Key Insights

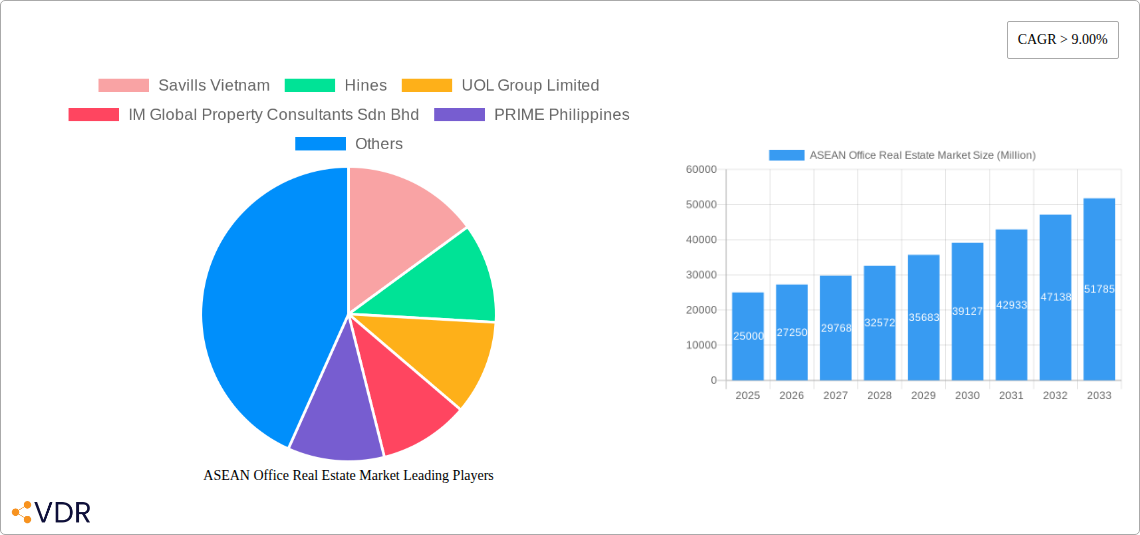

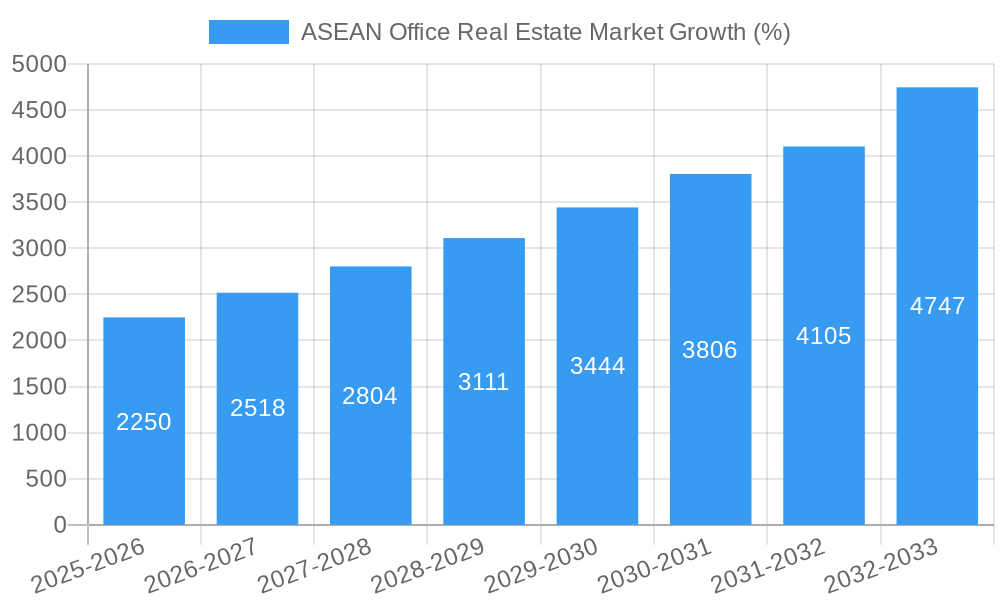

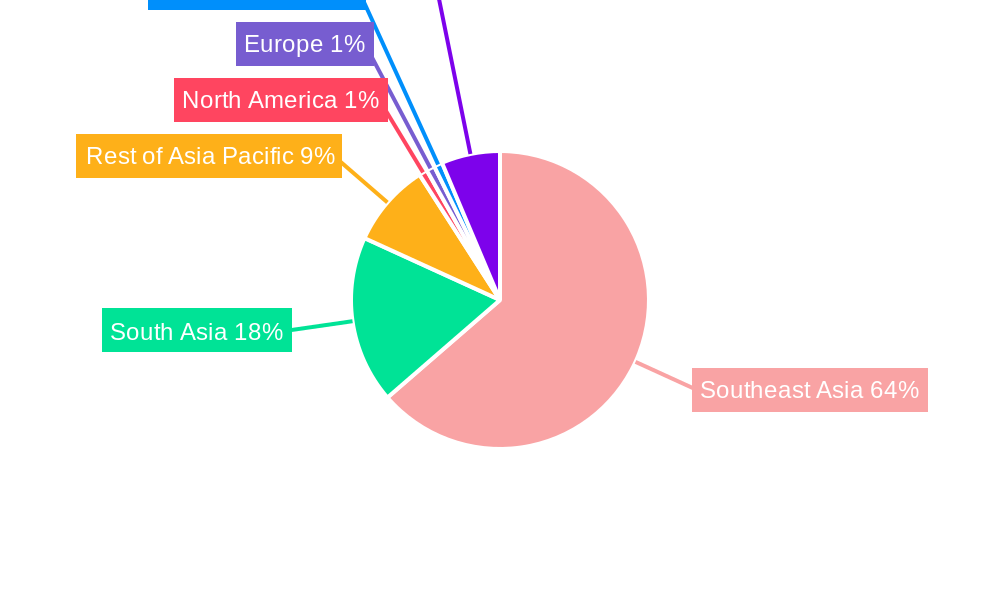

The ASEAN office real estate market, currently experiencing robust growth with a CAGR exceeding 9%, presents a lucrative investment opportunity. Driven by factors such as increasing urbanization, a burgeoning middle class fueling demand for commercial spaces, and the expansion of multinational corporations, the market is projected to expand significantly over the forecast period (2025-2033). The segment breakdown reveals strong performance across various office grades (A, B, and C), with Grade A offices commanding premium prices in prime locations like Singapore and Jakarta. Strong demand from corporate offices and SMEs, alongside government agency requirements, further fuels market expansion. Key locations within Southeast Asia are experiencing the most significant growth, driven by strong economic performance and infrastructure development. South Asia, while showing promising growth potential, lags slightly behind due to factors such as varying levels of economic development across the region and infrastructure limitations in certain areas. However, ongoing investments in infrastructure and government initiatives are expected to bridge this gap in the coming years.

While the market outlook is positive, several factors could pose challenges. These include potential economic downturns, fluctuations in global investment flows, and competition from emerging alternative office solutions, such as co-working spaces. Furthermore, maintaining sustainable growth requires addressing infrastructure limitations in certain areas and ensuring a consistent supply of high-quality office spaces to meet the rising demand. Nevertheless, the long-term prospects remain promising, driven by the region's overall economic growth trajectory and increasing demand for modern, efficient workspaces. The leading players in the market, including Savills Vietnam, Hines, UOL Group Limited, and others, are well-positioned to capitalize on these opportunities, focusing on strategic developments and expansion plans to solidify their market presence.

ASEAN Office Real Estate Market: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the ASEAN office real estate market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for investors, developers, and industry professionals seeking to navigate this dynamic market. The report analyzes the market across various segments including Grade A, B, and C offices, and by end-user (corporate, SME, government). The report also covers key markets in Southeast Asia and South Asia.

ASEAN Office Real Estate Market Dynamics & Structure

The ASEAN office real estate market is characterized by a moderate level of concentration, with a few large players such as Frasers Property and City Developments Limited holding significant market share (estimated at xx% and xx% respectively in 2024). Technological innovation, particularly in smart building technologies and proptech solutions, is a key driver, although adoption rates vary across the region. Regulatory frameworks, including zoning regulations and building codes, differ significantly between countries, creating both opportunities and challenges for investors. Competitive product substitutes, such as co-working spaces, are increasingly impacting the traditional office market. End-user demographics are shifting, with a growing demand for flexible and sustainable office spaces. M&A activity (estimated at xx Million USD in deal volume in 2024) is relatively high, driven by consolidation and expansion strategies of major players.

- Market Concentration: Moderately concentrated, with top players holding xx% combined market share in 2024.

- Technological Innovation: Smart building technologies and proptech are key drivers, but adoption rates vary.

- Regulatory Frameworks: Diverse across countries, impacting investment decisions.

- Competitive Substitutes: Co-working spaces pose a significant competitive challenge.

- End-User Demographics: Shifting preferences towards flexible and sustainable spaces.

- M&A Activity: Significant activity driven by consolidation and expansion.

ASEAN Office Real Estate Market Growth Trends & Insights

The ASEAN office real estate market experienced robust growth in the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth was driven by strong economic performance in several ASEAN countries, increased foreign direct investment, and expanding corporate sectors. However, the COVID-19 pandemic temporarily disrupted growth in 2020-2021, leading to a decline in occupancy rates and rental yields in some markets. The market is now recovering, with increasing adoption of hybrid work models impacting demand for office space. Technological disruptions, such as the rise of remote work and the increasing adoption of digital tools, are reshaping the office landscape. Consumer behavior shifts toward flexibility and sustainability are also influencing investment decisions. Market penetration of smart building technologies is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in ASEAN Office Real Estate Market

Singapore and Jakarta consistently dominate the ASEAN office market, driven by strong economic activity, well-developed infrastructure, and a large pool of multinational corporations. Within the segment breakdown, Grade A office spaces command the highest rental yields and attract premium tenants. Southeast Asia accounts for the largest share (xx%) of the total market, followed by South Asia (xx%). In terms of end-users, corporate offices remain the largest segment, though the SME sector is showing significant growth potential.

- Key Drivers (Singapore & Jakarta): Strong economies, developed infrastructure, large multinational corporations.

- Key Drivers (Grade A Offices): High rental yields, premium tenant base, superior amenities.

- Key Drivers (Southeast Asia): Higher economic growth, expanding corporate sector.

- Key Drivers (Corporate Offices): Large occupiers, long-term lease agreements.

- Market Share: Southeast Asia (xx%), South Asia (xx%), Grade A offices (xx%).

ASEAN Office Real Estate Market Product Landscape

The office real estate product landscape is evolving rapidly, driven by technological advancements and changing tenant preferences. Smart building technologies, such as IoT-enabled systems and energy-efficient designs, are increasingly integrated into new developments. Flexible office layouts and collaborative workspaces are becoming more common to cater to the evolving needs of businesses. The focus on sustainability is also a key feature of new office developments, with many projects targeting green building certifications. Unique selling propositions include advanced technologies, flexible lease terms, and sustainable design features.

Key Drivers, Barriers & Challenges in ASEAN Office Real Estate Market

Key Drivers: Strong economic growth in several ASEAN countries, rising foreign direct investment, growing corporate sectors, increasing demand for modern office spaces, and the development of smart city initiatives.

Challenges: Supply chain disruptions (e.g., material shortages) resulting in cost increases and project delays, regulatory hurdles in some markets, intensifying competition from co-working spaces, and economic uncertainty impacting investment decisions. These challenges are predicted to have a xx% negative impact on market growth in 2025.

Emerging Opportunities in ASEAN Office Real Estate Market

Emerging opportunities include the growth of co-working spaces, increasing demand for flexible office solutions, rising adoption of technology in commercial real estate, and growing focus on sustainability. Untapped markets in secondary cities across ASEAN offer significant potential for growth, driven by rising incomes and urbanization. Innovation in flexible lease structures and service offerings cater to evolving business needs.

Growth Accelerators in the ASEAN Office Real Estate Market Industry

Technological advancements, strategic partnerships between developers and technology providers, and government initiatives to improve infrastructure and promote foreign investment are driving long-term growth in the ASEAN office real estate market. Expansion into secondary and tertiary markets with growing populations and economic activity will also play a crucial role in shaping future market dynamics.

Key Players Shaping the ASEAN Office Real Estate Market Market

- Savills Vietnam

- Hines

- UOL Group Limited

- IM Global Property Consultants Sdn Bhd

- PRIME Philippines

- Frasers Property

- City Developments Limited

- PT Ciputra Development Tbk

- CBRE Vietnam

- Malton Berhad

Notable Milestones in ASEAN Office Real Estate Market Sector

- September 2022: Ciputra International inaugurated the Propan Tower in Jakarta, adding 17 floors and 6 office units to the market, signifying rising demand.

- February 2022: Hulic's USD 25.4 million acquisition of the Shintomicho Building in Tokyo highlights increasing cross-border investment in the office sector.

In-Depth ASEAN Office Real Estate Market Market Outlook

The ASEAN office real estate market is poised for continued growth over the forecast period (2025-2033), driven by strong economic fundamentals, ongoing urbanization, and increasing demand for modern and sustainable office spaces. Strategic partnerships, technological advancements, and government support will create opportunities for market expansion and innovation. The market is expected to reach a value of xx Million USD by 2033.

ASEAN Office Real Estate Market Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Vietnam

- 1.4. Indonesia

- 1.5. Malaysia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Office Real Estate Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Vietnam

- 4. Indonesia

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Demand for Co-Working Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Vietnam

- 5.1.4. Indonesia

- 5.1.5. Malaysia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Vietnam

- 5.2.4. Indonesia

- 5.2.5. Malaysia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Vietnam

- 6.1.4. Indonesia

- 6.1.5. Malaysia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Vietnam

- 7.1.4. Indonesia

- 7.1.5. Malaysia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Vietnam ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Vietnam

- 8.1.4. Indonesia

- 8.1.5. Malaysia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Indonesia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Vietnam

- 9.1.4. Indonesia

- 9.1.5. Malaysia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Malaysia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Vietnam

- 10.1.4. Indonesia

- 10.1.5. Malaysia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Vietnam

- 11.1.4. Indonesia

- 11.1.5. Malaysia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Vietnam

- 12.1.4. Indonesia

- 12.1.5. Malaysia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. North America ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United States

- 13.1.2 Canada

- 13.1.3 Mexico

- 14. South America ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Europe ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Germany

- 15.1.2 France

- 15.1.3 Italy

- 15.1.4 United Kingdom

- 15.1.5 Netherlands

- 15.1.6 Rest of Europe

- 16. Asia Pacific ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 China

- 16.1.2 India

- 16.1.3 Japan

- 16.1.4 Australia

- 16.1.5 Rest of Asia Pacific

- 17. Middle East & Africa ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 UAE

- 17.1.2 South Africa

- 17.1.3 Saudi Arabia

- 17.1.4 Rest of MEA

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Savills Vietnam

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Hines

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 UOL Group Limited

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 IM Global Property Consultants Sdn Bhd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 PRIME Philippines

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Frasers Property

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 City Developments Limited

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 PT Ciputra Development Tbk

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 CBRE Vietnam

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Malton Berhad

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Savills Vietnam

List of Figures

- Figure 1: Global ASEAN Office Real Estate Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 5: South America ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East & Africa ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East & Africa ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Singapore ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 13: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 14: Singapore ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Thailand ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 17: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 18: Thailand ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Vietnam ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 21: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 22: Vietnam ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Indonesia ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 25: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 26: Indonesia ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Malaysia ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 29: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 30: Malaysia ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Philippines ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 33: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 34: Philippines ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Rest of ASEAN ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 37: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 38: Rest of ASEAN ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 3: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherlands ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: UAE ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of MEA ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 35: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 43: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Office Real Estate Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the ASEAN Office Real Estate Market?

Key companies in the market include Savills Vietnam, Hines, UOL Group Limited, IM Global Property Consultants Sdn Bhd, PRIME Philippines, Frasers Property, City Developments Limited, PT Ciputra Development Tbk, CBRE Vietnam, Malton Berhad.

3. What are the main segments of the ASEAN Office Real Estate Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Demand for Co-Working Spaces Driving the Market.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

September 2022 - Ciputra International (a real estate company), inaugurated the Propan Tower. This project has 17 floors and is spread across 7.4 hectares, consisting of 10 buildings, 6 offices, 3 apartments, and 1 hotel. The project was developed to meet the increasing demand for office space in Jakarta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Office Real Estate Market?

To stay informed about further developments, trends, and reports in the ASEAN Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence