Key Insights

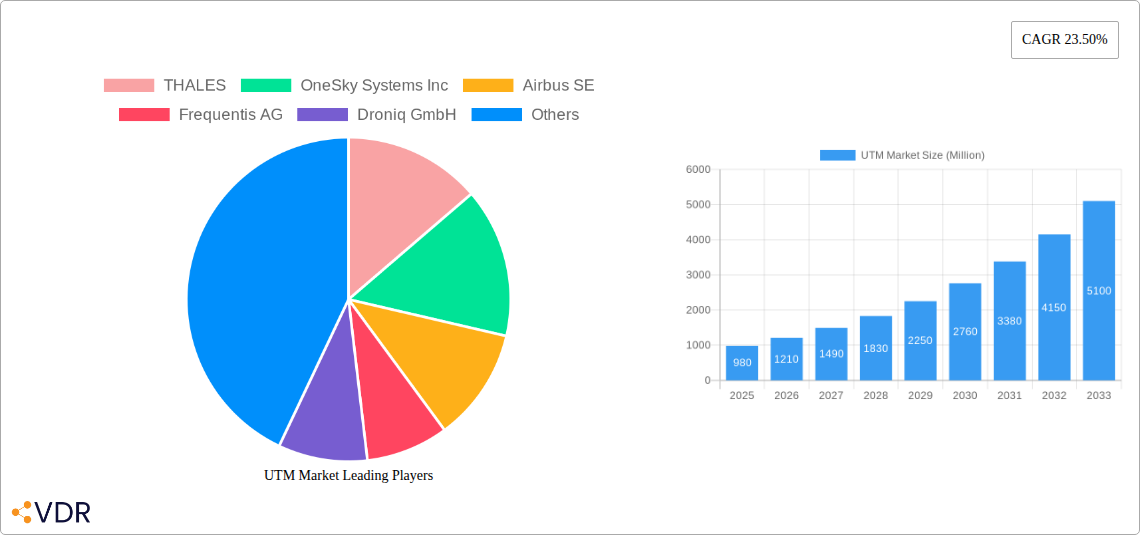

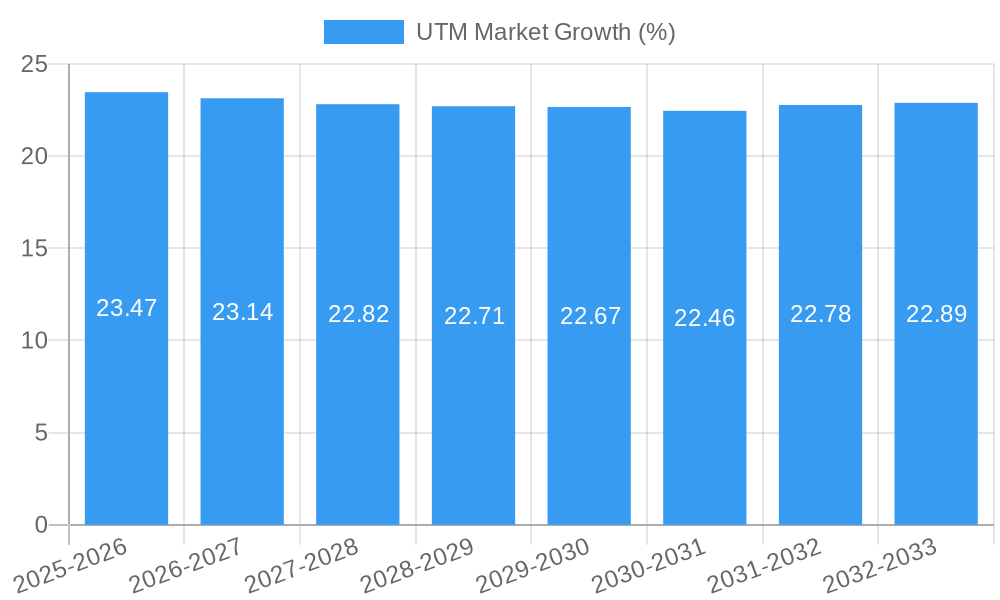

The Unmanned Traffic Management (UTM) market is poised for explosive growth, with an estimated market size of $0.98 billion in 2025, projected to ascend at a remarkable Compound Annual Growth Rate (CAGR) of 23.50% through 2033. This robust expansion is fueled by a confluence of factors, primarily driven by the increasing integration of drones in commercial operations across diverse sectors. The burgeoning demand for enhanced safety, security, and efficiency in airspace management for drones is a fundamental catalyst. Key drivers include the escalating adoption of drone technology in agriculture and forestry for precision farming and environmental monitoring, alongside its critical role in transportation and logistics for efficient package delivery and inventory management. Furthermore, the growing need for real-time surveillance and monitoring across industries such as infrastructure inspection, public safety, and event security significantly propels market expansion. The evolution of sophisticated software solutions for deconfliction, flight planning, and airspace authorization, coupled with the provision of essential services like training and certification, are integral to this upward trajectory.

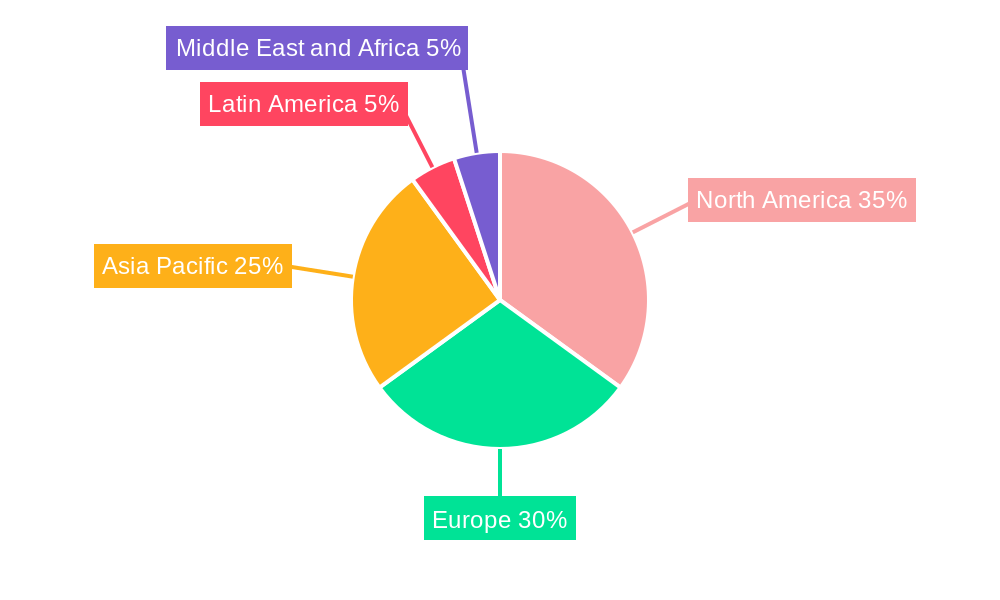

The UTM market's segmentation reveals a balanced growth across its core components and applications. The Hardware segment, encompassing drone detection systems and communication infrastructure, is crucial for enabling UTM capabilities. Simultaneously, the Software segment, offering advanced algorithms for traffic flow management and data analytics, is experiencing rapid innovation. The Services segment, including consulting, integration, and maintenance, is vital for the seamless deployment and operation of UTM systems. Geographically, North America and Europe are leading the adoption due to stringent regulatory frameworks and early commercialization of drone applications. Asia Pacific, particularly China and India, is emerging as a high-growth region, driven by government initiatives supporting drone technology and its widespread use in various industries. While the market's potential is immense, challenges such as evolving regulatory landscapes, cybersecurity concerns, and the need for standardized protocols will require continuous innovation and collaboration among stakeholders to ensure the safe and scalable integration of drones into the national airspace.

Unlocking the Skies: A Comprehensive UTM Market Report (2019-2033)

This in-depth UTM (Unmanned Traffic Management) market report delivers critical intelligence for navigating the rapidly evolving drone and air mobility ecosystem. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, this report provides a detailed analysis of market dynamics, growth trends, regional dominance, product landscapes, key drivers, emerging opportunities, and competitive strategies. Gain unparalleled insights into the parent and child markets, understanding how the broader drone economy fuels and is shaped by sophisticated UTM solutions. With all values presented in million units, this report is your essential guide to strategic decision-making in the burgeoning UTM industry.

UTM Market Market Dynamics & Structure

The UTM market is characterized by dynamic interplay between technological innovation, evolving regulatory frameworks, and increasing end-user adoption. Market concentration varies across segments, with hardware exhibiting a more fragmented landscape compared to specialized software and service providers. Key drivers of technological innovation include advancements in AI, sensor technology, and communication systems, enabling more sophisticated and autonomous drone operations. Regulatory bodies worldwide are actively developing frameworks to ensure the safe and secure integration of drones into airspace, which directly influences market growth and structure. Competitive product substitutes, such as traditional air traffic management systems, are being challenged by the agility and cost-effectiveness of UTM solutions. End-user demographics are diversifying rapidly, with significant growth anticipated from sectors like agriculture, logistics, and public safety. Mergers and acquisitions (M&A) are becoming increasingly prevalent as companies seek to consolidate offerings, expand geographical reach, and acquire critical technologies. For instance, the period has seen a rise in strategic partnerships and acquisitions aimed at bolstering cybersecurity and data management capabilities within UTM. Innovation barriers are primarily related to achieving full regulatory approval for complex operations, ensuring interoperability between different UTM systems, and building public trust.

- Market Concentration: Moderate to high in specialized software and services, with emerging players challenging established entities.

- Technological Innovation Drivers: AI for autonomous flight, advanced sensors for situational awareness, 5G for low-latency communication, blockchain for secure data management.

- Regulatory Frameworks: A critical factor shaping market entry, operational capabilities, and safety standards. Active development in regions like the US, EU, and Asia.

- Competitive Product Substitutes: Traditional Air Traffic Management (ATM), manual drone operation oversight, limited localized deconfliction solutions.

- End-User Demographics: Expanding beyond early adopters to include large enterprises in logistics, agriculture, infrastructure inspection, and government agencies for surveillance.

- M&A Trends: Increasing consolidation to offer end-to-end solutions, focus on cybersecurity and data analytics capabilities.

UTM Market Growth Trends & Insights

The UTM market is experiencing robust growth, driven by the exponential rise in drone adoption across various industries. Market size evolution is marked by consistent upward trajectory, propelled by the increasing demand for efficient and safe drone operations. Adoption rates are accelerating as businesses recognize the tangible benefits of UTM, including enhanced operational efficiency, reduced costs, and improved safety. Technological disruptions are continuously shaping the market, with innovations in areas such as remote identification, detect-and-avoid systems, and decentralized UTM architectures paving the way for more advanced applications. Consumer behavior shifts are also playing a significant role, with a growing acceptance of drone-based services and a demand for more automated and autonomous delivery solutions. The CAGR (Compound Annual Growth Rate) is projected to be substantial over the forecast period, reflecting the transformative potential of UTM. Market penetration is deepening, moving from niche applications to widespread integration in mainstream operations. The increasing investment in drone technology and the development of supportive infrastructure are further solidifying the growth trajectory. Understanding these trends is crucial for stakeholders to capitalize on the immense opportunities within this dynamic sector. The integration of advanced analytics and AI within UTM platforms is enabling predictive maintenance, optimized flight paths, and enhanced risk assessment, further driving market expansion.

- Market Size Evolution: Significant expansion driven by increasing drone deployment and regulatory support. Projected market size in 2025 is estimated at $1,250 Million units, with an expected surge to $4,875 Million units by 2033.

- Adoption Rates: Steadily increasing across commercial, government, and defense sectors, fueled by demonstrable ROI and enhanced capabilities.

- Technological Disruptions: Advancements in AI, blockchain for secure transactions, and integration with 5G networks are transforming UTM capabilities.

- Consumer Behavior Shifts: Growing demand for autonomous delivery, aerial photography, and remote sensing services are pushing UTM infrastructure development.

- CAGR: Expected to be in the high double digits (approx. 18%) for the forecast period (2025-2033).

- Market Penetration: Expanding from controlled environments to more complex and unsegregated airspace operations.

Dominant Regions, Countries, or Segments in UTM Market

The UTM market's dominance is currently being shaped by a confluence of technological adoption, regulatory maturity, and strategic investment. The Services segment, encompassing operational oversight, data management, and airspace authorization, is emerging as a dominant force. This dominance is driven by the increasing complexity of drone operations, necessitating specialized expertise and robust platforms to ensure safety and compliance.

North America is a leading region, characterized by significant investment in drone technology, a proactive regulatory approach by the FAA, and a strong presence of key industry players. The region’s extensive application of drones in agriculture, surveillance, and logistics fuels the demand for sophisticated UTM solutions. The estimated market share for services in North America is projected to be around 35% in 2025.

- Key Drivers: Favorable regulatory environment, substantial private and government funding for drone innovation, high adoption rates in key application sectors.

- Market Share & Growth Potential: Strong current market share with continued robust growth expected due to ongoing research and development and increasing commercial deployments.

The Surveillance and Monitoring application segment is also experiencing significant growth, driven by its critical role in public safety, infrastructure inspection, and border security. The ability of drones to provide real-time aerial intelligence makes UTM solutions essential for managing and coordinating these operations effectively.

Europe follows closely, with the European Union actively promoting drone integration through initiatives like EASA’s regulatory framework. The region’s focus on advanced manufacturing and smart city initiatives further bolsters the UTM market, particularly in the Transportation and Logistics application, where drone delivery is gaining traction. The Services segment in Europe is expected to account for approximately 30% of the global market share in 2025.

- Key Drivers: Harmonized regulatory approaches across member states, strong emphasis on sustainability and smart mobility, growing interest in drone-based infrastructure inspection.

- Market Share & Growth Potential: Significant current market share with substantial growth potential driven by increasing cross-border drone operations and smart city development.

The Software component is also a crucial driver, enabling the core functionalities of UTM, including flight planning, deconfliction, and data processing. As drone operations become more complex, the demand for advanced software solutions that can handle large volumes of data and ensure seamless integration will continue to surge.

Asia-Pacific, particularly countries like China and Japan, is emerging as a rapid growth market, driven by massive investments in drone technology and a burgeoning e-commerce sector demanding efficient logistics. The Agriculture and Forestry application segment is particularly strong in this region, with drones playing a vital role in crop management and yield optimization. The Services segment in Asia-Pacific is projected to grow at the highest CAGR, indicating its significant future potential.

- Key Drivers: Rapid technological advancements, large domestic markets for drone applications, significant government initiatives to foster drone industry growth.

- Market Share & Growth Potential: Lower current market share compared to North America and Europe but exhibiting the highest growth rate, driven by aggressive adoption and innovation.

Overall, the interplay between mature markets with established regulatory frameworks and rapidly growing regions with strong investment provides a dynamic landscape for the UTM market. The Services segment, supported by robust Software and driven by critical applications like Surveillance and Monitoring, Transportation and Logistics, and Agriculture, is set to define the future of UTM.

UTM Market Product Landscape

The UTM market product landscape is characterized by a rapidly evolving suite of integrated solutions designed to manage drone traffic safely and efficiently. Innovations focus on providing robust airspace management, real-time monitoring, and seamless communication between drones, operators, and air traffic control. Key product offerings include Unmanned Traffic Management (UTM) platforms, drone detection and identification systems, flight planning software, and cybersecurity solutions tailored for drone operations. Performance metrics emphasize latency reduction, data accuracy, scalability, and interoperability. Unique selling propositions often revolve around the ability to handle complex airspace scenarios, offer advanced analytics for risk assessment, and ensure compliance with diverse regulatory requirements. Technological advancements are pushing towards decentralized UTM architectures, AI-powered decision-making, and the integration of quantum-resistant cryptography for enhanced security.

Key Drivers, Barriers & Challenges in UTM Market

The UTM market is propelled by several key drivers, including the exponential growth of drone deployment across various industries, increasing demand for autonomous delivery and logistics solutions, and the critical need for enhanced aviation safety and security. Technological advancements in AI, sensor technology, and communication systems are also significant catalysts.

- Key Drivers:

- Explosion in drone usage for commercial and government applications.

- Demand for efficient and cost-effective logistics and delivery services.

- Government mandates for drone integration and airspace safety.

- Advancements in AI, IoT, and 5G technologies.

Conversely, the market faces significant barriers and challenges. Regulatory hurdles and the lack of standardized international frameworks can slow down adoption and operational expansion. Cybersecurity threats and the risk of malicious drone use pose a constant concern, requiring robust protective measures. Supply chain issues for specialized components and the high cost of advanced UTM system implementation can also be restraining factors.

- Barriers & Challenges:

- Evolving and fragmented regulatory landscapes globally.

- Cybersecurity vulnerabilities and the threat of unauthorized drone operations.

- Interoperability issues between diverse UTM systems and legacy air traffic control.

- High initial investment costs for advanced UTM infrastructure.

- Public perception and acceptance of widespread drone operations.

Emerging Opportunities in UTM Market

Emerging opportunities in the UTM market are abundant, driven by the increasing demand for specialized drone applications and the expansion into new operational domains. The integration of UTM with advanced air mobility (AAM) concepts presents a significant growth avenue, enabling the safe operation of passenger-carrying drones and electric vertical takeoff and landing (eVTOL) aircraft. Furthermore, the development of localized UTM solutions for specific industrial environments, such as mining sites, large-scale construction projects, and offshore platforms, offers untapped market potential. The increasing focus on sustainability is also creating opportunities for UTM solutions that optimize flight paths for reduced energy consumption and emissions.

- Untapped Markets: Urban air mobility (UAM) integration, specialized industrial site management, remote and underserved regions.

- Innovative Applications: Precision agriculture with real-time data feedback loops, advanced infrastructure inspection with predictive maintenance, last-mile delivery optimization.

- Evolving Consumer Preferences: Demand for faster, more reliable, and environmentally friendly delivery options.

Growth Accelerators in the UTM Market Industry

Several factors are acting as significant growth accelerators for the UTM market. Technological breakthroughs, particularly in artificial intelligence for autonomous decision-making and machine learning for predictive analytics, are enhancing the capabilities and efficiency of UTM systems. Strategic partnerships between UTM providers, drone manufacturers, and regulatory bodies are crucial for fostering industry-wide adoption and developing robust ecosystems. Market expansion strategies, including entering new geographical regions and targeting emerging application sectors, are further driving growth. The increasing government investment in smart city initiatives and defense modernization programs also acts as a powerful catalyst, demanding sophisticated drone management solutions.

- Technological Breakthroughs: AI-driven traffic management, enhanced detect-and-avoid systems, blockchain for secure data integrity.

- Strategic Partnerships: Collaboration between UTM providers, drone OEMs, and aviation authorities to ensure interoperability and standardization.

- Market Expansion Strategies: Penetration into new vertical markets and geographical regions with tailored UTM solutions.

Key Players Shaping the UTM Market Market

- THALES

- OneSky Systems Inc

- Airbus SE

- Frequentis AG

- Droniq GmbH

- PrecisionHawk Inc

- Leonardo S p A

- NovaSystem

- Unifly nv

- Altitude Angel Limited

Notable Milestones in UTM Market Sector

- December 2023: Unifly completed the Unified UTM Cybersecurity Model project with Rhea Group and the NY UAS Test Site, aiming to refine and validate a UTM cybersecurity model in an operational environment.

- March 2022: Japanese drone and air mobility technology company Terra Drone Corp announced it had raised USD 70 million, anticipating a sharp increase in the use of unmanned aircraft over the next two decades.

In-Depth UTM Market Market Outlook

The UTM market outlook is exceptionally promising, driven by a confluence of accelerating factors. The increasing integration of drones into everyday life and critical infrastructure necessitates sophisticated traffic management solutions, creating a fertile ground for expansion. Technological advancements, particularly in AI and autonomous systems, are continuously enhancing UTM capabilities, paving the way for more complex and large-scale operations. Strategic alliances and collaborations between industry stakeholders will be pivotal in establishing standardized protocols and fostering a cohesive ecosystem. Emerging applications in urban air mobility, advanced logistics, and specialized industrial sectors represent significant untapped potential. As regulatory frameworks mature and gain global harmonization, the market is poised for exponential growth, transforming the future of aviation and airspace management.

UTM Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Application

- 2.1. Agriculture and Forestry

- 2.2. Transportation and Logistics

- 2.3. Surveillance and Monitoring

UTM Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Israel

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

UTM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Software Segment will Showcase Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UTM Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Agriculture and Forestry

- 5.2.2. Transportation and Logistics

- 5.2.3. Surveillance and Monitoring

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America UTM Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Agriculture and Forestry

- 6.2.2. Transportation and Logistics

- 6.2.3. Surveillance and Monitoring

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe UTM Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Agriculture and Forestry

- 7.2.2. Transportation and Logistics

- 7.2.3. Surveillance and Monitoring

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific UTM Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Agriculture and Forestry

- 8.2.2. Transportation and Logistics

- 8.2.3. Surveillance and Monitoring

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America UTM Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Agriculture and Forestry

- 9.2.2. Transportation and Logistics

- 9.2.3. Surveillance and Monitoring

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa UTM Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Agriculture and Forestry

- 10.2.2. Transportation and Logistics

- 10.2.3. Surveillance and Monitoring

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America UTM Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe UTM Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific UTM Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America UTM Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Rest of Latin America

- 15. Middle East and Africa UTM Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Israel

- 15.1.4 South Africa

- 15.1.5 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 THALES

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 OneSky Systems Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Airbus SE

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Frequentis AG

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Droniq GmbH

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 PrecisionHawk Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Leonardo S p A

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 NovaSystem

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Unifly nv

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Altitude Angel Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 THALES

List of Figures

- Figure 1: Global UTM Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America UTM Market Revenue (Million), by Component 2024 & 2032

- Figure 13: North America UTM Market Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America UTM Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America UTM Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe UTM Market Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe UTM Market Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe UTM Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe UTM Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific UTM Market Revenue (Million), by Component 2024 & 2032

- Figure 25: Asia Pacific UTM Market Revenue Share (%), by Component 2024 & 2032

- Figure 26: Asia Pacific UTM Market Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Pacific UTM Market Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America UTM Market Revenue (Million), by Component 2024 & 2032

- Figure 31: Latin America UTM Market Revenue Share (%), by Component 2024 & 2032

- Figure 32: Latin America UTM Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Latin America UTM Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Latin America UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America UTM Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa UTM Market Revenue (Million), by Component 2024 & 2032

- Figure 37: Middle East and Africa UTM Market Revenue Share (%), by Component 2024 & 2032

- Figure 38: Middle East and Africa UTM Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa UTM Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa UTM Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa UTM Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UTM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UTM Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global UTM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global UTM Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: India UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Israel UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global UTM Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Global UTM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global UTM Market Revenue Million Forecast, by Component 2019 & 2032

- Table 35: Global UTM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global UTM Market Revenue Million Forecast, by Component 2019 & 2032

- Table 43: Global UTM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: India UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global UTM Market Revenue Million Forecast, by Component 2019 & 2032

- Table 51: Global UTM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Brazil UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Latin America UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global UTM Market Revenue Million Forecast, by Component 2019 & 2032

- Table 56: Global UTM Market Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global UTM Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: United Arab Emirates UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Saudi Arabia UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Israel UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa UTM Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UTM Market?

The projected CAGR is approximately 23.50%.

2. Which companies are prominent players in the UTM Market?

Key companies in the market include THALES, OneSky Systems Inc, Airbus SE, Frequentis AG, Droniq GmbH, PrecisionHawk Inc, Leonardo S p A, NovaSystem, Unifly nv, Altitude Angel Limited.

3. What are the main segments of the UTM Market?

The market segments include Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.98 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Software Segment will Showcase Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2023: Unifly completed the Unified UTM Cybersecurity Model project with Rhea Group and the NY UAS Test Site. The project aimed to refine and validate a UTM cybersecurity model in an operational environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UTM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UTM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UTM Market?

To stay informed about further developments, trends, and reports in the UTM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence