Key Insights

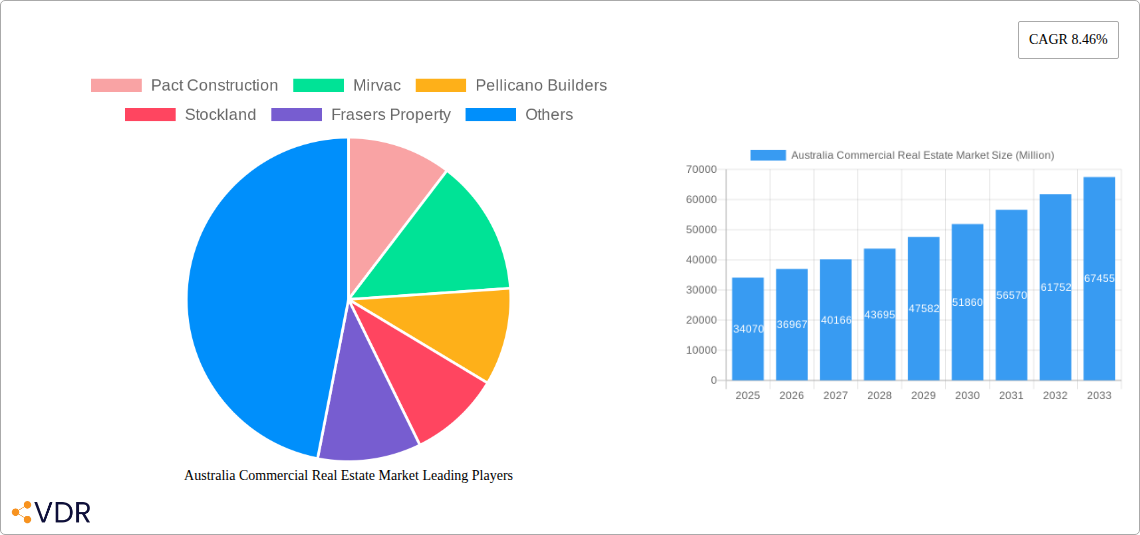

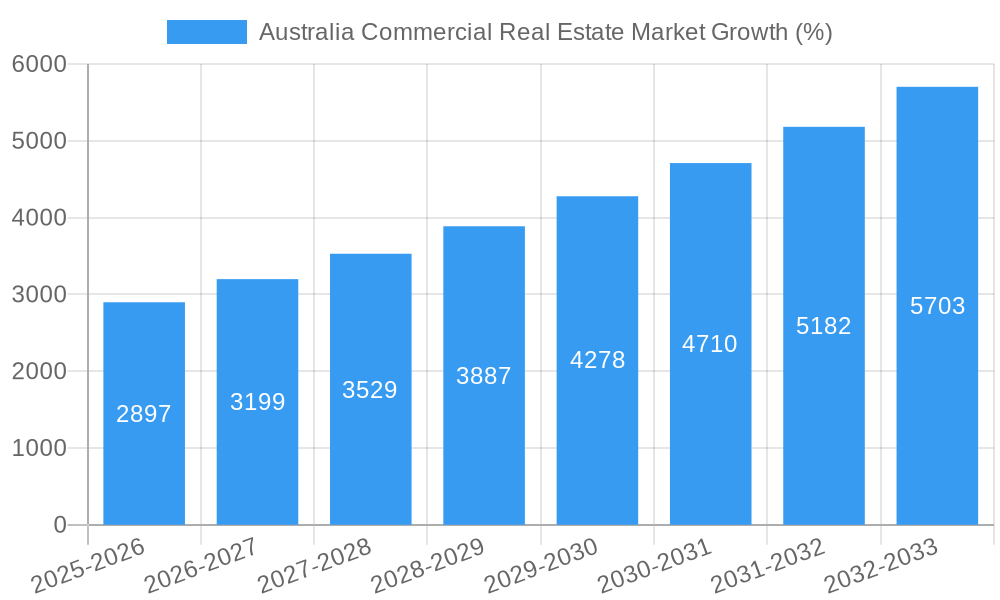

The Australian commercial real estate market, valued at $34.07 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.46% from 2025 to 2033. This expansion is driven by several key factors. Strong population growth and urbanization in major cities like Sydney, Melbourne, and Brisbane are fueling demand for office, retail, and industrial spaces. The burgeoning e-commerce sector is significantly boosting the demand for logistics facilities, while a thriving tourism industry supports the hospitality sector's real estate needs. Government initiatives promoting infrastructure development and investment in smart cities further contribute to market dynamism. However, challenges remain. Interest rate fluctuations and potential economic slowdowns could temper growth. Competition among developers and rising construction costs also pose constraints. Segmentation analysis reveals that the office and retail sectors currently dominate market share, although the industrial and logistics sector is anticipated to witness the fastest growth trajectory in the coming years. The market is characterized by a mix of large established players like Lendlease, Mirvac, and Stockland alongside smaller, specialized developers. This competitive landscape reflects the diverse nature of the Australian commercial real estate market, catering to a wide range of needs and investment strategies.

The forecast period (2025-2033) anticipates continued growth, albeit potentially at a moderated pace towards the later years. Factors influencing this projection include the potential stabilization of construction costs, adjustments in interest rates, and the evolving dynamics of remote work and e-commerce. Ongoing government policies supporting sustainable development and infrastructure projects will play a significant role in shaping the market trajectory. While certain segments might experience fluctuations based on specific economic cycles, the overall outlook for the Australian commercial real estate market remains positive, propelled by long-term trends in population growth, urbanization, and technological advancements.

Australia Commercial Real Estate Market: A Comprehensive Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Australian commercial real estate market, offering invaluable insights for investors, developers, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this study delves into market dynamics, growth trends, key players, and emerging opportunities across various segments and locations. The report leverages extensive data analysis to deliver actionable intelligence for strategic decision-making.

Keywords: Australia Commercial Real Estate, Commercial Real Estate Market Australia, Australian Property Market, Sydney Commercial Real Estate, Melbourne Commercial Real Estate, Brisbane Commercial Real Estate, Office Space Australia, Retail Property Australia, Industrial Property Australia, Logistics Real Estate Australia, Pact Construction, Mirvac, Pellicano Builders, Stockland, Frasers Property, Qube Property Group, Scentre Group, Lendlease, Meriton Apartments, Multiplex Constructions, Real Estate Investment Australia, Commercial Property Investment.

Australia Commercial Real Estate Market Dynamics & Structure

The Australian commercial real estate market is a dynamic landscape shaped by a complex interplay of factors. Market concentration is moderate, with a few large players like Mirvac, Stockland, and Lendlease holding significant shares, while numerous smaller firms compete in niche segments. Technological innovation, particularly in areas like proptech and smart building technologies, is driving efficiency gains and reshaping property management. Stringent regulatory frameworks, including environmental regulations and building codes, influence development and investment decisions. Competitive product substitutes, such as co-working spaces and flexible office solutions, are impacting traditional office leasing. End-user demographics, particularly the growing millennial and Gen Z workforce with evolving workplace preferences, are reshaping demand across segments. M&A activity remains relatively robust, with deal volumes fluctuating based on economic conditions.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Increasing adoption of proptech solutions enhancing efficiency and tenant experience.

- Regulatory Framework: Stringent building codes and environmental regulations impact development costs.

- Competitive Substitutes: Growth of co-working spaces and flexible office arrangements impacts traditional office leasing.

- M&A Activity: Annual deal volume estimated at xx Million AUD in 2025, projected to increase to xx Million AUD by 2033.

Australia Commercial Real Estate Market Growth Trends & Insights

The Australian commercial real estate market is projected to experience robust growth throughout the forecast period (2025-2033). Driven by sustained economic growth, population increase, and urbanization, the market size is expected to expand significantly. Adoption rates of new technologies are accelerating, further boosting efficiency and productivity. Consumer behavior shifts, particularly preferences for sustainable and amenity-rich spaces, are influencing development trends. However, economic cycles and interest rate fluctuations can impact growth trajectories. The Compound Annual Growth Rate (CAGR) is estimated at xx% from 2025 to 2033, with market penetration increasing from xx% in 2025 to xx% by 2033. Detailed analysis incorporating macroeconomic factors like interest rate sensitivity, inflation, and GDP growth provides further nuanced perspectives. Further insights on the impact of technological advancements, including AI and data analytics in property management, are also provided.

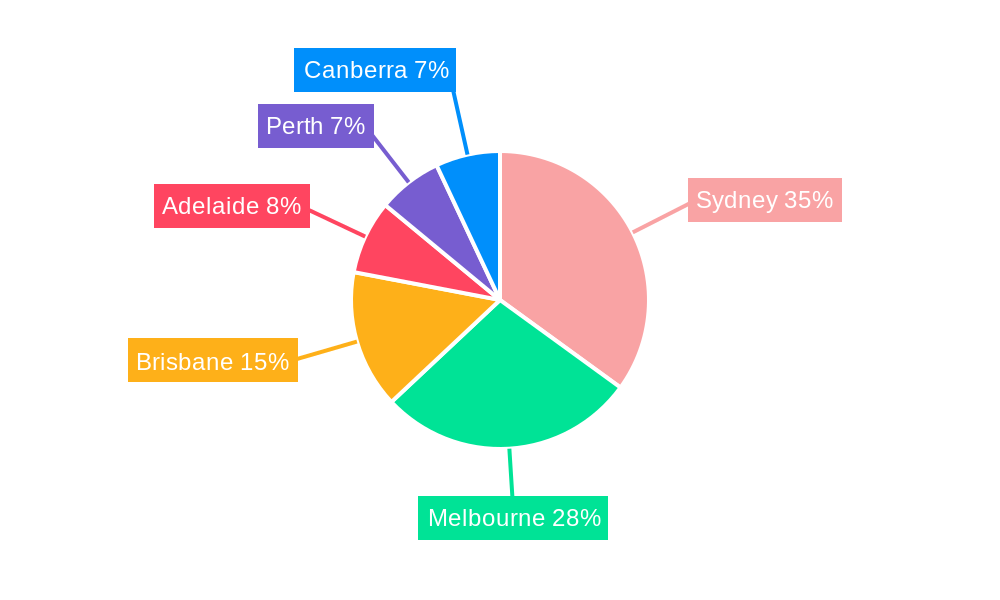

Dominant Regions, Countries, or Segments in Australia Commercial Real Estate Market

Sydney and Melbourne remain the dominant markets, accounting for the largest share of commercial real estate activity. The office segment is expected to continue its strong performance driven by corporate demand and limited supply in prime locations. The industrial and logistics sector is experiencing significant growth fueled by e-commerce expansion and supply chain optimization.

- By City:

- Sydney: Dominant market share due to strong economic activity and limited land availability.

- Melbourne: Strong growth driven by population increase and infrastructure development.

- Brisbane, Perth, Adelaide: Experiencing steady growth but at a slower pace compared to Sydney and Melbourne.

- By Type:

- Office: High demand in prime locations, driving rental growth.

- Industrial & Logistics: Significant expansion driven by e-commerce and supply chain dynamics.

- Retail: Facing challenges from online competition, but experiencing a shift towards experiential retail formats.

Australia Commercial Real Estate Market Product Landscape

The Australian commercial real estate market offers a diverse range of products, catering to various needs and preferences. Innovations focus on sustainable building materials, smart building technologies, and flexible workspace solutions. Performance metrics increasingly emphasize energy efficiency, environmental impact, and tenant satisfaction. Unique selling propositions focus on location, amenities, technological integration, and sustainability credentials. Technological advancements are driving the adoption of building management systems, IoT devices, and data-driven analytics for optimized operations and enhanced tenant experiences.

Key Drivers, Barriers & Challenges in Australia Commercial Real Estate Market

Key Drivers: Strong population growth, economic expansion, increasing urbanization, and government infrastructure investment are propelling market growth. Technological advancements improve efficiency and tenant experience.

Challenges: High construction costs, limited land availability in prime locations, regulatory complexities, and cyclical economic fluctuations pose challenges to market expansion. Supply chain disruptions cause delays and increase costs. Competition among developers and investors impacts profitability.

Emerging Opportunities in Australia Commercial Real Estate Market

Opportunities exist in sustainable development, build-to-rent projects, co-working spaces, and the integration of technology into commercial properties. Untapped markets in regional areas present potential for growth. The evolving preferences of tenants create opportunities for innovative property designs and management strategies.

Growth Accelerators in the Australia Commercial Real Estate Market Industry

Technological breakthroughs in construction and property management are significantly improving efficiency and productivity. Strategic partnerships between developers, technology providers, and investors are fostering innovation. Expansion into new markets and diversification of product offerings are crucial for sustained growth.

Key Players Shaping the Australia Commercial Real Estate Market Market

- Pact Construction

- Mirvac

- Pellicano Builders

- Stockland

- Frasers Property

- Qube Property Group Pty Ltd

- 73 Other Companies

- Scentre Group Limited

- Lendlease Corporation

- Meriton Apartments Pty Ltd

- Multiplex Constructions Pty Ltd

Notable Milestones in Australia Commercial Real Estate Market Sector

- 2020: Increased focus on sustainable building practices following government incentives.

- 2021: Significant investment in logistics and industrial properties driven by e-commerce growth.

- 2022: Several major M&A deals reshaped the market landscape.

- 2023: Introduction of new proptech solutions enhanced property management efficiency.

- 2024: Government initiatives promote the development of affordable housing.

In-Depth Australia Commercial Real Estate Market Market Outlook

The Australian commercial real estate market is poised for continued growth, driven by ongoing urbanization, economic expansion, and technological advancements. Strategic investments in sustainable and technologically advanced properties will be key to success. Opportunities exist for investors and developers to capitalize on emerging trends and untapped market segments. Understanding and adapting to evolving tenant preferences will be crucial for achieving long-term success in this dynamic market.

Australia Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

- 1.5. Other Types

-

2. City

- 2.1. Sydney

- 2.2. Melbourne

- 2.3. Brisbane

- 2.4. Adelaide

- 2.5. Canberra

- 2.6. Perth

Australia Commercial Real Estate Market Segmentation By Geography

- 1. Australia

Australia Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Supply chain issues and rising material costs

- 3.4. Market Trends

- 3.4.1. Retail real estate is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Sydney

- 5.2.2. Melbourne

- 5.2.3. Brisbane

- 5.2.4. Adelaide

- 5.2.5. Canberra

- 5.2.6. Perth

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Pact Construction

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mirvac

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pellicano Builders

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stockland

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frasers Property

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qube Property Group Pty Ltd**List Not Exhaustive 7 3 Other Companie

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Scentre Group Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lendlease Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Meriton Apartments Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Multiplex Constructions Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Pact Construction

List of Figures

- Figure 1: Australia Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Commercial Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Australia Commercial Real Estate Market Revenue Million Forecast, by City 2019 & 2032

- Table 4: Australia Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Australia Commercial Real Estate Market Revenue Million Forecast, by City 2019 & 2032

- Table 8: Australia Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Commercial Real Estate Market?

The projected CAGR is approximately 8.46%.

2. Which companies are prominent players in the Australia Commercial Real Estate Market?

Key companies in the market include Pact Construction, Mirvac, Pellicano Builders, Stockland, Frasers Property, Qube Property Group Pty Ltd**List Not Exhaustive 7 3 Other Companie, Scentre Group Limited, Lendlease Corporation, Meriton Apartments Pty Ltd, Multiplex Constructions Pty Ltd.

3. What are the main segments of the Australia Commercial Real Estate Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

Retail real estate is expected to drive the market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Supply chain issues and rising material costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Australia Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence