Key Insights

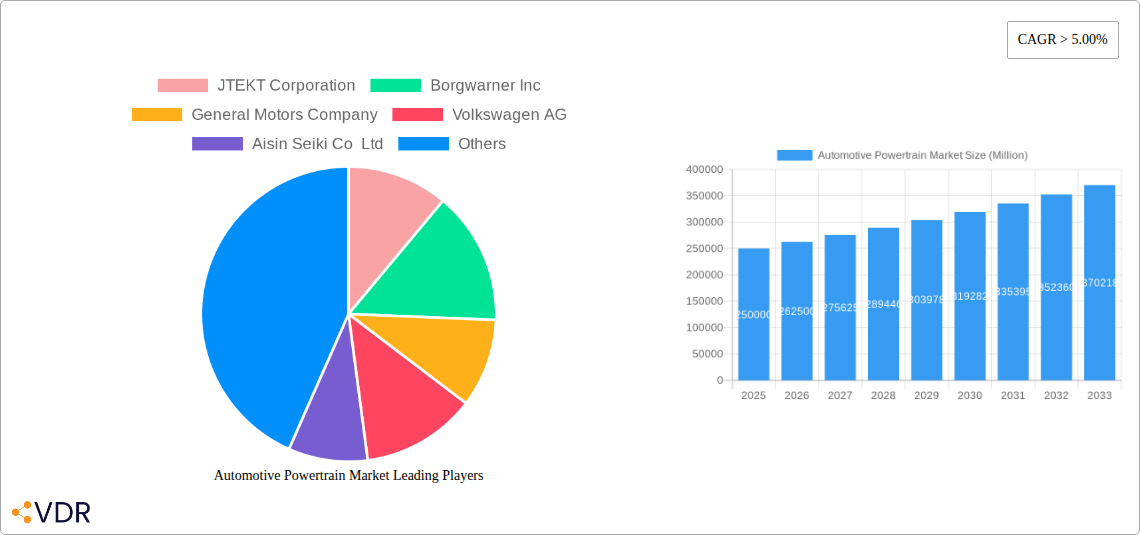

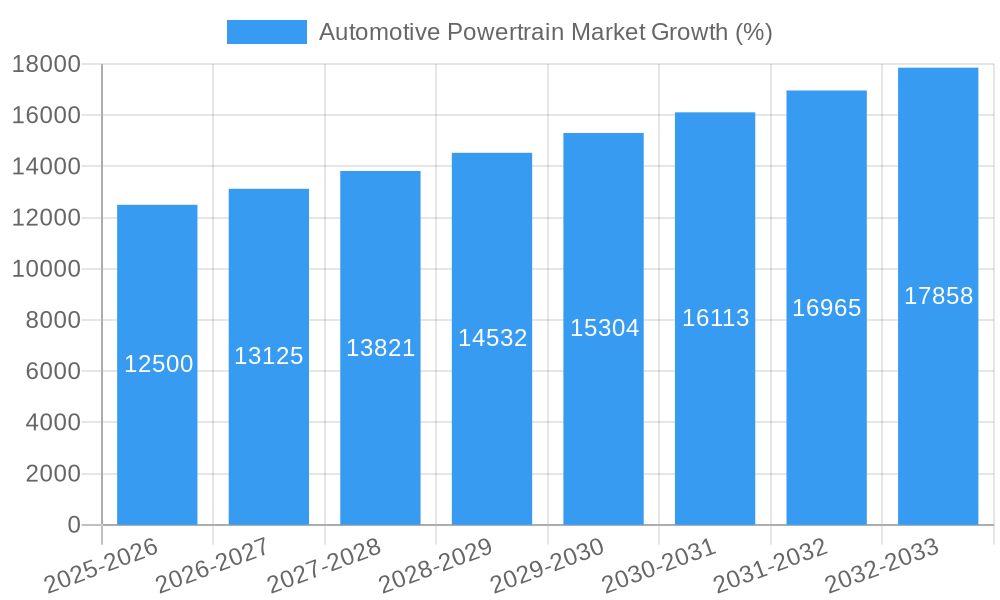

The global automotive powertrain market is experiencing robust growth, driven by the increasing demand for passenger and commercial vehicles, coupled with advancements in vehicle electrification and autonomous driving technologies. The market, valued at approximately $XX million in 2025 (assuming a reasonable value based on typical market sizes for this sector and the provided CAGR), is projected to exhibit a compound annual growth rate (CAGR) exceeding 5% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the rising global population and increasing urbanization are leading to a significant surge in vehicle ownership, particularly in developing economies. Secondly, stringent government regulations aimed at reducing carbon emissions are pushing automakers to invest heavily in fuel-efficient and electric powertrain systems. This includes the development of hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs), all of which require sophisticated and advanced powertrain components. Furthermore, advancements in autonomous driving technology are creating demand for more complex and integrated powertrain systems capable of supporting advanced driver-assistance systems (ADAS) and fully autonomous functionality. Finally, the increasing adoption of connected car technologies adds another layer of complexity and opportunity within the powertrain sector.

However, the market faces certain challenges. Fluctuations in raw material prices, particularly for precious metals used in electric vehicle batteries, can impact production costs and profitability. Supply chain disruptions, exacerbated by geopolitical instability, also pose a significant risk. Furthermore, the high initial cost of electric vehicles and the limited charging infrastructure in many regions could hinder widespread adoption. Despite these challenges, the long-term outlook for the automotive powertrain market remains positive, driven by the continuous innovation in powertrain technologies and the increasing demand for sustainable transportation solutions. Segmentation by component type (engine, transmission, differentials, driveshaft) and vehicle type (passenger cars, commercial vehicles) further reveals significant growth potential across different segments, with the passenger car segment currently dominating the market, but with significant growth anticipated in commercial vehicle powertrains due to electrification trends in this sector. Key players in the market, including JTEKT Corporation, Borgwarner Inc, and others, are strategically investing in research and development to maintain a competitive edge and capitalize on emerging opportunities.

Automotive Powertrain Market Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the global Automotive Powertrain Market, encompassing its parent market (Automotive Industry) and child markets (Engine, Transmission, Differential, Driveshaft components across Passenger Cars and Commercial Vehicles). The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report provides critical insights for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market. Expected market size in Million units is presented throughout.

Automotive Powertrain Market Dynamics & Structure

The automotive powertrain market is characterized by a moderately concentrated structure with a few dominant players controlling a significant market share. Technological innovation, particularly in electric and hybrid powertrains, is a key driver. Stringent emission regulations globally are also shaping the market landscape, pushing manufacturers towards cleaner technologies. The rise of electric vehicles (EVs) presents both opportunities and challenges, with incumbent players adapting their strategies and new entrants emerging. Competitive substitutes, such as alternative fuel vehicles, exert pressure on traditional internal combustion engine (ICE) powertrain manufacturers. The market is witnessing a surge in M&A activities, with an estimated xx M&A deals in the historical period (2019-2024), driven by the need for technological advancements and market expansion. End-user demographics, particularly the growing demand from developing economies, are significant growth factors.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Rapid advancements in electric, hybrid, and autonomous driving technologies.

- Regulatory Framework: Stringent emission norms driving the shift towards electrified powertrains.

- Competitive Substitutes: Growth of alternative fuel vehicles (AFVs) posing a competitive threat.

- M&A Activity: xx M&A deals recorded between 2019 and 2024.

- End-User Demographics: Growing demand from developing nations, especially in Asia-Pacific.

Automotive Powertrain Market Growth Trends & Insights

The automotive powertrain market experienced significant growth during the historical period (2019-2024), driven by increasing vehicle production and a rising preference for passenger cars, especially in emerging markets. The market size in 2024 is estimated at xx million units, with a CAGR of xx% during 2019-2024. The adoption of electric and hybrid powertrains is accelerating, driven by environmental concerns and government incentives. Technological disruptions, such as the rise of autonomous driving and connected vehicles, are impacting the design and functionality of powertrains. Consumer behavior shifts, including a preference for fuel efficiency and advanced features, are influencing the demand for sophisticated powertrain systems. The forecast period (2025-2033) is projected to witness continued growth, albeit at a slightly moderated pace, driven by the increasing adoption of electric vehicles and the ongoing innovation in powertrain technologies. The estimated market size in 2025 is xx million units, projected to reach xx million units by 2033, with a CAGR of xx% during the forecast period.

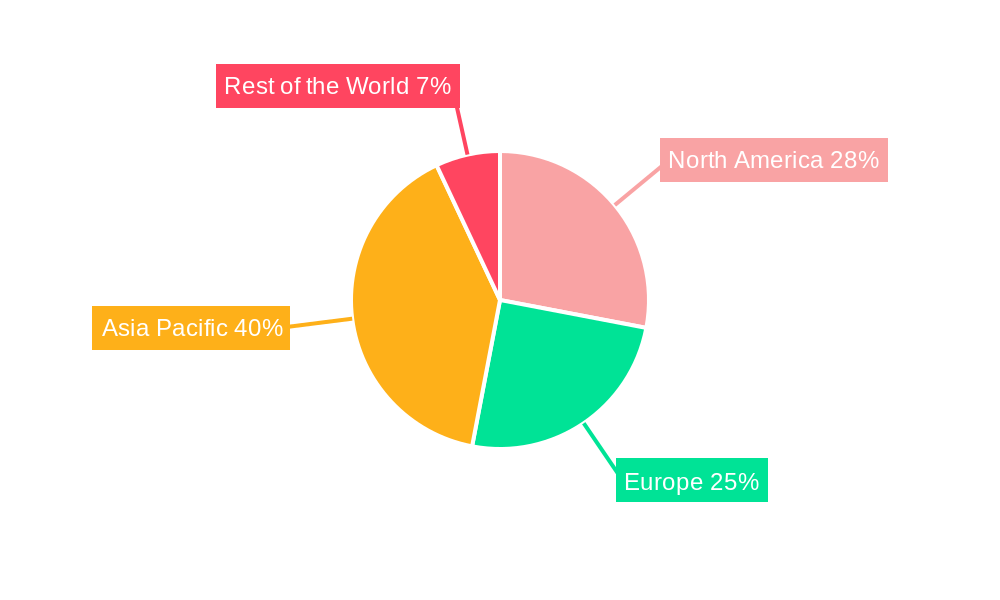

Dominant Regions, Countries, or Segments in Automotive Powertrain Market

Asia-Pacific is the dominant region in the automotive powertrain market, driven by strong automotive production and a rapidly expanding middle class. China and India, in particular, are major contributors to regional growth. The Passenger Car segment holds the largest market share within the Vehicle Type category, owing to high demand for personal vehicles. Within Component Types, Engines are the dominant segment in terms of volume, although the growth of electric powertrains is expected to increase the market share of other components like electric motors and inverters. Front-wheel-drive vehicles currently hold the majority of the market share within Drive Type, but All-wheel-drive is showing strong growth, especially in SUV and commercial vehicles.

- Key Regional Drivers: High vehicle production volumes in Asia-Pacific, growing demand in emerging markets.

- Key Country Drivers: China, India, and other Southeast Asian countries.

- Dominant Segment (Component Type): Engines (xx million units in 2024)

- Dominant Segment (Vehicle Type): Passenger cars (xx million units in 2024)

- Dominant Segment (Drive Type): Front-wheel drive (xx million units in 2024)

Automotive Powertrain Market Product Landscape

The automotive powertrain market offers a wide array of products, ranging from traditional internal combustion engines and transmissions to advanced electric and hybrid powertrains. Innovations focus on enhancing fuel efficiency, reducing emissions, and improving performance. Key features include downsized engines with turbocharging, advanced transmission technologies (e.g., dual-clutch transmissions), and electric motors with high power density. The integration of advanced driver-assistance systems (ADAS) and connected car technologies further enhances the functionality and value proposition of modern powertrains. Unique selling propositions (USPs) revolve around efficiency, performance, durability, and emission reduction capabilities.

Key Drivers, Barriers & Challenges in Automotive Powertrain Market

Key Drivers: Growing vehicle production, rising demand for fuel-efficient vehicles, government regulations promoting cleaner technologies (e.g., CAFE standards), technological advancements in electric and hybrid powertrains.

Key Challenges: High upfront costs of electric powertrains, limited charging infrastructure, dependence on raw materials for battery production, competition from alternative technologies, supply chain disruptions (e.g., semiconductor shortage impacting production), stringent emission regulations potentially increasing manufacturing costs. The semiconductor shortage alone estimated a xx% reduction in powertrain production in 2022.

Emerging Opportunities in Automotive Powertrain Market

Emerging markets in developing economies present significant opportunities for growth. The increasing adoption of electric vehicles and hybrid vehicles creates opportunities for manufacturers of electric motors, batteries, and related components. Furthermore, the integration of autonomous driving technologies offers opportunities for developing sophisticated powertrain systems with enhanced control and efficiency. Opportunities also lie in developing lightweight powertrain components to improve fuel efficiency.

Growth Accelerators in the Automotive Powertrain Market Industry

Technological breakthroughs in battery technology, particularly in terms of energy density and charging time, are crucial growth catalysts. Strategic partnerships and collaborations between automotive manufacturers and technology companies are accelerating innovation and market penetration. Expanding into emerging markets, especially in developing nations with a growing middle class, offers considerable growth potential.

Key Players Shaping the Automotive Powertrain Market Market

- JTEKT Corporation

- BorgWarner Inc

- General Motors Company

- Volkswagen AG

- Aisin Seiki Co Ltd

- Hyundai Motor Company

- Valeo

- GKN plc

- Toyota Motor Corporation

- Hella KGaA Hueck & Co

- Ford Motor Company

- ZF Friedrichshafen AG

Notable Milestones in Automotive Powertrain Market Sector

- July 2021: Valeo and Omega Seiki Mobility (OSM) signed an MoU for Valeo to supply electric powertrains to OSM's 3-wheeler commercial vehicle range in India. This signifies the growing demand for electric powertrains in the commercial vehicle segment.

- July 2021: Volvo Cars and Geely Automotive formed a joint venture, "Aurobay," to develop and supply powertrains. This strategic partnership highlights the increasing importance of collaboration in the powertrain market to leverage combined expertise and resources.

In-Depth Automotive Powertrain Market Market Outlook

The automotive powertrain market is poised for continued growth, driven by technological advancements, shifting consumer preferences, and supportive government policies. Opportunities exist in the development and adoption of electric and hybrid powertrains, as well as in the integration of autonomous driving technologies. Strategic partnerships and investments in research and development will be crucial for companies to maintain a competitive edge. The future of the market lies in creating sustainable, efficient, and intelligent powertrain systems that meet the evolving needs of the automotive industry.

Automotive Powertrain Market Segmentation

-

1. Component Type

- 1.1. Engine

- 1.2. Transmission

- 1.3. Differentials

- 1.4. Driveshaft

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Drive Type

- 3.1. Front-wheel Drive

- 3.2. Rear-wheel Drive

- 3.3. All-wheel Drive

Automotive Powertrain Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Powertrain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Push by Governments to Promote the Adoption of New-Energy Vehicles to Foster Market Growth

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Purchase to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. All-wheel Drive to Gain Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Engine

- 5.1.2. Transmission

- 5.1.3. Differentials

- 5.1.4. Driveshaft

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Drive Type

- 5.3.1. Front-wheel Drive

- 5.3.2. Rear-wheel Drive

- 5.3.3. All-wheel Drive

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Engine

- 6.1.2. Transmission

- 6.1.3. Differentials

- 6.1.4. Driveshaft

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Drive Type

- 6.3.1. Front-wheel Drive

- 6.3.2. Rear-wheel Drive

- 6.3.3. All-wheel Drive

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Engine

- 7.1.2. Transmission

- 7.1.3. Differentials

- 7.1.4. Driveshaft

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Drive Type

- 7.3.1. Front-wheel Drive

- 7.3.2. Rear-wheel Drive

- 7.3.3. All-wheel Drive

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Engine

- 8.1.2. Transmission

- 8.1.3. Differentials

- 8.1.4. Driveshaft

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Drive Type

- 8.3.1. Front-wheel Drive

- 8.3.2. Rear-wheel Drive

- 8.3.3. All-wheel Drive

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Rest of the World Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Engine

- 9.1.2. Transmission

- 9.1.3. Differentials

- 9.1.4. Driveshaft

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Drive Type

- 9.3.1. Front-wheel Drive

- 9.3.2. Rear-wheel Drive

- 9.3.3. All-wheel Drive

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. North America Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Russia

- 11.1.5 Rest of Europe

- 12. Asia Pacific Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Powertrain Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 JTEKT Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Borgwarner Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 General Motors Company

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Volkswagen AG

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Aisin Seiki Co Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Hyundai Motor Company

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Valeo

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 GKN plc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Toyota Motor Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Hella KGaA Hueck & Co

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Ford Motor Company

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 ZF Friedrichshafen AG

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 JTEKT Corporation

List of Figures

- Figure 1: Global Automotive Powertrain Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Powertrain Market Revenue (Million), by Component Type 2024 & 2032

- Figure 11: North America Automotive Powertrain Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 12: North America Automotive Powertrain Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 13: North America Automotive Powertrain Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 14: North America Automotive Powertrain Market Revenue (Million), by Drive Type 2024 & 2032

- Figure 15: North America Automotive Powertrain Market Revenue Share (%), by Drive Type 2024 & 2032

- Figure 16: North America Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automotive Powertrain Market Revenue (Million), by Component Type 2024 & 2032

- Figure 19: Europe Automotive Powertrain Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 20: Europe Automotive Powertrain Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 21: Europe Automotive Powertrain Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 22: Europe Automotive Powertrain Market Revenue (Million), by Drive Type 2024 & 2032

- Figure 23: Europe Automotive Powertrain Market Revenue Share (%), by Drive Type 2024 & 2032

- Figure 24: Europe Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Powertrain Market Revenue (Million), by Component Type 2024 & 2032

- Figure 27: Asia Pacific Automotive Powertrain Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 28: Asia Pacific Automotive Powertrain Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Powertrain Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Powertrain Market Revenue (Million), by Drive Type 2024 & 2032

- Figure 31: Asia Pacific Automotive Powertrain Market Revenue Share (%), by Drive Type 2024 & 2032

- Figure 32: Asia Pacific Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Powertrain Market Revenue (Million), by Component Type 2024 & 2032

- Figure 35: Rest of the World Automotive Powertrain Market Revenue Share (%), by Component Type 2024 & 2032

- Figure 36: Rest of the World Automotive Powertrain Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 37: Rest of the World Automotive Powertrain Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 38: Rest of the World Automotive Powertrain Market Revenue (Million), by Drive Type 2024 & 2032

- Figure 39: Rest of the World Automotive Powertrain Market Revenue Share (%), by Drive Type 2024 & 2032

- Figure 40: Rest of the World Automotive Powertrain Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Powertrain Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Powertrain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Powertrain Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 3: Global Automotive Powertrain Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Global Automotive Powertrain Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 5: Global Automotive Powertrain Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: South America Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Middle East and Africa Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Automotive Powertrain Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 26: Global Automotive Powertrain Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Global Automotive Powertrain Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 28: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of North America Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Automotive Powertrain Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 33: Global Automotive Powertrain Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 34: Global Automotive Powertrain Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 35: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Germany Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: France Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Russia Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Automotive Powertrain Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 42: Global Automotive Powertrain Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 43: Global Automotive Powertrain Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 44: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: India Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Automotive Powertrain Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 51: Global Automotive Powertrain Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 52: Global Automotive Powertrain Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 53: Global Automotive Powertrain Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: South America Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Middle East and Africa Automotive Powertrain Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Powertrain Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Automotive Powertrain Market?

Key companies in the market include JTEKT Corporation, Borgwarner Inc, General Motors Company, Volkswagen AG, Aisin Seiki Co Ltd, Hyundai Motor Company, Valeo, GKN plc, Toyota Motor Corporation, Hella KGaA Hueck & Co, Ford Motor Company, ZF Friedrichshafen AG.

3. What are the main segments of the Automotive Powertrain Market?

The market segments include Component Type, Vehicle Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Push by Governments to Promote the Adoption of New-Energy Vehicles to Foster Market Growth.

6. What are the notable trends driving market growth?

All-wheel Drive to Gain Traction.

7. Are there any restraints impacting market growth?

High Initial Cost of Purchase to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

July 2021: Valeo and Omega Seiki Mobility (OSM) entered an MoU for Valeo to supply electric powertrains to the OSM's vehicle range for a 3-wheeler commercial vehicle range in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Powertrain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Powertrain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Powertrain Market?

To stay informed about further developments, trends, and reports in the Automotive Powertrain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence