Extreme Networks, DPR CONSTRUCTION INC, Cisco Systems, AECOM, Caterpillar, NTT Ltd, Fortis ConstructionInc.

3. What are the main segments of the Belgium Data Center Construction Market?

The market segments include Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

9.1 5G Developments Fuelling Data Center Investments9.2 Growing Cloud Servce adoption9.3 Green Data Centers rising awarness of Carbon-Neutrality leading to Infrastructure upgrades.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

10.1 Security Challenges Impacting Growth of Data Centers.

8. Can you provide examples of recent developments in the market?

January 2022: Belgian infrastructure investment firm TINC has invested in local data center firm Datacenter United to fund its acquisition of DC Star. Datacenter United has increased the number of data centers it manages to six. In addition to the three existing locations in Antwerp and Brussels, the three DC Star data centers in Burcht, Ghent, and Oostkamp are now also part of the Datacenter United ecosystem.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Belgium Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence