Key Insights

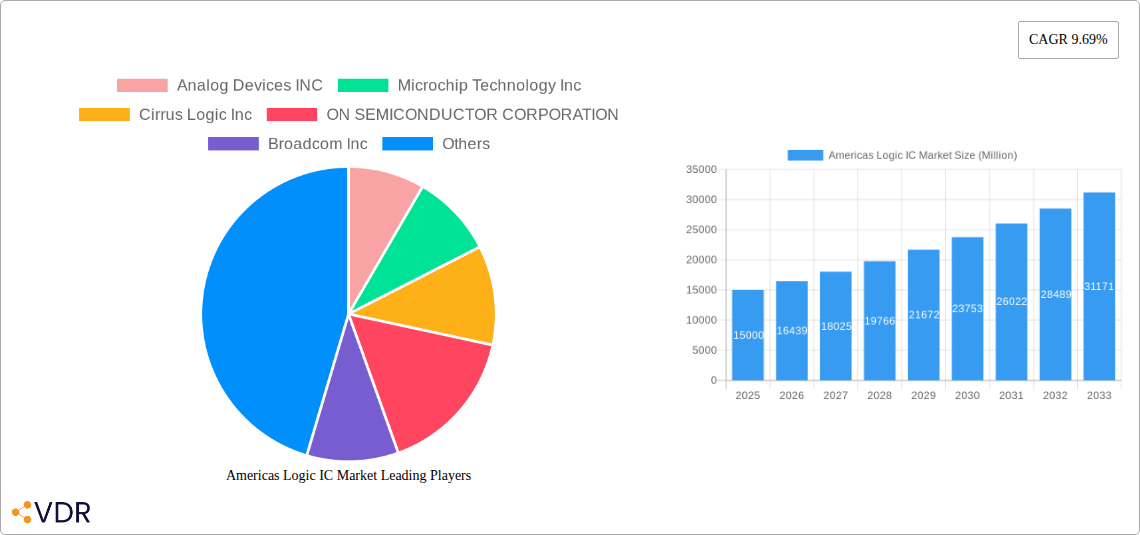

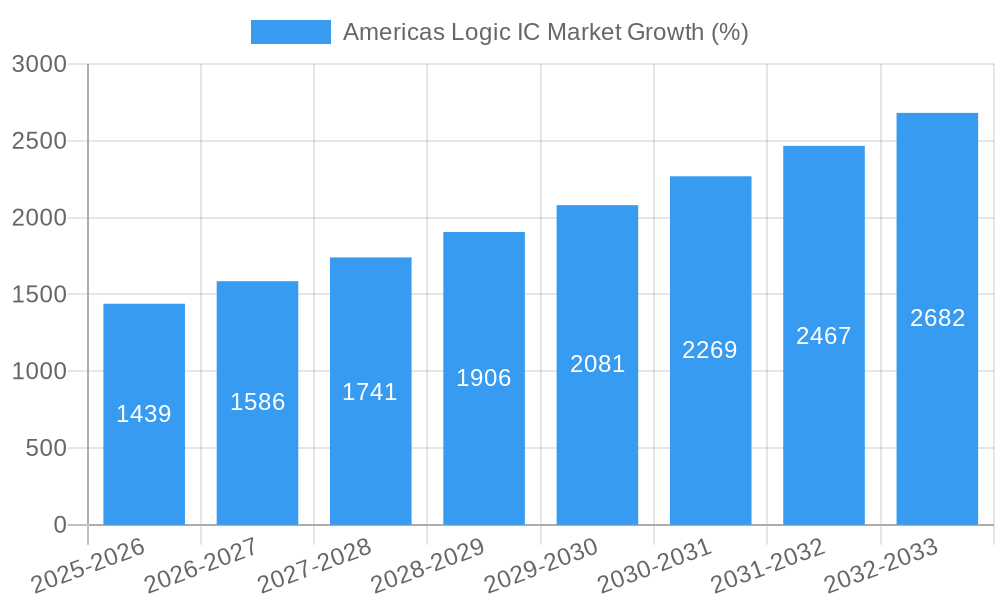

The Americas logic IC market, encompassing countries like the United States, Canada, Brazil, and Mexico, is experiencing robust growth, driven by the increasing demand for advanced electronics across diverse sectors. The market's Compound Annual Growth Rate (CAGR) of 9.69% from 2019 to 2024 suggests a significant upward trajectory. Key drivers include the proliferation of consumer electronics, the rapid expansion of the automotive industry (particularly in areas like ADAS and electric vehicles), and the continuous advancements in IT & telecommunications infrastructure. The rising adoption of automation across manufacturing and other end-user industries like healthcare and aerospace further fuels this expansion. Segment-wise, ASICs, ASSPs, and PLDs are key product types, with applications spanning consumer electronics (smartphones, wearables), automotive (ECU, infotainment systems), IT & telecommunications (networking equipment, servers), and industrial automation (robotics, process control). While the market faces restraints such as supply chain complexities and fluctuating component prices, the long-term outlook remains positive, underpinned by technological advancements and increasing digitalization across the Americas. The market is anticipated to maintain a healthy growth trajectory during the forecast period (2025-2033). Major players like Analog Devices, Microchip Technology, Texas Instruments, and Intel are strategically positioned to capitalize on the market's growth potential through innovation and strategic partnerships.

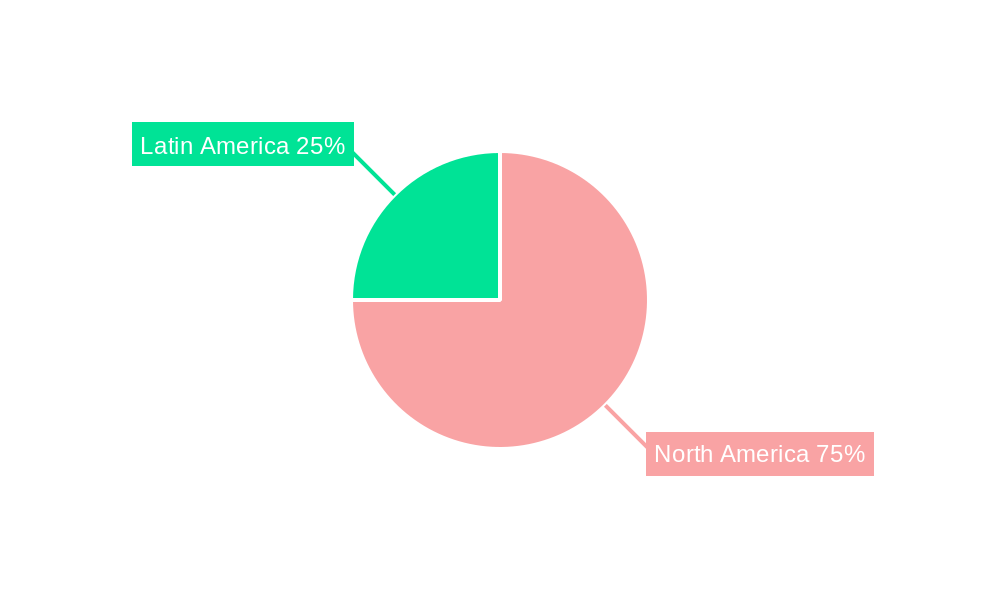

The dominance of North America, specifically the United States, within the Americas logic IC market is projected to continue. However, significant growth opportunities are expected in Latin America, particularly in Brazil and Mexico, fueled by expanding industrialization and government initiatives to promote technological advancements. The market segmentation by logic standard and MOS special-purpose logic reflects the diverse technological needs across the various application areas. Companies are focusing on developing energy-efficient, high-performance logic ICs to meet the evolving demands of the market. Competition is intense, with established players and emerging companies vying for market share through product innovation, strategic acquisitions, and geographic expansion. Analyzing the market dynamics across different regions and segments will be crucial for companies seeking to capitalize on the growth opportunities in the Americas logic IC market.

Americas Logic IC Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Americas Logic IC market, encompassing market dynamics, growth trends, dominant segments, product landscape, key drivers and challenges, emerging opportunities, growth accelerators, key players, notable milestones, and a detailed market outlook. The report covers the period 2019-2033, with 2025 as the base year and estimated year. The study analyzes the parent market of the Semiconductor Industry and the child market of Logic Integrated Circuits within the Americas region. The market is segmented by Product Type (ASIC, ASSP, PLD), Application (Consumer Electronics, Automotive, IT & Telecommunications, Manufacturing and Automation, Other End-user Industries), and Type (Logic Standard, MOS Special Purpose Logic). The report is invaluable for industry professionals, investors, and stakeholders seeking a clear understanding of this rapidly evolving market. Expected market size in Million Units are provided throughout the report where available.

Americas Logic IC Market Dynamics & Structure

The Americas Logic IC market is characterized by a moderately concentrated landscape with several major players holding significant market share. Technological innovation, particularly in areas like advanced node process technologies and low-power designs, is a key driver. Stringent regulatory frameworks, particularly concerning data security and environmental regulations, influence market dynamics. The market faces competition from alternative technologies, but the unique capabilities of Logic ICs in terms of performance and flexibility maintain its dominance. End-user demographics, especially the growing demand from the consumer electronics and automotive sectors, strongly influence market growth. Mergers and acquisitions (M&A) activity has been relatively high in recent years, with larger players consolidating their market positions. The estimated xx% market share of Analog Devices in 2025 reflects its strong position in the market, with other key players such as Texas Instruments and Intel also holding considerable shares. The number of M&A deals in the sector averaged xx per year during the historical period.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Technological Innovation: Focus on advanced node process technologies and low-power designs.

- Regulatory Frameworks: Compliance with data security and environmental regulations.

- Competitive Product Substitutes: Limited, due to the unique capabilities of Logic ICs.

- End-User Demographics: Strong growth driven by consumer electronics and automotive sectors.

- M&A Trends: Significant M&A activity, leading to market consolidation.

Americas Logic IC Market Growth Trends & Insights

The Americas Logic IC market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is primarily attributed to the increasing demand for high-performance and energy-efficient electronic devices across various applications. Technological disruptions, such as the adoption of artificial intelligence (AI) and the Internet of Things (IoT), are accelerating market growth. Consumer behavior shifts towards connected devices and advanced functionalities further fuel the demand for Logic ICs. The market is expected to maintain its growth trajectory during the forecast period (2025-2033), with a projected CAGR of xx%, driven by continued innovation, technological advancements, and expanding end-user applications. Market penetration in key sectors like consumer electronics and automotive is anticipated to reach xx% by 2033, indicating significant growth potential.

Dominant Regions, Countries, or Segments in Americas Logic IC Market

The United States is the dominant region in the Americas Logic IC market, accounting for approximately xx% of the total market value in 2025. This dominance is driven by a strong domestic semiconductor industry, robust technological innovation, substantial investments in R&D, and a large consumer electronics and automotive market. Canada and Mexico follow as major markets, although with considerably smaller market shares compared to the US.

Within product types, ASICs hold the largest market share due to their customizable nature and high performance. In terms of applications, consumer electronics drive significant demand, followed by the rapidly growing automotive sector. The IT & Telecommunications sector also contributes substantially.

Key Drivers in the US:

- Strong domestic semiconductor industry.

- Robust technological innovation.

- Significant R&D investments.

- Large consumer electronics and automotive markets.

- Supportive government policies (e.g., CHIPS Act).

Dominant Segments:

- Product Type: ASICs (xx% market share in 2025)

- Application: Consumer Electronics (xx% market share in 2025)

Americas Logic IC Market Product Landscape

The Americas Logic IC market features a diverse range of products, encompassing ASICs, ASSPs, and PLDs, each tailored to specific applications and performance requirements. Recent product innovations focus on enhancing performance, reducing power consumption, and improving integration capabilities. Advancements in fabrication technologies, like FinFET and GAAFET, are driving improvements in transistor density and performance. Unique selling propositions include low-power consumption, high speed, and advanced functionalities tailored to diverse applications.

Key Drivers, Barriers & Challenges in Americas Logic IC Market

Key Drivers:

- Increasing demand for high-performance and energy-efficient electronics.

- Technological advancements in areas like AI and IoT.

- Growth of end-user industries, particularly consumer electronics and automotive.

- Government initiatives promoting domestic semiconductor manufacturing (e.g., CHIPS Act).

Key Challenges and Restraints:

- Supply chain disruptions impacting component availability and pricing.

- Geopolitical uncertainties and trade tensions.

- Intense competition from established and emerging players.

- High R&D costs associated with developing advanced Logic ICs. These costs can impact profitability by xx% annually for smaller companies.

Emerging Opportunities in Americas Logic IC Market

- Growing demand for Logic ICs in emerging applications like wearable technology, smart homes, and industrial IoT.

- Opportunities in developing energy-efficient and sustainable designs to meet environmental regulations.

- Expanding into untapped markets in Latin America.

- Strategic partnerships and collaborations to expand product offerings and market reach.

Growth Accelerators in the Americas Logic IC Market Industry

Technological breakthroughs in areas such as advanced packaging and 3D integration are key catalysts for long-term growth. Strategic partnerships and collaborations between IC manufacturers, design houses, and end-users accelerate innovation and market expansion. The increasing adoption of AI and machine learning in the design and manufacturing process enhances efficiency and product performance, further driving market growth.

Key Players Shaping the Americas Logic IC Market Market

- Analog Devices INC

- Microchip Technology Inc

- Cirrus Logic Inc

- ON SEMICONDUCTOR CORPORATION

- Broadcom Inc

- Integrated Silicon Solution Inc ( ISSI)

- Advanced Micro Devices Inc

- Texas Instruments Incorporated

- Bourns Inc

- Intel Corporation

Notable Milestones in Americas Logic IC Market Sector

- September 2022: The US Department of Commerce announced its strategy to implement the CHIPS Act, allocating USD 50 billion to boost domestic semiconductor manufacturing. This is expected to significantly impact Logic IC production in the Americas.

- October 2022: The Biden administration imposed new export controls on semiconductor chips, limiting access for China. This move is likely to increase demand for Logic ICs produced in the Americas.

In-Depth Americas Logic IC Market Market Outlook

The Americas Logic IC market is poised for continued growth, driven by technological advancements, expanding applications, and government support. The market is expected to witness further consolidation among key players as they strive to secure market share and gain a competitive edge. Emerging applications in areas like 5G, automotive electronics, and industrial automation offer lucrative opportunities for Logic IC manufacturers. Strategic partnerships and investments in R&D will play a crucial role in shaping the future landscape of the Americas Logic IC market. The market is expected to reach xx Million Units by 2033.

Americas Logic IC Market Segmentation

-

1. Type

- 1.1. Logic Standard

- 1.2. MOS Special Purpose Logic

-

2. Product Type

- 2.1. ASIC

- 2.2. ASSP

- 2.3. PLD

-

3. Application

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. IT & Telecommunications

- 3.4. Manufacturing and Automation

- 3.5. Other En

Americas Logic IC Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

Americas Logic IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.69% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations; Lack of Skilled Radiation Professionals

- 3.4. Market Trends

- 3.4.1. Growing Adoption of Logic IC in Automotive Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Logic Standard

- 5.1.2. MOS Special Purpose Logic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. ASIC

- 5.2.2. ASSP

- 5.2.3. PLD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. IT & Telecommunications

- 5.3.4. Manufacturing and Automation

- 5.3.5. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Latin America Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 Mexico

- 6.1.2 Brazil

- 7. North America Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 United States

- 7.1.2 Canada

- 7.1.3 Mexico

- 8. South America Americas Logic IC Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 Brazil

- 8.1.2 Argentina

- 8.1.3 Rest of South America

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Analog Devices INC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Microchip Technology Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Cirrus Logic Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 ON SEMICONDUCTOR CORPORATION

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Broadcom Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Integrated Silicon Solution Inc ( ISSI)

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Advanced Micro Devices Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Texas Instruments Incorporated

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Bourns Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Intel Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Analog Devices INC

List of Figures

- Figure 1: Americas Logic IC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Americas Logic IC Market Share (%) by Company 2024

List of Tables

- Table 1: Americas Logic IC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Americas Logic IC Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Americas Logic IC Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Americas Logic IC Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Americas Logic IC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mexico Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Brazil Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Americas Logic IC Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Americas Logic IC Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Americas Logic IC Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Americas Logic IC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United States Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Mexico Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Chile Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Colombia Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Peru Americas Logic IC Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Logic IC Market?

The projected CAGR is approximately 9.69%.

2. Which companies are prominent players in the Americas Logic IC Market?

Key companies in the market include Analog Devices INC, Microchip Technology Inc, Cirrus Logic Inc, ON SEMICONDUCTOR CORPORATION, Broadcom Inc, Integrated Silicon Solution Inc ( ISSI), Advanced Micro Devices Inc, Texas Instruments Incorporated, Bourns Inc, Intel Corporation.

3. What are the main segments of the Americas Logic IC Market?

The market segments include Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Integration of Devices; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

Growing Adoption of Logic IC in Automotive Industries.

7. Are there any restraints impacting market growth?

Stringent Government Regulations; Lack of Skilled Radiation Professionals.

8. Can you provide examples of recent developments in the market?

October 2022: The Biden administration issued a new set of export controls. As per the new set of regulations, the US would be cutting China off from certain semiconductor chips made anywhere in the world with US equipment to slow down Beijing's technological and military advances. Such regulations are expected to further influence the demand for Logic ICs in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Logic IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Logic IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Logic IC Market?

To stay informed about further developments, trends, and reports in the Americas Logic IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence