Key Insights

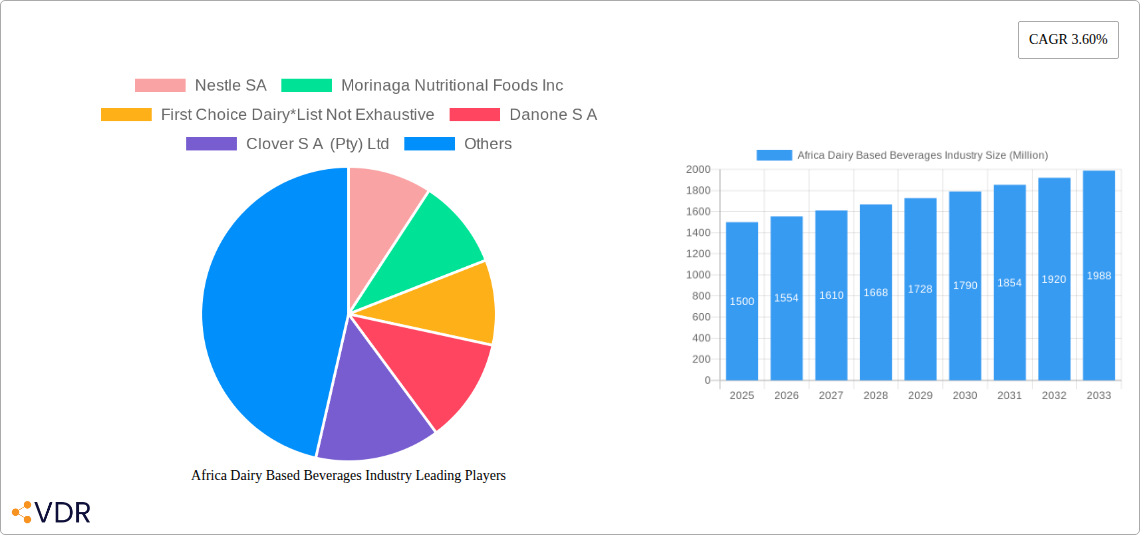

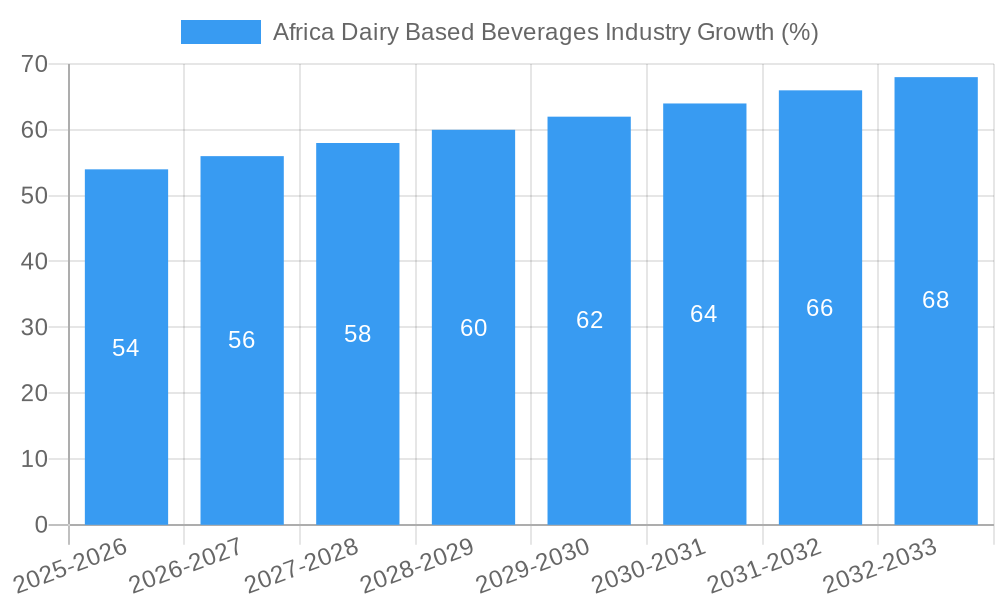

The African dairy-based beverages market, valued at approximately $XX million in 2025, is projected to experience steady growth with a CAGR of 3.60% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes across several African nations are driving increased consumer spending on convenient and nutritious food and beverages. A burgeoning young population and increasing urbanization are also contributing to market expansion, as these demographics tend to favor readily available, packaged products. The market is segmented by beverage type (milk, yogurt, and others), flavor (unflavored and flavored), and distribution channel (supermarkets/hypermarkets, convenience stores, specialist stores, and others). While the market faces challenges such as fluctuating milk prices and underdeveloped cold-chain infrastructure in certain regions, the overall positive trajectory is expected to persist. Key players like Nestle SA, Danone SA, and local players like Clover SA (Pty) Ltd are strategically investing in product innovation and expanding their distribution networks to capitalize on this growth opportunity. The increasing demand for healthier options, including fortified dairy drinks, presents a significant area for future development. Furthermore, the growing popularity of flavored dairy beverages tailored to local tastes is a crucial factor influencing market expansion.

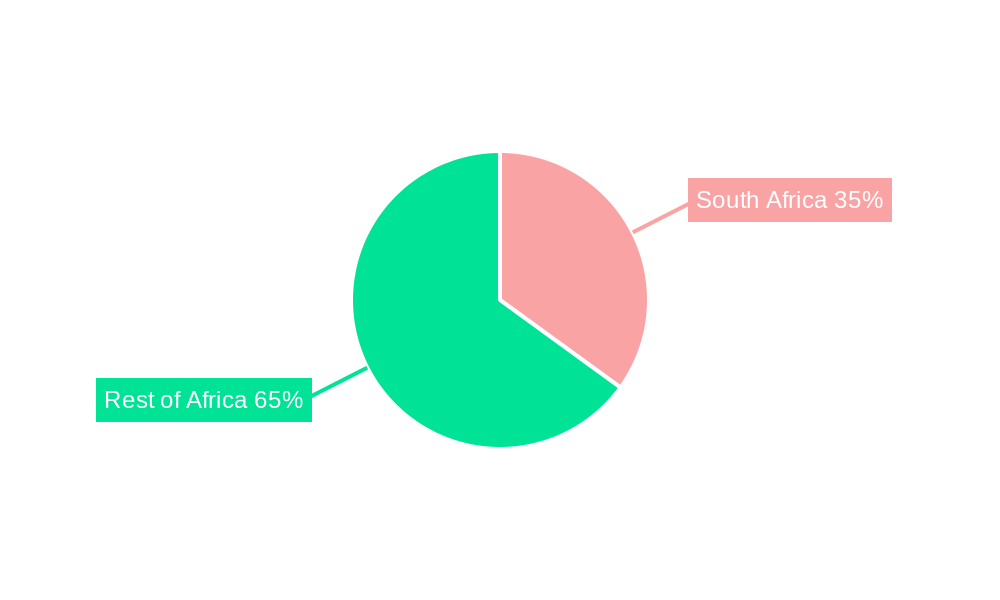

The dominance of specific product categories and distribution channels may vary across different African regions. South Africa, with its more developed infrastructure and higher per capita income, likely holds a larger market share compared to other regions like Sudan or Uganda. However, substantial growth potential exists in these less-developed markets as consumer preferences evolve and purchasing power increases. Future growth hinges on overcoming existing limitations, including improving cold-chain infrastructure to ensure product quality and shelf-life, promoting consumer awareness about the nutritional benefits of dairy beverages, and addressing potential price sensitivities in lower-income segments. Further investment in research and development focusing on locally relevant flavors and product formulations will be essential for sustained market growth. The expansion of retail networks in rural areas will also significantly impact accessibility and therefore market penetration.

Africa Dairy Based Beverages Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa dairy-based beverages industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 (Base Year: 2025, Estimated Year: 2025). The report segments the market by Type (Milk, Yogurt, Other Types), Category (Unflavored Drinks, Flavored Drinks), and Distribution Channel (Supermarket/Hypermarkets, Convenience/Grocery Stores, Specialist Stores, Other Distribution Channels), providing a granular understanding of market dynamics. Key players analyzed include Nestle SA, Morinaga Nutritional Foods Inc, First Choice Dairy, Danone S.A, Clover S.A (Pty) Ltd, Chobani LLC, and Groupe Lactalis.

Africa Dairy Based Beverages Industry Market Dynamics & Structure

This section analyzes the competitive landscape, market concentration, technological advancements, regulatory influences, and market trends within the African dairy-based beverage sector. We examine the impact of substitute products, evolving consumer demographics, and mergers and acquisitions (M&A) activity. Quantitative data, including market share percentages and M&A deal volumes (in millions of units where available), are provided alongside qualitative insights.

- Market Concentration: The market exhibits a [xx]% level of concentration, with [xx] players holding a significant market share. xx% of market share is held by top 5 companies.

- Technological Innovation: Technological advancements in processing, packaging, and distribution are driving efficiency and product innovation. Barriers to innovation include [List specific barriers e.g., infrastructure limitations, access to technology, etc.].

- Regulatory Framework: Government regulations concerning food safety, labeling, and import/export impact market operations. [Discuss specific regulations and their influence].

- Competitive Substitutes: [Identify and analyze key substitute products e.g., plant-based beverages and their market impact].

- End-User Demographics: Growth is driven by [Describe key demographic trends e.g., rising urban populations, changing consumer preferences].

- M&A Trends: The number of M&A deals in the period 2019-2024 totaled [xx] million units, indicating [Discuss the trend, e.g., consolidation or expansion].

Africa Dairy Based Beverages Industry Growth Trends & Insights

This section provides a comprehensive analysis of the market's historical and projected growth trajectory. We delve into market size evolution, adoption rates across different segments, the impact of technological disruptions, and shifting consumer behaviors. Key metrics, such as Compound Annual Growth Rate (CAGR) and market penetration rates, are presented to illustrate growth dynamics. The analysis leverages [Specify data sources e.g., industry reports, market research databases] to provide a robust understanding of market trends. [Insert 600 words of analysis here, incorporating the mentioned metrics].

Dominant Regions, Countries, or Segments in Africa Dairy Based Beverages Industry

This section identifies the leading regions, countries, and segments within the African dairy-based beverages market, highlighting the key drivers of their growth. Analysis is presented by Type, Category, and Distribution Channel, considering factors such as economic policies, infrastructure development, and consumer preferences. Market share and growth potential are assessed for each dominant segment.

- Leading Region/Country: [Identify the leading region/country and provide reasons for its dominance].

- Dominant Segment (Type): [Milk/Yogurt/Other – justify dominance based on market size, growth rate, and consumer preference].

- Dominant Segment (Category): [Flavored/Unflavored – provide reasons based on consumer preferences, product innovation, and market trends].

- Dominant Segment (Distribution Channel): [Supermarket/Hypermarkets/Convenience Stores/etc. – Explain the reasons behind dominance, e.g., accessibility, pricing strategies].

- Key Drivers: [List bullet points of key drivers e.g., rising disposable incomes, expanding retail infrastructure, government support for dairy farming].

[Insert 600 words of analysis here, expanding on the above bullet points with paragraphs detailing the dominance factors and growth potential.]

Africa Dairy Based Beverages Industry Product Landscape

This section offers a concise overview of product innovations, applications, and key performance indicators within the industry. It highlights unique selling propositions (USPs) and technological advancements that are shaping the product landscape. [Insert 100-150 words describing product innovations, applications, and performance metrics].

Key Drivers, Barriers & Challenges in Africa Dairy Based Beverages Industry

This section identifies the key factors driving market growth and the challenges hindering its expansion.

Key Drivers: [Insert 150 words discussing technological advancements, economic factors, and supportive government policies. Include specific examples]

Key Challenges and Restraints: [Insert 150 words analyzing supply chain complexities, regulatory hurdles, and competitive pressures, quantifying their impact where possible.]

Emerging Opportunities in Africa Dairy Based Beverages Industry

This section highlights emerging trends and untapped opportunities within the African dairy-based beverages market. [Insert 150 words discussing emerging trends such as the growth of plant-based alternatives, functional beverages, and the potential for market expansion into underserved regions].

Growth Accelerators in the Africa Dairy Based Beverages Industry

This section identifies the catalysts for long-term growth in the industry. [Insert 150 words focusing on technological breakthroughs, strategic partnerships, and market expansion strategies].

Key Players Shaping the Africa Dairy Based Beverages Industry Market

- Nestle SA

- Morinaga Nutritional Foods Inc

- First Choice Dairy

- Danone S.A

- Clover S.A (Pty) Ltd

- Chobani LLC

- Groupe Lactalis

Notable Milestones in Africa Dairy Based Beverages Industry Sector

- December 2020: MB Plc (Family Milk) installed an automatic UHT milk processing plant in Addis Ababa, boosting production capacity and shelf life.

- June 2021: Chobani LLC launched new zero-sugar yogurt flavors, targeting the diabetic patient segment and expanding its product portfolio.

In-Depth Africa Dairy Based Beverages Industry Market Outlook

This report concludes by summarizing the key growth accelerators and strategic opportunities within the African dairy-based beverages market. The industry's future potential is significant, driven by [mention key factors such as rising incomes, population growth, and evolving consumer preferences]. Strategic partnerships, product innovation, and efficient supply chain management will be crucial for success in this dynamic market. [Insert 150 words summarizing growth accelerators and future potential].

Africa Dairy Based Beverages Industry Segmentation

-

1. Type

- 1.1. Milk

- 1.2. Yogurt

- 1.3. Other Types

-

2. Category

- 2.1. Unflavored Drinks

- 2.2. Flavored Drinks

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarkets

- 3.2. Convenience/Grocery Stores

- 3.3. Specialist Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. South Africa

- 4.2. Egypt

- 4.3. Others

Africa Dairy Based Beverages Industry Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Others

Africa Dairy Based Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation In Flavors And Ingredients; Inclination Towards Fortified Biscuits

- 3.3. Market Restrains

- 3.3.1. Popularity Of Healthy Snacking And Other Alternatives

- 3.4. Market Trends

- 3.4.1. Rising Demand for Probiotic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milk

- 5.1.2. Yogurt

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Unflavored Drinks

- 5.2.2. Flavored Drinks

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarkets

- 5.3.2. Convenience/Grocery Stores

- 5.3.3. Specialist Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Egypt

- 5.5.3. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Milk

- 6.1.2. Yogurt

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Unflavored Drinks

- 6.2.2. Flavored Drinks

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarket/Hypermarkets

- 6.3.2. Convenience/Grocery Stores

- 6.3.3. Specialist Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Egypt

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Egypt Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Milk

- 7.1.2. Yogurt

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Unflavored Drinks

- 7.2.2. Flavored Drinks

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarket/Hypermarkets

- 7.3.2. Convenience/Grocery Stores

- 7.3.3. Specialist Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Egypt

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Others Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Milk

- 8.1.2. Yogurt

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Unflavored Drinks

- 8.2.2. Flavored Drinks

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarket/Hypermarkets

- 8.3.2. Convenience/Grocery Stores

- 8.3.3. Specialist Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Egypt

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Africa Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Nestle SA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Morinaga Nutritional Foods Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 First Choice Dairy*List Not Exhaustive

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Danone S A

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Clover S A (Pty) Ltd

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Chobani LLC

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Groupe Lactalis

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.1 Nestle SA

List of Figures

- Figure 1: Africa Dairy Based Beverages Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Dairy Based Beverages Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Africa Dairy Based Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Africa Dairy Based Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Africa Dairy Based Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Africa Dairy Based Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Africa Dairy Based Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Africa Dairy Based Beverages Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 16: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 21: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 26: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Africa Dairy Based Beverages Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Dairy Based Beverages Industry?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the Africa Dairy Based Beverages Industry?

Key companies in the market include Nestle SA, Morinaga Nutritional Foods Inc, First Choice Dairy*List Not Exhaustive, Danone S A, Clover S A (Pty) Ltd, Chobani LLC, Groupe Lactalis.

3. What are the main segments of the Africa Dairy Based Beverages Industry?

The market segments include Type, Category, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation In Flavors And Ingredients; Inclination Towards Fortified Biscuits.

6. What are the notable trends driving market growth?

Rising Demand for Probiotic Beverages.

7. Are there any restraints impacting market growth?

Popularity Of Healthy Snacking And Other Alternatives.

8. Can you provide examples of recent developments in the market?

June 2021: Chobani LLC launched new flavors (mixed berry and strawberry) of zero-sugar yogurt in the market. As per the company's claim, the product launch and innovation strategy is to offer consumers sugar-free products to target diabetic patients. As a result, it will enable the company to expand its business and helps to enlarge its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Dairy Based Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Dairy Based Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Dairy Based Beverages Industry?

To stay informed about further developments, trends, and reports in the Africa Dairy Based Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence