Key Insights

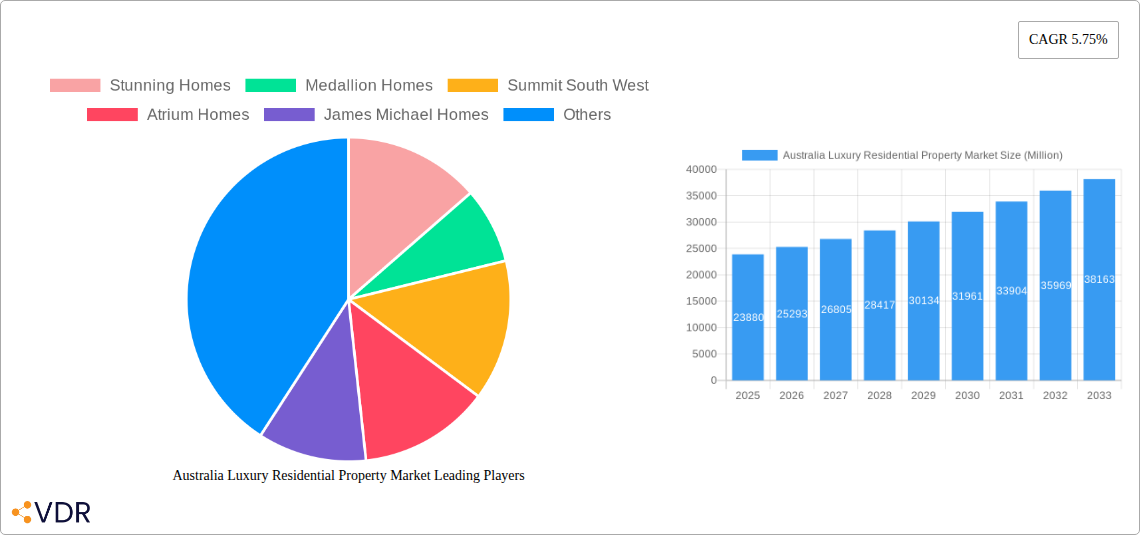

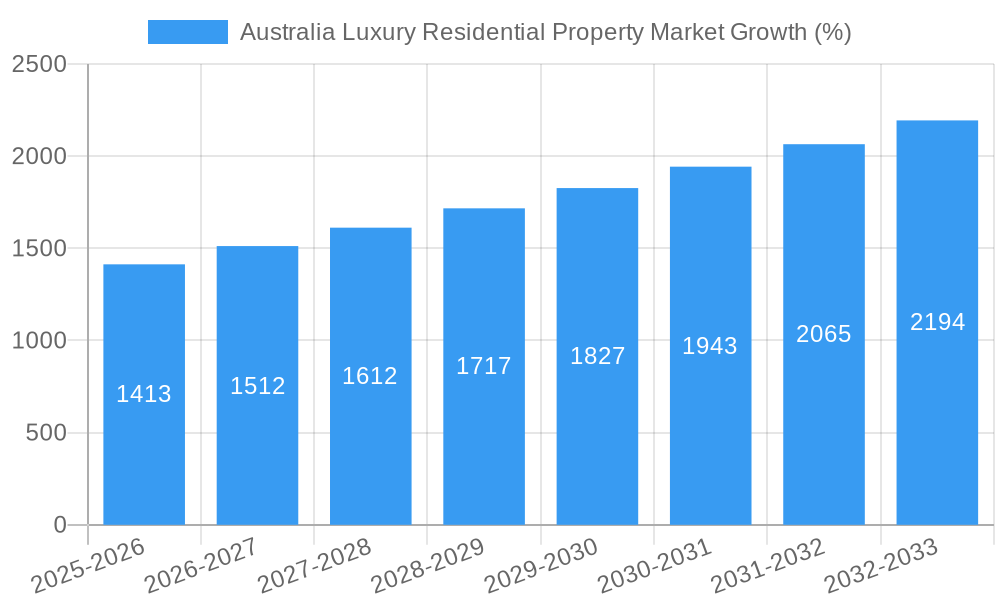

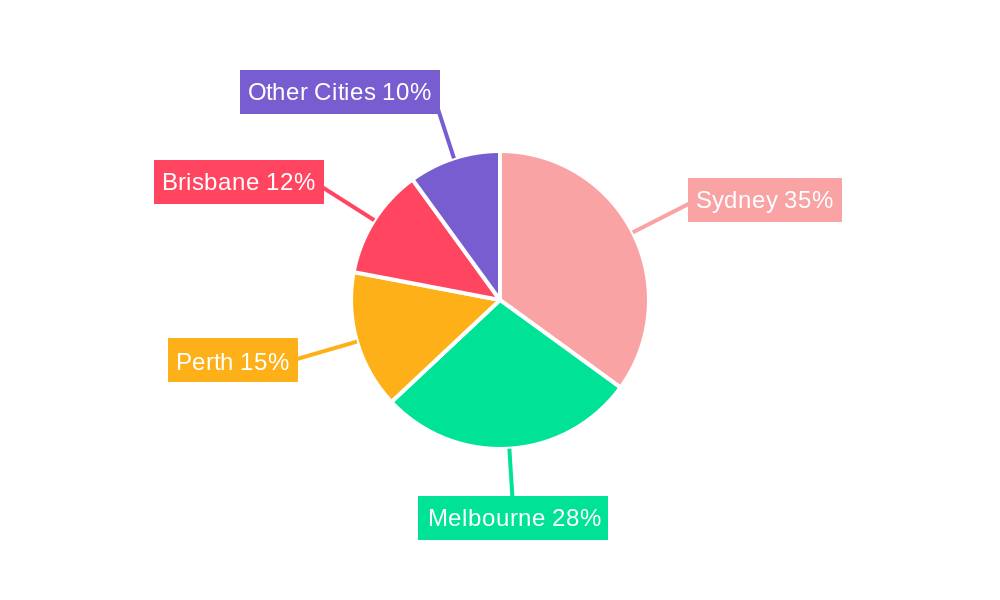

The Australian luxury residential property market, valued at $23.88 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.75% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a sustained increase in high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) residing in Australia, coupled with a strong preference for luxury properties, contributes significantly to demand. Secondly, limited supply of prime land in desirable locations like Sydney, Melbourne, and Perth, coupled with increasing construction costs, creates scarcity and further pushes prices upward. Thirdly, the ongoing appeal of Australia as a desirable location for international investment, especially in the luxury real estate sector, injects substantial capital into the market. While factors like interest rate fluctuations and economic downturns pose potential restraints, the resilience of the luxury segment and the long-term growth prospects of the Australian economy are expected to mitigate these challenges. The market is segmented by property type (apartments & condominiums, villas & landed houses) and by city (Sydney, Melbourne, Perth, Brisbane, and other cities), with Sydney and Melbourne currently dominating the market share. Prominent developers like Stunning Homes, Metricon Homes, and others cater to this high-end demand, offering bespoke designs and premium amenities.

The forecast period (2025-2033) anticipates continuous growth, albeit with potential fluctuations reflecting broader economic cycles. While the supply of luxury properties remains constrained, innovative construction techniques and design solutions are likely to adapt to meet evolving buyer preferences and environmental sustainability concerns. The increasing integration of smart home technology and a focus on sustainable luxury will likely shape future trends. Competition among developers will intensify, leading to the development of unique selling propositions and further enhancing the overall market dynamism. The long-term outlook remains positive, driven by sustained demand from both domestic and international high-net-worth buyers and investors, positioning the Australian luxury residential property market for sustained growth well into the next decade.

Australia Luxury Residential Property Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian luxury residential property market, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). The report segments the market by property type (Apartments & Condominiums, Villas & Landed Houses) and city (Sydney, Melbourne, Brisbane, Perth, Other Cities), offering granular insights for investors, developers, and industry professionals. Key players like Stunning Homes, Medallion Homes, Summit South West, Atrium Homes, James Michael Homes, Metricon Homes, High End Nicheliving, Broadway Homes, Lomma Homes, and Rossadale Homes (list not exhaustive) are analyzed to understand market dynamics and competitive landscapes. The report quantifies market size in millions of Australian dollars (AUD).

Australia Luxury Residential Property Market Dynamics & Structure

The Australian luxury residential property market is characterized by high concentration among a few large developers and numerous smaller, boutique firms. Technological innovation, particularly in smart home technology and sustainable building practices, is a significant driver, but regulatory hurdles and access to skilled labor pose challenges. The market faces competition from alternative investment options, yet strong demand persists among high-net-worth individuals and foreign investors. Mergers and acquisitions (M&A) activity is moderate, with larger players consolidating their market share.

- Market Concentration: Top 5 developers hold approximately xx% market share (2025).

- Technological Innovation: Focus on smart home integration, sustainable materials, and energy-efficient designs.

- Regulatory Framework: Stringent building codes and environmental regulations influence development costs.

- Competitive Substitutes: Alternative investments (e.g., commercial real estate, equities) compete for investor capital.

- End-User Demographics: High-net-worth individuals, expatriates, and foreign investors constitute primary demand.

- M&A Trends: xx M&A deals involving luxury residential developers recorded in the last 5 years (2019-2024).

Australia Luxury Residential Property Market Growth Trends & Insights

The Australian luxury residential property market witnessed significant growth during the historical period (2019-2024), driven by strong economic conditions and increasing disposable incomes among high-net-worth individuals. However, growth rates have moderated recently due to factors like rising interest rates and regulatory changes. We project a CAGR of xx% from 2025 to 2033, with market size reaching xx million AUD by 2033. This growth is influenced by sustained demand in key cities, especially Sydney and Melbourne, along with technological advancements and evolving consumer preferences for sustainable and technologically advanced homes. Market penetration of luxury residences remains relatively low, suggesting substantial growth potential. Consumer behavior shifts towards larger living spaces and premium amenities contribute to the ongoing demand.

Dominant Regions, Countries, or Segments in Australia Luxury Residential Property Market

Sydney and Melbourne dominate the luxury residential market, accounting for approximately xx% and xx% of the total market value respectively (2025). Strong economic performance, robust infrastructure development, and a desirable lifestyle contribute to the dominance of these cities. Villas and landed houses constitute a larger share of the luxury market compared to apartments and condominiums, driven by a preference for spacious living and private outdoor areas.

- Sydney: High demand for waterfront properties and inner-city luxury apartments.

- Melbourne: Strong growth driven by infrastructure upgrades and a thriving professional services sector.

- Brisbane: Emerging as a significant luxury residential market, with increasing demand for high-end properties.

- Perth: Market growth closely tied to the resources sector.

- Villas & Landed Houses: Preference for larger living spaces and private outdoor areas drives this segment's growth.

Australia Luxury Residential Property Market Product Landscape

Luxury residential properties in Australia are characterized by innovative designs, premium finishes, and advanced technologies. Smart home features, sustainable building materials, and energy-efficient systems are becoming increasingly common. Unique selling propositions often include bespoke design options, exclusive amenities (e.g., private pools, rooftop gardens), and prime locations. Technological advancements contribute to increased energy efficiency, enhanced security, and improved comfort.

Key Drivers, Barriers & Challenges in Australia Luxury Residential Property Market

Key Drivers: Strong economic growth, increasing high-net-worth individuals, demand for premium lifestyle, and technological advancements in building and design.

Challenges: Rising interest rates, stringent lending criteria, land scarcity in prime locations, regulatory approvals and compliance costs, and increasing construction costs impacting profit margins. This results in a xx% reduction in new project starts in 2024 compared to 2023 (estimated).

Emerging Opportunities in Australia Luxury Residential Property Market

Emerging opportunities lie in eco-friendly construction, smart home integration, and personalized luxury experiences. Demand for sustainable luxury properties is growing, presenting a significant opportunity for developers. Tailored design and concierge services cater to the preferences of affluent buyers. Expansion into regional areas with high tourism potential holds promise.

Growth Accelerators in the Australia Luxury Residential Property Market Industry

Strategic partnerships between developers and luxury brands enhance product offerings and attract discerning buyers. Technological advancements, such as 3D printing and off-site construction methods, reduce construction time and costs. Government incentives supporting sustainable building practices can further stimulate the market. Expanding into niche markets, such as luxury retirement villages, adds further growth potential.

Key Players Shaping the Australia Luxury Residential Property Market Market

- Stunning Homes

- Medallion Homes

- Summit South West

- Atrium Homes

- James Michael Homes

- Metricon Homes

- High End Nicheliving

- Broadway Homes

- Lomma Homes

- Rossadale Homes

Notable Milestones in Australia Luxury Residential Property Market Sector

- August 2023: Made Property announces the Corsa Mortlake development, a luxury waterfront apartment project in Sydney.

- September 2023: Launch of Burly Residences, a luxury beachfront apartment development in North Burleigh, Queensland.

In-Depth Australia Luxury Residential Property Market Market Outlook

The Australian luxury residential property market is poised for sustained growth in the forecast period (2025-2033). Strategic partnerships, technological innovation, and government initiatives fostering sustainable development will contribute to this growth. Continued demand for prime locations and high-end amenities will ensure a healthy market outlook, despite the challenges of interest rate fluctuations and construction costs. Opportunities exist for developers who focus on sustainability, technological integration, and personalized luxury offerings.

Australia Luxury Residential Property Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Sydney

- 2.2. Perth

- 2.3. Melbourne

- 2.4. Brisbane

- 2.5. Other Cities

Australia Luxury Residential Property Market Segmentation By Geography

- 1. Australia

Australia Luxury Residential Property Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of High Net-Worth Individuals (HNWIs)

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Ultra High Net Worth Population Driving the Demand for Prime Properties

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Luxury Residential Property Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Sydney

- 5.2.2. Perth

- 5.2.3. Melbourne

- 5.2.4. Brisbane

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Stunning Homes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medallion Homes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Summit South West

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atrium Homes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Michael Homes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Metricon Homes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 High End Nicheliving

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Broadway Homes**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lomma Homes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rossadale Homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Stunning Homes

List of Figures

- Figure 1: Australia Luxury Residential Property Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Luxury Residential Property Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Luxury Residential Property Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Luxury Residential Property Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Australia Luxury Residential Property Market Revenue Million Forecast, by City 2019 & 2032

- Table 4: Australia Luxury Residential Property Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Luxury Residential Property Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Luxury Residential Property Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Australia Luxury Residential Property Market Revenue Million Forecast, by City 2019 & 2032

- Table 8: Australia Luxury Residential Property Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Luxury Residential Property Market?

The projected CAGR is approximately 5.75%.

2. Which companies are prominent players in the Australia Luxury Residential Property Market?

Key companies in the market include Stunning Homes, Medallion Homes, Summit South West, Atrium Homes, James Michael Homes, Metricon Homes, High End Nicheliving, Broadway Homes**List Not Exhaustive, Lomma Homes, Rossadale Homes.

3. What are the main segments of the Australia Luxury Residential Property Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.88 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of High Net-Worth Individuals (HNWIs).

6. What are the notable trends driving market growth?

Ultra High Net Worth Population Driving the Demand for Prime Properties.

7. Are there any restraints impacting market growth?

4.; Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

August 2023: Sydney-based boutique developer Made Property laid plans for a new apartment project along Sydney Harbour amid sustained demand for luxury waterfront properties. The Corsa Mortlake development, positioned on Majors Bay in the harbor city’s inner west, will deliver 20 three-bedroom apartments offering house-sized living spaces and ready access to a 23-berth marina accommodating yachts up to 20 meters. With development approval secured for the project, the company is moving quickly to construction. Made Property expects construction to be completed in late 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Luxury Residential Property Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Luxury Residential Property Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Luxury Residential Property Market?

To stay informed about further developments, trends, and reports in the Australia Luxury Residential Property Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence