Key Insights

Asia-Pacific Precision Turned Product Manufacturing Market Market Size (In Billion)

Asia-Pacific Precision Turned Product Manufacturing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific precision turned product manufacturing market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook, with a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033). The market is segmented by product type, application, and end-user industry, offering granular data for informed strategic planning. The total market size is projected to reach xx Million units by 2033.

Asia-Pacific Precision Turned Product Manufacturing Market Dynamics & Structure

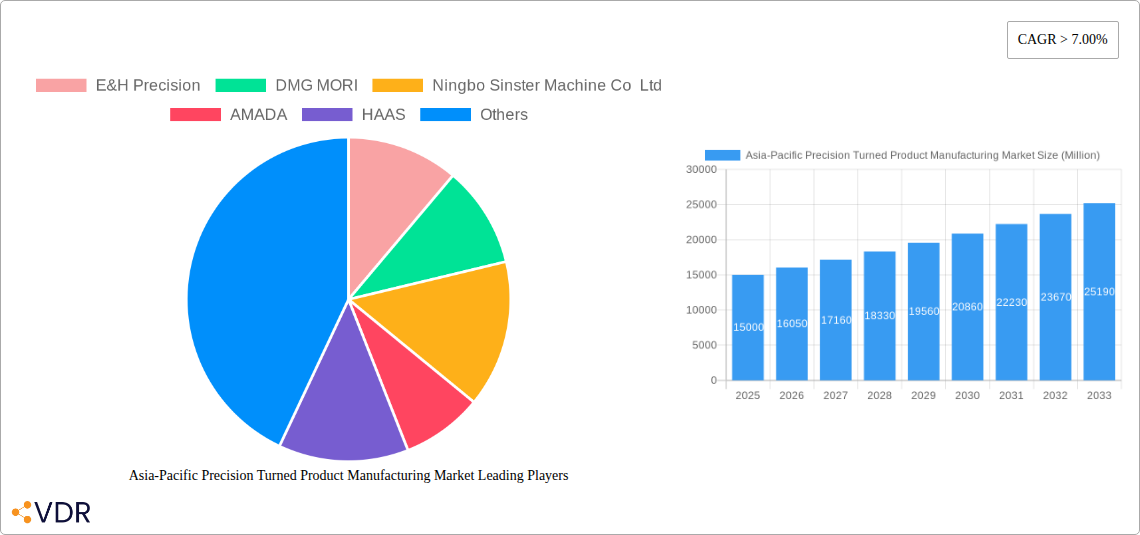

The Asia-Pacific precision turned product manufacturing market is characterized by a moderately concentrated landscape, with key players such as E&H Precision, DMG MORI, Ningbo Sinster Machine Co Ltd, AMADA, HAAS, MAZAK, Star Rapid, 3E Rapid Prototyping (3ERP), and Junying Metal Manufacturing Co Limited competing for market share. However, the market also accommodates numerous smaller, specialized manufacturers.

- Market Concentration: The market exhibits a Herfindahl-Hirschman Index (HHI) of xx, suggesting a moderately concentrated market structure. Larger players hold approximately xx% of the market share, while smaller players collectively contribute the remaining xx%.

- Technological Innovation: Advancements in CNC machining, automation, and additive manufacturing are driving significant improvements in precision, efficiency, and production speed. However, high initial investment costs and the need for skilled labor can act as barriers to innovation adoption.

- Regulatory Frameworks: Government regulations related to environmental protection, worker safety, and product quality standards significantly influence manufacturing practices and operational costs. Compliance requirements vary across the region.

- Competitive Product Substitutes: 3D printing and other additive manufacturing technologies are emerging as competitive substitutes, particularly for prototyping and low-volume production. However, traditional precision turning remains cost-effective for high-volume manufacturing.

- End-User Demographics: The primary end-users include the automotive, aerospace, electronics, medical device, and industrial machinery sectors. Growth in these sectors directly impacts market demand.

- M&A Trends: The market has witnessed xx M&A deals in the past five years, primarily driven by strategies to expand geographical reach, enhance technological capabilities, and access new customer segments.

Asia-Pacific Precision Turned Product Manufacturing Market Growth Trends & Insights

The Asia-Pacific precision turned product manufacturing market is projected to experience robust growth, driven by increasing industrial automation, rising demand from key end-user industries, and government initiatives promoting manufacturing modernization. The market size is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million units by 2033 from xx Million units in 2025. This growth is fueled by the increasing adoption of advanced technologies and the growing demand for high-precision components across various industries in the region. Market penetration for advanced CNC machines is expected to increase from xx% in 2025 to xx% by 2033. Changing consumer preferences towards higher quality and more specialized products are also contributing factors. Specific technological disruptions, such as the integration of AI and IoT in manufacturing processes, will further propel market growth.

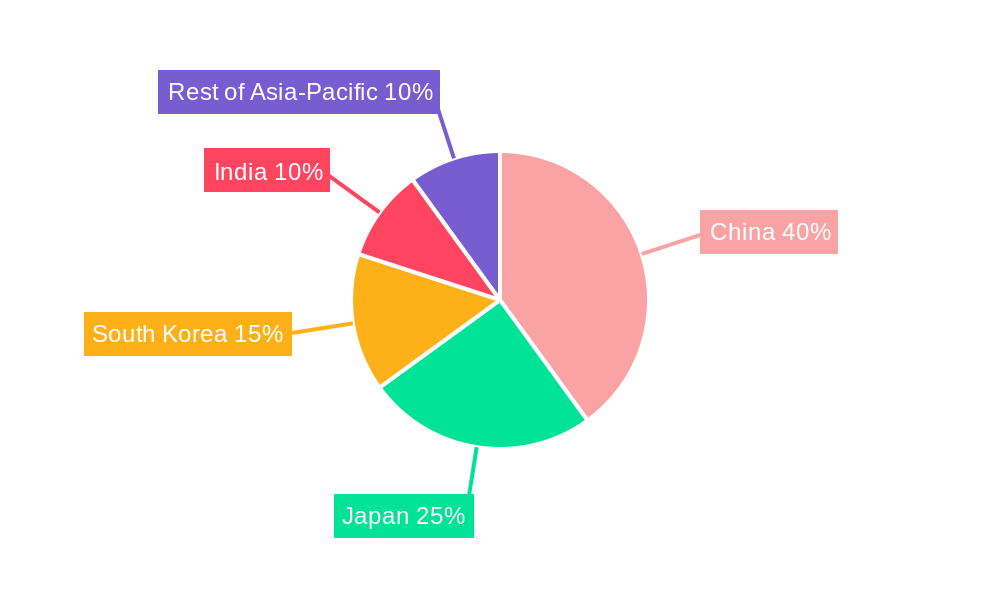

Dominant Regions, Countries, or Segments in Asia-Pacific Precision Turned Product Manufacturing Market

The Asia-Pacific region is a powerhouse in precision turned product manufacturing, with China and Japan currently holding dominant market positions. China, leveraging its vast industrial ecosystem and government-backed initiatives like "Made in China 2025," accounts for a substantial portion of the market share. Japan, renowned for its unwavering commitment to high-precision engineering and cutting-edge technology, also commands a significant segment. These nations' dominance is underpinned by their advanced manufacturing infrastructure, continuous investment in technological upgrades, and a skilled workforce.

- China: The country's sheer manufacturing scale, coupled with strong governmental support for industrial innovation and a deep talent pool, propels its leadership. The "Made in China 2025" strategy, in particular, has been instrumental in fostering technological advancements and expanding the industry's reach.

- Japan: Japan's esteemed reputation for meticulous engineering and groundbreaking technological innovation solidifies its market strength. It serves as a crucial manufacturing hub for a wide array of high-technology sectors, including automotive, aerospace, and medical devices.

- India: India is witnessing an accelerated trajectory in its manufacturing sector, fueled by economic liberalization policies and a surge in foreign direct investment. The burgeoning middle class and increasing industrialization are driving a growing demand for sophisticated precision-turned components.

- Other Key Contributors: Nations such as South Korea, Taiwan, and Singapore also play pivotal roles, largely due to their robust electronics and automotive industries, which require high-tolerance, precision-manufactured parts.

Asia-Pacific Precision Turned Product Manufacturing Market Product Landscape

The market offers a diverse range of precision turned products, catering to various applications and performance requirements. Products are categorized by material (e.g., steel, aluminum, brass), manufacturing process (e.g., CNC turning, Swiss-type turning), and surface finish. Technological advancements have resulted in improved tolerances, enhanced surface finishes, and increased efficiency in production. Unique selling propositions often include customized designs, rapid prototyping capabilities, and competitive pricing strategies.

Key Drivers, Barriers & Challenges in Asia-Pacific Precision Turned Product Manufacturing Market

Key Drivers:

- Increasing industrial automation

- Growing demand from key end-user sectors (automotive, aerospace, electronics)

- Government initiatives supporting manufacturing modernization

- Technological advancements improving precision and efficiency

Key Challenges:

- Fluctuations in raw material prices

- Intense competition from lower-cost manufacturers

- Skilled labor shortages

- Stringent environmental regulations

Emerging Opportunities in Asia-Pacific Precision Turned Product Manufacturing Market

- Expanding into niche markets such as medical devices and aerospace components.

- Adoption of Industry 4.0 technologies (AI, IoT) to optimize production processes.

- Development of sustainable and environmentally friendly manufacturing practices.

Growth Accelerators in the Asia-Pacific Precision Turned Product Manufacturing Market Industry

The Asia-Pacific precision turned product manufacturing market is poised for dynamic growth, driven by several key accelerators. Significant advancements in CNC machining technologies, the widespread adoption of automation and robotics, and the emerging capabilities of additive manufacturing are fundamentally reshaping production processes and efficiency. Furthermore, the formation of strategic alliances and collaborations between manufacturers, technology providers, and research institutions is crucial for fostering rapid innovation and accelerating market penetration. Geographic market expansion into emerging economies and diversification into high-growth application sectors, such as electric vehicles, renewable energy, and advanced medical equipment, will also serve as powerful drivers for sustained industry expansion.

Key Players Shaping the Asia-Pacific Precision Turned Product Manufacturing Market Market

- E&H Precision

- DMG MORI

- Ningbo Sinster Machine Co Ltd

- AMADA

- HAAS

- MAZAK

- Star Rapid

- 3E Rapid Prototyping (3ERP)

- Junying Metal Manufacturing Co Limited

- List Not Exhaustive

Notable Milestones in Asia-Pacific Precision Turned Product Manufacturing Market Sector

- October 2022: Dover Precision Components opened its innovation lab, enhancing its capabilities in fluid film bearings and compression products. This signifies a commitment to R&D and product innovation.

- June 2022: REHAU's collaboration with TITUS expands its market reach into the hardware sector, impacting the broader furniture and construction industries.

In-Depth Asia-Pacific Precision Turned Product Manufacturing Market Market Outlook

The outlook for the Asia-Pacific precision turned product manufacturing market is exceptionally promising, characterized by robust growth prospects. This optimistic forecast is a direct consequence of continuous technological innovation, increasing industrialization across the region, and a burgeoning demand for highly accurate and reliable components across a multitude of sophisticated industries. To maintain and enhance this growth trajectory, strategic investments in advanced automation, dedicated research and development (R&D) initiatives, and the cultivation of a highly skilled workforce are paramount. The market is well-positioned for sustained expansion, presenting lucrative opportunities for both established market leaders and agile new entrants seeking to capitalize on the evolving landscape of precision manufacturing.

Asia-Pacific Precision Turned Product Manufacturing Market Segmentation

-

1. Type

- 1.1. Copper

- 1.2. Brass

- 1.3. Other Metals

- 1.4. Plastic

- 1.5. Other Types

-

2. Manufacturing Method

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled (CNC) Lathes

- 2.4. Turning Centres

- 2.5. Other Machines

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Precision Turned Product Manufacturing Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of Asia-Pacific Precision Turned Product Manufacturing Market

Asia-Pacific Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth of Precision Manufacturing Sector and allied MSMEs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Copper

- 5.1.2. Brass

- 5.1.3. Other Metals

- 5.1.4. Plastic

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled (CNC) Lathes

- 5.2.4. Turning Centres

- 5.2.5. Other Machines

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Copper

- 6.1.2. Brass

- 6.1.3. Other Metals

- 6.1.4. Plastic

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 6.2.1. Automatic Screw Machines

- 6.2.2. Rotary Transfer Machines

- 6.2.3. Computer Numerically Controlled (CNC) Lathes

- 6.2.4. Turning Centres

- 6.2.5. Other Machines

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Copper

- 7.1.2. Brass

- 7.1.3. Other Metals

- 7.1.4. Plastic

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 7.2.1. Automatic Screw Machines

- 7.2.2. Rotary Transfer Machines

- 7.2.3. Computer Numerically Controlled (CNC) Lathes

- 7.2.4. Turning Centres

- 7.2.5. Other Machines

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Copper

- 8.1.2. Brass

- 8.1.3. Other Metals

- 8.1.4. Plastic

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 8.2.1. Automatic Screw Machines

- 8.2.2. Rotary Transfer Machines

- 8.2.3. Computer Numerically Controlled (CNC) Lathes

- 8.2.4. Turning Centres

- 8.2.5. Other Machines

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Copper

- 9.1.2. Brass

- 9.1.3. Other Metals

- 9.1.4. Plastic

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 9.2.1. Automatic Screw Machines

- 9.2.2. Rotary Transfer Machines

- 9.2.3. Computer Numerically Controlled (CNC) Lathes

- 9.2.4. Turning Centres

- 9.2.5. Other Machines

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Copper

- 10.1.2. Brass

- 10.1.3. Other Metals

- 10.1.4. Plastic

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 10.2.1. Automatic Screw Machines

- 10.2.2. Rotary Transfer Machines

- 10.2.3. Computer Numerically Controlled (CNC) Lathes

- 10.2.4. Turning Centres

- 10.2.5. Other Machines

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Copper

- 11.1.2. Brass

- 11.1.3. Other Metals

- 11.1.4. Plastic

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Manufacturing Method

- 11.2.1. Automatic Screw Machines

- 11.2.2. Rotary Transfer Machines

- 11.2.3. Computer Numerically Controlled (CNC) Lathes

- 11.2.4. Turning Centres

- 11.2.5. Other Machines

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 E&H Precision

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 DMG MORI

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ningbo Sinster Machine Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AMADA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 HAAS

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MAZAK

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Ningbo Sinster Machine Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Star Rapid

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 3E Rapid Prototyping (3ERP)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Junying Metal Manufacturing Co Limited**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 E&H Precision

List of Figures

- Figure 1: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 3: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 5: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 6: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: China Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 11: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 13: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 14: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: India Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 21: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 22: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 27: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 29: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 30: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 31: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South Korea Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 35: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 37: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 38: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 41: ASEAN Countries Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Type 2025 & 2033

- Figure 43: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Manufacturing Method 2025 & 2033

- Figure 45: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Manufacturing Method 2025 & 2033

- Figure 46: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific Asia-Pacific Precision Turned Product Manufacturing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 3: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 7: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 11: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 15: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 19: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 23: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Manufacturing Method 2020 & 2033

- Table 27: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global Asia-Pacific Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Asia-Pacific Precision Turned Product Manufacturing Market?

Key companies in the market include E&H Precision, DMG MORI, Ningbo Sinster Machine Co Ltd, AMADA, HAAS, MAZAK, Ningbo Sinster Machine Co Ltd, Star Rapid, 3E Rapid Prototyping (3ERP), Junying Metal Manufacturing Co Limited**List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Precision Turned Product Manufacturing Market?

The market segments include Type, Manufacturing Method, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.54 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth of Precision Manufacturing Sector and allied MSMEs.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Dover Precision Components officially opened its innovation lab. The lab team focused on installing and commissioning key test rigs for its fluid film bearings and compression products since the nearly 12,000-square-foot building was completed. The lab has four independent test bays to allow for simultaneous work on multiple rigs and dedicated control rooms to monitor and collect test data and help ensure the equipment's safe operation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence